Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

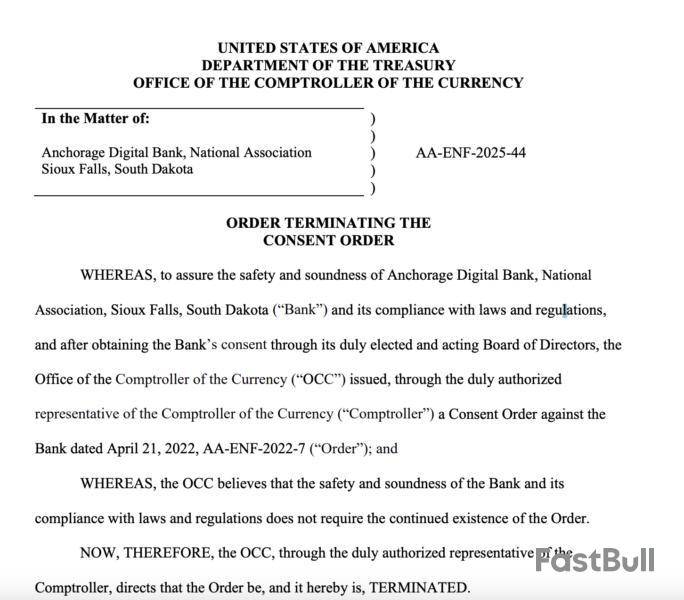

The US Office of the Comptroller of the Currency (OCC) said it had issued an order terminating a consent order made against cryptocurrency custody bank Anchorage Digital in 2022.

In a Thursday notice, the OCC said it had dropped the order “to assure the safety and soundness” of Anchorage. The financial regulator’s April 2022 order was based on Anchorage’s “failure to adopt and implement a compliance program” in accordance with Anti-Money Laundering (AML) standards. However, the OCC said the bank’s “compliance with laws and regulations does not require the continued existence of the order.”

“[W]e received—and have now resolved—feedback from regulators as we set the standard for federally-chartered custody of digital assets,” said Anchorage co-founder and CEO Nathan McCauley in a Thursday blog post, adding:

Anchorage was the first US-based crypto company to receive a national bank charter issued by the OCC in January 2021 under former US President Joe Biden. Under President Donald Trump, the US Senate confirmed Jonathan Gould, the former chief legal officer of Bitfury, to head the regulator in July.

Is politics playing a role in regulating crypto companies?

The dropping of the consent order signaled the US government’s softening on crypto enforcement and regulation under the Trump administration.

The Federal Reserve said in August it would sunset a program launched specifically to monitor banks’ digital asset activities. The OCC, Federal Reserve, and Federal Deposit Insurance Corporation also issued a joint statement in July clarifying the risks to banks holding digital assets for clients.

Other crypto companies seeking national trust bank charters from the OCC included Paxos, Ripple Labs and Circle. Under the GENIUS Act, a bill to regulate payment stablecoins signed into law in July, the OCC and qualifying state regulators will offer a pathway to licensing for crypto companies.

CoinDesk Bitcoin Price Index is down $2132.12 today or 1.87% to $112149.23

Note: CoinDesk Bitcoin Price Index (XBX) at 4 p.m. ET close

Data compiled by Dow Jones Market Data

Key takeaways:

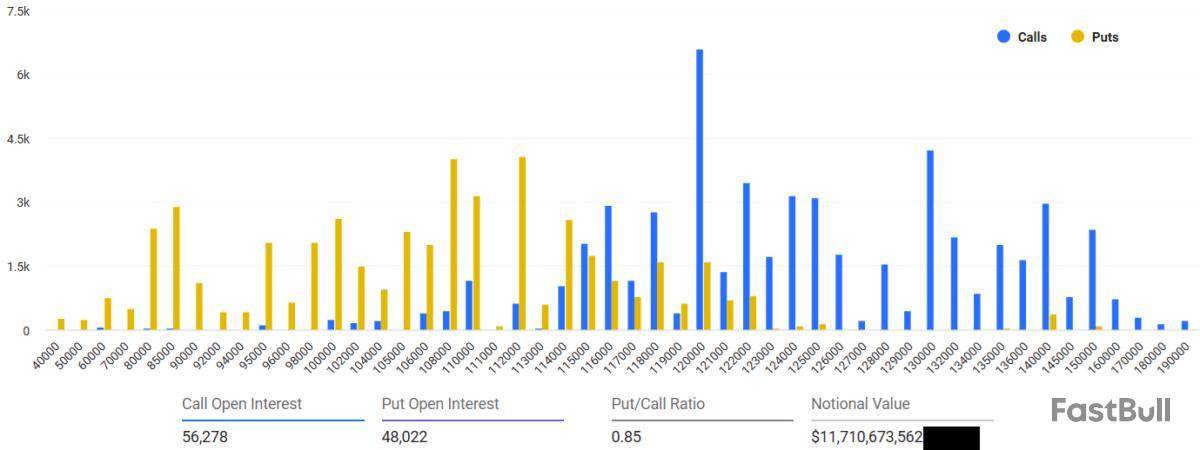

Bitcoin bears hold strong incentives below $114,000, likely intensifying pressure ahead of the options expiry.

AI-sector spending concerns add turbulence and weigh on investors’ broader risk appetite.

A total of $13.8 billion in Bitcoin (BTC) options are set to expire on Aug. 29, a moment many traders believe could determine whether the recent 9.7% correction marks the end of Bitcoin’s bull run or just a temporary pause. The drop to $112,100 on Thursday pushed Bitcoin to its lowest point in six weeks, intensifying bearish momentum ahead of the monthly options expiry.

Bullish Bitcoin strategies ill prepared for prices below $114,000

The $7.44 billion in open interest for call (buy) options stands 17% higher than the $6.37 billion in put (sell) contracts. Still, the actual outcome hinges on Bitcoin’s price at 8:00 am UTC on Aug. 29. Deribit dominates the market with an 85% share, followed by CME at 7% and OKX with 3%.

Bulls may have been overly confident, with some wagers set at $125,000 or higher. That optimism quickly eroded after Bitcoin’s decline, shifting momentum toward put instruments. Regardless of the rationale behind the recent BTC price correction, traders who opted for bullish strategies will likely come out disappointed.

Only 12% of call options were placed at $115,000 or below, leaving most out-of-the-money at current levels. By contrast, 21% of puts are positioned at $115,000 or higher, with significant clusters at $112,000. Thus, it is only natural to expect bears to continue negatively pressuring Bitcoin’s price ahead of the monthly expiry.

It might be too early to declare bullish options strategies entirely lost. Traders are awaiting comments from US Federal Reserve Chair Jerome Powell on Friday, as any suggestion of increased odds of rate cuts could support asset prices. Hotter-than-expected US jobless claims data on Thursday added to that anticipation, keeping macroeconomic uncertainty high.

US Federal Reserve and tech stocks could dictate Bitcoin’s outcome

Below are five probable scenarios at Deribit based on current price trends. These outcomes estimate theoretical profits based on open interest imbalances but exclude complex strategies, such as selling put options to gain upside price exposure.

Between $105,000 and $110,000: $210 million in calls (buy) vs. $2.66 billion in puts (sell). The net result favors the put instruments by $2.45 billion.

Between $110,100 and $114,000: $420 million calls vs. $1.94 billion puts, favoring puts by $1.5 billion.

Between $114,100 and $116,000: $795 million calls vs. $1.15 billion puts, favoring puts by $360 million.

Between $116,100 and $118,000: $1.3 billion calls vs. $830 million puts, favoring calls by $460 million.

Between $118,100 and $120,000: $1.7 billion calls vs. $560 million puts, favoring calls by $1.1 billion.

For bullish strategies to gain traction, Bitcoin would need to trade above $116,000 by Aug. 29. Yet, the most critical battle lies at $114,000, where bears are most motivated to push prices lower.

Ultimately, Bitcoin’s fate in the $13.8 billion monthly options expiry will be decided by broader macroeconomic trends, including investors’ discomfort with the artificial intelligence sector. Concerns deepened after Morgan Stanley warned that soaring spending could limit major tech firms’ ability to fund share buybacks, amplifying caution in equity markets.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Verb Technology Company, Inc., a Nasdaq-listed social commerce technology firm in the process of rebranding to Ton Strategy Company after adopting a digital asset treasury (DAT) strategy targeting The Open Network's native token Toncoin (TON), said on Thursday it has acquired $713 million worth of the cryptocurrency.

The firm, which raised $558 million in a private placement at the beginning of August, said its total treasury assets are worth $780 million, with $713 million worth of TON and $67 million in cash.

"By becoming the first and largest publicly traded treasury reserve of $TON, VERB is not just holding $TON on its balance sheet – we are helping to strengthen the economic foundation of the network itself,” said Executive Chairman Manuel Stotz in a statement. Stotz is also the CEO of Kingsway Capital and served as president of the TON Foundation until Wednesday, when he stepped down to focus on Verb.

The company aimed to acquire more than 5% of the circulating supply of TON. With $713 million worth of Toncoin, the firm currently holds about 8.5% of the token's current circulating supply. TON was launched with an initial token supply of 5 billion tokens and includes a modest inflation rate to reward validators. There are approximately 2.6 billion TON tokens in circulation, according to The Block's Toncoin Price page.

Toncoin has traded flat over the past twenty-four hours, according to The Block's data.

Verb Technology is currently the only publicly-traded company that has adopted a Toncoin treasury strategy. Toncoin is the native token of The Open Network, which powers the web3 infrastructure of encrypted messenger app Telegram. With Stotz involved in both the TON Foundation and Verb, the firm highlights another example of a DAT company closely entwined with the token project itself.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Arbitrum announces its participation in the upcoming Stablecoin Conference 2025, organized by Bitso, set to take place on August 27 in Mexico City (CDMX). The event focuses on building stablecoin infrastructure and fostering blockchain connections across Latin America. Visitors are invited to stop by Arbitrum’s booth to connect with the team and pick up promotional items.

Refer to the official tweet by ARB:

Arbitrum@arbitrumAug 20, 2025See you all in Mexico next week on August 27th at @Bitso’s Stablecoin Conference!

Swing by our booth, get some swag and meet the team

Arbitrum Everywhere 🇲🇽 pic.twitter.com/yXKod3QXtQ

ARB Info

Arbitrum is a layer 2 scaling solution designed for the Ethereum network. Its goal is to increase the scalability of Ethereum while preserving its decentralization and security.

Arbitrum operates by batching many transactions together off-chain and then submitting a single, combined proof of all these transactions to the Ethereum base layer. This greatly reduces the amount of computation and storage that the Ethereum network has to handle, allowing it to support a much higher throughput of transactions.

Oasis Protocol has made its Command Line Interface (CLI) tool accessible through Homebrew, streamlining the installation and update process for developers. This update enables one-line setup, eliminates the need for unsigned package workarounds, and improves workflow efficiency on macOS and Linux systems.

ROSE Info

Oasis Network is a first-layer, scalable blockchain network with a focus on privacy and proof of stake. Through confidential computing, users can control and protect their data even when it's being utilized in various applications and services.

The Oasis Network has the capacity to process a large number of transactions simultaneously due to its structure of subordinate parallel blockchains, also known as "shards." Instead of processing all transactions on a single main blockchain (which is a common practice for many blockchain networks and causes speed and scalability issues), Oasis Network distributes transactions across different subordinate blockchains that can process transactions in parallel.

The ROSE token serves as the governance token in the Oasis Network. The token is used for participating in voting on decisions related to network development and can also be staked to get rewards.

Propy highlights how its tech-enabled real estate solutions are eliminating traditional 30-day closing timelines. With escrow deposits processed in minutes, 24/7 transaction tools, AI workflows that reduce agent workload by 40%, and crypto payment options, the real estate process is becoming more efficient. A live virtual webinar with CRO Eric Cruz will take place on September 4 at 17:00 UTC, showcasing how these innovations work in practice across Texas.

Refer to the official tweet by PRO:

Propy@PropyIncAug 20, 2025Real estate doesn’t need 30-day timelines.

Agents are already proving it with escrow deposits in minutes, 24/7 closings, AI workflows that cut 40% of the workload, and secure crypto options.

Join our live, virtual webinar on Sep 4 at 12 PM CDT with Propy CRO @realEricCruz to… pic.twitter.com/smmzAs9aAP

PRO Info

Propy is a decentralized real-estate market place backed by superior blockchain infrastructure to facilitate real-time unified transaction in order to reduce fraud and redPropy (PRO) is a blockchain project that aims to reform the real estate market by making the process of buying, selling and registering property more transparent, secure and paperless. Propy is focused on solving problems in the international real estate market, where buying property in other countries can face legal and administrative obstacles.

Propy uses the blockchain to create a decentralized real estate registry that allows transaction participants to view and verify ownership of real estate. Propy offers a platform for online real estate transactions. The platform includes all stages of a deal, from offer to close, with blockchain registry integration to capture ownership. Thanks to the blockchain, Propy offers a high level of security and resilience, as all transactions and property registrations are recorded on an immutable and highly secure blockchain.

The PRO token is a native token of the Propy platform. The token is used to pay transaction fees on the platform and incentivize participation in the ecosystem.undancy. Propy is the world’s first international real-estate marketplace.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up