Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Palomar Holdings and the rest of the property & casualty insurance stocks fared in Q2.

Property & Casualty (P&C) insurers protect individuals and businesses against financial loss from damage to property or from legal liability. This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. On the other hand, P&C insurers face a major secular headwind from the increasing frequency and severity of catastrophe losses due to climate change. Furthermore, the liability side of the business is pressured by 'social inflation'—the trend of rising litigation costs and larger jury awards.

The 33 property & casualty insurance stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.5%.

In light of this news, share prices of the companies have held steady as they are up 2.9% on average since the latest earnings results.

Founded in 2013 to fill gaps in catastrophe insurance markets, Palomar Holdings is a specialty insurance provider that offers property and casualty insurance products in underserved markets, with a focus on earthquake coverage.

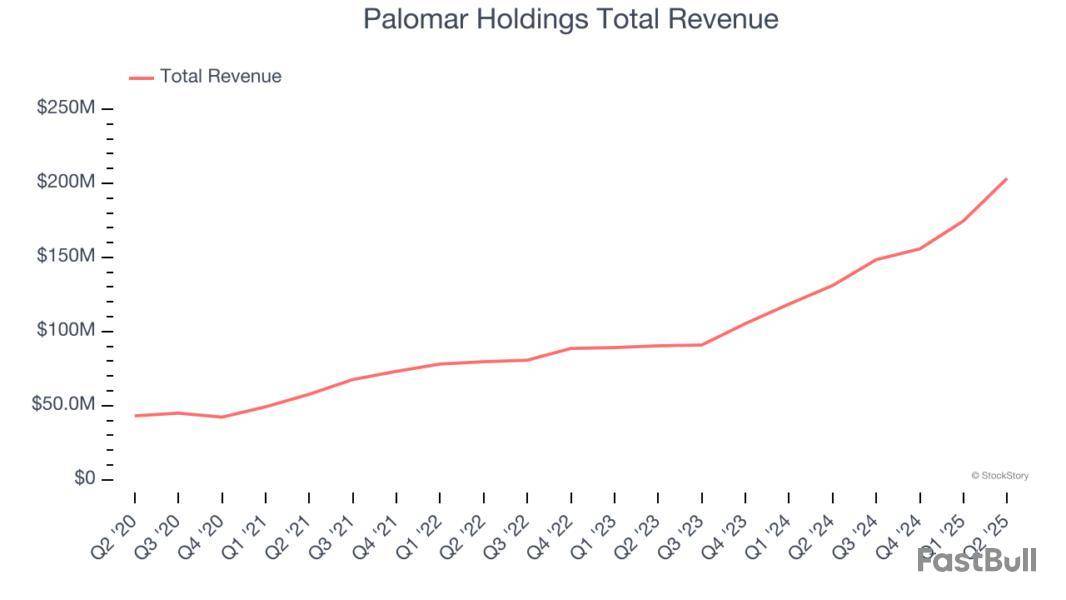

Palomar Holdings reported revenues of $203.3 million, up 55.1% year on year. This print exceeded analysts’ expectations by 9.2%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ net premiums earned estimates.

Mac Armstrong, Chairman and Chief Executive Officer, commented, “Our second quarter results highlight the sustained execution of our Palomar 2X strategic imperative. We achieved strong top and bottom-line growth in the quarter as gross written premium grew 29% across our diverse portfolio and adjusted net income increased 52%. This strong growth underscores the strength of our product set and the efficacy of our balanced book of property and casualty and residential and commercial products. Our financial metrics were equally stout as we generated an adjusted combined ratio of 73%, and a 24% adjusted return on equity.”

Palomar Holdings scored the fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 8.6% since reporting and currently trades at $120.53.

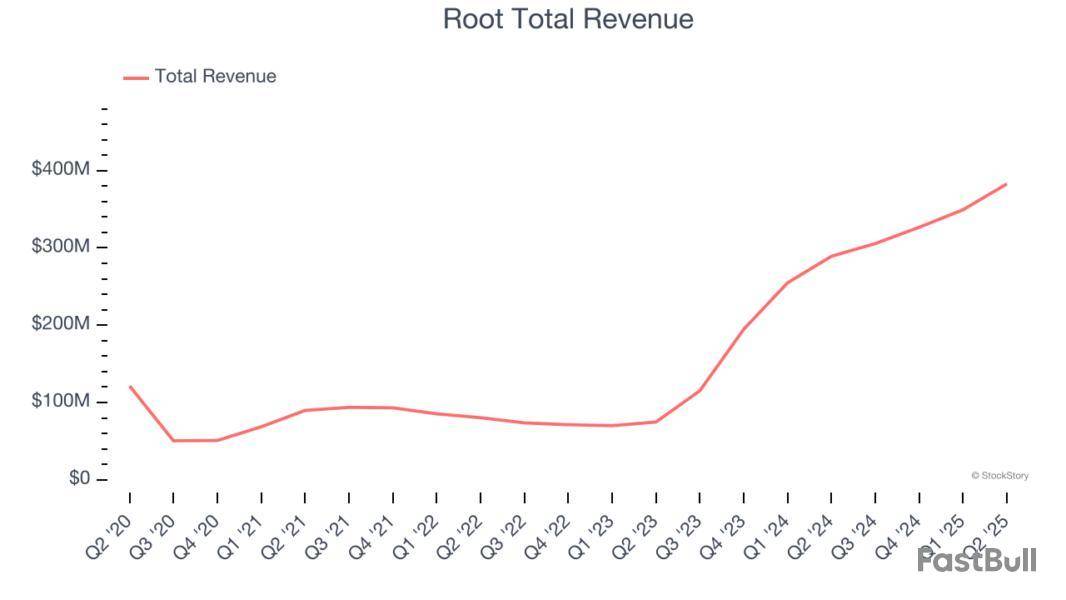

Pioneering a data-driven approach that rewards good driving habits, Root is a technology-driven auto insurance company that uses mobile apps to acquire customers and data science to price policies based on individual driving behavior.

Root reported revenues of $382.9 million, up 32.4% year on year, outperforming analysts’ expectations by 7.5%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ net premiums earned estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 28.1% since reporting. It currently trades at $88.50.

Is now the time to buy Root? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Selective Insurance Group

Founded in 1926 during the early days of automobile insurance, Selective Insurance Group is a property and casualty insurance company that sells commercial, personal, and excess and surplus lines insurance products through independent agents.

Selective Insurance Group reported revenues of $127.9 million, down 89.3% year on year, falling short of analysts’ expectations by 90.3%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates and a significant miss of analysts’ book value per share estimates.

Selective Insurance Group delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 16.2% since the results and currently trades at $75.78.

Read our full analysis of Selective Insurance Group’s results here.

With roots dating back to 1853 and majority ownership by Loews Corporation, CNA Financial is a commercial property and casualty insurance provider offering coverage for businesses, including professional liability, surety bonds, and specialized risk management services.

CNA Financial reported revenues of $3.72 billion, up 5.6% year on year. This number missed analysts’ expectations by 0.8%. Taking a step back, it was still a very strong quarter as it recorded a beat of analysts’ EPS estimates.

The stock is up 7.7% since reporting and currently trades at $47.21.

Read our full, actionable report on CNA Financial here, it’s free.

Born from a Sears, Roebuck & Co. initiative during the Great Depression with its famous "You're in good hands" slogan, Allstate is one of America's largest personal property and casualty insurers, offering protection for autos, homes, and personal property.

Allstate reported revenues of $16.63 billion, up 6% year on year. This result came in 0.7% below analysts' expectations. Zooming out, it was actually an exceptional quarter as it put up an impressive beat of analysts’ book value per share estimates and a beat of analysts’ EPS estimates.

The stock is up 8% since reporting and currently trades at $207.68.

Read our full, actionable report on Allstate here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Insurance firms play a critical role in the financial system, offering everything from property coverage to life insurance and specialized risk solutions. But worries about an economic slowdown and potential claims deterioration have kept sentiment in check, and over the past six months, the industry’s 3.2% return has trailed the S&P 500 by 2.3 percentage points.

Only some companies are subject to these dynamics, however, and a handful of high-quality businesses can deliver earnings growth in any environment. On that note, here are two insurance stocks boasting durable advantages and one best left ignored.

One Insurance Stock to Sell:

Radian Group (RDN)

Market Cap: $4.76 billion

Founded during the housing boom of 1977 and weathering multiple real estate cycles since, Radian Group provides mortgage insurance and real estate services, helping lenders manage risk and homebuyers achieve affordable homeownership.

Why Is RDN Not Exciting?

Radian Group is trading at $35.15 per share, or 1x forward P/B. If you’re considering RDN for your portfolio, see our FREE research report to learn more.

Two Insurance Stocks to Buy:

F&G Annuities & Life (FG)

Market Cap: $4.76 billion

Founded in 1959 and serving approximately 677,000 policyholders who rely on its financial protection products, F&G Annuities & Life provides fixed annuities, life insurance, and pension risk transfer solutions to retail and institutional clients.

Why Are We Bullish on FG?

F&G Annuities & Life’s stock price of $35.33 implies a valuation ratio of 1x forward P/B. Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Palomar Holdings (PLMR)

Market Cap: $3.23 billion

Founded in 2013 to fill gaps in catastrophe insurance markets, Palomar Holdings is a specialty insurance provider that offers property and casualty insurance products in underserved markets, with a focus on earthquake coverage.

Why Will PLMR Beat the Market?

At $120.60 per share, Palomar Holdings trades at 3.5x forward P/B. Is now the right time to buy? Find out in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

Specialty insurance provider Palomar Holdings beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 55.1% year on year to $203.3 million. Its non-GAAP profit of $1.76 per share was 4.5% above analysts’ consensus estimates.

Is now the time to buy PLMR? Find out in our full research report (it’s free).

Palomar Holdings (PLMR) Q2 CY2025 Highlights:

StockStory’s Take

Palomar Holdings’ second quarter results surpassed Wall Street expectations for both revenue and non-GAAP earnings, yet the market responded negatively. Management pointed to robust growth in specialty insurance lines, particularly residential earthquake, inland marine, and casualty, as key contributors to the quarter’s performance. CEO Mac Armstrong emphasized that the company’s balanced portfolio and disciplined underwriting allowed it to navigate increased competition and pricing pressure in large commercial earthquake accounts, while residential segments continued to gain traction. Armstrong also noted that new product launches and the expansion of underwriting talent helped drive strong premium growth, while a conservative approach to reserving maintained stability despite shifts in loss ratios. The negative market reaction suggests investor concerns about future growth rates or margin sustainability as some commercial lines face rate declines.

Looking ahead, management’s guidance reflects optimism about sustaining high single-digit growth in key segments, especially residential earthquake and inland marine, while remaining cautious about ongoing competition and pricing in large commercial property lines. Armstrong stated that new partnerships, such as the Neptune Flood agreement, and recent talent additions in casualty and surety are expected to support continued expansion in 2026 and beyond. CFO Chris Uchida highlighted that the timing of crop premium recognition and continued investment in technology and distribution will influence near-term results, but remains confident in Palomar’s ability to achieve its net income targets. Management maintains a conservative outlook on reserving and reinsurance, expecting near-term headwinds from crop seasonality and property rate softening, but believes their diversified book and strategic initiatives will drive growth over the medium term.

Key Insights from Management’s Remarks

Management attributed the quarter’s outperformance to strong execution in emerging lines, product diversification, and discipline in risk selection, even as commercial property pricing softened.

Drivers of Future Performance

Palomar expects forward growth to be driven by residential segment expansion, new product launches, and disciplined risk management, while managing headwinds from commercial property competition and crop seasonality.

Catalysts in Upcoming Quarters

In upcoming quarters, the StockStory analyst team will be watching (1) the pace and sustainability of residential earthquake and inland marine growth, (2) evidence of margin stability as commercial property competition persists, and (3) progress in scaling new specialty lines like crop, surety, and flood. The successful integration of recent partnerships and the impact of reinsurance renewals on risk-adjusted returns will also be key signposts for tracking Palomar’s execution against its strategic plan.

Palomar Holdings currently trades at $123.05, down from $131.89 just before the earnings. Is there an opportunity in the stock?Find out in our full research report (it’s free).

Stocks That Trumped Tariffs

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

(10:27 GMT) Palomar Holdings Price Target Cut to $158.00/Share From $170.00 by JP Morgan

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up