Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The company behind U.S. President Donald Trumps' Truth Social social-media platform has finalized its agreement with crypto exchange Crypto.com and asset management firm Yorkville America Digital to launch a series of exchange-traded funds and products through its fintech brand Truth.Fi. The binding agreement between the firms follows a non-binding deal floated last month.

Crypto.com will support the backend technology, provide custody and supply the cryptocurrencies for the ETFs, the companies said previously. The exchange-traded products are anticipated to include a unique basket of crypto-related equities, bitcoin and other altcoins with a "Made in America" focus, according to a statement on Tuesday.

"Crypto.com is the leading platform to bridge crypto and traditional finance, and this agreement is a testament to those capabilities," Crypto.com co-founder and CEO Kris Marszalek said. "This partnership gives the Trump Media ETFs global distribution powered by the Crypto.com platform. It's a win for Trump Media, Crypto.com, CRO and Yorkville America Digital."

Trump’s media company launched Truth.Fi in January, not long after President Donald Trump took office. Parent company Trump Media & Technology Group also operates the social media platform Truth Social and the streaming platform Truth+. Several members of the Trump family are also prominent backers and ambassadors for the DeFi project World Liberty Financial, where the president serves as "Chief Crypto Advocate."

'Made in America' ETFs expected to launch in 2025

The ETFs are expected to start launching later in 2025, pending regulatory approval. They are expected to be widely available internationally, including in the U.S., Europe and Asia, across existing platforms and brokerages, made available through Crypto.com's broker-dealer Foris Capital US LLC. Davis Polk & Wardwell LLP is advising the parties on the development and launch of the products.

"This agreement is a major step forward in diversifying TMTG into financial services and digital assets," TMTG CEO and Chairman Devin Nunes said in the release. "We're gratified to work with great partners, Crypto.com and Yorkville America Digital, and look forward to bringing ETFs to the market for investors who believe both the American economy and digital assets are poised for tremendous growth."

The ETFs are planned to launch alongside a slate of Separately Managed Accounts (SMAs) overseen by Truth.Fi, which has tapped Charles Schwab as a custodian and advisor. Earlier this year, the TMTG board approved a plan to invest up to $250 million worth of the company's cash reserves to back its forthcoming financial services products.

A previously published press release mentioned investing in cronos, the utility token for the Crypto.com platform. It also referred to backing equities related to the "energy" industry.

"Finalizing our agreement with Trump Media and Crypto.com for our ETF launch is a significant milestone as we work to bring to market new products that align with the America-First focus of our firm," Troy Rillo, CEO of Yorkville America Digital, added. "This is an exciting moment and we anticipate substantial interest in the ETFs upon their launch later this year."

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

SINGAPORE, April 22, 2025 (GLOBE NEWSWIRE) — As Bitcoin continues to trade below $90,000 and analysts predict that the crypto market will remain volatile, holding spot positions may not generate short-term profits. Recent economic shifts, including policy announcements such as President Trump’s tariff decisions, have brought some stabilization, but the volatility remains. For investors seeking to maximize returns in these uncertain times, BexBack Exchange offers a powerful solution. With 100x leverage, a 100% deposit bonus, and a $50 welcome bonus for new users, BexBack empowers traders to seize market opportunities. And with no KYC requirements, it provides a seamless and efficient way to trade.

What Is 100x Leverage and How Does It Work?

Simply put, 100x leverage allows you to open larger trading positions with less capital. For example:

Suppose the Bitcoin price is $60,000 that day, and you open a long contract with 1 BTC. After using 100x leverage, the transaction amount is equivalent to 100 BTC.

One day later, if the price rises to $63,000, your profit will be (63,000 - 60,000) * 100 BTC / 60,000 = 5 BTC, a yield of up to 500%.

With BexBack's deposit bonus

BexBack offers a 100% deposit bonus. If the initial investment is 2 BTC, the profit will increase to 10 BTC, and the return on investment will double to 1000%.

Note: Although leveraged trading can magnify profits, you also need to be wary of liquidation risks.

How Does the 100% Deposit Bonus Work?

The deposit bonus from BexBack cannot be directly withdrawn but can be used to open larger positions and increase potential profits. Additionally, during significant market fluctuations, the bonus can serve as extra margin, effectively reducing the risk of liquidation.

About BexBack?

BexBack is a leading cryptocurrency derivatives platform that offers 100x leverage on BTC, ETH, ADA, SOL, XRP, and more than 50 other major altcoins. Headquartered in Singapore, with offices in Hong Kong, Japan, the United States, the United Kingdom, and Argentina, BexBack holds a US MSB (Money Services Business) license and is trusted by over 500,000 traders worldwide. The platform accepts users from the United States, Canada, and Europe, and offers no deposit fees, along with exceptional customer service, including 24/7 support.

Why recommend BexBack?

No KYC Required: Start trading immediately without complex identity verification.

100% Deposit Bonus: Double your funds, double your profits.

High-Leverage Trading: Offers up to 100x leverage, maximizing investors' capital efficiency.

Demo Account: Comes with 10 BTC in virtual funds, ideal for beginners to practice risk-free trading.

Comprehensive Trading Options: Feature-rich trading available via Web and mobile applications.

Convenient Operation: No slippage, no spread, and fast, precise trade execution.

Global User Support: Enjoy 24/7 customer service, no matter where you are.

Lucrative Affiliate Rewards: Earn up to 50% commission, perfect for promoters.

Take Action Now—Don’t Miss Another Opportunity!

If you missed the previous crypto bull run, this could be your chance. With BexBack's 100x leverage and 100% deposit bonus and $50 bonus for new users (complete one trade within one week of registration), you can be a winner in the new bull run.

Sign up on BexBack now, claim your exclusive bonus and start accumulating more BTC today!

Website: www.bexback.com

Contact: business@bexback.com

Contact:

Amanda

business@bexback.com

Disclaimer: This content is provided by BexBack. he statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. We do not guarantee any claims, statements, or promises made in this article. This content is for informational purposes only and should not be considered financial, investment, or trading advice.

Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. However, due to the inherently speculative nature of the blockchain sector—including cryptocurrency, NFTs, and mining—complete accuracy cannot always be guaranteed.

Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/523f8f2b-7d69-4f8d-82cc-3553b1942be4

https://www.globenewswire.com/NewsRoom/AttachmentNg/767ebdd1-d389-4c08-bdf7-c0dd19c5e292

https://www.globenewswire.com/NewsRoom/AttachmentNg/23c3ed64-a791-4827-9477-7e2f847cea10

https://www.globenewswire.com/NewsRoom/AttachmentNg/c02a2226-64b9-4fcd-b1b8-4ef5865333e4

How to Clalm

How to Clalm

Bexback

Bexback

Double the funds

Double the funds

100x leverage, BTC Futures Trading

100x leverage, BTC Futures Trading

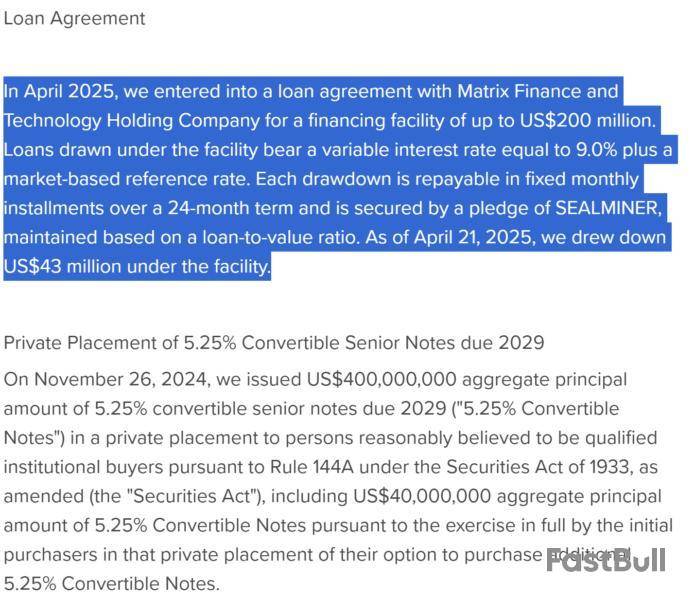

Bitcoin mining firm Bitdeer has secured a $60 million loan to ramp up its Bitcoin ASIC manufacturing efforts as global mining competition intensifies amid record-breaking network hashrates.

According to its annual report, Bitdeer entered a loan agreement in April with affiliate firm Matrixport, a crypto financial services company founded by Bitdeer chairman Jihan Wu.

The facility offers up to $200 million, backed by Bitdeer’s Sealminer hardware, with a floating interest rate of 9% plus market benchmarks. As of April 21, Bitdeer had drawn $43 million from the credit line.

The latest funding adds to a $17 million unsecured loan secured in January, alongside previous capital raises totaling $572.5 million via convertible notes in 2024. Bitdeer also issued over six million shares, raising nearly $119 million in equity markets this year.

Bitdeer acquires 101 MW Alberta power project

In February 2025, Bitdeer acquired a fully licensed 101 megawatt (MW) gas-fired power project near Fox Creek, Alberta, for $21.7 million in cash, per the annual filing.

The site, with potential to scale up to 1 gigawatt, includes all necessary permits for construction and a 99 MW grid connection. The power plant is set to be developed with an EPC partner and is expected to be operational by the fourth quarter of 2026.

In March, the company also purchased 40 MW worth of liquid-cooled mining containers from Saiheat.

More recently, it was reported that Bitdeer is expanding its self-mining operations and investing in United States-based production. The shift came in response to cooling demand for its mining hardware from other miners.

“Our plan going forward is to prioritize our own self-mining,” Jeff LaBerge, Bitdeer’s head of capital markets and strategic initiatives, reportedly said.

Additionally, on Feb. 28, 2025, Bitdeer launched a $20 million share repurchase program, effective through February 2026. To date, it has repurchased 1,056,500 Class A shares valued at approximately $12 million under this program.

Bitcoin hashrate surges while miner revenues shrink

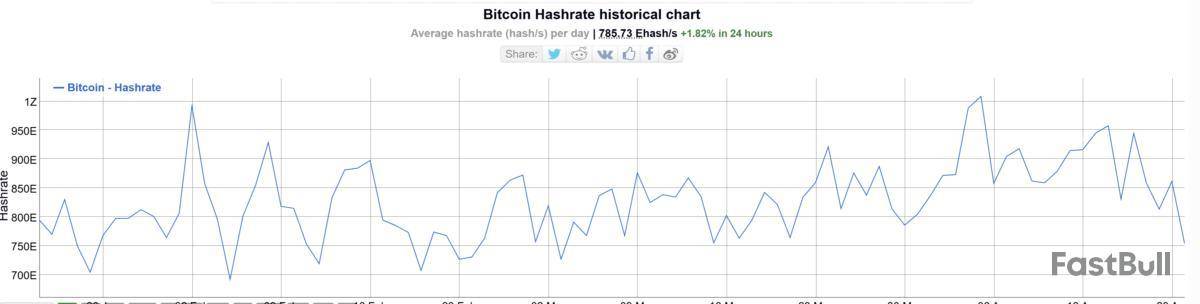

Bitdeer’s expansion comes as Bitcoin’s network computing power hit a record 1 sextillion hashes per second in early April, according to BitInfoCharts.

A higher hashrate indicates that more miners (or more powerful machines) are competing to solve Bitcoin blocks. As competition rises, each individual miner’s chance of earning block rewards decreases, implying declining profitability.

Further hurting miner revenue are low transaction fees. As of now, the average Bitcoin transaction fee hovers around $1, down from over $16 per transfer in April last year, according to YCharts.

The low transaction fees and rising hashrate forced public miners to sell over 40% of their BTC production in March — the highest since late 2024.

Firms like Hive, Bitfarms and Ionic Digital reportedly sold more than 100% of their monthly output.

Bitcoin daily

Yesterday was telling for bitcoin in a potential regime change. It rallied despite a poor day in the Nasdaq in a potential shift in a correlation that's dominated for the past two years.

Today, that move has accelerated but it's come with a relief rally in risk assets. That's still a good sign and the technicals are suddenly looking much better but the test going forward is going to be how it performs when we get back to the 'sell America' trade.

Mantra founder and CEO John Mullin has begun an $80 million burn of OM tokens to regain users’ trust following the token’s sudden crash earlier in April. However, the question of the underlying reasons for the OM crash remains unanswered, blockchain investigators told Cointelegraph.

Unpacking Mantra’s OM crash requires a detailed forensic study rather than just basic blockchain analysis, Natalie Newson, senior blockchain investigator at the blockchain security firm CertiK, said.

“A full forensic investigation, akin to what we saw post-FTX, would be needed to substantiate claims of calculated exploitation,” Newson told Cointelegraph, highlighting challenges of tracing over-the-counter (OTC) transactions.

Newson’s perspective on the OM crash came days after Mantra released its post-crash statement, asking centralized exchange partners to collaborate on further unpacking the incident.

Onchain activity versus opaque OTC deals

Addressing the OM token crash, CertiK’s Newson stressed the importance of distinguishing between public onchain activity and the “more opaque nature of OTC deals.”

Mantra CEO Mullin publicly disclosed that the Mantra team “has done a small amount of OTCs” up to $30 million of OM tokens in an interview with Coffeezilla on April 15.

Unlike traceable transactions on centralized exchanges, OTC crypto transfers involve a method of buying and selling cryptocurrencies outside of exchanges, designed to enable deep liquidity and big trades while mitigating the volatility of prices.

“In this case, the accumulation of approximately 100 million OM by a whale appears to have been the result of secondary market transactions — not necessarily direct activity from Mantra insiders,” Newson said.

Analysis by Arkham or Nansen is not enough

As previously mentioned, Mullin denied allegations that the OM crash resulted from an insider token dump, claiming that the blockchain analytics platform Arkham “mislabelled” some of the wallets.

Newson said that data from Arkham and similar platforms like Nansen would be insufficient to confirm or deny insider involvement.

“To confirm coordinated insider behavior, it would likely require more than just basic wallet tracing on platforms like Arkham or Nansen,” Newson said, adding:

Newson is not alone in highlighting the complicated nature of tracing transactions in the OM token crash.

“There are ways to get data from the node, but it does not seem to be easy to get a full history,” Whale Alert’s co-founder Frank Weert told Cointelegraph.

Mullin previously said that the team has been considering hiring a forensic auditor following the OM crash, but had made no decisions as of April 16.

Arkham did not respond to multiple Cointelegraph inquiries to comment on the Mantra incident.

Bitcoin rallied above $89,000 on April 22, its highest level since early March, buoyed by strong spot demand during US trading hours on April 21. The recovery, however, faced a serious challenge in breaking above $90,000 as sell-side liquidity blocked the way.

Bitcoin price faces stiff resistance on the upside

Data from Cointelegraph Markets Pro and TradingView shows that the price has been steadily moving toward the $89,000 level over the last six hours, leading to questions about whether the barrier at $90,00 will finally give in.

“BTC is closing in on the big $ 90 K-$91 K horizontal area which acted as the previous range low,” said popular trader Daan Crypto Trades in an April 22 post on X.

The trader explained that the price had swept the $89,000 level as it was consolidating below it. Note that the 200-day simple moving average (SMA) is currently located just above this level, reinforcing its significance.

Daan Crypto Trades said that the price needs to overcome these barriers in order to confirm a breakout.

Bitcoin price breaking $91-$92K is key — Analyst

Meanwhile, CryptoQuant’s head of Research, Julio Moreno, said that the traders’ onchain realized price between $91,000 and $92,000 is the real test for Bitcoin bulls.

According to Moreno, the traders’ realized price usually acts as resistance when the crypto market is bearish, which is the current situation of Bitcoin.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Los Angeles, CA, April 22, 2025 (GLOBE NEWSWIRE) — BlockInsight Innovations Inc. today released its latest market research report revealing how artificial intelligence and machine learning technologies are fundamentally reshaping global cryptocurrency exchanges and traditional financial markets. The report, based on in-depth analysis of over 200 exchanges worldwide, provides the most comprehensive assessment of AI trading technology applications to date.

BlockInsight's "Financial Technology Adoption Index" shows that exchanges implementing advanced AI solutions have experienced average trading volume increases of 21.7% and operational cost reductions of 16.5% since January 2025. These figures align with recent financial technology assessments from multiple international authoritative institutions, marking a clear inflection point in financial market operations.

"AI-driven trading infrastructure represents the most transformative technological advancement in financial markets since the introduction of electronic trading," stated Jonathan Parker, BlockInsight CEO. "Our research demonstrates that institutions successfully implementing these technologies are establishing measurable competitive advantages, improving market efficiency, drastically enhancing fraud prevention capabilities, and delivering personalized trading experiences."

Enhanced Market Surveillance and Real-Time Fraud Detection

The implementation of deep learning models for market surveillance has revolutionized fraud detection capabilities across major trading platforms. These AI systems simultaneously analyze transaction patterns across billions of data points, identifying potential market manipulation tactics that traditional rule-based systems often miss.

BlockInsight's "AI in Financial Security" report validates the effectiveness of these advancements. Company research indicates that leading cryptocurrency trading platforms have successfully prevented hundreds of millions of dollars in potential fraud attempts through AI monitoring systems in early 2025. Multiple independent research institutions confirm that exchanges using advanced AI monitoring systems have improved fraud detection rates by 31% compared to traditional methods.

"The sophistication of market manipulation attempts has increased dramatically in recent years," BlockInsight security analysts explain. "Traditional rule-based detection systems simply cannot keep pace with these evolving threats. Our testing confirms that machine learning models that continuously adapt to new patterns have proven significantly more effective."

Algorithmic Trading Advancements

According to BlockInsight's latest research, AI-driven algorithms now account for approximately 35% of all cryptocurrency trading volume, up from 22% at the end of 2023. The company's proprietary market analysis suggests this figure could reach 50% by year-end.

These systems continuously learn from market data, adjusting strategies based on changing conditions without explicit reprogramming. The most advanced implementations utilize deep reinforcement learning, allowing trading algorithms to develop strategies beyond traditional approaches. BlockInsight researchers have documented cases where these advanced algorithms discovered entirely novel trading strategies.

BlockInsight's research found that in major cryptocurrency markets, AI-optimized trading algorithms demonstrated a 12.3% improvement in risk-adjusted returns compared to conventional algorithmic strategies. The company's own benchmark tests produced similar results, showing a 13.1% improvement in controlled trading environments.

Personalized Trading Experiences

On the user-facing side, AI has enabled highly personalized trading experiences. BlockInsight's latest research shows that modern trading platforms now analyze individual trading patterns, risk preferences, and portfolio compositions to provide tailored recommendations and interfaces.

These personalized interfaces adjust in real-time based on user behavior, presenting relevant market information and analytics while filtering out noise that could lead to decision fatigue or impulsive trading decisions. BlockInsight's consumer research indicates that AI-optimized interfaces reduce decision errors by up to 17% compared to standard trading platforms.

According to BlockInsight's market monitoring, leading cryptocurrency exchanges recently launched AI-driven personalized trading dashboards, resulting in 27% increased user engagement and 14% fewer platform navigation support requests. These figures have been verified through multiple independent assessment methods.

Regulatory Challenges and Responses

Despite these advancements, the integration of AI into trading platforms has raised significant regulatory questions. BlockInsight's regulatory analysis shows that several major international regulatory bodies have recently begun developing guidelines regarding AI governance in trading platforms, emphasizing the need for human oversight and algorithm explainability. These institutions are forming specialized task forces aimed at developing comprehensive regulatory frameworks for AI-driven financial systems.

"The primary regulatory challenge centers around accountability," noted BlockInsight in its regulatory outlook section. "When AI systems make autonomous decisions that impact markets, determining responsibility for adverse outcomes becomes increasingly complex. We recommend a principles-based regulatory approach that balances innovation with market integrity."

The Road Ahead

As AI continues to transform trading infrastructure, BlockInsight predicts that exchanges without robust AI capabilities will face increasing competitive pressure. Their analysis suggests that by the end of 2025, over 80% of global trading volume will flow through AI-enhanced platforms, creating a two-tier market system that may disadvantage smaller traditional exchanges.

According to BlockInsight's market forecasts and analyses from multiple international consulting firms, the global market for AI trading technologies is projected to reach $38.5 billion by 2027, representing a compound annual growth rate of 23.8% from 2024 levels. BlockInsight's experts are even more bullish, projecting the market could reach $42 billion given current adoption trends.

About BlockInsight Innovations Inc.

BlockInsight Innovations Inc. is a global leader in financial technology research and data analytics, dedicated to providing authoritative analysis of blockchain and cryptocurrency markets. Headquartered in Los Angeles, California, the company helps financial institutions and investors make informed decisions through cutting-edge market intelligence and technology assessments.

Media Contact:

BlockInsight Innovations Inc.

Address: S GRAND AVE LOS ANGELES, CA 90071

Website: https://blockinsured.com

Email: support@blockinsured.com

Elizabeth Morgan

BlockInsight Innovations Inc

support (at) blockinsured.com

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up