Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

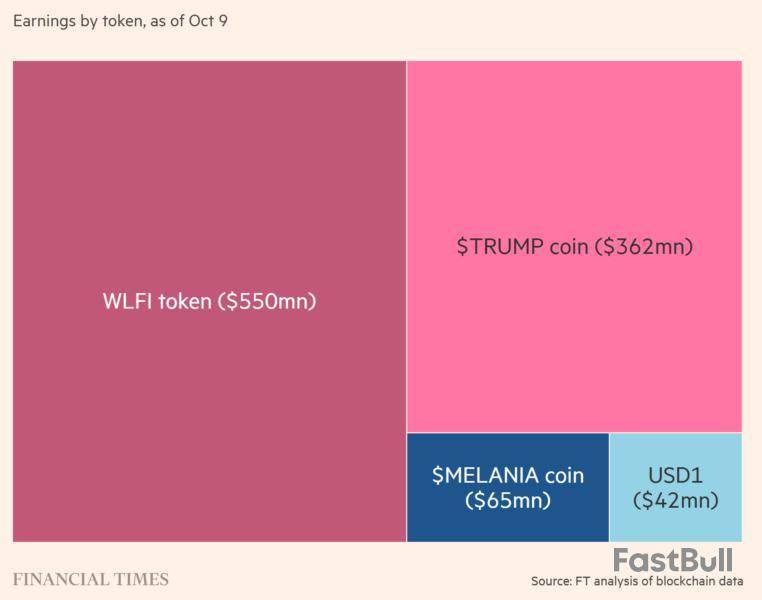

US President Donald Trump’s second term in office has coincided with an extraordinary rise in his personal wealth, much of it linked to a sprawling cryptocurrency empire built by the president and his family.

According to a Financial Times investigation, Trump’s crypto ventures have generated more than $1 billion in pre-tax profits over the past year. Trump’s son, Eric Trump, confirmed to the outlet that the family’s actual profits were “probably more.”

At the center of this new fortune is World Liberty Financial, a crypto firm founded by Trump’s sons and allies, which has sold billions of dollars in tokens and stablecoins. The project, whose website names President Donald Trump as “co-founder emeritus,” launched last year with plans for a crypto-lending app

In June, Trump disclosed $57.4 million in income from his involvement with World Liberty Financial. However, last month, the Trump family’s stake in the project surged to $5 billion after a token unlock. The FT estimates the family has earned $550 million from WLFI this year.

Trump family launches memecoins

The Trump family has also profited from memecoins like Official Trump (TRUMP) and Official Melania Meme (MELANIA), which collectively brought in hundreds of millions of dollars through sales and trading fees.

Per the FT report, the TRUMP memecoin has brought the family $362 million in profits while MELANIA has brought $65 million. Notably, the TRUMP memecoin is down by more than 90% from its all-time high, while MELANIA has performed even worse, down more than 99% from its high.

Finally, the Trump family has bagged $42 million from USD1, the stablecoin issued by World Liberty. Since its launch in early April, the Trump family-backed stablecoin has become the world’s fifth-largest stablecoin with a market cap of $2.68 billion, according to CoinMarketCap.

Meanwhile, Trump’s personal stake in Trump Media & Technology Group, the parent company of Truth Social and a Bitcoin treasury operation, is now valued at around $1.9 billion, according to the FT report.

On Wednesday, billionaire Peter Thiel–backed Erebor received preliminary regulatory approval to launch a bank aimed at serving crypto, AI and tech startups. The bank reportedly has ties to Trump.

Trump’s crypto ventures turn to treasury firms

Last week, it was reported that the startup behind Trump’s official memecoin is seeking to raise at least $200 million to build a digital-asset treasury aimed at buying back the token to shore up its value.

In August, ALT5 Sigma Corporation announced plans to raise $1.5 billion through the sale of 200 million common shares at $7.50 each to build out its WLFI corporate treasury.

The crypto market is down today, with the cryptocurrency market capitalization decreasing by 1.4%, rising to $3.88 trillion. Of the top 100 coins, 93 have dropped over the past 24 hours. At the same time, the total crypto trading volume is at $194 billion. TLDR:

At the time of writing, 9 of the top 10 coins per market capitalization have seen their prices decrease over the past 24 hours.

Bitcoin (BTC) decreased by 2.2% since this time yesterday, currently trading at $110,774.Bitcoin (BTC)24h7d30d1yAll time

Ethereum (ETH) is down by 4.4%, now changing hands at $3,993.

The highest drop in the category is 6.8% by Solana (SOL), which currently trades at $192.

It’s followed by XRP’s 5.5% to $2.39.

The only green coin is Tron (TRX), which appreciated 0.4% to the price of $0.3216.

Looking at the top 100 coins, we find 93 of them in red. Among these, Bittensor (TAO) is the reddest, having dropped 14.2% to $388.

Two more coins recorded double-digit drops: Aster (ASTER) with 12.8% and Story (IP) with 10%, now trading at $1.32 and $6, respectively.

On the other side, ChainOpera AI (COAI) is at the top, recording another substantial day of gains, with a rise of 53.1% to $24.

It’s followed by the only other two coins with increases over 0.5%: Provenance Blockchain (HASH) and Figure Heloc (FIGR_HELOC), which are up by 5.4% and 3.2% to $0.03561 and $1.02, respectively.

Meanwhile, a long-dormant Bitcoin wallet awoke on Thursday to transfer a whopping 2,000 BTC, worth about $222 million, into 51 new addresses. This has prompted discussion about whether early holders will be potentially selling or just shuffling their funds.

Just In: OG has moved 2,000 ($222.13M) into 51 new wallets.Of these, 50 wallets received 37.576 each, while one wallet received 121.18 . — Onchain Lens (@OnchainLens) ‘The Market Risks Deeper Contraction’

“Bitcoin’s rally to $126.1k reversed amid macro stress and a $19B futures deleveraging, one of the largest in history,” the Glassnode analysts in their latest report.

The renewed sell pressure was amplified by the trade threats from the US towards China.

Notably, the drop below the $117,000–$114,000 cost-basis zone put top buyers in the loss territory. It also exposed renewed market fragility.

Moreover, the weaker ETF inflows signal “fading institutional demand,” the report notes, while spot markets saw a sharp though orderly sell-off.

An Early Black FridayBitcoin’s rally to $126k reversed amid macro stress and a $19B futures wipeout. ETF inflows slowing and volatility spiking, the market enters a reset phase marked by a historic leverage flush.Read the full Week On-Chain below👇 — glassnode (@glassnode)

“This latest contraction is particularly concerning, as it marks the third instance since late August where Bitcoin’s spot price has dipped below the 0.95-quantile price model ($117.1k)—a level where over 5% of supply, primarily held by top buyers, sits at a loss,” say the analysts.

“Without a renewed catalyst to lift prices back above $117.1k, the market risks deeper contraction toward the lower boundary of [the $108.4k–$117.1k] range.”

Historically, when price fails to hold this zone, the report argues, “it has often preceded prolonged mid- to long-term corrections, making a sustained drop below $108k a critical warning signal of structural weakness.”

They concluded that “despite rapid stabilization, the market remains in a reset phase, where renewed ETF inflows and sustained on-chain accumulation will be key to restoring confidence and confirming a durable recovery.”Levels & Events to Watch Next

At the time of writing on Thursday morning, BTC trades at $110,774. Early in the day, the coin decreased to the intraday low of $110,392 from the intraday high of $112,697. It’s been trading sideways since that point.

A breakout above $114,600 could lead to the move toward $117,600. That may result in an increase to $119,800 and $120,000. On the other hand, BTC could drop to $109,500 and proceed towards the $100,000 level, possibly even dip below that level.Bitcoin Price Chart. Source: TradingView

Ethereum is currently changing hands at $3,993. It saw a plunge from the day’s high of $4,165 to the low of $3,944. The coin has been consolidating between $3,900 and $4,700 for the past several months.

There is still a chance for ETH to continue dropping towards the $3,700 level, followed by $3,550. On the other hand, it may break above $4,200 and rise toward $4,450.Ethereum (ETH)24h7d30d1yAll time

Meanwhile, the crypto market sentiment keeps dropping within the fear zone, reaching the lowest point in six months. The crypto fear and greed index has dropped from 37 yesterday to , the lowest value since April this year.

There is a notable increase in caution among investors and traders, which may push the prices down further. On the other hand, lower prices may also provide a buying opportunity.Source: CoinMarketCapETFs See Mixed Picture

The US BTC spot exchange-traded funds (ETFs) went back into the red on Wednesday, after a single day of inflows, with in outflows. The total net inflow is now down to $62.45 billion.

Of the 12 ETFs, two saw flows, and both are negative. Grayscale recorded outflows of $82.9 million, while Invesco let go of $11.1 million.Source: SoSoValue

However, the US ETH ETFs recorded in inflows on 15 October. The cumulative total net inflow now stands at $14.72 billion.

Two of the nine finds saw positive flows, and one saw negative flows. The highest among these is Bitwise’s $12.31 million, followed by Fidelity’s $996,440 million. At the same time, 21Shares let go of $7.98 million.Source: SoSoValue

Meanwhile, BitMine Immersion Technologies increased its ETH holdings on Thursday, acquiring 104,336 ETH, worth about $417 million. With the latest addition, the firm now holds roughly 3.03 million ETH, valued at about $12.2 billion. They aim to amass 5% of the coin’s total supply.

It looks like Bitmine() just bought another 104,336 ($417M).Over the past 7 hours, 3 new wallets received 104,336 ($417M) from and .Despite the crypto market crash, Tom Lee still predicts will hit $10K by year-end.… — Lookonchain (@lookonchain)

Furthermore, the US Office of the Comptroller of the Currency (OCC) has granted preliminary conditional approval to Erebor Bank, a new financial institution/bank backed by major players Peter Thiel, Palmer Luckey, and Joe Lonsdale.

The OCC granted preliminary conditional approval to Erebor Bank after thorough review of its application. In granting this charter, the OCC applied the same rigorous review and standards applied to all charter applications. — OCC (@USOCC) Quick FAQ

The crypto market has decreased over the past day, and the stock market saw a mixed picture on Wednesday. By the closing time on 15 October, the S&P 500 was up by 0.4%, the Nasdaq-100 increased by 0.68%, and the Dow Jones Industrial Average fell by 0.037%. The stock market has turned lower due to the US President’s trade threats against China.

It’s likely that we will continue to see the market fluctuate in this period of increased market volatility.You may also like:(LIVE) Crypto News Today: Latest Updates for October 16, 2025Crypto prices continued to fall across most sectors as the entire crypto market lost 1.2% in the past 24 hours, but the AI sector stood out with a second straight day of gains, rising 4.51% in the past 24 hours. ChainOpera AI (COAI) led the rally, soaring 56.47% after a 25% jump yesterday. In contrast, the leading crypto Bitcoin (BTC) declined 1.29% to below $112,000, while Ethereum (ETH) dropped 2.60% to around $4,000. Other sectors remained under pressure, CeFi fell 1.99%, DeFi slid 3.89%,...

Tron price has emerged from a turbulent September and October with a renewed sense of optimism, delivering a 1.12% price gain in the past 24 hours to $0.322. This short-term bounce stands out against a week-long pullback of -5.07% and a steeper monthly loss of -6.93%, signaling potential for a technical rebound. What’s driving this change in sentiment? First, Tron’s oversold RSI and accumulating Futures CVD data.

Moreover, the SRM merger, which lands Tron’s ecosystem a Nasdaq listing and institutional spotlight, has further bolstered market confidence. Beyond technicals, the network’s dominant position as the leading stablecoin settlement chain, with more than $80 billion USDT hosted and a record $15.6 trillion in transfers last quarter. Intriguing isn’t it? Join me as I decode the potential TRX price targets.

Tron TRX Price Analysis

At press time, the TRX price hovers at $0.3217, up 1.05% since yesterday, with a market capitalization of $30.45 billion. Trading volume sits at $1.19 billion, marking a noticeable 9.82% daily decrease. Yet liquidity remains robust around the $0.31–$0.32 range, which is a proven demand zone since August 2025. This is where buyers have consistently stepped in, even after TRX’s sharp 8.27% slide over the past two months.

The RSI at 39.16 has now exited oversold territory, confirming that recent selling fatigue is fading. Derivatives traders, meanwhile, are accumulating positions, evidenced by the 90-day Futures Taker CVD uptick.

Looking ahead, the crucial resistance to watch is $0.335, matching the 38.2% Fibonacci retracement level. If Tron can close above this mark, $0.354 emerges as the next target for bullish momentum. Conversely, any drop below $0.30 could spur a retest of yearly lows, which is a risk for short-term bulls.

FAQs

Is TRON crypto a good investment?Tron boasts deep stablecoin adoption and strategic partnerships, offering utility and upside for risk-tolerant investors; however, its price does display volatility, so use judicious entry points.

Will TRON reach $10?With the current market cap and supply, a $10 price target appears highly unrealistic without extraordinary, world-changing adoption and blockchain integrations.

Will TRON reach $1 in 2025?As per our TRX price prediction, Tron could surge to a maximum of $0.75 by the end of 2025

How much will TRON be worth in 5 years?The price of 1 TRX token could be a maximum of $3.55 by the end of 2030.

Recently, social media and crypto forums have been flooded with sensational claims that Alibaba founder Jack Ma is “building a strategic Ethereum reserve.” The news rapidly took hold across X, YouTube, and crypto influencer channels, with many asserting that Ma’s reported ETH holdings could mark one of the largest corporate or private accumulations of Ethereum in Asia.

But how credible is this claim, and what do the facts actually show?

Where Did This Claim Come From?

The claim emerged after several viral posts on X around October 13, 2025, from influential accounts like MerlijnTrader & Crypto Rover, claiming that “Jack Ma is building a strategic Ethereum reserve.”

These posts quickly gained traction, citing unnamed sources and market optimism.

Fact Check: What’s Actually True?

Jack Ma Firm Purchased Ethereum

Yunfeng Financial, a company co-founded by Jack Ma and David Yu, confirmed in regulatory filings that it had indeed purchased 10,000 Ethereum, worth about $44 million—on the open market in early September 2025.

The move was described as part of a strategic Web3 and blockchain investment initiative aimed at exploring decentralized infrastructure, not specifically for strategic reserve.

No Direct Evidence of Personal Accumulation

There is no on-chain proof, company filing, or public statement verifying that Jack Ma personally owns or is “building a strategic reserve” of Ethereum. Binance posts mentioning “Jack Ma’s Ethereum reserve” appear to interpret Yunfeng Financial’s acquisition rather than confirm a personal one.

Social Media Claims Lack Official Verification

The viral claims originated solely from influencer accounts and Telegram news channels without any corroboration from Alibaba, Ant Group, or Ma’s representatives.

The post by MerlijnTrader, which first popularized the rumor, included no wallet addresses, institutional confirmations, or official documents linking the ETH purchases to Ma personally.

Summary Table: Coinpedia’s Evidence Against the Theory

| Claim Made by Theory | Coinpedia’s Counter-Evidence |

| Jack Ma is building an Ethereum reserve | ❌ No confirmed or verifiable evidence supports this claim. |

| Social media posts confirmed Ma’s involvement | ❌ False—claims originated from influencers without official proof |

| Yunfeng Financial (Ma-linked company) purchased Ethereum | ✅ True—Yunfeng bought 10,000 ETH (~$44M) for Web3 investments |

Conclusion

| Claim | Jack Ma is building a strategic Ethereum reserve. |

| Verdict | ❌ False |

| Fact-Check by Coinpedia | As per Coinpedia research and a review of official sources, there is no credible or verifiable evidence linking Jack Ma is building a “strategic Ethereum reserve” Until an official statement is released by either Jack Ma or the Yunfeng firm, this remains just a rumor. |

On October 20, 2025, the crypto market saw a major flash crash that sent Bitcoin down 20%, and altcoins suffered between 50% and 80% losses as a result. Reports from data trackers show that more than $19 billion in leveraged positions were liquidated as a result. This led to the largest liquidation event in the crypto industry up until that point, leading to comparisons and speculations that this could be a repeat of the infamous COVID-19 crash of 2020.

What It Means For Bitcoin And Crypto If This Is A Repeat Of 2020

One of the key crypto players who has pointed out that the current cycle could be similar to that of 2020 is crypto analyst Rekt Fencer. Fencer took to X (formerly Twitter) to share with their over 330,000 followers, a side-by-side chart showing the 2020 performance compared to what is happening now in 2025.

To put this in perspective, back in 2020, the crypto market suffered a flash crash where the Bitcoin price fell by more than 50%, and the altcoin market followed. This was a result of the COVID-19 lockdowns that were announced around the world in a bid to curb the spread of the virus.

In response to the shutdowns, the stock market had crashed, taking Bitcoin and the crypto market down with it. This led to over $1.2 billion in daily liquidation, which at the time was the most significant liquidation in crypto history. However, this figure now pales in comparison to the over $19 billion in liquidations that were recorded last week.

Despite the disparity in the liquidation volumes, crypto analyst Rekt Fencer believes that this could lead to a repeat of what happened after the COVID-19 crash. Back then, the bounce from the crash had been rapid. By 2021, one year later, the entire crypto market had risen to new all-time highs.

Taking that performance and using it to map out the Bitcoin and crypto market performance after last week’s crash, it would mean that the market is ready for another bull run. It would also put the market at the bottom of the bull run, meaning that the Bitcoin price is far from its all-time high price.

Rekt Fencer explains that “History is about to repeat itself” and “The real move starts when everyone thinks it’s over.” Thus, another explosive rally could be right on the horizon, if this isn’t the start of a bear run.

The cryptocurrency community has been abuzz with debate over the Bitcoin Core v30 upgrade and Knots implementation. JAN3 CEO Samson Mow has joined the conversation with a cryptic post that sheds light on how the debate could harm the coin.

Samson Mow warns against internal threats to Bitcoin

In a post on X, Mow stated, “The best attack on Bitcoin is one you don’t think is an attack.”

Mow suggests that the ongoing debates are not contributing to the improvement of Bitcoin as an asset but rather a subtle way to erode trust in it. He considers the back and forth as an effective attack on the flagship crypto asset, disguised as trying to seek what is best for the ecosystem.

However, Samson Mow believes that such debates and actions that appear harmless, and are not a direct "attack" like an obvious ban or hack, are the most dangerous. For instance, if there is a regulatory issue regarding Bitcoin, the community could mobilize and hire a legal team to defend against it.

In the case of the ongoing debate, Mow’s opinion is that it is dividing the community against itself and is not in the overall interest of the project.

It is worth mentioning that, recently, the Bitcoin Core v30 upgrade proposed the removal of spam filters and OP_RETURN limits. Some developers in the space consider it as enabling abuse and the distribution of child sexual abuse material (CSAM).

On the other side of the divide are notable figures like Luke Dashjr, who argues that Knots offers better protection against malicious attacks.

Mow’s remark is a reminder to the Bitcoin community to remain vigilant against complacency. He is warning that members of the community should not quietly erode Bitcoin principles under the guise of progress or convenience.

Bitcoin faces market volatility amid internal debate

Users have also reacted to the development, with one noting that the first step to destroying a system is to initiate a change and dismiss it as not being important. He noted that trying to silence people for raising concerns about such change does no good to the ecosystem.

Meanwhile, as the debate continues in the community, Bitcoin is facing a performance challenge, with its yearly return standing at a low 18.45%. Some fear that if nothing significant happens, Bitcoin might post its fourth-worst year-to-date figures.

As of press time, Bitcoin is changing hands at $110,888.48, which represents a 1.92% decline in the last 24 hours. It dropped from an intraday peak of $113,154.63 as large-holder activity triggered fears of possible sell pressure. Trading volume has also suffered a 20.97% decrease to $68.7 billion.

India’s largest telecom operator, Reliance Jio, has entered a partnership with Aptos Labs and Aptos Foundation. The collaboration is set to launch a blockchain-based rewards system for Jio’s 500 million subscribers.

Jio Partners With Aptos

The main goal of this partnership is to launch the digital rewards known as JioCoin into Jio’s consumer services through Aptos Layer 1 blockchain. That way, blockchain services will enter into daily life utility and not just for speculative tokens or memecoins. The initiative is currently in a beta testing phase with approximately 9.4 million users

This will also boost user interactions on both platforms, as Aptos’ high-speed, low-cost infrastructure will enhance Jio’s utility. In return, the mobile network operator will boost Aptos’ visibility to attract more users. This was announced at the Aptos Experience event held on October 15, 2025..

Aptos said, “Reliance Jio will leverage Aptos’ high-performance network to deliver blockchain-based rewards directly to users, building on Jio’s ongoing efforts to provide advanced technology to daily customer experiences.”

Why This Matters

This move is a great milestone for India’s blockchain landscape, as the Aptos collaboration could be a blueprint for Web3 adoption. India has already topped the crypto adoption chart of 2025, and this move will further strengthen the country’s position in becoming a global crypto hub.

Jio chose Aptos for this initiative because of its reliability, secure environment, developer tools, and ability to handle massive transaction volumes for consumer-grade blockchain applications. This move expands Jio’s strategy of enhancing digital innovation. The network has already shown its efforts in evolving AI, 5G, cloud, and financial services, positioning itself as the leader in the digital ecosystem.

Earlier this year, in January, Jio partnered with Polygon Labs to integrate Web3 capabilities into its services. By integrating the infrastructure, Jio aimed at leveraging seamless payments, decentralized data control, with enhanced privacy security for its users.

FAQs

What is the Jio and Aptos partnership about?Reliance Jio is partnering with Aptos Labs to launch a blockchain-based rewards system, using JioCoin, for its 500 million subscribers to integrate Web3 into daily services.

How will JioCoin benefit Jio users?JioCoin will offer digital rewards directly within Jio’s services, moving beyond speculation to provide tangible utility and value for everyday customer experiences.

How does this partnership impact blockchain adoption in India?This collaboration is a major milestone, providing a blueprint for mainstream Web3 adoption in a country that already leads in global crypto adoption.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up