Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

TL:DR;

The third-largest cryptocurrency failed to go into uncharted territory a few weeks back, and it wasstopped 1% awayfrom its 2018 all-time high of $3.4 (CoinGecko data). Since then, the asset has failed to resume its rally and actually slipped to $2.8 during the Monday correction.

Nevertheless, it turned the tables during the business week by reclaiming the coveted $3 line. Moreover, it jumped to a weekly high of $3.15 on Friday, but its progress was halted at that point.

It started to lose value gradually over the weekend but slumped hard in the past 12 hours or soalongside bitcoin and the rest of the alts. Its price fell to a 6-day low of $2.82, thus dropping by more than 8% on a daily scale from top to bottom.

Despite recovering some ground to almost $2.9 now, XRP is still over 5% down on the day. This correction for the cross-border token comes not only with the rest of the market but also following a strategy reversal by whales.

These large market participants were among the biggest propellers of XRP’s surge since the elections by accumulating billions of dollars worth of the asset within months. Now, though, Ali Martinez showed that they have changed their tune and actually offloaded $70 million worth of XRP within a few days.

Whales are particularly important to the overall market movements as they have the ability to move it with their large purchases or sell-offs.

Whales have offloaded over 70 million $XRP in the past 96 hours! pic.twitter.com/qEe56f4Ujt

— Ali (@ali_charts) February 1, 2025

Bitcoin’s weekend took a wrong turn in the past 12 hours or so as the asset plunged below $100,000 for the first time since the Monday crash.

As expected, the altcoins have turned red as well, with substantial losses from the likes of LINK, SOL, AVAX, DOGE, and others.

Recall that the primary cryptocurrency had a strong end for the business week and, subsequently,the month, as its price stood above $105,000 and even challenged $106,000 on a couple of occasions.

However, the bears stepped up and didn’t allow a surge toward a new all-time high. Just the opposite, BTCslumpedon Friday evening and Saturday morning to $102,000.

It maintained that level for most of Saturday but started to lose traction again in the past several hours. As a result, it dropped to $99,000, which became its lowest levels since the Monday correction that pushed it below $98,000.

As of now, the cryptocurrency stands about a grand higher and is striving to return within six-digit territory.

However, the altcoins have suffered a lot more, with SOL, DOGE, LINK, AVAX, LTC, and HYPE dumping by almost double-digits. Even more painful declines come from the likes of VIRTUAL (-19%), TAO (-15%), RAY (-13%), LDO (-13%), GALA (-13%), and TRUMP (-13%).

This enhanced volatility has led to more than $500 million in liquidations over the past day, and the number is north of $400 million within the last 12 hours alone. Nearly 250,000 traders have been wrecked on a 24-hour scale. The single-largest liquidation order took place on Binance. It was worth close to $12 million.

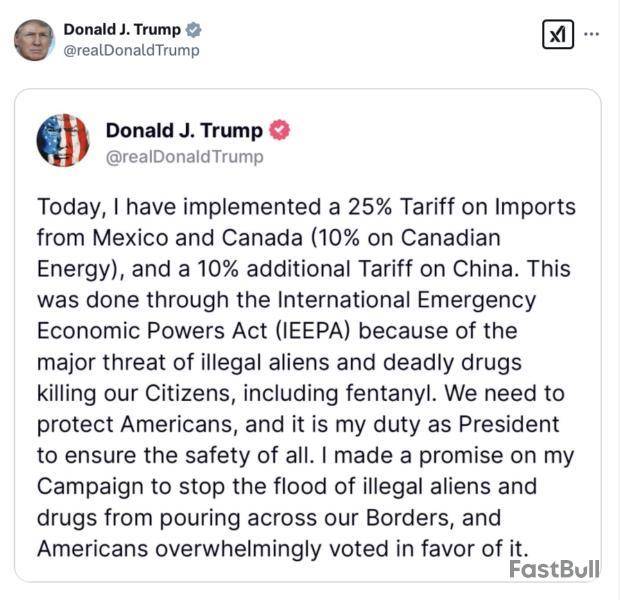

Bitcoin has dropped below $100,000 for the first time in six days following US President Donald Trump signing an executive order to impose import tariffs on goods from China, Canada, and Mexico.

The imposed tariffs have already triggered retaliation from the three countries, and the crypto industry is divided on how this will affect the broader market.

According to a Feb. 1 statement from the White House, “Trump is implementing a 25% additional tariff on imports from Canada and Mexico and a 10% additional tariff on imports from China. Energy resources from Canada will have a lower 10% tariff.”

The statement said that “Trump is taking bold action to hold Mexico, Canada, and China accountable to their promises of halting illegal immigration and stopping poisonous fentanyl and other drugs from flowing into our country.”

Tariffs could raise inflation, leading to higher interest rates, which typically causes investors to move away from riskier assets like crypto and toward more traditional assets like bonds and term deposits.

The 3 countries were quick to retaliate

Shortly after Trump’s announcement, Canada’s Prime Minister Justin Trudeau announced in a press conference that Canada would impose a 25% tariff on $106.5 billion worth of US goods.

China’s commerce ministry reportedly said it would file a complaint with the World Trade Organization (WTO) and “take corresponding countermeasures.”

Mexican President Claudia Sheinbaum said in a lengthy X post that she has instructed the Secretary of Economy to “implement plan B” which includes “tariff and non-tariff measures in defense of Mexico’s interests.”

Following the retaliations, Bitcoin slipped below the psychological $100,000 price level for the first time since Jan. 27, trading at $99,540 at the time of publication, according to CoinMarketCap.

According to CoinGlass data, around $22.70 million in long positions were liquidated in the four hours leading up to publication.

Crypto industry split on how tariffs will impact market

The crypto industry is divided on how much the imposed tariffs will impact the broader crypto market.

Crypto Capital Venture founder Dan Gambardello isn’t buying into the narrative.

Gambardello said, “I cannot believe there’s a popular opinion floating around that Trump tariffs and his memecoins ended the bull cycle.”

“BlackRock is continuing to accumulate ETH and BTC while retail frantically panics because crypto is currently consolidating,” Gambardello said.

While Bitwise Invest head of alpha strategies Jeff Park said, “How amazing a sustained tariff war is going to be for Bitcoin in the long run,” not all crypto commentators agreed.

One opponent, Cinnaeamhain Ventures partner Adam Cochran, said, “Bitcoin is not separated enough from the global markets and trades like triple-levered tech these days.”

“An economic squeeze of this scale just means pain all around, and we should be ok with denouncing that,” Cochran said.

The past week was one of two distinct halves for the AAVE price, which initially kicked off with a bearish downturn beneath the $300 mark. The DeFi coin has since shown strong signs of recovery, jumping to as high as $340 on Friday, January 31st.

Based on its latest price setup, the AAVE token looks set to be one of the best performers in the crypto market this February. However, a crypto analyst has clarified that it might not be a smooth sailing journey for the AAVE price over the next few months.

Here’s How AAVE Could Reach Its High In This Cycle

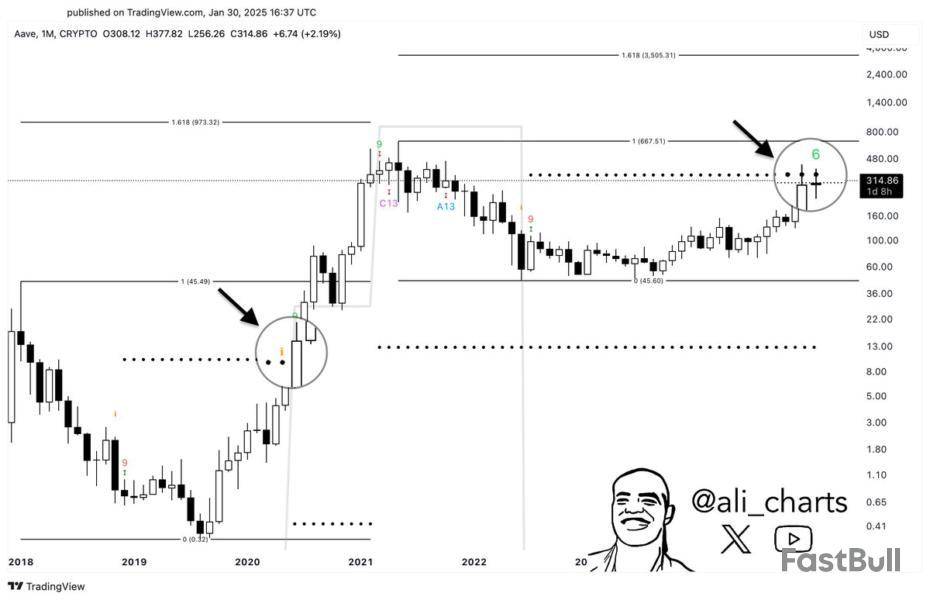

Prominent crypto trader Ali Martinez took to the X platform to share an exciting bullish projection for the price of AAVE. According to the pundit, the DeFi coin could be readying for an over 6,400% rally before the end of this current cycle.

This bullish prediction is based on the action of the AAVE’s price around a TD (Tom Demark) Sequential resistance trendline. The TD Sequential indicator is a tool used in technical analysis to identify the exact time of trend exhaustion and price reversal for a specific token.

However, the TD Sequential indicator can also generate trendlines, which can serve as crucial resistance and support levels for price. These levels are determined using the extremes of the first candle in the Setup phase of TD Sequential.

In the last cycle — specifically in 2020, the AAVE price breached the TD Sequential resistance trendline (represented as the black dots in the chart above). This singular action was followed by a 6,400% rally, which saw AAVE reach its current all-time high price of $661 in 2021.

As it stands now, the price of AAVE is testing a similar resistance trendline around the $350 level on its monthly chart. If the price successfully breaks through this resistance zone — and history holds true, AAVE could witness a move to $3,500.

AAVE Price In The Short Term?

As of this writing, AAVE’s price stands around $337, reflecting an almost 7% increase in the past 24 hours. According to data from CoinGecko, the altcoin is down by 1% in the last seven days.

While AAVE’s future looks incredibly bullish, there are certain obstacles the DeFi coin might need to overcome sooner than expected. According to Martinez in a separate post on X, the AAVE price faces two key resistance zones at $243 and $365, where investors purchased 1.3 million and 971,000 tokens, respectively.Martinez noted that breaching these supply barriers is crucial for AAVE’s bullish breakout and a potential run to a new all-time high.Featured image from Binance Academy, chart from TradingView

Crypto exchange Coinbase has acquired Spindl, an onchain advertising and infrastructure platform, as part of a broader push to expand the reach for projects built on its Ethereum layer-2 network Base.

“Coinbase has acquired Spindl, an onchain ads and attribution platform (re)building the ad tech stack onchain, to improve the onchain discovery problem for onchain builders,” Coinbase said in a Jan. 31 statement.

Aiming to replicate Facebook ads success, but onchain

In a Jan. 31 X video, Base creator Jesse Pollak said Spindl’s founder, Antonio García Martínez, was part of the team behind Facebook’s original ads platform, which played an important role in scaling the platform and helping small businesses and “other folks” go viral online.

“Now they’re coming to do it again onchain, and they’ve built it from the ground up in smart contracts all onchain, and they’re helping builders right now go viral,” Pollak said.

Pollak explained that Spindl will give builders “the resources they need” to reach more customers.

Echoing a similar sentiment, Coinbase head of business development Shan Aggarwal said in a Jan. 31 X post that the acquisition was “to help builders go viral and find their power users.”

“Spindl’s built the first truly robust onchain advertising protocol that helps builders find their audience and users find more compelling things to do onchain. Win-win,” Aggarwal said.

Eric Seufert, an investor at Heracles Capital and one of Spindl’s early backers, said in an X post on the same day that he first met Garcia-Martinez when he visited Austin to appear on Joe Rogan’s podcast.

Moving ‘advertising forward’ is the goal

Seufert decided to invest in Spindl after García Martínez explained his vision for “onchain attribution and measurement.”

“I committed to investing. I’m excited to see how the Spindl team moves advertising forward in partnership with Coinbase,” Seufert said.

Meanwhile, it was only recently that Pollak said that Coinbase is considering making tokenized shares of its stock available to US users of Base.

Pollak said on Jan. 3 that while tokenized COIN shares are already available to non-US users through protocols like Backed, a tokenized real-world assets (RWA) platform, COIN on Base is “something we are looking into in the new year.”

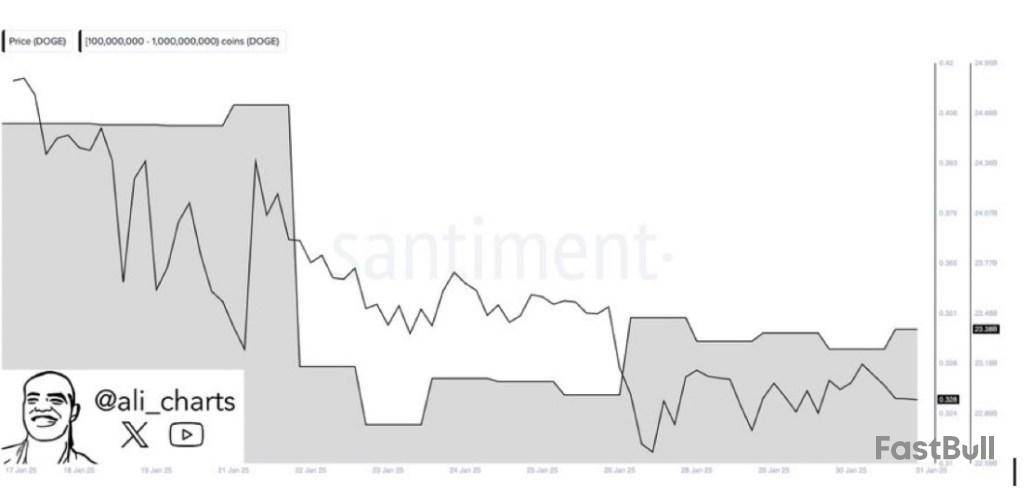

Dogecoin whales are making moves again, scooping up a whopping 560 million DOGE tokens in just one week, as market conditions become more favorable. This large-scale purchase underscores the renewed interest and growing confidence in Dogecoin’s future potential. As demand surges, crypto community members ponder the reasons behind the massive accumulation and the impact on the price of Dogecoin.

Dogecoin Whales Gobble Up 560 Million Tokens

Dogecoin‘s biggest players are back in action, as reports from crypto analyst Ali Martinez reveal that these deep-pocketed investors, often called “Whales,” have been aggressively adding to their Dogecoin holdings. Whale transactions, typically defined as transfers exceeding $100,000, have risen lately, suggesting strategic accumulation among investors.

Martinez disclosed in his X (formerly Twitter) post on January 31 that Whales have accumulated 560 million DOGE tokens in one week. This significant Whale activity comes after the market experienced a deep selloff, with many investors opting to liquidate their bags for profit due to bearish market conditions.

Following its explosive surge in December, Dogecoin has been struggling to reclaim previous price highs and spark a rally past its ATH of $0.74. The cryptocurrency had risen above $0.4 initially, triggering excitement amongst analysts as multiple bullish predictions spread the market. After this significant price increase, the Dogecoin price declined towards the $0.3 zone and has been attempting to break resistance levels ever since.

Due to bearish pressures and unexpected declines, the market experienced an intense sell off. However, now, Dogecoin whales seem to be diving back into the market with vigor, gobbling up as many DOGE tokens as possible.

Just before Donald Trump’s Presidential inauguration, Martinez reported in another X post that Dogecoin whales had initiated a monumental transaction, acquiring a whopping 1.83 billion DOGE tokens within 48 hours. This massive buying spree has caught the attention of crypto community members, with many pondering the impact of these large-scale transactions.

Notably, a crypto member, Mohd Atif, had commented on the recent rise in whale activity, highlighting that these Dogecoin Whales may possess insights into the meme coin’s future price trajectory, as a surge in accumulation often shows increased confidence in a cryptocurrency’s potential. The crypto member went on to predict that a $1 price leap for Dogecoin, possibly driven by the activities of these large-scale investors.

Analyst Predicts ‘Massive Rally’ For Dogecoin Price

While Dogecoin Whales are buying up more tokens, the price of the meme coin is getting ready for a potentially massive rally. Crypto analyst Trader Tardigrade shared a distinct price chart, highlighting past trends when Dogecoin experienced a rally to new highs.

In 2017, the meme coin skyrocketed to its highest level, experiencing a similar upward surge in 2021 during the previous bull run. With the 2025 bull market already ongoing, Trader Tardigrade believes that the Dogecoin price could have a repeat of historical trends and potentially surge to a new ATH target of $3.8.

Featured image from Pexels, chart from TradingView

President Trump on Saturday declared steep tariffs on all imported goods from Canada, Mexico, and China, setting the stage for a trade war with the U.S.'s largest trading partners. Trump set the tariffs at 25% on Canada and Mexico, with a 10% carve-out for Canada's oil and energy exports, and a 10% tariff on all goods from China.

Though the tariffs were initially set to go into effect on Saturday, Feb. 1, the implementation was delayed to Tuesday, Feb 4, at 12:01 am. The tariffs will be imposed on top of any existing tariffs, and have been implemented in response to the flow of illegal drugs into the United States, according to the White House.

"The government of Mexico has afforded safe havens for the cartels to engage in the manufacturing and transportation of dangerous narcotics, which collectively have led to the overdose deaths of hundreds of thousands of American victims," a White House fact sheet states.

Mexico's President Claudia Sheinbaum was the first to announce retaliatory tariffs and non-tariff measures in response, in a post on X Saturday evening. In the post, Sheinbaum proposed that the U.S. and Mexico establish a working group to combat criminal organizations, warned against using tariffs to solve problems, and forcefully denounced the White House's accusation that the Mexican government has alliances with drug cartels.

"I instruct the Secretary of Economy to implement Plan B that we have been working on, which includes tariff and non-tariff measures in defense of Mexico's interests," a translation of Sheinbaum's post reads.

The Canadian government is also reportedly considering levying counter-tariffs on American goods in response. Canadian Prime Minister Justin Trudeau said he would announce more details to the Canadian people in an address on Saturday night.

The Canadian government's response may include export tariffs on energy, Bloomberg reported Saturday, setting the stage for a critical trade war between the U.S. and its largest foreign energy supplier. The price of energy factors heavily into the cost of mining Bitcoin in the U.S., which has an estimated 36% share of the global hashrate, according to mining firm Luxor.

The Block's GMCI 30 index of the top 30 crypto tokens by market cap is down about 4% over the past 24 hours as the market responds to Trump's executive order.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up