Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The US dollar rose against its major trading partners early Tuesday, ahead of a light data release day.

Earlier Tuesday, the National Federation for Independent Business reported that small business sentiment improved modestly but that uncertainty remains. Taxes were cited as the largest problem by 18% of respondents, above labor quality and inflation for the first time since December 2020.

Weekly Redbook same-store sales are due to be released at 8:55 am ET.

Federal Reserve officials are in their 'quiet period' ahead of the next Federal Open Market Committee meeting on June 17-18.

A quick summary of foreign exchange activity heading into Tuesday:

fell to 1.1424 from 1.1425 at the Monday US close but was above a level of 1.1420 at the same time Monday morning. Eurozone investor confidence rose in June to indicate slightly more optimism than pessimism, according to data released earlier Tuesday. European Central Bank President Christine Lagarde is due to speak at 11:15 pm ET. The next European Central Bank meeting is scheduled for July 24.

fell to 1.3501 from 1.3559 at the Monday US close and 1.3560 at the same time Monday morning. UK employment and earnings growth slowed in April while the unemployment rate increased, according to data released overnight. The next Bank of England meeting is scheduled for June 19.

rose to 144.5864 from 144.5770 at the Monday US close and 144.1785 at the same time Monday morning. Japanese machine tool orders growth slowed in May while money stock growth accelerated according to data release overnight. The next Bank of Japan meeting is scheduled for June 16-17.

rose to 1.3698 from 1.3685 at the Monday US close and 1.3675 at the same time Monday morning. There are no Canadian data on Tuesday's schedule. The next Bank of Canada meeting is scheduled for July 30.

The yen (JPY) has been one of the more volatile currencies overnight Monday, said MUFG.

briefly rose to an intra-day high of 145.29 before dropping back towards 144.50, wrote the bank in a note to clients. The yen initially weakened on the back of comments from Bank of Japan Governor Kazuo Ueda, who was speaking before parliament.

The yen weakened after Governor Ueda stated that there was still some distance for the price trend to rise to its, target of 2.0% which initially dampened expectations for further BoJ rate hikes, stated MUFG. However, Ueda went on to reiterate that if the price trend becomes more certain, then the BoJ will raise rates further.

The comments indicate that the BoJ remains cautious over raising rates further amidst the "extremely" high uncertainties surrounding the outlook for the economy. The bank isn't expecting the BoJ to provide a stronger signal over rate hikes at next week's policy meeting, even though recent inflation data has been stronger.

The BoJ is in no rush to hike rates further and can wait to see how trade talks play out between the United States and Japan ahead of the July 9 deadline for higher "reciprocal" tariffs. Japan's Economic Revitalization Minister Ryosei Akazawa stated overnight that the trade negotiations with the U.S. are still in a fog.

The comment supports MUFG's expectations that the main policy change at next week's BoJ policy meeting will be updated plans for tapering. It has been reported that the BoJ is considering slowing the pace of tapering for the next fiscal year. The BoJ is currently slowing monthly Japanese government bond purchases by 400 billion yen every quarter.

The pace of tapering could slow to between 200 billion-400 billion yen from April next year. Market expectations for slower tapering could already be encouraging yen selling and helping to dampen upward pressure on long-term JGB yields, pointed out the bank.

At the same time, market attention is also focused on trade talks between the U.S. and China taking place in London at the start of this week. The trade talks will continue into a second day, according to a U.S. official. President Donald Trump told reporters at the White House on Monday that "we are doing well with China. China's not easy and that "I'm only getting good reports."

The comments have encouraged building investor optimism that a trade deal/agreement can be reached in the coming months to avoid the higher "reciprocal" tariffs being re-imposed on trade between the U.S. and China, added the bank.

According to a Bloomberg report, the U.S. has signalled a willingness to remove restrictions on some tech exports in exchange for assurances that China is easing limits on rare earth shipments. Head of the White House's National Economic Council Kevin Hassett did add, though, that they would stop short of removing restrictions on the most sophisticated H20 chips made by Nvidia.

The talks are taking place amidst growing evidence of the economic disruption from the tariff war. The latest trade report from China released Monday revealed that exports to the U.S. declined by almost 20% in May, which was the largest monthly drop since the start of COVID.

The developments have had limited impact on the renminbi, according to MUFG. continues to trade just below the 7.2000 level and is trading close to year-to-date lows.

Traded volatility levels are a little softer as spot continues to sit well within range confines, said ING.

It costs investors around 2.5% per annum to sit with a long position, wrote the bank in a note. As such, those bullish on need to be fed some bad news on the US dollar.

That potentially could come with later Tuesday's United States Treasury auction results, but it isn't a given.

In terms of the eurozone calendar on Tuesday, there is the Sentix Investor Confidence reading for June and a speech from European Central Bank Governing Council member Robert Holzmann, who was the sole dissenter against last week's 25bps ECB rate cut. It's hard to see breaking out of a 1.1370-1.1430 range today, with directional breakout risks equally balanced, stated ING.

Sterling is fractionally softer on early Tuesday's United Kingdom labor market data for April and May.

On the face of the data, it's a fairly dovish U.K. jobs report, pointed out the bank. Wages are down more than expected — private sector at 5.1% year over year. These were due to come lower anyway as a result of base effects, but this is a bigger drop. More eye-catching is the sharp fall in payrolled employees at 109,000. That would be the biggest monthly drop outside of the COVID-19 pandemic since the data series began in 2014. But this data always gets revised, and more often than not, it is revised up. Still, there is a more negative flavor to these numbers over the past few months, and it reinforces the need to keep cutting rates, else the Bank of England risks slipping behind the curve.

This softer data comes at a time when sterling's relatively high yield is in demand, added the bank. It has, however, triggered a 20-pip rally in to 0.8435 and could prove a reminder that the BoE is well behind the ECB in its easing cycle, and the policy spread may narrow some 100bps-125bps against sterling over the next 12-18 months. 0.8445/60 looks like important short-term resistance for .

It would also not be a surprise to hear that Romania's central bank (NBR) is now intervening to buy and replenish its foreign exchange reserves after all the intervention it took to protect the leu (RON) during the recent presidential elections, according to ING.

The euro hovered around the $1.14 mark, near the three-year highs reached in April, as traders closely monitored developments in the ongoing US-China trade talks.

At the same time, investors assessed comments from European Central Bank officials for clues about the ECB's next policy moves.

Governing Council member François Villeroy de Galhau noted that the ECB could still act swiftly to adjust interest rates, even after its eighth consecutive cut, which he said had "normalized" monetary policy.

Last week, the ECB lowered rates as expected, but President Christine Lagarde indicated the easing cycle may be approaching its end.

The deposit facility rate now stands at 2%, while Eurozone inflation eased to 1.9% in May 2025.

Meanwhile, the bloc’s economy expanded by 0.6% in Q1 2025, the fastest growth rate since Q3 2022.

The British pound weakened to $1.35 after fresh economic data signaled a notable slowdown in the labour market, strengthening the case for a Bank of England rate cut.

Wage growth came in below expectations, with private sector pay, a key metric closely monitored by the central bank, also decelerating.

Meanwhile, the unemployment rate rose to its highest level since 2021, and the number of payrolled employees posted the steepest drop since 2020, suggesting early signs of the impact from higher National Insurance Contributions (NICs) and the recent increase in the National Living Wage.

While the Bank of England is mostly expected to leave interest rates unchanged at its policy meeting next week, market odds for a rate cut in August have increased.

Traders are also closely watching upcoming monthly GDP data and the government’s spending review, both due later this week, for further insight into the UK’s economic trajectory.

The dollar rises as trade talks between the U.S. and China extended into a second day and investors hope for a successful outcome. U.S. chip stocks rallied on Monday as signs emerged that the Trump administration could ease restrictions on China's access to semiconductors. Still, gains in the dollar remain limited. Sentiment toward the currency remains fragile due to concerns over "erratic U.S. trade policy and fiscal risks," IG analysts say in a note. The DXY dollar index rises 0.2% to 99.1399. The euro falls 0.2% to $1.1401. (jessica.fleetham@wsj.com)

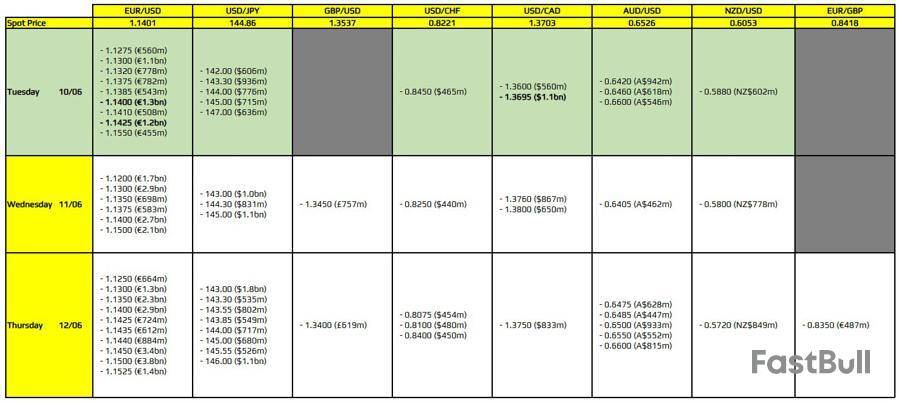

There are a couple to take note of on the day, as highlighted in bold.

The first ones are for EUR/USD at the 1.1400 and 1.1425 levels. Similar to yesterday, that should help to lock price action more intact until we get a change in broader sentiment from US-China trade talks. The 200-hour moving average in the pair, now at 1.1390, continues to also help maintain price action closer to the figure level for the time being.

EUR/USD hourly chart

Unless that breaks, the price action reinforces the impact of the expiries above at least for the session ahead.

Then, there is one for USD/CAD at the 1.3695 level. It isn't one that ties to any technical significance but the expiries could just keep price action more muted until we get more meaningful headlines from the US-China talks in London.

For more information on how to use this data, you may refer to this post here. This article was written by Justin Low at www.forexlive.com.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up