Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Pre-market stock movers are a hot topic as we dive into all of the biggest news traders need to know about on Monday morning!

Moving stocks this morning are an acquisition deal, a strategic alliance, earnings data and more.

Let’s get into that news below!

Biggest Pre-Market Stock Movers: 10 Top Gainers

10 Top Losers

On the date of publication, William White did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

More from InvestorPlace

Analysts predict that the recent global tech outage caused by cybersecurity firm CrowdStrike could cost over $1 billion, but the question of who will foot the bill remains unanswered.

What Happened: Experts predict that there will be demands for remuneration and possibly lawsuits, CNN reported on Monday.

“If you’re a lawyer for CrowdStrike, you’re probably not going to enjoy the rest of your summer,” said Dan Ives, a tech analyst for Wedbush Securities.

On Friday, CrowdStrike was identified as the source of a massive global tech outage, which led to the cancellation of over 5,000 commercial airline flights worldwide and caused disruptions in various sectors, from retail to healthcare. The issue was traced back to a few bits of faulty code in a software content update by CrowdStrike.

The company acknowledged the issue in a social media post late Sunday, stating that a “significant number” of the approximately 8.5 million affected devices were back online. However, CrowdStrike has not addressed whether it plans to provide compensation to affected customers.

Despite the uncertainty, some experts believe that CrowdStrike’s customer contracts may shield it from liability.

“I would guess that the contracts protect them,” said James Lewis, a researcher at the Center for Strategic and International Studies.

While the final cost of the outage is yet to be determined, the damage to CrowdStrike’s reputation could be significant, potentially making it difficult for the company to attract new customers.

Why It Matters: The outage, triggered by a faulty update from CrowdStrike, impacted millions of Windows users, causing widespread disruptions to various services worldwide. The incident, which was not a result of a hacker attack, was due to a technical error in the software update.

Following the incident, Jen Easterly, director of the Cybersecurity and Infrastructure Security Agency, criticized CrowdStrike’s faulty software update as a "serious mistake" with significant impacts on critical infrastructure operations across the world.

Price Action: On Monday’s pre-market, CrowdStrike shares were down 3.54% at $294.15 while Microsoft Corporation shares were up 0.7% at $440.15., at the time of writing, according to Benzinga Pro.

Read Next:

Photo courtesy: Wikimedia

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

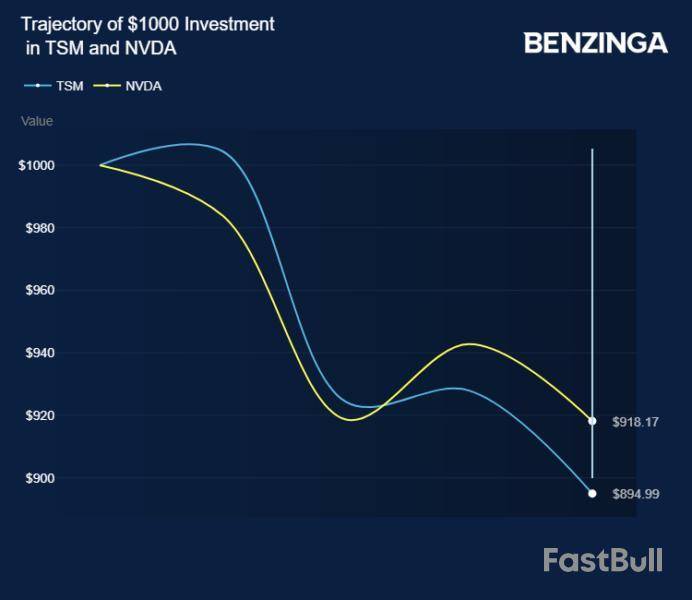

Taiwan Semiconductor Manufacturing Co stock opened lower Monday premarket as U.S. President Joe Biden withdrew from the 2024 Presidential race.

On Sunday, Biden, 81, revealed his decision through a letter on social media platform X after a lackluster debate performance and increasing pressure from fellow Democrats to step aside.

The broader artificial intelligence chip sector led by Taiwan Semiconductor, Nvidia Corp , and Advanced Micro Devices, Inc noted a selloff last week after former President Donald Trump suggested that Taiwan should compensate the U.S. for its defense, highlighting the lack of a formal defense treaty.

Additionally, last week, reports indicated the U.S. intensified its advanced semiconductor sanctions against China, a significant market for Nvidia and its U.S. peers.

SPDR S&P 500 ETF Trust , representing the US S&P500 index, lost 2.4% last week. iShares China Large-Cap ETF , representing China, lost over 4%.

The AI chip stocks, including Nvidia and AMD, opened higher Monday premarket, reversing last week's losses.

Nvidia is reportedly developing a new AI chip tailored to meet US export restrictions for the Chinese market. Reports indicated Nvidia collaborating with Inspur, a key distribution partner in China, to introduce and distribute the new chip, tentatively named "B20," which is part of Nvidia's "Blackwell" series.

The chip stocks also got a boost from China, which lowered key interest rates. China is a key AI chip market. However, it faces several economic challenges, including weak growth in the second quarter and looming deflation.

On Monday, the People's Bank of China (PBOC) announced that it would cut the seven-day reverse repo rate to 1.7% from 1.8% and reduce the one-year loan prime rate (LPR) to 3.35% from 3.45%. Additionally, Reuters reports that China lowered the five-year LPR to 3.85% from 3.95%.

Price Actions: At the last check on Monday, NVDA was up 1.76% at $120 premarket. AMD was up 1.10% at $153.25. TSM was down 1.06% at $164.02.

Photo via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up