Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Real-world asset (RWA) tokenization has become a key focus for venture capital, as investors zero in on the intersection of two powerful trends: institutional adoption of blockchain technology and the search for alternative sources of yield.

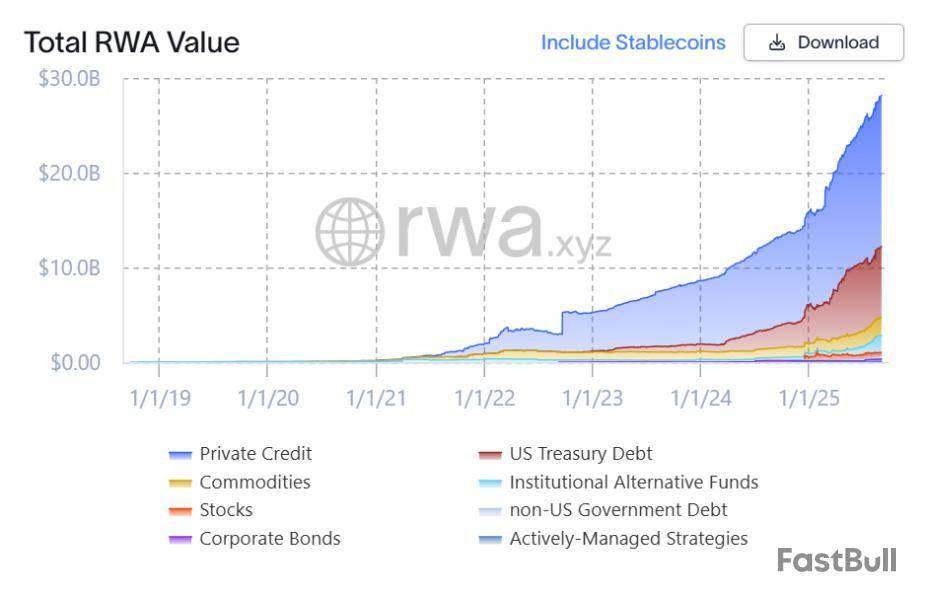

In 2025, tokenization has emerged as one of blockchain’s biggest growth areas, with the total value of onchain assets rising to $28 billion from $15 billion over the course of the year. As venture firms grow more selective with their capital allocations, tokenized assets have stood out as a clear area of opportunity.

So far, much of the activity has centered on private credit and US Treasury bonds, but the scope is steadily widening to include equities and even energy assets.

Reflecting this momentum, several major blockchain players — including Plume, Galaxy Ventures, Morpho, OKX Ventures, Anchorage Digital and Centrifuge — have launched a nine-week accelerator program called Ascend to support developers building tokenization infrastructure and applications.

This month’s VC Roundup spotlights several companies active in the space, including tokenization platform Plural, data chain Irys, programmable credit protocol Credit Coop, Web3 infrastructure provider Yellow Network and stablecoin infrastructure developer Utila.

Tokenization platform Plural closes $7 million seed round

Plural, a tokenization platform that enables high-yield investments in energy assets such as solar, storage and data centers, has raised $7.13 million in a seed round led by Paradigm, with participation from Maven 11, Neoclassic Capital and Volt Capital.

The company brings energy assets onchain, a move it sees as critical as artificial intelligence reshapes global energy demand. According to the International Energy Agency, electricity consumption from AI-driven data centers is projected to more than quadruple by 2030, making energy infrastructure an increasingly vital investment category.

Plural’s approach aligns with the broader trend of asset tokenization in the blockchain industry, where more real-world assets are being brought onchain to open new sources of yield for investors.

Irys raises $10 million to build programmable data blockchain

Irys, a layer-1 blockchain designed for data-intensive applications such as artificial intelligence, has raised $10 million in a Series A round led by CoinFund. Amber Group, Hypersphere, Breed VC and other investors also participated.

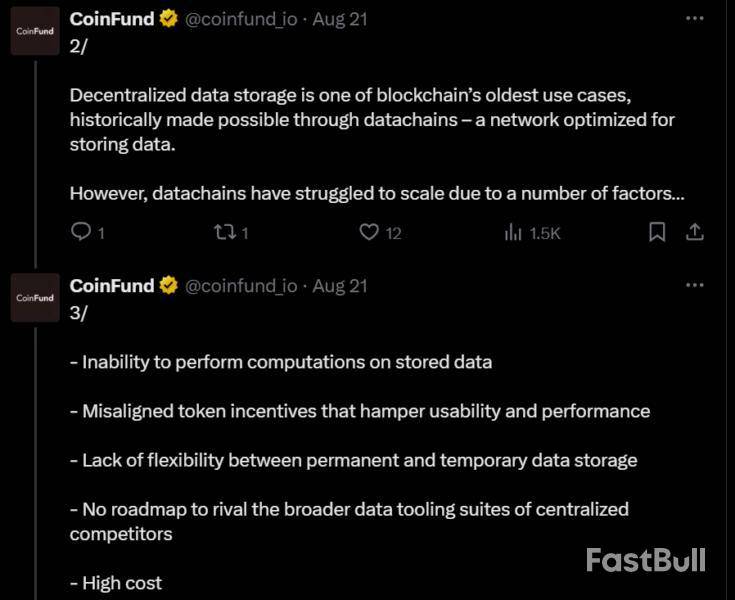

Irys describes itself as a “datachain” — a blockchain built to store large volumes of data at low cost. By providing this infrastructure, the company says it enables data creators to transform stored information into “programmable economic assets.”

CoinFund called decentralized data storage one of the blockchain industry’s oldest promises, but noted that datachains have long struggled to scale. Challenges include limits on how much data can be stored, misaligned economic incentives and the lack of flexibility between permanent and temporary storage, the firm said.

Programmable credit protocol secures $4.5 million seed round

Credit Coop, a blockchain-based credit protocol, has raised $4.5 million from venture firms including Maven 11, Lightspeed Faction and Coinbase Ventures. The funding will support the company’s operational expansion.

The platform connects institutional lenders with yield opportunities backed by a borrower’s verifiable cash flows. For businesses, it enables traditional assets and projected cash flows to be used as collateral for credit.

To date, Credit Coop has processed more than $150 million in total volume, with $8.5 million in active loans outstanding.

Ripple co-founder-backed Yellow raises $1M in token sale

Web3 infrastructure company Yellow Network has raised over $1 million from accredited US investors through a token sale on Republic. The Reg D-compliant offering of YELLOW tokens was oversubscribed, the company said.

Backed by Ripple co-founder Chris Larsen, Yellow Network is building infrastructure for digital asset trading, providing brokers, exchanges and institutions with back-end systems that enable secure cross-chain trading.

The company said the raise demonstrates that crypto fundraising can be conducted within regulated frameworks. “The US market is ready for regulated digital infrastructure, where institutions and creators can engage with confidence,” said Alexis Sirkia of Yellow Network.

Stablecoin infrastructure provider Utila raises $22 million

Utila, a blockchain infrastructure company specializing in stablecoin operations, has raised $22 million in a Series A extension round led by Red Dot Capital Partners, with participation from Nyca Partners, Wing VC and others. The company offers custody, wallet management and compliance solutions to help businesses integrate stablecoin operations.

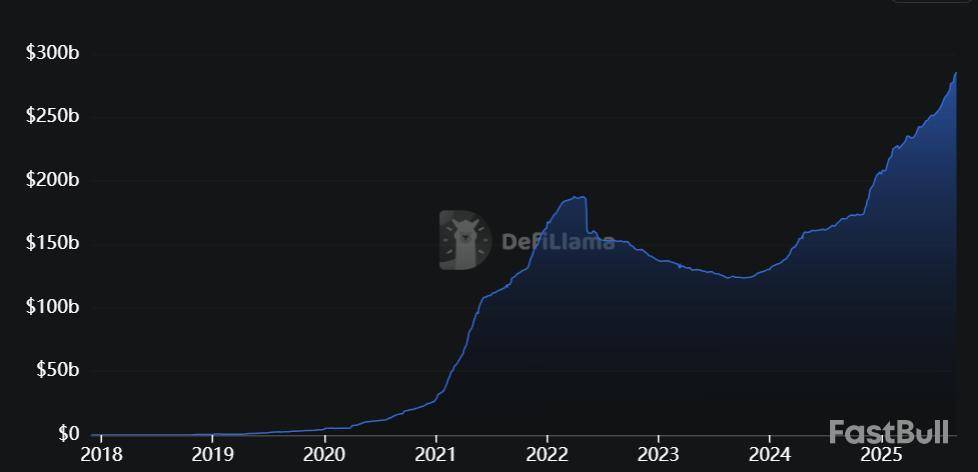

The funding comes amid rising adoption of stablecoins, which are approaching a combined market capitalization of $300 billion. Utila reports it has processed more than $60 billion in transactions as demand grows for stablecoin-focused operating systems.

Wilder World and Peapods are planning a talk about “Volatility Farming for the Wilder Economy.” Community talks can bring more attention, but they do not always move the price right away. If the talk shares big news, partnerships, or updates, the price could react. Many investors join these events to hear about new plans or products. If the information is strong and positive, the price may rise. But if it is just normal discussion, there might be little change. It is important to watch the reaction after the event. source

Wilder World@WilderWorldSep 03, 2025Join us to discuss live tomorrow at 12:30PT https://t.co/WGgLzDGNru

Saga Vibes Hours is an event where the community and project team talk about the latest news in the Saga ecosystem. These events are good for keeping the community interested, but they rarely drive big price moves unless special news or product launches are announced. Still, if the team announces a new partnership or update, the price may rise fast. Usually, the market waits for more information. Watch this event mainly for early signs of bigger changes or updates. source

Saga ⛋@Sagaxyz__Sep 03, 2025Tomorrow @internetmick & @art_is_found are back.

Join us to chat about developments in the Saga ecosystem and other market news & updates.

Boost will be listed on the Bitget exchange with the BOOST/USDT trading pair. Listings on well-known exchanges often lead to increased interest and more buyers, as it is easier for people to invest. This can cause a strong price move if there is enough excitement. However, if many investors were expecting the news, the impact could be smaller. Sometimes, prices rise before the listing and fall after it starts. Still, this listing is important because Bitget has many users and strong trading volume. source

Bitget ️️@bitgetglobalSep 04, 2025Initial Listing - $BOOST @boostdotgg

Pair: BOOST/USDT

Deposit available: Now

Trading available: Sep 5, 9:00 AM (UTC)

TL;DR

Millions of SHIB Tokens in Flames

The second-largest meme coin in terms of market capitalization has retraced by 3% in the past week and currently trades at around $0.00001223 (per CoinGecko’s data).

However, data shows that the burn rate has skyrocketed by over 200,000% in the last 24 hours, resulting in roughly 4.5 million SHIB tokens sent to a null address. While the USD equivalent of the destroyed stash is negligible, continuous burning efforts will make the asset scarcer and could positively impact its valuation (should demand not diminish).

Since introducing the program, the team and the community have burned approximately 410.75 trillion tokens, leaving 584.68 trillion in circulation.

Some analysts on X continue making bullish predictions despite SHIB’s negative performance as of late. Mark.eth is among the examples, arguing that Shiba Inu can “make you rich” like no other altcoin. For their part, CryptoELITES envisioned a whopping 17x increase to a new all-time high of $0.00023.

Important indicators, on the other hand, hint that the correction might intensify in the short term. Daily transactions processed on the layer-2 scaling solution Shibarium have plummeted to monthly lows, showcasing decreased user engagement in the ecosystem.

In addition, Shiba Inu’s exchange netflow has been predominantly positive in the last week. This means that investors have shifted from self-custody methods toward centralized platforms, which increases the immediate selling pressure.Interest is Low, but Is That a Bullish Sign?

When examining SHIB’s performance and trying to predict its future price movement, it is always helpful to observe the overall interest in the asset. According to Google Trends, searches involving the meme coin in the past several months are far below the record high at the end of 2021 and the local peak in March last year.

While this may sound like another bearish element, high retail interest typically comes late in the bull cycle when the price is already booming. That said, the current condition might be interpreted as a sign indicating there’s more room for growth.

Trump family-backed crypto projects World Liberty Financial and American Bitcoin saw their respective token and share prices decline significantly on Thursday.

Inspired by President Trump, DeFi project World Liberty Financial's token is down 24% on the day. Meanwhile, American Bitcoin (ticker ABTC), the bitcoin mining and BTC treasury venture the president's two eldest sons have invested in, saw its shares drop 21% in early trading. Wednesday was American Bitcoin's first day of trading on the Nasdaq.

The two Trump-linked crypto project's decline comes as the market as a whole fell on Thursday with Bitcoin and Ethereum down 2.4% and 3.6%, respectively, according to The Block's price page.

While it's uncertain why World Liberty's WLFI token was down 24%, American Bitcoin's decline could be tied, in part, to a report that the Nasdaq had decided to increase oversight of companies raising funds to accumulate cryptocurrencies.

The stepped-up review comes amid a wave of companies raising equity to buy digital assets like Bitcoin, Ethereum, and many altcoins. Since January, 154 U.S.-listed companies have announced plans to raise about $98.4 billion to purchase crypto, per the Financial Times, citing data from crypto advisory firm Architect Partners, which tracks such activity. The figure is up from about $33.6 billion raised by 10 companies before 2025.

American Bitcoin and WLFI launches

American Bitcoin's market decline follows a successful first day of trading. The company, which is blending a strategy of both buying and mining BTC, saw its stock rise nearly 17% on Wednesday.

On Monday, WLFI started trading on crypto exchanges and changed hands at over $0.30 shortly after its launch, implying a fully diluted valuation of over $30 billion based on a total supply of 100 billion tokens, according to The Block's price page.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

September has traditionally been a difficult month for Bitcoin , with price charts often showing weakness. However, some experts predict a potential surge, pointing to falling exchange reserves as a signal of upward momentum.

The optimistic outlook comes despite Bitcoin’s recent struggles. The largest cryptocurrency has slipped 2% over the past week, reflecting broader market uncertainty.

Bitcoin Outlook: Seasonal Lows or Rally Ahead?

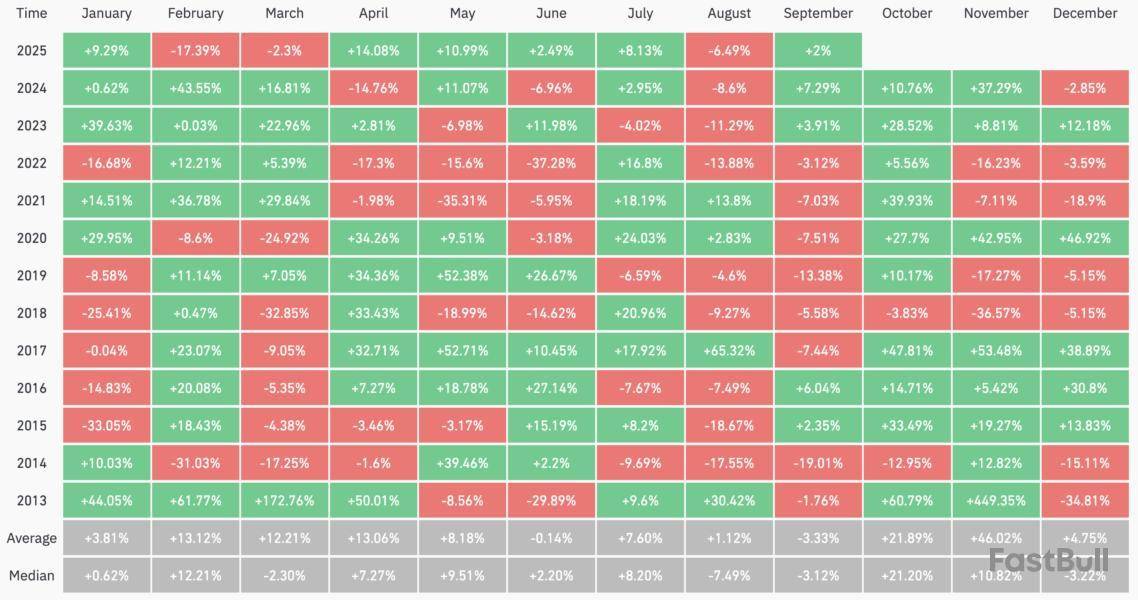

According to data from Coinglass, Bitcoin’s average return in September stood at -3.33%, making it the cryptocurrency’s worst month. BTC ended the month in red for six consecutive years between 2017 and 2022, making its prospects for this year also somber.

Notably, many experts agree on this perspective. An analyst has characterized the current market as resembling a ‘classic stock market top.’ This indicated potential vulnerability to further corrections.

Furthermore, analyst Timothy Peterson highlighted that Bitcoin’s value dipped 6.5% last month. The analyst predicted a price range of $97,000 to $113,000 by the end of September, reflecting a continuation of this trend.

‘It’s part of a seasonal pattern that has played out over many years,” Peterson added.

Meanwhile, many anticipate that while declines may come, the coin will bounce back next quarter. Based on past patterns, October and November are the strongest months for Bitcoin, so that could very well happen.

“Historically, Bitcoin has always bottomed out in September after the year of the halving. After that, it’s mostly smooth sailing. Despite me usually not looking at the past and using it as a signal for accuracy (I look at price action today). Looking at charts right now, this could actually very well play out again,” Crypto Nova wrote.

This view is supported by Benjamin Cowen, CEO of Into The Cryptoverse. He noted that September often marks a low point in post-halving years, typically followed by a rebound into a market cycle peak in the fourth quarter.

Nonetheless, some maintain a more optimistic view. Data shared by crypto analyst Rand showed a steady decline in BTC held on exchanges. Moreover, the exchange supply has plunged to a six-year low.

This signals reduced selling pressure. In addition, if demand increases, this shrinking supply can support a more bullish outlook for Bitcoin.

“Bullish supply shock,” Cade Bergmann added.

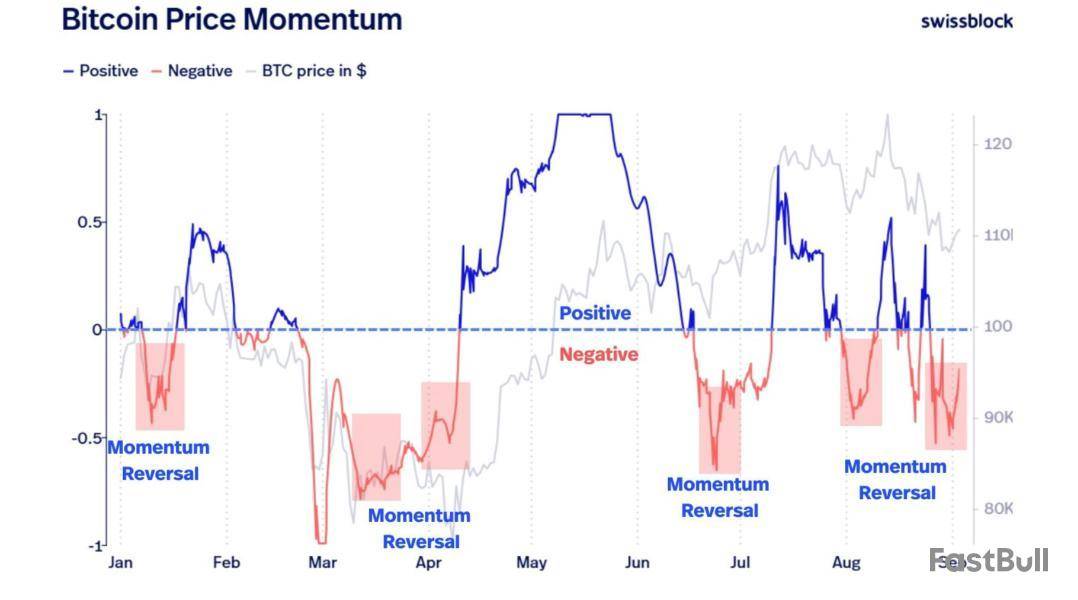

Rand also emphasized that momentum appears to be reversing from negative to positive, signaling a potential shift in market sentiment. With just under two weeks until the market expected Fed rate cuts, the analyst suggested the policy shift could provide the catalyst for a stronger recovery in September.

Lastly, market watchers are also eyeing key dates. Analyst Marty Party pointed to September 6 as a potential trigger, tied to market maker activity.

“Bitcoin market makers have cooked on the 6th of each month. IMO: Sept 6th is a move. That’s the event window till Sept 17th FOMC,” he said.

Now, Bitcoin’s price remains under pressure, with experts divided on whether September will mark a bottom or a continued decline. The coming weeks, particularly around the forecasted Fed decision, will be critical in determining whether the cryptocurrency can defy its seasonal weakness and capitalize on the current supply dynamics.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up