Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[CITIC Securities: Current US Financial Market Environment Does Not Favor Balance Sheet Reduction] CITIC Securities Points Out That Although Warsh Repeatedly Mentioned The Policy Direction Of Interest Rate Cuts And Balance Sheet Reduction In 2025, Considering That The Liquidity Pressure In The US Money Market Only Significantly Eased In January, The Current Reserve-to-GDP Ratio Is Still Around 10%, And The Fed's Assets Held As A Percentage Of GDP Are Around 20%, Approaching The Pre-pandemic Level Of 2018, Indicating Limited Overall Reserve Adequacy. If Warsh Becomes The Next Fed Chairman, And If He Quickly Initiates Balance Sheet Reduction After Taking Office, The US Money Market May Face Liquidity Pressure Again. Therefore, Overall, CITIC Securities Believes That The Current US Financial Market Environment Does Not Favor Balance Sheet Reduction

UN Secretary General Guterres: Dissolution Of New Start Could Not Come At A Worse Time, With Risk Of Nuclear Weapon Use At Highest In Decades

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)A:--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)A:--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)A:--

F: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)A:--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)A:--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)A:--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)A:--

F: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)A:--

F: --

P: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)A:--

F: --

P: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction Yield--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP Growth--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)--

F: --

P: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. Yield--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)--

F: --

P: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)--

F: --

P: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest Rate--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing Rate--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

ECB Press Conference

ECB Press Conference

Aris Aris

ID: 9979627

No matching data

View All

No data

What Happened?

Shares of cross-border payment platform Payoneer fell 4.3% in the afternoon session after Benchmark lowered its price target on the stock, citing macroeconomic uncertainty. The financial services firm cut its price target on Payoneer to $10 from $12. The adjustment was linked to headwinds that faced the company's small and medium-sized business customers as they struggled to adapt to changing U.S. tariff policies. Despite the lower price target, Benchmark maintained its "Buy" rating on the company's shares.

What Is The Market Telling Us

Payoneer’s shares are very volatile and have had 21 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The biggest move we wrote about over the last year was about 2 months ago when the stock dropped 11.2% on the news that the company's third-quarter 2025 financial results revealed a significant drop in profitability that overshadowed its revenue growth. While revenue grew 9.1% year-over-year to $270.9 million, beating analysts' expectations, the company's profitability took a significant hit. GAAP earnings per share (EPS), a key measure of profit, came in at $0.04. This result was not only a steep decline from the $0.11 reported in the same quarter last year but also missed Wall Street's consensus estimate of $0.06. Although Payoneer’s full-year revenue guidance came in slightly ahead of expectations, this positive point was not enough to reassure investors, who focused on the sharp drop in earnings.

Payoneer is down 45.5% since the beginning of the year, and at $5.54 per share, it is trading 49.9% below its 52-week high of $11.04 from February 2025. Investors who bought $1,000 worth of Payoneer’s shares 5 years ago would now be looking at an investment worth $538.95.

Marketplace volumes remain soft, but B2B and card products are driving growth, with strong momentum in APAC and LATAM. Adaptive pricing and upmarket focus are expanding take-rates, while a stablecoin wallet launch in 2026 aims to enhance cross-border payment innovation.

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how diversified financial services stocks fared in Q3, starting with NCR Atleos .

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

The 10 diversified financial services stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 3% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 1.7% on average since the latest earnings results.

Spun off from NCR Voyix in 2023 to focus exclusively on self-service banking technology, NCR Atleos provides self-directed banking solutions including ATM and interactive teller machine technology, software, services, and a surcharge-free ATM network for financial institutions and retailers.

NCR Atleos reported revenues of $1.12 billion, up 4.5% year on year. This print exceeded analysts’ expectations by 0.6%. Despite the top-line beat, it was still a softer quarter for the company with a significant miss of analysts’ EPS estimates.

Unsurprisingly, the stock is down 2.5% since reporting and currently trades at $36.89.

Is now the time to buy NCR Atleos? Access our full analysis of the earnings results here, it’s free for active Edge members.

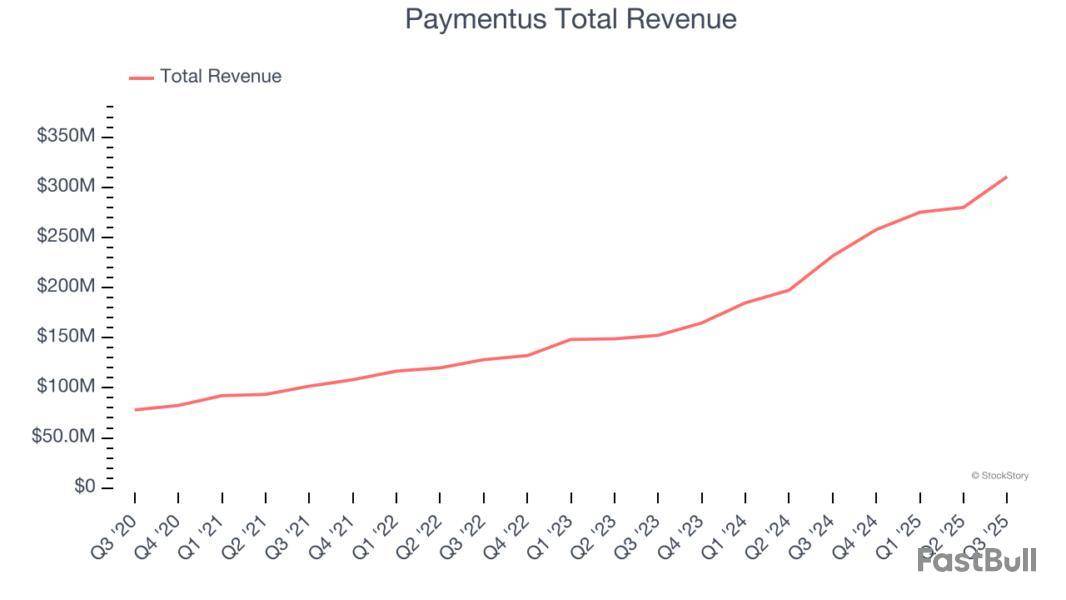

Founded in 2004 to simplify the complex world of bill payments, Paymentus provides a cloud-based platform that helps utilities, municipalities, and service providers automate billing and payment processes.

Paymentus reported revenues of $310.7 million, up 34.2% year on year, outperforming analysts’ expectations by 10.7%. The business had a stunning quarter with an impressive beat of analysts’ revenue estimates and a solid beat of analysts’ EBITDA estimates.

Paymentus achieved the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 19.8% since reporting. It currently trades at $34.27.

Is now the time to buy Paymentus? Access our full analysis of the earnings results here, it’s free for active Edge members.

Operating a global network of over 47,000 ATMs and 821,000 point-of-sale terminals across more than 60 countries, Euronet Worldwide provides electronic payment solutions including ATM services, prepaid product processing, and international money transfer services.

Euronet Worldwide reported revenues of $1.15 billion, up 4.2% year on year, falling short of analysts’ expectations by 4.5%. It was a softer quarter as it posted a significant miss of analysts’ EFT Processing segment estimates and a significant miss of analysts’ Money Transfer segment estimates.

Euronet Worldwide delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 17.8% since the results and currently trades at $72.84.

Read our full analysis of Euronet Worldwide’s results here.

Founded during the early days of global e-commerce in 2005 to solve international payment challenges, Payoneer provides financial technology services that enable small and medium-sized businesses to send and receive payments globally across borders.

Payoneer reported revenues of $270.9 million, up 9.1% year on year. This number beat analysts’ expectations by 2.9%. Taking a step back, it was a mixed quarter as it also recorded a solid beat of analysts’ yield estimates but EPS in line with analysts’ estimates.

The stock is down 2% since reporting and currently trades at $5.68.

Read our full, actionable report on Payoneer here, it’s free for active Edge members.

Born from founder Tim Chen's frustration with the lack of transparent credit card information when helping his sister in 2009, NerdWallet is a digital platform that provides financial guidance to help consumers and small businesses make smarter decisions about credit cards, loans, insurance, and other financial products.

NerdWallet reported revenues of $215.1 million, up 12.4% year on year. This print surpassed analysts’ expectations by 11.3%. It was an exceptional quarter as it also put up an impressive beat of analysts’ revenue estimates and a solid beat of analysts’ EBITDA estimates.

NerdWallet achieved the biggest analyst estimates beat among its peers. The stock is up 23% since reporting and currently trades at $14.74.

Read our full, actionable report on NerdWallet here, it’s free for active Edge members.

Wrapping up Q3 earnings, we look at the numbers and key takeaways for the diversified financial services stocks, including WEX and its peers.

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

The 10 diversified financial services stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 3% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 1.7% on average since the latest earnings results.

Originally founded in 1983 as Wright Express to serve the fleet card market, WEX provides payment processing and business solutions across fleet management, employee benefits, and corporate payments sectors.

WEX reported revenues of $691.8 million, up 4% year on year. This print exceeded analysts’ expectations by 1.5%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ Account Servicing segment estimates but a slight miss of analysts’ Payment Processing segment estimates.

“Our strategy to return to revenue growth was demonstrated in the third quarter with both revenue and earnings exceeding the high end of our guidance ranges,” said Melissa Smith, WEX’s Chair, Chief Executive Officer, and President.

Unsurprisingly, the stock is down 2.9% since reporting and currently trades at $149.61.

Is now the time to buy WEX? Access our full analysis of the earnings results here, it’s free for active Edge members.

Founded in 2004 to simplify the complex world of bill payments, Paymentus provides a cloud-based platform that helps utilities, municipalities, and service providers automate billing and payment processes.

Paymentus reported revenues of $310.7 million, up 34.2% year on year, outperforming analysts’ expectations by 10.7%. The business had a stunning quarter with an impressive beat of analysts’ revenue estimates and a solid beat of analysts’ EBITDA estimates.

Paymentus pulled off the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 19.8% since reporting. It currently trades at $34.27.

Is now the time to buy Paymentus? Access our full analysis of the earnings results here, it’s free for active Edge members.

Spun off from NCR Voyix in 2023 to focus exclusively on self-service banking technology, NCR Atleos provides self-directed banking solutions including ATM and interactive teller machine technology, software, services, and a surcharge-free ATM network for financial institutions and retailers.

NCR Atleos reported revenues of $1.12 billion, up 4.5% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 2.5% since the results and currently trades at $36.89.

Read our full analysis of NCR Atleos’s results here.

With a history dating back to 1851 when it began as a telegraph company, Western Union is a global money transfer service that enables consumers and businesses to send funds across borders and currencies, typically within minutes.

Western Union reported revenues of $1.03 billion, flat year on year. This number topped analysts’ expectations by 1%. It was a strong quarter as it also recorded a beat of analysts’ EPS estimates and full-year revenue guidance slightly topping analysts’ expectations.

Western Union achieved the highest full-year guidance raise among its peers. The stock is up 5.8% since reporting and currently trades at $8.61.

Read our full, actionable report on Western Union here, it’s free for active Edge members.

Founded during the early days of global e-commerce in 2005 to solve international payment challenges, Payoneer provides financial technology services that enable small and medium-sized businesses to send and receive payments globally across borders.

Payoneer reported revenues of $270.9 million, up 9.1% year on year. This result beat analysts’ expectations by 2.9%. Aside from that, it was a mixed quarter as it also logged a solid beat of analysts’ yield estimates but EPS in line with analysts’ estimates.

The stock is down 2% since reporting and currently trades at $5.68.

Read our full, actionable report on Payoneer here, it’s free for active Edge members.

What Happened?

A number of stocks jumped in the afternoon session after investors grew more optimistic about a potential Federal Reserve interest rate cut in December.

The positive sentiment was fueled by comments from New York Fed President John Williams, a voting member of the rate-setting Federal Open Market Committee, who stated the central bank could cut rates "in the near term" without jeopardizing its inflation targets. Following his remarks, market expectations for a rate cut in December shifted significantly. According to the CME FedWatch Tool, the probability of a December rate reduction surged from a 37% chance earlier in the day to 70%. While lower rates can compress bank profit margins, investors often view them as a catalyst for broader economic activity, potentially boosting loan demand and reducing the risk of defaults.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks.

Among others, the following stocks were impacted:

Zooming In On Piper Sandler (PIPR)

Piper Sandler’s shares are somewhat volatile and have had 11 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The previous big move we wrote about was 21 days ago when the stock gained 2.8% on the news that the company reported strong third-quarter 2025 results that surpassed analyst expectations for both earnings and revenue. The investment bank announced adjusted earnings per share of $3.82, beating consensus estimates of $3.27. Revenue was also a bright spot, coming in at $479.3 million against estimates of $436.7 million. This represented a 33.3% increase compared to the same period last year. The firm's pre-tax profit margin also showed significant improvement, expanding to 22.4%, which was 6.9 percentage points better than the same quarter last year. Overall, it was a solid quarter for the company, with significant beats on both the top and bottom lines.

Piper Sandler is up 8.6% since the beginning of the year, but at $325.18 per share, it is still trading 12% below its 52-week high of $369.40 from September 2025. Investors who bought $1,000 worth of Piper Sandler’s shares 5 years ago would now be looking at an investment worth $3,499.

Payoneer’s third quarter results were met with a significant negative market reaction, as investors digested the company’s revenue growth and margin dynamics alongside management’s strategic focus. While the company delivered year-over-year growth driven by higher average revenue per user and an expanding B2B business, management acknowledged modest softness in marketplace volumes, particularly influenced by ongoing global trade volatility and tariffs. CEO John Caplan credited the results to deliberate moves upmarket, stating, “We are focusing on industries and countries where we have the strongest product market fit,” and highlighted the shift to serving larger, more complex customers as a key driver of performance.

Is now the time to buy PAYO? Find out in our full research report (it’s free for active Edge members).

Payoneer (PAYO) Q3 CY2025 Highlights:

While we enjoy listening to the management's commentary, our favorite part of earnings calls are the analyst questions. Those are unscripted and can often highlight topics that management teams would rather avoid or topics where the answer is complicated. Here is what has caught our attention.

Our Top 5 Analyst Questions From Payoneer’s Q3 Earnings Call

Mayank Tandon (Needham & Company) asked about the sustainability of Payoneer’s volume and take rate growth, and seasonality impacts for 2026. CFO Bea Ordonez highlighted the business’s resilience and durable ARPU growth but did not provide specific guidance for next year.

Mayank Tandon (Needham & Company) followed up on evolving sales capacity and go-to-market strategy as Payoneer diversifies beyond China. CEO John Caplan explained a deliberate focus on acquiring higher-quality customers through partnerships and selective paid acquisition.

Sanjay Sakhrani (KBW) inquired about the impact of tariffs and macro volatility on SMB customer volumes. Ordonez noted some marketplace softness, particularly in China, but said the Q3 performance was within expected ranges and that guidance accounts for ongoing trade uncertainties.

Unknown Analyst (Jefferies) questioned the sustainability of take rate expansion and B2B volume growth. Ordonez pointed to product adoption, pricing optimization, and B2B outperformance as key factors, with expectations for continued but moderating growth.

Christopher Svensson (Deutsche Bank) asked about the drivers behind customer funds growth and client incentives to retain more balances on the platform. Ordonez cited upmarket movement, broader product utility, and increased AP adoption as reasons for higher balances, which in turn support future revenue streams.

Catalysts in Upcoming Quarters

In upcoming quarters, the StockStory team will be monitoring (1) the pace of B2B revenue and AP product adoption, (2) execution on partnerships—particularly the migration of Checkout to Stripe and expansion in APAC markets, and (3) the growth and retention of larger, multi-entity customers as Payoneer moves upmarket. Progress toward blockchain and stablecoin integration will also be a key area to watch.

Payoneer currently trades at $5.64, down from $5.79 just before the earnings. Is there an opportunity in the stock?The answer lies in our full research report (it’s free for active Edge members).

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at PayPal and the best and worst performers in the diversified financial services industry.

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

The 10 diversified financial services stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 3% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 1.2% on average since the latest earnings results.

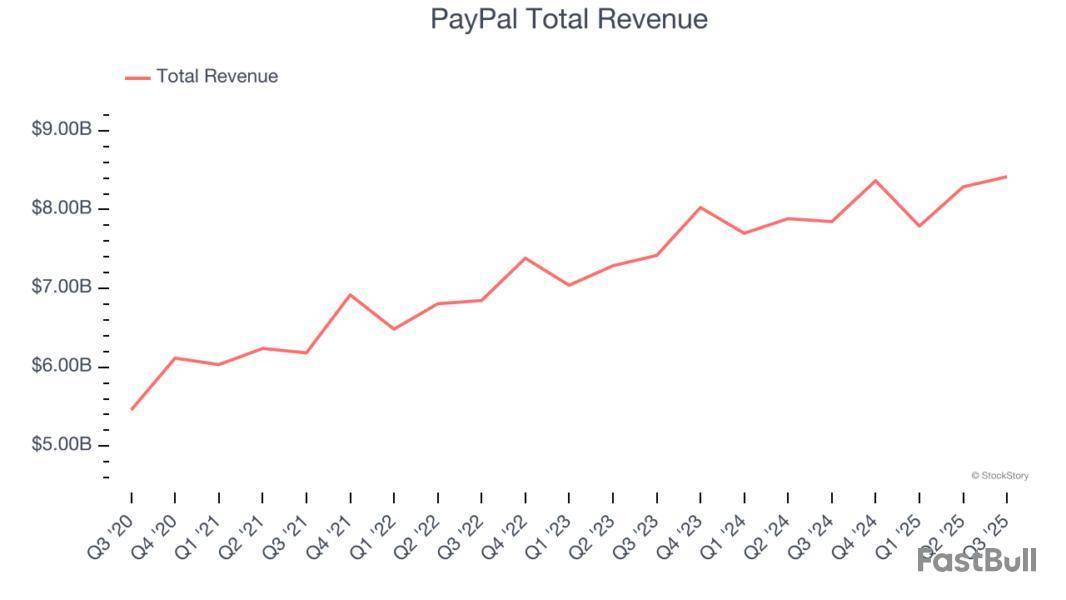

Originally spun off from eBay in 2015 after being acquired by the auction giant in 2002, PayPal operates a global digital payments platform that enables consumers and merchants to send, receive, and process payments online and in person.

PayPal reported revenues of $8.42 billion, up 7.3% year on year. This print exceeded analysts’ expectations by 2.2%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ transaction volumes estimates.

Unsurprisingly, the stock is down 4.5% since reporting and currently trades at $67.07.

Is now the time to buy PayPal? Access our full analysis of the earnings results here, it’s free for active Edge members.

Founded in 2004 to simplify the complex world of bill payments, Paymentus provides a cloud-based platform that helps utilities, municipalities, and service providers automate billing and payment processes.

Paymentus reported revenues of $310.7 million, up 34.2% year on year, outperforming analysts’ expectations by 10.7%. The business had a stunning quarter with a solid beat of analysts’ revenue estimates and an impressive beat of analysts’ EBITDA estimates.

Paymentus delivered the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 32.9% since reporting. It currently trades at $37.94.

Is now the time to buy Paymentus? Access our full analysis of the earnings results here, it’s free for active Edge members.

Spun off from NCR Voyix in 2023 to focus exclusively on self-service banking technology, NCR Atleos provides self-directed banking solutions including ATM and interactive teller machine technology, software, services, and a surcharge-free ATM network for financial institutions and retailers.

NCR Atleos reported revenues of $1.12 billion, up 4.5% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 6% since the results and currently trades at $35.62.

Read our full analysis of NCR Atleos’s results here.

Founded during the early days of global e-commerce in 2005 to solve international payment challenges, Payoneer provides financial technology services that enable small and medium-sized businesses to send and receive payments globally across borders.

Payoneer reported revenues of $270.9 million, up 9.1% year on year. This print beat analysts’ expectations by 2.9%. Taking a step back, it was a mixed quarter as it also produced a solid beat of analysts’ yield estimates but EPS in line with analysts’ estimates.

The stock is down 6.7% since reporting and currently trades at $5.40.

Read our full, actionable report on Payoneer here, it’s free for active Edge members.

Born from founder Tim Chen's frustration with the lack of transparent credit card information when helping his sister in 2009, NerdWallet is a digital platform that provides financial guidance to help consumers and small businesses make smarter decisions about credit cards, loans, insurance, and other financial products.

NerdWallet reported revenues of $215.1 million, up 12.4% year on year. This result surpassed analysts’ expectations by 11.3%. It was an exceptional quarter as it also recorded a solid beat of analysts’ revenue estimates and an impressive beat of analysts’ EBITDA estimates.

NerdWallet achieved the biggest analyst estimates beat among its peers. The stock is up 14.3% since reporting and currently trades at $13.73.

Read our full, actionable report on NerdWallet here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up