Markets

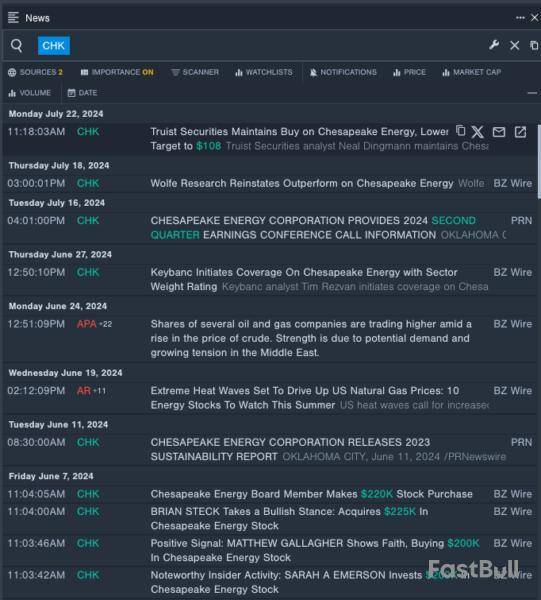

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Shares of LENZ Therapeutics, Inc. rose sharply in today's pre-market trading.

CORXEL and LENZ Therapeutics revealed topline data from China Phase 3 Presbyopia trial of LNZ100.

LENZ Therapeutics shares jumped 18% to $31.88 in the pre-market trading session.

Here are some other stocks moving in pre-market trading.

Gainers

Losers

Now Read This:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

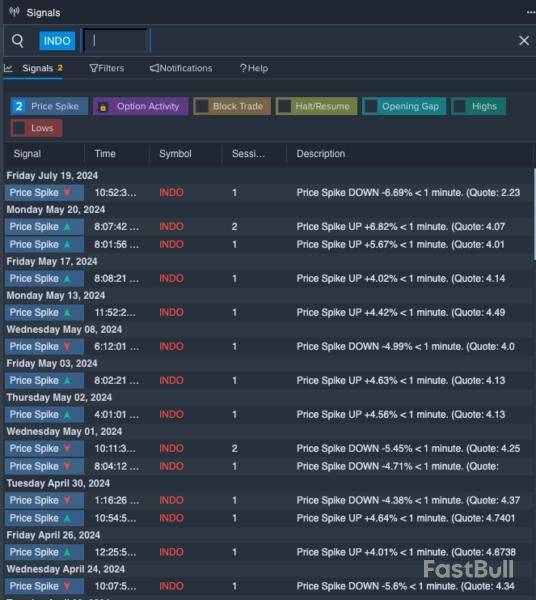

Indonesia Energy Corporation stock is trading higher on Monday, along with other companies in the oil and gas sector, as tensions in the Middle East rise after Israel and Hezbollah fired missiles across the Lebanon border.

The Details: Reuters reported that Hezbollah launched hundreds of rockets and drones aimed at northern Israel on Sunday. Israel’s military stated that it hit Lebanon with about 100 jets to avoid a larger attack.

Hezbollah leader Sayyed Hassan Nasrallah said that the attacks had been completed, “as planned,” and added that “if the result is not enough, then we retain the right to respond another time.”

Israel’s foreign minister stated that the country is not aiming for a full-scale war. Prime Minister Benjamin Netanyahu said, “This is not the end of the story.”

According to Reuters, Libya’s eastern government said that it would shut down oil production. However, the National Oil Corp, which controls Libya’s oil supply, did not confirm this; Tripoli’s government did not confirm this either.

Waha Oil Company, a National Oil Corp subsidiary, announced that it planned to slowly stop oil output due to protests and pressure. The company also operates a joint venture with both Total Energy and ConocoPhillips.

How To Buy Indonesia Energy Stock

By now you're likely curious about how to participate in the market for Indonesia Energy Corp – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy ‘fractional shares,' which allows you to own portions of stock without buying an entire share. For example, some stock, like Berkshire Hathaway, or Amazon.com, can cost thousands of dollars to own just one share. However, if you only want to invest a fraction of that, brokerages will allow you to do so.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to ‘go short' a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

See Also: From Data Centers To The Cloud: Transition Creates New Challenges For IT Pros, Analyst Says

INDO Price Action: At the time of publication, Indonesia Energy stock is trading 16.0% higher at $3.62, per data from Benzinga Pro.

Image: Photo via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shares of Kellanova rose sharply in today's pre-market trading following a report suggesting Mars is considering an acquisition of the company.

Kellanova shares jumped 14.5% to $72.10 in pre-market trading.

Here are some other stocks moving in pre-market trading.

Gainers

Losers

Now Read This:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The most oversold stocks in the energy sector presents an opportunity to buy into undervalued companies. `

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Read Next:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shares of Vaxxinity, Inc. fell sharply during Monday's session after the company announced its intention to voluntarily delist and deregister its Class A common stock.

Vaxxinity shares dipped 54.8% to $0.2150 on Monday.

Here are some other stocks moving in today’s mid-day session.

Gainers

Losers

Also Read: How To Earn $500 A Month From AZZ Stock Ahead Of Q4 Earnings

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shares of Riot Platforms, Inc. rose sharply in today's pre-market trading amid a rise in Bitcoin.

Bitcoin prices gained around 1.5% over the past 24 hours to $66,012 this morning.

Riot Platforms shares gained 5.3% to $9.61 in pre-market trading.

Here are some other stocks moving in pre-market trading.

Gainers

Losers

Read More: Investor Sentiment Edges Lower, S&P 500 Falls For Sixth Straight Day

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The blue-chip Dow and the S&P 500 were on track for weekly losses on Friday after most megacap growth stocks and chipmakers retreated, while some big banks fell after reporting dour quarterly earnings.

At 11:30 ET, the Dow Jones Industrial Average was down 0.84% at 38,136.43. The S&P 500 was down 0.92% at 5,151.28 and the Nasdaq Composite was down 1.08% at 16,263.911.

The top three S&P 500 (.PG.INX) percentage gainers:

** Globe Life , up 14.2%

** Newmont , up 2.6%

** Occidental Petroleum , up 2%

The top three S&P 500 (.PL.INX) percentage losers:

** Zoeti , down 7.5%

** Arista Networks , down 7.3%

** JPMorgan Chase , down 5.4%

The top three NYSE (.PG.N) percentage gainers:

** Indonesia Energy Corporation , up 57.1%

** Houston American Energy , up 38.1%

** HNR Acquisition , up 25.7%

The top two NYSE (.PL.N) percentage losers:

** Destiny Tech100 , down 23.6%

** GCT Semiconductor , down 12.5%

The top three Nasdaq (.PG.O) percentage gainers:

** EZGO Technologies (EZGO.O), up 49.9%

** Mobile-Health Network Solutions , up 24.3%

** Q32 Bio , up 25.5%

The top three Nasdaq (.PL.O) percentage losers:

** Monogram Orthopaedics , down 27.3%

** Agenus , down 18.8%

** Tritium DCFC , down 16.7%

** JPMorgan Chase & Co : down 5.4%

BUZZ - Falls on lower-than-expected 2024 NII forecast

** Newmont Corp : up 2.6%

** Barrick Gold Corp : up 1.8%

** AngloGold Ashanti Ltd : up 3.1%

** Gold Fields Ltd : up 3.2%

BUZZ - Gold miners jump as bullion hits record high

** Rio Tinto PLC : up 1.0%

** Southern Copper Corp : up 0.8%

** Freeport-McMoRan Inc : up 0.5%

BUZZ - Copper miners rise as metal hits highest since June 2022

** Advanced Micro Devices Inc : down 3.8%

** Intel Corp : down 3.4%

BUZZ - Slide after report of Chinese curbs on foreign chips

** Hecla Mining : up 1.4%

** Coeur Mining : up 4.7%

** First Majestic Silver : up 0.1%

** Pan America Silver : up 1.6%

BUZZ - Silver miners rise as metal hits over three-year high

** CarMax : down 0.4%

BUZZ - CFRA cuts CarMax's PT on higher interest rates impacting consumers

** Packaging Corp of America : down 2.2%

BUZZ - BNP Paribas downgrades Packaging Corp to 'neutral' after strong price performance

** Wells Fargo & Co : down 0.3%

BUZZ - Falls as quarterly profit shrinks

** Fastenal Co : up 1.2%

BUZZ - Stephens raises Fastenal's PT over long-term prospect

** Mondelez International : down 1.0%

BUZZ - Brokerages cut PT on Mondelez on weaker demand, rising cocoa prices

** Applied Digital : down 4.7%

BUZZ - Slumps as ballooning quarterly loss disappoints

** Corteva : down 3.0%

BUZZ - Falls after J.P.Morgan downgrades to 'neutral', cuts PT

** JPMorgan Chase : down 5.4%

BUZZ - Falls on lower-than-expected 2024 NII forecast

** Nurix Therapeutics : down 5.7%

BUZZ - Drops after upsized $175 mln stock offering

** Alcoa : up 0.2%

BUZZ - Jefferies raises Alcoa's PT on better free cash flow expectation

** Las Vegas Sands : down 0.8%

** MGM Resorts International : down 2.8%

BUZZ - Citigroup cuts PTs for casinos on lower earnings expectations

** Arista Networks : down 7.3%

BUZZ - Slides as Rosenblatt downgrades to 'sell'

** Progressive : up 1.7%

BUZZ - Rises after upbeat first-quarter results

** Exxon Mobil : up 0.8%

BUZZ - Shares rise on final investment decision for Guyana offshore project

** Zoetis : down 7.5%

BUZZ - Falls after WSJ reports on possible side effects of pet arthritis drugs

** Ciena : down 2.8%

BUZZ - Slips as Citi starts coverage with "sell"

** Marathon Oil Corp : up 1.0%

** ConocoPhillips : up 0.5%

** Occidental Petroleum Corp : up 2.0%

BUZZ - Oil stocks rise as Middle East tensions heighten

** Roku : down 2.0%

BUZZ - Falls on notice of security incident

** Nextplat : up 30.0%

BUZZ - Soars on merger with Progressive Care

** Jack in the Box : down 0.9%

** McDonald's : down 0.4%

** Restaurant Brands International : down 1.2%

BUZZ - TD Cowen trims PTs of quick-service restaurants on slowing customer traffic

** Virco Mfg : up 4.3%

BUZZ - Up after posting upbeat annual results

** Argan : up 22.0%

BUZZ - Jumps on Q4 revenue beat

** Southwest Airlines : down 2.4%

** Jetblue Airways : down 3.1%

** Alaska Air Group : down 2.8%

BUZZ - BofA cuts Southwest PT on domestic operation challenges

** DocuSign : up 1.6%

BUZZ - Rallies after UBS moves out of bear camp

** RTX : up 0.4%

BUZZ - Jefferies says RTX on track with GTF recall costs guide, ups PT

** State Street : up 1.4%

BUZZ - Rises on record Q1 AUM, revenue beat

The 11 major S&P 500 sectors:

Communication Services |

down 0.92% |

|

Consumer Discretionary |

down 1.09% |

|

Consumer Staples |

down 0.56% |

|

Energy |

up 0.35% |

|

Financial |

down 1.13% |

|

Health |

down 1.02% |

|

Industrial |

down 0.63% |

|

Information Technology |

down 1.13% |

|

Materials |

down 0.93% |

|

Real Estate |

down 0.73% |

|

Utilities |

down 0.17% |

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up