Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A trader known for profiting handsomely after shorting Bitcoin and Ethereum ahead of the recent market crash has opened fresh short positions, even as the market shows signs of recovery.

Lookonchain on Tuesday showing the investor entered at $115,783 and currently holds a 3,440 BTC short position worth about $392.67m, with an unrealized profit near $5.7m and a liquidation threshold of $128,030.

Despite Bitcoin rebounding to around $115,000 over the weekend, the trader has added to the position aggressively, indicating a renewed bearish conviction.

The who shorted and before the crash — making over $160M — is adding to his short again!Current position: 3,440 ($392.67M)Liquidation price: $128,030 — Lookonchain (@lookonchain) “Trump Insider” Reloads Massive Bet, Fueling Talk Of Another Market Shakeout

To fund the move, about $80m in USDC was bridged into Hyperliquid and deployed, suggesting the trader is doubling down on expectations of a further downturn.

Market watchers are now mulling whether this is an attempt to shake out weak longs or part of a larger, calculated push toward another engineered collapse.

In a prior episode, the same wallet gained notoriety after opening massive shorts just before Donald Trump’s tariff announcement triggered a sharp market drop, netting an estimated $160m in profits.

That trade stoked debate over whether political signals and insider timing were colluding, especially since the trader has been branded a “Trump insider” in crypto circles.Other Hyperliquid Whales Join “Trump Insider” In Mounting Bearish Positions

Compounding the tension, other heavy hitters on the Hyperliquid platform are also . Whale 0x9eec9 currently holds $98m in shorts across DOGE, ETH, PEPE, XRP, and ASTER. Whale 0x9263 is wagering $84m against SOL and BTC.

These are not impulsive bets by retail speculators, but decisive moves by seasoned players betting on coordinated downside.

Since the crash, markets have seen an increase in hedging activity and put buying, pointing to growing bearish sentiment.

Nonetheless, the sheer size and timing of these bets maintain pressure on Bitcoin and crypto markets, especially as volatility returns to centre stage.

The Kingdom of Bhutan is migrating its national digital identity system from Polygon to Ethereum, with the full process expected to finish by Q1 2026.

The move enables nearly 800,000 citizens to verify their credentials on a public blockchain, marking it the first of its kind.

According to the Ethereum Foundation President Aya Miyaguchi, the integration of the system on Ethereum “is now fully operational.”

“This milestone marks not only a national achievement but a global step toward a more open and secure digital future for the long term,” Miyaguchi .

1/ Today, Bhutan celebrates a historic milestone, becoming the first nation to anchor its national digital identity system on Ethereum. 🇧🇹 and I were honored to join the launch ceremony on behalf of the Ethereum community, graced by His Royal Highness. — Aya Miyaguchi (@AyaMiyagotchi)

Aya Miyaguchi, Ethereum co-founder Vitalik Buterin, joined Bhutan’s prime minister, Tshering Tobgay, and crown prince on Monday at the launch ceremony.Bhutan Government’s Decentralized Adoption

The move aligns with Ethereum’s 10th anniversary, underscoring a shared commitment to open public data.

“When I first visited Bhutan in May 2024, I felt a strong resonance between Bhutan and Ethereum: both believe that visions for the future must be grounded in strong foundational values,” wrote Miyaguchi. “It’s deeply inspiring to see a nation commit to empowering its citizens with self-sovereign identity.”

Ethereum boasts a globally distributed network of validator nodes. By leveraging the blockchain, Bhutan’s NDI benefits from greater decentralization, transparency and resilience.

With this integration, Bhutan’s national digital identity system can now issue Verifiable Credentials (VCs) and enable digital signing directly on Ethereum.

“By leveraging Ethereum’s globally distributed network, we are strengthening the security, transparency, and resilience of Bhutan’s digital infrastructure,” said Lyonchen Tshering Tobgay, the Prime Minister of Bhutan.National ID System From Polygon to Ethereum Blockchain

Per a , His Royal Highness The Gyalsey of Bhutan launched its National Digital Identity in 2023 and became the first digital citizen.

In August 2024, the South Asian nation made a transition of its national digital self-sovereign identity .

Bhutan adopted the Polygon Blockchain, and its zero-knowledge protocols, aiming to enhance the system’s scalability, ensuring it can handle high transaction volumes without compromising performance.

“Bhutan’s transition reflects what Ethereum was always designed for — empowering individuals with sovereignty over their own data, fostering trust without central points of failure, and enabling inclusive digital systems that serve people first,” Aya Miyaguchi added. Besides, the Bhutan government is also staking Bitcoin, becoming the fifth-largest nation to hold the asset in treasuries. According to , the country currently holds 11,286 BTC, priced at $1.28 billion

The race for crypto ETFs is heating up, and XRP is once again in the spotlight. With Paul Atkins taking over as the new Chair of the U.S. Securities and Exchange Commission (SEC), investors are hopeful for a more crypto-friendly stance.

Multiple asset managers have already submitted ETF applications, and with key SEC ETF approval deadlines approaching, both the XRP ETF and the Solana ETF are emerging as leading contenders due to their growing liquidity and rising investor interest.

Why Market Depth Matters for XRP ETF Approval

Unlike trading volume, which only reflects the amount traded, market depth measures how much can be bought or sold without significantly impacting price. Analyst WrathofKahneman explained that for ETF approval, market depth is even more critical than volume, as it ensures stability during large-scale trades.

A Kaiko report from April revealed that XRP and Solana lead in 1% market depth among major exchanges, while Cardano follows closely. This deep liquidity strengthens XRP’s ETF case, indicating smoother trading and reduced volatility. If approved, ETFs that physically hold XRP would boost liquidity further through the constant creation and redemption of ETF shares, enhancing price stability.

Ripple’s $1.25 billion acquisition of Hidden Road, a key digital asset brokerage, adds significant institutional depth to XRP’s ecosystem. This strategic move increases XRP’s appeal for large-scale investment products like spot XRP ETFs, reinforcing its market positioning among institutional investors.

Despite optimism surrounding XRP ETF approval, overall market sentiment remains cautious. Deribit options data shows traders hedging for downside risks, suggesting short-term uncertainty. Additionally, China’s 125% tariffs on U.S. goods have heightened global financial tension, further weighing on risk appetite.

Upcoming XRP ETF List

A decisive week lies ahead for XRP. Six spot XRP ETF applications are set for review between October 18 and 25, including Grayscale’s ETF, whose SEC decision is expected this week.

Other filings from 21Shares, Bitwise, WisdomTree, CoinShares, and Canary Capital are also queued for review next week. These rulings will mark a turning point for XRP’s regulatory outlook, potentially reshaping the crypto ETF landscape.

FAQs

What is an XRP ETF and why is it important?An XRP ETF is a fund that tracks XRP’s price, allowing investors to gain exposure without directly holding the crypto. It’s important as it provides easier, regulated access for mainstream and institutional investors.

When will we know about the XRP ETF decision?Key SEC decisions on several spot XRP ETF applications are expected between October 18 and 25, 2024, starting with a ruling on Grayscale’s filing this week.

What are the benefits of a spot XRP ETF?A spot XRP ETF offers security through regulated custodians, simplifies investing via traditional brokerage accounts, and enhances market liquidity and price stability for all holders.

Peter Schiff, a prominent financial commentator, claims that the Friday Bitcoin flash crash was a "warning" instead of merely a "buying opportunity."

"Crypto buyers are in for a rude awakening and will soon learn a very valuable but expensive lesson," Schiff said.

Bitcoin's uncertain recovery

As reported by U.Today, Bitcoin and U.S. equities plunged sharply lower on Friday due to rapidly worsening trade tensions between the US and China.

Altcoins got absolutely clobbered after the U.S. announced draconian 100% tariffs on Chinese goods. The market witnessed $19 billion worth of liquidations, and Fundstrat's Tom Lee argues that this figure might actually be understated.

Cryptocurrencies then saw a rather sharp recovery after the White House seemingly opened the door to a trade deal with China.

However, they have erased some of these gains once again as trade tensions between the two superpowers continue to simmer.

Bitcoin dipped to an intraday low of $113,030 earlier today, according to CoinGecko data.

Both stocks and crypto remain extremely sensitive to the latest headlines.

Gold's new peak

In the meantime, the price of gold recently reached a new peak above the $4,100 level.

According to Schiff, gold's massive surge is exposing the "fiction" that Bitcoin is actually "digital gold."

"The bottom can drop out of Bitcoin at any time," the gold bug warned.

The odds of Bitcoin outperforming Bitcoin this year appear to be extremely slim given that "Uptober" has so far been extremely lackluster.

Crypto analysts speculate that the massive weekend leverage flushout, which wiped billions of dollars from the crypto markets, may have just paved the path for “altseason 3.0”

“Every major expansion in crypto has included sharp 30% to 60% resets along the way,” observed analyst and researcher ‘Bull Theory’ on Monday.

March 2020 saw almost 70% wiped off markets in the pandemic-induced black swan event, and May 2021 saw more than 50% wiped out. There were at least five other 30% to 40% altcoin slumps during the last bull market cycle.

The market crash in April this year had many calling it the beginning of the bear market. Yet “each of those wipes looked like the end [and] each was followed by the strongest rallies of the cycle,” the analyst added.

Altcoins will bounce back

Altcoins are usually hit hardest during these epic market resets, and this was the case over the weekend with XRP (XRP) dumping at least 18%, Solana (SOL) 22%, Dogecoin (DOGE) 28%, Cardano (ADA) 25%, and Chainlink (LINK) 26% in just a day.

After the March 2020 flash crash, “we had a huge altseason where altcoins pumped 25x to 100x,” said analyst Ash Crypto before adding, “I think it will happen again.”

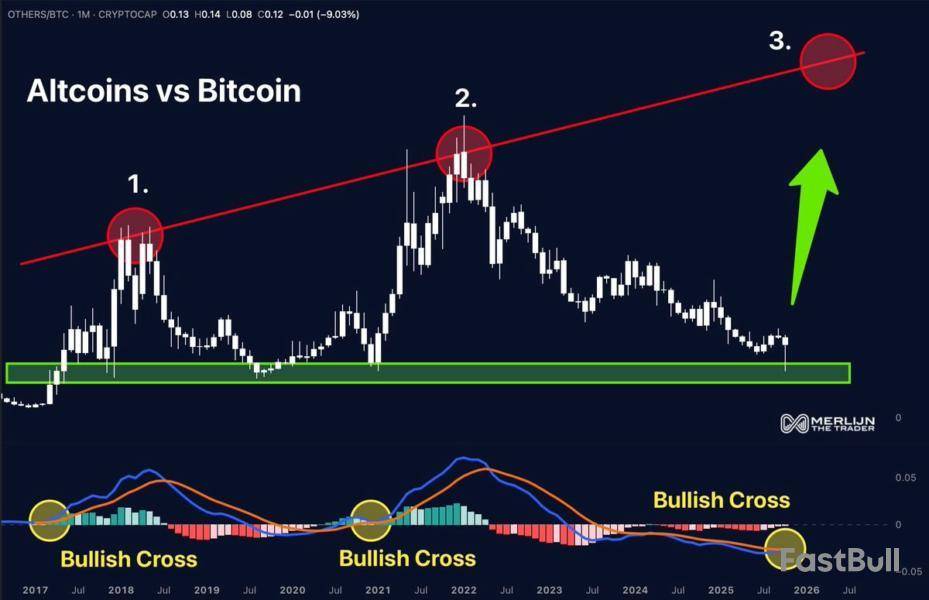

Meanwhile, analyst ‘Merlijn The Trader’ identified a setup for “altseason 3.0” with a monthly bullish MACD cross on the BTC/altcoins chart, the same pattern that occurred in 2017 and 2021.

Total crypto cap falls back below $4T

The total crypto market capitalization dipped back below the psychological $4 trillion mark on Tuesday, despite the bullish sentiment regarding the recovery and a potential altseason.

Bitcoin (BTC) is leading losses with a 1.4% decline on the day as it fell below $113,500 on Tuesday morning. This comes at the same time as several altcoins were posting daily gains.

Additionally, Bitcoin dominance, another key indicator of altcoin performance, is forming its first red weekly candle in five weeks as it fell below 59% on Tuesday, according to TradingView.

Solana started a fresh increase above the $188 zone. SOL price is now consolidating above $200 and might aim for more gains above the $208 zone.

Solana Price Jumps Further Above $200

Solana price started a decent increase after it settled above the $172 zone, beating Bitcoin and Ethereum. SOL climbed above the $180 level to enter a short-term positive zone.

The price even smashed the $188 resistance. The bulls were able to push the price above the 61.8% Fib retracement level of the main drop from the $225 swing high to the $155 low. Besides, there is a bullish trend line forming with support at $199 on the hourly chart of the SOL/USD pair.

Solana is now trading above $202 and the 100-hourly simple moving average. On the upside, the price is facing resistance near the $208 level and the 76.4% Fib retracement level of the main drop from the $225 swing high to the $155 low. The next major resistance is near the $218 level.

The main resistance could be $225. A successful close above the $225 resistance zone could set the pace for another steady increase. The next key resistance is $242. Any more gains might send the price toward the $250 level.

Another Pullback In SOL?

If SOL fails to rise above the $208 resistance, it could start another decline. Initial support on the downside is near the $199 zone and the trend line. The first major support is near the $195 level.

A break below the $195 level might send the price toward the $190 support zone. If there is a close below the $190 support, the price could decline toward the $180 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $199 and $190.

Major Resistance Levels – $208 and $218.

WhiteBridge Network (WBAI) will list on Gate.io, with trading in the WBAI/USDT pair starting soon. Listings on big exchanges often create more interest and higher liquidity, because more people can buy or sell the token easily. Usually, the price could move up after the listing, at least for a short time. But sometimes, there is selling after the early excitement, which might push the price back down. Long-term effects depend on project developments and trading volume. Watch for volatility when trading begins. Read more information here source.

Gate@GateOct 14, 2025Gate Initial Listing: $WBAI @AiWhitebridge

Trading Starts: 12:00 PM, October 15th (UTC)

Trade: https://t.co/AC6PySIWrR

More details: https://t.co/pvg3UxKY3K pic.twitter.com/AmfjuycpaX

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up