Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

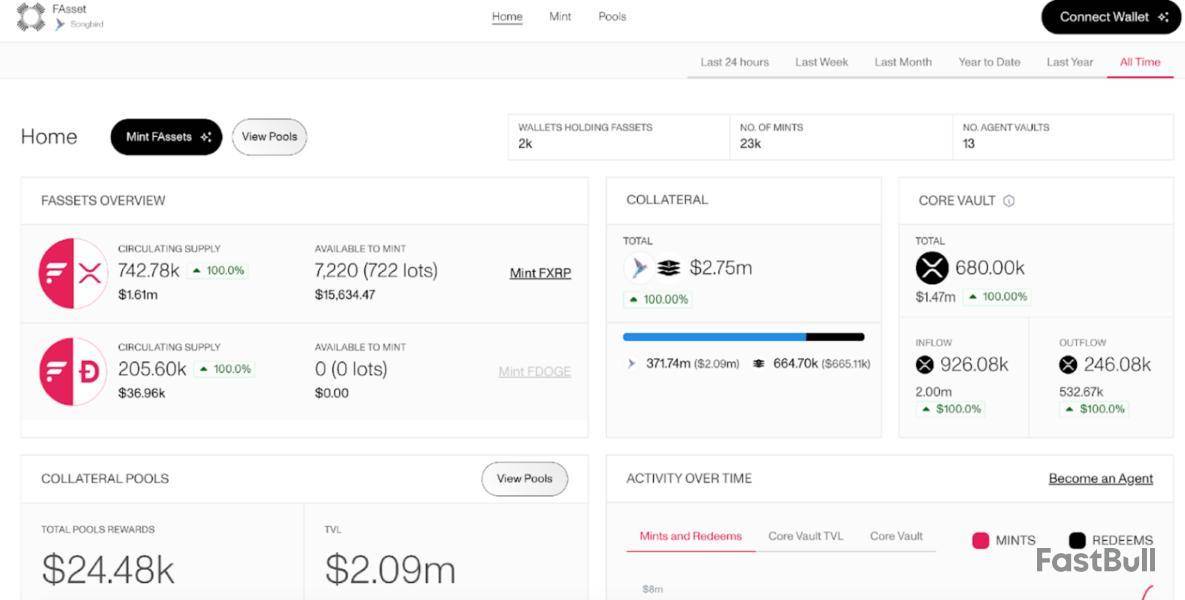

Despite its massive popularity, XRP has remained largely absent from decentralized finance (DeFi) because of the technical limitations of the XRP Ledger (XRPL).

XRPFi, a DeFi ecosystem centered on XRP, aims to narrow that gap. It leverages Flare Network’s bridging and smart contract technology to bring XRP into the realm of programmable finance.

Flare Network, a full-stack layer-1 blockchain designed for data-intensive applications, serves as a crucial bridge connecting non-smart-contract assets like XRP to the DeFi ecosystem.

At the heart of Flare’s infrastructure is FAssets, a system that creates fully collateralized representations of these assets. One notable example is FXRP, a wrapped version of XRP that enables holders to deploy their XRP in DeFi protocols within Flare’s network.

By staking FXRP, holders receive stXRP, a liquid staking token that represents a claim on the staked FXRP. Max Luck, head of growth at Flare, told Cointelegraph: “This setup allows XRP holders to unlock native-like staking yields on an asset that otherwise doesn’t support staking, enabling passive income without sacrificing liquidity.”

Institutions are showing growing interest in XRPFi: Digital money platform Uphold, which holds over 1.8 billion XRP, has signaled plans to engage with the FAssets ecosystem, while NASDAQ-listed VivoPower recently announced a $100 million XRP deployment on Flare, underscoring how major players are validating and accelerating the momentum of XRPFi.

With XRP’s market capitalization exceeding $130 billion, directing even a fraction of that liquidity into DeFi could unlock a significant new capital source for the broader ecosystem. Flare’s technology expands XRP’s utility, encouraging greater participation from both institutional investors and retail holders.

Liquid staking is coming to the XRP ecosystem through the launch of stXRP

Liquid staking is set to make its debut in the XRP ecosystem with the launch of stXRP on the Firelight protocol, powered by Flare. Much like the liquid staking token stETH (stETH) for staked ETH offered by protocols like Lido, Firelight will allow users to stake FXRP and receive stXRP, a liquid staking token that can be utilized across Flare’s growing DeFi ecosystem.

The process works by depositing FXRP into Firelight’s Launch Vault, which mints stXRP at a 1:1 ratio. These ERC-20 tokens are fully transferable and can be used across decentralized exchanges, lending markets, and other yield-generating DeFi protocols.

Importantly, the underlying FXRP will remain staked on Secured Service Networks (SSNs), which help secure decentralized protocols across multiple ecosystems while potentially earning rewards for users.

As holders of stXRP, users may also earn Firelight Points, which can influence future reward distributions. In the long run, this dynamic could increase the composability of stXRP within the XRPFi ecosystem, enabling its use as collateral, liquidity or a yield-bearing asset across a wide range of DeFi applications.

Bitcoin’s recent price activity has been characterized by sharp swings as global uncertainties persist, particularly following the escalation of tensions between Israel and Iran. After plunging by nearly 5% amid the rising geopolitical strain, Bitcoin managed to recover, bouncing back above $105,000 and currently trading around $106,800.

The past 24 hours have been highlighted by Bitcoin recovering toward $108,000 briefly again, but with escalating tensions in the Middle East, there’s a good chance it could crash soon. This aligns with an outlook from a crypto analyst, who noted that Bitcoin might crash toward $100,000.

Resistance Band Faces Test For Bitcoin

According to crypto analyst Pejman_Zwin on the TradingView platform, Bitcoin is hovering within a confluence of resistance and short liquidation zones, stretching from $105,330 to $107,120. This range, he notes, is not only a structural resistance zone but also corresponds with the cumulative short liquidation leverage area.

Basically, this means there’s a high possibility of an intensified price volatility if this zone is challenged or broken. The charts also reveal the presence of a possible contracting triangle pattern, which is a bearish continuation setup in the context of a larger correction.

According to the analyst, if Bitcoin fails to reclaim $106,600 convincingly, the structure could shift from a corrective triangle to a five-wave downward impulse. This would cause a deeper retracement, especially as the price is already forming lower highs within the triangle. As such, the longer Bitcoin lingers in this resistance range without a breakout, the higher the likelihood of a rapid downward move.

Bearish And Bull Targets

If Bitcoin were to confirm this breakdown, the analyst noted the first major target around the lower boundary of the support zone, which lies between $105,330 and $103,162. This zone is reinforced by the monthly pivot point and also overlaps with the cumulative long liquidation leverage region. The 1-hour candlestick timeframe chart further highlighted a potential short setup from the reversal zone near $107,100 and a projected target close to $104,300.

Further downside could pull the price toward the next support band around $102,600 or even down to $101,000, should liquidation pressure persist. Pejman, on the other hand, pointed out that a sustained breakout above the $107,120 resistance line could initiate a bullish reversal and push Bitcoin back towards the heavy resistance cluster above $108,000. A strong daily close above $108,000 could cancel the bearish outlook. However, failure to break above here could lead to a rejection and another downside move.

Although Bitcoin is starting to show some signs of bullishness, its price action is still vulnerable to a quick pullback, especially if the tensions in the Middle East continue to unfold. At the time of writing, Bitcoin is trading at $106,638, down 0.02% in the past 24 hours. This subdued price action shows its current consolidation nature.

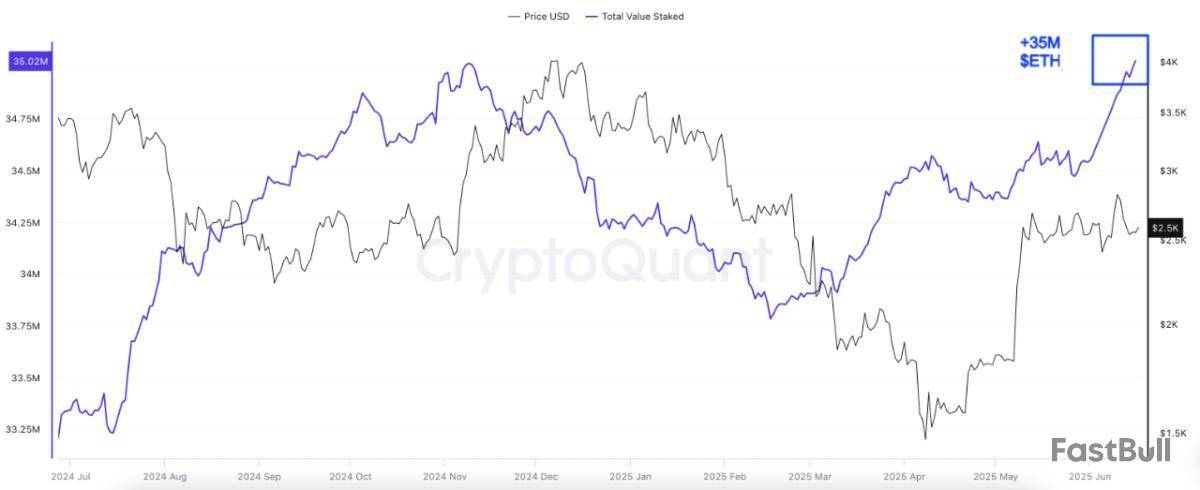

The supply of staked Ether reached an all-time high this week, signaling growing investor confidence and a squeeze on the liquid supply of the world’s second-largest cryptocurrency.

Over 35 million Ether coins are now staked under the Ethereum blockchain’s proof-of-stake consensus model, according to data from Dune Analytics.

Over 28.3% of the total Ether supply is now locked into smart contracts and is unsellable for a pre-determined time in exchange for generating passive income for investors.

A growing staked supply also indicates that a large percentage of investors are preparing to hold their ETH instead of selling at current prices.

Over 500,000 ETH has been staked in the first half of June, signaling “rising confidence and a continued drop in liquid supply,” said pseudonymous CryptoQuant author Onchainschool in a Tuesday post.

Ether accumulation addresses, or holders with no history of selling, have also reached an all-time high of 22.8 million in ETH holdings, signaling that Ethereum is among the “strongest crypto assets in terms of long-term fundamentals and investor conviction,” the analyst said.

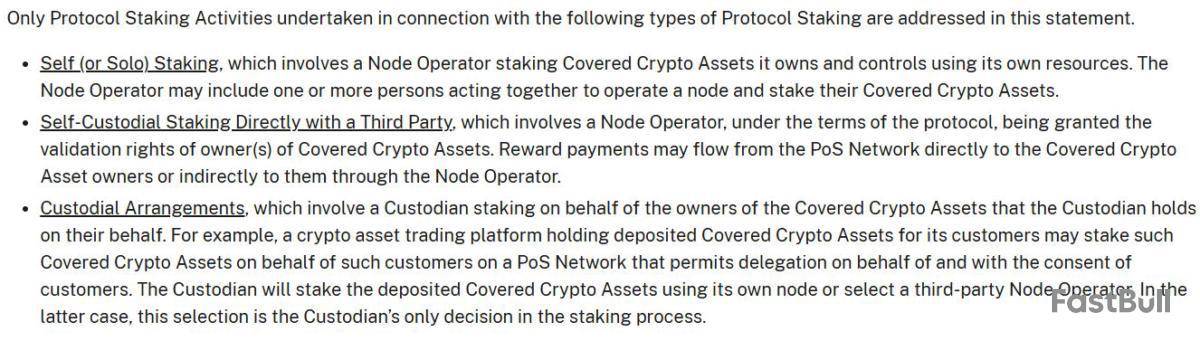

The recent rise in staking comes amid a more favorable US regulatory outlook. The record comes nearly three weeks after the US Securities and Exchange Commission (SEC) released new guidance on cryptocurrency staking, widely seen as a victory for crypto regulations, Cointelegraph reported on May 30.

“Protocol Staking Activities,” such as cryptocurrencies staked in a proof-of-stake blockchain, “don’t need to register with the Commission transactions under the Securities Act,” SEC’s Division of Corporation Finance said in a May 29 statement.

However, industry participants are still waiting for the approval of the first Ether staking ETFs after the SEC delayed its decision on Bitwise’s application to add staking to its Ether ETF on May 21.

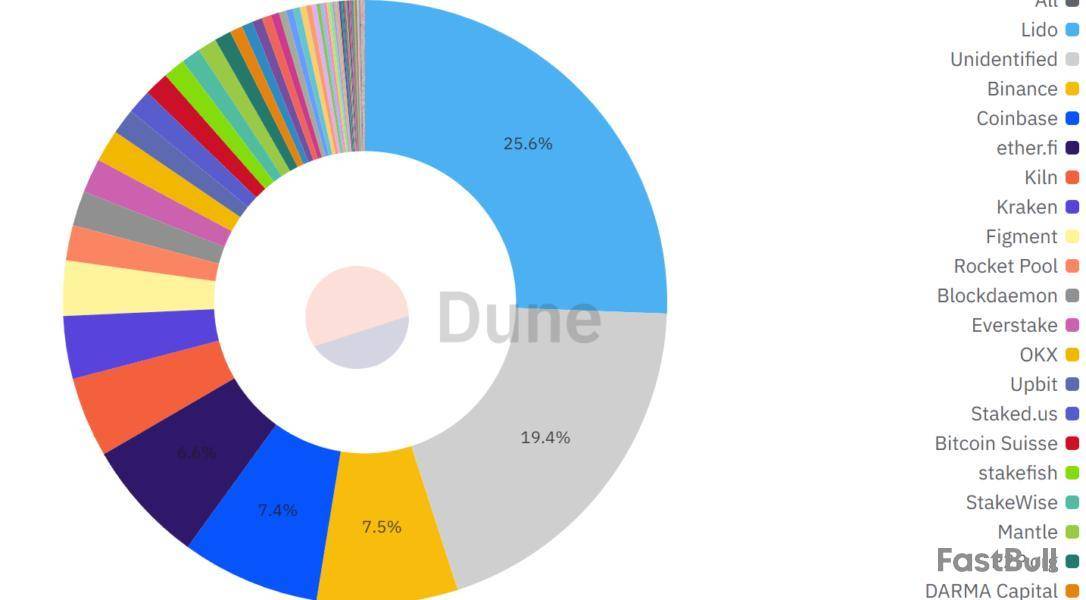

Lido accounts for 25% of the staked Ether supply

Over 25% of the 35 million staked Ether tokens have been deployed through the liquid staking protocol Lido. Binance holds 7.5% of the staked Ether supply, and Coinbase holds 7.4%, according to Dune data.

Coinbase exchange has become Ethereum’s largest node operator, holding over 11.4% of staked Ether supply through its validators, Cointelegraph reported on March 20.

Decentralization purists have previously criticized the growing Ether supply staked through liquid staking protocols as a potential centralization risk, which may create a single point of vulnerability for the network.

Despite the criticism, institutional adoption saw a significant uptick thanks to the development of liquid staking infrastructure, as a “significant percentage of Lido’s TVL already comes from institutions” amid growing demand, Konstantin Lomashuk, founding contributor at Lido protocol, told Cointelegraph.

Dogecoin long position traders have again been stunned as a 514% liquidation hit the meme coin’s market space. Notably, after DOGE flashed rebound signals, some traders bet on sustained momentum, but volatility turned the tide.

Dogecoin longs take hit as $6.33 million wiped out

According to CoinGlass data, in the last 24 hours, Dogecoin’s total liquidation stood at $7.36 million. Out of this amount, long position traders saw $6.33 million wiped out as price action shifted, resulting in losses. These investors were betting on a sustained recovery as prices lifted, but the volatility of the crypto space prevented it from materializing.

Short position traders recorded about one-sixth of the losses suffered by those betting long on DOGE. A total of $1.03 million was liquidated from short position traders, signaling less exposure on the market.

As of press time, Dogecoin remains in the red zone, declining by 2.74% to trade at $0.1711 in the last 24 hours, according to CoinMarketCap.

Nonetheless, trading volume has witnessed an uptick of 28.23% to $1.25 billion within the same time frame. This suggests that investors use the price dip to accumulate more of the meme coin at a reduced rate.

It remains unclear if DOGE whales are behind the current spike in volume. However, investors hope that the sustained increase could trigger a reversal in the price outlook. In the past week, Dogecoin whales were active, transacting over $23 billion worth of DOGE within 24 hours.

DOGE loses market cap ground to Tron

There are lingering concerns in the Dogecoin community as the meme coin faces pressure on the broader crypto market. As U.Today predicted, Dogecoin recently lost the eighth position ranking per market capitalization to Tron .

Dogecoin was ahead of Tron by about $580 million, but slow price growth caused it to lose against Tron. The only consolation amid the current market setup is that Bitcoin is also experiencing a price decline. Dogecoin investors can only hope that if the leading digital currency rebounds, DOGE might mirror it.

Fold Holdings (ticker FLD), the parent company behind the Fold Bitcoin wallet and app, has secured a $250 million equity purchase facility to expand its Bitcoin treasury, according to an announcement on Tuesday.

The firm says it has “entered into an agreement” to sell up to $250 million worth of newly issued shares to fund its Bitcoin acquisition strategy.

“The Company is not required to use the Facility and controls the timing and amount of any drawdown,” the announcement reads, implying no coins have been purchased as of the date of its filing with the U.S. Securities and Exchange Commission.

Like many recent crypto corporate treasury firms — such as 21 Capital and Nakamoto, both of which took cues from Michael Saylor’s BTC acquisition vehicle, Strategy — Fold is funding its purchase through private placements, which effectively turn its stock into a leveraged play on the price of Bitcoin.

Fold, launched in 2019, began as a wallet company and has since expanded into broader financial services, including the Fold Card — a debit card offering Bitcoin cashback rewards — and a Bitcoin treasury strategy. It has entered into at least one other convertible note agreement to purchase 475 BTC.

According to Bitcoin Treasuries, Fold holds approximately 1,488 BTC worth some $157.23 million, making it one of the larger publicly traded Bitcoin treasury firms.

Fold went public in 2024 through a SPAC merger with Nasdaq-traded FTAC Emerald Acquisition Corp., at a pre-money valuation of $365 million. At the time, it held an estimated 1,000 BTC.

FLD was trading at $4.71 on Tuesday, up 0.43% from around $4.31 at market open, according to The Block’s price data.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

In a fresh development in the Ripple-SEC lawsuit, both parties have requested that the Second Circuit continue to hold the appeals in abeyance, pending a motion for an indicative ruling. The SEC is now expected to file a status update by Aug. 15, 2025.

In the past week, Ripple and the SEC renewed their request for an indicative ruling after Judge Torres's initial denial of the motion in May.

With the next SEC update filing due by mid-August, the XRP community is in a holding pattern. Speculation is growing about whether Judge Torres might alter any part of her ruling and what the outcome of the motion for the indicative ruling would be.

"I really would be baffled if she rejects the refile," one XRP supporter said on X, "Do you think we should tell people that if things go south and one or both proceed with their respective appeals, the case will get kicked back to Torres?"

Marc Fagel@Marc_FagelJun 17, 2025I don't think there's any way to predict whether she will modify her order. I could see it going either way.

Marc Fagel, former SEC regional director, joined the conversation with a measured response. "I don't think there's any way to predict whether she will modify her order. I could see it going either way," Fagel said.

What's next?

Ripple and SEC are winding down the case that began in December 2020, centered on XRP sales as alleged unregistered securities.

Going forward, Judge Torres would need to provide an indicative ruling as to whether the court would dissolve the injunction and release the escrow, with $50 million going to the SEC and $75 million returned to Ripple.

After the injunction is dissolved, the funds distributed and the SEC’s appeal and Ripple’s cross-appeal dismissed, the case would finally be over.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up