Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin’s strong performance this year has been largely driven by surging demand through ETFs and Digital Asset Treasuries (DATs), but this price momentum masks a more concerning trend.

In fact, data suggest that network activity has not kept pace with demand for the asset. This divergence creates an opaque outlook for Bitcoin’s long-term health, particularly as transaction fees, the critical incentive to reward miners for securing the network, remain low.“Digital Gold” Narrative Could Backfire

Similar to how a company’s revenue drives value to its share price, fees are expected to drive value for Bitcoin’s price. With the fourth halving in April 2024, cutting block rewards, fees today account for less than 1% of miner revenues.

CoinMetrics said that this has left miners increasingly reliant on BTC price appreciation. If fees do not rise to compensate for declining issuance, many miners could be forced offline after prolonged drawdowns. This, in turn, would end up jeopardizing the network’s decentralization and censorship-resistance.

The centralization of hashpower already looms large, with Foundry commanding 30% of total hashpower and Antpool 18%. While mining pools continue to invest heavily in hardware to maintain dominance, individual minersstrugglewith profitability, often liquidating their BTC holdings to cover operational costs.

The long-term challenge becomes clearer when considering the 2028 halving, which will reduce block rewards to just 1.5625 BTC. Without higher fee revenue, the risk of miner attrition will rise, and potentially concentrate security into fewer operators.

This structural challenge is compounded by weak demand for blockspace.

Because there isn’t much demand for Bitcoin’s blockspace, transaction fees stay low. This makes it easier and cheaper for everyday users to send money on the network. However, the demand for Bitcoin as an asset, especially from large institutional investors, doesn’t translate into more transactions happening on the blockchain itself. Instead, these investors mainly treat Bitcoin as “digital gold” or a long-term store of value.

Institutional investors buying ETFs and DATs contribute to price but not to on-chain activity, leaving miners without the fee-based incentives needed for long-term security. To address this imbalance, developers are experimenting with native BTC applications that could restore fee revenue to miners instead of offshoring activity to other chains.

Projects like Babylon Genesis Chain, which allows BTC holders to stake with operators securing external proof-of-stake networks, point to how Bitcoin could expand its role beyond passive value storage. Babylon’s launch in August 2024 temporarily drove fees above $150 per block and sparked demand for blockspace. However, these spikes have proven short-lived, and fee revenue remains low.Base Layer Starves

The tokenization trend, too, reveals the risks of activity migrating elsewhere: while Coinbase’s cbBTC has grown rapidly to over 52,000 BTC in supply, largely at theexpenseof BitGo’s wBTC, much of this demand occurs outside the Bitcoin base layer. This also generates little fee income for miners.

For Bitcoin to sustain its “lofty” valuation, CoinMetrics believes that the ecosystem must find ways to stimulate more consistent network activity and create new demand for blockspace and reward miners for their role in securing the chain.

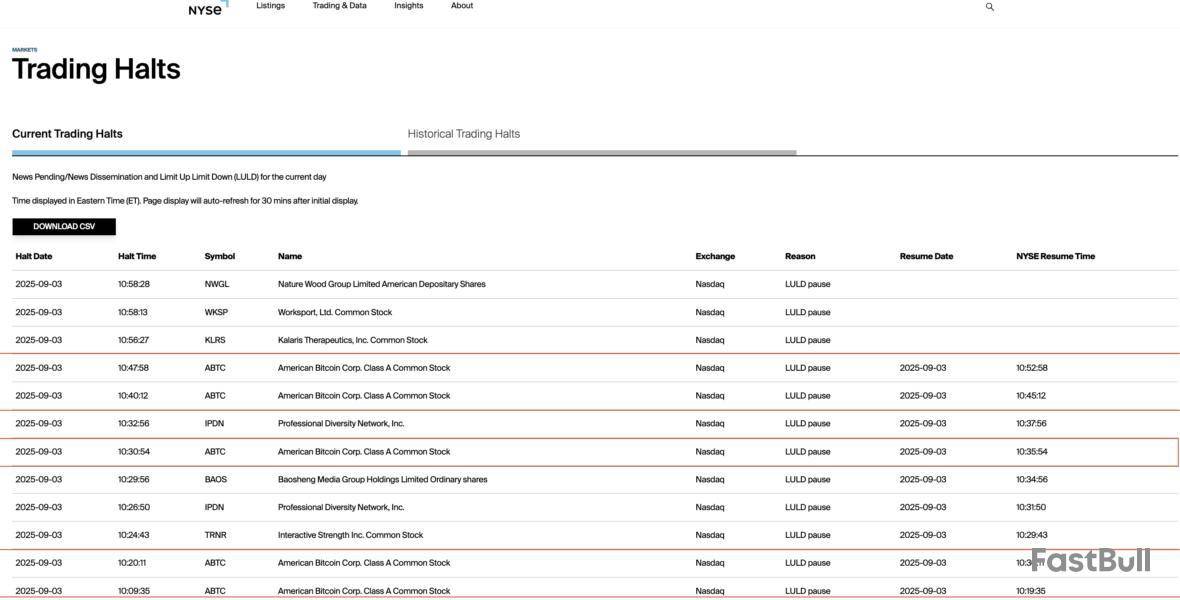

The Nasdaq stock exchange halted trading of American Bitcoin (ABTC) shares five times Wednesday as volatility spiked on the stock’s relisting debut.

Shares of ABTC, a Bitcoin mining company co-founded by Eric Trump and Donald Trump, Jr., climbed by nearly 85%, hitting a high of $14 per share during intraday trading, following American Bitcoin’s stock merger with Gryphon Digital Mining, another crypto mining company.

ABTC trading was first halted at 3:09:35 UTC for 10 minutes and again at 3:20:11 UTC, with two additional halts at 3:30:54 and 3:40:12.

The most recent trading halt occurred at 3:47:58 UTC; however, trading has since resumed, according to the New York Stock Exchange (NYSE), and shares of ABTC are currently swapping hands at about $9.80.

American Bitcoin’s debut to a trading frenzy reflects Wall Street’s growing appetite for digital asset firms and mining companies, as the crypto industry matures and courts institutional investment.

Crypto firms eye merges to go public

American Bitcoin went public through an all-stock merger with Gryphon. The deal, disclosed in late August, gave Trump’s family company a faster pathway to US markets.

Crypto companies are increasingly turning to mergers to reach American investors, particularly through special purpose acquisition companies (SPACs) — vehicles that allow private companies to go public by combining with existing publicly traded “blank check” companies.

These SPACs are not operating businesses and only exist to find a suitable private company to merge with, offering an avenue to go public without having to go through the lengthy and costly initial public offering (IPO) process.

In August, Parataxis, a digital asset investment firm, announced plans to go public via a SPAC merger with SilverBox Corp IV. Once the deal closes, the new company will be listed as Parataxis Holdings (PRTX).

Investor Chamath Palihapitiya filed for a SPAC called “American Exceptionalism Acquisition Corp A,” a $250 million blank check company focused on decentralized finance (DeFi), artificial intelligence, and energy.

Trump Media and Technology Group, a tech company co-founded by US president Donald Trump, announced a $6.4 billion SPAC deal with Crypto.com to set up a Cronos (CRO) treasury company in August.

The following article is adapted from The Block’s newsletter, The Daily, which comes out on weekday afternoons.

Happy Wednesday! Neglected macro catalysts may spark a renewed bout of selling pressure that could drag bitcoin back below the $100,000 mark this month, analysts warn.

In today's newsletter, Coinbase is rolling out futures trading for a new equity index, Ondo debuts over 100 tokenized U.S. stocks and ETFs on Ethereum, the SEC and CFTC clarify that the NYSE and Nasdaq can list spot crypto assets, and more.

Meanwhile, the U.S. Federal Reserve is set to hold a conference with a focus on stablecoins, tokenization, and decentralized finance. Plus, Polymarket can go live in the U.S. following a CFTC ruling, its CEO says.

Let's get started.

P.S. Don't forget to check out The Funding, a biweekly rundown of crypto VC trends. It's a great read — and just like The Daily, it's free to subscribe!

Coinbase unveils futures trading for index tied to Nvidia, Google, and BlackRock's Bitcoin ETF

Coinbase is launching trading for its new Mag7 + Crypto Equity Index Futures product later this month, blending top tech stocks with BlackRock's Bitcoin and Ethereum ETFs.

Ondo rolls out 100 tokenized US stocks and ETFs on Ethereum

Ondo Finance and the Ondo Foundation have launched more than 100 tokenized U.S. stocks and ETFs onchain, starting with Ethereum.

SEC and CFTC's new joint guidance 'opens the door' for mainstream crypto adoption

The SEC and CFTC clarified for the first time that registered U.S. exchanges like the NYSE and Nasdaq can list and facilitate trading for certain spot crypto assets.

Story-based IP tokenization platform Aria raises $15 million at $50 million valuation

Story-based Aria raised $15 million in seed and strategic rounds at a $50 million valuation, co-led by Polychain and Neoclassic with backing from Story Protocol Foundation.

Ray Dalio says soaring US debt threatens dollar, fueling demand for crypto and gold

Ray Dalio, billionaire founder of Bridgewater Associates, warned that soaring U.S. government debt is undermining the dollar's reserve status and pushing investors toward crypto and gold.

In the next 24 hours

Never miss a beat with The Block's daily digest of the most influential events happening across the digital asset ecosystem.

Disclaimer: This article was produced with the assistance of OpenAI’s ChatGPT 3.5/4 and reviewed and edited by our editorial team.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The Federal Reserve Board announced on Wednesday that it will host a conference on payment innovation on October 21, 2025. According to the announcement, the Federal Reserve Board will discuss how best to innovate and improve the payment system with the use of modern technology including Blockchain and Artificial Intelligence (AI).

Fed Governor Christopher Waller noted that innovation in the payment system is crucial to meet the changing demand for customers and businesses. Waller noted that the conference will feature discussion on the convergence of traditional and decentralized finance, stablecoins, tokenization of financial products, and the intersection of AI and payments.

“I look forward to examining the opportunities and challenges of new technologies, bringing together ideas on how to improve the safety and efficiency of payments, and hearing from those helping to shape the future of payments,” Waller noted.

Why is the Federal Reserve Keen on Innovating its Payment Systems?

The Federal Reserve has in the past year made strategic moves to enable the mainstream adoption of blockchain-relayed payment systems. The Federal Reserve has played a crucial role in the implementation of President Donald Trump’s crypto agenda.

For instance, the Fed recently withdrew its restrictive supervisory guidance on crypto assets by banks. As a result, U.S. banks have gained more freedom to provide crypto-related services.

The Fed is keen to help the U.S. dollar remain the desired global reserve currency amid changing geopolitical circumstances fueled by the BRICS movement. Notably, the rising demand for Gold has seen its use as a global reserve currency increase while that of major currencies drops due to their poor monetary policies including an infinite supply of money.

Nasdaq-listed SUI Group Holdings said on Wednesday its holdings of SUI tokens have surpassed $300 million after the company added approximately 20 million tokens, according to a statement.

The company said it held 101,795,656 SUI tokens, which are worth $344 million as of Wednesday. SUI was changing hands up nearly 5% to $3.38 as of 12:36 p.m. ET.

"We plan to continue to seek accretive capital raises to make additional purchases of discounted locked SUI and, in turn, increase our SUI per share to generate value for our shareholders," said SUI Group CIO Stephen Mackintosh.

Publicly-traded digital asset treasuries (DATs) continue to add crypto as supporters and holders of certain tokens look to generate returns from the stock market while promoting ecosystems like that of Solana, Toncoin, and others.

Sui Group, previously short-term lender Mill City Ventures before the rebrand, has a deal in place that allows it to acquire tokens directly from Sui Foundation at a discount. Mill City established itself as the official SUI treasury with the closing of a $450 million private placement.

The company said it has approximately $58 million in cash available for more SUI token purchases.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The US Commodity Futures Trading Commission (CFTC) said it will not pursue enforcement against two entities tied to prediction platform Polymarket.

In a Wednesday notice, the CFTC said it had issued a no-action letter “regarding swap data reporting and recordkeeping regulations for event contracts” with QCX LLC and QC Clearing LLC.

“The divisions will not recommend the CFTC initiate an enforcement action against either entity or their participants for failure to comply with certain swap-related recordkeeping requirements and for failure to report to swap data repositories data associated with binary option transactions and variable payout contract transactions […],” said the regulator.

The action essentially allows Polymarket to offer event contracts without reporting the data required under US financial regulations, providing temporary relief from enforcement while not exempting the companies from regulatory compliance.

Polymarket reported acquiring QCEX in July for $112 million, which included the CFTC-licensed derivatives exchange and clearinghouse, giving it a greater foothold in US markets.

According to the request for no-action relief in July, QCX said the event contracts at issue are still “required to be fully collateralized” and “no market participant will clear QCEX Contracts through a third party clearing member.”

This is a developing story, and further information will be added as it becomes available.

TL;DR

TD Sequential Points to Shift in Price Trend

Cardano (ADA) is showing a possible change in direction based on the TD Sequential indicator. A “9” buy signal appeared on the daily chart, a setup often seen when downward pressure starts to ease. Crypto analyst Ali Martinez commented,

Cardano $ADA is a buy, according to the TD Sequential indicator! pic.twitter.com/0DtVO8mhBq

— Ali (@ali_charts) September 3, 2025

Following the signal, ADA closed at $0.82 with a daily gain of 2% and has since moved to $0.83. Trading volume over the past 24 hours stands at $1.46 billion. Market participants are watching for further signs of strength to confirm whether a recovery is underway.

ADA is testing resistance between $0.83 and $0.86, an area where sellers were active in previous attempts. Analyst CW said, “$ADA is breaking through its first sell wall.” If buyers maintain pressure and close above this zone, the next price levels to watch are $0.90 and $1.00.

According to our weeklyprediction, support remains around $0.77 and $0.70. Larger demand zones stretch from $0.50 to $0.69, where the price previously found stability. These levels may offer a cushion if the current move loses strength.Technical Indicators Show Moderate Momentum

Bollinger Bands on the weekly chart show ADA trading above the midline at $0.74. The upper band is at $0.96, placing current price action near the top half of the range. This setup often suggests a slight upward bias as the price holds above the average.

MACD also shows a favorable structure. The MACD line is above the signal line, with both in positive territory. The histogram remains green, reflectingcontinuedbuying interest.

Whether this trend continues may depend on price holding above near-term support and the strength of market flows in the coming days.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up