Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

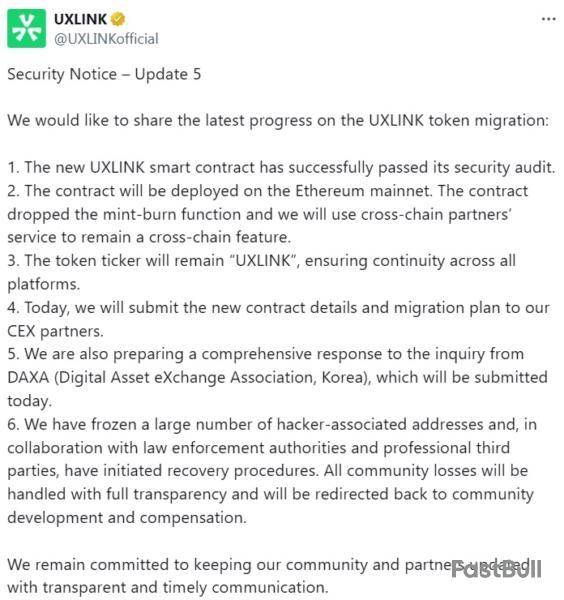

Decentralized social platform UXLink said Wednesday it deployed a new Ethereum contract after a multisignature wallet exploit allowed attackers to mint billions of unauthorized tokens and crash the value of its native asset.

UXLink said its new smart contract had passed a security audit and will be deployed on the Ethereum mainnet. The project said the new contract dropped the mint-burn function to prevent any similar incidents in the future.

The project confirmed the breach on Tuesday, saying that a significant amount of crypto was transferred to exchanges. Estimates of the losses from the hack vary, with Cyvers Alerts estimating it saw at least $11 million stolen, and Hacken placing the figure at more than $30 million.

What is clear is that the incident highlighted smart contract security flaws that projects should address. Marwan Hachem, co-founder and CEO of Web3 security firm FearsOff, told Cointelegraph that the incident highlighted the risks of rushing ahead without the necessary security layers.

UXLink exploit highlights “centralized control” risks

Attackers took control of UXLink’s smart contract through a multisignature wallet breach and initially minted 2 billion UXLINK tokens. The token’s price dropped 90% from $0.33 to $0.033 as the attacker continued minting, with security firm Hacken estimating nearly 10 trillion tokens were created.

Hachem told Cointelegraph that the UXLink breach comes from a delegate call vulnerability in their multisignature wallet. This allowed the hacker to run arbitrary code and take over the administrative control of the contract. He added that this led to the minting of unauthorized tokens.

“This really spotlights some design flaws in UXLink’s setup,” Hachem told Cointelegraph. “A multisignature wallet that wasn’t properly shielded from delegate call exploits, lax controls on who could mint and no built-in code to enforce the supply cap.”

Hachem said that at the end of the day, this shows how risky it is to “keep too much centralized control in projects that claim to be decentralized.”

The need for timelocks, hardcoded caps and better audits

From a technical standpoint, Hachem said the UXLink hack could have been avoided with a few standard safeguards.

This includes adding timelocks to sensitive actions like minting new tokens or changing contract ownership. “A 24 to 48-hour delay gives the community a chance to spot anything unusual before it goes through,” Hachem said.

The second solution includes renouncing minting privileges once the tokens are launched, so that not even insiders can create more. Hachem said hard-coding supply caps directly on smart contracts would prevent risks of new tokens being minted.

On the operational side, Hachem stressed the importance of independent reviews and ongoing transparency.

“You can’t just audit the token contract. The multisig setup needs scrutiny, too,” he said, urging projects to make wallet addresses public and require multiple signers on every transaction.

The broader lesson, according to Hachem, is that even commonly used tools like multisig wallets shouldn’t be treated as bulletproof. He said pushing for more decentralized governance and emergency stops for critical functions are also of utmost importance.

“UXLink’s incident highlights that rushing ahead without solid and ongoing security can shatter community confidence. Better to layer up defenses from the start,” Hachem told Cointelegraph.

Fundstrat co-founder and BitMine Chairman Tom Lee said Ethereum is a "truly neutral chain" that will be favored by Wall Street and the White House.

"I don't think anyone ever feels that someone's got a fat finger tilting [Ethereum] in their favor," Lee said, during Korea Blockchain Week 2025's Impact conference on Wednesday. "If you think about how Wall Street operates, they will only wanna do and operate on a neutral chain."

Lee further explained that he observed the White House and Congress, which had become more pro-crypto under the Trump administration, are primarily turning to Ethereum.

"So when I look at that, combined with agentic AI and robots that are really gonna create the need for a token economy for robots, a lot of that will happen on Ethereum," Lee said. "In fact, President Trump today just talked about how he needs proof-of-human to protect us, and a lot of that work is going to be done on Ethereum."

When the Wall Street strategist engineered BitMine's transformation into an ETH treasury vehicle, Lee said he saw the possibility that Ethereum was entering a "super cycle" that would last 10 to 15 years.

Largest Ethereum DAT

Since transitioning into an Ethereum treasury company, BitMine's market capitalization grew from around $37.6 million in June, before the transition, to around $9.45 billion as of Wednesday.

BitMine is currently the largest Ethereum treasury in the world, holding 2.15 million ETH, according to The Block's corporate treasuries data. It is also the second largest crypto treasury firm overall, behind Michael Saylor's Strategy.

Lee said that he thinks there is room for more than one Ethereum treasury firms, but stated that the market is picking its winners and losers.

"Bitmine trades $3 billion a day, Microstrategy trades $3.4 billion a day. I think the two of us represent 95% of all trading volume in the DATs," Lee said. "The two of us are 90% of the trading volume. That means institutions really only want to buy us."

Lee said the two companies have essentially become large-cap stocks, and they are going to receive passive flows as they will become a part of major indices when they rebalance.

"That really helped MicroStrategy too, and that's actually what sustains valuation premiums, because now you have someone who's buying every day."

Still bullish on BTC

Meanwhile, Lee said he expects bitcoin price to end the year between $200,000 and $250,000, while ether is expected to land between $10,000 and $12,000.

"I'm still bullish on bitcoin," Lee said during the conference discussion. "In the fourth quarter, seasonally bitcoin is strong. But now we have the Fed flipping dovish after being essentially hawkish all year. That's a tailwind for bitcoin."

Lee added that his estimate aligns with Fundstrat CMT Mark Newton's technical targets.

"Ethereum, as a price ratio to bitcoin, should recover to its prior, either average or at least five-year highs," Lee stated. "Using a $250,000 Bitcoin, that implies somewhere between 10 and 12,000 for Ethereum by the end of the year."

The BitMine chairman said he expects Ethereum to surpass its prior highs, and the cryptocurrency's "real price discovery" will be between $12,000 and $15,000. "But I don't think that would be the ceiling for Ethereum," Lee added.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Bitcoin has seen massive crashes lately, dropping below $112,000 levels. It has slipped over 9% from its all-time high of $124K just a month ago, raising concerns over its next move.

In contrast, gold has been rising to new all-time highs. Although Bitcoin is often compared to “digital gold,” critics are now questioning its role against the proven stability and strength of the gold.

Is Bitcoin In A Bear Market?

Known Bitcoin critic Peter Schiff took to X to argue that Bitcoin is not living up to its hype.

Peter Schiff@PeterSchiffSep 23, 2025Bitcoin is not living up to its hype. Priced in gold, Bitcoin is now 20% below its record high set in August. In other words, Bitcoin is in a bear market. Since Bitcoin is promoted as being digital gold, being down 20% in gold is more significant than being down 10% in dollars.

He notes that when priced in gold, BTC is down 20% from its August peak. That is a steeper decline than the 10% drop in dollar terms.

Since Bitcoin is marketed as digital gold, Schiff argues this comparison matters even more. If Bitcoin is losing ground to gold itself, he says, then the case for it as a safe-haven asset is weaker, and the market is already showing bearish conditions. The argument speaks for itself as BTC is down 4% over the past week.

Signs of Weakness in the Rally?

Cryptoquant analyst Darkfost notes that recent small pullbacks are starting to dent investor sentiment. Historically, markets often hit a low sentiment before reversing, offering opportunities for patient traders who go against the crowd. He notes that this shift is worth watching closely.

Social media sentiment also gives another hint about where Bitcoin might go next.

Santiment shows a wide split between predictions. Bearish calls are placing Bitcoin between $70K-$100K, while bullish forecasts are aiming much higher at $130K-$160K. Interestingly, Santiment notes that extreme bullish predictions come before short-term corrections, clearly suggesting that some turbulence could lie ahead for BTC.

How Low Could Bitcoin Go?

The debate now turns to how low Bitcoin might actually go if bearish momentum builds.

Expert Benjamin Cowen suggests Bitcoin could potentially drop 70% from its next all-time high. Previous cycles saw declines of 94%, 87%, and around 77%. While such a steep correction can never be guaranteed, historical patterns indicate that it remains a possibility worth considering.

Reasons to Stay Optimistic for Q4

Despite the bearish sentiment, BTC is up 4.15% over the last month, with just a week left. Historically when September ends in the green, the following months often continue the trend and Q4 may be gearing up for a strong run.

Michael Saylor recently explained that despite Bitcoin’s recent downward price action, the real driver now is corporate and institutional adoption.

This is putting upward pressure on Bitcoin’s price. As resistance and macro headwinds ease, he expects BTC to climb sharply again toward the end of the year.

Ripple's stablecoin desk is playing active supply games, with the latest sequence showing both sides of the ledger. First, there was an eight million RLUSD mint, then an eleven million burn, and then another three million tokens spun out of the treasury.

The pattern is not random; it is controlled cycling that shows Ripple is adjusting liquidity around live flows rather than just letting supply drift.

The total float is now around $741 million, which is enough to push Ripple USD above Raydium — the token of Solana's main decentralized exchange — in the market cap rankings. The jump is important because RLUSD is still pretty young, only launching months ago, but it is already moving $150 million in daily volume.

Ripple Stablecoin Tracker@RL_TrackerSep 23, 2025💵💵💵💵💵💵 3,000,000 #RLUSD minted at RLUSD Treasury.https://t.co/gA5eIvLjGI

That means it has a turnover rate of over 20% of supply every single day. For a stablecoin that is still finding its distribution rails, that kind of speed is a statement.

What is so specific about Ripple USD stablecoin?

What makes RLUSD stand out is how well institutions are already plugging in. Investors can swap tokenized fund shares like BlackRock's BUIDL into RLUSD using Securitize, closing the loop between tokenized treasuries and dollars.

DBS Bank is listing RLUSD alongside sgBENJI in Asia, enabling trading, borrowing and collateralizing using Ripple's stablecoin in the same environment as tokenized money market funds.CoinMarketCap">

The mint-burn-mint cycle shows that Ripple is treating RLUSD like a live monetary instrument, not a one-way issuance machine. If you look at the market size of Raydium, it is already overtaking some of the big names in DeFi.

Connections with large institutions show the target is bigger than crypto trading pairs; Ripple wants RLUSD to be at the center of global tokenized finance.

XRP’s price action in September 2025 is shaping up to be crucial, as the token consolidates near key support levels that could define its next major move. Market participants are closely watching how XRP reacts to liquidity shifts and buying pressure, with momentum building around its long-term structure. A decisive rebound from current ranges could trigger stronger demand, setting the stage for a sharp rally. If this recovery unfolds, XRP may have the potential to retest the $3.60 zone.

What’s Impacting the XRP Price Today

XRP is navigating a pivotal phase, with recent developments setting the stage for potential short-term swings and medium-term momentum. Traders are closely watching how institutional activity, regulatory clarity, and network growth interact with market sentiment.

These dynamics show that XRP’s current range is not random—short-term volatility is likely, but structural developments are aligning to support a potential rebound.

Will XRP Price Reach $5 in 2025?

Since the start of the month, the XRP price has maintained a strong ascending trend. However, the bulls managed to prevent further loss and initiated a w-shaped recovery in the short term. Meanwhile, the volume also surged to a large extent, hinting towards a strong presence of the buyers. Regardless of this, the token remains under bearish influence, raising concerns over the next price action.

The XRP/USDT 4-hour chart shows heightened volatility after a steep drop below $2.95, breaking the ascending support. The price is consolidating around $2.87, with buyers attempting to defend the $2.80 zone. Stochastic RSI suggests an oversold recovery, hinting at short-term upside momentum. If bulls regain strength, XRP could target $2.95 and $3.05 as resistance levels. However, failure to hold above $2.80 may expose the token to further declines toward $2.70 and possibly $2.62 in the near term.

Besides, a popular analyst, Ali, believes that the XRP price may head into the buying range around $2.7, where buying pressure could build and trigger a rebound above $3.5 and rise above $3.6.

The cryptocurrency market faced a sharp sell-off over the past three days, wiping out weeks of gains and causing panic among traders. While some analysts call this a “sell the news” reaction following the Federal Reserve’s latest meeting, historical seasonal trends suggest this dip could create the perfect setup for a strong fourth-quarter crypto rally.

Bitcoin recently saw a small retracement after market liquidations, but analysts suggest this is a healthy retest before the next upward move. Fake price drops can trigger sell orders, which may help push Bitcoin higher.

Julian Patel, a well-known crypto analyst, explained on X that Bitcoin’s four-year cycle is extending alongside the macroeconomic business cycle. “Most people overcomplicate it,” he said. “If the business cycle extends, the crypto cycle extends.”

This aligns with recent market moves, where Bitcoin and Ethereum are showing expected price dips as part of a broader macro trend.

Crypto Whales Are Buying These Top Altcoins Amid Market Crash

XRP

XRP has seen significant whale buying following the recent sell-off. A single 30 million XRP purchase in the last 24 hours highlights strong institutional interest in XRP. Ripple has also launched a new phase of institutional DeFi on the XRP Ledger, including over $1 billion in stablecoin volume and upcoming native lending protocols.

Traders are watching for a high-low-high pattern formation, indicating XRP could move toward $3.50 if support holds between $2.70–$2.95. XRP is emerging as a top altcoin that whales are buying after the crypto market crash, making it a key altcoin to watch in Q4 2025.

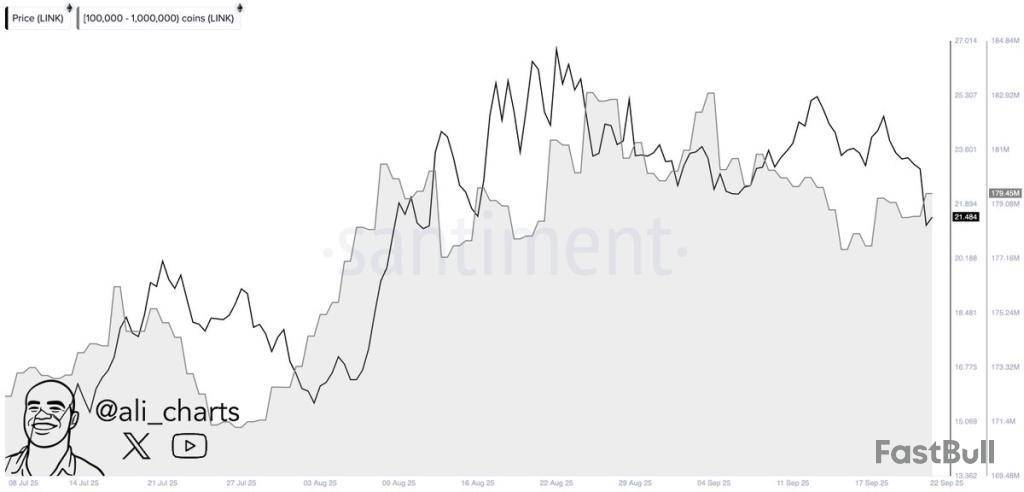

Chainlink continues to attract whales, with over 800,000 LINK purchased recently and 5.5 million LINK removed from exchanges. This shows institutional confidence in Chainlink for long-term DeFi growth.

Chainlink powers advanced DeFi applications, cross-chain compliance, and secure data connectivity. With total DeFi value locked (TVL) hitting $300 billion, LINK is positioned for further growth as more institutions integrate blockchain solutions. LINK as a must-watch altcoin for Q4 crypto gains.

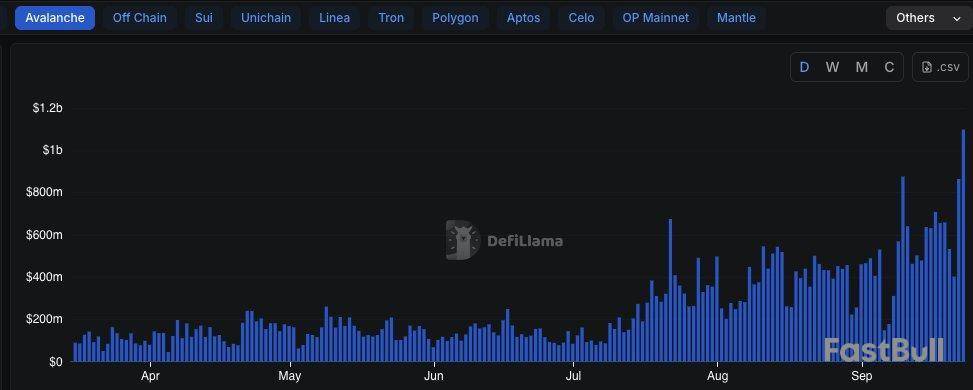

Avalanche has shown strong performance amid recent volatility. Major corporate strategies, including Hive Miners’ $550 million AVAX investment and creation of AVAC1, indicate growing institutional adoption of Avalanche.

AVAX has surpassed Chainlink to become the 12th largest cryptocurrency, with a 30-day TVL of $417 million. AVAX could continue upward momentum, targeting around $44 after consolidating near support levels. Avalanche is now one of the top altcoins whales are accumulating after the crypto market crash.

SharpLink Gaming's CEO, Joseph Chalom, stated that the Ethereum treasury company's ultimate goal is to bring the traditional market structure on-chain.

At a panel discussion at Wednesday's Korea Blockchain Week 2025 Impact conference, Chalom said the company is looking beyond the goal of owning 5% of Ethereum supply as a treasury firm.

"It really doesn't matter if we get there first or we get there second," Chalom said. "Are we fighting over the $4 trillion of crypto market cap? Or is our target the $700 trillion of traditional finance market structure that we believe should be on a decentralized network that's trusted, programmable, digitally native, that is atomic in instant settlement."

Chalom, who spent most of his career at BlackRock, called the elimination of time and cost friction in traditional financial markets the "greatest risk reduction" in financial services history. To seize this opportunity, Chalom said treasury companies must focus on promoting protocols, stablecoin initiatives, and institutional DeFi in their respective chain ecosystems.

Digital asset treasuries, or DATs, have become one of the biggest trends in crypto, signifying the rising institutional acceptance and demand for the asset class. Spurred by Michael Saylor's success with Strategy's bitcoin treasury, dozens have appeared, providing exposure to various cryptocurrencies.

During the same discussion, Solana treasury firm DeFi Development Corp's CSO, Dan Kang, said that buying an ETF is like sitting on a life raft in a river, but buying a DAT is like riding a speedboat.

"It gets you to your destination much faster. You get the benefit of the price action of the current, but you can accelerate, you can steer, you can slow down if you need to," Kang said.

Success metric of DATs

The two treasury firm executives also discussed metrics that gauge the success of DATs.

Chalom listed three criteria: daily average trading volume, great management and stock liquidity.

"Most of the fundraising is coming through something called an at-the-market facility, and you do that by listing and issuing new securities every day as a percentage of your daily volume," Chalom said. "You have to have great management, and you have to have a liquid stock. Otherwise, you're going to end up doing dilutive deals."

On the other hand, DeFi Development Corp's Kang mentioned SOL per share growth, as he explained the company must be able to provide shareholders with more of the underlying asset over time.

"The only reason Microstrategy has outperformed bitcoin by 2.5x over the last few years is … it has driven bitcoin per share denominated in bitcoin, by 5x over the past five years," Kang said.

Weathering bear cycles

The future of crypto asset treasuries is a growing concern, as most were established during the recent bull run and now face a potential market downturn. Nonetheless, the two DAT experts say their proof-of-stake treasury vehicles are relatively free from such risks.

"The bigger your treasury gets, the more of it you can stake, the more you can deploy on-chain, the more of an organic source of yield that you have, and they're really like revenue-generating business and incredibly high incremental margins," Kang said. "I think a share repurchase program makes a lot of sense, but only if you are not going to sell the underlying asset to repurchase your shares."

Chalom said he's in the game to build an operating company out of SharpLink that builds additional revenue businesses that lend, borrow, run transactions, validate, and secure transactions with billions worth of ETH the company owns.

"I'm not in this to create a 5% ownership in ETH and stop, and do nothing and just become a giant dividend company," Chalom said. "We're gonna lift the community, we're going to seed and support protocols, and over time, we're to help accelerate institutional adoption of digital assets, and it's gonna transform the world."

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up