Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

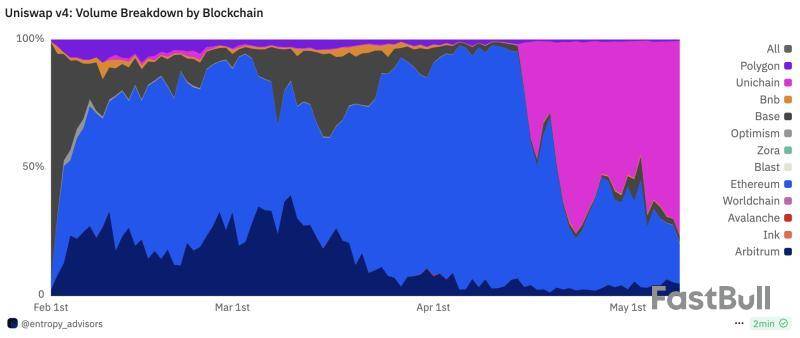

Unichain, Uniswap's native Layer 2 blockchain, has emerged as the dominant chain for Uniswap version 4, surpassing Ethereum in transaction volume.

A Dune Analytics dashboard by Entropy Advisors shows that Unichain has overtaken Ethereum to become the leading chain for Uniswap v4, with a market share of about 75% at the time of writing. Ethereum's share, by contrast, is below 20%. This shift began accelerating in mid-April 2025, driven by Unichain's growth and strategic incentives.

Notably, Ethereum remains the dominant chain for Uniswap v3 in terms of trading volume, and that version is currently more widely used by end users.

Uniswap v4, launched in January 2025, is the DEX's latest version and introduces hooks for custom code execution, dynamic fees, gas savings, and native ETH support. Unichain primarily focuses on Uniswap v4 and does not operate Uniswap v3 as a core component of its ecosystem.

Uniswap v4: Volume Breakdown by Blockchain. Source: Dune Analytics (via entropy_advisors)

Unichain's dominance in v4 is also attributed to a $45 million liquidity incentive program, which has driven a sharp increase in active addresses and value locked. According to DeFiLlama, it is currently the third-largest Layer 2 rollup by total value locked, at $800 million.

Unichain, built on the Optimism Superchain, offers roughly 95% lower transaction costs than Ethereum's Layer 1. It features one-second block times, with plans to introduce 250ms sub-blocks to achieve near-instant transactions.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Jeffy Yu, co-founder of Zerebro, who was believed to have committed suicide during a Pump.fun livestream on May 4, was recently seen at his parents’ home in the Crocker-Amazon neighborhood, The San Francisco Standard revealed .

The developer, who was discovered by The Standard on Wednesday, looked shaken and uneasy as he stepped outside his family’s two-story home. Wearing a T-shirt, shorts, and flip-flops, Yu seemed nervous and confused, the report stated.

After faking his own death, launching a memorial meme coin, and sprinkling enough on-chain breadcrumbs to summon on-chain sleuths from every corner of the crypto community on X, Yu expressed concern about being seen in public. He said he's planning to relocate his parents.

When confronted about the false death report and the $LLJEFFY meme coin, which was released shortly after his staged death as a memorial token, Yu refused to answer. The reporter was asked to leave moments later.

On-chain analysts spotted unusual activity from crypto addresses belonging to Yu after reports surfaced that he had taken his own "exit."

According to crypto commentator @RepeatAfterVee, Yu’s crypto address, which is linked to the creation of $ZEREBRO and $LLJEFFY is still alive and very active, offloading tokens and shuffling funds across known wallets just days after reports of his death.

These transfers triggered a wave of skepticism across crypto community members. Some questioned whether Yu’s reported death was genuine.

Data from Bubblemaps shows that accounts linked to Yu moved up to $1.4 million in crypto assets after his supposed death, leading to accusations of a "pseudocide exit strategy."

On May 6, Daniele Sestagalli, the founder of the Wonderland protocol, published a letter that he said he received from Yu, in which the developer allegedly admitted to fabricating his death.

Yu described the act as a last resort to prevent a collapse in the prices of Zerebro and Opaium.Source: @danielesesta

Legacy.com, the obituary platform where the tribute was posted, has since removed the listing without comment.

$ZEREBRO is currently trading at around $0.048, up 24% in the last 24 hours, per CoinGecko. The token is down nearly 94% from its all-time high set in January.

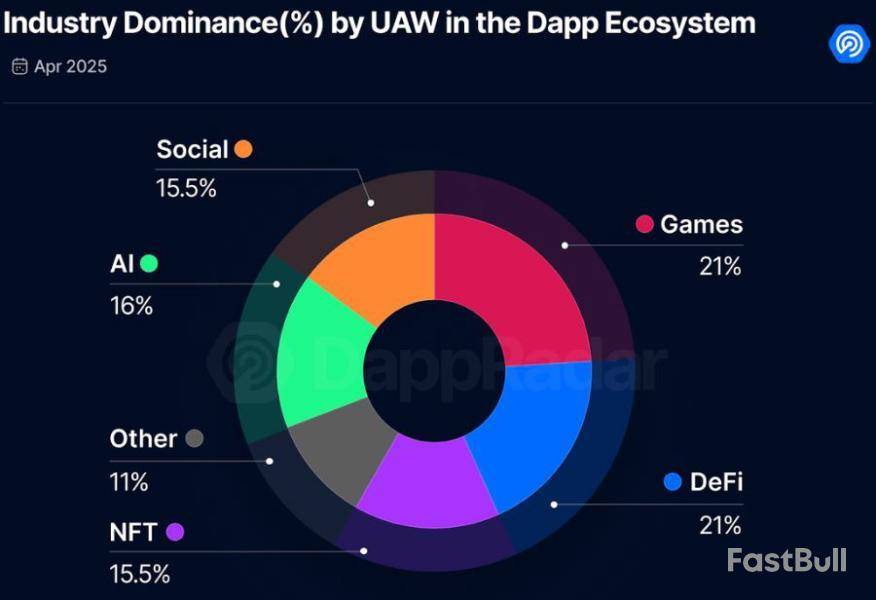

AI decentralized apps (DApps) have seen a spike in user activity and could soon challenge gaming and DeFi for the top spot in the DApp ecosystem, according to blockchain analytics platform DappRadar.

Gaming and DeFi are both sitting on 21% dominance in April, judged by percentage of unique active wallets, while AI has climbed to 16%, up from the 11% recorded in the February report, data in DappRadar’s April industry report shows.

“As user interest in artificial intelligence tools grows across industries, AI-powered DApps are steadily carving out their place in the decentralized ecosystem,” DappRadar analyst Sara Gherghelas said.

“If this trend continues, AI could soon challenge the traditional dominance of DeFi and Gaming, signaling a new era in the DApp landscape.”

At the same time, AI DApp activity surged over 26% to reach 3.8 million daily unique active wallets (dUAW), up from the 2.6 million dUAW recorded in February.

In contrast, DeFi activity dropped by 16%, settling at 4.8 million dUAW, which is equal to the gaming sector, which saw a 10% decline as well.

Gherghelas said most of the top AI DApps being tracked by DappRadar have remained the same, with many tied to AI agent infrastructure and those building utility.

LOL, a project that styles itself as an AI-powered mining system, is the top AI DApp on DappRadar’s list in dUAW.

LOL encourages users to send a voice recording of laughter to Telegram groups that use the LOL AI bot, which then uses factors like pitch and frequency to calculate the number of LOL tokens paid out in rewards.

Coming in second is AI-powered decentralized messaging service Dmail Network. Rounding out the top three is World.Fun, a launchpad that allows users to deploy AI agents into massive multi-agent simulations.

“This month, the top AI DApps on our platform remain largely unchanged, reinforcing the staying power of early leaders in this space. These projects are not just riding the hype: they’re building utility,” she added.

Last December, crypto industry execs told Cointelegraph they expected AI agents to transform Web3 in 2025, flagging crypto staking and onchain trading as emerging early use cases.

However, there was also speculation that AI would face headwinds, including technical challenges, regulatory hurdles, and centralization.

Social DApps rise as Web3 holds ground

Social DApps also saw a spike in activity for April, with an 18% increase to 3.6 million dUAW. Social DApp market dominance also grew to over 15% for the month.

Gherghelas said overall that “Web3 is holding its ground,” despite wider market turbulence in the wake of sweeping US tariffs, with 23 million daily active wallets recorded in April, compared to the 24 million recorded in February.

“April’s top performers underscore a key narrative: utility and narrative-driven hype, especially around memecoins and AI, are major drivers of user engagement,” Gherghelas said.

Over the past 24 hours, the cryptocurrency market has experienced significant volatility as Bitcoin officially broke above the $100,000 mark. This price movement triggered massive liquidations, totaling nearly $1 billion across the market, and led to a shift in trader behavior.

Additionally, data from the Bitcoin derivatives market is heating up. Analysts are now concerned about the potential for even larger liquidation waves.

Long Position Liquidations Surge as Bitcoin Breaks $100,000

According to data from CoinGlass, around 190,000 traders were liquidated, with total losses reaching $970 million. Short positions were hit the hardest, accounting for $836 million in losses. This event marks the largest short liquidation since 2021. CoinGlass also noted that the actual numbers might be even higher.

“This is the largest short liquidation since 2021… Binance has not fully disclosed its liquidation data, and the actual data is more,” CoinGlass stated.

Although short positions have been wiped out, the market faces a new risk: a sharp rise in long positions.

CoinGlass’s 24-hour Bitcoin liquidation map shows that if Bitcoin drops below $100,000, total long positions across exchanges could face nearly $2 billion in liquidations. This raises concerns about a potential “long squeeze”—a phenomenon where mass liquidation of long positions triggers panic selling and accelerates a price drop.

The same map also shows that if Bitcoin falls below $98,000, total liquidation volume could reach as high as $3.45 billion.

This overwhelming potential liquidation from long positions signals a shift in trader sentiment. Many are betting more money and using higher leverage, expecting Bitcoin’s price to continue rising.

In addition, data from CoinGlass shows that Bitcoin Futures Open Interest (OI) across exchanges has reached a record $67.4 billion. This reflects a surge in demand for short-term leveraged trading. Traders are making large bets on the uptrend, which increases the risk if the market suddenly reverses.

Historically, every time Bitcoin’s OI has surpassed $65 billion, a market correction has followed shortly after.

Bitcoin is now making headlines not just for surpassing $100,000, but also for its rising influence in global finance. At one point, Bitcoin even surpassed Amazon to become the fifth-largest asset in the world, with a market capitalization of $2.05 trillion. Meanwhile, Standard Chartered predicts Bitcoin could soon break its all-time high and reach $120,000 in Q2.

TL;DR

Ever since Ripple’s cross-border token reclaimed the crucial $2 line in mid-April, it has been stuck within a trading range between the aforementioned level, which became psychological support, and $2.26. The latter turned into key resistance, which withheld the bulls’ attempt at a breakthrough in late April.

In the past ten days, XRP failed to move outside of either one of those lines. The bears unsuccessfully challenged the lower boundary on May 6, but the asset remained well above it. The subsequent bounce-off has been rather gradual but seems sustainable as of now.

Earlier today, XRP surged to an 11-day peak of over $2.33 before it faced some resistance and was pushed south to the current $2.3. Nevertheless, it’s still 5% up on the day, and, more importantly, it has surged past the upper boundary of $2.26. Ali Martinez told his over 135,000 followers on X that if XRP managed to close above that line, it could head toward $2.6 next.

If $XRP breaks through the $2.26 resistance, it could trigger a bullish breakout toward $2.60! pic.twitter.com/2bdG315vgi

— Ali (@ali_charts) May 8, 2025

Although XRP is yet to close above that level on the daily, the community was quick to pick up the move and celebrate with some big pricepredictionsfor the following weeks and months. Also, you can check why another popular analyst believes the current price levels are an “absolute gift.”SEC Files to Settle

The first obvious reason behind XRP’s surge is the overall market resurgance as the entire industry has added roughly $300 billion within the past few days. However, there seems to be another, and it involves the legal case between the company behind the token and the US regulator that sued it for over four years.

The SEC has filed a motion to receive court approval to settle with Ripple Labs. This could be considered a confirmation of previous statements by Ripple’s CEO and CLO, as both claimed that the case has effectively ended. The agency’s filing requests a $50 million settlement, which is far off the previously ordered $125 million and way less than the $2 billion the SEC initially sought.

Apple is reportedly working on its own microchips across multiple product categories, including smart glasses and artificial intelligence — a hint at what’s next for the massive Silicon Valley-based tech giant.

A May 8 report from Bloomberg, citing people familiar with the matter, said the company is working on new processors to power its future devices, including its first smart glasses to rival Meta’s Ray-Bans, more powerful Macs, and artificial intelligence servers.

The smart glasses — a first for Apple — would rely on a specialized chip codenamed N401. The processor is based on Apple Watch chips but is further optimized for power efficiency and designed to control multiple cameras planned for the glasses, the sources said.

Apple’s smart glasses will initially be non-augmented reality versions that will include cameras, microphones and integrated AI, much like rival offerings from Meta. They would presumably have similar functions like snapping photos, recording video and offering translation options, the report added.

The product may also integrate a visual intelligence feature for scanning the environment and describing objects, looking up information about products and providing directions.

Mass production targeted for late 2026 or 2027, suggesting a product launch within approximately two years, they added.

The Bloomberg sources added that other semiconductors were also developing chips to power future Macs and AI servers that can power the firm’s “Apple Intelligence” platform.

Meanwhile, MacRumors reported that chips codenamed “Komodo” will likely be M6 chips that will follow this year’s M5 chips, while chips codenamed “Borneo” will be Apple’s future M7 processors with another more advanced chip that will debut in the future codenamed “Sotra.”

Dedicated Apple AI chips

Apple is also working on its first dedicated AI server chips in a project codenamed “Baltra” to power its Apple Intelligence platform, according to Bloomberg.

The firm’s Baltra chips could have up to eight times the processing and graphics cores of the current M3 Ultra chips, the report added. Apple has targeted completion by 2027 to make its AI services faster and more competitive.

In late April, it was reported that Chinese tech giant Huawei has developed a powerful AI chip that could rival high-end processors from US chip maker Nvidia.

BNB price is consolidating above the $605 support zone. The price is now showing positive signs and might aim for more gains in the near term.

BNB Price Eyes More Gains

After forming a base above the $600 level, BNB price started a fresh increase. There was a move above the $605 and $612 resistance levels, like Ethereum and Bitcoin.

The bulls even pushed the price above the $625 level. A high was formed at $629 and the price is now consolidating gains above the 23.6% Fib retracement level of the recent wave from the $597 swing low to the $629 high.

The price is now trading above $622 and the 100-hourly simple moving average. There is also a key bullish trend line forming with support near $622 on the hourly chart of the BNB/USD pair.

On the upside, the price could face resistance near the $628 level. The next resistance sits near the $630 level. A clear move above the $630 zone could send the price higher. In the stated case, BNB price could test $642. A close above the $642 resistance might set the pace for a larger move toward the $650 resistance. Any more gains might call for a test of the $655 level in the near term.

Another Decline?

If BNB fails to clear the $630 resistance, it could start another decline. Initial support on the downside is near the $622 level. The next major support is near the $620 level.

The main support sits at $612 and the 50% Fib retracement level of the recent wave from the $597 swing low to the $629 high. If there is a downside break below the $612 support, the price could drop toward the $605 support. Any more losses could initiate a larger decline toward the $600 level.

Technical Indicators

Hourly MACD – The MACD for BNB/USD is gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BNB/USD is currently above the 50 level.

Major Support Levels – $622 and $612.

Major Resistance Levels – $630 and $642.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up