Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Flightradar24: Airspace In Southeastern Poland Has Once Again Been Closed For The Past Few Hours

[Ethereum Surges Above $2,100, Up 10.9% In 24 Hours] February 7Th, According To Htx Market Data, Ethereum Has Rebounded And Broken Through $2100, Currently Trading At $2114, A 24-Hour Increase Of 10.9%

Booz Allen Hamilton Maintains Its Fiscal Year Guidance After Treasury Cancels Contracts And Trump Sues IRS For $10 Billion. Consulting Giant Booz Allen Hamilton Confirmed Its Fiscal Year Guidance Remains Unchanged, Expecting The Treasury Department's Contract Cancellations By President Trump To Have An Impact Of Less Than 1.0% On Overall Revenue For The Fiscal Year (the 12 Months Ending March 31, 2027). In Late January, The U.S. Treasury Announced The Cancellation Of 31 Contracts With The Company—with Total Annual Expenses Of $4.8 Million

US Plans Initial Payment Towards Billions Owed To UN In A Matter Of Weeks - Washington's UN Envoy Mike Waltz Tells Reuters

[Bitcoin Touched $71,751 This Morning, Rebounding Nearly 20% From The Low.] February 7Th, According To Htx Market Data, Bitcoin Rebounded This Morning To Touch $71,751, A 19.58% Increase From The Intraday Low Of $60,000, Making It The Day With The Highest Single-Day Price Increase During This Bull-Bear Cycle

In The Week Ending February 6, The US Stock Market's "interest Rate Cut Winners" Index Rose 4.41% Cumulatively. The "Trump Tariff Losers" Index Rose 4.03% Cumulatively, And The "Trump Financial Index" Rose 2.46% Cumulatively. The Retail Investor-heavy Stock Index/meme Stock Index Fell 3.35% Cumulatively

US Defense Secretary Hegseth: His Dept Is Formally Ending All Professional Military Education, Fellowships, And Certificate Programs With Harvard University

[Deutsche Bank: Large-Cap Tech Stocks Fall To Bottom Of 10-Year Trend Channel Relative To S&P 500] Deutsche Bank Strategists, Including Parag Thatte, Wrote In A Research Report That On Thursday, Large-cap And Tech Stocks Rebounded From The Bottom Of A 10-year Trend Channel Relative To The Rest Of The S&P 500, And Continued Their Rally On Friday. The Strategists Stated That Historically, This Group Has Typically Seen A Rally After Hitting The Bottom Of The Channel, Especially Against A Backdrop Of Rising Earnings. The Report Noted That This Year's Performance "is Entirely Driven By Changes In Valuation Multiples, Rather Than Adjustments In Earnings Expectations, A Stark Contrast To Last Year When It Was Entirely Driven By Upward Revisions In Earnings Expectations."

[German Industrial Output Shrinks For Fourth Consecutive Year] Data Released By The Federal Statistical Office Of Germany On February 6 Showed That, Affected By Factors Such As Weak Production In The Automotive Industry, German Industrial Output Will Decline By 1.1% In 2025 Compared To The Previous Year, Marking The Fourth Consecutive Year Of Decline. Statistics Show That, Excluding The Construction And Energy Sectors, Output In Other German Industrial Sectors Will Decline By 1.3% In 2025. Among Them, Key Sectors Such As The Automotive Industry And Machinery Manufacturing Saw The Most Significant Declines, Falling By 1.7% And 2.6% Respectively

India Repo Rate

India Repo RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)A:--

F: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)A:--

F: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)A:--

F: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)A:--

F: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)A:--

F: --

Mexico Consumer Confidence Index (Jan)

Mexico Consumer Confidence Index (Jan)A:--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

No matching data

View All

No data

Tron (TRX) has recorded notable price gains over the past month, rising by nearly 20% in the past 30 days. Currently trading at around $0.3392, the asset has also posted a 1.5% gain in the past 24 hours.

These developments occur amid growing on-chain activity, particularly driven by the increased use of the TRON network for Tether (USDT) transactions, positioning the blockchain as a major player in the stablecoin infrastructure space.

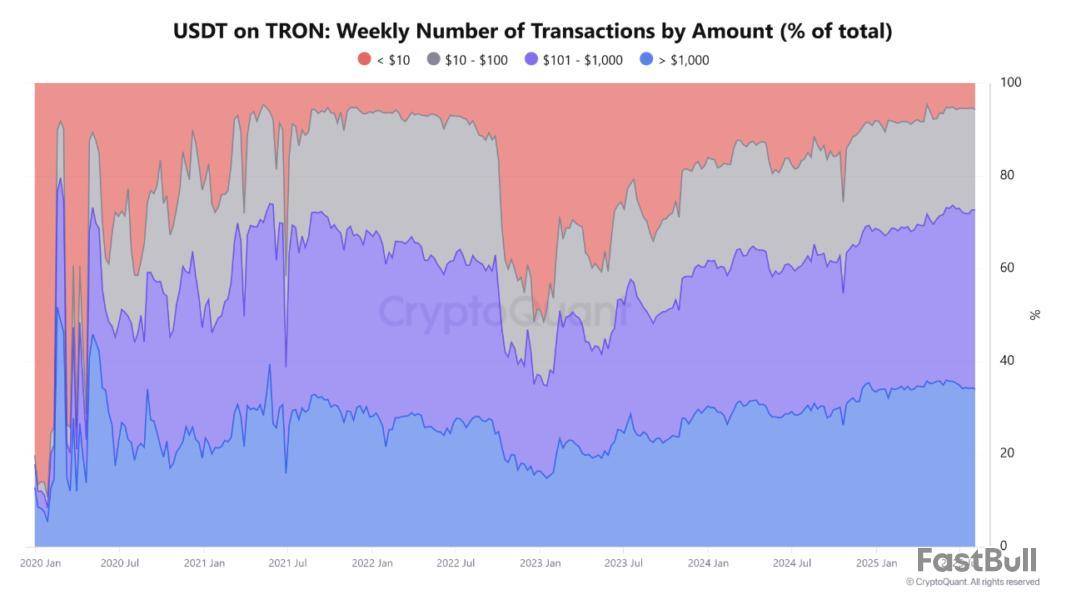

One of the key observations has been the network’s sharp rise in USDT transaction volume. According to CryptoQuant contributor Arab Chain, TRON processed over 8.29 million USDT transactions in the week ending August 3, 2025.

This figure not only indicates heightened activity but also reveals the diversity of transaction sizes across the network. Transfers between $101 and $1,000 made up the largest proportion at 38.66%, with significant activity also observed in transactions exceeding $1,000.

TRON’s Dual Adoption: Retail and Institutional Activity on the Rise

Arab Chain emphasized that this distribution highlights TRON’s appeal across different user groups. The presence of mid-sized transactions suggests usage by freelancers, online vendors, and remittance users.

In contrast, the substantial number of larger transactions implies participation by institutional traders, high-net-worth individuals, and potentially corporate entities.

The analyst also noted a decline in transactions below $10, suggesting a reduced reliance on micro-payments or testing activity and a pivot toward practical use cases.

The growing use of TRON for real-world settlement purposes is reinforced by its infrastructure, which supports low-cost, high-volume stablecoin transactions. Unlike networks that cater predominantly to large institutional transfers, TRON’s environment facilitates both high-frequency and high-value transfers.

Arab Chain stated that this makes TRON a core component in enabling digital commerce, payroll systems, and cross-border payments.

Meanwhile, CryptoQuant analyst Burak Kesmeci linked TRX’s recent momentum to regulatory developments in the United States. On July 18, 2025, the US Congress passed the GENIUS Act, marking the first formal federal regulatory framework for payment stablecoins.

Kesmeci noted that this legislation provides a clearer legal foundation for dollar-backed digital assets by establishing guidelines for anti-money laundering (AML), consumer protection, and financial stability.

Post-GENIUS Act: TRON Expands USDT Dominance

Following the passage of the GENIUS Act, TRON moved swiftly to expand its footprint. According to Kesmeci, approximately $1 billion worth of new USDT was minted on the TRON network shortly after the bill became law.

This increased TRX’s share of the total circulating USDT supply to over 83 billion out of 163 billion, accounting for approximately 51% of all USDT in circulation. The analyst suggested that this reinforces TRON’s position as the leading blockchain for stablecoin transfers.

The GENIUS Act may catalyze stablecoin adoption in the US, with TRON expected to benefit due to its efficiency in handling stablecoin transactions.

As more institutions and users seek reliable, low-fee solutions for digital payments, TRON’s role in the growing ecosystem of tokenized dollars might just continue to expand.

Featured image created with DALL-E, Chart from TradingView

A malicious campaign has netted more than $1 million in stolen crypto using a trifecta of attack types through hundreds of browser extensions, websites and malware, says cybersecurity firm Koi Security.

Koi Security researcher Tuval Admoni said on Thursday that the malicious group, which the company dubbed “GreedyBear,” has “redefined industrial-scale crypto theft.”

“Most groups pick a lane — maybe they do browser extensions, or they focus on ransomware, or they run scam phishing sites — GreedyBear said, ‘why not all three?’ And it worked. Spectacularly,” Admoni said.

The types of attacks undertaken by GreedyBear have been used before, but the report highlights that cybercriminals are now deploying a range of complex scams to target crypto users, which Admoni said shows scammers have stopped “thinking small.”

Over 150 fake crypto browser extensions

More than $1 million has reportedly been stolen from cryptocurrency users from over 650 malicious tools specifically targeting crypto wallet users, Admoni said.

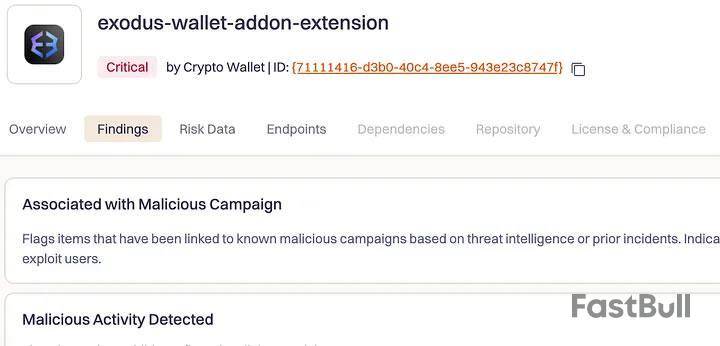

The group has published over 150 malicious browser extensions to the Firefox browser marketplace, each designed to impersonate popular crypto wallets such as MetaMask, TronLink, Exodus, and Rabby Wallet.

The malicious actors use an “Extension Hollowing” technique, first creating a legitimate extensions to bypass the marketplaces’ checks to later make them malicious.

Admoni explained that the malicious extensions directly capture wallet credentials from user input fields within fake wallet interfaces.

Deddy Lavid, CEO of the cybersecurity firm Cyvers, told Cointelegraph that the GreedyBear campaign “shows how cybercriminals are weaponizing the trust users place in browser extension stores. Cloning popular wallet plugins, inflating reviews, and then silently swapping in credential-stealing malware.”

In early July, Koi Security identified 40 malicious Firefox extensions, suspecting Russian threat actors behind what it called the “Foxy Wallet” campaign.

Crypto-themed malware

The second arm of the group’s attacks focuses on crypto-themed malware, of which Koi Security uncovered almost 500 samples.

Credential stealers like LummaStealer specifically target crypto wallet information, while ransomware variants such as Luca Stealer are designed to demand crypto payments.

Most of the malware is distributed through Russian websites offering cracked or pirated software, Admoni said.

A network of scam websites

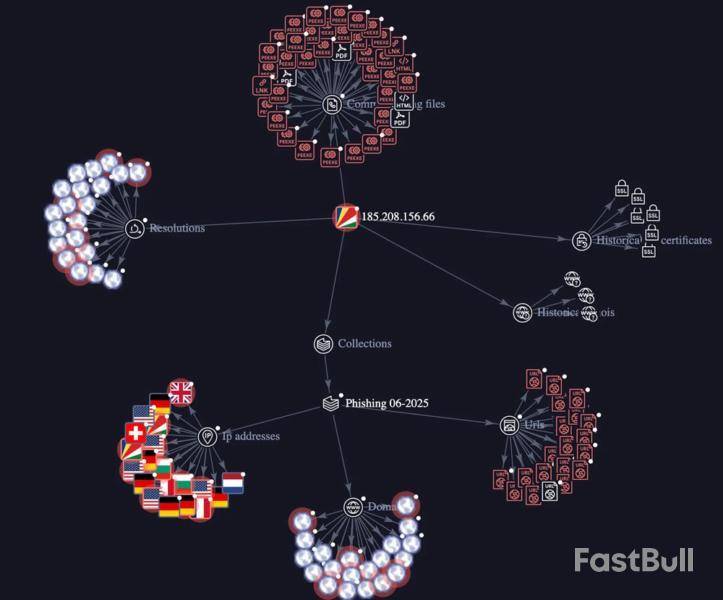

The third attack vector in the trifecta is a network of fake websites posing as crypto-related products and services.

“These aren’t typical phishing pages mimicking login portals — instead, they appear as slick, fake product landing pages advertising digital wallets, hardware devices, or wallet repair services,” Admoni noted.

He said one server acts as a central hub for command-and-control, credential collection, ransomware coordination, and scam websites, “allowing the attackers to streamline operations across multiple channels.”

The campaign also shows signs of AI-generated code, enabling rapid scaling and diversification of crypto-targeting attacks, representing a new evolution in crypto-focused cybercrime.

“This isn’t a passing trend — it’s the new normal,” Admoni warned.

“These attacks exploit user expectations and bypass static defenses by injecting malicious logic directly into wallet UIs,” Lavid said before adding, “This underscores the need for stronger vetting by browser vendors, developer transparency, and user vigilance.”

Two men have reportedly been arrested for allegedly throwing sex toys during Women’s National Basketball Association (WNBA) games, a controversial prank which a memecoin group has taken responsibility for.

Five incidents of sex toys, mainly green in color, being thrown onto the court during WNBA matches have occurred in the past two weeks, the last of which occurred on Thursday in Chicago.

Speaking to USA Today on Thursday, a spokesperson for the group behind the recently launched Green Dildo Coin (DILDO) memecoin, who goes by Daldo Raine on X, said he and other crypto enthusiasts were behind the stunts.

The stunts have drawn criticism from WNBA players and coaches, as the already polarizing and niche memecoin culture looks to make their bets stand out by any means in a crowded market that’s recently struggled to maintain steam.

Daldo Raine said the token was created as a lighthearted protest against what he described as a toxic environment dominated by influencers and scammers within the memecoin space.

“We knew that in order to get a voice in the space ... we had to go out and do some viral stunts to save us from having to pay that influencer cabal,” he said. “We wanna shift the culture in crypto, and we wanna be the 1,000 against the one.”

To help the project stand out, he said the dildos are green as a homage to the crypto slang for when upward price action on trading charts shows a green bar, while also being an attempt to spark curiosity from onlookers.

He suggested the memecoin group would pivot toward lighter and “more tasteful” pranks to continue gaining attention.

Two alleged sex toy throwers arrested

Two men, Kaden Lopez and Delbert Carver, have been arrested for allegedly taking part in the sex toy throwing stunts — though Daldo Raine told USA Today that neither of the men are part of the memecoin’s group.

FOX 10 Phoenix reported on Wednesday, citing court documents, that the 18-year-old Lopez told police he saw the viral trend on social media and purchased a sex toy to participate.

USA Today reported that Carver was arrested in Georgia on Saturday, with authorities accusing him of throwing a sex toy onto a basketball court in Atlanta.

He reportedly faces charges related to disorderly conduct, public indecency and criminal trespass.

WNBA expresses outrage

The stunts have drawn sharp criticism from WNBA players and coaches, who said the stunts pose a safety risk and show a lack of respect for the game.

“It’s ridiculous, it’s dumb, it’s stupid,” Los Angeles Sparks coach Lynne Roberts said after an incident at the Crypto.com arena on Tuesday.

According to the WNBA’s code of conduct page, any fan caught throwing objects onto the court is to be tossed from the stadium and may face possible criminal charges.

Daldo Raine reportedly shrugged off suggestions that the stunt was meant as a sign of disrespect toward the women athletes — though others insist the stunt has misogynistic roots.

Similar pranks have cropped up in other sports, including a 2018 National Football League game between the New England Patriots and Buffalo Bills, when a sex toy landed in the end zone.

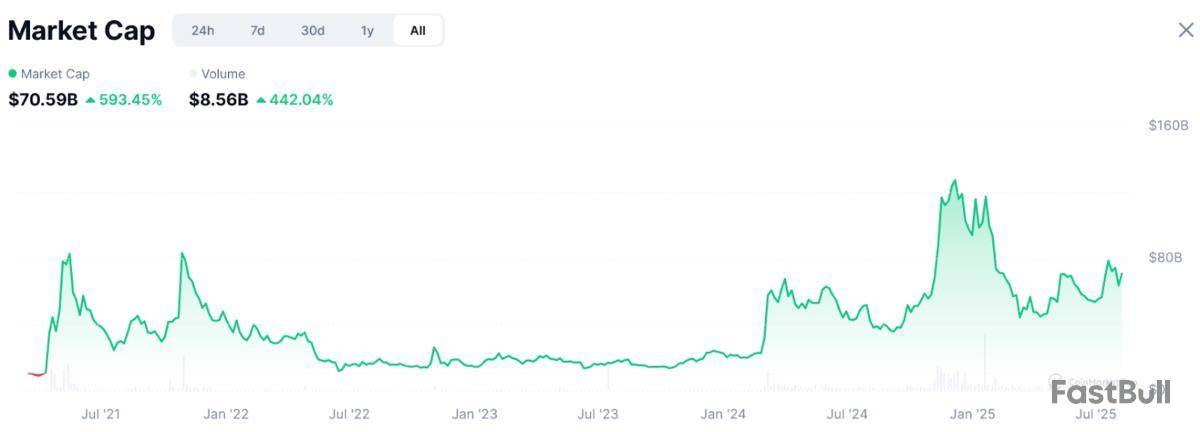

Memecoin market down from peak

The memecoin market is currently at a market cap of $70.6 billion, down nearly 45% from its $127.26 billion peak on Dec. 6, according to CoinMarketCap data.

Pump.fun, the largest launchpad in the memecoin industry, has seen revenue plunge 80% from its January peak to just $24.96 million in July, marking its worst month of 2025.

Crypto trading platform Kraken now allows American users to make instant USD deposits via PayPal. The integration has already shown strong traction during its soft launch, with over $1 million in deposits already processed.

Kraken Facilitates Seamless Transactions With PayPal

The new feature allows US clients to facilitate speedy trading without the need for traditional banking processes. Users can choose to fund their Kraken wallet instantly without having to enter bank credentials or navigate third-party login pop-ups.

For quicker transactions, Kraken has added options of ACH transfers (through Plaid), FedWire, and debit cards. To use this, U.S. clients can log into their accounts, select PayPal at checkout, and follow the instructions for instant funding. The users can trade more than 400 cryptocurrencies through the Kraken Pro or Kraken app.

The integration is simplifying the crypto trading process for both new and experienced users. Additional services in the integration include staking, earning rewards, or sending money with Kraken Pay.

PayPal’s Broader Mission With Crypto

PayPal is a secure platform that has already integrated with Kraken in the EU, UK, and Australia, and it continues to expand its reach. It also recently revealed a “Pay with Crypto” solution for United States merchants, supporting over 100 cryptos, including Bitcoin, Ethereum, and leading stablecoins.

The platform is designed to reduce cross-border fees by up to 90%, enabling instant settlements and conversion to stablecoins or fiat. PayPal supports global reach without slowing down payments and adding costs.

PayPal president and CEO Alex Chriss said, “Last week, we launched PayPal World, our global partnership bringing together five of the world’s largest digital wallets on a single platform, fundamentally reimagining how money moves around the world.

“By enabling seamless cross-border crypto payments, we’re breaking long-standing barriers in global commerce,” he added.

FAQs

What cryptocurrencies can I trade with PayPal deposits?PayPal-funded accounts can trade 400+ cryptos on Kraken, including BTC, ETH, and major stablecoins through Kraken Pro or mobile app.

Does Kraken charge fees for PayPal deposits?While Kraken hasn’t specified fees, PayPal typically charges minimal costs for instant transfers between verified accounts.

What other services can I use with PayPal deposits?Funds enable trading, staking rewards, and Kraken Pay transfers – part of PayPal’s mission to reduce cross-border fees by 90%.

Ethereum co-founder Vitalik Buterin has welcomed the rise of ETH treasury companies, saying they open the door for a broader range of investors to gain exposure to ETH. However, he cautioned that the trend could backfire if it turns into an “overleveraged game.”

Speaking on the Bankless podcast, Buterin noted that these treasury firms, public companies that buy and hold ETH, offer “valuable services” and provide “more options” for investors who may not want or be able to hold the token directly.

Notably, ETH has surged over 160% in 2025, but Vitalik Buterin warns that treasury companies must manage their holdings responsibly to maintain this momentum and avoid the kind of collapses seen in past crypto booms.

The Rise of ETH Treasuries

Over the past year, crypto treasury companies have become a hot play on Wall Street, mirroring the strategy of Bitcoin treasury holders like MicroStrategy. By pooling investor capital to buy and hold ETH, these firms create indirect exposure for traders through publicly traded shares.

The sector has already ballooned to $11.77 billion in assets. BitMine Immersion Technologies leads the pack with 833,100 ETH worth $3.2 billion, followed by SharpLink Gaming with $2 billion, and The Ether Machine with $1.34 billion. The Ethereum Foundation and PulseChain round out the top five largest holders. Meanwhile, Fundamental Global has filed with the SEC to launch a new $5 billion Ethereum treasury fund, signaling rising institutional demand for ETH exposure.

In short, ETH treasuries can boost Ethereum adoption and price by putting large amounts of Ether in the hands of public companies and investment firms, which makes it easier for traditional investors to get exposure without directly buying and managing crypto.

Leverage: The Potential Achilles’ Heel

While Buterin is optimistic, he also warned of a worst-case scenario in which excessive leverage could trigger a chain reaction of forced liquidations. A sharp price drop, he said, could lead to margin calls, further sell-offs, and ultimately a collapse in credibility for Ethereum.

“If you woke me up three years from now and told me that treasuries led to the downfall of ETH… my guess for why would basically be that somehow they turned it into an overleveraged game,” Buterin said.

Still, he expressed confidence that current ETH treasury companies are more disciplined than the reckless risk-taking seen in past collapses, quipping: “These are not Do Kwon followers.”

ETH’s Price Comeback

The growth of ETH treasury holdings has coincided with a strong market recovery for the token. After plunging to $1,470 in April, ETH has surged more than 160% to around $3,870. Analysts say this influx of treasury demand has been a major factor behind Ethereum’s price rally, helping it close the performance gap with Bitcoin and Solana.

For now, the future of ETH treasuries looks bright, but Buterin’s warning is clear: success will depend on resisting the temptation to overextend in pursuit of bigger returns.

FAQs

How big is the ETH treasury market in 2025?It’s worth about $11.77B, led by BitMine Immersion Technologies with 833,100 ETH.

How has ETH’s price changed in 2025?ETH surged over 160% from $1,470 in April to around $3,870, partly driven by treasury demand.

Why does Vitalik Buterin support ETH treasuries?He says they expand ETH access for investors who can’t or don’t want to hold crypto directly.

Dogecoin started a fresh increase from the $0.1950 zone against the US Dollar. DOGE is now consolidating and might aim for more gains above $0.2250.

Dogecoin Price Regains Traction

Dogecoin price started a fresh increase above the $0.2020 resistance zone, like Bitcoin and Ethereum. DOGE was able to clear the $0.2120 and $0.2150 resistance levels.

There was a clear move above the $0.220 level. Finally, the price tested $0.2250. A high is formed at $0.224 and the price is now consolidating above the 23.6% Fib retracement level of the upward move from the $0.1956 swing low to the $0.2243 high.

Dogecoin price is now trading above the $0.220 level and the 100-hourly simple moving average. There is also a key bullish trend line forming with support at $0.2150 on the hourly chart of the DOGE/USD.

Immediate resistance on the upside is near the $0.2250 level. The first major resistance for the bulls could be near the $0.2320 level. The next major resistance is near the $0.2420 level. A close above the $0.2420 resistance might send the price toward the $0.250 resistance. Any more gains might send the price toward the $0.2650 level. The next major stop for the bulls might be $0.2780.

Another Decline In DOGE?

If DOGE’s price fails to climb above the $0.2250 level, it could start a fresh decline. Initial support on the downside is near the $0.2175 level. The next major support is near the $0.2150 level.

The main support sits at $0.210 or the 50% Fib retracement level of the upward move from the $0.1956 swing low to the $0.2243 high. If there is a downside break below the $0.2150 support, the price could decline further. In the stated case, the price might decline toward the $0.2050 level or even $0.2020 in the near term.

Technical Indicators

Hourly MACD – The MACD for DOGE/USD is now gaining momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for DOGE/USD is now above the 50 level.

Major Support Levels – $0.2175 and $0.2150.

Major Resistance Levels – $0.2250 and $0.2320.

Ethereum (ETH) is attempting to break out of a crucial resistance level after recovering from last week’s lows. Some analysts suggested that the cryptocurrency is repeating past breakout playbooks, which could lead to a new high this quarter.

Fourth Time’s The Charm?

On Thursday, Ethereum retested the $3,850 level after recording a 6.3% surge in the daily timeframe. The surge was fueled by news of President Donald Trump’s alleged plan to sign an executive order that would allow private equity, real estate, cryptocurrency, and other alternative assets investments in 401(k) plans.

The executive order would reportedly direct the Department of Labor (DOL) to revise the guidelines related to alternative asset investments in retirement plans, opening the doors to the $12.5 trillion industry.

Notably, the King of Altcoins has been trading between the $3,400-$3,800 price range since the mid-July breakout, attempting to break out from the last “major resistance” zone three times during this period.

Last week, ETH surged to a seven-month high of $3,941, briefly trading above the key resistance zone before retracing to its local range. The start-of-August correction saw the cryptocurrency retreat to the range lows, retesting the $3,350-$3,400 area as support.

Ethereum attempted to reclaim the range highs as this week started, trading in the $3,600-$3,700 mid-zone for the past three days. However, today’s pump saw the second-largest crypto surge past the $3,800 area and retest the $3,850 local resistance.

Following its recent performance, analyst Alex Clay considers that ETH’s correction “seems to be over.” He highlighted an 18-month descending broadening wedge on the daily chart, affirming that a “breakout is imminent” as the cryptocurrency neared the formation’s upper boundary.

Ethereum To Hit New Highs Soon

Analyst Ted Pillows affirmed that ETH is “just one bullish candle away from a major breakout,” highlighting the similarities between its May-June setup and its current one.

Following the May breakout, Ethereum traded within its local range, failing to break above the $2,700 resistance multiple times before its June bull and bear traps. Following the fake-out and retest of the lows, the cryptocurrency broke out of its range and hit a new yearly high in the following weeks.

Similarly, ETH has been trading within its current range after the July breakout, as the analyst’s chart shows, retesting the local resistance before the late July bull trap. After the early August bear trap, the King of Altcoins is now retesting the $3,850-$3,900 area.

A breakout from this zone could propel the price above the $4,000 barrier if history repeats. Based on this, the analyst suggested that a $5,000 target is possible before the quarter ends.

Meanwhile, Rekt Capital highlighted that the Ethereum Dominance (ETHDOM) has surged above the 12% level in an uptrend for the first time in five years.

He noted that the last time ETHDOM rallied to this area was in July 2020, when it consolidated between the 12% to 16% zone for months before breaking out in 2021. According to the analyst, ETHDOM is now challenging to transition into a similar consolidation phase.

As of this writing, ETH trades at $3,826 in the one-week chart, a 48% increase in the monthly timeframe.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up