Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Brian Quintenz, policy lead at a16z, is no longer being considered to lead the Commodity Futures Trading Commission, according to reporting from Politico.

Quintenz, whose nomination process has been thrown into disarray, was tapped to lead the agency earlier this year. One of those roadblocks had stemmed from Gemini's Tyler and Cameron Winklevoss over concerns about conflicts of interest. A source familiar told The Block that part of the concern also was around a16z's lobbying efforts and said that Quintenz was out.

Quintenz was a commissioner at the CFTC during Trump's first administration, and at the time, many in the crypto industry cheered that move. The CFTC will be instrumental in how crypto is regulated. Lawmakers in Washington are currently working on legislation that would give the agency broader authority over the industry.

"Being nominated to chair the CFTC and going through the confirmation process was the honor of my life," Quintenz told The Block in a statement. "I am grateful to the President for that opportunity and to the Senate Agriculture Committee for its consideration. I am looking forward to returning to my private sector endeavors during this exciting time for innovation in our country."

Quintenz's nomination vote in the Senate Agriculture Committee earlier this summer wavered as votes to move forward with his nomination had been canceled twice. After the second vote's cancellation, a Senate Agriculture Committee spokesperson said that it was due to a request from the White House.

The White House did not respond to a request for comment from The Block.

The top contender for the role is Mike Selig, who is currently chief counsel to the Securities and Exchange Commission's crypto task force and senior advisor to the chair, the source familiar said. Law firm Milbank LLP partner Josh Sterling, Baker & Hostetler LLP Counsel Isabelle Corbette Sterling, and former CFTC Commissioner Jill Sommers are also being considered, the source said.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Brian Quintenz, policy lead at a16z, is no longer being considered to lead the Commodity Futures Trading Commission, according to reporting from Politico.

Quintenz, whose nomination process has been thrown into disarray, was tapped to lead the agency earlier this year. One of those roadblocks had stemmed from Gemini's Tyler and Cameron Winklevoss over concerns about conflicts of interest. A source familiar told The Block that part of the concern also was around a16z's lobbying efforts and said that Quintenz was out.

Quintenz was a commissioner at the CFTC during Trump's first administration, and at the time, many in the crypto industry cheered that move. The CFTC will be instrumental in how crypto is regulated. Lawmakers in Washington are currently working on legislation that would give the agency broader authority over the industry.

"Being nominated to chair the CFTC and going through the confirmation process was the honor of my life," Quintenz told The Block in a statement. "I am grateful to the President for that opportunity and to the Senate Agriculture Committee for its consideration. I am looking forward to returning to my private sector endeavors during this exciting time for innovation in our country."

Quintenz's nomination vote in the Senate Agriculture Committee earlier this summer wavered as votes to move forward with his nomination had been canceled twice. After the second vote's cancellation, a Senate Agriculture Committee spokesperson said that it was due to a request from the White House.

The White House did not respond to a request for comment from The Block.

The top contender for the role is Mike Selig, who is currently chief counsel to the Securities and Exchange Commission's crypto task force and senior advisor to the chair, the source familiar said. Law firm Milbank LLP partner Josh Sterling, Baker & Hostetler LLP Counsel Isabelle Corbette Sterling, and former CFTC Commissioner Jill Sommers are also being considered, the source said.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The market is trying to avoid entering a prolonged downtrend and is fighting back. With Bitcoin smashing through the 50 EMA, XRP is trying to recover but failing for now, and Ethereum hitting $4,200, with solid volume growth.

Bitcoin fights back

After a period of erratic trading and downward pressure, Bitcoin has successfully pushed back above a critical level, regaining $113,000. This move occurs as Bitcoin surpasses its 50-day EMA, a dynamic resistance that has frequently held back price action in September.

Although the breakout is a good technical development, it is still unclear if Bitcoin will be able to sustain these gains. Bitcoin’s continuous struggle in a midterm consolidation zone is highlighted by the daily chart. Buyers intervened to protect the 100-day EMA after the market had dropped to about $111,000 earlier this week, which led to a dramatic recovery. Chart by TradingView">

The 50 EMA’s successful recovery points to fresh bullish momentum, but the overhead supply is still high between $113,000 and $115,000, the starting point of earlier breakdowns. The rally has seen moderate volume, lacking the bursts of inflows typically seen during long-term breakouts. This makes it more likely that Bitcoin will be rejected at the current levels once more and fall back toward the $111,000-$112,000 range.

Bitcoin would need to clear the September swing highs around $118,000, in addition to maintaining above the 50 EMA, for a more robust bullish confirmation. This uncertainty is reflected in momentum indicators. The RSI, which is neutral and allows for movement in either direction, is at about 50.

Upward targets in the near term point toward $115,000 and $118,000, if bulls continue to exert pressure and consolidate above $113,000. On the downside, if the 50 EMA is not maintained, there may be a quick retest of the 100 EMA and, in a more severe correction, the 200 EMA close to $106,500.

Bulls now have the upper hand again, as Bitcoin has reclaimed a significant resistance zone at $113,000. However, the market may just as easily experience another retracement before attempting a more definitive breakout, given the low volume and resistance above.

XRP secures recovery

Although XRP has recovered from its September lows around $2.80, the recovery is already beginning to show signs of weakness. The token is having difficulty breaking through a significant technical barrier, the 26-day EMA, which is still acting as overhead resistance despite bulls’ optimism following the rebound. The recent upward push runs the risk of being little more than a brief relief rally if there is not a clear break above this level.

The issue is evident on the daily chart. XRP tried to rise higher after retesting the 100-day EMA as support, but the rally halted as soon as the price hit the 26 EMA. The short-term momentum is often determined by this moving average, and XRP’s failure to break through it indicates weakened buying pressure. Additionally, volume has been quiet during the recent rebound, not indicating that there was strong conviction behind the move. Chart by TradingView">

To make matters more cautious, the overall structure of XRP continues to show a downward trendline that has capped each rally since the middle of July. Upward targets like $3.00-$3.10 are still out of reach until bulls decisively break through the trendline and the 26 EMA. The 200-day EMA at $2.61, the next significant support zone, could be reached by XRP if it is unable to maintain above $2.80.

Momentum indicators range from neutral to marginally pessimistic. Since the RSI is at 46 and does not appear to be oversold, there is potential for additional declines if sellers take advantage of the situation.

Ethereum's attempt

Ethereum has recovered somewhat, returning to $4,200 following a decline to the $3,800 region last week. Bulls are somewhat reassured by the rebound, but the move’s momentum is not very strong. Technical indicators show that ETH might be running into significant resistance, which could prevent further gains.

The way that Ethereum interacts with the 26-day EMA is the most pressing problem. ETH tried to regain this short-term moving average following the recent rebound, but it was canceled at the 26 EMA, indicating a lack of short-term momentum. The market runs the risk of rolling over once more in the direction of deeper support zones unless ETH can maintain a firm close above this level.

Volume is another warning sign. Trading volume has been steadily declining despite the price recovery, indicating a thinning of participation. Usually, strong recoveries need growing volume to validate buyer conviction. The absence of volume expansion, in ETH’s case, suggests hesitancy and casts doubt on the viability of the current rally.

Ethereum is still capped on the daily chart by a descending triangle pattern made up of strong horizontal support and lower highs. Despite not fully collapsing, ETH’s inability to overcome the $4,400-$4,500 resistance cluster keeps bulls on edge. Because it is in neutral territory and does not exhibit any overbought or oversold signals, the RSI at 45 reflects this uncertainty.

To boost confidence in the near future, ETH needs to push volume higher and reclaim the 26 EMA. An additional retracement toward the 100-day EMA at $3,870, or in a bearish scenario even the 200-day EMA close to $3,620, could result from failing to do so.

Ethereum’s recovery to $4,200 is currently not a complete bullish reversal but rather a cautious one. ETH might be vulnerable in the upcoming sessions if there is not more buying interest and a clear break above resistance.

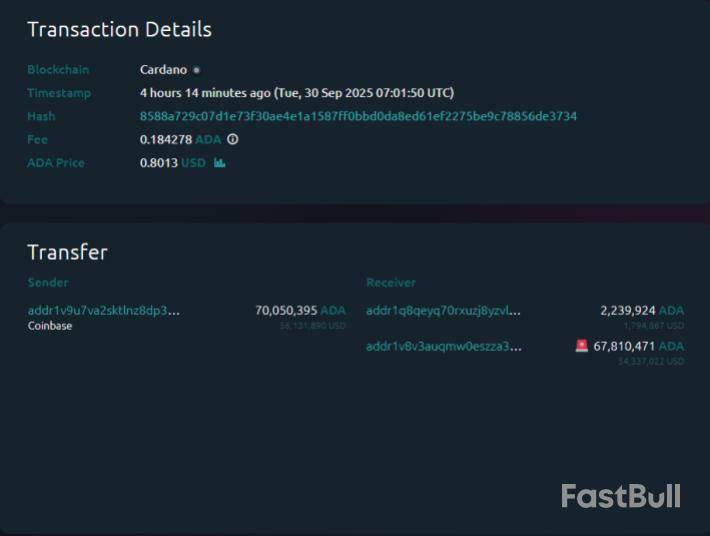

On-chain data shows a Cardano whale has made a massive withdrawal from Coinbase, a sign that may be bullish for the ADA price.

Cardano Whale Has Withdrawn Big From Coinbase

According to data from cryptocurrency transaction tracker service Whale Alert, a large transfer has been spotted on the Cardano blockchain during the past day. The move in question involved the shifting of about 67.8 million ADA across the network, worth over $54.3 million at the time that the sender executed the transaction.

Considering the significant scale of the transfer, it’s likely that a whale entity was responsible for it. Whales are big-money investors who carry large amounts in their wallets and hold the power to make huge individual transactions. Because of this, these holders can have some degree of influence in the market.

As such, what they are doing on the network can be worth keeping an eye on, as it may reveal the sentiment among them. Usually, though, the anonymous nature of the blockchain means it can be hard to comment on the motive behind a particular transaction.

In the case of the current Cardano whale transfer, however, one side of the move involves a wallet that’s already known. Below are the address details related to the transaction.

As is visible, the sending address for this Cardano whale transaction was a wallet attached to cryptocurrency exchange Coinbase. Meanwhile, the receiver was an unknown wallet, meaning that it was likely the investor’s self-custodial address.

Transfers of this type, where coins flow out of the custody of a centralized exchange, are known as exchange outflows. Generally, investors make exchange outflows when they plan to hold their tokens in the long term, as self-custody tends to be a safer option for them.

The latest large Coinbase withdrawal has come as Cardano is significantly down compared to its peak from earlier in September. As such, it’s possible that the move could be an indication of the whale betting on the asset at the current post-dip prices. It only remains to be seen whether the gamble will pay off for the investor.

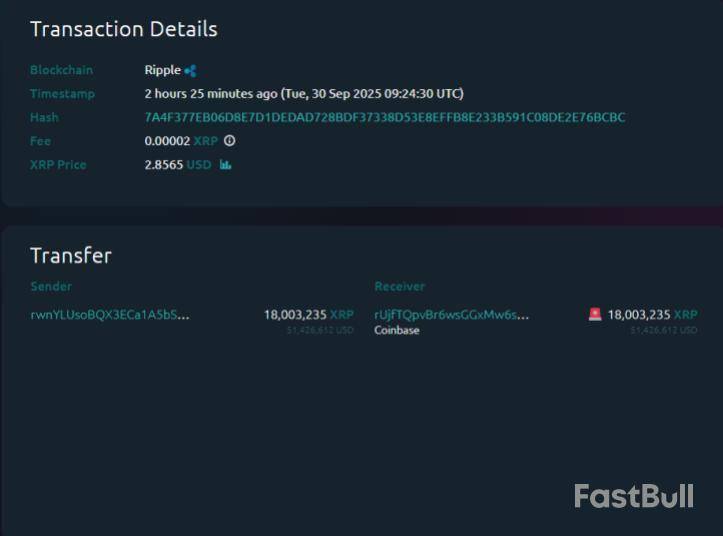

Another altcoin, XRP, has also just witnessed a large transaction, as Whale Alert has pointed out in another X post. Unlike ADA’s transfer, however, this whale move has been an Exchange Inflow.

In total, the XRP whale has shifted 18 million tokens of the cryptocurrency (worth around $51.4 million) to Coinbase with the transaction. Holders use exchanges for trading purposes, so it’s possible that the large investor may be looking to exit.

ADA Price

At the time of writing, Cardano is floating around $0.79, down almost 4% over the last seven days.

South Koreans are increasingly turning to overseas crypto exchanges, with trading volumes on domestic platforms dropping, a new report has found.

The South Korean media outlets and reported that the report was compiled by the country’s two top financial regulators, the Financial Services Commission and the Financial Supervisory Service.

The regulators examined data from a total of 17 crypto exchanges in the first six months of 2025, as well as eight crypto custody platforms and crypto wallet providers.

They found that amount of money and crypto transferred to overseas platforms reached 78.9 trillion won ($56.2 billion), making for a 4% increase.Trading volumes on the Bithumb crypto exchange over the past 12 months. (Source: CoinGecko)South Korean Crypto Exchanges: Missing Out as Market Cools?

The report also found that the overall crypto market’s “upward trend” has begun to slow, following a strong finish to 2024.

The figures were not all grim reading for the South Korean crypto industry. User numbers grew, hitting the 10.77 million mark.

This represents an 11% increase from the end of last year, with a few corporate users opening accounts as Seoul relaxes restrictions. Most crypto traders are aged 30-39, making up 3 million or 27.9% of the total.

However, the regulators found that the size of the crypto-to-fiat market fell by 12%, even though the crypto-to-crypto market ballooned by 286%.

The domestic crypto market capitalization dropped 14%, with overseas market cap figures only falling by 7%.

South Korea’s largest crypto exchange Upbit will list FLUID with KRW, BTC, and USDT pairs. Fluid is a lending protocol and decentralized exchange (DEX). Upbit also announced the listing of Infinit (IN) and B3. IN will trade against BTC and USDT, while B3 will trade against USDT.…— Wu Blockchain (@WuBlockchain) Deposits Down

While South Koreans remain relatively active on domestic crypto exchange platforms, they appear less keen to invest more of their fiat holdings.

KRW deposits fell by 42% to 6.2 trillion won ($4.4 billion), with the media outlets calling the drop “a sign of a significant decrease in standby trading funds.”

Traders also made less profits, with a 17% decrease since the second half of last year.The top 10 coins per trading volume on the Upbit crypto exchange on September 30, 2025. (Source: CoinGecko)Geopolitics Giving Traders Cold Feet, Say Regulators

Exchanges also appear to be listing more tokens than ever in a bid to drive up trading volumes, with the trading pair total rocketing up from 181 to 1,538.

The regulators noted that 121 (or 43%) of these coins have a market capitalization of less than KRW 100 million ($71,232).

They noted that this “highlights the need to be mindful of market risks such as rapid price fluctuations and a lack of liquidity.”

Customer withdrawals also grew by 5% to reach the KRW 101.6 trillion ($72.4 billion) mark.

The total value of assets under the management of domestic custody and wallet operators decreased by a whopping 50% compared to the end of last year.

User numbers for these services also saw a sharp drop of 41%. The financial regulators wrote:

“Market growth has slowed and volatility has increased compared to the previous year due to global tariff-related disputes and heightened geopolitical tensions. Overseas corporate crypto buying has driven up Bitcoin prices. But weakening retail investor sentiment has led to mixed results for other tokens.”

🤝 South Korea’s internet giant Naver is closing in on a stock swap deal for Upbit operator Dunamu, a move that could shake up the country’s crypto market. — Cryptonews.com (@cryptonews) Kimchi Coins: South Korean Crypto Exchanges Turn Their Backs?

The report also contained bad news for so-called “kimchi coins,” low-cap South Korean projects that are typically only traded on domestic exchanges.

The number of kimchi coins listed on domestic exchanges has dropped by 3% over the past six months, despite the recent outbreak of a “listings war.”

The media outlets concluded that the decline of kimchi coins reflects recent listing trends. News1 wrote:

“Lately, crypto exchanges, both domestic and international, are increasingly looking to list promising overseas coins around the time of token launches. [South Korean exchanges are] listing tokens that are already actively traded on overseas exchanges, rather than opting for relatively high-risk [kimchi coin] listings.”

A fresh bout of tribal sparring over token valuations broke out on X after CoinRoutes founder Dave Weisberger asked why XRP trades at more than ten times the market value of Chainlink’s LINK despite Chainlink’s high-profile role in financial-market infrastructure. The exchange, which followed Swift’s announcement at Sibos that it will launch a blockchain-based ledger, quickly crystallized two very different theories of “value capture” in crypto: a native asset securing and settling an L1 network versus a utility token powering oracle middleware.

Weisberger set the stage with a direct challenge to the XRP community: “Can someone from the XRP army (@xrpmickle) explain how XRP is more than TEN times LINK’s value, when LINK has a REAL partnership with SWIFT, AND a clear path to revenue to be shared with Token holders…” The prompt referenced Chainlink’s post congratulating Swift on adopting “blockchains and oracle networks as a key next step,” and emphasizing that Chainlink and Swift “have collaborated across numerous initiatives” to connect financial institutions to blockchains using existing infrastructure and standards.

Why Is XRP 10x More ‘Valuable’ Than LINK

What followed was equal parts token-economics debate and culture clash. Weisberger, who later clarified “To be clear, I hold both,” added that he thinks “XRP bulls are delusional in their calls,” while conceding that such delusion does not preclude outperformance versus traditional assets. His framing invited two lines of reply: the “volume and adoption” argument and the “different problem, different TAM” argument.

On the data front, one respondent, @baggins_cc, asserted that “The XRP token has a $172B market cap, while LINK has $14B (1/10th). And when looking at the last 24h, by volume, XRPL has processed $4.9B in revenue, compared to LINK, which only has processed $641M. Marketcap is absolute when it comes to ranking, and Volume is empirical & objectively a fact, when it comes to real world adoption.”

Weisberger pushed back with a counterexample intended to decouple throughput from token value: “What is the value of XRPL to XRP when TRX processes more than 500 TIMES USDT by value and is 1/5th the market cap?” The thrust: raw settlement or messaging volume does not automatically translate into superior price performance or capitalization for a token.

The second, more structural line of response came from former Ripple engineer Matt Hamilton. In a succinct distinction, he wrote: “Trying to compare their value is sort of meaningless. Link is a protocol, the XRP Ledger is an actual network. XRP is the native asset of that entire network. Link is just the token used within the link protocol.” In other words, the two assets occupy different positions in the technology stack: XRP is the base-layer currency of an L1 that provides security, fee payment, and liquidity for its ledger; LINK is the work token for an oracle protocol that sits above execution layers to deliver data and cross-chain services.

That stack-positioning argument was amplified by the XRP army member “Ripple Bull Winkle,” who reframed the comparison in terms of addressable markets: “Because XRP isn’t competing with LINK — it’s solving a different problem on a much larger scale. LINK = middleware for data feeds. XRP = bridge asset for global settlement. One secures oracles, the other settles value between banks, CBDCs, tokenized treasuries, & stablecoins. The TAM for cross-border payments dwarfs oracle revenue. And by the way — Ripple has been partnered with SWIFT participants for years. This isn’t XRP vs LINK, it’s XRP in the heart of the plumbing that moves the actual money. That’s why the market values it 10x higher.”

Other replies took aim at investor narratives themselves. When a commenter criticized Weisberger’s “lazy ask,” he volleyed back with a reminder that many were “talked into XRP based on SWIFT, despite no clear token economics and no definitive use case,” nodding to years of marketing-driven expectations that official banking rails would one day require XRP.

In the end, the thread does not “prove” why XRP is worth ten times LINK or vice versa; instead, it exposes a fundamental split in crypto investing frameworks. One camp prioritizes native-asset economics of base layers and their role as neutral settlement media; the other prioritizes revenue-bearing middleware whose services are indispensable to a tokenized financial system.

As the Swift news resets expectations about how legacy rails will interface with blockchains, the core question for markets remains unchanged: which designs actually trap value, and how verifiably do those mechanics funnel real-world usage into persistent demand for the token itself? On that score, the debate is far from settled.

At press time, XRP traded at $2.84.

A fresh bout of tribal sparring over token valuations broke out on X after CoinRoutes founder Dave Weisberger asked why XRP trades at more than ten times the market value of Chainlink’s LINK despite Chainlink’s high-profile role in financial-market infrastructure. The exchange, which followed Swift’s announcement at Sibos that it will launch a blockchain-based ledger, quickly crystallized two very different theories of “value capture” in crypto: a native asset securing and settling an L1 network versus a utility token powering oracle middleware.

Weisberger set the stage with a direct challenge to the XRP community: “Can someone from the XRP army (@xrpmickle) explain how XRP is more than TEN times LINK’s value, when LINK has a REAL partnership with SWIFT, AND a clear path to revenue to be shared with Token holders…” The prompt referenced Chainlink’s post congratulating Swift on adopting “blockchains and oracle networks as a key next step,” and emphasizing that Chainlink and Swift “have collaborated across numerous initiatives” to connect financial institutions to blockchains using existing infrastructure and standards.

Why Is XRP 10x More ‘Valuable’ Than LINK

What followed was equal parts token-economics debate and culture clash. Weisberger, who later clarified “To be clear, I hold both,” added that he thinks “XRP bulls are delusional in their calls,” while conceding that such delusion does not preclude outperformance versus traditional assets. His framing invited two lines of reply: the “volume and adoption” argument and the “different problem, different TAM” argument.

On the data front, one respondent, @baggins_cc, asserted that “The XRP token has a $172B market cap, while LINK has $14B (1/10th). And when looking at the last 24h, by volume, XRPL has processed $4.9B in revenue, compared to LINK, which only has processed $641M. Marketcap is absolute when it comes to ranking, and Volume is empirical & objectively a fact, when it comes to real world adoption.”

Weisberger pushed back with a counterexample intended to decouple throughput from token value: “What is the value of XRPL to XRP when TRX processes more than 500 TIMES USDT by value and is 1/5th the market cap?” The thrust: raw settlement or messaging volume does not automatically translate into superior price performance or capitalization for a token.

The second, more structural line of response came from former Ripple engineer Matt Hamilton. In a succinct distinction, he wrote: “Trying to compare their value is sort of meaningless. Link is a protocol, the XRP Ledger is an actual network. XRP is the native asset of that entire network. Link is just the token used within the link protocol.” In other words, the two assets occupy different positions in the technology stack: XRP is the base-layer currency of an L1 that provides security, fee payment, and liquidity for its ledger; LINK is the work token for an oracle protocol that sits above execution layers to deliver data and cross-chain services.

That stack-positioning argument was amplified by the XRP army member “Ripple Bull Winkle,” who reframed the comparison in terms of addressable markets: “Because XRP isn’t competing with LINK — it’s solving a different problem on a much larger scale. LINK = middleware for data feeds. XRP = bridge asset for global settlement. One secures oracles, the other settles value between banks, CBDCs, tokenized treasuries, & stablecoins. The TAM for cross-border payments dwarfs oracle revenue. And by the way — Ripple has been partnered with SWIFT participants for years. This isn’t XRP vs LINK, it’s XRP in the heart of the plumbing that moves the actual money. That’s why the market values it 10x higher.”

Other replies took aim at investor narratives themselves. When a commenter criticized Weisberger’s “lazy ask,” he volleyed back with a reminder that many were “talked into XRP based on SWIFT, despite no clear token economics and no definitive use case,” nodding to years of marketing-driven expectations that official banking rails would one day require XRP.

In the end, the thread does not “prove” why XRP is worth ten times LINK or vice versa; instead, it exposes a fundamental split in crypto investing frameworks. One camp prioritizes native-asset economics of base layers and their role as neutral settlement media; the other prioritizes revenue-bearing middleware whose services are indispensable to a tokenized financial system.

As the Swift news resets expectations about how legacy rails will interface with blockchains, the core question for markets remains unchanged: which designs actually trap value, and how verifiably do those mechanics funnel real-world usage into persistent demand for the token itself? On that score, the debate is far from settled.

At press time, XRP traded at $2.84.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up