Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Vision (VSN) will hold its first token burn between September 22 and 28, 2025. Burning tokens means taking some out of supply forever, which usually makes the remaining tokens more rare. Lower supply, if demand stays the same, can push the price up. Traders often watch burns and may buy before or during them. However, if the burn is small or many already expect it, the effect might be limited. It will depend on how much VSN is burned and how excited the community feels. More info at source.

US-based REX Shares has stirred significant anticipation in the crypto community by announcing the launch of its Dogecoin (DOGE) and XRP exchange-traded funds (ETFs) on September 18.

Imminent Launch Of REX Shares’ DOGE And XRP ETFs?

In a post on social media platform X (formerly Twitter), REX Shares promoted the upcoming launch of the REX-Osprey XRP ETF, under the ticker symbol XRPR, and the REX-Osprey DOGE ETF, designated as DOJE.

These ETFs can potentially be the first exchange-traded products that allow US investors to access Dogecoin and XRP. This could open new avenues for retail and institutional investors and increase demand, which could further raise their prices.

Nate Geraci, co-founder of the ETF Institute, echoed REX Shares’ excitement, emphasizing the significance of these products. He declared, “First ever DOGE ETF, period. First XRP ETF offering spot XRP exposure.”

Crypto ETF Surge In Coming Months

Bloomberg ETF experts Eric Balchunas and James Seyffart have recently projected that REX-Osprey’s offerings could hit the market on Thursday, despite the SEC’s recent extension of decisions for other cryptocurrency ETFs.

The landscape for ETF approvals is further complicated by the delayed amendment for BlackRock’s Ethereum staking application, which has also been postponed to October 30.

Balchunas attributes these delays to ongoing coordination between the SEC and exchanges like Cboe and NYSE regarding updated listing standards.

However, Balchunas anticipates that streamlined procedures, expected to be approved in October, could lead to a “flood of ETFs probably in a couple months,” significantly enhancing institutional adoption of cryptocurrency investments.

Despite the bold proclamation from REX Shares, the US SEC has yet to officially confirm the approval of these ETFs or any similar applications from other firms seeking to provide direct exposure to the spot prices of these digital assets.

Featured image from DALL-E, chart from TradingView.com

P2P.org has become a validator on the Canton Network, a blockchain platform for institutional finance that handles more than $4 trillion in tokenized assets. As a validator, P2P.org will operate nodes that verify and record transactions on the network.

Launched in May 2023, Canton is a blockchain platform developed to support regulated institutions, with emphasis on real-world asset (RWA) tokenization, interoperability and adherence to compliance standards.

The move adds P2P.org — a staking infrastructure provider that reports managing over $10 billion in assets across more than 40 blockchain networks — to a growing list of participants in Canton’s ecosystem, including Goldman Sachs, JPMorgan, Citi, Santander, Bank of America, HSBC and BNP Paribas.

Jonathan Reisman, product manager at P2P.org, told Cointelegraph that many blockchains were not designed with institutional requirements in mind, slowing adoption in traditional finance.

However, Reisman said solutions such as the Canton Network bring “firms into an ecosystem where tokenization of assets, secure trading, and even innovations like BTC wrapping can be developed in a way that aligns with institutional standards.”

He added, “Validators only process the transactions they’re a party to and maintain them on their own ledger. This makes privacy more straightforward and institution-friendly.”

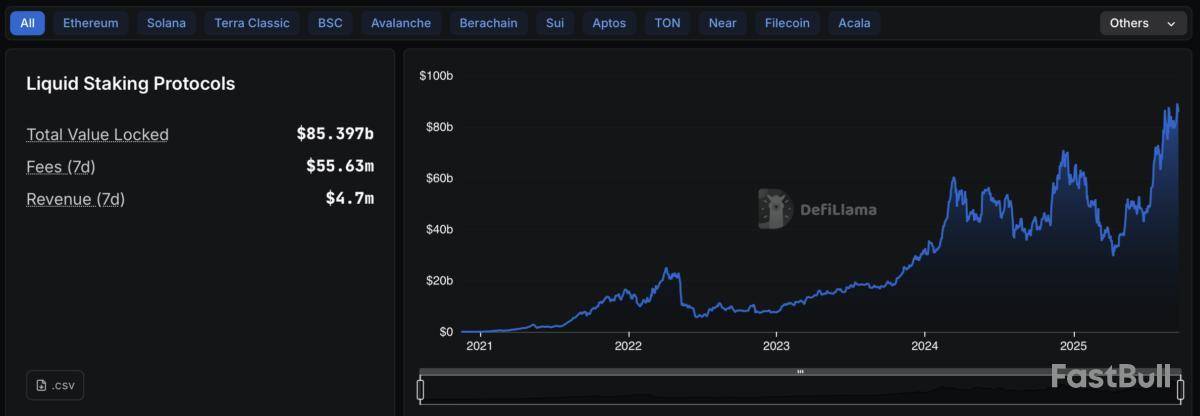

Institutional staking on the rise

On most proof-of-stake blockchains, validators earn rewards for securing the network by staking tokens. In other words, validators lock up crypto in exchange for yields.

Staking has become one of the dominant trends in the industry this year, with a broader push by institutions into networks such as Ethereum and other public blockchains.

Rather than following the proof-of-stake model of paying validators through staking yields, the Canton Network issues its native token, Canton Coin, aligned with how participants contribute to activity on the network. Infrastructure providers receive 35% of the distribution, application developers 50%, and users 15%.

According to Canton, the design is meant to tie rewards to actual usage and engagement on the network. Each application also has the flexibility to set its own degree of openness and confidentiality.

Like Canton, more protocols are building blockchain infrastructure to address institutional demand. In February, Lido launched its v3 upgrade with “stVaults,” modular contracts designed to give institutions more control and compliance features, citing growing demand from institutions.

More recently, Anchorage Digital added institutional custody and staking for Starknet’s STRK token. The service launched with an initial yield of 7.28% APR.

Regulatory developments in the US are helping to boost investors’ demand for crypto yield.

In August, the Securities and Exchange Commission (SEC) issued new guidance on liquid staking, which allows investors to deposit crypto with a provider and receive “receipt tokens” to trade or use in decentralized finance (DeFi) while their assets remain staked.

The SEC said that these receipt tokens do not constitute securities offerings under certain conditions, a decision industry executives described as a win for both DeFi and institutions.

Magazine: Ethereum is destroying the competition in the $16.1T TradFi tokenization race

TL;DR

Great meeting today. XRP nation, the ripple folks did really well as did A16Z. Lot more work to do, but great progress is being made on bipartisan legislation being passed this year

— Charles Hoskinson (@IOHK_Charles) September 17, 2025

Although the details he shared about the meeting are scarce, executives from several of the largest US-based crypto companies have been involved in working on the GENIUS Act, which passed the Senate in July and was signed into law by US President Trump.

Experts believe the legislation can reshape cryptocurrency markets, while also enhancing adoption and transparency for stablecoins.

Hoskinson’s praise for Ripple in particular is something that seemed impossible just a year ago. Recall that the two sides had engaged in an online spat for a few years, especially since Hoskinson referred to the XRP Army as “toxic and petty.”

However, both sides cleared the air in late 2024, andreportsactually emerged that they could be working on a collaboration.

The speculations only intensified in the following months, especially since the launch of Ripple’s stablecoin (RLUSD). At the time, it wasbelievedthat RLUSD would eventually go live on Cardano’s blockchain, but that’s yet to materialize.

The XRP price is once again at the center of discussion in the cryptocurrency market after a market expert reiterated their bold long-term forecast. The founders of EasyA, Dom and Phil Kwok, say the token still has the potential to hit $1,000, even if it takes longer than first expected. They explain that the short-term view is not yet clear, but the long-term case for XRP remains strong.

EasyA Founders Stand By $1,000 XRP Price Prediction

Dom and Phil Kwok joined host Tony Edward on the Thinking Crypto podcast to share their updated thoughts on XRP. Edward recalled their earlier bold forecast of $1,000 by 2030, which still excites many supporters. Dom Kwok made it clear that the short-term outlook is still “formulating,” meaning they are not ready to set a concrete target for the current cycle. However, he confirmed that the long-term thesis remains intact, and the bold forecast is still alive.

According to Dom, a significant amount of new money could enter the market once the rules are clarified. When those approvals are in place, Dom believes that large amounts of new capital could flow into XRP.

The market expert noted that the legal teams of hedge funds and asset managers are working out the rules to determine how they can start investing in other tokens. With the SEC lawsuit against Ripple now resolved, many of the barriers that held back institutions are gone. For the EasyA founders, this shift in the investment landscape is key to why the XRP $1,000 price target remains in place.

Network Effects And Developer Momentum Strengthen XRP’s Case

Phil Kwok spoke about another driver for the XRP’s growth: network effects. He explained that when prices rise, more developers become involved and build. Recent performance shows why the EasyA founders remain confident. The XRP price has climbed 456% since last year, trading above $3, and it is now the best-performing large-cap altcoin.

Dom also pointed out that price charts matter because falling prices scare off both users and builders. With the XRP price showing steady gains, it is drawing more investors and developers to its network. The short-term outlook is still uncertain, but the long-term belief in $1,000 continues to drive discussion. While Dom and Phil Kwok stand by their bold forecast, other experts, such as Matthew Brienen of CryptoCharged, have suggested that the price could reach that level by 2035 instead.

Even with the extended timeline, XRP’s strong position, growing utility, and the attention of institutions and developers all point toward a long-term path of significant growth. For many in the XRP community, the $1,000 price target remains a central rallying point, even if the timeline shifts.

Vet, a validator on the XRP Ledger, claims that he has voted to veto the Token Escrow amendment.

Reason behind the veto

He argues that it would be more prudent to wait until the token escrow is fixed so that it can properly support multi-purpose tokens (MPTs), which is a new standard on the ledger that makes it possible to support various types of tokens, including real-world assets (RWAs).

If both the Token Escrow amendment and MPTs were enabled at once, there could be bugs and unintended behavior.

According to Vet, the amendment is already just one vote away from passage.

A fix is ready

The validator has explained that a fix is ready for a future release. No timeline yet for that release but please don't worry, everyone wants Token Escrows and it will come to the XRPL as evident by the Yes votes thus far, Vet explained.

The boldest step yet

Solana has always pitched itself as the blockchain for speed. With Alpenglow, it’s attempting a quantum leap.

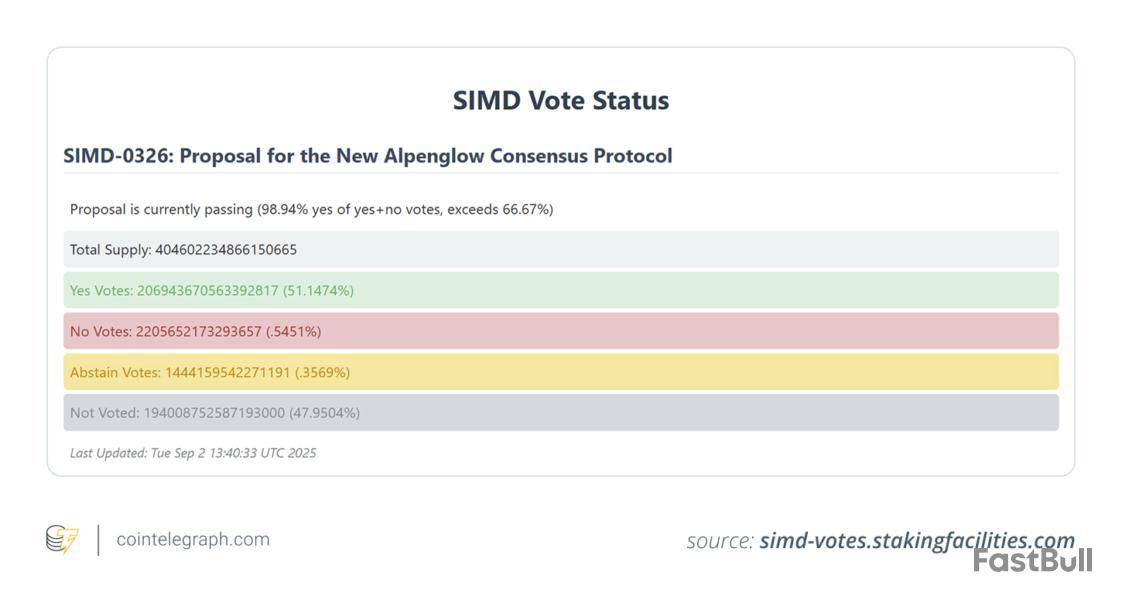

Validators have voted overwhelmingly in favor of the upgrade, with almost 99% support across the network. If successfully implemented, Alpenglow is expected to reduce transaction finality from roughly 12.8 seconds to just 100 to 150 milliseconds.

That’s close to a hundred times faster than current speeds and well within the range of internet benchmarks most people take for granted.

To put that into perspective, a Google search averages about 200 ms. Payment processors like Visa settle card transactions in a similar timeframe. If Solana can truly operate in that window, blockchain applications might feel indistinguishable from traditional systems.

The shift could redefine user expectations of crypto entirely.

How Solana stacks up against rivals

Even before Alpenglow, Solana carved out a reputation as one of the fastest major blockchains.

Its 12.8-second finality already outpaces Ethereum’s confirmation cycle, which typically takes 12 seconds for inclusion and around 12 minutes to reach true finality through its checkpointing mechanism.

By comparison, Sui, a layer-1 built for performance, boasts around 400-ms finality, which is impressive but still more than double what Alpenglow targets.

If Solana delivers on its promises, the gap could reshape the competitive landscape. For decentralized exchanges, derivatives platforms and blockchain-based games, sub-second finality becomes a prerequisite for real-time interaction.

Users who have grown accustomed to the lag of most Web3 systems could experience something far closer to the immediacy of Web2.

Did you know? In 2024, CoinGecko Research revealed that Solana garnered a whopping 38% of global crypto investor interest in chain-specific narratives, surpassing Ethereum’s 10%.

Inside the governance vote

The governance process for Alpenglow kicked off on Aug. 21, 2025, spanning epochs 840 through 842.

Participation was strong right from the outset. Validators and stakers quickly cleared the 33% quorum requirement, ensuring the proposal couldn’t stall out.

As ballots rolled in, support proved overwhelming. Early tallies showed backing between 99.6% and 99.7%, with only a sliver of participants voting against.

By the time the vote closed on Sept. 4, 2025, 98.94% of all participating stakeholders had approved the measure. Roughly 0.5% opposed, and another almost half-percent abstained.

Crucially, participation hit around 52% of the network’s total stake, comfortably above the minimum threshold and strong enough to suggest broad legitimacy.

Such near-unanimity is unusual in decentralized governance, where divisions often emerge even on technical upgrades. For Solana, the outcome shows alignment among stakeholders regarding Alpenglow’s necessity.

The mechanics of Alpenglow

At Alpenglow’s core are two new architectural components: Votor and Rotor.

These systems overhaul how Solana processes and finalizes transactions, allowing the chain to confirm blocks in 100-150 ms. Instead of waiting for multiple rounds of validator communication, the upgrade enables faster consensus without compromising security guarantees.

Alongside speed, Alpenglow introduces a new economic model. Validator Admission Tickets (VATs) aim to streamline validator onboarding while reducing operational costs.

Paired with the “20 20” resilience model, where the network can tolerate up to 20% of validators failing and another 20% behaving maliciously, Solana gains robustness against disruptions.

Now, building decentralized finance (DeFi) platforms, trading engines or multiplayer games will be possible without the awkward delays users often endure. Transactions could feel instant, which will likely unlock use cases that previously required centralized infrastructure.

Risks native to Solana

Alpenglow’s promise is extraordinary, but the upgrade doesn’t erase every concern hanging over Solana.

The network still depends almost entirely on Agave, its main validator client. A bug or exploit in that client could ripple across the entire ecosystem.

However, relief is coming in the form of Firedancer, a second validator client built by Jump Crypto.

Expected to debut on the mainnet later this year, Firedancer could diversify the network’s software base and drastically improve resilience.

Having multiple independent clients is standard in other ecosystems (Ethereum runs on Geth, Nethermind, Besu and Erigon), so Solana’s reliance on just one remains a red flag until Firedancer is fully operational.

There are also questions about centralization.

While VATs and cost reductions aim to lower entry barriers, some critics argue that fixed-tier fees and fault-tolerance thresholds could favor larger validators with deeper resources.

If that dynamic plays out, the network risks trading one bottleneck (speed) for another (concentration of power).

Did you know? Researchers recently uncovered specialized phishing techniques targeting Solana (coined “SolPhish”) that have led to $1.1 million in losses. Ahead of this, they developed SolPhishHunter, a pioneering detection tool for the ecosystem.

Why it matters beyond speed

The headline number (150 ms) grabs attention, but the real story is what that speed enables.

Consider a decentralized exchange (DEX). Today, even the best DeFi platforms can’t match the responsiveness of centralized order books. It is not unusual to see market conditions shifting considerably by the time a transaction clears.

With Alpenglow, order books could update in real time, giving traders the same fluid experience they expect from centralized platforms — without sacrificing custody.

The benefits are even more obvious with gaming. Blockchain-based games often stumble when interactions lag or require long confirmation windows. Sub-second finality could make in-game economies feel flawless, whether that’s trading items, earning rewards or settling bets.

Moreover, for payments, Alpenglow could be a breakthrough. Sending stablecoins across borders in 150 ms would put crypto payments on par with credit card networks.

Combined with Solana’s low fees, the upgrade positions the network as a genuine alternative for real-time settlement.

Infrastructure for enterprise-grade finance

Sub-second finality paired with stronger resilience mechanisms creates a blockchain that appeals greatly to businesses that can’t afford downtime.

The same goes for the 20 20 resilience model, reassuring players who worry about network stability.

The numbers already point to growing institutional trust. Three publicly listed companies have collectively staked around $1.7 billion on Solana, which demonstrates confidence in its long-term stability.

Beyond staking, the ecosystem is broadening. Tokenized real-world assets (RWAs) on Solana now total roughly $390 million, while total value locked (TVL) has climbed past $8.6 billion.

Staking yields averaging about 7% are also fueling demand for new investment products, with exchange-traded funds (ETFs) tied to Solana (SOL) recording millions in inflows.

Solana is moving well beyond retail adoption and speculation, positioning itself as infrastructure capable of supporting enterprise-level finance.

Did you know? Major financial entities, including HSBC, Bank of America, Euroclear and the Monetary Authority of Singapore, are integrating Solana into their tokenization efforts via a strategic partnership with R3.

What’s next for Solana?

With governance finalized, Solana’s roadmap is firmly in motion.

A testnet deployment of Alpenglow is scheduled for December 2025 at the Breakpoint conference, followed by a mainnet upgrade in Q1 2026. In parallel, Firedancer is progressing through a phased rollout.

Already operating in a hybrid “Frankendancer” mode on more than 10% of validators as of mid-2025 (and demonstrating throughput above 1 million transactions per second in testing), it represents a decisive step toward client diversity.

For Solana, the stakes are high as it aims for sub-100 ms finality while also ensuring resilience against single-client risk.

If successful, the combination of Alpenglow and Firedancer will both lock in Solana’s performance edge for high-throughput applications. Together, these updates will provide a more inclusive foundation for smaller validators and developers, strengthening the ecosystem’s long-term credibility.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up