Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Key takeaways

If you’re managing assets on Solana, chances are you’ve heard of Phantom Wallet — it’s the go-to choice for many users. Over the years, it has evolved beyond Solana and now supports the Ethereum, Polygon and even Bitcoin blockchains, making it a versatile multichain wallet.

Whether you’re a decentralized finance (DeFi) enthusiast, a non-fungible token (NFT) collector or just getting started with crypto, Phantom provides the tools and security you need — all wrapped in an intuitive interface.

This article will walk you through everything you need to know about Phantom Wallet, from setup to advanced features.

What is Phantom Wallet?

Phantom Wallet is a non-custodial cryptocurrency wallet that has become a cornerstone of the Solana ecosystem, offering users a platform to manage their digital assets. Beyond basic functionalities such as storing, sending and receiving tokens, Phantom enables users to stake Solana (SOL) tokens, interact seamlessly with decentralized applications (DApps), and manage NFTs.

As of January 2025, Phantom boasts notable metrics in the crypto ecosystem:

Phantom Wallet was founded in January 2021 by a team of engineers, designers and former founders and was initially developed for the Solana blockchain. The leadership team includes co-founder and CEO Brandon Millman, chief technology officer and co-founder Francesco Agosti and chief product officer and co-founder Chris Kalani.

In January 2025, Phantom secured a $150-million Series C funding round, co-led by Sequoia Capital and Paradigm, elevating its valuation to $3 billion. This substantial investment underscores the platform’s rapid growth and the confidence investors have in its future.

Key features of Phantom Wallet

Phantom Wallet is accessible across multiple devices, including desktop (browser extensions) and mobile (iOS and Android apps). This cross-platform availability ensures users can access their assets and interact with DApps seamlessly, regardless of the device they are using. Some key features include:

How to set up a Phantom wallet

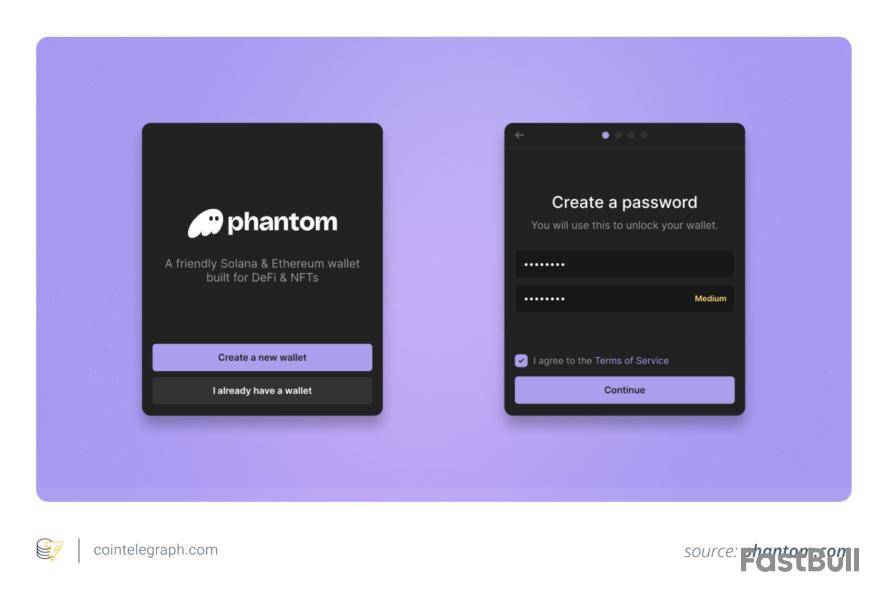

Setting up a Phantom wallet is a straightforward process that can be completed on both desktop browsers and mobile devices.

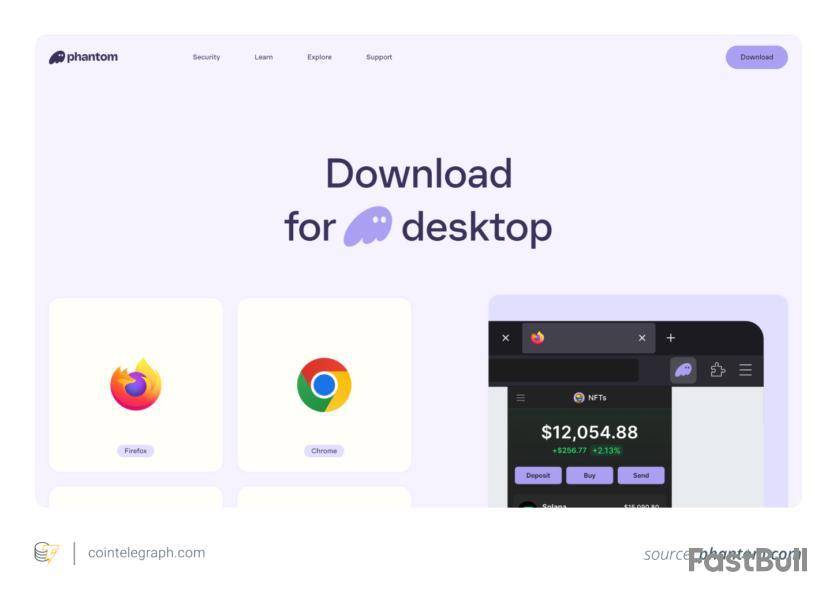

Method 1: For desktop users

Step 1: Download the browser extension:

Step 2: Create a new wallet:

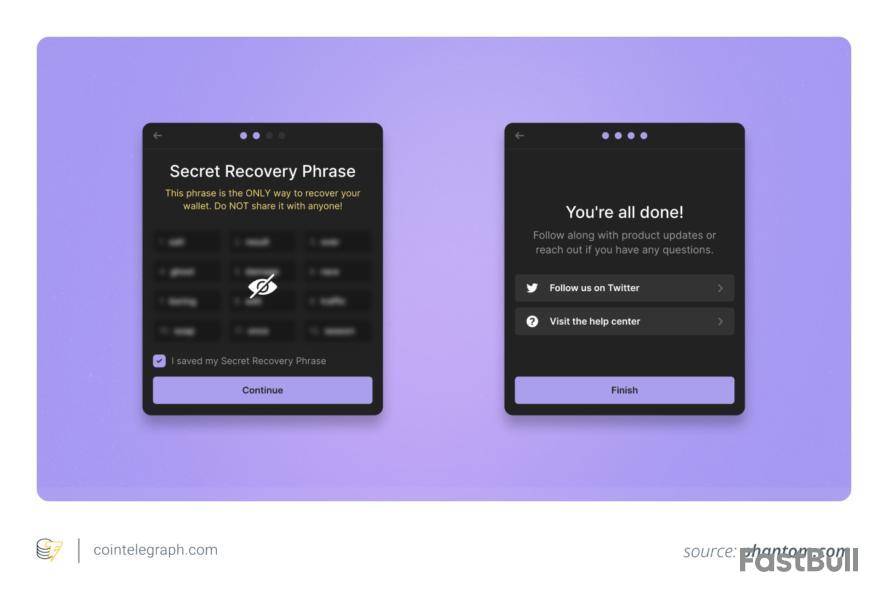

Step 3: Secure your secret recovery phrase:

Step 4: Accessing the wallet:

Method 2: For mobile users

Step 1: Download the app:

Step 2: Create a new wallet:

Step 3: Secure your secret recovery phrase:

Step 4: Accessing the wallet:

Did you know: In January 2024, Phantom Wallet users were targeted by a phishing attack disguised as a fake wallet update. Attackers tricked users into downloading malicious software that compromised their private keys and drained their funds. This incident highlights the importance of verifying official sources before installing updates.

How to use a Phantom wallet

Once your wallet is set up, you can start managing your digital assets and interacting with the decentralized web.

Did you know: In January 2025, Phantom Wallet’s in-app exchange fees exceeded $29 million, setting a new monthly revenue record. This surge highlights the growing adoption of its built-in swap feature, as more users rely on Phantom for seamless token trading across multiple chains. The wallet’s expansion beyond Solana to Ethereum, Polygon and Bitcoin has further driven transaction volumes, solidifying its position as a key player in the multichain wallet space.

Managing gas fees on Phantom Wallet

Like any crypto wallet, Phantom comes with gas fees. But don’t worry — Phantom automatically optimizes them, so you don’t overpay.

These gas fees cover the cost of processing transactions on the blockchain and compensate validators for securing the network. Each blockchain requires its native token to pay for gas fees, and gas fees will vary with the network.

Phantom automatically calculates the optimal gas fee for transactions, ensuring they are processed efficiently without unnecessary overpayment. However, users can adjust gas fees manually, particularly when transacting on Ethereum, to prioritize speed or cost savings. Users must ensure they have a sufficient balance of these tokens to complete transactions.

Security tips for Phantom Wallet users

Want to keep your assets safe? Follow these golden rules:

By following these security measures, you can significantly reduce the risk of compromising your Phantom Wallet and protect your digital assets. Staying cautious and proactive in securing your recovery phrase, passwords and wallet connections is key to maintaining a safe and seamless experience while managing your Solana-based assets.

North Carolina Speaker of the House Destin Hall has filed a bill that proposes authorizing the State Treasurer to invest in “qualifying digital assets,” joining over a dozen other U.S. states that are pursuing similar bills.

The bill, HB92, intends to allow the treasurer to diversify the state’s portfolio by investing in crypto assets such as bitcoin. However, such crypto assets have been described as "exchange-traded products" with a minimum average market capitalization of $750 billion over the preceding 12 months, a criterion that currently only bitcoin meets.

The proposed legislation — co-sponsored by Representatives Stephen Ross, Mark Brody and Mike Schietzelt — also stipulates that the crypto investment must not exceed 10% of the balance of the fund.

“Investing in digital assets like Bitcoin not only has the potential to generate positive yields for our state investment fund but also positions North Carolina as a leader in technological adoption and innovation,” Hall said in a statement on Monday.

In a separate X post, Hall wrote that the “North Carolina Digital Assets Investments Act” aligns with U.S. President Donald Trump’s vision for “a national bitcoin stockpile” and ensures that “North Carolina leads at the state level.”

Over a dozen other U.S. states have also introduced similar acts. Representatives from states including Texas, Pennsylvania, Ohio and Oklahoma have recently pushed to build bitcoin reserves in their respective states.

Bitcoin has become an investment project among lawmakers in US states, especially after pro-crypto Trump took office in January. The world’s largest crypto gained 1.1% in the past 24 hours to trade at $98,351 at the time of writing, according to The Block’s price page.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

WazirX hack victims will receive 85% of their portfolio value as recorded on Jul.18 as the exchange completed its asset rebalancing on Tuesday, with the first round of distributions slated in April.

As of Tuesday, users can see both the U.S. dollar and Indian rupee values of assets that were lost in a $230 million hack in July 2024. Upside from unstolen tokens belonging to individuals have been distributed across all users, allowing for a higher amount to be returned to users.

Creditors now have until Feb.19 to accept the rebalancing under the current scheme, with a majority vote of 75% required for the plan to move forward.

Part of the refund plan is to launch a decentralized exchange (DEX), issue recovery tokens that can be traded, and perform a periodic buyback of recovery tokens using platform profits and new revenue streams over the next three years.

However, if the scheme is not approved, the restructuring plan fails and the process moves towards liquidation under section 301 of the Singapore Companies Act — potentially leading to a fire sale of assets and creditors receiving less compensation as assets are sold off at possibly lower values.

WazirX was hit by a security breach in one of its multisig wallets last July, causing over $100 million in shiba inu and $52 million in ether, among other assets, to be drained from the exchange.

The stolen funds accounted for over 45% of the total reserves cited by the exchange in a June 2024 report, leading to a restructuring process to clear liabilities. North Korean hacking unit Lazarus is believed to be behind the attack, as CoinDesk previously reported.

Binance and the U.S. Securities and Exchange Commission have jointly requested the court to pause their legal case for 60 days.

The court filing, submitted Monday, stated that the request to stay the case was made with consideration of the SEC’s new task force for developing a clear regulatory framework for cryptocurrencies.

“The work of this task force may impact and facilitate the potential resolution of this case,” the document said. “Accordingly, the SEC proposed a brief stay to Defendants, and the Defendants agreed that a stay is appropriate.”

The defendants in the case are Binance, its co-founder Changpeng Zhao, BAM Trading Services and BAM Management US Holdings.

The filing also noted that at the end of the 60-day period, the parties plan to submit a joint status report that decides whether an extension of the stay is warranted.

Originally filed in June 2023, the SEC’s complaint against Binance and affiliated entities included 13 charges based on its claim that the exchange operated unregistered exchanges, broker-dealers and clearing agencies for financial securities.

In June 2024, a federal judge partially dismissed the charges regarding Binance’s BUSD, Simple Earn programs and the secondary sales of BNB, but still upheld a large part of the SEC’s claims.

The agency, under the leadership of former chair Gary Gensler, also filed lawsuits against other major crypto players, including Ripple, Coinbase and Kraken, with charges of a similar nature to the Binance case.

The SEC’s claims against the crypto platforms have been criticized by industry members and experts who claim that it failed to deliver clear instructions on what offerings or services of cryptocurrencies may violate federal securities laws.

SEC Crypto 2.0

Gensler, who faced heavy criticism from the crypto sector for his “regulation by enforcement” approach against major players, stepped down last month following crypto proponent Donald Trump’s reelection as U.S. President.

Gensler’s departure from the agency has been touted as a major positive shift for crypto regulations.

Trump has since named pro-crypto SEC Commissioner Mark T. Uyeda as the acting chair of the SEC, and appointed former regulator Paul Atkins to assume the role of SEC chairman. Atkins, who also shares a friendly view toward crypto, has yet to be confirmed by the Senate.

Under new leadership, the SEC was also said to be scaling down its crypto enforcement unit. The Wall Street Journal reported that the SEC reassigned chief litigation counsel Jorge Tenreiro, who has overseen several crypto lawsuits, to the agency’s IT department.

SEC Commissioner Hester Peirce, the leader of the SEC’s crypto task force, said in a statement last week that the team will work to provide clarity on which crypto assets are financial securities, and prioritize classifying some tokens as “non-securities.”

“To date, the SEC has relied primarily on enforcement actions to regulate crypto retroactively and reactively,” the SEC said in the crypto task force announcement, titled SEC Crypto 2.0. “The Task Force’s focus will be to help the Commission draw clear regulatory lines, provide realistic paths to registration, craft sensible disclosure frameworks, and deploy enforcement resources judiciously.”

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Ether has underperformed year-to-date, declining over 20%, but fundamentals are improving and total value locked (TVL) on the Ethereum blockchain has risen dramatically, Wall Street bank Citi C said in a research report Monday.

"While user activity has been volatile in recent weeks, the fundamental backdrop is not all that murky," analysts led by Alex Saunders wrote.

Citi noted that TVL on the Ethereum network has risen sharply, while ether exchange-traded funds (ETFs) are still seeing inflows, and search interest is rising.

Following the U.S. election in November, ether ETF flows turned positive, the report noted, with total inflows of $3.2 billion since their July launch.

Stronger user growth on layer-2s and rival blockchain's such as Solana has raised questions about Ethereum's competitive advantage, the report said.

President Trump's World Liberty Financial holds more than $200 million of ether, and this could be viewed as "additional motivation for ensuring the U.S. strengthens its support for the crypto industry," the bank said.

"Relative ETH and altcoin performance may serve as a gauge for how optimistic the industry is regarding follow-through on regulatory clarity in the U.S.," the report added.

Citi noted that weakness in ether has coincided with an increase in bitcoin dominance, which is now at multi-year highs above 60%.

Read more: Ethereum Faces 'Intense' Competition From Other Networks: JPMorgan

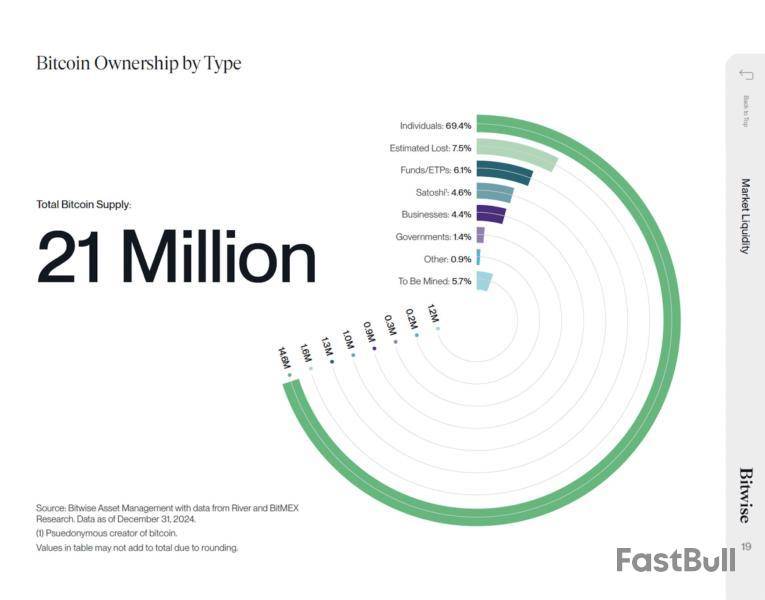

According to Bitwise Asset Management, individual holders control most of Bitcoin’s total supply. 69.4% of the 21 million BTC in circulation belong to private investors.

Given this concentration of ownership among individuals, large institutions and governments seeking to acquire Bitcoin may face challenges.

Institutions Face Scarcity as Bitcoin Supply Declines

In a recent X post, Bitwise outlined Bitcoin’s total supply distribution. Apart from individual holders, approximately 7.5% of Bitcoin is considered lost. Funds and exchange-traded products (ETPs) control 6.1%.

The wallet associated with Satoshi Nakamoto, Bitcoin’s pseudonymous creator, holds 4.6%. Moreover, governments and businesses collectively own just 5.8% of Bitcoin.

The asset manager highlighted that if companies and governments wish to acquire Bitcoin, they will primarily need to purchase it from individuals willing to sell.

“That market dynamic between buyers and sellers could get very interesting,” the post read.

Hunter Horsley, CEO of Bitwise, also pointed out that despite consistent buying from corporates and ETFs, Bitcoin’s price has still faced downward pressure. He also stressed that the bulk of Bitcoin’s value remains in the hands of individual holders.

“Every new buyer must find a seller. Obvious but important as ever,” Horsley added.

Is a Bitcoin Supply Shock Coming?

Meanwhile, only 5.7% of Bitcoin remains to be mined. In addition, OTC (Over-the-Counter) markets are running low on Bitcoin. A crypto analyst highlighted that just 140,000 BTC remains in the OTC market.

“There’s almost no Bitcoin left even for institutions,” he claimed.

The analyst explained ETFs collectively purchased 50,000 BTC last month. Yet, price movements remained subdued. This suggested that institutions source Bitcoin from OTC markets rather than exchanges to avoid triggering price surges.

Nonetheless, this strategy may no longer be viable with OTC supply depleting.

“Every billion dollars worth of money going into BTC raises its price by 3-5%. Thats why OTC drying up is so insane,” the analyst remarked.

He added that if MicroStrategy (now Strategy) continues its aggressive acquisitions or ETFs maintain their January-level accumulation, OTC Bitcoin could be depleted. A similar scenario would unfold if the US and the states began buying Bitcoin as part of their reserves.

Strategy has maintained a consistent Bitcoin acquisition plan. On February 10, the firm purchased 7,633 BTC for approximately $742.4 million. This marked its fifth Bitcoin purchase in 2025 alone. According to Saylor Tracker, the firm now holds 478,740 BTC, valued at $47.12 billion.

Institutions such as BlackRock are also adding pressure to supply. The asset manager reportedly acquired $1 billion worth of BTC in January. In fact, it bought 227 BTC today, according to Arkham Intelligence.

Nevertheless, as supply tightens, institutions may soon be forced to buy directly from exchanges, potentially driving Bitcoin’s price significantly higher.

This supply shock threat looms as Bitcoin adoption accelerates. In a previous report, BlackRock noted that cryptocurrency reached 300 million users faster than the internet and mobile phones.

Brian Armstrong, CEO of Coinbase, also weighed in on the adoption timeline comparison.

“Bitcoin adoption should get to several billion people by 2030 at current rates,” Armstrong predicted.

He added that the comparison depends on how one defines the official starting points for Bitcoin, the internet, and mobile phones. However, Armstrong acknowledged that the overall trend is still accurate despite these variables.

Lawmakers and industry leaders are calling for a regulatory overhaul of the cryptocurrency sector under President Donald Trump’s administration to ensure the US maintains an edge over global competitors.

On Feb. 11, the Digital Assets, Financial Technology, and Artificial Intelligence Subcommittee of the House Financial Services Committee will hold a hearing titled “A golden age of digital assets: charting a path forward.”

Witnesses will include senior executives specializing in cryptocurrencies such as Jose Fernandez da Ponte from PayPal, Jonathan Jachym from Kraken crypto exchange and Timothy Massad from Harvard University.

In a written testimony to Congress, Ji Hun Kim, president and acting CEO of the Crypto Council for Innovation (CCI), emphasized the importance of a clear, comprehensive digital asset policy at the federal level.

He noted that international competitors, such as the European Union, the United Kingdom, Japan and Singapore, are advancing with clear regulations, putting the United States at risk of falling behind. Kim outlined four key legislative priorities to ensure the US remains a global leader in digital assets.

The need for a regulatory revamp

These include passing comprehensive market structure legislation, passing stablecoin legislation, enhancing coordination between the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) and supporting decentralized finance and individual empowerment.

Coy Garrison, partner at the Steptoe law firm, supported the call for regulatory changes under the new administration. He noted that the SEC, CFTC and the Federal Deposit Insurance Corporation (FDIC) are trying to attract crypto businesses back to the US by rolling back restrictive policies of the administration of former President Joe Biden.

Garrison’s testimony also stated that congressional action is needed to implement oversight of spot market digital asset trading in addition to the SEC’s duty to provide regulatory clarity under its existing jurisdiction:

He also asked the government to withdraw lawsuits against crypto exchanges like Coinbase, Binance and Kraken and instead create registration pathways for digital asset businesses.

Magazine: Trump’s crypto ventures raise conflict of interest, insider trading questions

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up