Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Kremlin Says There Are Contacts Between Russia And France At A Working Level But There Are Is No Confirmation Of Plans For High-Level Contacts For Now

Kremlin Says Russia's Military Campaign In Ukraine Will Continue Until Kyiv Takes Some Decisions

Kremlin, Asked About India's Plans To Diversify Its Oil Supplies, Says Moscow Is Aware That Russia Is Not The Only Supplier

Eurostat - Euro Zone Jan Inflation Excluding Unprocessed Food And Energy Estimated At 2.2% Year-On-Year (Consensus 2.3%) Versus 2.3% Year-On-Year In Dec

Eurostat - Euro Zone Jan Inflation Estimated At 1.7% Year-On-Year (Consensus 1.7%) Versus 2.0% Year-On-Year In Dec

Morgan Stanley Raises Near-Term Brent Forecasts As The Geopolitical Risk Premium Likely Persists For A Period, But Expects Prices Below $60/ Bbl Later This Year

UBS CEO Ermotti: Some Clarifaction Needed On Use Of AT1 Debt But Credit Suisse Showed They Play A "Critical" Role In Financial Stability

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)A:--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)A:--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)A:--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)A:--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)A:--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)A:--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)A:--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)A:--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)A:--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)A:--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)A:--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)A:--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)A:--

F: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)A:--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)--

F: --

P: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)--

F: --

P: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)--

F: --

P: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction Yield--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP Growth--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)--

F: --

P: --

No matching data

View All

No data

What Happened?

Shares of gaming company Inspired jumped 7.6% in the morning session after the company's Chairman, A. Lorne Weil, purchased a large block of shares. This insider purchase involved 50,000 shares at an average price of $8.11 each, totaling around $405,500. The transaction boosted the chairman's holdings by 9.56% to a total of 572,771 shares. Investors often interpret significant stock purchases by top executives as a strong sign of confidence in the company's future performance and direction, which can lead to increased positive sentiment in the market.

Is now the time to buy Inspired? Access our full analysis report here.

What Is The Market Telling Us

Inspired’s shares are very volatile and have had 21 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The previous big move we wrote about was 11 days ago when the stock gained 5.8% on the news that comments from a key Federal Reserve official bolstered hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to markets amid concerns over high valuations, particularly in AI-related stocks.

Inspired is up 1.9% since the beginning of the year, but at $9.00 per share, it is still trading 21.8% below its 52-week high of $11.50 from February 2025. Investors who bought $1,000 worth of Inspired’s shares 5 years ago would now be looking at an investment worth $1,319.

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Rush Street Interactive and the best and worst performers in the gaming solutions industry.

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

The 7 gaming solutions stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 4.3% on average since the latest earnings results.

Best Q3: Rush Street Interactive

Specializing in online casino gaming and sports betting, Rush Street Interactive is an operator of digital gaming platforms.

Rush Street Interactive reported revenues of $277.9 million, up 19.7% year on year. This print exceeded analysts’ expectations by 4.3%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ adjusted operating income and EPS estimates.

Richard Schwartz, Chief Executive Officer of RSI, said, "We’re pleased to report another strong quarter that underscores the resilience of our business model and player-first approach. Our third quarter results demonstrate continued momentum and acceleration of growth across key markets, led by our continued outperformance in the online casino space. Another quarter of record revenue, up 20% year-over-year, marks our tenth consecutive quarter of sequential revenue growth over the prior quarter. This growth was driven by record player acquisition and strong player engagement across our higher-value markets.

Rush Street Interactive achieved the biggest analyst estimates beat and fastest revenue growth, but had the weakest full-year guidance update of the whole group. Unsurprisingly, the stock is up 1.3% since reporting and currently trades at $18.40.

Is now the time to buy Rush Street Interactive? Access our full analysis of the earnings results here, it’s free for active Edge members.

Specializing in digital casino gaming, Inspired is a provider of gaming hardware, virtual sports platforms, and server-based gaming systems.

Inspired reported revenues of $86.2 million, up 11.7% year on year, outperforming analysts’ expectations by 3.9%. The business had a satisfactory quarter with a beat of analysts’ EPS estimates but a miss of analysts’ Virtual Sports revenue estimates.

The market seems happy with the results as the stock is up 5.8% since reporting. It currently trades at $8.06.

Is now the time to buy Inspired? Access our full analysis of the earnings results here, it’s free for active Edge members.

Founded by a team of former gaming industry executives, PlayStudios offers free-to-play digital casino games.

PlayStudios reported revenues of $57.65 million, down 19.1% year on year, falling short of analysts’ expectations by 3%. It was a disappointing quarter as it posted a miss of analysts’ daily active users estimates and a significant miss of analysts’ adjusted operating income estimates.

PlayStudios delivered the slowest revenue growth in the group. The company reported 2.21 million monthly active users, down 25.3% year on year. As expected, the stock is down 28.3% since the results and currently trades at $0.65.

Read our full analysis of PlayStudios’s results here.

Established in Illinois, Accel Entertainment is a provider of electronic gaming machines and interactive amusement terminals to bars and entertainment venues.

Accel Entertainment reported revenues of $329.7 million, up 9.1% year on year. This number beat analysts’ expectations by 0.5%. Zooming out, it was a satisfactory quarter as it also produced a beat of analysts’ EPS estimates but a miss of analysts’ adjusted operating income estimates.

The stock is up 1.9% since reporting and currently trades at $10.12.

Read our full, actionable report on Accel Entertainment here, it’s free for active Edge members.

Getting its start in daily fantasy sports, DraftKings is a digital sports entertainment and gaming company.

DraftKings reported revenues of $1.14 billion, up 4.4% year on year. This print came in 5.6% below analysts' expectations. Overall, it was a softer quarter as it also logged full-year revenue guidance missing analysts’ expectations significantly and full-year EBITDA guidance missing analysts’ expectations significantly.

DraftKings achieved the highest full-year guidance raise but had the weakest performance against analyst estimates among its peers. The stock is up 13% since reporting and currently trades at $31.72.

Read our full, actionable report on DraftKings here, it’s free for active Edge members.

What Happened?

A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official bolstered hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to markets amid concerns over high valuations, particularly in AI-related stocks.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks.

Among others, the following stocks were impacted:

Zooming In On Sonos (SONO)

Sonos’s shares are very volatile and have had 20 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The previous big move we wrote about was 17 days ago when the stock dropped 3.5% on the news that markets became increasingly wary of high valuations following a significant AI-driven rally. The tech-heavy Nasdaq fell approximately 1.4% as a wave of caution swept through the market. A key example of this trend is Palantir Technologies, which saw its shares drop around 7% despite reporting record quarterly results that surpassed analyst estimates and raising its full-year revenue outlook. This seemingly contradictory movement highlighted a broader sentiment shift. Investors appeared to be engaging in profit-taking, concerned that the recent surge in AI-related stocks had led to stretched valuations. This broader market caution affected high-growth technology companies that had previously surged on AI optimism but faced increased scrutiny, signaling a potential cooling-off period for the sector. Adding serious weight to this caution, leadership at both Goldman Sachs and Morgan Stanley highlighted the possibility of a correction in the equity markets over the next couple of years.Despite the euphoria driven by AI optimism and the promise of future rate cuts, these banks viewed this cooling-off period not as a disaster, but as a necessary and healthy feature of a long-term bull market.

Sonos is up 13.8% since the beginning of the year, and at $16.78 per share, it is trading close to its 52-week high of $18.04 from October 2025. Investors who bought $1,000 worth of Sonos’s shares 5 years ago would now be looking at an investment worth $782.42.

Looking back on gaming solutions stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including Inspired and its peers.

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

The 7 gaming solutions stocks we track reported a slower Q3. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 1% on average since the latest earnings results.

Specializing in digital casino gaming, Inspired is a provider of gaming hardware, virtual sports platforms, and server-based gaming systems.

Inspired reported revenues of $86.2 million, up 11.7% year on year. This print exceeded analysts’ expectations by 3.9%. Despite the top-line beat, it was still a slower quarter for the company with a miss of analysts’ Virtual Sports revenue estimates and a significant miss of analysts’ adjusted operating income estimates.

“Inspired delivered a strong quarter driven by strategic execution, digital expansion, and product innovation,” said Brooks Pierce, President and CEO of Inspired.

Interestingly, the stock is up 2.1% since reporting and currently trades at $7.78.

Read our full report on Inspired here, it’s free for active Edge members.

Best Q3: Rush Street Interactive

Specializing in online casino gaming and sports betting, Rush Street Interactive is an operator of digital gaming platforms.

Rush Street Interactive reported revenues of $277.9 million, up 19.7% year on year, outperforming analysts’ expectations by 4.3%. The business had a very strong quarter with an impressive beat of analysts’ adjusted operating income estimates and a beat of analysts’ EPS estimates.

Rush Street Interactive delivered the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 6.4% since reporting. It currently trades at $17.01.

Is now the time to buy Rush Street Interactive? Access our full analysis of the earnings results here, it’s free for active Edge members.

Founded by a team of former gaming industry executives, PlayStudios offers free-to-play digital casino games.

PlayStudios reported revenues of $57.65 million, down 19.1% year on year, falling short of analysts’ expectations by 3%. It was a disappointing quarter as it posted a miss of analysts’ daily active users and adjusted operating income estimates.

PlayStudios delivered the slowest revenue growth in the group. The company reported 2.21 million monthly active users, down 25.3% year on year. As expected, the stock is down 24.6% since the results and currently trades at $0.69.

Read our full analysis of PlayStudios’s results here.

Established in Illinois, Accel Entertainment is a provider of electronic gaming machines and interactive amusement terminals to bars and entertainment venues.

Accel Entertainment reported revenues of $329.7 million, up 9.1% year on year. This number surpassed analysts’ expectations by 0.5%. Zooming out, it was a satisfactory quarter as it also recorded a beat of analysts’ EPS estimates but a miss of analysts’ adjusted operating income estimates.

The stock is up 3.5% since reporting and currently trades at $10.28.

Read our full, actionable report on Accel Entertainment here, it’s free for active Edge members.

Light & Wonder (NASDAQ:LNW)

With names as crazy as Ultimate Fire Link Power 4 for its products, Light & Wonder (NASDAQ:LNW) is a gaming company supplying the casino industry with slot machines, table games, and digital games.

Light & Wonder reported revenues of $841 million, up 2.9% year on year. This result lagged analysts' expectations by 1.1%. More broadly, it was a mixed quarter as it also produced a decent beat of analysts’ adjusted operating income estimates but a miss of analysts’ Social Gaming revenue estimates.

The stock is up 23.8% since reporting and currently trades at $90.91.

Read our full, actionable report on Light & Wonder here, it’s free for active Edge members.

Q3 2025 saw 12% revenue growth to $86.2M, led by Interactive's 48% surge and margin expansion. Strategic divestitures and digital focus are expected to drive further Adjusted EBITDA growth, with full-year 2025 guidance above $110M.

Original document: Inspired Entertainment, Inc. [INSE] SEC 8-K Current Report — Nov. 5 2025

Third quarter results exceeded expectations, driven by strong interactive and gaming segment growth, the sale of the holiday parks business, and a shift to higher-margin operations. Management projects margin expansion, reduced leverage, and continued robust free cash flow, with significant upside from new iGaming states.

Based on Inspired Entertainment, Inc. [INSE] Q3 2025 Audio Transcript — Nov. 5 2025

Gaming company Inspired reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 10.5% year on year to $86.2 million. Its non-GAAP profit of $0.28 per share was 41% above analysts’ consensus estimates.

Is now the time to buy Inspired? Find out by accessing our full research report, it’s free for active Edge members.

Inspired (INSE) Q3 CY2025 Highlights:

“Inspired delivered a strong quarter driven by strategic execution, digital expansion, and product innovation,” said Brooks Pierce, President and CEO of Inspired.

Company Overview

Specializing in digital casino gaming, Inspired is a provider of gaming hardware, virtual sports platforms, and server-based gaming systems.

Revenue Growth

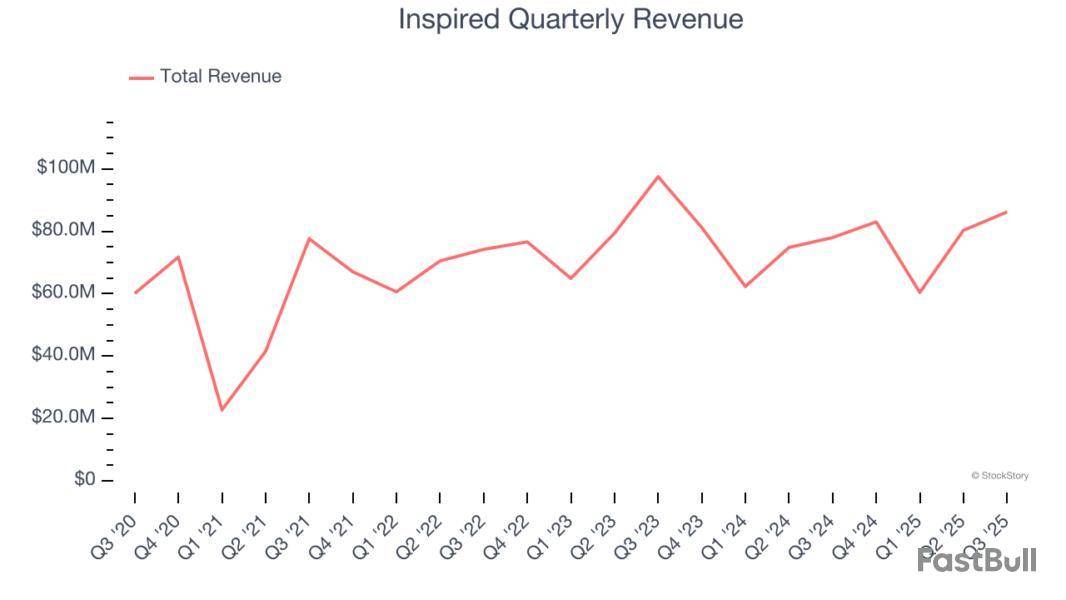

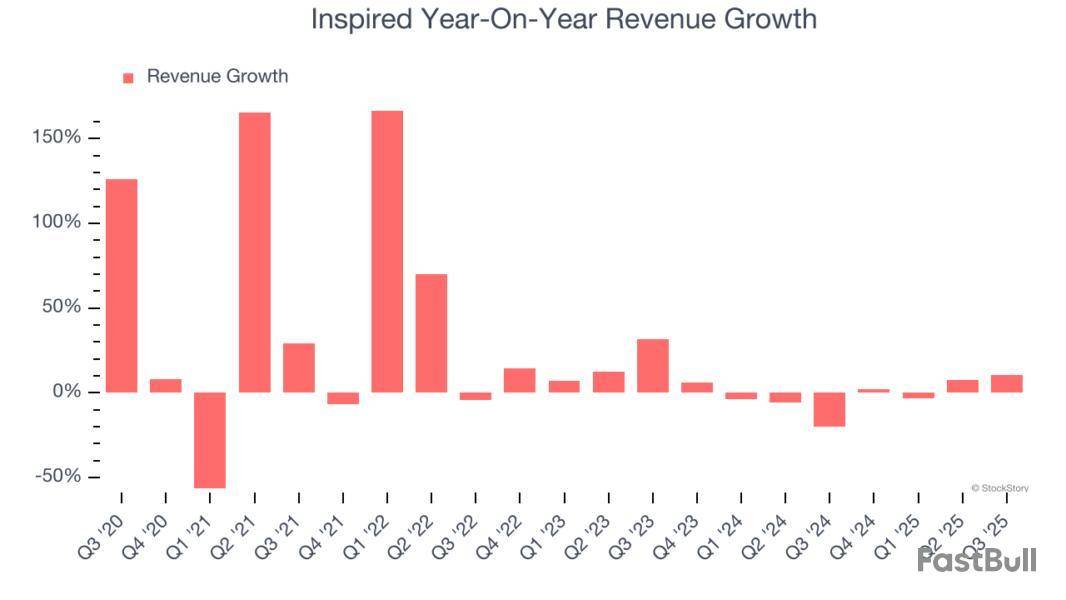

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Inspired’s 9.8% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the consumer discretionary sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Inspired’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.3% annually.

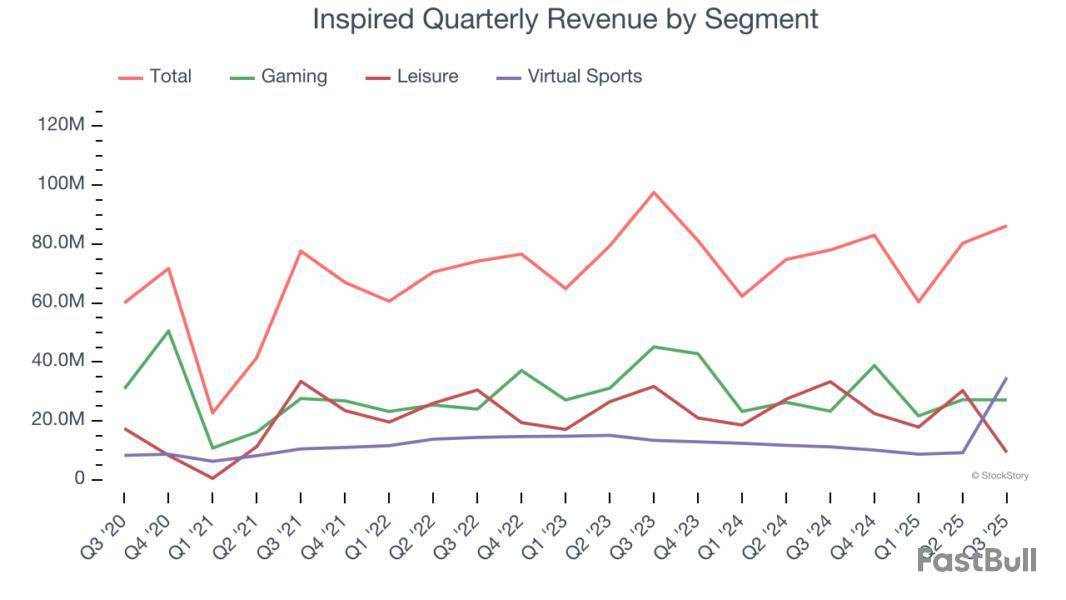

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Gaming, Leisure, and Virtual Sports, which are 31.4%, 10.8%, and 40.3% of revenue. Over the last two years, Inspired’s Gaming (land-based casino games) and Leisure (gaming terminals and amusement machines) revenues averaged year-on-year declines of 7.4% and 4.1% while its Virtual Sports revenue (digital gaming and sports betting) averaged 8.7% growth.

This quarter, Inspired reported year-on-year revenue growth of 10.5%, and its $86.2 million of revenue exceeded Wall Street’s estimates by 3.9%.

Looking ahead, sell-side analysts expect revenue to decline by 11.6% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Inspired’s operating margin has been trending up over the last 12 months and averaged 9.7% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports mediocre profitability for a consumer discretionary business.

This quarter, Inspired generated an operating margin profit margin of 11.3%, down 4 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

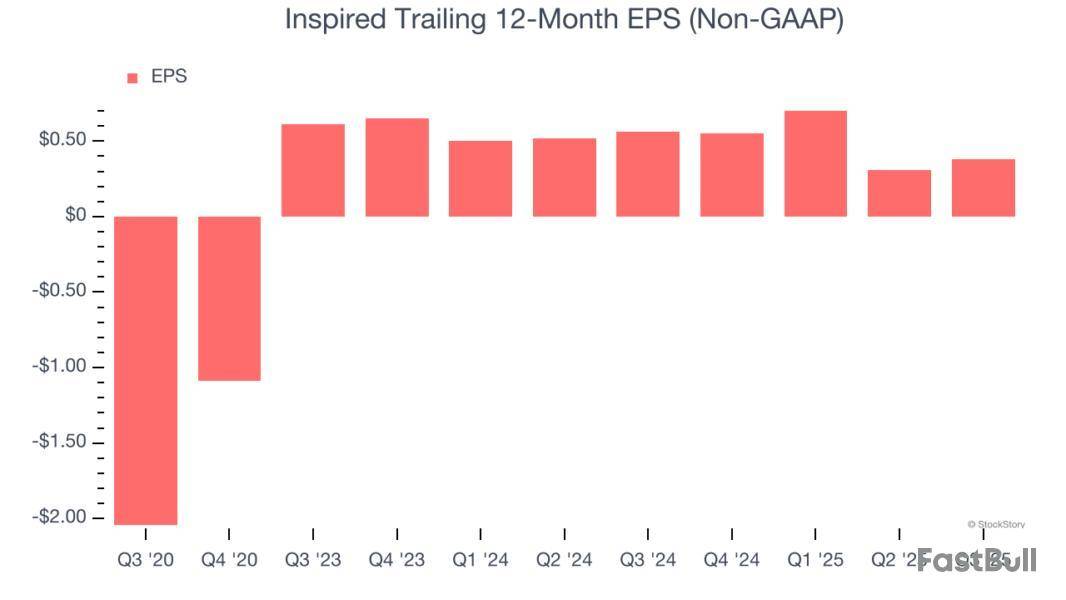

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Inspired’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, Inspired reported adjusted EPS of $0.28, up from $0.21 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Inspired’s full-year EPS of $0.38 to shrink by 11.8%.

Key Takeaways from Inspired’s Q3 Results

It was good to see Inspired beat analysts’ EPS expectations this quarter. We were also glad its Virtual Sports revenue outperformed Wall Street’s estimates. On the other hand, its Leisure revenue missed. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $7.59 immediately after reporting.

So should you invest in Inspired right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up