Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The crypto industry received a significant legal victory as Ripple CEO Brad Garlinghouse announced on March 19 that the U.S. Securities and Exchange Commission (SEC) had officially dropped its appeal against the company. The announcement came in a video posted on social media platform X, where Garlinghouse noted the regulatory agency’s decision to end its pursuit of further litigation.

Besides this interesting development, another major financial development has taken center stage in the crypto market in the past 24 hours; the outcome of the Federal Reserve’s latest meeting.

Fed Keeps Interest Rates Steady Amid Uncertainty

The outcome of the latest Fed meeting can be divided into six key decisions. First, the Federal Reserve opted to maintain interest rates at their current level, keeping the borrowing rate in a range between 4.25% and 4.5% for the second consecutive meeting. This decision is part of a continued pause in the Fed’s tightening cycle.

Secondly, the Fed noted that uncertainty surrounding the economy has increased, and third, the Fed’s updated projections were the shift in expectations for rate cuts in 2025. The median forecast suggests 50 basis points of cuts for the year, but a growing number of Fed officials are less convinced that rate reductions will be necessary. In December, only one official anticipated no rate cuts in 2025. However, there’s now a more divided outlook, and that number has now risen to four, as noted in a post on social media platform X by analysts at The Kobeissi Letter.

Beyond interest rates, the Fed revised its economic growth projections downward for 2025, suggesting that policymakers see slower expansion ahead. This adjustment comes alongside an increase in the Fed’s inflation forecast for the same period, reflecting concerns about price pressures persisting longer than previously anticipated. With inflation remaining a key focus, the central bank is treading carefully as it evaluates the right time to pivot toward a looser monetary stance.

Fourthly, the Fed announced that it would slow the pace of its balance sheet runoff beginning in April. This is alongside a sharp reduction in the Fed’s 2025 growth projections and a markup in their 2025 inflation forecast.

Implications For Crypto Markets And Digital Assets

For the crypto industry, the Fed’s decision to hold rates steady and its mixed messaging on future cuts introduce a dynamic situation to Bitcoin and others. The fact that the Fed is still concerned about inflation and economic uncertainty shows that the path to more accommodative policies regarding the crypto industry may not be as smooth.

However, if the Fed stays hesitant to cut rates and economic growth slows as projected, digital assets may face headwinds later in the year, which may slow down the predicted growth by crypto analysts.

Ethereum has experienced a crucial surge above the $2,000 mark, a key level that bulls have struggled to reclaim since March 10. This breakout brings renewed optimism, as analysts believe a stronghold above this level could trigger a rally toward higher prices. However, if ETH fails to maintain support above $2,000, a significant drop could follow, leading to further market instability.

Macroeconomic uncertainty and trade war fears have continued to shake the crypto market, with Ethereum being one of the most affected assets. The recent price action reflects investor caution, as global financial conditions remain unpredictable.

Top analyst Jelle shared a technical analysis on X, revealing that ETH is trading at a critical level that will determine its long-term direction in the coming weeks. Bulls must sustain momentum to solidify a bullish structure, while bears are watching for signs of weakness to drive prices lower. With ETH at a pivotal juncture, the next few trading sessions could be decisive for its trajectory.

Ethereum at a Crossroads: Breakout or Breakdown?

Ethereum has lost over 57% of its value since mid-December, with bulls struggling to reclaim higher prices as selling pressure dominates the market. Despite occasional relief rallies, ETH has remained under key resistance levels, leaving investors uncertain about its next move. Speculation about a potential recovery and a continuation of the downtrend are colliding, as price action shows no clear direction.

The $2,000 level has become the ultimate test for Ethereum. Bulls must defend this price with conviction to sustain any meaningful recovery. Losing this support could lead to a sharp decline, pushing ETH into deeper bearish territory.

Jelle stated in his analysis that either ETH is about to put in a massive reclaim or it’s about to jump off a cliff. The $2,000 level is the key limit that will determine Ethereum’s next move. If bulls can maintain strength above this mark, a push toward $2,300 and beyond could follow. However, failure to hold $2,000 would signal further downside, with the next major support sitting around $1,750.

Ethereum’s fate hangs in the balance, and the coming days will be crucial in deciding whether it regains bullish momentum or continues its descent.

Ethereum Battles to Hold $2,000: Key Levels to Watch

Ethereum is currently trading at $1,980 after days of struggling below the crucial $2,000 mark. Bulls managed to briefly push the price above this level, but sustaining it is now the real challenge. Holding above $2,000 is critical for Ethereum’s recovery, as it would signal strength and open the door for a rally toward the $2,200 mark.

The $2,200 level is the most important resistance for ETH to reclaim in order to confirm a bullish reversal. A successful break and consolidation above this point would indicate that bulls are regaining control, potentially leading to a move toward higher targets.

However, if Ethereum fails to hold above $2,000, selling pressure could increase, leading to a deeper correction. A drop below this level could trigger a sharp decline, pushing ETH toward the $1,800 support zone. If this support fails, the next major liquidity level would be around $1,750, where buyers might step in to prevent further downside.

Ethereum is at a critical turning point, and the coming sessions will determine whether bulls can establish a strong foothold above $2,000 or if another wave of selling pressure will drive prices lower.

Featured image from Dall-E, chart from TradingView

NEW YORK, March 20, 2025 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, announces an investigation of potential state and federal law claims on behalf of purchasers of Nike-themed non-fungible tokens (“NFTs”), crypto collectibles, or other crypto assets (“The Nike NFTs”) issued by RTFKT, Inc.

SO WHAT: If you purchased Nike NFTs issued by RTFKT, Inc., you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement. The Rosen Law Firm is preparing a class action seeking recovery of investor losses.

WHAT TO DO NEXT: To join the prospective class action, go to https://rosenlegal.com/submit-form/?case_id=36711 call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

WHAT IS THIS ABOUT: On December 2, 2024, RTFKT announced on the platform X, its plan to wind down RTFKT operations, injuring investors holding NFTs promoted by Nike.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm achieved the largest ever securities class action settlement against a Chinese Company at the time. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

-------------------------------

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

The recent strength indicators for XRP have sparked debates about whether the asset will be able to return to the $3 mark anytime soon. The likelihood of such a move cannot be completely ruled out in light of the cryptocurrency's recent price spike and improving sentiment. But in order for XRP to overcome this crucial psychological and technological obstacle, a number of conditions must come together.

To stop further drops, XRP has been able to build a solid base around the $2.20 mark. The asset recently approached the descending channel's upper trendline, which is still a crucial point of resistance. The likelihood of XRP rising toward $3 would be greatly increased by a breakout above this trendline. But if this is not done, there may be another correction that would keep the asset range-bound. The 200-day EMA is currently serving as an extra resistance level, hovering just above the price action. Chart by TradingView">

XRP could rise in the upcoming weeks if it were to close decisively above this moving average, which would be a strong bullish signal. The market's continued perception of Ripple and its legal dispute with the SEC continues to be one of the main factors driving XRP.

Confidence in XRP has increased as a result of recent favorable rulings, which have raised its price. If good news keeps coming in, it might serve as a spur for XRP to test higher price points. The general state of the market is also very important. More capital inflows could help XRP reach its $3 target if Bitcoin and the cryptocurrency market as a whole go through another bullish phase.

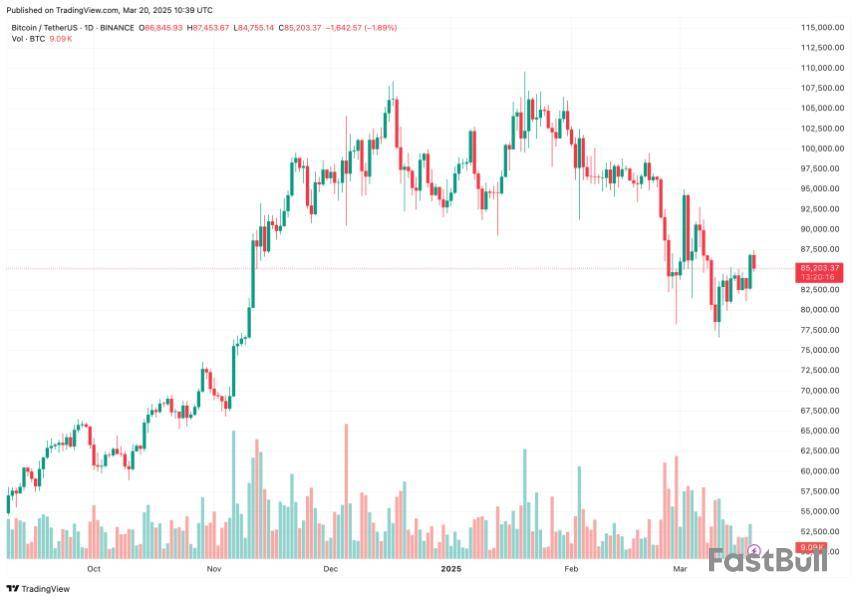

Bitcoin breaks through

Finally making a big breakthrough, Bitcoin has made its largest move of 2025 thus far. The 200-day Exponential Moving Average (EMA), a critical level that had maintained the asset's downward trend, has finally been overcome by Bitcoin after weeks of difficulty. Although obstacles remain, this breakout might be the start of a reversal. An essential turning point for Bitcoin is the break above the 200 EMA, which signals a change in market sentiment.

But there is still some risk for the cryptocurrency. The 26 EMA is still a significant resistance level and the uptrend is still uncertain, unless Bitcoin can break through it. The volume spike that accompanied this breakout was also unanticipated. Generally speaking, decreasing volume has accompanied BTC's price movements, indicating weak buying pressure.

However, this time, volume increased in tandem with the price spike, suggesting that bulls may finally be aggressively intervening. Bitcoin continues to face significant resistance in spite of this breakout. Bitcoin could revert to its prior downward trend and erase recent gains if the price is rejected at the 26 EMA. However, a more robust rally might be in store if Bitcoin is able to maintain momentum and overcome this resistance.

Ethereum back on track

In a crucial reversal of its recent bearish trend, Ethereum has successfully recovered to the $2,000 price level. The asset had trouble keeping up after falling below this psychological barrier, but ETH has recovered thanks to an unexpected increase in buying pressure. The recent spike in trading volume is a significant contributing factor to this recovery, suggesting that market participants are very interested.

ETH has shown a series of green candles with rising volume on the chart, indicating that buyers are intervening to support the asset at this point. Among the main causes of this increase is whale activity. The aggressive actions of large holders are escalating the bullish mood. Just 10 hours ago, three whales took 14,217 ETH (worth $29 million) out of Binance and transferred it to the decentralized lending platform Aave, according to on-chain data.

They borrowed $12 million USDT from Aave, shortly after which they then moved to exchanges, probably in order to get more ETH. This shows that high-net-worth individuals and institutional investors are still optimistic about Ethereum's future growth. ETH continues to encounter resistance levels in spite of this recovery. Where sellers previously gained control between $2,150 and $2,200 is the next significant obstacle. An aggressive push toward the $2,400-$2,500 range where long-term moving averages are located may be possible with a clear move above this area.

A return below $2,000 might lead to yet another round of selling pressure if Ethereum is unable to sustain momentum. Caution is still necessary in light of recent liquidation events on the larger cryptocurrency market. For now, it appears that bulls are taking back control of Ethereum due to its recovery above $2,000 and the resurgence of whale accumulation. ETH might be in line for more gains soon if buying pressure does not abate.

According to a recent X post by crypto entrepreneur Arthur Hayes, Bitcoin (BTC) probably hit its bottom during the plunge to $77,000 on March 10. However, Hayes cautioned that while BTC may have bottomed, stock markets could face more pain ahead.

BTC Bottomed At $77,000? Hayes Thinks So

Former BitMEX CEO Arthur Hayes recently took to X to declare that BTC may have likely bottomed at $77,000. The acclaimed crypto market commentator referred to the US Federal Reserve’s (Fed) latest remarks signaling the end of quantitative tightening (QT). Hayes remarked:

JAYPOW delivered, QT basically over Apr 1. The next thing we need to get bulled up for realz is either SLR exemption and or a restart of QE. Was BTC $77K the bottom, prob. But stonks prob have more pain left to fully convert Jay to team Trump so stay nimble and cashed up.

For the uninitiated, QT is one of the Fed’s monetary policies aimed at reducing the money supply by selling off assets like government bonds or letting them mature without reinvesting. While this helps control inflation, it can also lead to higher interest rates and slower economic growth.

The Fed began its most recent QT cycle nearly three years ago in June 2022 to combat high inflation resulting from COVID-era economic stimulus. Now that inflation appears to be easing, the Fed has little reason to continue QT.

Yesterday, the Fed announced that from April 1 onwards, it will slow the pace of its balance sheet drawdown. Such a shift in monetary policy is likely to benefit risk-on assets like BTC and stocks.

As stated in his X post, Hayes emphasized that the next potential bullish catalysts could be either a Supplementary Leverage Ratio (SLR) exemption or the start of quantitative easing (QE).

To explain, the SLR exemption temporarily allowed banks to exclude certain assets, like US Treasuries and central bank reserves, from their leverage calculations to encourage lending and support financial markets during crises. Similarly, QE is a monetary policy through which the Fed increases the money supply in the economy, potentially benefiting high-risk assets like BTC.

Axie Infinity co-founder Jeff Jirlin echoed Hayes’ sentiments, stating that an end to QT from April onwards would be “great for both crypto and equity markets.” Jirlin added that the current monetary policy is the tightest he has observed since 2010.

Bitcoin Not Out Of The Woods Yet

While market optimism has increased following the Fed’s recent comments, the premier cryptocurrency is not fully out of the woods yet. For instance, BTC recently broke down through a 12-year trend line against gold, raising fears of heightened economic uncertainty in the near term.

Further, CryptoQuant CEO Ki Young Ju recently spooked the market by declaring that the Bitcoin bull run is likely over. At press time, BTC trades at $85,203, up 2% in the past 24 hours.

At long last, President Donald Trump's nominee to lead the U.S. Securities and Exchange Commission will undergo a hearing from the U.S. Senate.

The Committee on Banking Housing and Urban Affairs will meet on Thursday, March 27, to question Paul Atkins, as well as Jonathan Gould (Comptroller of the Currency) and Luke Pettit (Assistant Secretary of the Treasury).

Trump tapped Atkins, a long-time crypto supporter, back on Dec. 4 to lead the SEC under his administration. Former Chairman Gary Gensler stepped down from the position on Jan. 20, and the SEC has been led by Acting Chair Mark Uyeda. Atkins was previously appointed by former President George W. Bush as an SEC commissioner from 2002 to 2008.

Atkins' hearing had been delayed due to pending financial disclosure paperwork. Atkins’ financial disclosure likely had a "heavy lift" given his marriage into a billionaire family, Semafor reported earlier this month.

Atkins founded the consulting firm Patomak Global Partners in 2009, whose clients included crypto exchanges and DeFi platforms. He also joined The Digital Chamber's board of advisers in 2020.

A crypto task force, led by Republican SEC Commissioner Hester Peirce, was launched last month and among other priorities has been working on distinguishing which "crypto assets" are securities.

Over the past month, the agency has rescinded controversial crypto accounting guidance and dropped cases against Coinbase, OpenSea, XRP and UniSwap, among others. Notably, there are also at least 60 spot crypto ETF proposals waiting for review.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The U.S. Office of the Comptroller of the Currency said it has ended examining national banks and other financial institutions for reputation risk following condemnation from the crypto industry over being cut out from the financial sector.

In a statement released on Thursday, the OCC Acting Comptroller of the Currency Rodney E. Hood said the agency's examination process has been focused on "appropriate risk management processes," not on drawing judgment on certain activities.

"The OCC has never used reputation risk as a catch-all justification for supervisory action," Hood said. "Focusing future examination activities on more transparent risk areas improves public confidence in the OCC’s supervisory process and makes clear that the OCC has not and does not make business decisions for banks."

The OCC also said it would be removing references to reputation risk from its handbooks and guidance, though noted it would not change its expectation on how banks handle risks.

The OCC also recently set out to clarify that crypto activities are allowed in the federal banking system, representing a major reversal of its previous position.

Lawmakers and the crypto industry have argued that digital asset firms face unique challenges when looking to establish and maintain bank accounts in the U.S. Last week, the Senate Banking Committee voted to advance a bill that would eliminate references to reputational risk as a way for federal regulators to supervise financial institutions. The vote was divided among party lines, with no Democrats in support.

The bill, introduced by Senate Banking Committee Chair Tim Scott, R-S.C., addresses other reputational risks, including "disfavored political groups." The Federal Reserve defines reputational risk as the "potential that negative publicity regarding an institution's business practices, whether true or not, will cause a decline in the customer base, costly litigation, or revenue reductions."

Operation Choke Point?

President Donald Trump has also vowed to end "Operation Choke Point 2.0," wording often used when discussing crypto debanking. That phrase was coined by Castle Island Ventures co-founder Nic Carter in 2023, drawing a comparison to Operation Choke Point 1.0, a 2013 U.S. Department of Justice Initiative that sought to limit banking services for industries considered high-risk for fraud and money laundering, including payday lenders and firearm dealers.

There have been murmurs that Trump could issue a crypto debanking-related executive order, but that has not yet come to fruition.

The OCC's call to remove reputational risk was a "good move," said Custodia Bank CEO Caitlin Long on Thursday in a post on X.

" It was subjective & was captured by some politically-motivated managers at the federal bank regulators for use as their cudgel against industries & people they didn’t like," Long said.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up