Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Truth Social, the social media network owned by Trump Media, has denied it is launching a memecoin following circulating rumors on social media.

“Contrary to rumors, Truth Social is not launching a memecoin,” the official Truth Social account posted on its platform. The social media platform is owned by the Trump Media & Technology Group, with US President Donald Trump owning a majority stake in the company.

“There’s no truth whatsoever about Truth Social launching a memecoin. Don’t be fooled by false information people are circulating,” Donald Trump Jr., the eldest son of President Donald Trump, stated on X.

The rumors started circulating after influencer Ran Neuner, who hosts the Crypto Banter podcast, tweeted that a Truth Social token will be launched within the next 72 hours and that it appears to be backed by a similar team involved with the launch of the TRUMP token.

Cointelegraph reached out to Neuner to find out more about the source of the claim, but did not receive a response by the time of publication.

Trump is no stranger to memecoins and crypto plays

The US president is known for his pro-crypto stance and has launched his own TRUMP token, while first lady Melania Trump launched a MELANIA token.

However, Trump has found himself amid controversies after announcing that the top tokenholders of the TRUMP token will be invited to a special gala dinner on May 22.

The move drew criticism from many, including many US senators, who had previously demanded that Trump be impeached for launching the TRUMP token.

Meanwhile, a Bloomberg report indicated that the vast majority of the top holders of the TRUMP token might not be from the US, sparking concern from US lawmakers.

According to the latest data, 220 wallets held more than 13.7 million TRUMP tokens, worth approximately $174 million at the time of publication.

While it is unclear who the top holders are, wallets with the names of “Sun” and “elon” appear to reference Tron founder Justin Sun and Tesla CEO Elon Musk, both of whom are Trump supporters.

The TRUMP token is down more than 80% after hitting an all-time high of $73.43 on Jan. 19. However, the token is up nearly 14% in the past 7 days and is currently trading at $12.52, according to CoinGecko.

Japanese firm Metaplanet has announced that it is issuing $15 million in ordinary bonds, with funds dedicated to acquiring Bitcoin .

The decision signals its intention to double down on its accumulation strategy, shrugging off BTC’s latest price dip from its multi-month high of $105,000.

Metaplanet’s $15 Million Bet on Bitcoin

According to the official disclosure, the bonds carry a 0% interest rate and are set to mature on November 12. They are valued at $375,000. Metaplanet’s latest bond issuance aims to push its holdings closer to its target of 10,000 Bitcoins by the end of 2025.

If the firm raises the full $15 million, it could acquire approximately 147 BTC at current prices. This move follows its acquisition of 1,241 Bitcoin yesterday, valued at $126.7 million, bringing its total holdings to 6,796 BTC.

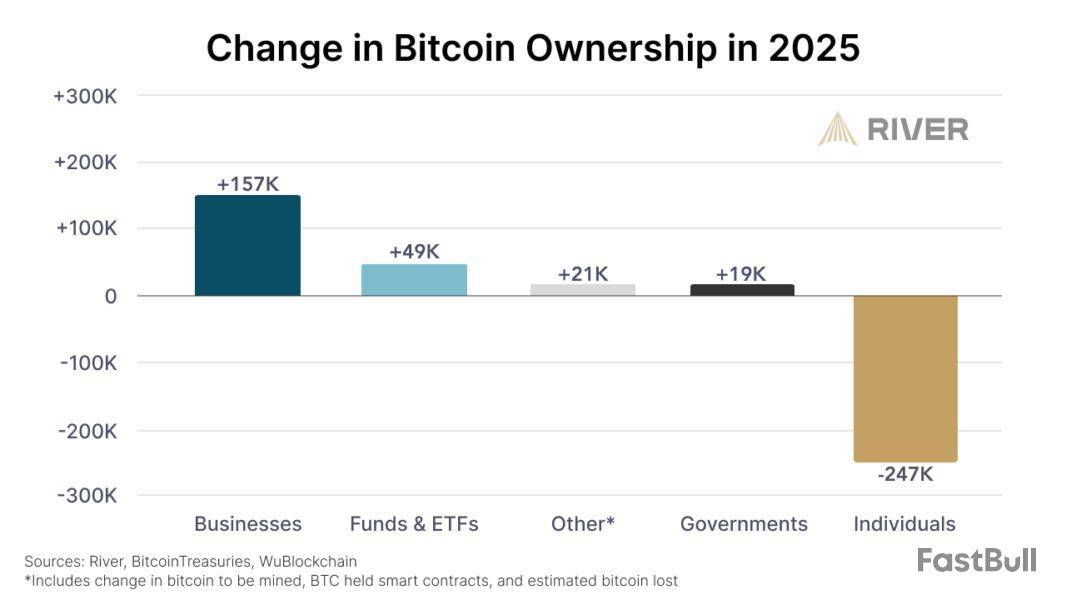

This strategy aligns with a broader trend in 2025: a shift in Bitcoin ownership from individual investors to institutions and governments. According to data from River, businesses are now the leading buyers of Bitcoin, even outpacing governments and exchange-traded funds (ETFs).

“Businesses are the largest net buyer of bitcoin so far this year, lead by Strategy which makes up 77% of the growth,” the post read.

Strategy — previously known as MicroStrategy — continues to spearhead this trend. The company disclosed on May 12 that it had acquired 13,390 BTC for $1.34 billion. The coins were purchased at an average price of $99,856 per coin.

This addition increased Strategy’s total Bitcoin holdings to 568,840 BTC, acquired at an average cost of $69,287 per coin.

Still, not everyone views this plan as sustainable. Economist and Bitcoin critic Peter Schiff took to X to caution against the potential fallout.

“You next buy will likely push your average cost above $70,000,” Schiff wrote.

He stressed that if Bitcoin’s price falls again, it could dip below Strategy’s average purchase price for their coins. Since Strategy borrowed money to fund these acquisitions, a price drop could be problematic.

If forced to sell their holdings to repay debt, the losses would become “real” instead of just theoretical. This magnifies the risk of leveraging Bitcoin, especially when the market is volatile.

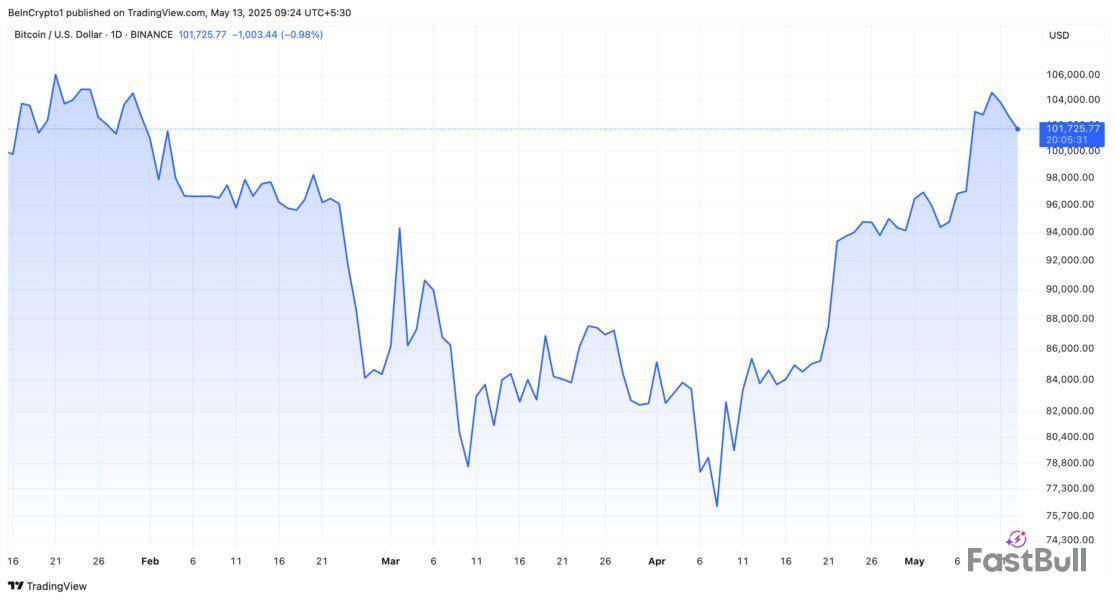

This warning comes amid BTC’s latest dip. On May 12, the price pumped to highs last seen on January 31 after the US and China agreed on a 90-day tariff deal.

Nevertheless, after peaking at $105,705, Bitcoin tumbled. It quickly shed 3.7% of its gains to trade at $101,725 at press time. Despite this, analysts remain optimistic that the current rally still has room to grow and could propel BTC to all-time highs.

Cardano price started a fresh increase above the $0.750 zone. ADA is now correcting gains from $0.8650 and testing the $0.7750 support.

Cardano Price Dips To Support

In the past few days, Cardano saw a fresh increase above the $0.750 level, like Bitcoin and Ethereum. ADA was able to clear the $0.7750 and $0.80 resistance levels.

It tested the $0.8650 zone. A high was formed at $0.8634 and the price recently corrected some gains. There was a move below the $0.80 level. Besides, there was a break below a connecting bullish trend line with support at $0.820 on the hourly chart of the ADA/USD pair.

The pair tested the $0.7750 zone. A low was formed at $0.7742 and the price is now consolidating below the 23.6% Fib retracement level of the recent decline from the $0.8634 swing high to the $0.7742 low.

Cardano price is now trading below $0.80 and the 100-hourly simple moving average. On the upside, the price might face resistance near the $0.80 zone. The first resistance is near $0.8180. The next key resistance might be $0.8450.

If there is a close above the $0.8450 resistance, the price could start a strong rally. In the stated case, the price could rise toward the $0.880 region. Any more gains might call for a move toward $0.90 in the near term.

More Losses in ADA?

If Cardano’s price fails to climb above the $0.80 resistance level, it could start another decline. Immediate support on the downside is near the $0.7750 level.

The next major support is near the $0.740 level. A downside break below the $0.740 level could open the doors for a test of $0.7050. The next major support is near the $0.680 level where the bulls might emerge.

Technical Indicators

Hourly MACD – The MACD for ADA/USD is losing momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for ADA/USD is now below the 50 level.

Major Support Levels – $0.7750 and $0.7400.

Major Resistance Levels – $0.8000 and $0.8180.

Bitcoin has continued its upward trend, recording a weekly price increase of 10.4% and currently trading at $103,881. The asset has surged over 24% in the last month, fueled by growing optimism across both crypto and traditional markets.

Although still about 4% below its January all-time high, the latest developments suggest that bullish momentum may be building again. This renewed price strength appears to be supported by significant capital movements, including a notable Bitcoin outflow from the Binance exchange.

Bitcoin Exchange Outflows Suggest Accumulation Phase

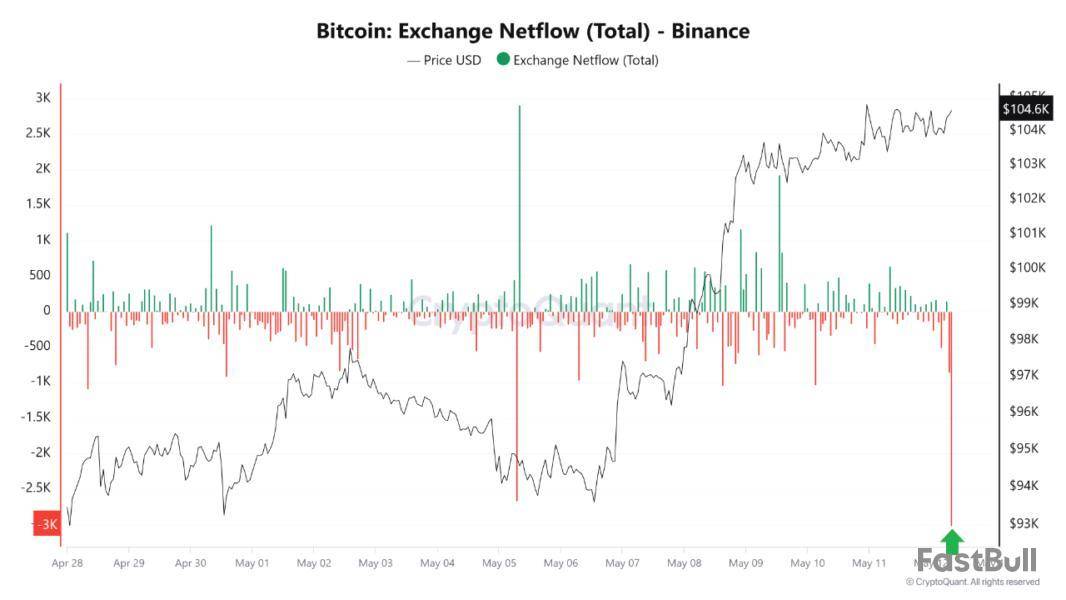

According to recent data shared on CryptoQuant’s QuickTake platform by analyst Amr Taha, over 3,000 BTC, valued at approximately $312 million, was withdrawn from Binance on May 12, marking one of the largest daily outflows in recent months.

This coincided with a key macroeconomic development: a new trade agreement between the United States and China, which also sparked a sharp rebound in US equity markets, with the S&P 500 jumping more than 3%.

Taha’s analysis indicates that this substantial Bitcoin withdrawal is part of a broader trend. Binance’s BTC reserves have declined consistently, falling from approximately 595,000 BTC in late February to 541,400 BTC by mid-May.

The ongoing reduction in exchange balances typically signals a preference among investors for cold storage solutions or private wallets. Historically, such moves are viewed as indicative of accumulation behavior, suggesting lower near-term selling pressure and a more bullish medium-term outlook.

The timing of the withdrawal, immediately following a geopolitical breakthrough between two of the world’s largest economies, adds further context. Taha highlights that capital markets responded positively to the easing of US-China tariff tensions, and the corresponding activity in the crypto space suggests Bitcoin investors are aligning their strategies accordingly.

With macro uncertainty temporarily subdued, large holders appear to be repositioning for potential future gains, removing liquidity from exchanges to mitigate exposure and reduce immediate sell-side pressure.

Macro Trends Influence Market Positioning

The analyst further noted that market participants seem to be increasingly responsive to macro signals. The scale of the BTC withdrawal on May 12, paired with rising equity markets, illustrates how capital is shifting across asset classes in response to broader economic developments.

Taha suggests this coordinated movement reflects renewed risk appetite and a possible recalibration of investor strategies in light of improving global trade dynamics.

While it remains to be seen whether this momentum can be sustained, recent patterns support the view that long-term holders and institutional participants are gaining confidence in Bitcoin’s role within a diversified investment strategy.

As traditional markets recover and geopolitical risks ease, Bitcoin’s reduced exchange reserves and growing off-exchange holdings may lay the groundwork for another test of its all-time high. The coming weeks will likely be crucial in determining whether current inflows translate into a full-scale breakout or a period of consolidation.

Featured image created with DALL-E, Chart from TradingView

Blockasset’s first airdrop for Season 1 may cause a quick price move. Airdrops often bring excitement, as users get free tokens. This can quickly push up volume and price if new users join. Still, some may sell their free tokens fast, which can cause the price to drop after the first jump. The real effect will depend on how big the airdrop is and if there are rules to keep people from selling right away. The project’s plans for future airdrops are also important. source

BlockBet 20% Cashback Live@BlockBetGGMay 12, 2025The final grind is on...

Airdrop season one. First drop coming May 31st. pic.twitter.com/kJVGocfRbi

The launch of Moon Tropica’s game is a big step for the project. Game launches can bring new users and attention. If the game is liked, it may bring more investment to the CAH token. This extra interest could cause the price to rise fast. However, if people do not enjoy the game, or if there are problems, the price could also drop. The true price effect will depend on players’ first experiences and the number of people taking part. Watch how the community reacts for an early sign of price moves. source

Kennie@crypto_kennieMay 12, 2025It's almost time, mark your calendars$ETH is picking and $CAH is dropping the game at the perfect time

⁰Get ready………

CAHBOOOOMMMMMM https://t.co/bWkT8znKkl

Hydranet’s Web DEX Alpha move from closed to public means everyone can now use and test the service. For traders, opening the doors to more people could mean more activity and higher demand for the HDN token. If the alpha shows strong interest and users like it, the price may rise because of higher trust in the project. But if problems with the service are found, or if people do not use it, this could limit or hurt the price move. User feedback after launch will be important. source

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up