Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

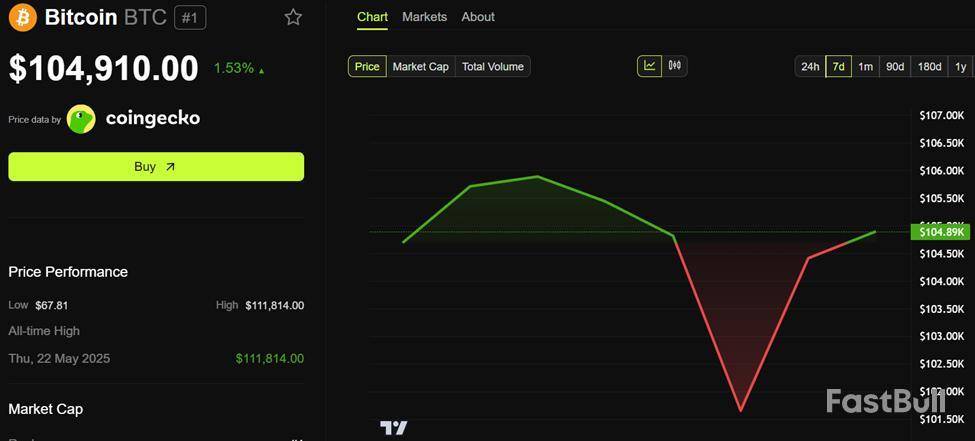

US President Donald Trump has reignited discussions about replacing Federal Reserve (Fed) Chair Jerome Powell. This has sparked waves across traditional and crypto markets, with Bitcoin poised to reclaim $105,000.

The implications are significant, extending beyond monetary policy to the trajectory of Bitcoin, altcoins, and macro risk sentiment globally.

Trump’s Phantom Fed Chair Plan Shakes Markets

On June 6, Trump stated that his pick for the next Fed Chair is “coming out very soon,” even though Powell’s term does not officially end until May 2026.

The move would amount to a political earthquake in monetary policy circles, with Trump preparing to install a “phantom” Fed Chair-in-waiting.

Two months ago, when Trump first suggested firing Powell, the US Dollar Index (DXY) tumbled, sending Bitcoin soaring. As BeInCrypto reported, Bitcoin rallied hard as the market priced in looser monetary policy and declining confidence in Fed independence.

When Trump backpedaled in late April, Bitcoin briefly corrected, illustrating how tightly crypto assets are now tied to Fed credibility and Treasury policy.

“I have no intention of firing him…I would like to see him be a little more active in terms of his idea to lower interest rates,” Reuters reported, citing Trump telling reporters in the Oval Office on Tuesday.

Now that the Powell replacement narrative is back on the table, Bitcoin is again flashing volatility.

“This could shake markets big time. It might spark a crypto bull run or cause big drops,” said Rananjay Singh, founder of TodayCrypto.

Can Trump Even Fire Powell?

It is worth noting that legally, Trump cannot outright fire Powell as Fed Chair unless he explores legal loopholes. The Federal Reserve Act only allows a sitting Fed Chair to be removed “for cause,” which has historically meant ethical violations or gross misconduct.

However, Trump could nominate Powell’s successor well before the 2026 deadline, a strategy Scott Bessent of Key Square Capital suggested.

“…the nominee would have to wait to chair the central bank’s powerful Federal Open Market Committee, which sets one of the nation’s most important interest rates…that person’s guidance, predictions, and potential criticism of the Fed’s actions would weigh heavily on financial markets,” explained Jon Herold.

Bessent is also the United States Secretary of the Treasury. Trump has reportedly been exploring whether to fire the Fed chair.

Despite legal loopholes, some say removing him without cause would trigger legal and market chaos.

What a New Fed Chair Would Mean for Bitcoin and Altcoins

Geoff Kendrick, Head of Digital Asset Research at Standard Chartered, recently told BeInCrypto that Bitcoin is no longer just a hedge against inflation. Rather, it is now a hedge against traditional finance (TradFi) and Treasury risk.

“The threat to remove US Federal Reserve Chair Jerome Powell falls into Treasury risk—so the hedge is on,” Kendrick told BeInCrypto.

With monetary uncertainty rising, Bitcoin is increasingly viewed as a decentralized alternative to fiat-controlled systems. This is especially true in times of political interference.

“If ‘Too Late’ at the Fed would CUT, we would greatly reduce interest rates, long and short, on debt that is coming due. Biden went mostly short term. There is virtually no inflation (anymore), but if it should come back, RAISE “RATE” TO COUNTER. Very Simple!!! He is costing our Country a fortune. Borrowing costs should be MUCH LOWER!!!” Trump wrote on Truth Social.

Trump feels the US would do better economically without Powell, sentiments amid rising debt. Against this backdrop, experts say Bitcoin presents as a life raft. Based on this outlook, the pioneer crypto is making a play to reclaim the $105,000 threshold.

Meanwhile, the implications extend beyond Bitcoin. Altcoins, which have lagged in 2025 amid quantitative tightening (QT) and muted rate-cut expectations, could finally get the green light for a rally.

“This is the most important news for altcoin holders. The primary reason behind altseason delay is the QT program and less rate cuts. But this might change soon… the new FED chair will definitely fulfill [Trump’s] demands. Altseason is coming,” wrote analyst Cas Abbé.

A Trump-aligned Fed Chair would likely advocate aggressive rate cuts, loosening financial conditions, and enabling the kind of liquidity that fuels crypto bull markets. Still, the potential downside remains.

“That day will be the black swan event globally if it happens,” World of Finance, a popular account on X, warned.

The move could usher in a new bull run or trigger systemic shocks.

One of the reasons that the altcoin season seemed to not have begun until now is the fact that Bitcoin has dominated the market recovery, and thus, the BTC dominance remains very high. For the altcoin season to actually begin, past market performances show that there needs to be a major decline in the Bitcoin dominance. This is the ultimate trigger the market needs to confirm that altcoins will begin their own independent run.

Bitcoin Dominance Needs To Fall To 62%

The Bitcoin dominance is still trending at a high 64%, and this continues to be a thorn in the side of altcoins. With the dominance this high, the Bitcoin price continues to dictate where the market goes and has seen altcoins suffer crashes as a result of even the tiniest movement triggering a decline in prices.

However, crypto analyst Quantum Ascend has pointed out an interesting formation in the chart, which is a 7-wave crashing pattern. This pattern has been completed, and this signals a possible drop in the Bitcoin dominance as time goes on. The last phase of the 7-wave pattern was when the dominance hit a peak of 64.6% before declining back down toward 64%.

This pattern suggests that the Bitcoin dominance could possibly drop to 62%, which would be good news for those waiting for the altcoin season. The last time that the dominance was this low was back on May 14, and altcoins had rallied hard as a result.

For this decline to be completed, the crypto analyst reveals that confirmation lies below 63.45%, as this is the Wave 6 lows. Once this support is broken, a sharp drop toward 62% is expected from here. As the analyst explains, “real momentum kicks in under 62%,” and this is when altcoin season moves with full force.

Altcoin Season Is Not Over

The topic of a possible altcoin season is currently one of the most debated in the crypto community as market participants remain split on where it is in the cycle. Some have said there will be no altcoin season similar to what was seen in 2021, while others have maintained that it is still possible.

One analyst on the X (formerly Twitter) platform has lent their voice, pushing the narrative that the altcoin season is far from over. For a 2021-style altcoin season to happen, though, the crypto analyst says the altcoin market, which excludes the top 10 cryptos by market cap, must break above the $470 billion resistance like it did in previous cycles. Once this happens, then they expect the altcoin season to begin.

XRP in the last 24 hours rebounded from $2.15 to over $2.17 as the asset signals a growing recovery in the market space. Despite this development, XRP’s death cross remains at play and is expanding as the MA Cross indicator teases.

XRP's volume declines undermine price action

CoinMarketCap data shows that investors have pulled back from transacting XRP within this period. The trading volume has suffered a massive 49.55% decline to $1.74 billion.

This suggests that the slight price increase could have been triggered by speculative news about XRP and not substance-driven. More market participants might have been interested if volume had aligned with the price increase.

However, XRP’s death cross, confirmed in late May, appears to affect the asset still. Notably, the death cross is a bearish technical pattern that suggests a potential decline in price due to weakening short-term momentum.XRP Daily Chart With MA Cross | Source: TradingView/CoinMarketCap">

XRP’s recent 1.58% price increase might be considered a short-term recovery, as volume has stayed in the red zone. Additionally, XRP must break out above critical resistance levels such as $2.40 and $2.50.

If the asset can find stability above $2.50, it could help invalidate the bearish death cross that has kept it below $2.30 since the last days of May 2025. As of this writing, XRP was trading at $2.18.

Bullish sentiment builds despite price resistance

Despite XRP’s current performance, community sentiments remain bullish. Many anticipate that XRP could still break out in a pattern similar to its 2017 cycle. These optimists are convinced that XRP is consolidating and could break out at another mega rally soon.

XRP veterans predict this upward movement could occur in the next three or four weeks. However, for this to happen, XRP needs stability above $2.50.

XRP chart analysis shows that the asset needs to break the $2.20 resistance zone and above it to avoid slipping below the $2 level again. How XRP manages this will interest investors and the broader market.

Over the last two weeks, Bitcoin has rallied to a new high of $111,800, briefly exceeding the previous all-time high set in January 2025. However, this gain was followed by a retracement, implying a possible pause in bullish momentum.

With signs of older investors selling, the bulls now confront a crucial test of their resolve.

According to Glassnode, the STH cost basis now stands at $97,100, which represents the average entry price for recent buyers. The +1 standard deviation band, which is generally associated with overbought or bullish breakout conditions, is at $114,800, while the -1 standard deviation band at $83,200 indicates an elevated level of downside risk.

glassnode@glassnodeJun 07, 2025With $BTC recently changing hands near ATHs, the Short-Term Holder Cost Basis offers key insight. It sits at $97.1k, with key thresholds (based off standard deviation bands) at $114.8k (+1σ) and $83.2k (–1σ). A breakout or breakdown from this range could define the next major… pic.twitter.com/nayH2TT6VX

As profit-taking by long-term holders began to weigh on momentum, these three levels, $114,800, $97,100 and $83,200, now define the statistical boundaries of short-term sentiment. A break above or below these levels might likely shape the next leg of the market direction, indicating whether momentum is returning or fading.

Key levels to watch

BTC reached a new all-time high of nearly $112,000 on May 22. According to Glassnode, the rise appears to be spot-driven, with probable support in accumulation zones of $81,000 to $85,000, $93,000 to $96,000 and $102,000 to $104,000.

Based on the CBD heat map per Glassnode, many historical accumulation zones have flipped into distribution zones. Sellers in the $25,000 to $31,000, $38,000-$44,000 and $60,000-$73,000 ranges are now weighing on price action.

Cost basis quantiles and short-term holder bands indicate immediate support near $103,700 and $95,600, with resistance at $114,800. These levels are statistically significant markers of broader sentiment shifts.

Notably, top buyers from Q1, 2025, who held through the downturn below $80,000, are now again being tested as the market moves sideways. At the time of writing, Bitcoin was up 1.05% in the last 24 hours to $104,925 following its drop to lows of $100,377 on Thursday.

Opulous (OPUL) will be listed on a new exchange soon. The team says trading will start on June 10, and futures will be added after that. Listing on a new exchange can bring new buyers and higher trading volume. If the exchange is popular, this can lift the price of OPUL for a short time. Futures trading can also bring volatility, as traders bet on price moves. But if only a few people join, or if the listing is on a small exchange, the impact might be weak. source

Opulous@opulousappJun 06, 2025Update:

Exchange reveal Monday

Trading starts Tuesday

Futures shortly after

Happy Friday $OPUL fam! https://t.co/rFUMuwSoFE

EXMO.com will stop trading PARSIQ (PRQ) on June 9, and people have time to withdraw their tokens until July 4. Delisting often means less demand and lower price, because fewer people can buy or sell the token. The official message says demand and liquidity for PRQ were too low. This is usually seen as a bad sign by traders, as it can bring more selling. PRQ price may drop, especially if other exchanges follow and also remove the token. Holders should manage their balances soon. source

EXMO.com@Exmo_ComJun 06, 2025$PRQ didn’t deliver — time to free up space.

We keep only the assets with real demand and liquidity.

Trading ends June 9, withdrawals open until July 4.

Make sure your balance is sorted. pic.twitter.com/9w5DvUzf9S

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up