Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

European small cap stocks have “bottomed out (or at the very least stabilised) relative to large caps,” says Aleksander Peterc – a Bernstein analyst.

Small caps have underperformed over the past two years but Peterc is convinced that they’ll recover sharply in 2025.

The Bernstein analyst is particularly bullish on three names: Duerr AG, Ipsos SA, and Soitec SA.

Each of these three names, he believes, could return well over 50% over the next twelve months.

Let’s see what Duerr, Ipsos, and Soitec have in store for potential investors.

Duerr AG (ETR: DUE)

Duerr stock has been a disappointment for shareholders this year but its promising growth outlook makes it a great pick for 2025, as per Aleksander Peterc.

He expects the material and plant engineering company to benefit from a continued shift to electric vehicles.

Other industry trends that could help Duerr share price recover over the next twelve months include increasing global interest in sustainable construction materials, the analyst added.

Additionally, shares of the company based out of Stuttgart, Germany are currently trading at an attractive valuation as well.

Bernstein expects Duerr stock to gain as much as 80% and hit €38 by the end of 2025.

Ipsos SA (EPA: IPS)

Aleksander Peterc expects the US business of Ipsos to recover next year.

He recommends investing in this market research company that ranks third globally also because it has improved its margins from 10% before the pandemic to 13% in 2023.

“Although Ipsos is affected by weak macroeconomic climate, its operations should prove resilient, allowing it to maintain its operating margin at around 13%, while generating a solid free cash flow,” the analyst told clients in a recent research note.

Bernstein expects Ipsos stock to hit €79 over the next twelve months that suggests potential for a whopping 68% gain from here.

Soitec SA (EPA: SOI)

Soitec is a semiconductor manufacturer based out of Isere, France that Bernstein dubs a “potentially compelling AI story”.

Aleksander Peterc is bullish on the company’s Photonics-SOI product that currently accounts for a tiny percentage of its overall revenue.

But the analyst is confident that its contribution will grow significantly moving forward.

“Demand for high-bandwidth data centre optical interconnects grows in step with high-performance AI/ML clusters used in [AI model] training,” which could help the Photonics-SOI revenue to grow by 40% every year, he added.

Bernstein sees Soitec stock hitting €130 that translates to about a 65% upside from here.

AI image

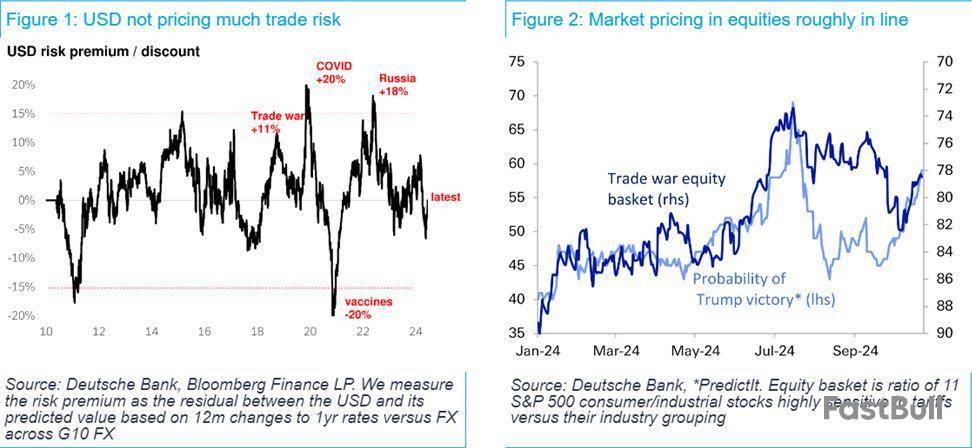

Despite recent poll shifts favoring Trump, market pricing remains cautious, according to Deutsche Bank.

The extent to which a Trump win is being priced in remains cautious despite discussions about "Trump trades" in the market. DB illustrates this in both the FX market via the US dollar and a basket of the S&P 500 companies most sensitive to tariffs.

The drop from 1.12 to 1.09 in EUR/USD is mainly due to the repricing of Fed expectations following strong US payroll numbers, they argue. Only the recent decline reflects changes in US election probabilities. They also note that a basket of S&P 500 companies sensitive to tariffs has been moving sideways, only recently starting to underperform, mirroring recent polling trends.

"The market has started to price an increasing probability of a Trump win, but the degree to which this is impacting market pricing is still quite modest," Deutsche Bank writes.

Bank of America made a similar point this week.

The dollar cooled off alongside bond yields yesterday and that's setting for a mixed mood towards the end of the week. Tech shares led gains in Wall Street but stock futures are looking more muted in the new day. As a whole this week though, equities are still down with a watchful eye on bond market developments.

In FX, we are seeing light changes on the day thus far. EUR/USD not even breaking a 8 pips range underscores the lack of appetite ahead of European trading. The antipodeans are slightly lower and that is bringing some attention to the charts at least. AUD/USD is taking a peek below its 200-day moving average of 0.6628, so that's one to watch out for.

Looking to the session ahead, there won't be much on the agenda to shake things up. The German Ifo business survey is the main highlight but it should just reaffirm more sluggish conditions in the economy to start Q4. As much as the outlook reading might show an improvement, it hasn't been followed up by hard data over the last four to five months. So, take any beats there with a pinch of salt.

This just means we might be in for a quieter one with some light extensions to the daily ranges. As yields cool, the dollar is also taking a breather but we'll see if there is appetite to chase anything again but only later in US trading.

0645 GMT - France October consumer confidence0800 GMT - Eurozone September M3 money supply0800 GMT - Germany October Ifo business climate index

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.

The euro is at the highs of the day as it rebounds following three days of selling. The gains are mostly driven by the US dollar slide as it retraces following a long run. Treasury yields are down today with US 10s lower by 5 bps to 4.19%.

Zooming out further, the euro has dug itself into a big hole since late September and there are calls for new lows before year end.

EURUSD daily

To their credit, ECB policymakers this week are widely acknowledging that inflation will be lower than they thought. What needs to come with that is an acknowledgement that they're behind the curve and need to cut rates by 50 basis points at successive meetings or risk dismal growth in 2025 (and beyond as fiscal excess is reigned in).

We're in a regime right now -- I believe -- where early aggressive rate cuts will see currencies rewarded. That's exactly what has happened with the US dollar in the past month. However as time goes on, that window of opportunity is closing, particularly for the ECB.

So I take this bounce in the euro as a standard overbought bounce. Nothing in the data suggests a pickup or one that's coming. The best hope for EUR/USD bulls is the US dollar side of the equation. This pair bottomed yesterday after the Beige Book continued to highlight poor economic growth in the US, something that hasn't appeared in the data yet.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up