Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

What Happened?

Shares of regional banking company Valley National Bancorp jumped 4.5% in the afternoon session after the broader market rallied as a favorable inflation report boosted optimism for a potential interest rate cut by the Federal Reserve. The positive market sentiment was triggered by the July Consumer Price Index report, which showed annual inflation holding steady at 2.7%, slightly better than economists had anticipated. This news fueled optimism for a potential interest rate cut from the Federal Reserve, sending major indexes like the S&P 500 and Nasdaq to new all-time highs. Bank stocks, which are highly sensitive to interest rate expectations, joined the broader market rally. While higher interest rates can sometimes increase bank profits, the prospect of a stable or declining rate environment can reduce fears of an economic slowdown, which is generally positive for financial institutions.

The shares closed the day at $9.75, up 4.6% from previous close.

Is now the time to buy Valley National Bank? Access our full analysis report here, it’s free.

What Is The Market Telling Us

Valley National Bank’s shares are not very volatile and have only had 7 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful, although it might not be something that would fundamentally change its perception of the business.

The previous big move we wrote about was 11 days ago when the stock dropped 3.5% on the news that a surprisingly weak July jobs report and the announcement of sweeping new tariffs fueled fears of an economic slowdown and an impending interest rate cut. The U.S. economy added just 73,000 jobs in July, the weakest gain in over two years, while the unemployment rate rose to 4.2%. This dismal data significantly increased market expectations for a Federal Reserve interest rate cut, with traders now pricing in an 80% probability of a cut in September. Lower interest rates typically harm bank profitability by compressing their net interest margins—the difference between what they earn on loans and pay on deposits. Compounding these worries, the announcement of new tariffs on imports from 92 countries has sparked fears of a global trade war, which could further dampen economic growth and disrupt supply chains, creating a challenging environment for the banking industry.

Valley National Bank is up 9.2% since the beginning of the year, but at $9.75 per share, it is still trading 9.6% below its 52-week high of $10.78 from November 2024. Investors who bought $1,000 worth of Valley National Bank’s shares 5 years ago would now be looking at an investment worth $1,201.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

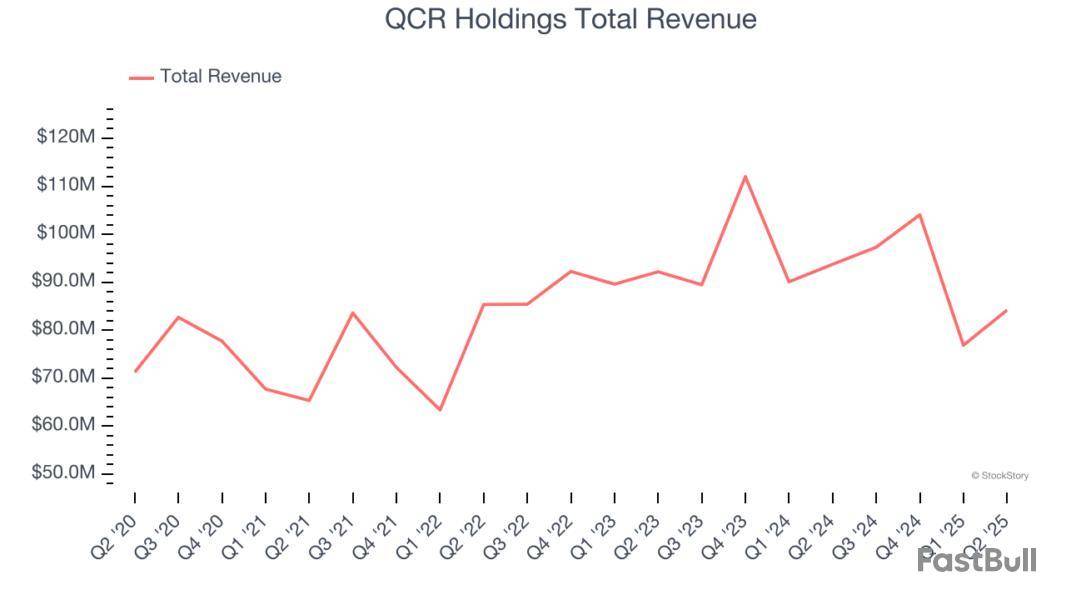

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how QCR Holdings and the rest of the regional banks stocks fared in Q2.

Regional banks, financial institutions operating within specific geographic areas, serve as intermediaries between local depositors and borrowers. They benefit from rising interest rates that improve net interest margins (the difference between loan yields and deposit costs), digital transformation reducing operational expenses, and local economic growth driving loan demand. However, these banks face headwinds from fintech competition, deposit outflows to higher-yielding alternatives, credit deterioration (increasing loan defaults) during economic slowdowns, and regulatory compliance costs. Recent concerns about regional bank stability following high-profile failures and significant commercial real estate exposure present additional challenges.

The 78 regional banks stocks we track reported a satisfactory Q2. As a group, revenues were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.9% since the latest earnings results.

With roots dating back to 1993 and a name reflecting its original Quad Cities market, QCR Holdings (NASDAQGM:QCRH) operates four community banks across Iowa and Missouri, providing commercial, consumer banking, and trust services to businesses and individuals.

QCR Holdings reported revenues of $84.2 million, down 10.2% year on year. This print fell short of analysts’ expectations by 1.2%. Overall, it was a mixed quarter for the company with a decent beat of analysts’ EPS estimates but net interest income in line with analysts’ estimates.

“We delivered strong second quarter results highlighted by a significant increase in net interest income from the previous quarter, driven by both net interest margin expansion and strong loan growth, as well as improved capital markets revenue, and disciplined noninterest expense management,” said Todd Gipple, President and Chief Executive Officer.

Unsurprisingly, the stock is down 7.3% since reporting and currently trades at $69.91.

Is now the time to buy QCR Holdings? Access our full analysis of the earnings results here, it’s free.

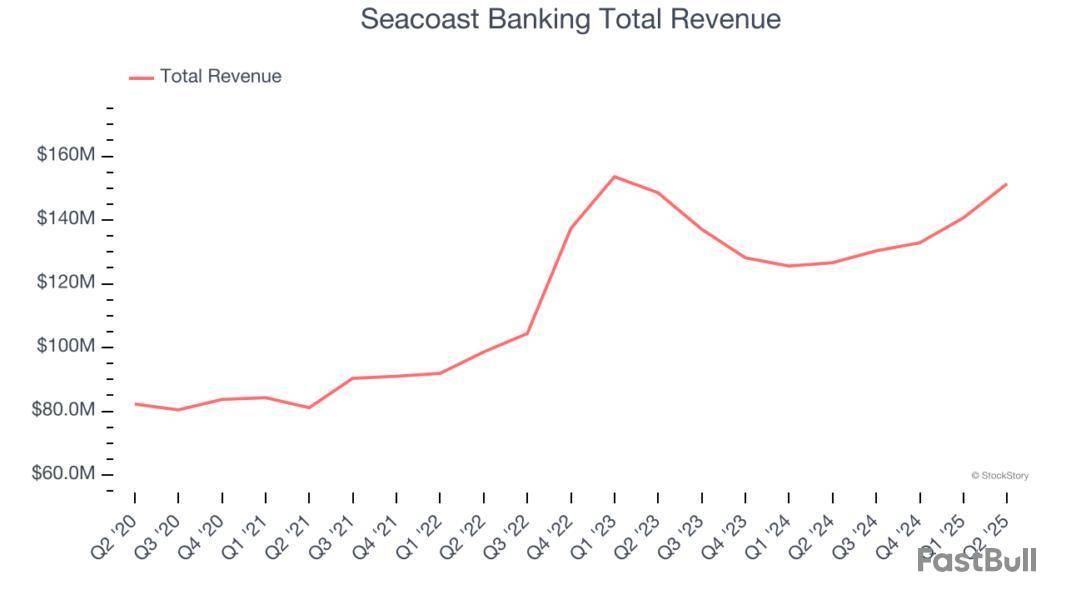

Founded during the Florida land boom of 1926 and surviving the Great Depression, Seacoast Banking Corporation of Florida is a financial holding company that provides commercial and retail banking, wealth management, and mortgage services throughout Florida.

Seacoast Banking reported revenues of $151.4 million, up 19.6% year on year, outperforming analysts’ expectations by 5%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ net interest income estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 5% since reporting. It currently trades at $27.43.

Is now the time to buy Seacoast Banking? Access our full analysis of the earnings results here, it’s free.

Pioneering the intersection of traditional banking and financial technology in the Pacific Northwest, Coastal Financial operates as a bank holding company that provides traditional banking services and Banking-as-a-Service (BaaS) solutions to consumers and businesses.

Coastal Financial reported revenues of $119.4 million, down 11.7% year on year, falling short of analysts’ expectations by 21.5%. It was a disappointing quarter as it posted a significant miss of analysts’ net interest income estimates and a significant miss of analysts’ EPS estimates.

As expected, the stock is down 7.7% since the results and currently trades at $93.59.

Read our full analysis of Coastal Financial’s results here.

Tracing its roots back to 1927 during the economic boom before the Great Depression, Valley National Bancorp (NASDAQGS:VLY) operates Valley National Bank, providing commercial, consumer, and wealth management banking services across several states.

Valley National Bank reported revenues of $495 million, up 9% year on year. This print topped analysts’ expectations by 0.5%. Aside from that, it was a mixed quarter as it also logged a decent beat of analysts’ EPS estimates but net interest income in line with analysts’ estimates.

The stock is down 5.3% since reporting and currently trades at $9.19.

Read our full, actionable report on Valley National Bank here, it’s free.

With roots dating back to 1885 and a strategic focus on middle-market commercial lending, Cadence Bancorporation is a bank holding company that provides commercial banking, retail banking, and wealth management services to middle-market businesses and individuals.

Cadence Bank reported revenues of $476.3 million, up 7.6% year on year. This number beat analysts’ expectations by 1.6%. It was a satisfactory quarter as it also produced a narrow beat of analysts’ tangible book value per share estimates.

The stock is down 5.6% since reporting and currently trades at $33.95.

Read our full, actionable report on Cadence Bank here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

What Happened?

A number of stocks fell in the morning session after a surprisingly weak July jobs report and the announcement of sweeping new tariffs fueled fears of an economic slowdown and an impending interest rate cut.

The U.S. economy added just 73,000 jobs in July, the weakest gain in over two years, while the unemployment rate rose to 4.2%. This dismal data significantly increased market expectations for a Federal Reserve interest rate cut, with traders now pricing in an 80% probability of a cut in September. Lower interest rates typically harm bank profitability by compressing their net interest margins—the difference between what they earn on loans and pay on deposits. Compounding these worries, the announcement of new tariffs on imports from 92 countries has sparked fears of a global trade war, which could further dampen economic growth and disrupt supply chains, creating a challenging environment for the banking industry.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks.

Among others, the following stocks were impacted:

Zooming In On Valley National Bank (VLY)

Valley National Bank’s shares are not very volatile and have only had 7 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful, although it might not be something that would fundamentally change its perception of the business.

Valley National Bank is up 2.6% since the beginning of the year, but at $9.16 per share, it is still trading 15% below its 52-week high of $10.78 from November 2024. Investors who bought $1,000 worth of Valley National Bank’s shares 5 years ago would now be looking at an investment worth $1,233.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Valley National Bancorp’s VLY second-quarter 2025 adjusted earnings per share of 23 cents surpassed the Zacks Consensus Estimate by a penny. Also, the bottom line increased 76.9% on a year-over-year basis.

Results were primarily aided by increased net interest income (NII) and non-interest income. A decline in provisions was another tailwind. However, higher expenses hurt the results to some extent. This seems to have disappointed investors as shares of VLY lost 1.8% in yesterday’s trading session.

Results excluded non-core income and charges. After considering these, net income was $133.2 million, surging 89.1% from the year-ago quarter.

Valley National’s Revenues Improve, Expenses Rise

Total revenues (fully-taxable-equivalent or FTE basis) were $496.3 million, up 9.3% year over year. The top line beat the Zacks Consensus Estimate of $493.2 million.

NII (FTE basis) was $433.7 million, up 7.6% year over year. The net interest margin (FTE basis) was 3.01%, which expanded 17 basis points (bps).

Non-interest income increased 22.2% year over year to $62.6 million. The rise was driven by an increase in almost all fee income components, except for insurance commissions.

Non-interest expenses of $284.1 million increased 2.4% year over year. Meanwhile, adjusted non-interest expenses rose 1.2% to $273.3 million.

The adjusted efficiency ratio was 55.20%, down from 59.62% in the prior-year quarter. A decline in the efficiency ratio indicates an improvement in profitability.

VLY’s Loans & Deposits Rise

As of June 30, 2025, total loans were $49.4 billion, up 1.5% on a sequential basis. Total deposits were $50.7 billion, up 1.5% from the previous quarter.

Valley National’s Credit Quality: A Mixed Bag

As of June 30, 2025, total non-performing assets were $360.8 million, up 15.3% year over year. Allowance for credit losses as a percentage of total loans was 1.20%, up 14 bps from the year-ago quarter.

However, provision for credit losses was $37.8 million, down 53.9% year over year.

VLY’s Profitability & Capital Ratios Improve

At the end of the second quarter, adjusted annualized return on average assets was 0.87%, up from 0.47% in the year-earlier quarter. Adjusted annualized return on average shareholders’ equity was 7.15%, up from 4.24%.

VLY's tangible common equity to tangible assets ratio was 8.63% as of June 30, 2025, up from 7.52% in the corresponding period of 2024. Tier 1 risk-based capital ratio was 11.57%, up from 9.98%. Also, the common equity tier 1 capital ratio of 10.85% was up from 9.55% as of June 30, 2024.

Our Take on Valley National

VLY’s organic growth trajectory, strategic acquisitions and solid balance sheet will support its financials. However, persistently increasing costs and deteriorating asset quality are major concerns. The company’s huge CRE loan exposure is worrisome.

Valley National Bancorp Price, Consensus and EPS Surprise

Valley National Bancorp price-consensus-eps-surprise-chart | Valley National Bancorp Quote

Valley National currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of VLY’s Peers

Zions Bancorporation’s ZION second-quarter 2025 adjusted earnings per share of $1.58 beat the Zacks Consensus Estimate of $1.31. Moreover, the bottom line rallied 30.6% from the year-ago quarter.

Zions’ results were primarily aided by higher net interest income and non-interest income, alongside a provision benefit. Higher loan amounts were another positive. However, a rise in adjusted non-interest expenses acted as a major headwind.

Bank OZK’s OZK second-quarter 2025 earnings per share of $1.58 surpassed the Zacks Consensus Estimate of $1.51. Moreover, the bottom line reflected a rise of 3.9% from the prior-year quarter.

Overall, the results benefited from a rise in NII and non-interest income and lower provisions. Higher loans and deposit balances were other positives. However, higher non-interest expenses acted as spoilsports for Bank OZK.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up