Investing.com — The first week of December has left investors uneasy. The S&P 500 barely moved, and the market continues to drift without clear direction. Some traders see stretched valuations and worry that a correction may be approaching. Others believe the rapid spread of AI across the economy is about to spark a new wave of productivity and growth. The result is a market caught between fear and opportunity, which makes confident decision-making harder than ever.

This kind of environment rewards investors who rely on more than instinct. It calls for a focused strategy built on high-conviction ideas supported by deep fundamental research and advanced AI analytics. That is where our approach stands out. Our AI-driven stock selections have a proven record of identifying future outperformers long before the broader market catches on. The latest update to our system went live on Monday, and the early results from the new list have already been remarkable.

*InvestingPro members can click HERE to jump straight to our new list of stock picks.

Still not a member? Then this is your chance to subscribe at up to 55% off and secure access to the top picks for December.

Here’s how some of our high-conviction picks have performed so far:

- NASDAQGS:FTRE Fortrea Holdings: +16.56% in December ALONE

- NASDAQGS:ENTG Entegris: +15.53% in December ALONE

- NYSE:ONTO Onto Innovation: +14.65% in December ALONE

- IBSE:VERUS Verusa Holding: +22.44% in December ALONE

- SET:AOT Airports of Thailand: +19.10% in December ALONE

- KOSE:A064400 LG CNS: +17.48% in December ALONE

- SGX:D01 DFI Retail Holdings: +16.81% in December ALONE

- IBSE:LIDER LDR Turizm AS: +16.34% in December ALONE

Among several others...

But how does the AI behind these picks actually work?

At the start of each month, the AI refreshes every strategy with up to 20 new stock picks, analyzing more than 150 investor-grade financial models built on over 15 years of global market data. It identifies where risk and reward align best — removing underperformers, keeping promising names, and adding fresh opportunities.

The strategies use equal weighting across all selected stocks, creating a transparent and consistent way to track results. The goal is not just to find winners but also to know when to move on from the ones that stop performing.

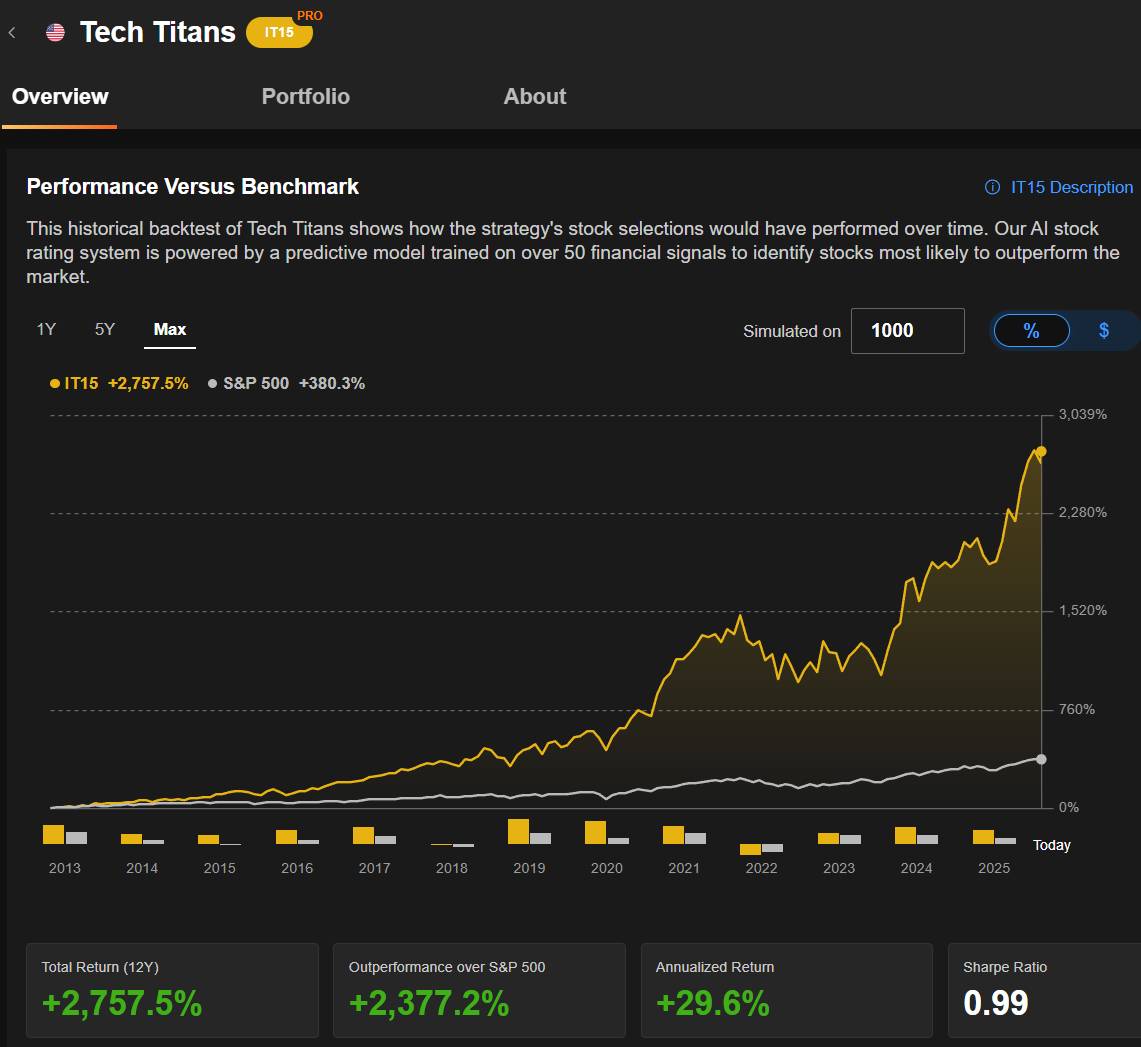

Check out the 12-year outperformance of Tech Titans over the S&P 500 below:

This means a $100K principal in our strategy would have turned into an eye-popping $2,757,500.

Use your chance to get InvestingPro with up to 55% off during our Cyber Monday Extended sale.

Disclaimer: Prices mentioned in articles are accurate at the time of publication. We regularly test different offers for our members, which may vary by region.