Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

T-Mobile today provided updated guidance for its recently closed acquisition of UScellular and shared details on additional actions as part of the company's ongoing transformation.

BELLEVUE, Wash.--(BUSINESS WIRE)--September 04, 2025--

T-Mobile today is providing updated customer and financial guidance as applicable after incorporating the impacts of the UScellular transaction, which closed on August 1(st) . The company is also providing a brief update on additional business transformation initiatives driven by the Un-carrier's digital transformation journey.

"As a part of the Un-carrier's unparalleled track record of exceeding our own ambitious goals, we're pleased to announce today that we're both increasing and accelerating our synergy target with UScellular," said Srini Gopalan, T-Mobile COO. "We're bringing the same winning formula of our unique value proposition, including our industry-leading network to UScellular customers, while further augmenting our network for our customers."

Synergy updates:

Customer updates:

For Q3, T-Mobile expects the following financial impacts from the UScellular acquisition:

Business Transformation Initiatives and Additional Updates

T-Mobile also continues to strategically invest in the business to drive further differentiation across its unique value proposition of best network, best value and best customer experiences. This includes thoughtful decisions to enable the company's successful ongoing digital transformation efforts and ongoing investments by the Lumos and Metronet joint ventures as they continue to ramp on fiber deployment.

In Q3, to further enable the ongoing rapid success of its digital transformation strategy, T-Mobile is accelerating its move to a more streamlined and dynamic billing technology stack. As a result of the acceleration, the company expects to recognize approximately $350 million in predominantly non-cash costs associated with its digital technology transformation, including non-cash impairment expense and accelerated depreciation related to the retirement of software as part of its shift to a more streamlined and dynamic billing technology stack enabling the company's rapid digital transformation, and personnel costs primarily associated with technology modernization.

Also in Q3, the company expects its recent acquisitions outside of UScellular, alongside ongoing network investments, to generate an additional $120 million in depreciation, amortization, integration and other expenses.

These costs will be excluded from Core Adjusted EBITDA.

(1): T-Mobile is not able to forecast Net Income on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in predicting certain items that affect GAAP Net income, including, but not limited to, Income tax expense and Interest expense. Core Adjusted EBITDA should not be used to predict Net income as the difference between this measure and Net income is variable.

About T-Mobile US, Inc.

T-Mobile US, Inc. is America's supercharged Un-carrier, delivering an advanced 4G LTE and transformative nationwide 5G network that will offer reliable connectivity for all. T-Mobile's customers benefit from its unmatched combination of value and quality, unwavering obsession with offering them the best possible service experience and undisputable drive for disruption that creates competition and innovation in wireless and beyond. Based in Bellevue, Wash., T-Mobile provides services through its subsidiaries and operates its flagship brands, T-Mobile, Metro by T-Mobile, and Mint Mobile. For more information please visit: https://www.t-mobile.com.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains certain forward-looking statements concerning T-Mobile. All statements other than statements of fact, including information concerning future results, are forward-looking statements. These forward-looking statements are generally identified by the words "plan," "anticipate," "believe," "estimate," "expect," "intend, " "may," "could" or similar expressions. Such forward-looking statements include, but are not limited to, statements about the benefits of the acquisition of substantially all of UScellular's wireless operations, including anticipated future financial and operating results and T-Mobile's objectives, expectations and intentions, and statements about the financial and operational impact of T-Mobile's business transformation initiatives. There are several factors which could cause actual plans and results to differ materially from those expressed or implied in forward-looking statements. Such factors include, but are not limited to, adverse economic, political or market conditions in the U.S. and international markets; negative effects of the acquisition on the market price of T-Mobile's common stock and on T-Mobile's operating results, including as a result of changes in key customer, supplier, employee or other business relationships; costs or difficulties related to the integration of UScellular's operations and financial reporting and internal controls into T-Mobile; effects of changes in the regulatory environment in which T-Mobile operates; the risk of litigation or regulatory actions; and other risks and uncertainties detailed in T-Mobile's Annual Report on Form 10-K for the fiscal year ended December 31, 2024, including in the sections thereof captioned "Risk Factors" and "Cautionary Statement Regarding Forward-Looking Statements," as well as in its subsequent reports on Form 8-K and Form 10-Q, all of which are filed with the SEC and available at www.sec.gov and www.t-mobile.com. Forward-looking statements are based on current expectations and assumptions, which are subject to risks and uncertainties that may cause actual results to differ materially from those expressed in or implied by such forward-looking statements. Given these risks and uncertainties, persons reading this communication are cautioned not to place undue reliance on such forward-looking statements. T-Mobile assumes no obligation to update or revise the information contained in this communication (whether as a result of new information, future events or otherwise), except as required by applicable law. References to our and the SEC's website are inactive textual references only. Information contained on our and the SEC's website is not incorporated by reference in this communication and should not be considered to be a part of this communication.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250904333578/en/

CONTACT: T-Mobile US, Inc. Media Relations

MediaRelations@t-mobile.com

T-Mobile Investor Relations

investor.relations@t-mobile.com

https://investor.t-mobile.com

Court: N.D. Illinois

Case: 1:23-cv-02764

Telephone & Data Systems ($NYSE-TDS) agreed to settle claims that it misled them about the financial impact and effectiveness of its 2022 “Any Phone Free” promotion.

This settlement presents a great opportunity for investors to recover some of their losses. Here’s what you need to know to claim your payout.

Who is eligible?

All persons or entities that purchased or otherwise acquired TDS publicly traded securities between May 6, 2022, and November 3, 2022, inclusive, and were damaged thereby.

Do you have to sell securities to be eligible?

No, if you have purchased securities within the class period, you are eligible to participate. You can participate in the settlement and retain (or sell) your securities.

How much will my payment be?

The final payout amount depends on your specific trades and the number of investors participating in the settlement.

If 100% of investors file their claims, the average payout will be $0.5 per share. Although typically only 25% of investors file claims, in this case, the average recovery will be $2 per share.

How long will it take to receive your payout?

The entire process usually takes 4 to 9 months after the claim deadline. But the exact timing depends on the court and settlement administration.

How to claim your payout — and why it's important to act now?

The settlement will be distributed based on the number of claims filed, so submitting your claim early may increase your share of the payout.

In some cases, investors have received up to 200% of their losses from settlements in previous years.

More than 100 companies are currently paying out settlements. Connect your portfolio to automatically see which ones you might have missed — or file manually for this case. Don’t miss your chance to get yours back.

The Russell 2000 is home to many small-cap stocks, offering investors the chance to uncover hidden gems before the broader market catches on. However, these companies often come with higher volatility and risk, as their smaller size makes them more vulnerable to economic downturns.

Picking the right small caps isn’t easy, and that’s exactly why StockStory exists - to help you focus on the best opportunities. That said, here is one Russell 2000 stock that could deliver strong gains and two that may face some trouble.

Two Stocks to Sell:

Telephone and Data Systems (TDS)

Market Cap: $4.6 billion

Operating primarily through its majority-owned subsidiary UScellular and wholly-owned TDS Telecom, Telephone and Data Systems provides wireless, broadband, video, and voice communications services to 4.6 million wireless and 1.2 million broadband customers across the United States.

Why Should You Dump TDS?

Telephone and Data Systems is trading at $40.76 per share, or 3.9x forward EV-to-EBITDA. Dive into our free research report to see why there are better opportunities than TDS.

Brink's (BCO)

Market Cap: $4.67 billion

Known for its iconic armored trucks that have been a fixture in American cities since 1859, Brink's provides secure transportation and management of cash and valuables for banks, retailers, and other businesses worldwide.

Why Are We Wary of BCO?

At $112.04 per share, Brink's trades at 14x forward P/E. To fully understand why you should be careful with BCO, check out our full research report (it’s free).

One Stock to Buy:

EVERTEC (EVTC)

Market Cap: $2.28 billion

Operating one of Latin America's leading PIN debit networks called ATH, EVERTEC is a payment transaction processor and financial technology provider that enables merchants and financial institutions across Latin America and the Caribbean to accept and process electronic payments.

Why Do We Love EVTC?

EVERTEC’s stock price of $35.68 implies a valuation ratio of 10.2x forward P/E. Is now the right time to buy? Find out in our full research report, it’s free.

Stocks We Like Even More

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

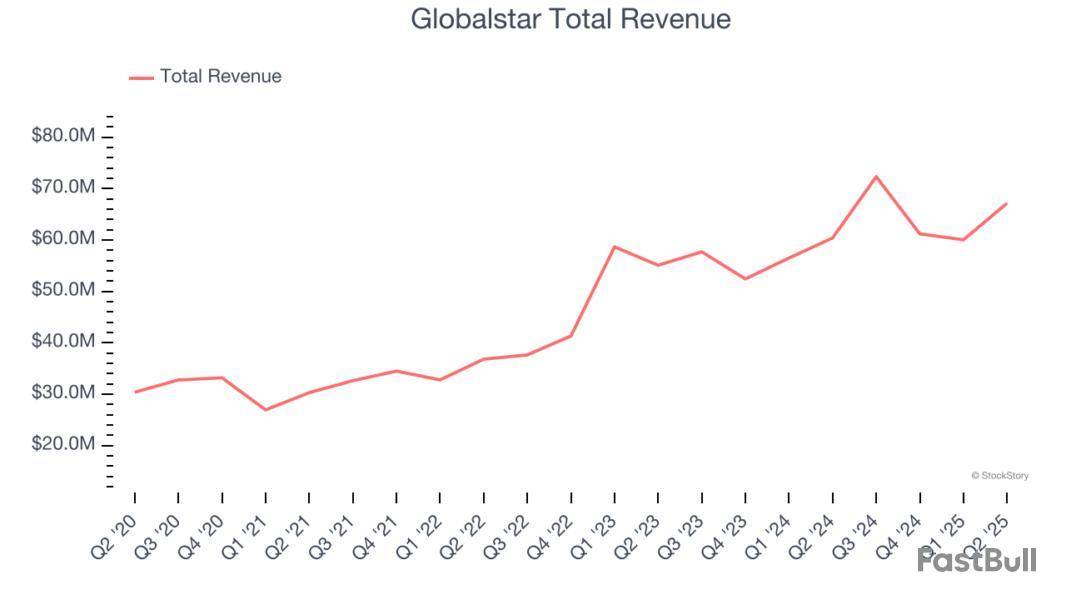

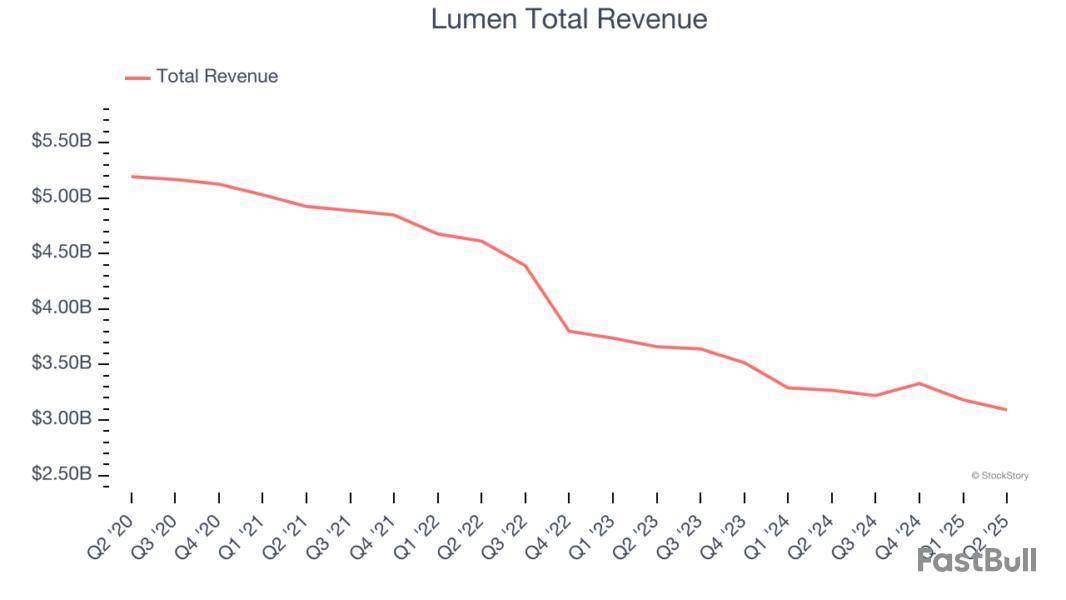

As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the telecommunication services industry, including Globalstar and its peers.

The sector is a tale of two cities. Satellite telecommunication is generally buoyed by rising global demand for connectivity in costly-to-connect and remote areas. On the other hand, terrestrial telecommunication companies face an uphill battle, as they mostly sell into a deflationary market, where the price of moving a bit tends to decrease over time with better technology. Despite the differences in demand drivers, companies across the entire industry must contend competition from larger telecom conglomerates and hyperscalers expanding their own networks as well as newer entrants such as SpaceX's StarLink.

The 6 telecommunication services stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 1.6%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Known for powering the emergency SOS feature in newer Apple iPhones, Globalstar operates a network of low-earth orbit satellites that provide voice and data communications services in remote areas where traditional cellular networks don't reach.

Globalstar reported revenues of $67.15 million, up 11.2% year on year. This print exceeded analysts’ expectations by 6.4%. Overall, it was an incredible quarter for the company with a beat of analysts’ EPS estimates and full-year revenue guidance exceeding analysts’ expectations.

Globalstar pulled off the biggest analyst estimates beat and fastest revenue growth of the whole group. Unsurprisingly, the stock is up 11.9% since reporting and currently trades at $28.20.

We think Globalstar is a good business, but is it a buy today? Read our full report here, it’s free.

With approximately 350,000 route miles of fiber optic cable spanning North America and the Asia Pacific, Lumen Technologies operates a vast fiber optic network that provides communications, cloud connectivity, security, and IT solutions to businesses and consumers.

Lumen reported revenues of $3.09 billion, down 5.4% year on year, falling short of analysts’ expectations by 0.7%. However, the business still had a very strong quarter with a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 18.2% since reporting. It currently trades at $5.29.

Is now the time to buy Lumen? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Telephone and Data Systems

Operating primarily through its majority-owned subsidiary UScellular and wholly-owned TDS Telecom, Telephone and Data Systems provides wireless, broadband, video, and voice communications services to 4.6 million wireless and 1.2 million broadband customers across the United States.

Telephone and Data Systems reported revenues of $1.19 billion, down 4.2% year on year, exceeding analysts’ expectations by 1.5%. Still, it was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 3.4% since the results and currently trades at $40.08.

Read our full analysis of Telephone and Data Systems’s results here.

With a constellation of 66 low-earth orbit satellites providing coverage to every inch of the planet, Iridium Communications operates a global satellite network that provides voice and data services to customers in remote areas where traditional telecommunications are unavailable.

Iridium reported revenues of $216.9 million, up 7.9% year on year. This print topped analysts’ expectations by 1.6%. Taking a step back, it was a softer quarter as it recorded a significant miss of analysts’ EPS estimates.

The stock is down 23.2% since reporting and currently trades at $24.93.

Read our full, actionable report on Iridium here, it’s free.

Operating a massive network spanning 20,000 miles of fiber optic cable and connecting to over 3,200 buildings worldwide, Cogent Communications provides high-speed Internet access, private network services, and data center colocation to businesses and bandwidth-intensive organizations across 54 countries.

Cogent reported revenues of $246.2 million, down 5.5% year on year. This result lagged analysts' expectations by 0.7%. More broadly, it was actually a very strong quarter as it recorded a beat of analysts’ EPS estimates.

Cogent had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is down 13.9% since reporting and currently trades at $37.79.

Read our full, actionable report on Cogent here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up