Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The crypto market never fails to surprise, and this time it was JuCoin’s turn in the spotlight. The platform’s native token, JU, shocked traders when its price suddenly dropped from a high of $24 to $7 in just a few minutes.

That’s a stunning 70% crash that has shaken investor confidence and wiped billions from its market cap.

$1 Billion Sell-Off and Liquidations

JU token markets were shaken by a wave of heavy sell orders and liquidations that quickly dragged prices lower. In just one day, more than $1.39 billion worth of JU was traded, as holders rushed for the exits in reaction to mounting regulatory scrutiny.

The panic didn’t stop there. JU’s 24-hour trading volume dropped by 23.9% to $1.03 billion, showing how quickly demand dried up once fear took over.

At the same time, the token’s turnover ratio jumped to 7.24, a clear signal of sharp volatility in an already fragile, low-liquidity environment.

Analysts note that the spike in JU’s unusual trading activity looks abnormal compared to Bitcoin or Ethereum. Such unstable swings hint at possible manipulation and raise doubts about JU’s long-term stability.

JuCoin’s quick response

Not long after the incident, JuCoin stepped in with a public statement. The team insisted that all operations are running as usual and, most importantly, that users’ funds are safe.

They explained that business functions remain unaffected, trying to calm fears of a deeper problem. Although the exchange didn’t provide clear details about what triggered the collapse.

Ju Token Technical Analysis

After dropping to $7, attention now turns to whether it can stay above the yearly low of $6.03. Some traders see room for a small rebound after the steep fall, but the overall market mood is still weak.

The RSI shows oversold levels, which often signal panic selling. At the same time, the MACD histogram has turned negative (-0.17), confirming a loss of momentum and a stronger bearish trend.

For now, a close above $9.87 could spark a short-lived bounce, often called a “dead-cat bounce.” But analysts warn that a real recovery can only happen if JU climbs back to $15 and holds that level.

Following an all-time high (ATH) reached last August, Ethereum (ETH), the market’s second-largest cryptocurrency, has found itself in a consolidation phase, trading between $4,200 and $4,700.

This price range reflects a broader stagnation in the cryptocurrency market, as various digital assets, including Bitcoin (BTC), struggle to regain the momentum that led both BTC and ETH reach new records above $124,000 and $4,9000 respectively.

Notably, Citigroup, the third-largest investment bank in the United States, has tempered expectations for the Ethereum price, forecasting a year-end price target of $4,300 for the altcoin.

Citi Forecasts Moderate ETF Inflows Into Ethereum

According to a report by Reuters, Citigroup’s analysis attributes the current demand for Ethereum to burgeoning interest in Ethereum-based applications, including stablecoins and tokenization.

However, the bank cautions that the recent price strength may be more a reflection of market sentiment than underlying fundamentals.

In a note released on Monday, Citi remarked, “Current prices are above activity estimates, potentially driven by recent buying pressure and excitement over use-cases.”

Ethereum’s appeal has grown among investors looking for more than just price appreciation. Analysts forecast increased price growth for the altcoin due to the recent passage of bills, including the GENIUS Act, which aims to provide a new framework for stablecoins, as well as the surge in interest in tokenization.

Despite these developments, Citigroup predicts that the inflow of exchange-traded funds (ETFs) into Ethereum will be less robust compared to Bitcoin. In contrast, Standard Chartered has recently revised its year-end target for Ethereum significantly upward, from $4,000 to $7,500.

Bearish And Bullish Scenarios For ETH

This adjustment reflects stronger engagement within the industry and increasing corporate investments. The bank anticipates that the stablecoin sector could grow eightfold by 2028, which would likely drive up Ethereum network fees and demand.

Citi also presented a more optimistic bull case, projecting a potential price of $6,400 if activity and adoption of Ethereum-based applications continue to rise. This would represent a major 42% uptrend ahead for the leading altcoin.

Conversely, the bank outlined a bearish scenario in which the Ethereum price would drop to $2,200 in the event of a macroeconomic downturn or a decline in the equity market. If this scenario plays out, it could spell major trouble for bulls, as it would represent a 50% drop from current levels.

Interestingly, a recent report from Sygnum, a digital asset bank, has painted a more favorable outlook for Ethereum. The bank highlights Ethereum’s upgrades and increasing institutional interest as significant factors that could position ETH to benefit from anticipated trends in stablecoin issuance and broader adoption.

Furthermore, the digital asset bank highlighted that as liquid Ethereum reserves on exchanges diminish and demand intensifies, the possibility of a supply squeeze arises, potentially sending the altcoin into a new leg up to retest all-time high levels.

As of this writing, ETH is trading at $4,480, which is up 5% on the weekly time frame. Compared to record prices, the altcoin is trading nearly 10% below all-time high levels.

Featured image from DALL-E, chart from TradingView.com

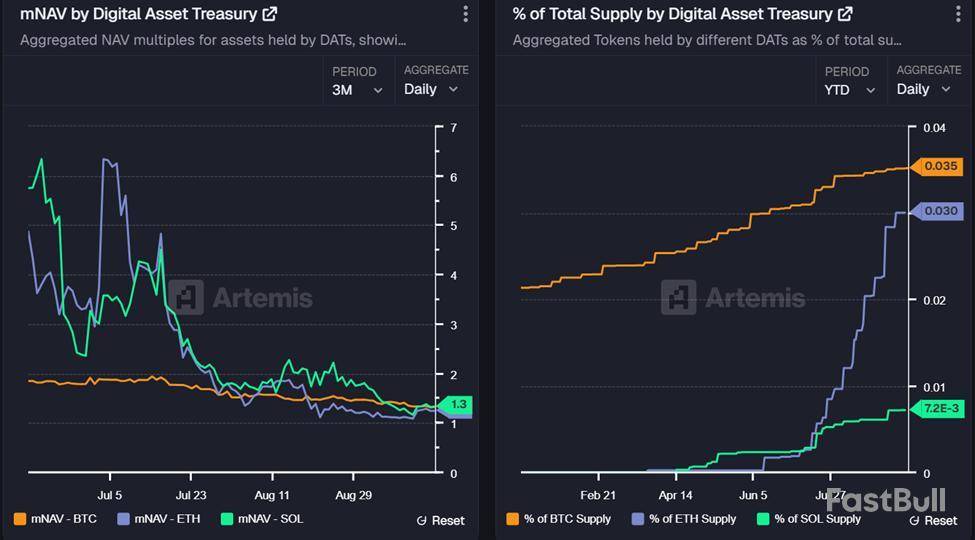

September is showing an uneasy mood across digital asset treasuries (DATs).

What began as a year of aggressive accumulation by corporate players has now run into the harsh reality of collapsing market net asset values (mNAVs), investor caution, and punishing stock declines.

DATs Holding Top Crypto Assets Are Losing Purchasing Power as September Mutes the Rally

According to Kaiko’s latest report, digital asset treasury companies have been central to crypto’s 2025 rally.

Firms like Strategy (MSTR), BitMine, and SharpLink have been steadily accumulating Bitcoin, Ethereum, and Solana, helping to support spot prices and attracting new inflows.

Strategy has been the most visible example. In less than nine months, it has added 190,000 BTC, bringing total holdings to over 638,000, almost on pace with its record 2024 purchases.

BitMine and SharpLink have mirrored this strategy with Ethereum , while new entrants are diversifying into XRP, SOL, and even smaller coins like HYPE and ENA.

This activity has fueled enthusiasm around listed crypto treasury firms, particularly in Asia-Pacific, where the model has taken off.

mNAV Collapse Signals Investor Caution

However, risks are piling up beneath the surface. Artemis Analytics data shows that the mNAV of companies holding BTC, ETH, and SOL has dropped sharply for three consecutive months, hitting a fresh low in September.

The numbers suggest that, despite accumulation, DATs are bleeding purchasing power as underlying assets fail to offset equity declines.

The pressure has been visible in stock performance. BeInCrypto previously reported that Next Technology Holding’s shares (NXTT) fell nearly 5% after the firm filed to raise $500 million for additional Bitcoin purchases.

The firm already holds 5,833 BTC, valued at $673 million, but the announcement triggered skepticism rather than confidence.

The sharpest losses came from KindlyMD’s NAKA stock, which plunged 55% after PIPE shares entered the market, adding to a 90% monthly drop.

CEO David Bailey told shareholders that volatility was expected and framed the turbulence as an opportunity to align with long-term backers. However, the severity of the crash reflects the structural risks critics have long warned about.

“From the beginning, I warned that Bitcoin treasury companies were Ponzi schemes built on a pyramid. Today, NAKA dropped by 55%, now down 96% since May,” gold advocate Peter Schiff remarked.

Similarly, MicroStrategy’s NAV compression has limited new BTC buys. Its net asset value (NAV) multiple fell from 1.75x in June to 1.24x in September, curbing new purchases.

Innovation or Recklessness?

Amid the turbulence, some in crypto circles are floating unconventional fixes. DeFi analyst Ignas argued that tokenizing DAT stocks could create arbitrage opportunities, bring liquidity on-chain, and re-engage crypto-native investors.

“DATs are running out of buying power as mNAVs collapse. They should tokenize their stock so even crypto degens could buy,” he said.

While tokenization could widen access, it would also add another layer of speculation to already volatile instruments.

ETH-based treasuries, Ignas added, have yet to explore debt financing, leaving more potential stress ahead.

Nevertheless, the September downturn highlights a paradox. DATs support crypto spot markets through heavy accumulation.

Yet, their equities are collapsing as investors question sustainability. The model appears caught between its promise as a new corporate treasury strategy and the brutal reality of public market scrutiny.

On September 16, spot Ethereum ETFs saw a net outflow of $61.74 million, with only Bitwise ETHW posting inflows for the day. According to SoSoValue, Bitcoin ETFs recorded a total net inflow of above $290 million, marking the seventh consecutive day of inflows.

Bitcoin ETF Breakdown

Bitcoin spot ETFs saw a combined inflow of $292.27 million, led by $209.18 million of BlackRock IBIT. Fidelity FBTC followed with $45.76 million, while Ark & 21Shares ARKB added $40.68 million. VanEck HODL also made a smaller gain of $7.42 million.

Bitwise BITB is the only ETF to record an outflow of $10.78 million on Tuesday. The total trading volume of Bitcoin ETF has dropped to $2.95 billion, with $153.78 billion of total net assets. This marks 6.61% of the bitcoin market cap, mildly higher than the previous day’s records.

Ethereum ETF Breakdown

Ethereum ETFs broke the streak of making the sixth consecutive day of inflows. Instead, it recorded a combined outflow of $61.74 million, led by BlackRock ETHA $20.34 million and Fidelity FETH $48.15 million.

Bitwise ETHW is the only ETF to make a gain of $6.75 million in Ethereum inflows. Overall, the trading volume reached $1.70 billion with total net assets of $29.60 billion. This represents 5.45% of the Ethereum market cap, marking 0.01% lower than the previous day.

Market Context

Bitcoin is trading at $116,704 with a market cap of $2.324 trillion, showing impressive progress. Its daily trading volume has reached $40.535 billion, while Ethereum trades at $4,489.87, with a market cap of $541.400 billion. Its trading volume has dropped to $29.609 billion, slightly lower than the previous day.

In recent days, both of these assets have seen strong inflows in the ETF market, which represents the growing institutional interest. Bitcoin and Ethereum continue to benefit from the evolving global regulatory climate of cryptocurrency and hints of rate cut.

The cryptocurrency market is holding steady as traders await the U.S. Federal Reserve’s highly anticipated interest rate decision. Bitcoin is consolidating between $114,600 and $117,100, currently trading in the upper range. Analysts view this setup as constructive, with market sentiment at 68.8%, a level close to peak bullishness.

According to Glassnode, Bitcoin is respecting its short-term holder cost basis bands. Staying above the 1-month and 3-month realized price levels is seen as a sign of optimism heading into the Fed’s announcement.

Gold Price Today: Record Highs Before the Fed

Gold is also in focus as it trades just under $3,700 per ounce, holding firm near record highs. However, gold mining stocks dipped as investors booked profits ahead of the Fed decision.

Commenting on this divergence, economist Peter Schiff noted: “Gold remains strong even as miners take a breather. I expect buyers to come rushing back once the FOMC outcome is known.”

The connection between gold and Bitcoin lies in liquidity. A Fed rate cut not only strengthens gold as a hedge but also channels speculative flows into Bitcoin and other risk assets.

What Markets Expect from Powell’s Speech Today

Traders overwhelmingly expect a 25 basis point cut, with market odds above 90%. Such a move would keep the bullish structure intact for both crypto and gold. Still, analysts warn that front-running and leverage could spark short-term volatility.

Crypto strategist Biupa explained: “A 25 bps cut may continue the uptrend, but we could still see a pullback driven by profit-taking and liquidations, not by deteriorating fundamentals.”

For Bitcoin, the key level to watch is $117,900. A breakout could open the path toward new highs, while rejection might trigger a temporary dip toward the $113,300–$110,000 zone.

FED Interest Rate Expectations

While unlikely, a 50 basis point cut could shock markets. In that case, Bitcoin might briefly spike to $120,000 as retail traders rush in before a possible “sell-the-news” reversal if recession fears take hold.

On the other hand, if the Fed were to skip a cut, analysts expect a sharp drop in both crypto and gold, followed by the potential for an emergency larger cut later, which could set the stage for a V-shaped recovery.

The setup closely mirrors September 2024, when the Fed cut rates and Bitcoin initially dipped before doubling to over $100,000 by year-end. With Powell set to speak, traders are bracing for volatility.

Whether it’s the expected 25 bps cut or a surprise move, the outcome of today’s FOMC meeting could set the tone for the next major trend in Bitcoin, gold, and the broader crypto market.

FAQs

What time is the FOMC announcement?The FOMC announcement is scheduled for 2:00 PM Eastern Time (ET). This is followed by a press conference with Fed Chair Powell at 2:30 PM ET.

How will the Fed rate decision affect Bitcoin?A 25 bps rate cut is expected to maintain Bitcoin’s bullish trend, though short-term volatility from profit-taking is likely. Key resistance is at $117,900 for a breakout.

Why is gold rising alongside Bitcoin?Both act as liquidity-sensitive assets. Fed rate cuts weaken the dollar, boosting gold as a safe haven and Bitcoin as a speculative risk-on asset.

What happens if the Fed doesn’t cut rates?A surprise hold could trigger short-term drops in Bitcoin and gold, but may lead to larger emergency cuts later, potentially fueling a rapid V-shaped recovery.

Is now a good time to buy Bitcoin before the Fed?While momentum is bullish, high leverage and “sell-the-news” risk mean cautious entry near support levels ($113,300–$110,000) may be prudent post-announcement.

Binance Coin has been on a remarkable run, as it has run to another fresh ATH of $962.29 just hours ago. The token has added 2.81% in gains since yesterday and is up 8.13% over the week, pushing its market cap to $132.35 billion.

Successively, the trading volume also jumped 36.39% to $3.33 billion, showing that traders are actively participating in this breakout. With Binance’s ecosystem expanding, institutional demand rising, and optimism around regulatory clarity, BNB’s momentum looks far from over. Interesting right? Now, let us decipher the top factors driving the surge and where the BNB coin price could head next!

Top Reasons Behind BNB Price Surge

The reasons behind this surge are clear. Binance’s regular token burns continue to restrict supply, while institutional players are betting big. Nasdaq-listed BNC recently expanded its BNB holdings to 325,000 tokens, worth about $309 million. This signals confidence in the token’s long-term potential. Meanwhile, the Maxwell Upgrade has improved block speeds to 0.75 seconds, boosting DeFi and network utility.

Another factor stoking excitement is speculation that Binance may soon settle with the DOJ to drop its compliance monitor. Rumors of a possible CZ comeback have only amplified bullish sentiment. If this unfolds, BNB price could quickly find its way past $1,000.

BNB Price Analysis

BNB is trading near $951 after briefly testing $962.29 while I write this analysis for you. The 4-hour chart shows a strong bullish structure, with price staying above key moving averages and Bollinger Bands signaling volatility expansion. The immediate resistance for BNB is at $958–$962, while the psychological $1,000 level is now within reach.

Conversely, a close below $925 could spark profit-taking, exposing $905 as the next support level aligned with the 38.2% Fibonacci retracement. However, RSI remains healthy near 64, suggesting that while BNB is strong, it is not yet overbought.

FAQs

Why is BNB price going up right now?BNB price hit new highs due to strong institutional accumulation, Binance’s ecosystem growth, and network upgrades that boosted utility.

What are the key support and resistance levels?Immediate resistance lies at $962 and $1,000, while support rests at $925 and $905.

Can BNB sustain above $950?Yes, as long as trading volume remains strong and support at $925 holds, BNB has room to extend its rally.

The Cathie Wood-led ARK Invest has bought more than 160,000 shares in the crypto exchange Bullish in the asset manager’s latest scoop of crypto-related stocks.

In a filing on Tuesday, the company revealed it bought around $8.21 million worth of Bullish shares across two of its funds, the ARK Innovation ETF (ARKK) and the ARK Next Generation Internet ETF (ARKW), with the funds buying up 120,609 shares and 40,574 shares, respectively.

The firm now holds over $129 million worth of Bullish stock across ARKK, ARKW, and its ARK Fintech Innovation ETF (ARKF).

ARK has backed Bullish since its debut on the New York Stock Exchange mid last month, when it acquired 2.53 million shares, worth $172 million at the time.

ARK’s latest buy aims to rebuild Bullish position

The investment firm bought $7.5 million shares in Bullish earlier this month, and had acquired $21 million worth of Bullish stock on Aug. 20.

Despite the recent buys, Ark’s total Bullish holdings across all three of its ETFs currently stand at 2.52 million shares, indicating that the firm has booked some partial profits and is now reacquiring the stock after it fell heavily since its debut.

Bullish stock declines post-IPO

Shares in Bullish (BLSH) soared on its listing day, as the stock touched an intraday high of $118, registering a gain of 218% from its IPO price of $37.

However, since its debut on Aug. 13, the stock has shed most of its gains and closed trading on Tuesday flat at $51.36, down nearly 57% from its all-time high, according to Google Finance.

The firm reported its revenue dropped 0.2% year-over-year as of the quarter ending March, while its operating income was down 270% during the same period.

Bullish is set to release its second-quarter results on Thursday, its first since its debut.

Analysts are mixed on the exchange, with some neutral while others are optimistic that it can outperform.

Last week, Jefferies initiated a “hold” rating on Bullish, while JP Morgan and Bernstein assigned a “neutral” rating, according to Yahoo Finance.

Conversely, Cantor Fitzgerald had an “overweight” rating, meaning it thinks Bullish will outperform.

Ark has been accumulating other crypto-related stocks in recent months.

It acquired a $4.4 million in BitMine on Sept. 9, which increased its total stack to 6.7 million BitMine shares worth $284 million.

The firm also bought shares of Jack Dorsey-backed financial services company Block, and held $193 million worth of Block shares on Aug. 12.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up