Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Russian Foreign Minister: Russia's Patience Is Not Without Limits] Russian Foreign Minister Sergey Lavrov, In A Media Interview On February 5, Addressed Russia's Previous Goodwill Gestures, Including The Reneging Of The 2025 Energy Truce Agreement With Ukraine. Lavrov Stated That Russia's Patience Is Not Without Limits, And That Russia Always Carefully Weighs Its Options Before Taking Any Action

(US Stocks) The Philadelphia Gold And Silver Index Closed Down 6.25% At 372.66 Points. (Global Session) The NYSE Arca Gold Miners Index Fell 6.03% To 2660.11 Points. (US Stocks) The Materials Index Closed Down 3.87%, And The Metals & Mining Index Closed Down 2.95%

Spot Gold Fell 4.0% To $4,763.2 Per Ounce. New York Gold Fell 3.0% To $4,793 Per Ounce. New York Silver Fell 15.5% To $71.12 Per Ounce. Spot Silver Fell 18.5% To $71.67 Per Ounce. The Commodity Currency Australian Dollar Fell 1.0% Against The US Dollar To 0.6927

Securities And Exchange Commission (SEC) Chairman Atkins Will Appear Before The Senate On February 12

The Federal Reserve's Discount Window Lending Balance Was $4.52 Billion In The Week Ending February 4, Unchanged From The Previous Week

Argentina End-2026 Inflation Seen At 22.4%, Up 2.3 Percentage Points From Prior Forecast, In Central Bank Market Expectations Survey

Argentina End-2026 GDP Growth Seen At 3.2%,Down 0.3 Percentage Points From Prior Forecast, In Central Bank Market Expectations Survey

Toronto Stock Index .GSPTSE Unofficially Closes Down 576.95 Points, Or 1.77 Percent, At 31994.60

The Nasdaq Golden Dragon China Index Closed Up 0.8% Initially. Among Popular Chinese Concept Stocks, Dingdong Maicai Closed Down 15%, Canadian Solar Fell 8.4%, Alibaba And New Oriental Fell 1%, While Xiaomi, Li Auto, And Meituan Rose Over 2%, WeRide Rose 3.6%, Yum China Rose 4.6%, And NIO Rose 6%. In The ETF Market, Ashes Fell 1.7%, Ashr Fell 0.8%, Cqqq Fell 0.8%, And Kweb Fell 0.1%

On Thursday (February 5), The Bloomberg Electric Vehicle Price Return Index Fell 1.88% To 3467.18 Points In Late Trading. It Briefly Rose At 08:17 Beijing Time Before Continuing Its Decline. Among Its Components, Volvo Cars (European Shares) Closed Down 22.53%, Aurora Innovation Shares Fell 9.7%, Plug Power Systems Fell 9%, Mp Materials Fell 7.3%, RoboSense H Shares Closed Up 2.79%, Ranking Fifth, Xiaomi Group H Shares Closed Up 2.83%, WeRide Rose 3.5%, Horizon Robotics H Shares Closed Up 3.64%, And Panasonic Corporation Closed Up 8.41%

Argentina's Merval Index Closed Down 2.65% At 2.936 Million Points, Fluctuating At Low Levels For More Than Half Of The Trading Session

Chicago Soybean Futures Rose About 1.7%, And Soybean Meal Futures Rose More Than 2.2%. At The Close Of Trading In New York On Thursday (February 5), The Bloomberg Grains Index Rose 1.57% To 29.8095 Points. CBOT Corn Futures Rose 1.34%, And CBOT Wheat Futures Rose 1.57%. CBOT Soybean Futures Rose 1.69% To $11.1075 Per Bushel, Soybean Meal Futures Rose 2.26%, And Soybean Oil Futures Were Roughly Unchanged

The US Dollar Index Rose More Than 0.2% In Late New York Trading On Thursday (February 5), With The ICE Dollar Index Rising 0.24% To 97.849, Trading Between 97.607 And 97.915. The Bloomberg Dollar Index Rose 0.20% To 1194.03, Trading Between 1191.07 And 1194.76

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)A:--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)A:--

F: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)A:--

F: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)A:--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)A:--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)A:--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest RateA:--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)A:--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending RateA:--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit RateA:--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing RateA:--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

ECB Press Conference

ECB Press Conference U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Mexico Policy Interest Rate

Mexico Policy Interest RateA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Reserve Bank of Australia Governor Bullock testified before Parliament.

Reserve Bank of Australia Governor Bullock testified before Parliament. Japan Foreign Exchange Reserves (Jan)

Japan Foreign Exchange Reserves (Jan)--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest Rate--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve Ratio--

F: --

P: --

India Repo Rate

India Repo Rate--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo Rate--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)--

F: --

P: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)--

F: --

P: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)--

F: --

P: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)--

F: --

P: --

No matching data

View All

No data

Regional bank Westamerica Bancorporation reported revenue ahead of Wall Streets expectations in Q4 CY2025, but sales fell by 9.1% year on year to $63.55 million. Its non-GAAP profit of $1.12 per share was 5.2% above analysts’ consensus estimates.

Westamerica Bancorporation (WABC) Q4 CY2025 Highlights:

"Westamerica’s fourth quarter 2025 results benefited from the Company’s valuable low-cost deposit base, of which 46 percent was represented by non-interest bearing checking accounts during the quarter; the annualized cost of funding our loan and bond portfolios was 0.24 percent in the quarter. Operating expenses remained well controlled at 40 percent of total revenues. At December 31, 2025, nonperforming assets were stable at $1.8 million and the allowance for credit losses was $11.6 million” said Chairman, President and CEO David Payne.

Company Overview

Founded in 1884 and serving communities from Mendocino County in the north to Kern County in the south, Westamerica Bancorporation provides banking services to individuals and small businesses throughout Northern and Central California.

Sales Growth

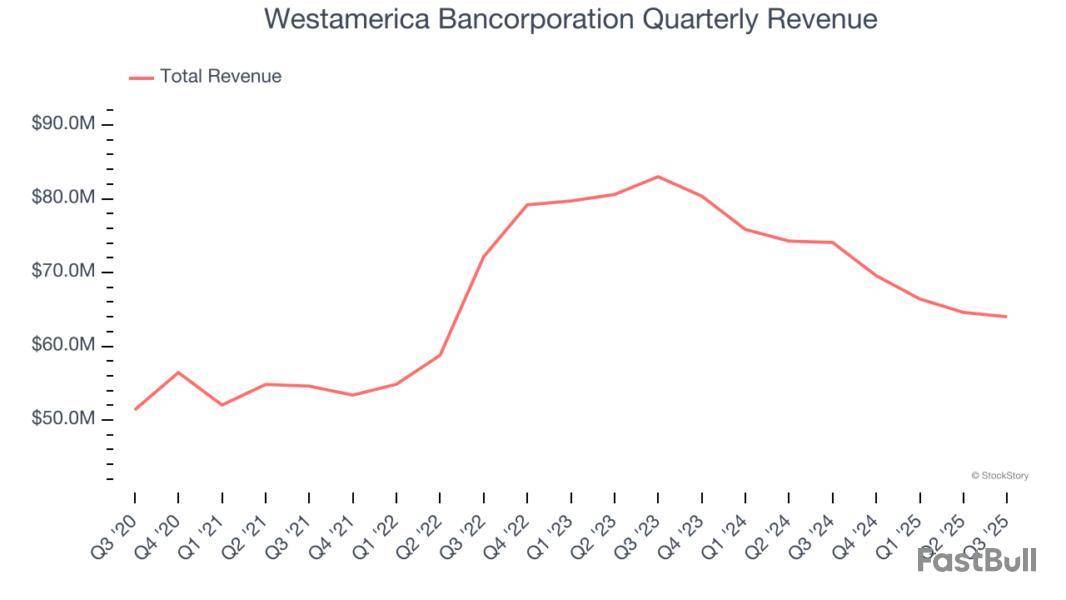

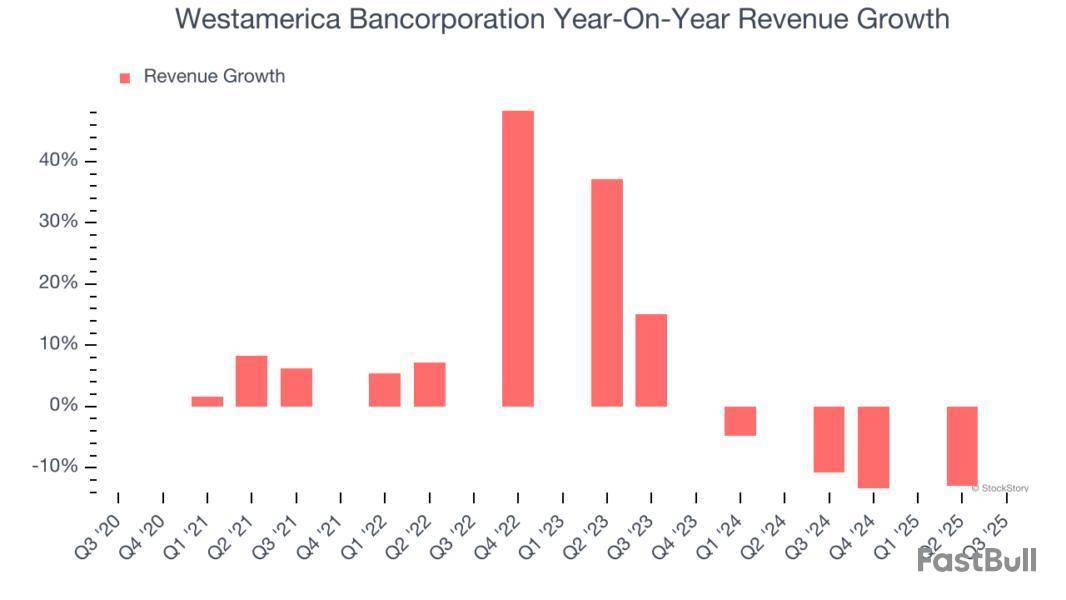

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions. Regrettably, Westamerica Bancorporation’s revenue grew at a sluggish 4% compounded annual growth rate over the last five years. This fell short of our benchmark for the banking sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Westamerica Bancorporation’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 10.7% annually.

This quarter, Westamerica Bancorporation’s revenue fell by 9.1% year on year to $63.55 million but beat Wall Street’s estimates by 2.7%.

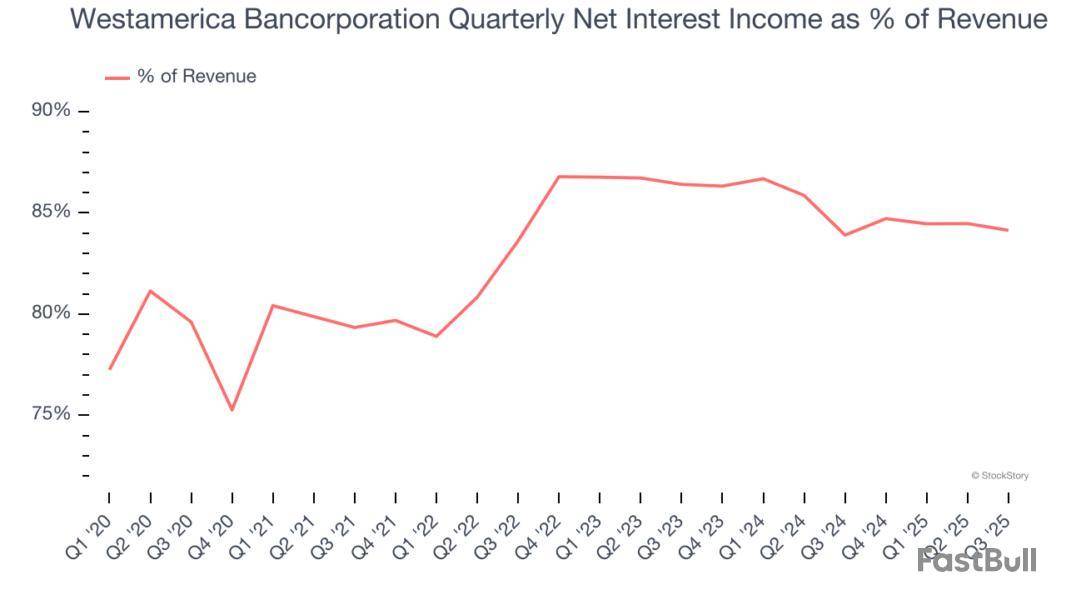

Net interest income made up 83.2% of the company’s total revenue during the last five years, meaning Westamerica Bancorporation barely relies on non-interest income to drive its overall growth.

Net interest income commands greater market attention due to its reliability and consistency, whereas non-interest income is often seen as lower-quality revenue that lacks the same dependable characteristics.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Key Takeaways from Westamerica Bancorporation’s Q4 Results

We enjoyed seeing Westamerica Bancorporation beat analysts’ net interest income expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $50.92 immediately after reporting.

So do we think Westamerica Bancorporation is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).

Westamerica Bancorporation ( WABC ) is currently at $50.80, up $2.28 or 4.7%

All data as of 2:41:13 PM ET

Source: Dow Jones Market Data, FactSet

By Katherine Hamilton

Westamerica Bancorp approved a plan to repurchase 2 million shares.

The San Rafael, Calif., bank said Thursday that the buyback will last until Dec. 31, 2026.

The program represents 8% of Westamerica's total outstanding shares as of Sept. 30.

Write to Katherine Hamilton at katherine.hamilton@wsj.com

What Happened?

Shares of regional bank Westamerica Bancorporation jumped 2.6% in the afternoon session after comments from a key Federal Reserve official boosted hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to markets amid concerns over high valuations, particularly in AI-related stocks.

The shares closed the day at $47.64, up 2.5% from previous close.

Is now the time to buy Westamerica Bancorporation? Access our full analysis report here.

What Is The Market Telling Us

Westamerica Bancorporation’s shares are not very volatile and have only had 2 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful, although it might not be something that would fundamentally change its perception of the business.

The biggest move we wrote about over the last year was 3 months ago when the stock gained 4.1% on the news that the major indices rebounded, as Fed Chair Jerome Powell delivered dovish remarks at the much-awaited Jackson Hole symposium. Powell suggested that with inflation risks moderating and unemployment remaining low, the Federal Reserve might consider a shift in its monetary policy stance, including potential interest rate cuts. This outlook eased market concerns about prolonged high interest rates and their impact on economic growth. The prospect of lower borrowing costs bolstered investor confidence, particularly in sectors that have lagged, leading to a broad rally across the market.

Westamerica Bancorporation is down 7.6% since the beginning of the year, and at $47.65 per share, it is trading 18.2% below its 52-week high of $58.23 from November 2024. Investors who bought $1,000 worth of Westamerica Bancorporation’s shares 5 years ago would now be looking at an investment worth $825.74.

As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the regional banks industry, including Westamerica Bancorporation and its peers.

Regional banks, financial institutions operating within specific geographic areas, serve as intermediaries between local depositors and borrowers. They benefit from rising interest rates that improve net interest margins (the difference between loan yields and deposit costs), digital transformation reducing operational expenses, and local economic growth driving loan demand. However, these banks face headwinds from fintech competition, deposit outflows to higher-yielding alternatives, credit deterioration (increasing loan defaults) during economic slowdowns, and regulatory compliance costs. Recent concerns about regional bank stability following high-profile failures and significant commercial real estate exposure present additional challenges.

The 94 regional banks stocks we track reported a satisfactory Q3. As a group, revenues missed analysts’ consensus estimates by 1.1%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Founded in 1884 and serving communities from Mendocino County in the north to Kern County in the south, Westamerica Bancorporation provides banking services to individuals and small businesses throughout Northern and Central California.

Westamerica Bancorporation reported revenues of $63.74 million, down 14% year on year. This print exceeded analysts’ expectations by 2%. Overall, it was a strong quarter for the company with a solid beat of analysts’ net interest income estimates and a decent beat of analysts’ revenue estimates.

"Westamerica’s third quarter 2025 results benefited from the Company’s low-cost operating principles. The annualized cost of funding interest-earning loans, bonds and cash was 0.26 percent for the third quarter 2025. The Company recognized no provision for credit losses in the third quarter 2025. At September 30, 2025, nonperforming assets were $2.6 million and the allowance for credit losses on loans was $11.9 million. Westamerica operated efficiently, spending 40 percent of its revenue on operating costs in the third quarter 2025,” said Chairman, President and CEO David Payne.

Interestingly, the stock is up 3.3% since reporting and currently trades at $47.99.

Is now the time to buy Westamerica Bancorporation? Access our full analysis of the earnings results here, it’s free for active Edge members.

Originally founded with a "high-tech, high-touch" branch-light banking strategy, Customers Bancorp is a bank holding company that provides commercial and consumer banking services through its Customers Bank subsidiary, with a focus on business lending and digital banking.

Customers Bancorp reported revenues of $232.1 million, up 38.5% year on year, outperforming analysts’ expectations by 7%. The business had a stunning quarter with an impressive beat of analysts’ net interest income estimates and a solid beat of analysts’ revenue estimates.

The market seems content with the results as the stock is up 2% since reporting. It currently trades at $66.83.

Is now the time to buy Customers Bancorp? Access our full analysis of the earnings results here, it’s free for active Edge members.

Operating behind the scenes of many popular fintech apps and prepaid cards you might use daily, The Bancorp is a bank holding company that specializes in providing banking services to fintech companies and offering specialty lending products.

The Bancorp reported revenues of $174.6 million, up 38.8% year on year, falling short of analysts’ expectations by 10%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue and net interest income estimates.

As expected, the stock is down 20.3% since the results and currently trades at $61.55.

Read our full analysis of The Bancorp’s results here.

Founded in 1975 and headquartered in Chico, California, TriCo Bancshares operates Tri Counties Bank, providing personal, small business, and commercial banking services through branches across California.

TriCo Bancshares reported revenues of $107.6 million, up 8.6% year on year. This number beat analysts’ expectations by 1.2%. Overall, it was a strong quarter as it also produced a beat of analysts’ EPS and tangible book value per share estimates.

The stock is up 7.5% since reporting and currently trades at $45.74.

Read our full, actionable report on TriCo Bancshares here, it’s free for active Edge members.

With roots dating back to the Great Depression era of 1933, SouthState is a financial holding company that provides banking services, wealth management, and correspondent banking services across six southeastern states.

SouthState reported revenues of $698.8 million, up 63.9% year on year. This result topped analysts’ expectations by 6.5%. It was a stunning quarter as it also put up an impressive beat of analysts’ net interest income estimates and a solid beat of analysts’ revenue estimates.

The stock is down 5.3% since reporting and currently trades at $88.88.

Read our full, actionable report on SouthState here, it’s free for active Edge members.

Regional bank Westamerica Bancorporation reported revenue ahead of Wall Street’s expectations in Q3 CY2025, but sales fell by 13.6% year on year to $64 million. Its GAAP profit of $1.12 per share was 4.2% above analysts’ consensus estimates.

Is now the time to buy Westamerica Bancorporation? Find out by accessing our full research report, it’s free for active Edge members.

Westamerica Bancorporation (WABC) Q3 CY2025 Highlights:

"Westamerica’s third quarter 2025 results benefited from the Company’s low-cost operating principles. The annualized cost of funding interest-earning loans, bonds and cash was 0.26 percent for the third quarter 2025. The Company recognized no provision for credit losses in the third quarter 2025. At September 30, 2025, nonperforming assets were $2.6 million and the allowance for credit losses on loans was $11.9 million. Westamerica operated efficiently, spending 40 percent of its revenue on operating costs in the third quarter 2025,” said Chairman, President and CEO David Payne.

Company Overview

Founded in 1884 and serving communities from Mendocino County in the north to Kern County in the south, Westamerica Bancorporation provides banking services to individuals and small businesses throughout Northern and Central California.

Sales Growth

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees. Thankfully, Westamerica Bancorporation’s 5.3% annualized revenue growth over the last five years was decent. Its growth was slightly above the average banking company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Westamerica Bancorporation’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 9.4% over the last two years.

This quarter, Westamerica Bancorporation’s revenue fell by 13.6% year on year to $64 million but beat Wall Street’s estimates by 2.4%.

Net interest income made up 83.3% of the company’s total revenue during the last five years, meaning Westamerica Bancorporation barely relies on non-interest income to drive its overall growth.

Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Key Takeaways from Westamerica Bancorporation’s Q3 Results

It was encouraging to see Westamerica Bancorporation beat analysts’ revenue and EPS expectations this quarter. We were also happy its net interest income outperformed Wall Street’s estimates. On the other hand, net interest margin was just in line and efficiency ratio missed slightly. Overall, this print was still solid. The stock remained flat at $45.80 immediately after reporting.

Big picture, is Westamerica Bancorporation a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up