Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A World Bank economist said on Thursday that Malaysia should reduce tariffs for all trading partners, not just major ones like the US, because selective cuts can distort trade and reduce overall welfare.

A World Bank economist said on Thursday that Malaysia should reduce tariffs for all trading partners, not just major ones like the US, because selective cuts can distort trade and reduce overall welfare.

Chief economist for East Asia and the Pacific Apurva Sanghi said non-discriminatory tariff cuts would make Malaysia's economy more open and efficient.

"Tariff cuts are good, but if you are going to cut them, you need to cut them in a non-discriminatory fashion," he said at the National Economic Outlook Conference 2025 organised by Malaysian Institute of Economic Research (MIER). He added that preferential tariffs often benefit less efficient foreign producers, while hurting the country's overall welfare.

Sanghi made the remarks during a presentation on global economic challenges, warning that slowing growth, weak investment, and rising debt make trade openness especially important for middle-income countries.

He noted that Malaysia signed a Reciprocal Trade Agreement (ART) with the US in October, its third-largest trading partner, creating a delicate balance with its biggest trading partner, China. The deal has raised concerns that Malaysia might be forced to align with US sanctions, potentially affecting its neutral stance in the US-China rivalry.

To illustrate the economic impact of selective tariffs, Sanghi presented a simple model: Malaysia imports only BYD from China and Tesla from the US, with no domestic cars. Prices before tariffs are US$20,000 for BYD and US$30,000 for Tesla, with a 100% tariff.

With tariffs, BYD costs US$40,000, and Malaysia imports 50 units, generating US$1 million in government revenue.

If tariffs are removed only for Tesla, it drops to US$30,000, and consumers switch to Tesla, saving money, but the government loses US$1 million, creating a net welfare loss.

If tariffs are removed for all cars, BYD drops to US$20,000, generating US$1 million in consumer savings, offsetting the loss of revenue.

"The net outcome is zero, which is better than the negative outcome under unilateral preferential treatment," Sanghi said. He emphasised that the example was about economic logic, not fairness or geopolitics. "Preferential treatment leads to both trade creation and trade diversion," he noted. "But when it is extended to a less efficient country, the negative impact of diversion outweighs the positive effect of trade creation."

Earlier, Sanghi warned that the world economy faces slowing growth, stalling investment, and rising debt, with investment in low- and middle-income countries at its slowest in 30 years, and global policy uncertainty at record highs.

The United States is celebrating Thanksgiving, meaning trading activity across financial markets will be lower than usual today (and to some extent tomorrow). Yesterday, we noted a decline in volatility in the gold market.

Against this backdrop, the silver market is drawing attention – and may not allow traders to relax. As the XAG/USD chart shows, silver has risen by more than 7% since the start of the week.

It is reasonable to assume that the holiday-induced drop in liquidity has opened the door to broader price movements. It is not impossible that we may soon see an attempt to break the all-time high (around $54.45 per ounce), which as of this morning lies roughly 1% away.

Examining the XAG/USD chart, we can identify key swing points that allow us to outline an ascending channel. This week's strong advance has pushed silver into the upper half of that channel.

The bulls' strength is reflected in:

→ the steep slope of the orange channel, within which we see impulsive bullish candles followed by brief corrections – a classic pattern of a strong market;

→ a higher peak on the Awesome Oscillator.

Given this context, it is plausible that the median line could switch from resistance to support (as it has previously – shown by arrows), potentially helping the bulls gather the confidence needed to challenge the record high.

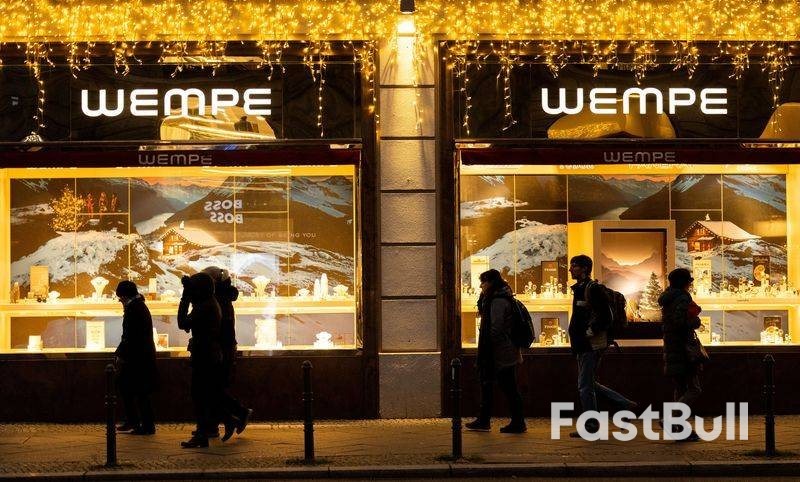

Consumer sentiment in Germany is set to improve slightly in December as households show more willingness to spend money ahead of the holiday season, though less rosy income prospects are preventing a stronger recovery, a survey showed on Thursday.

The consumer sentiment index, published by the GfK market research institute and the Nuremberg Institute for Market Decisions (NIM), rose to -23.2 points for December from -24.1 points the month before, in line with analysts' expectations.

Overall sentiment was boosted by a 3.3-point rise in consumers' willingness to buy for a second month in a row, bringing it to the same level as a year earlier at -6.0 points.

A 2.1-point dip in their readiness to save also helped.

"Consumer sentiment is currently at almost exactly the same level as last year. This is good news for retailers with an eye to year-end business: The data points to stable Christmas sales," said Rolf Buerkl, head of consumer climate at NIM.

"On one hand this shows a certain stability in consumer sentiment but on the other hand, it shows that consumers do not expect a drastic recovery in the short term," he added.

Households' economic expectations for the next 12 months fell nearly 2 points month on month, to -1.1 points, but were still 2.5 points higher compared with last year's level.

Germany's economy is expected to grow by only 0.2% in 2025 after two years of contraction as Chancellor Friedrich Merz's spending measures need time to translate into better conditions.

DEC NOV DEC

2025 2025 2024

Consumer climate -23.2 -24.1 -23.1

Consumer climate components

NOV OCT NOV

2025 2025 2024

- economic expectations -1.1 0.8 -3.6

- income expectations -0.1 2.3 -3.5

- willingness to buy -6.0 -9.3 -6.0

- willingness to save 13.7 15.8 11.9

The survey period was from October 30 to November 10, 2025.

An indicator reading above zero signals year-on-year growth in private consumption. A value below zero indicates a drop compared with the same period a year earlier.

According to GfK, a one-point change in the indicator corresponds to a year-on-year change of 0.1% in private consumption.

The "willingness to buy" indicator represents the balance between positive and negative responses to the question: "Do you think now is a good time to buy major items?"

The income expectations sub-index reflects expectations about the development of household finances in the coming 12 months.

The economic expectations index reflects respondents' assessment of the general economic situation over the next 12 months.

($1 = 0.8618 euros)

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up