Investing.com -- InvestingPro members are extending their massive winning streak this August.

At the beginning of the month, they received an AI-powered list of stock picks (available now for less than $9 a month as part of our limited-time only summer sale), which included ViaSat Inc (NASDAQ:VSAT)—among several other winners.

Fast forward to today, and the Carlsbad, California-based satellite company is up a mind-blowing 70% since. Not only that, but as of this writing, the stock looks poised to continue its streak, up another 1.79% in pre-market trading.

But ViaSat is far from being the lone exception on this list. In fact, amongst the stocks picked by our AI-powered model for August, a massive 86% are in the green, with 45% rallying more than 10% MTD, and 10% rallying more than 20%, including major winners such as:

- Bausch Health Companies (NYSE:BHC): +31.17% in August.

- Sapiens (taken private on August 15): +59.89% in August.

- Unitedhealth Group (NYSE:UNH): +29.29% in August.

- Clear Secure (NYSE:YOU): +26.07% in August.

Among several others...

*Already an InvestingPro member? See the full selection of stock picks for August here.

Still not a member? Then here’s your FINAL chance to subscribe for less than $9 a month for a limited time only during our exclusive summer sale. Hurry up; prices will come back to normal over the next few days.

- App users can subscribe here

- Web users can subscribe here

In fact, after the massive month for our AI stock picker, our composed list of tech picks is now up a game-changing +127.03% since the official launch in November 2023. This represents an +88.24% outperformance over the S&P 500 during the same period.

*These are not backtested or fictional results. They’re real-world results since the AI agent went live in November 2023.

But why did our AI pick ViaSat in the first place? Check out below its rationale, published on the first of August—i.e., before the 70%+ rally:

Explosive Growth Amid Strategic Transformation

- Our ML engine selected ViaSat Inc. as a strong buy based on exceptional market performance, robust growth metrics, and favorable volatility patterns creating a potential inflection point.

- The stock shows remarkable momentum with 79% 3-month, 71% 6-month, and 93% YTD price returns, while trading at just 0.48x book value.

- Revenue exceeded expectations ($1.15B vs $1.13B forecast) with impressive EBITDA growth of 23% and stronger-than-expected earnings (loss of $0.02 vs expected $0.59 loss).

- Activist investor Carronade Capital (2.6% stake) recently proposed spinning off ViaSat’s Defense unit, potentially valuing the company between $50-$100 per share (current price ~$16).

- The incoming $568M settlement from Ligado Networks in FY2026 provides significant financial flexibility to address debt concerns while supporting continued growth initiatives.

Here’s ViaSat’s chart since:

But how does the AI stock picker actually work?

At the start of each month, our AI refreshes each strategy with up to 20 stock picks. These selections are based on a blend of more than 150 well-established financial models compiled by our machine learning model on over 15 years of financial data worldwide.

Some stocks are added, others retained, and a few are removed, reflecting how the model reassesses each company’s medium-term growth potential.

To track performance, each strategy uses equal weighting across all selected stocks. While you’re not required to follow that weighting exactly, it offers a consistent benchmark to evaluate how well the model identifies opportunities across the board.

At the end of the day, stock picking is still a game of probabilities. But the key isn’t just finding winners — it’s knowing when to move on from the ones that no longer stack up.

Since launch, the model has done just that — delivering more than a few standout success stories along the way.

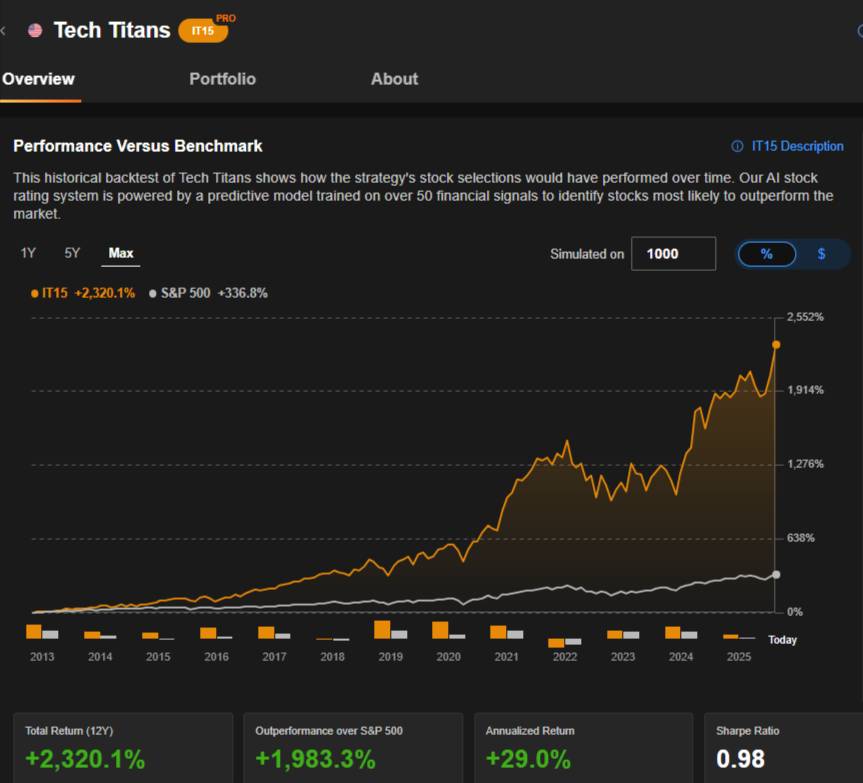

As a matter of fact, our backtest suggests that going the long run is the surest path to long-term wealth generation.

Check out the 12-year outperformance of over the S&P 500 below:

This means a $100K principal in our strategy would have turned into an eye-popping $2,420,100.

.

Disclaimer: Prices mentioned in articles are accurate at the time of publication. We regularly test different offers for our members, which may vary by region.