Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how GoDaddy and the rest of the e-commerce software stocks fared in Q2.

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

The 5 e-commerce software stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 1.3% on average since the latest earnings results.

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

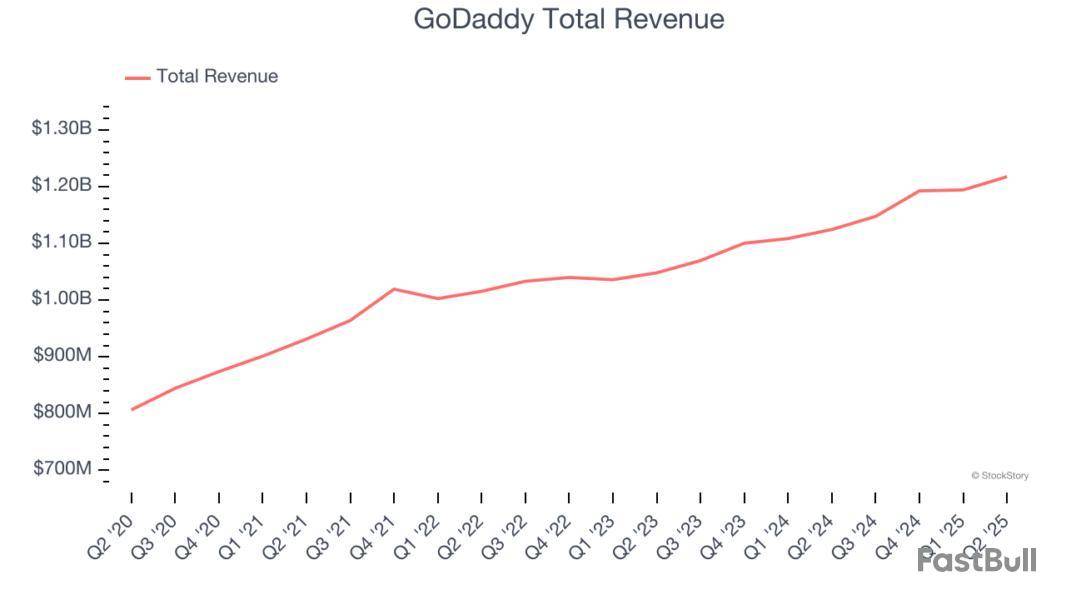

GoDaddy reported revenues of $1.22 billion, up 8.3% year on year. This print exceeded analysts’ expectations by 0.9%. Overall, it was a satisfactory quarter for the company with a decent beat of analysts’ EBITDA estimates but bookings in line with analysts’ estimates.

GoDaddy delivered the weakest full-year guidance update of the whole group. The company lost 75,000 customers and ended up with a total of 20.41 million. Unsurprisingly, the stock is down 4.5% since reporting and currently trades at $143.60.

Is now the time to buy GoDaddy? Access our full analysis of the earnings results here, it’s free.

Originally created as an internal tool for a snowboarding company, Shopify (NYSE:SHOP) provides a software platform for building and operating e-commerce businesses.

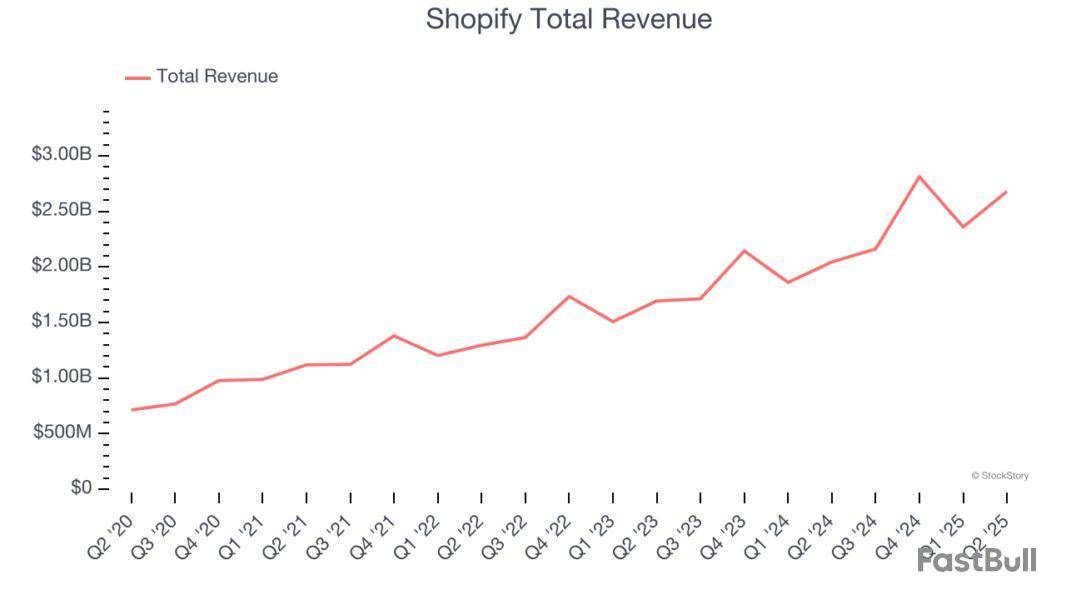

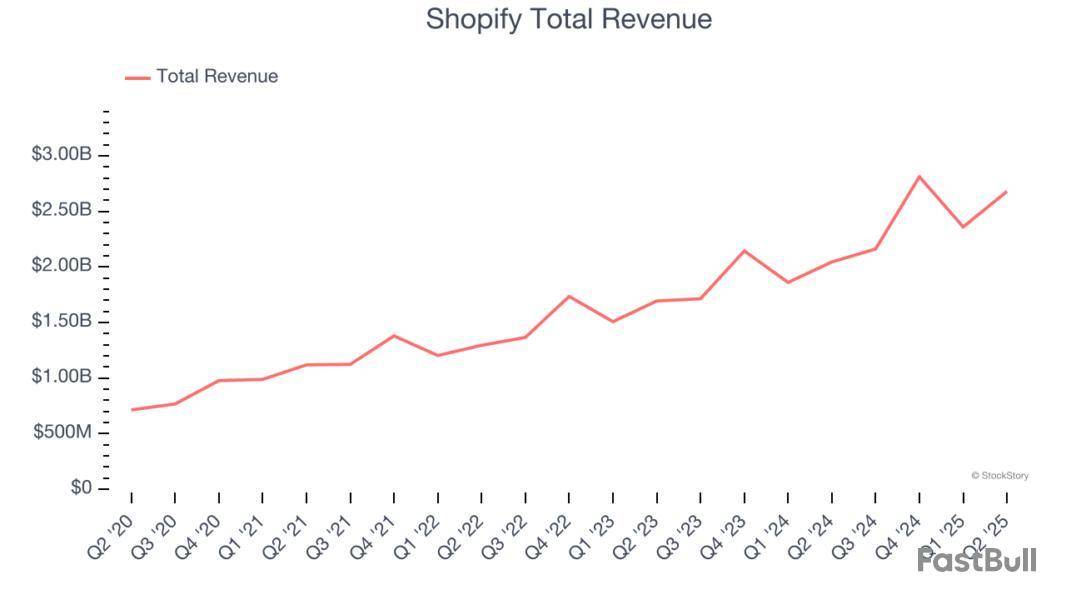

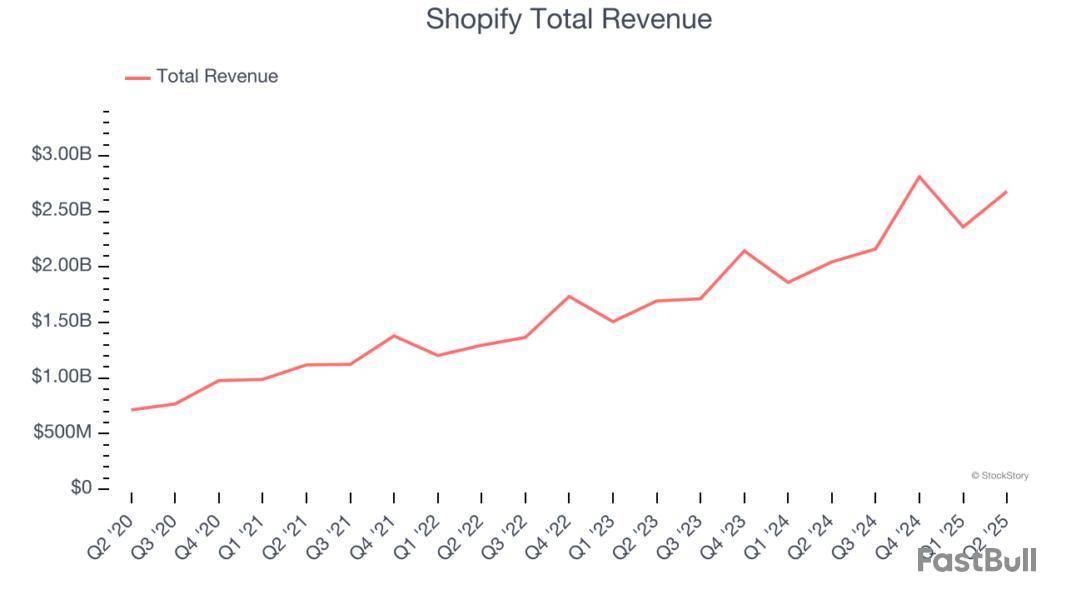

Shopify reported revenues of $2.68 billion, up 31.1% year on year, outperforming analysts’ expectations by 5.2%. The business had an exceptional quarter with an impressive beat of analysts’ gross merchandise volume estimates and a solid beat of analysts’ EBITDA estimates.

Shopify scored the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 18.1% since reporting. It currently trades at $150.11.

Is now the time to buy Shopify? Access our full analysis of the earnings results here, it’s free.

While the company is not a domain registrar and does not directly sell domain names to end users, Verisign operates and maintains the infrastructure to support domain names such as .com and .net.

VeriSign reported revenues of $409.9 million, up 5.9% year on year, in line with analysts’ expectations. It was a slower quarter, leaving some shareholders looking for more.

VeriSign delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 6.3% since the results and currently trades at $268.88.

Read our full analysis of VeriSign’s results here.

Founded in 2006 in Tel Aviv, Wix.com offers a free and easy to operate website building platform.

Wix reported revenues of $489.9 million, up 12.4% year on year. This result topped analysts’ expectations by 0.6%. More broadly, it was a mixed quarter as it also recorded billings in line with analysts’ estimates but a slight miss of analysts’ EBITDA estimates.

Wix scored the highest full-year guidance raise among its peers. The stock is down 5.5% since reporting and currently trades at $120.84.

Read our full, actionable report on Wix here, it’s free.

BigCommerce (NASDAQ:BIGC)

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ:BIGC) provides software for businesses to easily create online stores.

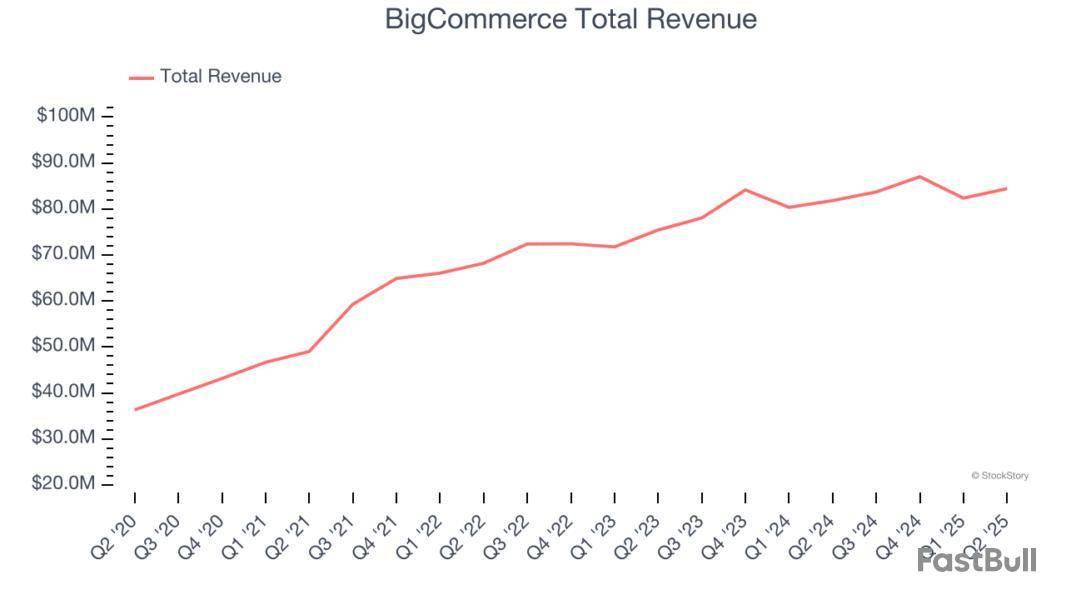

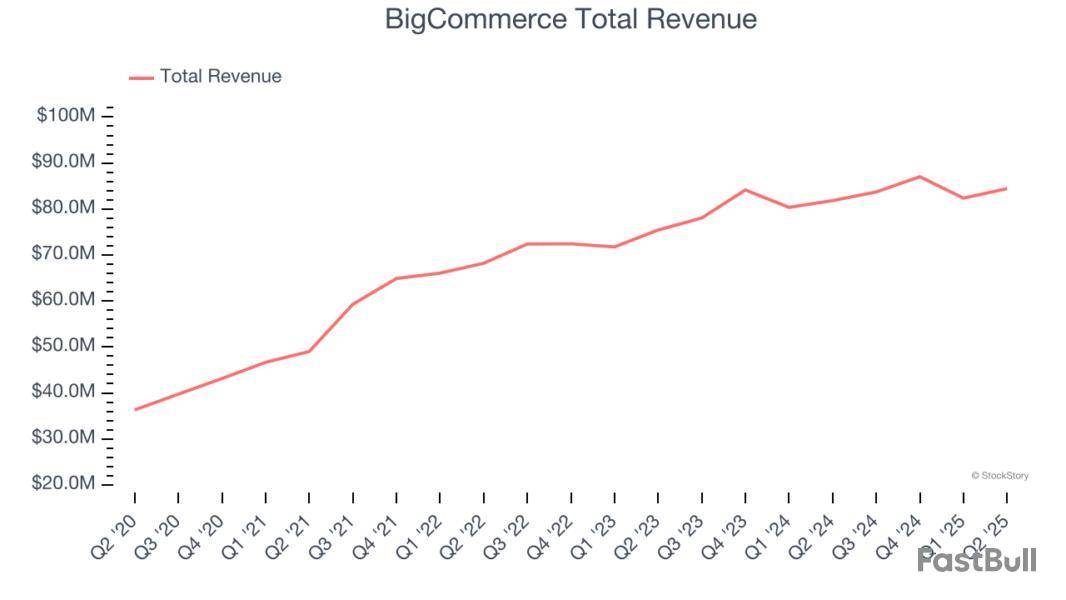

BigCommerce reported revenues of $84.43 million, up 3.2% year on year. This print surpassed analysts’ expectations by 1.3%. It was a strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

BigCommerce had the slowest revenue growth among its peers. The stock is up 4.6% since reporting and currently trades at $4.99.

Read our full, actionable report on BigCommerce here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how e-commerce software stocks fared in Q2, starting with BigCommerce (NASDAQ:BIGC).

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

The 5 e-commerce software stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

BigCommerce (NASDAQ:BIGC)

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ:BIGC) provides software for businesses to easily create online stores.

BigCommerce reported revenues of $84.43 million, up 3.2% year on year. This print exceeded analysts’ expectations by 1.3%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

“The second quarter was a defining period for our company, and today we mark an important milestone as we reintroduce ourselves as Commerce,” said Travis Hess, CEO of Commerce.

BigCommerce delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 4.6% since reporting and currently trades at $4.99.

Is now the time to buy BigCommerce? Access our full analysis of the earnings results here, it’s free.

Originally created as an internal tool for a snowboarding company, Shopify (NYSE:SHOP) provides a software platform for building and operating e-commerce businesses.

Shopify reported revenues of $2.68 billion, up 31.1% year on year, outperforming analysts’ expectations by 5.2%. The business had an exceptional quarter with a solid beat of analysts’ gross merchandise volume estimates and an impressive beat of analysts’ EBITDA estimates.

Shopify delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 18% since reporting. It currently trades at $150.00.

Is now the time to buy Shopify? Access our full analysis of the earnings results here, it’s free.

While the company is not a domain registrar and does not directly sell domain names to end users, Verisign operates and maintains the infrastructure to support domain names such as .com and .net.

VeriSign reported revenues of $409.9 million, up 5.9% year on year, in line with analysts’ expectations. It was a slower quarter, leaving some shareholders looking for more.

VeriSign delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 8.7% since the results and currently trades at $262.

Read our full analysis of VeriSign’s results here.

Founded in 2006 in Tel Aviv, Wix.com offers a free and easy to operate website building platform.

Wix reported revenues of $489.9 million, up 12.4% year on year. This number surpassed analysts’ expectations by 0.6%. Aside from that, it was a mixed quarter as it also logged billings in line with analysts’ estimates but a slight miss of analysts’ EBITDA estimates.

Wix pulled off the highest full-year guidance raise among its peers. The stock is down 8.1% since reporting and currently trades at $117.50.

Read our full, actionable report on Wix here, it’s free.

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

GoDaddy reported revenues of $1.22 billion, up 8.3% year on year. This print beat analysts’ expectations by 0.9%. Taking a step back, it was a satisfactory quarter as it also produced a decent beat of analysts’ EBITDA estimates but bookings in line with analysts’ estimates.

GoDaddy had the weakest full-year guidance update among its peers. The company lost 75,000 customers and ended up with a total of 20.41 million. The stock is down 6.6% since reporting and currently trades at $140.41.

Read our full, actionable report on GoDaddy here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Shopify and the best and worst performers in the e-commerce software industry.

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

The 5 e-commerce software stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Originally created as an internal tool for a snowboarding company, Shopify (NYSE:SHOP) provides a software platform for building and operating e-commerce businesses.

Shopify reported revenues of $2.68 billion, up 31.1% year on year. This print exceeded analysts’ expectations by 5.2%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ gross merchandise volume estimates and an impressive beat of analysts’ EBITDA estimates.

Shopify achieved the biggest analyst estimates beat and fastest revenue growth of the whole group. Unsurprisingly, the stock is up 18.5% since reporting and currently trades at $150.59.

We think Shopify is a good business, but is it a buy today? Read our full report here, it’s free.

BigCommerce (NASDAQ:BIGC)

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ:BIGC) provides software for businesses to easily create online stores.

BigCommerce reported revenues of $84.43 million, up 3.2% year on year, outperforming analysts’ expectations by 1.3%. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

The market seems content with the results as the stock is up 4.6% since reporting. It currently trades at $4.99.

Is now the time to buy BigCommerce? Access our full analysis of the earnings results here, it’s free.

While the company is not a domain registrar and does not directly sell domain names to end users, Verisign operates and maintains the infrastructure to support domain names such as .com and .net.

VeriSign reported revenues of $409.9 million, up 5.9% year on year, in line with analysts’ expectations. It was a slower quarter, leaving some shareholders looking for more.

VeriSign delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 4.8% since the results and currently trades at $273.17.

Read our full analysis of VeriSign’s results here.

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

GoDaddy reported revenues of $1.22 billion, up 8.3% year on year. This number topped analysts’ expectations by 0.9%. Aside from that, it was a satisfactory quarter as it also produced a decent beat of analysts’ EBITDA estimates but bookings in line with analysts’ estimates.

GoDaddy had the weakest full-year guidance update among its peers. The company lost 75,000 customers and ended up with a total of 20.41 million. The stock is down 11.3% since reporting and currently trades at $133.35.

Read our full, actionable report on GoDaddy here, it’s free.

Founded in 2006 in Tel Aviv, Wix.com offers a free and easy to operate website building platform.

Wix reported revenues of $489.9 million, up 12.4% year on year. This print surpassed analysts’ expectations by 0.6%. Taking a step back, it was a mixed quarter as it also logged billings in line with analysts’ estimates but a slight miss of analysts’ EBITDA estimates.

Wix scored the highest full-year guidance raise among its peers. The stock is down 3% since reporting and currently trades at $123.99.

Read our full, actionable report on Wix here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

We recently learned that Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) was yet again a net seller of stocks in the second quarter of 2025. We don't yet have all the details about what the Warren Buffett-led conglomerate bought and sold, but we know that several billion dollars' worth of stocks were disposed of.

This has been an ongoing trend for Berkshire over the past couple of years. Buffett and his team have unloaded significant portions of the massive investments in Apple (NASDAQ: AAPL) and Bank of America (NYSE: BAC) and have reduced or completely sold several other major stock positions. We also learned of recent dispositions of some Verisign (NASDAQ: VRSN) and DaVita (NYSE: DVA) shares. Berkshire has even stopped buying back its own shares for the time being, which came as a surprise to many investors after a decline of more than 10% in its share price.

However, this isn't to say that Buffett and his stock pickers aren't buying any stocks. In fact, there's one company whose stock Berkshire has continued to buy, and it recently bought even more.

According to recent SEC filings, Berkshire bought another 5 million shares of SiriusXM (NASDAQ: SIRI) for a cost of about $106.5 million.

Of course, an investment of this size isn't exactly massive for Berkshire. In fact, it represents about 0.03% of the company's $344 billion cash stockpile. But it's especially significant because of how much of the satellite radio operator Berkshire owns now. In fact, after this investment -- which is just the latest in a series of additions -- Berkshire now owns 37% of Sirius.

The short explanation is that Buffett most likely added more shares of SiriusXM because the stock is extremely cheap. As of this writing, SiriusXM trades for just over 7 times forward earnings estimates. The business is highly profitable, with over $1 billion in annual free cash flow, and pays a 5% dividend yield that is well covered by its earnings.

To be fair, there's a lot not to like about SiriusXM. Revenue has fallen in recent years, as has the subscriber base, which peaked way back in 2019. Free cash flow has declined by about one-third in the past two years, and the company continues to report a declining number of paid subscribers.

On the other hand, SiriusXM's management is well aware of the problem and is taking steps to fix it. And there are two components to a turnaround that are worth watching: money flowing out (expenses) and money flowing in (revenue).

On the expense side of the equation, SiriusXM has done an excellent job of cost reductions and is on track to achieve $200 million in run-rate savings by the end of this year, with significant capex reductions expected in 2026 and beyond.

When it comes to revenue, SiriusXM's leaders are getting creative, and it's starting to pay off. One example is the new three-year dealer-sold subscription package available with new vehicles (creating a paid customer as opposed to the traditional free trial given to new vehicle buyers). There's also a new ad-supported free version of its service available in some new vehicles, and with just 2.5% of SiriusXM's revenue coming from ads today, this is a massive growth opportunity.

In all, SiriusXM believes it can grow free cash flow by about 50% in the not-too-distant future and reach a new all-time high for subscribers. If it can show significant progress toward either goal, it could be a major win for Warren Buffett and the rest of the company's shareholders.

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $631,505!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,103,313!*

Now, it’s worth noting Stock Advisor’s total average return is 1,039% — a market-crushing outperformance compared to 181% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 4, 2025

Bank of America is an advertising partner of Motley Fool Money. Matt Frankel has positions in Bank of America, Berkshire Hathaway, and Sirius XM. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, and VeriSign. The Motley Fool has a disclosure policy.

Warren Buffett Just Bought Even More of This Dirt-Cheap Stock was originally published by The Motley Fool

When you're building a diversified portfolio for long-term wealth, it sometimes can be easy to ignore dividend stocks in favor of high-powered growth names in the tech sector. After all, companies like Nvidia, Palantir Technologies, and Microsoft are some of the biggest players out there, and investors flock to them to lock in market-beating gains.

I love those stocks too. But I also know that it's important to have a well-rounded portfolio which includes value stocks that represent several different sectors. These value stocks provide stable earnings, solid returns, and often a sustainable dividend that pays you back for holding them.

I get a lot of my value stocks by holding exchange-traded funds (ETFs) because they provide instant diversification. But if you're looking to add some individual dividend stocks without breaking the bank, I'm suggesting CVS Health (NYSE: CVS), VeriSign (NASDAQ: VRSN), and PepsiCo (NASDAQ: PEP).

And you can pick up shares of each for less than $500 -- and still have some money left over.

CVS Health is one of the biggest pharmacy and retail companies in the U.S. It operates more than 9,000 pharmacies, as well as more than 1,000 walk-in clinics. The stock is on a roll this year, up 33% in 2025, which is a massive turnaround following a disappointing 2024.

In addition, CVS is a health insurer through its 2018 purchase of Aetna, giving the company another valuable revenue stream. Its healthcare segment, which includes Aetna, saw revenue of $34.8 billion in the first quarter, up from $32.2 billion a year ago.

The company's health services segment, which includes its pharmacy benefits manager Caremark, also saw a strong quarter with revenue of $43.5 billion versus $40.3 billion the previous year. The third segment, pharmacy, saw revenue increase from $28.7 billion in Q1 2024 to $31.9 billion in Q1 2025.

CVS projects full-year guidance to include revenue of at least $382.6 billion and adjusted earnings per share of $6 to $6.20. The company offers a strong dividend yield of 4.5%, making it an appealing healthcare dividend stock to hold for the long term.

VeriSign is a tech company, but you may not have heard of it. However, the company plays an indispensable role in how the internet works, which makes it a great long-term play for income investors looking for a stable stock.

This company provides domain name registry services and internet infrastructure. In short, it is the exclusive registrar for websites that include the .com and .net suffix, and it provides processing services for many other domains as well.

VeriSign says it handles 428.1 billion domain name system queries each day. That gives it a massive competitive moat -- nobody is going to come around and take the business, so you can be assured that the company's going to be around and profitable for a long time. Revenue in the second quarter was $409.9 million, up nearly 6% from a year ago. Earnings were $2.21 per share, up from $2.01 per share last year.

The stock doesn't offer the biggest dividend -- currently, it's only about 1%. But considering the stability this company has, plus its market-beating 34% gain in 2025, I'll take it all day as a solid long-term dividend stock.

PepsiCo is on this list because of its solid year-to-date performance, its dividend, and its role in the market. The company is a consumer staples stock, as it makes its namesake Pepsi soda, as well as Frito-Lay snacks, Quaker oatmeal, and Gatorade sports drinks, among other products. I'll also look for a solid consumer staples stock when I'm looking for stocks to hold for a long period because they tend to be more recession-proof than a consumer discretionary stock.

Currently, PepsiCo is off a bit, dropping 5% in 2025 although it's gained nearly 10% in the last month as the company unveiled a plan to cut costs and promote healthier snack options. Its revenue in the second quarter was a solid $22.5 billion, down from $22.7 billion a year ago. But its operating profit boomed to $4.04 billion, up from $1.78 billion, and EPS of $2.23 was much better than the $0.92 per share the company earned in the second quarter of 2024.

Pepsi may not be beating the market like CVS or VeriSign, but it's a stock that is showing signs of life. Coupled with a strong 4% dividend yield, PepsiCo is a very appealing dividend stock in the consumer staples sector.

Before you buy stock in CVS Health, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CVS Health wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $625,254!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,257!*

Now, it’s worth noting Stock Advisor’s total average return is 1,036% — a market-crushing outperformance compared to 181% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 29, 2025

Patrick Sanders has positions in Nvidia and Palantir Technologies. The Motley Fool has positions in and recommends Microsoft, Nvidia, Palantir Technologies, and VeriSign. The Motley Fool recommends CVS Health and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The Smartest Dividend Stocks to Buy With $500 Right Now was originally published by The Motley Fool

What Happened?

Shares of domain name registry operator Verisign fell 8.5% in the morning session after news that major shareholder Berkshire Hathaway sold a significant portion of its stake in the company at a discount. Warren Buffett's Berkshire Hathaway announced it sold 4.3 million shares of the company in a secondary offering. The shares were priced at $285 each, representing a discount of nearly 7% to VeriSign's previous closing price. The sale, which raised approximately $1.23 billion for Berkshire, reduced its ownership stake in VeriSign from 14.2% to 9.6%. The move was primarily motivated by regulatory reasons, as dropping below the 10% ownership threshold allows Berkshire to avoid stricter reporting requirements from the Securities and Exchange Commission. VeriSign itself did not sell any shares in the offering and received no proceeds from the transaction.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks. Is now the time to buy VeriSign? Access our full analysis report here, it’s free.

What Is The Market Telling Us

VeriSign’s shares are not very volatile and have only had 3 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful, although it might not be something that would fundamentally change its perception of the business.

The previous big move we wrote about was 4 days ago when the stock gained 6.5% on the news that the company reported strong second-quarter financial results that beat earnings expectations and demonstrated healthy revenue growth. The internet infrastructure provider posted revenue of $410 million, marking a 5.9% increase from the prior year's quarter. VeriSign's earnings per share came in at $2.21, slightly ahead of consensus estimates. The positive results were supported by solid operational metrics, including an improved domain renewal rate of 75.5% and an increase in its .com and .net domain name base. In a move signaling confidence, the company's board also authorized a substantial share repurchase plan. Following the impressive quarter, investment firm Baird raised its price target on the stock to $340.

VeriSign is up 34% since the beginning of the year, but at $274.74 per share, it is still trading 10.2% below its 52-week high of $305.98 from July 2025. Investors who bought $1,000 worth of VeriSign’s shares 5 years ago would now be looking at an investment worth $1,316.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up