Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

NEW YORK, NY, March 28, 2025 (GLOBE NEWSWIRE) — WiseChain.io, a global leader in next-generation trading technology, announces the launch of its cutting-edge AI-driven social trading platform, now available exclusively to its elite clients. This breakthrough solution enables users to mirror strategies of top-performing traders through advanced, automated bots — delivering precision, speed, and real-time adaptability.

By integrating automation with artificial intelligence, WiseChain.io redefines the modern investing experience. The platform is ideal for both beginners and professionals, empowering users to benefit from expert-level trading without needing deep financial expertise.

A Trusted Partner for Canadian Investors

For Canadian clients, WiseChain.io offers a secure, fully compliant platform that operates under strict international standards. With rigorous KYC and AML protocols, segregated fund storage, and end-to-end encryption, users can trade confidently in a transparent and legally sound environment. Bilingual support in English and French, combined with access to a broad range of markets — including forex, crypto, stocks, commodities, and ETFs — positions WiseChain.io as a top choice for Canadian investors.

Empowering Seniors Toward Financial Independence

Understanding the needs of older investors, WiseChain.io also provides a user-friendly and low-risk environment tailored to individuals over 50. With step-by-step guidance, flexible strategies, and minimal commissions, seniors can easily manage their savings, build passive income, and secure a more comfortable retirement — even without prior trading experience.

Thousands of users have already embraced WiseChain.io as their partner in financial growth, thanks to its intuitive design, 24/7 customer support, and clear educational resources.

Discover the Future of Smart Investing

Whether you’re a high-net-worth trader, a cautious retiree, or a Canadian investor looking for a reliable platform, WiseChain.io offers the tools, technology, and transparency to help you succeed.

Visit wisechain.io to start your journey toward smarter, safer investing.

Social Links

Media Contact

Brand: WiseChain

Contact: media team

Email: support@wisechain.io

Website: https://wisechain.io

After losing almost 6% in a dramatic daily move, XRP fell below an important support levels and entered a critical zone. It is currently trading at about $2.20. The decline is putting the $2.00 threshold in sight and may serve as the next significant test for bulls after it was rejected at several resistance points.

What's even worse is that XRP is currently trading below the 100-day Exponential Moving Average (EMA), which traders frequently monitor to confirm trends. If selling pressure increases on the larger cryptocurrency market, this breakdown may mark the start of a longer downward trend. With lower highs forming since the December peak, the technical chart indicates that XRP is still trapped inside a descending channel. Chart by TradingView">

The recent failure to recover the resistance zone between $2.37 and $2.42 has strengthened the bearish argument. Additionally, volume is increasing on red candles, indicating that bears are becoming more active while buyers are pulling back. The psychological level of $2.00 is the next local support, followed by $1.93, where the 200-day EMA is presently trading.

The $1.75 zone, which served as a crucial support during the late 2024 consolidation phase, could see an acceleration of losses if this support cluster is broken. The Relative Strength Index (RSI), which shows increasing bearish momentum but also leaves room for volatility, has dropped to about 42. A short-term bounce is feasible if XRP can maintain the $2.00 level; however, in order to turn the trend back in favor of bulls, it would need to swiftly regain the 100 EMA.

Shiba Inu's bullishness is gone

Once again, Shiba Inu has faltered at a crucial resistance level, raising questions about its short-term bullishness. The asset has experienced a significant retracement following a promising upward move that momentarily lifted the price above $0.00001400. It is currently trading at $0.00001327, down more than 5% for the day. The 50-day Exponential Moving Average (EMA), which has continuously served as a barrier during SHIB's recent decline, was exactly where the rejection occurred.

The price's inability to sustain momentum resulted in what now seems to be a classic fakeout, disappointing traders who were expecting a breakout. SHIB temporarily regained higher territory on the chart after breaking above a descending trendline. But the move's weakness was soon revealed by the lack of volume and follow-through. SHIB reversed back into its previous range, invalidating the signal and raising the possibility that bulls may have jumped the gun rather than confirming a bullish breakout.

The increasing selling volume, which indicates that market participants are unloading positions as confidence wanes, adds to the bearish tone. Indicating that momentum has turned back to the downside, the Relative Strength Index (RSI) has also dropped to 47. SHIB needs to protect the $0.00001300 support level in the near future.

The asset may be exposed to additional downside if it breaks below it, possibly dragging it back toward the $0.00001200-$0.00001230 region. The likelihood of additional downside is still high until SHIB can clearly break above the 50 EMA and maintain its gains. The beginning of what appeared to be a bull run has swiftly evolved into a warning about resistance denial, reminding traders that genuine trend reversals require conviction to support momentum.

Dogecoin risking

Dogecoin is currently trading at around $0.1802, down more than 5% over the past day, and it is once again under bearish pressure as the meme coin is unable to hold onto important resistance and support levels. This recent action raises the possibility that Dogecoin is about to undergo a much more significant change — a possible decline that might add a zero and push DOGE below the $0.10 threshold.

When an asset loses a significant decimal place as a result of rapid devaluation, the term adding a zero in the context of cryptocurrency frequently denotes psychological breakdown. Additionally, Dogecoin's current technical configuration is moving in that direction. The $0.20 level, which was adjacent to DOGE's 50-day EMA, was recently rejected.

This rejection signaled a sea change and supported the wider downward trend that had been present since the beginning of February. Red candles and rising volume suggest that sellers are taking back control as the price is now dropping back into a descending range. Only $0.17, which was a bounce zone during February's consolidation, and $0.14, which was a crucial base during its Q4, 2024, rally remain important support levels for DOGE.

The path to $0.10 and perhaps even lower is straightforward if $0.17 is lost in the upcoming days. With its current downward trend and no indications of a reversal, the RSI is at 45. For Dogecoin bulls, the lack of buying pressure and the waning momentum could mean more difficulties down the road.

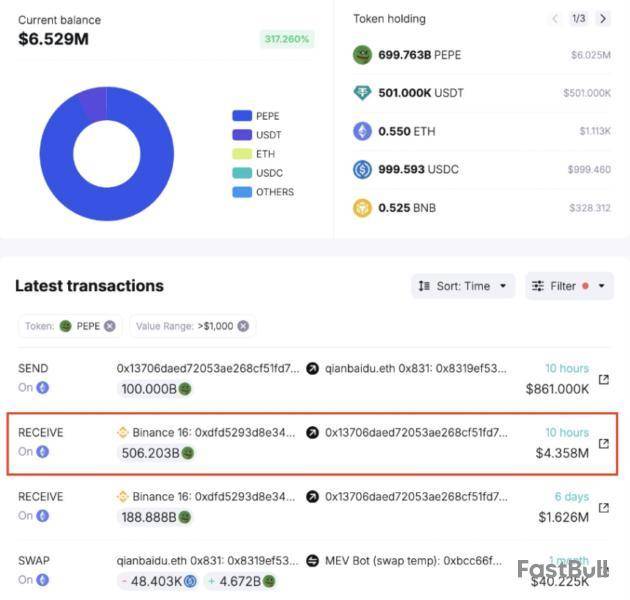

Deep pockets, big appetite. A major player in the cryptocurrency world has moved a lot of Pepe coins. According to reports, this whale, known as qianbaidu.eth, took out 506 billion Pepe tokens from the Binance exchange on March 26, 2025.

Big Appetite

That’s a lot of coins, worth about $4.4 million. This isn’t the first time this particular whale has played with Pepe; they previously made a good chunk of money, around $7.34 million, trading this meme coin.

Spot On Chain@spotonchainMar 27, 2025qianbaidu.eth, an early PEPE buyer who once made a $7.34M profit (+110%), withdrew 506.2B $PEPE ($4.4M) from #Binance ~10 hours ago!

Now, the whale holds 699.8B $PEPE ($5.11M), with a floating profit of $164K (+2.8%).

Follow @spotonchain and track the whale’s two active… pic.twitter.com/8NRljYTIBs

Why is Pepe suddenly attracting the attention of these major investors? As the story notes, Pepe has experienced some notable peaks in the past.

Its entire market value was $1.6 billion in 2023. It reached an even greater $11 billion in December 2024. These whales may be feeling more confident as a result of their previous performance. More People Are Holding Pepe

The number of people holding the meme coin has also gone up recently. Reports indicate that 542 new Pepe holders appeared in March 2025.

While the number of people holding Pepe for a long time has decreased, the fact that new investors are coming in, combined with the whales’ buying activity, suggests there might be some renewed interest in the coin.

Some believe that this whale buying frenzy may be signaling that the price of Pepe may rise once more. They recall the way the price skyrocketed earlier, driven by internet hype. The only question is if this is just a temporary rise in price, or if Pepe may again experience a big spike like last time.

It’s worth remembering that cryptocurrencies, particularly meme coins such as Pepe, can be extremely volatile. What the big investors do may at times provide a clue as to where the market is heading, but it isn’t a promise.

People need to exercise caution and carry out their own research before doing anything about buying or selling.

Featured image from Gemini Imagen, chart from TradingView

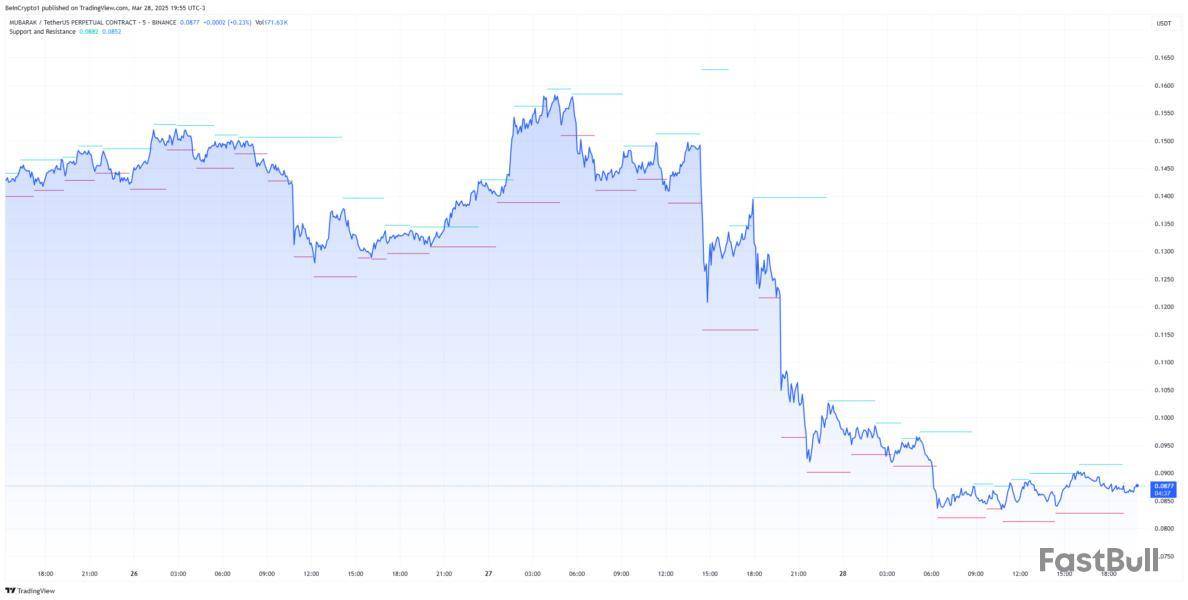

MUBARAK’s sharp 40% drop after its Binance listing has reignited debate around centralized exchange listing practices and the broader state of the meme coin ecosystem.

This came alongside growing scrutiny over speculative meme coin launches like JELLY, which recently triggered a short squeeze and dragged HYPE down, sparking fears of deeper structural risks.

MUBARAK Made The Community Discuss CEX Listing Processes

The steep drop in MUBARAK, now down 40% since its Binance debut, has reignited concerns about the quality of recent listings on centralized exchanges. Binance recently ended its first listing vote, with BROCCOLI and Tutorial surging.

Critics argue that these incidents undermine trust in both DeFi and CEX platforms, as meme coins continue to dominate headlines while more stable crypto sectors struggle for attention.

Still, some platforms like Pump.fun are pushing for innovation, introducing features like token burning and revenue sharing in an effort to steer meme coins toward a more sustainable future.

These concerns have only grown louder following the listing of speculative meme coins on Binance, including BNB Chain tokens like JELLY, which have added to the scrutiny.

Binance founder Changpeng Zhao (CZ) has addressed this criticism, stating that token listings should not dictate long-term price action.

While listings can offer liquidity and improve market access, CZ emphasized that any price impact should be short-term. In the long run, token value should reflect real fundamentals—such as team commitment, development activity, and network performance.

Still, even as the community pushes for more transparency, Binance Alpha has continued to list controversial tokens, including two Studio Ghibli-themed meme coins.

Hyperliquid Crisis Made Users Question Meme Coins

MUBARAK’s drop was not the only crisis in the meme coin ecosystem this week. HYPE experienced a sharp decline following the JELLY short squeeze, triggering widespread speculation about the role of Hyperliquid and meme coins in the crypto ecosystem.

Some users have even questioned if this could be the beginning of an FTX-style collapse as concerns grow over the unchecked volatility tied to meme coin derivatives.

The JELLY controversy has ignited debate around the fragility of emerging platforms and whether enough safeguards are in place to prevent systemic fallout from meme-driven market events. In response to the backlash, Hyperliquid announced it would strengthen its security measures to prevent similar incidents in the future.

Jean Rausis, co-founder of the decentralized finance ecosystem SMARDEX, told BeInCrypto that the DeFi ecosystem needs to think about the image it sends to the market:

“If we want DeFi to be adopted, the ecosystem needs to gain trust not only with its existing users but also in terms of the image it presents in the news. And it’s clear that with projects wrongly labelling themselves as “decentralized”, more incidents like this will happen.”

Sectors Like RWA Could Help To Grow Crypto Credibility

Kevin Rusher, founder of decentralized lending protocol RAAC, described the situation as a major blow to DeFi’s credibility. “This is another setback for DeFi adoption, but it’s not a surprise,” he said, noting that meme coins have reignited retail greed and diverted liquidity away from more sustainable sectors of the ecosystem.

He warned that tokens like TRUMP and MELANIA had captured too much mindshare during the last market surge, leaving DeFi vulnerable to speculative chaos.

Still, Rusher pointed to the growing involvement of institutions like BlackRock as a sign of hope:

“But it looks like institutions and big players like BlackRock also understand this need for stability in crypto, which is why they are now seriously focused on the tokenization of Real World Assets (RWAs). The unfortunate reality is that memecoins are likely here to stay, and they will be a real obstacle for DeFi growth in the short term. However, with RWAs bringing huge liquidity into the system from traditional finance, this sector will finally have the opportunity to grow without memecoin frenzies putting the whole ecosystem in danger.” – Rusher told BeInCrypto.

More Innovation Could Bring Renewed Interest In Meme Coins

In a recent conversation with Bankless, PumpFun co-founder Alon Cohen shared insights about the meme coins market, highlighting PumpFun’s 4Chan-inspired aesthetic, bonding curve pricing model, and new creator-focused initiatives.

Pump.fun has generated over 8.8 million tokens and once peaked with a record $14 million in daily revenue, totaling $600 million since launch.

Alon emphasized that while the meme coin market is cooling—down nearly 49% from its $125 billion peak in December 2024—Pump.fun remains committed to supporting creative and community-driven projects.

To boost long-term sustainability, the team is now introducing revenue-sharing mechanisms for token creators, a transparent fee structure, and token-burning features to reduce the extractive nature of meme coin launches.

With new mechanisms like this, more buyers could come in, and a new generation of meme coin traders could emerge as the ecosystem tries to become more sustainable.

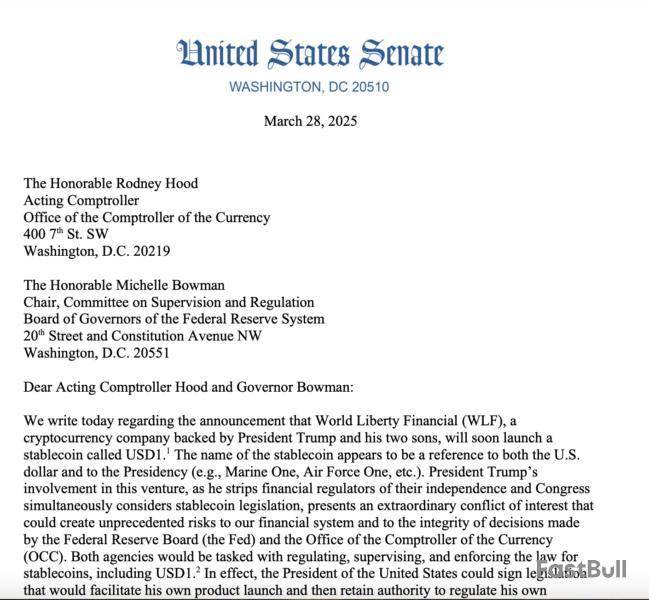

Five Democratic lawmakers in the US Senate have called on leadership at regulatory agencies to consider the potential conflicts of interest from a stablecoin launched by World Liberty Financial (WLFI), the crypto firm backed by US President Donald Trump’s family.

In a March 28 letter from the US Senate Banking Committee, Massachusetts Senator Elizabeth Warren and four other Democrats asked the Federal Reserve’s committee chair on supervision and regulation, Michelle Bowman, and acting comptroller of the currency, Rodney Hood, how they intended to regulate WLFI and its stablecoin, USD1.

The letter came as members of Congress are considering legislation to regulate stablecoins through the Guiding and Establishing National Innovation for US Stablecoins, or GENIUS Act. The bill, if signed into law, would essentially allow the Office of the Comptroller of the Currency (OCC) and Federal Reserve to oversee stablecoin regulation, including for issuers like WLFI and its USD1 coin.

Trump also signed an executive order in February attempting to have all federal agencies — purportedly including the OCC — “regularly consult with and coordinate policies and priorities” with White House officials, giving the US president unprecedented control.

“President Trump’s involvement in this venture, as he strips financial regulators of their independence and Congress simultaneously considers stablecoin legislation, presents an extraordinary conflict of interest that could create unprecedented risks to our financial system and to the integrity of decisions made by the [Fed and OCC],” said the letter, adding:

Since World Liberty launched in September 2024 — months before the US election and Trump’s inauguration — many of the firm’s goals have been shrouded in secrecy. The project’s website notes that Trump and some of his family members control 60% of the company’s equity interests.

As of March 14, World Liberty had completed two public token sales, netting the company a combined $550 million. On March 24, the project confirmed launching its first stablecoin on the BNB Chain and Ethereum. The president’s son, Donald Trump Jr., also pitched USD1 from the DC Blockchain Summit on March 26 with three of WLFI’s co-founders.

The launch of Alpha Season 5 in The Sandbox (SAND) with exclusive Jurassic World rewards is a significant event. This brings in excitement and could attract new users, especially fans of Jurassic World. The increase in users and activities can stimulate demand for SAND tokens, potentially increasing its price. However, if the season does not meet player expectations, there might be less interest and a chance of price stagnation. Observing user engagement and feedback will be essential to gauge the actual price impact. source

The Sandbox@TheSandboxGameMar 28, 2025The wait is almost over. Alpha Season 5 is coming on March 31st!

Pre-register now for an exclusive @JurassicWorld reward https://t.co/FlVlHgMiRV#TheSandbox #AlphaSeason5 $SAND #JurassicWorld pic.twitter.com/Hvh4PmrRGp

Alchemist AI (ALCH) is deploying important updates like Deepseek V3 and Sonnet 3.7, which could be crucial for user experience. Improved UI/UX may draw more users, increasing demand for the token. These updates can show progress and innovation, boosting investor confidence and possibly driving prices up. However, if the updates fail to meet user expectations or there's a bug, it may cause prices to drop. Attention to community feedback and update success will be vital to understand potential price changes. source

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up