Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Russian Central Bank: Sets Official Rouble Rate For February 5 At 76.9102 Roubles Per USA Dollar (Previous Rate - 76.9817)

US Vice President Vance: The United States Will Establish A System To Set A Price Floor For Critical Minerals; The United States Is Proposing To Establish A Critical Minerals Trading Bloc

White House Border Czar Homan: Have Made Significant Progress On Increasing Coordination Between State And Local Officials And ICE

Fed Data - USA Effective Federal Funds Rate At 3.64 Percent On 03 February On $107 Billion In Trades Versus 3.64 Percent On $93 Billion On 02 February

[Pinterest's CEO Reprimands And Fires "Obstructive" Employee: Due To His Development Tool Tracking Layoffs] Last Week, Pinterest Announced It Would Lay Off Less Than 15% Of Its Workforce And Reduce Office Space As Part Of A Larger Restructuring Plan. Several Pinterest Engineers Created An Internal Software Tool To Attempt To Quantify Specific Layoff Figures. Meeting Recordings Show That CEO Bill Ready Stated At A Company-wide Meeting Last Week, "We Look Forward To Healthy Debate And Differing Opinions; That's How We Make Decisions. But There's A Clear Line Between Constructive Debate And 'obstructive' Behavior." The CEO Fired The Individual Involved

According To The Iranian Students' News Agency, The Talks Between Iran And The United States Were Limited To The Nuclear Issue And Sanctions Easing

US Treasury Says Cuts In Bill Auction Sizes Will Likely Lead To Decline In Net Bill Supply By $250-$300 Billion By Early May

US Treasury Says It Continues To Evaluate 'Potential Future Increases' To Coupon, Floating Rate Note Auction Sizes

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)A:--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)A:--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)A:--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)A:--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)A:--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)A:--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)A:--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)A:--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)A:--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)A:--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)A:--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)A:--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)A:--

F: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)A:--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)A:--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)A:--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)A:--

F: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)--

F: --

P: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)--

F: --

P: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction Yield--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP Growth--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)--

F: --

P: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)--

F: --

P: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)--

F: --

P: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest Rate--

F: --

P: --

MPC Rate Statement

MPC Rate Statement

No matching data

View All

No data

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee because whispers are growing louder, charts are shifting, and an old Ripple IPO (Initial Public Offering) debate is starting to resurface — but this time, with billion-dollar implications.

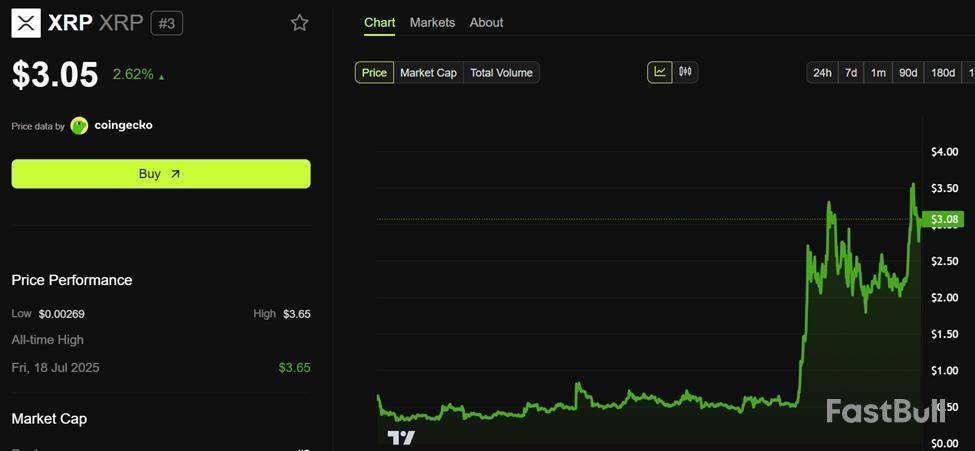

Crypto News of the Day: Ripple IPO Speculation Reignites

While the Ripple IPO remains elusive, market watchers are already gaming out what a $20 billion valuation might mean for XRP and the broader crypto equities arena.

Despite Ripple’s official stance that no IPO is scheduled for 2025, the buzz is back. Paul Barron noted this week that Ripple’s pre-IPO shares are already trading over-the-counter (OTC) at a $20 billion valuation. This is almost double the $11.3 billion figure from its recent buyback round.

He emphasized that going public would grant Ripple access to institutional capital, investor liquidity, and mainstream legitimacy. However, according to Barron, there’s a caveat.

“Ripple stock ≠ [is not the same as] XRP token performance,” Barron warned.

Notwithstanding, XRP holders are paying close attention, with a Ripple IPO expected to move markets.

Analysts Draw XRP-Stock Connection

The most bullish voices argue that Ripple’s IPO could catalyze a new era of token-equity convergence. Analyst Virtual Bacon said that, Citing Circle’s post-IPO surge from $31 to $134 per share, traditional finance (TradFi) demand for crypto firms is real.

According to the analyst, a prospective Ripple IPO could open the floodgates, especially with the unique XRP-stock link.

That link, while informal, hinges on Ripple’s central role in the XRP Ledger ecosystem and its treasury of XRP holdings.

A soaring stock valuation could indirectly boost sentiment and visibility for XRP, even if the asset is not legally tied to Ripple equity.

Further, analyst SMQKE pointed to a recent SBI Holdings statement suggesting that the long-running Ripple-SEC lawsuit, which was once a major IPO blocker, is nearing resolution.

“The price suppression of XRP is coming to an end,” they said.

This remark implies legal clarity could clear the runway for both XRP and Ripple’s market debut.

Big Money Plays in the Background

Meanwhile, Jeremy Raper, tracking private equity movements, sees signs of high-stakes positioning. He estimates insiders could unlock up to $1.1 billion if Ripple retires float shares before IPO, based on current NAV and discounted XRP holdings.

This analysis suggests that Ripple’s IPO could trigger a cascade of financial recalibrations across intertwined equity and crypto markets. Ripple CEO Brad Garlinghouse, however, remains non-committal. Back in April, he refuted any interest in an IPO.

“Most companies that go public do that to raise capital. We haven’t needed to raise capital,” Garlinghouse articulated.

Notwithstanding, this has not stopped analysts from suggesting a listing could happen within 6–12 months. The optimism comes amid 2025’s IPO revival, with firms like Circle, Gemini, and Tron making their market debuts.

If Ripple goes public, it wouldn’t just be a corporate milestone; it could signal the mainstreaming of crypto-native ecosystems through traditional financial (TradFi) rails.

For XRP, the IPO might not provide a direct price pump, but it could legitimize its network in a way no airdrop or partnership ever has.

Meanwhile, it is imperative to remember that Coinbase IPO investors finally made a profit for the first time in four years, as indicated in a recent US Crypto News publication.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

The legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC), which started in 2020, has continued to linger. However, today, Aug. 7, 2025, might prove crucial as the regulatory body is set to deliberate on its decision to withdraw its Ripple lawsuit appeal.

Ripple lawsuit decision may set precedent for crypto regulation

In an update shared by Scott Melker, The Wolf of All Streets, in a matter of hours, the SEC will discuss internally whether to accept the withdrawal. This suggests that the regulatory body will likely accept Ripple’s stance or respond with further action.

The Wolf Of All Streets@scottmelkerAug 07, 2025TODAY: SEC EXPECTED TO DELIBERATE RIPPLE'S DECISION TO WITHDRAW ITS APPEAL

Notably, the SEC vs. Ripple case remains one of the most high-profile crypto legal battles, and the decision will impact the crypto sector. It might serve as a reference point for future lawsuits between Web3 firms and crypto regulators.

The SEC meeting today remains pivotal ahead of the approaching deadline. As U.Today reported, the next status report is due on Aug. 15, with anticipation high in the broader crypto sector and particularly among the XRP community.

As per the timeline, if Ripple and the SEC dismiss their appeal before Aug. 15, then the case is essentially over. However, if, after today’s meeting, the SEC decides against Ripple, the case might linger for much longer.

XRP price gains despite Ripple-SEC legal uncertainty

Despite the ongoing lawsuit, Ripple continues to perform well in the financial space. The company recently ranked as the 23rd biggest private entity by market capitalization, with a value of $15 billion. Ripple outperformed notable Swedish fintech company Klarna, which boasts of $14.5 billion.

Meanwhile, on the broader crypto market, Ripple’s associated digital currency, XRP, has recorded significant gains ahead of the SEC decision. As of press time, XRP is changing hands at $3.04, reflecting a 2.16% increase in the last 24 hours.

However, the trading volume remains in the red zone, down by 5.35% at $4.8 billion.

The Shiba Inu burn rate has recently witnessed a 3,464% spike, with 9,614,765 SHIB gone in a matter of hours.

According to Shibburn, 9,614,765 SHIB were burned in the last 24 hours, resulting in a significant surge in daily burn rate.

Shibburn@shibburnAug 07, 2025HOURLY SHIB UPDATE$SHIB Price: $0.00001238 (1hr -0.14% ▼ | 24hr 1.69% ▲ )

Market Cap: $7,290,625,900 (1.63% ▲)

Total Supply: 589,247,910,639,779

TOKENS BURNT

Past hour: 69,420 (1 transaction)

Past 24Hrs: 9,614,765 (3464.69% ▲)

Past 7 Days: 23,387,171 (-96.30% ▼)

This sudden spike in SHIB burns has triggered attention in the SHIB community. While the amount burned might seem small relative to SHIB's total supply, the large percentage rise in burn rate is what is getting people's attention.

Several single transactions accounting for hundreds of thousands of SHIB each accounted for the total burn figure. Although the identity of the sending wallets remains unknown, these kinds of coordinated burns often reflect strong community sentiment.

Meanwhile, 23,317,751 SHIB were destroyed in the last seven days. The prior week, the ecosystem had a 16,855.93% increase in the burn rate in one day, burning 602 million tokens.

A total of 410,752,089,360,220 SHIB had been burned from the cryptocurrency's initial one quadrillion token supply. This leaves the cryptocurrency market with 584,612,601,558,519 SHIB in circulation.

SHIB price jumps 4%

Around press time, Shiba Inu was up 4% in the last 24 hours to $0.00001258, reflecting a broader rise in the crypto market.

Cryptocurrencies jumped Thursday on speculation that Bitcoin and other digital assets could soon be added to 401(k) retirement plans.

An executive order allowing 401(k) accounts to invest in alternative assets such as private equity, real estate and digital assets is expected to be revealed soon, marking the most significant move yet to introduce private assets to defined-contribution plans.

Shiba Inu is currently battling resistance at the daily SMA 50 at $0.00001267 ahead of the daily SMA 200 at $0.00001375. If surmounted, Shiba Inu might kickstart its next leg of uptrend. On the other hand, support lies at $0.0000116.

Dogecoin , probably the most popular meme coin, is once again testing what analyst Ali Martinez called a "historical buy zone." This is the same ascending range that has preceded every major upward cycle in DOGE's price history, including the crazy 2017 and 2021 breakouts.

The latest weekly figures suggest that DOGE is sitting just above $0.20, right on the lower boundary of a well-established parallel channel that has been around since 2015.

This zone has only been touched a few times in the last 10 years, but each time it has been the start of a big upward move — like a 9,237% rally in 2017, followed by a 13,337% breakout in 2021. In both cases, Dogecoin briefly stabilized near the bottom of the channel before shooting up to the top.

Ali@ali_chartsAug 07, 2025Dogecoin $DOGE is trading within a historically strong buy zone, which has repeatedly triggered major bull runs in past cycles! pic.twitter.com/oYZF8BVKmE

What is interesting is that the structure has not changed. Even though the crypto market has been all over the place and the narratives have been changing, DOGE has been holding this rising channel for over 10 years.

The latest touch — now the fourth since early 2023 — comes after a 243% rally earlier this cycle, also triggered from the same support region.

Resistance for DOGE

It looks like the resistance is still at $0.34 to $0.45, which is where the previous rallies lost momentum. But DOGE's current positioning suggests a good risk-to-reward ratio for those watching the big picture rather than daily headlines.

Historically, every time the market has tested this lower band, it has always moved in a new direction.

The next few weeks will be important to see if the trend keeps going and if DOGE can build on this. With the market getting more liquid and money moving into older altcoins, Dogecoin might be about to enter a phase it is familiar with — one that usually does not stay quiet for long.

Institutional adoption of decentralized finance (DeFi) and asset tokenization remains limited, despite years of infrastructure development and recent regulatory progress, according to JPMorgan analysts.

DeFi total value locked (TVL) still hasn’t recovered to 2021 highs, the analysts led by managing director Nikolaos Panigirtzoglou said in a report Wednesday, suggesting stagnation or slower recovery since the 2022 market collapse. Most DeFi usage continues to come from retail and crypto-native participants, with little involvement from traditional institutions despite the rise of compliance features like KYC-gated vaults and permissioned lending pools, they said.

The analysts highlight three key barriers to adoption: lack of harmonized cross-border regulations, lack of legal clarity on onchain investments, and lack of assurances on smart contract enforceability or protocol security and reliability. As a result, institutional crypto adoption has largely focused on bitcoin investment products, the analysts noted.

They acknowledged that recent and future regulatory shifts — such as the U.S. Securities and Exchange Commission's "Project Crypto" — could improve participation by modernizing compliance for token-based trading. However, they added that it remains to be seen how effective regulations would be in addressing traditional institutional investors' hurdles and concerns.

Tokenization 'hype'

As for tokenization, despite the "hype" around it, the total amount of tokenized assets at around $25 billion currently remains "rather insignificant" and primarily driven by crypto-native firms and hedge funds, the analysts said.

Even in areas where tokenization adds tangible benefits to traditional investors — such as intraday liquidity in repo markets or automated settlements for bonds — adoption has been slow. Over 60 tokenized bonds worth a combined $8 billion have been issued, but most see little to no secondary trading, "rendering these tokenized bond efforts rather experimental," according to the analysts. Tokenized money market funds like BlackRock’s BUIDL have gained traction, but recent outflows show momentum is lacking, they added.

In private assets as well, the hype about tokenization seems "rather exaggerated to us," the analysts said. While the $15 billion of reported tokenized private credit seems significant, it is concentrated among a few players and lacks a real secondary market, they added.

"In our mind, in addition to the regulatory and legal hurdles, this rather disappointing picture on tokenization also reflects traditional investors not seeing a need for it thus far," the analysts noted. "The traditional financial system aided by fintech is evolving towards faster and cheaper settlements and payments, reducing the need for blockchain-based systems."

They also highlighted that institutional investors may be reluctant to move equity or bond trading onchain due to transparency concerns. Blockchains can expose trading strategies, whereas "dark pools" offer protection from detection or front-running. This preference is reflected in the growing share of off-exchange trading in U.S. equities, they said.

Meanwhile, tokenized bank deposits also have yet to gain traction. The analysts said there’s evidence so far of banks or customers shifting deposits onto blockchain-based rails, largely because the traditional system already allows fast, electronic settlement between deposits and financial assets. In short, fintech advancements have reduced the perceived need for blockchain-based alternatives.

Tokenizing private assets

As for private assets like private equity or private credit, investors typically hold positions until maturity and may prefer the lack of daily price updates. In those cases, a transparent blockchain-based market with constant trading may not be attractive.

For private assets such as private equity and private credit — which are typically held to maturity and benefit from return smoothing due to the lack of mark-to-market pricing — many traditional investors may question the appeal of tokenizing these assets on transparent blockchains with active secondary markets, according to the analysts.

Overall, JPMorgan said the "disappointing" progress in both DeFi and tokenization reflects not only regulatory barriers, but also a broader lack of perceived value among traditional investors.

JPMorgan itself is one of the most advanced U.S. banks in blockchain adoption, having developed multiple initiatives over the years. JPMorgan's blockchain business unit, Kinexys (formerly Onyx), houses four main components: Kinexys Digital Payments, a blockchain-based deposit and payments rail; Kinexys Digital Assets, for asset tokenization; Kinexys Liink, a permissioned network for payments information; and Kinexys Labs, the unit's dedicated blockchain research arm.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The crypto market is seeing strong upward movement today, with prices climbing across major coins. In the past 24 hours, the total market capitalization has grown to around $3.83 trillion, rising by 2.75 percent. Ethereum is also making headlines, jumping nearly 6 percent in one day. It’s now trading at $3,821 with a market cap of $461 billion. Experts are now looking for a possible break above $4,000, which could lead to a push toward $4,400 or higher.

One of the biggest headlines of the day comes from Ripple. Ripple has agreed to acquire stablecoin platform Rail in a deal worth $200 million. The move is seen as part of Ripple’s wider push into the stablecoin market and payments infrastructure. Following the news, XRP has jumped over 3 percent in 24 hours and is now trading at $3.04.

Brad Garlinghouse@bgarlinghouseAug 07, 2025No such thing as the August doldrums at @Ripple…very excited to share that we’re acquiring @RailFinancial!

Ripple + Rail together will be THE go-to provider of stablecoin payments infrastructure for global financial institutions around the world. https://t.co/JzUoHjulZB

Some analysts say this could push XRP even higher, especially if the acquisition leads to new partnerships or regulatory clarity.

Bitcoin is currently trading at $116,474, up nearly 2 percent. Though its pace is slower compared to altcoins, Bitcoin remains strong with a market cap of over $2.3 trillion. A clean break above $120,000 could attract fresh buying interest.

Across the market, other top altcoins are also starting to rise. Solana has climbed to $170, Dogecoin is now above $0.21, and Cardano is trading at $0.76. Sui has surged to $3.72, and Chainlink is sitting at $17.62 with a strong 7 percent gain today.

The Fear and Greed Index is at 54, showing a neutral sentiment. However, the rising interest in altcoins is pushing the Altcoin Season Index up to 36, hinting that more traders are exploring tokens beyond Bitcoin.

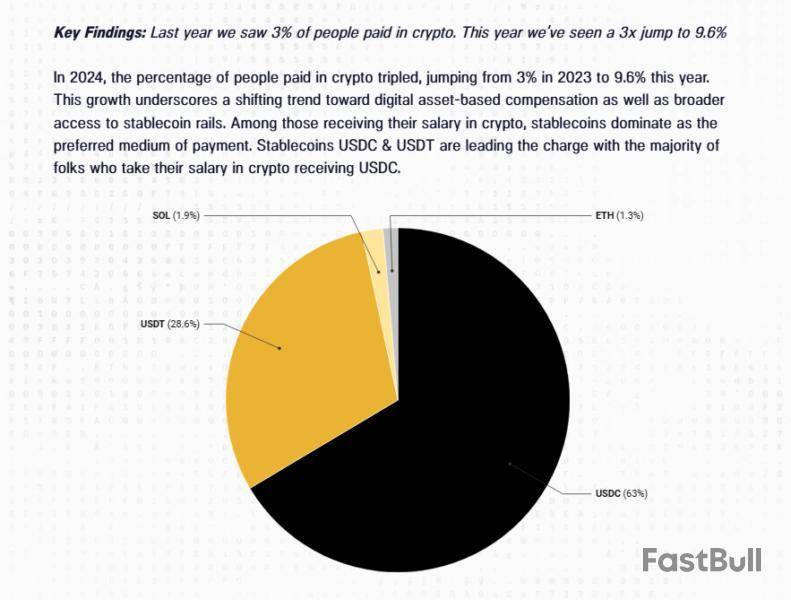

A growing number of workers are now getting paid in crypto. In 2023, just 3% of those surveyed said part of their salary arrived as digital tokens. By 2024, that share jumped to 9.6%.

This shift comes as blockchain firms and DAOs explore new ways to handle cross-border pay. Reports have disclosed that purely fiat payments fell from 95% to 85% over the same period.

Pantera Capital@PanteraCapitalAug 06, 2025Our mission is to support the long-term success of both our portfolio companies and the broader crypto ecosystem.

One major gap we’ve consistently seen? Reliable, transparent compensation data for crypto teams.

That’s why we created our annual Crypto Compensation Survey – a…

Rise In Crypto Payroll

According to Pantera Capital’s 2024 Blockchain Compensation Survey, USDC leads the pack. It now makes up over 60% of all crypto wages.

USDT trails with 28%. Smaller slices go to Solana at 1.9% and Ethereum at 1.3%. These numbers point to stablecoins becoming a regular tool for payroll. That’s a big change from just a year ago.

Many companies are drawn by faster settlement times and lower fees. And workers in regions with shaky banking systems see real benefit.

Reports have disclosed that Asia-based teams and contractors are among the biggest drivers of this trend. They often rely on stablecoins to avoid high transfer costs or strict local rules.

A handful of firms now let staff split pay between cash and crypto. This hybrid model gives people the freedom to hold tokens or spend fiat. It also helps those who want to dollar-cost average into crypto markets.

Pantera’s data shows these arrangements are on the rise, though full-crypto pay remains rare.

Stablecoin Salaries Soar

Circle’s decision to publish monthly reserve reports has strengthened trust in USDC. The company even secured access to US Treasuries for its backing.

That transparency helps explain why more payroll departments pick USDC over other coins. Tax teams also get clearer data when they see monthly reserve disclosures.

Behind the scenes, better payroll platforms and accounting tools have made on-chain payments simpler. Real-time rails now link digital wallets to corporate treasuries. And more firms are building internal processes to track taxable events.

Based on reports from industry insiders, this is only the beginning. As more crypto-native companies formalize their operations, they’ll need reliable ways to pay people.

And wider acceptance by regulators could give traditional firms the confidence to join in.

Featured image from Young Platform, chart from TradingView

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up