Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[The Third Meeting Of The China-US High-Level Track II Dialogue Held In The United States] From February 8 To 12, 2026, Wu Ken, President Of The Chinese People's Institute Of Foreign Affairs, Led A Delegation To New York To Co-host The Third Meeting Of The China-US High-Level Track II Dialogue With A US Team Led By Evan Greenberg, Executive Vice President Of The Board Of Directors Of The National Committee On US-China Relations. During Their Stay In New York, The Delegation Also Met With Former US Political Figures, Think Tank Representatives, And Business Leaders. (China People's Institute Of Foreign Affairs WeChat Official Account)

UK Labour Party Leader Starmer: We Must Build Our Hard Power, Must Be Able To Deter Aggression And If Necessary Be Ready To Fight

EU Commission Chief Von Der Leyen: This Starts By Working With Our Closest Partners, Like The UK, Norway, Iceland Or Canada

EU Commission Chief Von Der Leyen: We Face The Very Distinct Threat Of Outside Forces Trying To Weaken Our Union From Within

Chinese Foreign Minister Wang Yi: We Don't Want To See Narrative Of Systemic Rivalry Between EU And China Amplified

Chinese Foreign Minister Wang Yi: China Wants Cooperation Not Conflict But Well Prepared To Address All Kinds Of Risks

Chinese Foreign Minister Wang Yi: Attempts To Split China From Taiwan Would Very Likely Push China And USA Towards Conflict

[State Administration For Market Regulation Summons 7 Platform Companies] On February 13, The State Administration For Market Regulation Summoned Representatives From Alibaba, Douyin, Baidu, Tencent, JD.com, Meituan, And Taobao Flash Sale, Among Other Platform Companies. The Administration Demanded That These Companies Strictly Abide By The Provisions Of The *Anti-Unfair Competition Law Of The People's Republic Of China*, The *Price Law Of The People's Republic Of China*, The *Consumer Rights Protection Law Of The People's Republic Of China*, And The *E-commerce Law Of The People's Republic Of China*, Proactively Fulfill Their Primary Responsibilities, And Further Regulate Their Platform Promotional Activities. The Administration Also Reminded These Companies To Eliminate All Forms Of "involutionary" Competition, Jointly Maintain A Fair Competitive Market Environment, And Promote The Innovation And Healthy Development Of The Platform Economy

Chinese Foreign Minister Wang Yi: The Other Prospect Is Seeking To Decouple, Sever Supply Chains In A Knee Jerk Way

Rubio Says President Has Said Its His Preference To Reach A Deal With Iran But That's Very Hard To Do

[F2Pool Co-Founder Wang Chun: Smart Money Is Now Buying Bitcoin] February 14Th, F2Pool Co-Founder Wang Chun Posted On Social Media, Saying, "Smart Money Is Now Buying Bitcoin."

Rubio Says He Does Not Think It Is Possible For Russia To Achieve What Initial Objectives It Had At The Start Of The Ukraine War

Germany Current Account (Not SA) (Dec)

Germany Current Account (Not SA) (Dec)A:--

F: --

U.S. Existing Home Sales Annualized MoM (Jan)

U.S. Existing Home Sales Annualized MoM (Jan)A:--

F: --

U.S. Existing Home Sales Annualized Total (Jan)

U.S. Existing Home Sales Annualized Total (Jan)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

U.S. 30-Year Bond Auction Avg. Yield

U.S. 30-Year Bond Auction Avg. YieldA:--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Jan)

China, Mainland Outstanding Loans Growth YoY (Jan)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)A:--

F: --

P: --

Euro Zone Employment Prelim QoQ (SA) (Q4)

Euro Zone Employment Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Revised YoY (Q4)

Euro Zone GDP Revised YoY (Q4)A:--

F: --

P: --

Euro Zone Trade Balance (SA) (Dec)

Euro Zone Trade Balance (SA) (Dec)A:--

F: --

Euro Zone Employment YoY (SA) (Q4)

Euro Zone Employment YoY (SA) (Q4)A:--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Dec)

Euro Zone Trade Balance (Not SA) (Dec)A:--

F: --

Russia Key Rate

Russia Key RateA:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Retail Sales MoM (Dec)

Brazil Retail Sales MoM (Dec)A:--

F: --

P: --

U.S. Real Income MoM (SA) (Jan)

U.S. Real Income MoM (SA) (Jan)A:--

F: --

U.S. Core CPI YoY (Not SA) (Jan)

U.S. Core CPI YoY (Not SA) (Jan)A:--

F: --

P: --

U.S. Core CPI MoM (SA) (Jan)

U.S. Core CPI MoM (SA) (Jan)A:--

F: --

P: --

U.S. CPI MoM (Not SA) (Jan)

U.S. CPI MoM (Not SA) (Jan)A:--

F: --

P: --

U.S. CPI MoM (SA) (Jan)

U.S. CPI MoM (SA) (Jan)A:--

F: --

P: --

U.S. CPI YoY (Not SA) (Jan)

U.S. CPI YoY (Not SA) (Jan)A:--

F: --

P: --

U.S. Core CPI (SA) (Jan)

U.S. Core CPI (SA) (Jan)A:--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Jan)

U.S. Cleveland Fed CPI MoM (SA) (Jan)A:--

F: --

P: --

Russia CPI YoY (Jan)

Russia CPI YoY (Jan)A:--

F: --

P: --

U.S. Cleveland Fed CPI MoM (Jan)

U.S. Cleveland Fed CPI MoM (Jan)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Saudi Arabia CPI YoY (Jan)

Saudi Arabia CPI YoY (Jan)--

F: --

P: --

Japan GDP QoQ (SA) (Q4)

Japan GDP QoQ (SA) (Q4)--

F: --

P: --

Japan GDP Annualized QoQ (SA) (Q4)

Japan GDP Annualized QoQ (SA) (Q4)--

F: --

P: --

Japan Real GDP QoQ (Q4)

Japan Real GDP QoQ (Q4)--

F: --

P: --

Japan Nominal GDP Prelim QoQ (Q4)

Japan Nominal GDP Prelim QoQ (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Feb)

U.K. Rightmove House Price Index YoY (Feb)--

F: --

P: --

Japan Industrial Output Final YoY (Dec)

Japan Industrial Output Final YoY (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Dec)

Japan Industrial Output Final MoM (Dec)--

F: --

P: --

Euro Zone Industrial Output MoM (Dec)

Euro Zone Industrial Output MoM (Dec)--

F: --

P: --

Euro Zone Industrial Output YoY (Dec)

Euro Zone Industrial Output YoY (Dec)--

F: --

P: --

Euro Zone Total Reserve Assets

Euro Zone Total Reserve Assets--

F: --

P: --

Canada New Housing Starts (Jan)

Canada New Housing Starts (Jan)--

F: --

P: --

Canada Manufacturing New Orders MoM (Dec)

Canada Manufacturing New Orders MoM (Dec)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Dec)

Canada Manufacturing Unfilled Orders MoM (Dec)--

F: --

P: --

Canada Manufacturing Inventory MoM (Dec)

Canada Manufacturing Inventory MoM (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Jan)

Canada Trimmed CPI YoY (SA) (Jan)--

F: --

P: --

RBA Monetary Policy Meeting Minutes

RBA Monetary Policy Meeting Minutes U.K. 3-Month ILO Employment Change (Dec)

U.K. 3-Month ILO Employment Change (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Jan)

U.K. Unemployment Claimant Count (Jan)--

F: --

P: --

U.K. Unemployment Rate (Jan)

U.K. Unemployment Rate (Jan)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Dec)

U.K. 3-Month ILO Unemployment Rate (Dec)--

F: --

P: --

Germany CPI Final YoY (Jan)

Germany CPI Final YoY (Jan)--

F: --

P: --

Germany CPI Final MoM (Jan)

Germany CPI Final MoM (Jan)--

F: --

P: --

Germany HICP Final YoY (Jan)

Germany HICP Final YoY (Jan)--

F: --

P: --

Germany HICP Final MoM (Jan)

Germany HICP Final MoM (Jan)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Dec)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Dec)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Dec)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Dec)--

F: --

P: --

U.K. Labor Productivity (Q3)

U.K. Labor Productivity (Q3)--

F: --

P: --

South Africa Unemployment Rate (Q4)

South Africa Unemployment Rate (Q4)--

F: --

P: --

No matching data

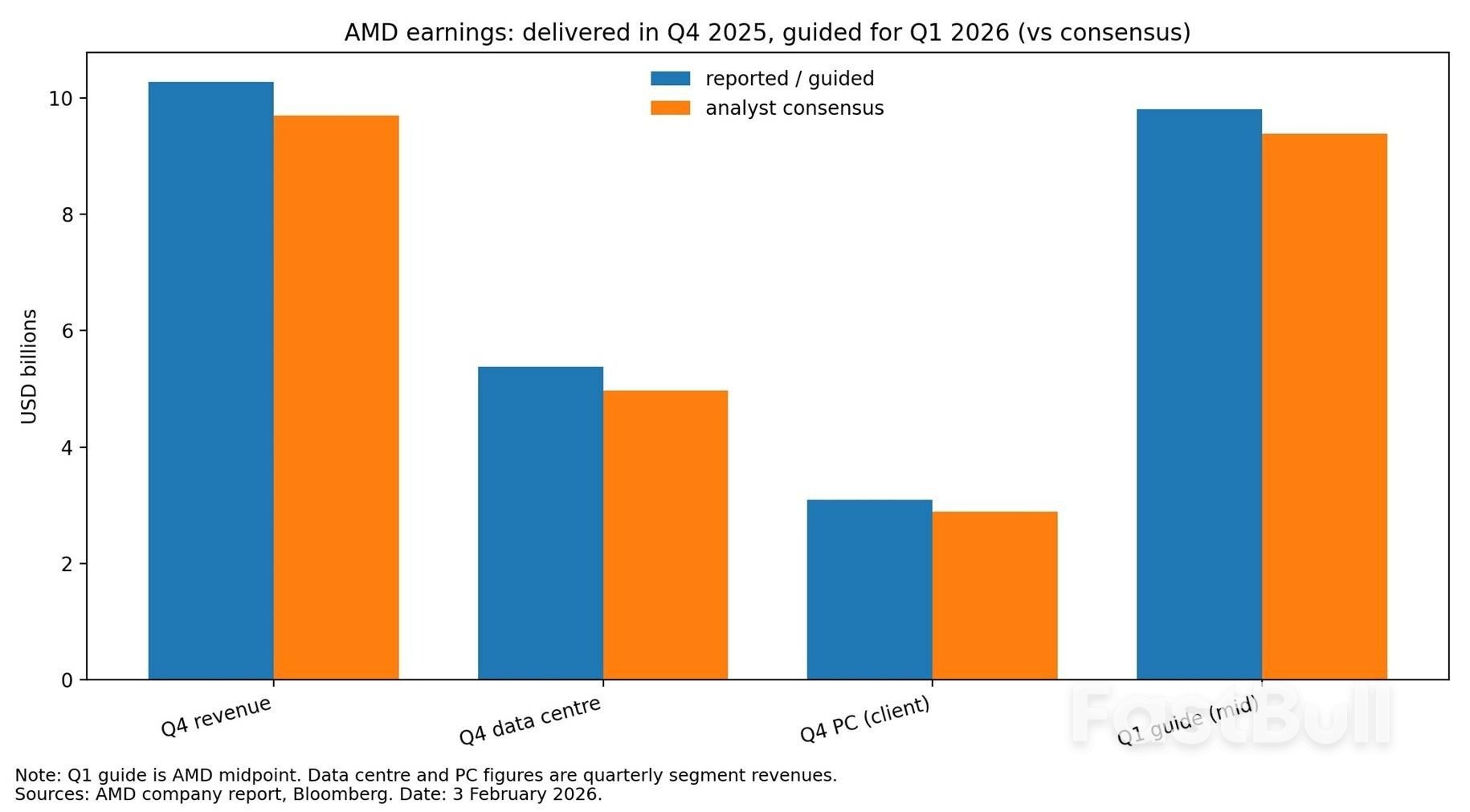

Key takeaways AMD beats on the quarter, led by data-centre strength, but investors focus on what comes next.

· AMD beats on the quarter, led by data-centre strength, but investors focus on what comes next.

· China-related AI chip shipments lift revenue, yet they also muddy margins and visibility.

· The key 2026 question is repeatability: more named deals, more volume, and clearer timing.

Late on 3 February 2026 in the US, and early 4 February 2026 in Europe, Advanced Micro Devices (AMD) reports a strong quarter. Then the share price falls in after-hours trading. That sounds contradictory, but it is actually very normal in the artificial intelligence era.

AMD's numbers say "we are executing". The market's reaction says "show me the next step". In plain terms: this is not a test of whether demand exists. It is a test of whether amd can turn demand into a predictable, repeatable business that investors can model with confidence.

That is the hook. Amd is trying to move from "credible challenger" to "credible alternative". The difference is not marketing. It is a steady flow of shipments, margins, and customer wins that do not require a footnote.

Start with what works. AMD reports fourth-quarter revenue of 10.3 billion USD and adjusted earnings per share (earnings per share is profit per share) of 1.53 USD. Data-centre revenue, the part most linked to artificial intelligence spending, rises 39% year on year to about 5.4 billion USD.

Data centres are the factories of modern software, and AMD is selling more machines into those factories. That matters because data-centre chips tend to be higher value than many consumer chips. It is also where long-term growth lives, because cloud companies and large enterprises keep building computing capacity.

The client side also improves. Pc-related revenue rises, helped by demand for newer pc chips and market share gains. This is not as fashionable as artificial intelligence, but it matters because it keeps the business balanced. AMD is at its best when it grows in data centres without needing the pc market to be perfect.

So why does the share price fall? Because earnings are not a history exam. They are a confidence exam.

AMD's quarter includes a material contribution from shipping older-generation Instinct MI308 data-centre graphics processing units (graphics processing units are specialised chips for heavy computing) to China. That adds revenue, and it shows AMD can operate inside export rules.

But it also creates two problems for the story investors want.

First, it can pressure margins. AMD itself points out that if you strip out both the inventory reserve reversal and the China MI308 shipments, adjusted gross margin would look lower than the headline suggests. In other words, some of the profit quality is not as clean as it appears at first glance.

Second, it reduces visibility. Those China sales are not guaranteed, and licensing for newer products remains uncertain. Management signals that China MI308 revenue falls sharply in the next quarter, which makes the near-term path bumpier.

This is not a "China is good" or "China is bad" issue. It is a "China is harder to forecast" issue. Markets dislike fog. They can handle rain.

For the first quarter of 2026, AMD guides to revenue of about 9.8 billion USD, plus or minus 0.3 billion USD. That is above the average Bloomberg analyst estimate. Yet the market reaction is negative.

The reason sits in expectations, not arithmetic.

AMD is in the shadow of a dominant rival in artificial intelligence chips. Investors are not only asking, "are you growing?". They are asking, "are you closing the gap fast enough to justify the valuation and the excitement?". Some investors were looking for a clearer acceleration, especially in the parts of the business tied to data-centre accelerators.

Management keeps a bullish long-term tone, including the idea that artificial intelligence revenue can reach the tens of billions of dollars in 2027. That might be true. The market simply wants a tighter bridge between today's shipments and that future claim.

Think of it like a new restaurant that promises it will be fully booked next year. Great. But investors still want to see the reservations for next week.

The first risk is an expectations gap. Artificial intelligence stocks can fall even on good results if the outlook does not match the market's imagination. The early warning sign is guidance that beats consensus but still fails to explain "why growth accelerates from here".

The second risk is margin noise. China mix, inventory adjustments, and product transitions can all move gross margin in ways that confuse investors. The early warning sign is a strong revenue print paired with cautious margin commentary.

The third risk is concentration. Big artificial intelligence deals often involve a small number of very large customers. That can produce lumpy quarters. The early warning sign is when growth depends on a few one-off shipments rather than a broad ramp across many customers.

· Watch data-centre revenue growth and margin commentary together. Growth without stable margins often triggers scepticism.

· Track product and platform milestones. Look for clear timelines on next-generation accelerators and systems, not only ambition.

· Listen for customer breadth. More named wins across cloud, enterprise, and public sector lowers "one big deal" risk.

· Separate "quarter quality" from "story quality". One can be strong while the other still needs proof.

AMD delivers a quarter that looks genuinely solid. Data-centre momentum improves, pcs rebound, and management sounds confident about demand. On paper, this is a company moving in the right direction.

But the share price reaction is a reminder of what artificial intelligence investing looks like in 2026. It is not enough to say the opportunity is huge. The market wants a clean chain from orders to shipments to margins, repeated quarter after quarter, with fewer special items and fewer "this part is complicated" footnotes.

AMD's challenge is simple to state and hard to execute: turn promise into a habit. When the receipts become boringly consistent, the stock reaction usually becomes boring too. That is often a compliment.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up