Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

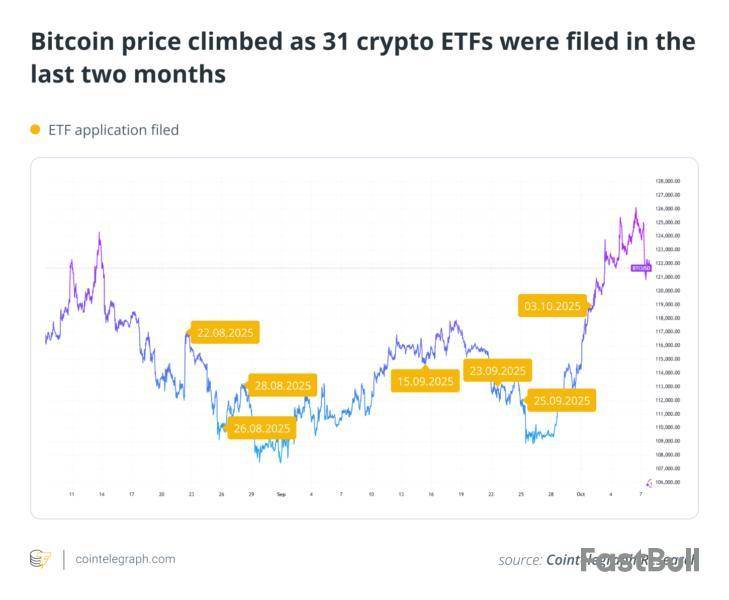

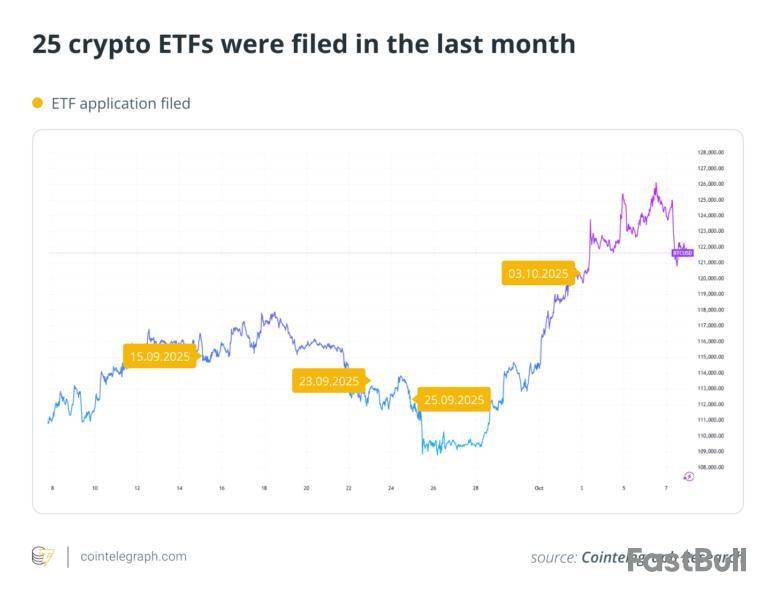

Over the last two months, at least 31 crypto exchange-traded fund (ETF) applications were filed with the US Securities and Exchange Commission, 21 of which were filed in the first eight days of October.

This ETF wave comes amid increased optimism in crypto markets, which have seen impressive gains over the last month. The price action has started a familiar pattern of markets booming in October, dubbed “Uptober.”

This also coincides with major geopolitical developments that can affect the finance sector. In France, Prime Minister Sébastien Lecornu has stepped down after just 26 days, rocking the country’s financial markets. In the US, a government shutdown has put federal business on pause, including ETF considerations at the SEC.

Despite these headwinds, analysts are optimistic about the next month for crypto, with the “floodgates” set to open for crypto ETFs.

“Uptober” launches with 21 crypto ETF filings

The crypto-friendly pivot at the SEC has led to a slew of filings from fund managers seeking to list crypto-related ETFs. Bloomberg Intelligence ETF analyst James Seyffart noted that, as of Aug. 29, some 92 crypto exchange-traded products were awaiting the SEC’s decision.

At the time, NovaDius Wealth Management president Nate Geraci said, “Look at all the crypto ETF filings out there... […] What I mean by ‘crypto ETF floodgates about to open soon.’”

That number has grown over September and the first week of October. Cointelegraph Research found that over the past two months, at least 31 crypto-related ETFs were filed. This includes 21 ETFs filed by REX Shares and Osprey Funds on Oct. 3.

Other funds include iShares Bitcoin Premium Income ETF, Bitwise Hyperliquid ETF, Grayscale Stellar Lumens Trust and Bitwise Avalanche ETF — all filed in September.

August saw ETF submissions containing a diverse range of cryptocurrencies, including Chainlink (LINK), Solana (SOL), Sei (SEI) and even Official Trump (TRUMP), the president’s memecoin.

Interest in crypto ETFs has been growing. Iliya Kalchev, a dispatch analyst at digital asset platform Nexo, previously told Cointelegraph that the US Federal Reserve’s cutting interest rates has sparked new demand for Bitcoin ETFs.

Demand for hedge assets further spiked after Oct. 1, when the US federal government shut down. Congressional Democrats could not agree with the funding proposal of President Donald Trump’s administration. As a result, thousands of federal employees are on furlough, and the doors of many federal agencies are shut.

More than $5 billion flowed into ETFs tracking cryptocurrency in the week ending Oct. 4. “This level of investment highlights the growing recognition of digital assets as an alternative in times of uncertainty,” said CoinShares head of research James Butterfill.

Analysts have pointed to a number of signals that Uptober is set to continue. Onchain data provider CryptoQuant said that the relatively low stablecoin supply ratio shows there is more stablecoin buying power in the market. It said, “Rising stablecoin supply is a strong tailwind during bull markets.”

ETFs get simplified standards, but the shutdown could drag on

The US government shutdown has put ETF approvals on pause. The SEC is one of the many federal agencies that will be operating on a skeleton crew until lawmakers can agree on a budget. Still, October could shape up to be a big month for ETFs.

Several ETFs have October deadlines, and as of Sept. 17, the SEC has approved a new, simplified set of standards for crypto ETF approvals.

SEC Chair Paul Atkins said, “This approval helps to maximize investor choice and foster innovation by streamlining the listing process and reducing barriers to access digital asset products within America’s trusted capital markets.”

Grayscale head of research Zach Pandl told Cointelegraph on “Byte-Sized Insight” last week that, with these new rules, there are many cryptocurrencies that are “ready to go into an ETF wrapper as far as the SEC is concerned.”

Still, there’s no guarantee that the shutdown will be settled anytime soon. Democrats oppose Republicans’ proposed cuts to healthcare spending and want to see previous cuts to Medicaid reversed. Trump, who has already made cutting government spending a defining trait of his administration, has hinted that he will use the shutdown to institute further rollbacks on government spending.

In the past, government shutdowns rarely lasted longer than a few days. But Trump has already shown that he is especially willing to ride out a shutdown. His first administration holds the record for the longest US government shutdown in history, at 35 days, costing the federal government $5 billion and delaying $18 billion in federal spending.

While lawmakers continue to meet and debate spending proposals, it’s anyone’s guess as to when the SEC could open its doors again and make a decision on crypto ETFs. But when that does happen, observers are bullish that ETFs representing a more diverse range of cryptocurrencies will hit markets.

Opinion by: Elisenda Fabrega, general counsel at Brickken

Europe’s rulebook was written for assets that move. Yet a large class of assets, including non-listed company quotas and bespoke revenue-sharing contracts, is non-transferable by design. Because Markets in Crypto-Assets’ (MiCA) definitions presuppose transferability, and MiFID II targets transferable securities and continues to apply to the digital representations of such securities, these “digital but nontransferable” instrument representations fall into a regulatory blind spot.

The EU Blockchain Sandbox offers a way out: recognizing that a faithful “digital twin” can preserve the legal nature of the original non-transferable asset rather than being automatically qualified as a new, transferable security token.

Some might argue that carving out non-freely transferable tokens opens loopholes. The opposite — that any token on a public chain is inherently tradeable — can also be brought to the table. Both instincts are understandable, and both are wrong, as the report makes it clear. If the legal, technical and contractual measures are aligned to preserve the underlying asset’s nature, the legal classification of the digital representation remains the same.

Tokenization has outpaced the rulebook

A security on a ledger remains a security by law. In other words, a bond remains a bond, and a share remains a share, whether issued in traditional or tokenized form. But the converse is equally important: If a digital twin of a non-transferable asset can be created, merely recording it onchain does not turn it into a security token or a MiCA-regulated crypto asset.

A practical sequence that emerged from the EU Blockchain Sandbox process keeps analysis grounded. First, ask if the token is a MiFID II financial instrument; if not, test whether it falls within the scope of MiCA; if still not, consider Alternative Investment Fund Managers Directive (AIFMD) for collective investment structures; otherwise, national law applies. That order matters because it keeps engineered token features from driving the legal outcome. MiCA’s transferability gate is pivotal: If a token is not transferable, it is not a MiCA crypto-asset, and MiCA’s utility/asset-referenced token/electronic money token buckets do not apply.

Engineered transferability can requalify a token

When the underlying asset is replicated exactly (a genuine digital twin), the legal classification should remain unchanged. Where they bolt on transferability workarounds or wrappers, they may create a new instrument of a non-transferable underlying asset that does fall under MiCA or MiFID II. Qualification depends on the token’s technical and contractual characteristics, not just the offchain paper.

When developers want to create a digital representation of a nontransferable asset but then bolt on transferability for liquidity demands, they may not mirror the underlying asset, and they are manufacturing a new digital instrument that may fall under a different regulation than their underlying asset. For this reason, adequate technical measures, full compliance with applicable regulations and legal advice grounded in specific national laws are essential to avoid requalification into transferable assets.

What the EU Blockchain Sandbox clarifies

For participants in the second cohort, the dialogue with regulators crystallized what the Best Practices Report now defines as the “digital twin” test. If the token is a perfect digital replica of the original asset, its legal qualification remains unchanged. However, if tokenization introduces new features, such as transferability, that were absent in the underlying asset, the legal classification could change. That reading also aligns with ongoing analysis on when tokens qualify as financial instruments under MiFID II.

The report dives into the concept of nontransferability itself. Contractual limits or allow-list gating alone are insufficient. The decisive factor is the technical impossibility of transferring to anyone other than the issuer or offeror, with enforced redemption and reissuance mechanics in place if a holder changes hands. This is the level of engineering that keeps a token outside MiCA’s transferability bucket.

The fix matters for Europe’s market

Supervisors do not need a new statute to mitigate the risk associated with innovation. They need short, practical guidance that codifies the sandbox’s sequence and “twin” test: (1) Start with MiFID II; (2) if outside MiFID II, test if it falls under any of MiCA’s asset classifications; (3) if neither applies, check if it is a digital twin of an asset recognized in a national law, like private company quotas.

Finally, the sandbox experience illustrated for us the immense value of structured dialogue between regulators and industry and the importance of addressing legal gaps. This requires clarifying how existing frameworks such as MiFID II, MiCA and AIFMD interact with tokenization. It also means examining the uncertainties that arise and how to resolve them in practice. The key tools are the concepts of digital twins, transferability and fungibility. These features directly determine legal qualification.

The next step will likely be to observe how national sandboxes across jurisdictions apply their respective laws consistently with these principles and whether this process contributes to greater uniformity among member states, thereby reinforcing legal certainty across the European market.

Clear guidance would unlock compliant digitization of Europe’s vast private-company and contractual rights market while avoiding accidental requalification that chills issuance. By drawing a clear distinction between digital twins and engineered transferability, the EU can maintain real-world asset (RWA) tokenization onshore rather than directing developers to non-EU venues.

The bottom line

Tokenization is not a free pass, and it is not a trap either.

The EU Blockchain Sandbox has shown the way. Now, supervisors should solidify it so builders know where the guardrails are and investors know what they are buying. That is how Europe protects markets and keeps them moving.

Opinion by: Elisenda Fabrega, general counsel at Brickken.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Bitcoin’s bull market may be approaching a decisive moment, according to trader Tony “The Bull” Severino, who says the cryptocurrency could either surge into a parabolic rally or mark the end of its current cycle within the next 100 days.

Key Takeaways:

In , Severino highlighted the Bollinger Bands indicator, a classic volatility tool, which has reached record “tightness” on Bitcoin’s weekly chart.Bitcoin Stalls Below Key Resistance as Volatility Tightens, Analyst Warns

Historically, such compressions have preceded explosive price movements in either direction.

“For now, BTCUSD has failed to break out above the upper band with strength,” Severino wrote.

“According to past local consolidation ranges, it could take as long as 100+ days to get a valid breakout — or breakdown, if BTC dumps instead.”

The Bollinger Bands measure volatility by plotting standard deviations above and below a moving average. When the bands contract, it signals reduced volatility, a setup often followed by major directional moves.

Severino warned, however, that “head fakes,” false breakouts before a real move, are common in such conditions.

Bitcoin’s weekly Bollinger Bands recently hit record tightnessFor now, BTCUSD has failed to break out above the upper band with strength According to past local consolidation ranges, it could take as long as 100+ days to get a valid breakout (or breakdown, if BTC dumps… — Tony "The Bull" Severino, CMT (@TonyTheBullCMT)

“Expanding from a squeeze setup like this can lead to head fakes. We might have seen one with this latest move above $126,000, and we could see another dip before a real breakout higher,” he cautioned.

Bitcoin currently trades around $122,700, down slightly from its recent all-time high. Analysts have been debating whether the bull market, which began in early 2023, has entered its final stretch or is preparing for a new phase of price discovery.

Historically, Bitcoin bull runs have culminated in sharp, “blow-off” tops roughly 18 months after halving events, a timeline that points toward late 2025.

Yet, as analyst Rekt Capital noted last month, BTC’s market cycles are lengthening, suggesting this rally may still have room to run.

“It’s unlikely Bitcoin has already peaked because that would make this one of the shortest cycles ever,” Rekt Capital said, adding that Bitcoin might soon enter a “price discovery uptrend.”

Price Discovery Correction 2 is overIn the end, it was indeed shallower but it took roughly the same amount of time to resolve as in previous cycles (2017, 2021)Now, Bitcoin is on the cusp of entering Price Discovery Uptrend 3 — Rekt Capital (@rektcapital)

Severino, however, believes the next few months will be decisive. “This has the potential to send Bitcoin parabolic — or put an end to the three-year bull rally,” he said.Bitcoin Surges Past $125K, Matching Gold’s Safe-Haven Momentum

Bitcoin (BTC), often dubbed “digital gold,” has mirrored gold’s recent surge, soaring past $125,000 over the weekend in its strongest October rally on record.

The leading cryptocurrency is drawing billions in ETF inflows, and JPMorgan analysts now project BTC could reach $165,000 by year-end if momentum continues.

“The more institutional dollars experience Bitcoin returning toward all-time highs after dips, the more comfortable they’ll become as long-term holders,” said Timot Lamarre, Head of Market Research at Unchained, a Bitcoin-native financial services firm managing over $11 billion in assets.

“If debasement is viewed as structural rather than temporary, Bitcoin could be entering its next major revaluation phase.”

As reported, mounting fiscal uncertainty in major economies is accelerating a shift into Bitcoin, gold, and silver, as investors brace for further currency debasement.

The so-called “debasement trade” has gained traction amid rising national debts and political instability, prompting a broad retreat from fiat assets.

XRP is trading at $2.82, down just over 1% as investors react to the latest Federal Open Market Committee (FOMC) minutes. The report shows most Fed members favor further monetary easing this year. Inflation remains the main risk.

The federal funds target range is currently 4.00% to 4.25% after a 25 basis point cut in September. This was the first reduction of 2025 and came amid rising concerns about employment. The minutes show a near-even split on future moves, with 10 of 19 participants expecting two more cuts this year.

XRP Price Action

This week has been weak for XRP. On Monday, broader markets moved higher, but XRP failed to break above the 90-day rolling VWAP. The token rejected that level and pulled back. On Tuesday, XRP moved lower with the markets, testing $2.86–$2.88, which aligns with previous forecasts.

The initial reaction to the FOMC minutes was muted. XRP briefly moved up but met resistance at the fair value gap, leaving the token below $2.85. This is normal given the current market structure and does not mean unusual weakness.

Support Levels

Technical charts show strong support around $2.80. Additional support lies near $2.78–$2.76. These levels could hold if XRP stabilizes against Bitcoin.

XRP’s performance relative to Bitcoin is crucial. If the XRP/BTC pair holds support, XRP can recover more quickly. If Bitcoin falls further, XRP may test lower levels before bouncing.

Upside Targets

Once support holds, XRP could move toward $2.95. A push above this level would clear the fair value gap and signal a short-term recovery.

Momentum is limited compared to other altcoins, so aggressive gains are unlikely without broader market strength.

For the long term, analyst Casi Trades said, “Currently, subwaves are getting constricted, which is why extensions are being limited to $4.50 & $6.50. However, the macro targets of $8–$13 remain entirely possible if momentum continues strong!”

Market Outlook

XRP remains in a consolidation phase. Key levels to watch are $2.80–$2.76 on the downside and $2.95 on the upside. The next move depends on Bitcoin’s trend and market reaction to the Fed’s policy.

FAQs

Why is the XRP price down today?XRP is experiencing normal market volatility, reacting to the latest Fed minutes and facing technical resistance, which is causing a short-term pullback from recent highs.

What is the price prediction for XRP?Analyst projections suggest near-term resistance at $2.95, with longer-term macro targets between $8–$13 possible if strong bullish momentum returns to the market.

How do Federal Reserve rate cuts affect XRP?Fed rate cuts can weaken the US dollar, often benefiting risk assets like crypto. However, XRP’s short-term price is more directly influenced by its own technical market structure.

What does XRP need to do to start a recovery?For a short-term recovery, XRP needs to hold its $2.80 support and break above the $2.95 resistance level, which would signal a shift in momentum.

After an overnight drop of 3.28%, the Ethereum price is wrestling against the selling pressure. The breach of the crucial $4,500 support level forced stop-loss orders to activate, causing a wave of cascading liquidations. Alongside macroeconomic headwinds from a stronger U.S. dollar and lingering uncertainty around Federal Reserve policy, market volatility intensified. As traders rotated capital toward BNB Chain, chasing lower fees and heightened on-chain activity.

On-Chain Signals: ETF Flows & Liquidations

Recent ETF and liquidation charts paint a stark picture of increased volatility across Ethereum’s derivatives landscape. After failing to reclaim its 7-day SMA at $4,524, the asset plummeted past the Fibonacci 23.6% retracement level at $4,542, resulting in over $109.6 million in long position liquidations within 24 hours.

ETF inflows appear to be stalling, indicating cautious institutional sentiment. Meanwhile, market cap eroded to $523.56 billion, down 3.4%. Previous strength from ETF demand has taken a back seat, and traders are now readjusting risk in favor of alternative chains.

ETH Price Analysis:

Ethereum’s latest selloff has invalidated multiple technical support zones. The asset trades near $4,337.51, off 3.4% for the day and 1.12% on the week. With the average true high at $4,556.22 and a 24-hour low of $4,324.88, the price is consolidating near the key breakdown area. The loss of support at $4,500 exposes the Ethereum price to further downside, with immediate support eyed at $4,308.81. That being said, a deeper risk toward $4,101.88 is possible if bearish momentum sustains.

The RSI currently hovers around neutral territory but leans toward bearishness, signaling potential for continued selling. If ETH remains below its critical averages, retests of monthly lows and a broader crypto correction are possible. The all-time high of $4,953.73 remains distant, with upside capped unless risk sentiment turns.

FAQs

Is Ethereum a good investment right now?Given the recent breakdown below $4,500, the Ethereum price faces elevated short-term risk, but long-term prospects remain tied to fundamentals.

Is Ethereum good to buy after this drop?Buying after sharp corrections carries risk, Ethereum could see further downside if market sentiment stays bearish. Waiting for clear signs of support or strong on-chain flows is advised.

What is the Ethereum price prediction for 2025?If bullish trends and ETF momentum return, we expect the Ethereum price to hit a maximum of $9,428.11 by the end of 2025.

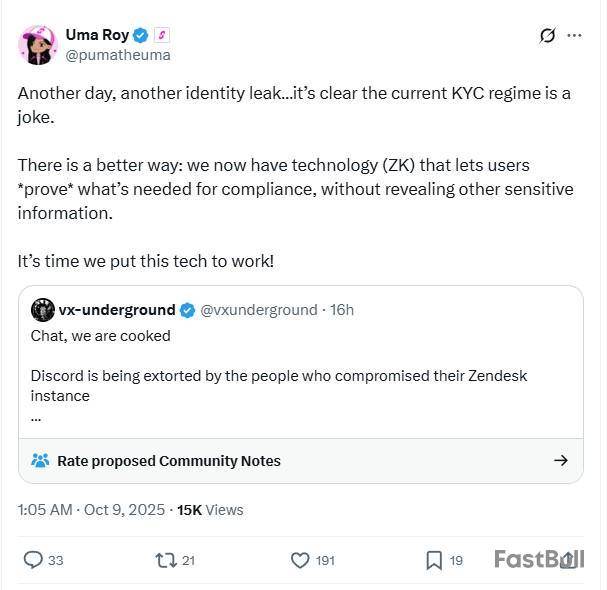

The idea behind Worldcoin (now called World) is an excellent one: without some way to verify human-based accounts, the internet will be completely overrun with AI bots.

To a large extent, it already is: More than half of web traffic now comes from unidentified accounts, and Facebook and X are drowning in AI slop and pointless reply guys. More worryingly, hostile countries are using AI bots and content to divide the population of open and democratic societies.

And if you are already worried about the UK’s mandatory digital ID plan, then World ID should also be on your radar. Apart from those creepy eyeball scanning Orbs, is it really a good idea to implement a global identity system co-founded by the CEO of the worlds largest private company, OpenAI?

The project has raised significant privacy and ethical concerns, with Canadian public broadcaster CBC describing Worlds aims as utopian but not without raising dystopian fears. Techmonitor and CoinDesk have both reported that critics of the project call it “Orwellian.”

While these fears are somewhat overblown, there are genuine concerns with how World has been set up

The projects designers have attempted to counter those fears with strong privacy protections. The system doesnt retain biometric data; instead, it uses zero-knowledge proofs to create a cryptographic hash that proves a user is unique without revealing who they are or tying that ID to a name and address.

One World ID: is it a feature, or a bug?

World no doubt thinks of it as a feature, not a bug, but each verified human is issued a single World ID, which can be used to sign into other sites anonymously.

In theory, third parties cannot determine a users identity from their online activity, but critics worry that having a single World ID increases the chances that various governments could legislate to give themselves access, and reverse engineer identities and track citizens activities using this identifier.

In the real world, pseudonymity generally requires having multiple accounts, warned Ethereum creator Vitalik Buterin earlier this year, so under one-per-person ID, even if ZK-wrapped, we risk coming closer to a world where all of your activity must de facto be under a single public identity.

In the search for an alternative solution that aligns more closely with cypherpunk and crypto ideals, AI Eye caught up with Evin McMullen, co-founder of Billions Network, in Singapore last week.

Its part of a new wave of decentralized identity projects that prioritize privacy and pseudonymity through zero-knowledge proofs and selective disclosures, including zkKYC by Polygon, Sismo Protocol, and Self Sovereign Identity (SSI) by Everynum, and Penverse. A forthcoming Ethereum L2 called Aztec utilizes a similar combination of device-generated proofs to make RWAs more permissionless, while remaining AML-compliant.

Billions Network, featuring Privado ID, aka Polygon ID

Billions Network began life six years ago as Polygon ID, before rebranding to Privado ID. It later raised $30 million from Polychain, Coinbase Ventures and Polygon Ventures as Billions Network.

It faces an uphill battle to gain the edge over World, however, with Billions Networks 2 million users a mere drop in the bucket to Worlds 17 million.

However, the underlying Circom technology stack Billions created is open source and permissionless and has been employed by 9,000 sites, including TikTok, HSBC and Deutsche Bank.

One of the cool things about our tech stack is that, because it is open and permissionless, folks around the world are able to pick it up and utilize it for many different use cases. One of which includes the local newspaper in Barcelona [Ara] is leveraging our libraries to be able to prove the origin, provenance and original nature of images that they publish.

The system aims to strike a balance between verification and privacy. Users can verify themselves using their own phone to generate zero-knowledge proof of identity documents and send the proof to third parties instead of the documents.

Also read: Accidental jailbreaks and ChatGPTs links to murder, suicide

Explain zero-knowledge proofs like Im five

A zero-knowledge proof is basically magical math that can prove a fact while keeping the details hidden like proving youre over 18 without sharing your date of birth, or proving youre a resident of the UK and allowed to work there, without revealing your name and address.

Much of the controversy over the Digital ID scheme in the UK (reportedly introduced to make it tougher for illegal immigrants to work there), or enforcing age limits for social media in Australia, or keeping kids away from porn in various US states, is because other users are worried about losing their privacy when verifying their identity. ZK-based systems potentially solve both issues.

We make it easy for you to prove who you are things like the fact youre a person, a unique human, not a bot, over a certain age, things like your KYC status, from the comfort of your own device, McCullen says. The system uses the updated Decentralized Identifiers (DIDs) open standard from the World Wide Web Consortium “the good people who brought us the internet.

Users can create multiple identities and pseudonyms via its Profiles mechanism, which generates new DIDs with an anonymous, random and unlinkable nonce. That bit of jargon just means theres no centralized registry linking your various accounts together.

DIDs also allow individuals to rotate the keys behind their identification, which McMullen explains is similar to updating your password, and to associate multiple identities together.

So being able to have different facets to your personality that are all controlled by you, proveably you, but do not necessarily all disclose the same set of data to the same set of parties.

Read also Features Ethereums roadmap to 10,000 TPS using ZK tech: Dummies guide Features TradFi is building Ethereum L2s to tokenize trillions in RWAs: Inside storyBillions Network: Verifying users with crypto ideals

McMullen spent four years working at Consensys, co-founded by Ethereums Joe Lubin, so shes in tune with the crypto ethos around pseudonymity and privacy.

I agree with Vitalik that your identity should not be tied to keys you cannot rotate, and furthermore, you cannot rotate your eyeballs [referring to Worlds Orbs]. And so that persistent identifier, inescapably, is very limiting.”

While these systems are promising, some problems remain to be solved, and there are tradeoffs to make.

For example, teenagers turning 16 who are finally allowed to access social media under the new Australian laws often dont have the requisite drivers license or passport. A partner of Billions called Privately uses a local AI model on your device, along with its camera, to estimate age from facial scans. McMullen says its now accurate to within six months and is being trialed as part of the European blockchain sandbox.

Fighting AI bots slightly less convenient with Billions Network

Having totally unlinkable accounts and rotating keys means that, in theory, a user could spin up and verify a million social media accounts and set up an AI bot to post from each one. This is one of the issues that no doubt led World to settle on providing just a single World ID for each human.

Billions approach is to get social platforms to check if a real human is behind the account by switching on the camera.

What we can do there is actually just a liveness check to ensure, via opening the camera, that there is indeed a live human being on the other side, she says, explaining that this generates a zero-knowledge proof credential applied to the account, which would expire after a set time, necessitating another check.

Read also Features Baby boomers worth $79T are finally getting on board with Bitcoin Features How Silk Road Made Your Mailman a DealerSo slightly more annoying for users, but arguably worth it to avoid the potential Big Brother single global ID scenario.

A related approach is to assign reputational scores to pseudonymous identities, which can be based on anything from social following to someones investment history. This allows counterparties to make judgments about otherwise anonymous accounts.

Billions has worked on providing Sybil resistance for a variety of crypto projects airdrops. The term simply means preventing users from spinning up a large number of bots to collect additional tokens in the airdrop. Users open their camera and generate a unique hash from a picture of their face that ensures they cant make a second claim, at least not without getting plastic surgery.

While Billions Network plays nicely with blockchain, its not required to use the underlying tech. The network does offer Power reward points for engaging with the system and conducting activities, which will be used to determine eligibility for its own airdrop in December. Just dont try and claim more than once.

Subscribe The most engaging reads in blockchain. Delivered once a week.Email address

SUBSCRIBE

Ripple, a major blockchain company and issuer of the XRP cryptocurrency, is expanding operations in the Kingdom of Bahrain through a partnership with a local fintech ecosystem builder.

Ripple on Thursday announced a strategic partnership with Bahrain Fintech Bay (BFB), a major local fintech incubator closely collaborating with government partners, including the Central Bank of Bahrain (CBB).

As part of collaboration, Ripple and BFB will work together to contribute to Bahrain’s digital asset ecosystem, including running fintech pilot projects and testing solutions in areas like cross-border payments, stablecoins, tokenization and more.

According to Ripple’s Middle East managing director, Reece Merrick, the company ultimately looks to offer its digital asset custody solution and Ripple USD (RLUSD) stablecoin to Bahrain’s financial institutions.

BFB’s work with Bahrain government

BFB was launched in 2018 as a major fintech hub in Bahrain’s Manama, through a public-private initiative involving the Bahrain Economic Development Board (EDB) and the FinTech Consortium to support fintech and innovation in the region.

The company has emerged as a major fintech partner of Bahrain’s central bank, announcing collaborations with CBB prior to its formal foundation in late 2017.

The central bank has repeatedly mentioned the work with BFB in official announcements, referring to the company as a key fintech partner in 2018 and 2019.

In June, BFB also participated in the Bahraini-Emirati Business Forum hosted by the Bahrain Chamber of Commerce and Industry, with BFB executive Tariq Mattar taking the stage at the event to discuss Bahrain’s fintech development.

Bahrain’s central bank allows issuance of USD stablecoins

“Bahrain has long been recognised as a financial services hub, and today this legacy is being further enhanced in the digital assets and blockchain space,” BFB chief operating officer Suzy Al Zeerah said.

“This partnership with Ripple reflects BFB’s commitment to bridging global innovators with the local ecosystem, creating opportunities for pilots, talent development, and cutting-edge solutions that will shape the future of finance,” the executive noted.

BFB’s partnership with Ripple came months after the central bank of Bahrain introduced a framework for licensing and regulating stablecoin issuers in July.

“Under the new stablecoin regulation, licensed stablecoin issuers are permitted to issue single currency stablecoins backed by Bahraini Dinar (BHD), United States Dollar (USD), or any other fiat currency acceptable by the CBB,” the CBB said in an official statement on July 4.

Ripple’s move in Bahrain is yet another milestone for the company’s growing ties with global jurisdictions, as it holds more than 60 regulatory approvals in countries around the globe.

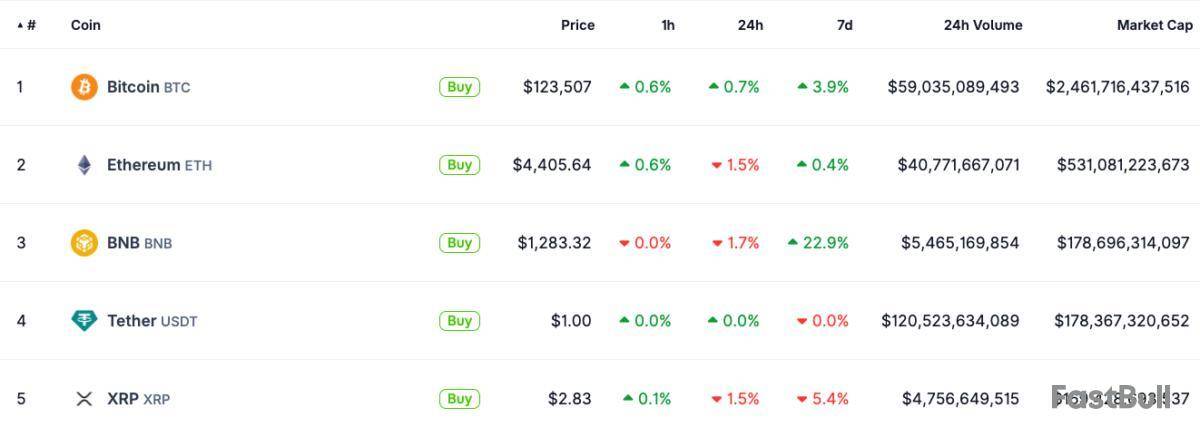

The news came as XRP (XRP) fell to the fifth-largest cryptocurrency by market capitalization on Thursday, after a strong rally in BNB (BNB) earlier this week pushed it past XRP to become the third-largest token by market value.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up