Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Swedish Central Bank Governor Thedeen:-, My Assessment Is That The Likelihoodof Very Restrictive Trade Barriers Is Nevertheless Limited

Swedish Central Bank Governor Thedeen:-The Greenland Crisis Hascreated Renewed Uncertainty Regarding The Rules That Will Apply To Our Economicexchanges With The United States

Swedish Central Bank's Seim: I Assess That The Increased Uncertainty Reduces The Risk Of Demand Driven Inflation In Sweden Somewhat

Swedish Central Bank's Deputy Governor Bunge: Will Probably Have To Monitor Both Whether The Strengthening Of The Krona Continues And Its Impact On Prices

Iceland's Central Bank: Further Decisions To Lower Interest Rates Will Depend On Clear Evidence That Inflation Is Falling Back To Bank's 2½% Inflation Target

Swedish Central Bank Governor Thedeen:-At Present I Assess That Monetarypolicy Is Following A Stable And Reasonable Course

Regional Official: Regional Invitees To Istanbul Talks Were Discussed With Iran During Planning Process

Regional Official: Iran Has Said From The Start That It Will Only Discuss With US Its Nuclear Programme, Americans Wanted Other Issues On Agenda

Estonia Tax And Customs: Detained A Container Ship Sailing Under The Bahamian Flag In Estonia's Internal Waters, Which May Be Linked To Smuggling From Ecuador

Wartsila CEO: USA Tariffs On Batteries Are 50% To 60%, Have Put "A Wet Blanket" Over USA Market

Afreximbank President : We Have Put Together An Initial Package Of 8.5 Billion Dollars For South Africa

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction YieldA:--

F: --

P: --

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown.

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown. Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)A:--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)A:--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)A:--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)A:--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)A:--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)A:--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)A:--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)--

F: --

P: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

No matching data

View All

No data

THORChain DEX aggregator THORSwap has made a series of repeated bounty offers to the exploiter of a user's personal wallet over the past few days, with the victim likely to be THORChain founder John-Paul Thorbjornsen, according to ZachXBT.

"Bounty offer: Return $THOR for reward. Contact contact @ thorswap.finance or THORSwap discord for OTC deal," the latest onchain message to the hacker on Friday morning reads. "No legal action will be taken if returned within 72 hours."

Blockchain security company PeckShield flagged the messages on X, initially suggesting the THORChain protocol itself had suffered an exploit of around $1.2 million. However, that post was subsequently corrected to confirm it was a user's personal wallet that had been exploited after clarification from the THORChain team. "This incident involved a user's personal wallet being exploited, and is not related to THORChain," the project said. "This is just a bounty requesting for return of stolen assets. No protocol (thorchain or thorswap) were exploited." THORSwap CEO "Paper X" added.

THORChain founder likely victim

Responding to PeckShield's post on X, onchain sleuth ZachXBT said the exploited wallet likely belongs to THORChain founder John-Paul Thorbjornsen, who had a personal wallet drained for $1.35 million by North Korean hackers on Tuesday.

The source of the attack came via a message from the hacked Telegram account of a friend of the THORChain founder containing a fake Zoom meeting link, Thorbjornsen acknowledged earlier this week. "Ok so this attack finally manifested itself," he followed up on Tuesday. "Had an old MetaMask cleaned out."

Thorbjornsen said the MetaMask wallet was only in another logged-out Chrome profile with its key stored in iCloud Keychain, yet attackers likely accessed one or both via a 0-day exploit — reinforcing his view that threshold signature wallets, which split key shares across devices, are the only real protection.

According to ZachXBT, the attacker stole approximately $1.03 million in Kyber Network tokens and $320,000 in THORSwap tokens. The theft address sent funds to the same "Exploiter 6" address that the onchain bounty messages were sent to. The majority of the stolen funds, matching PeckShield's $1.2 million figure, currently sit at an address beginning "0x7Ab," seemingly swapped to ETH, ZachXBT noted on his official Telegram channel.

The Block reached out to Thorbjornsen for comment.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Bitcoin is trading around $115,400, up about 1% today. Ethereum has also inched higher, while Dogecoin jumped 4–5%, making it one of the day’s top performers. Overall sentiment in the crypto market is cautiously positive as traders wait for clues from the U.S. Federal Reserve. Hopes of interest rate cuts, along with steady progress on crypto ETFs and regulation, are keeping momentum alive.

Altcoins Attract Big Money

While Bitcoin remains range-bound, altcoins are pulling in fresh capital.

These moves are bringing not just money, but also renewed momentum and excitement into the altcoin sector.

Bitcoin’s Quiet Phase

Over the past week, Bitcoin has been trading between $110,000 and $116,000 without a clear breakout. According to Galaxy Digital CEO Mike Novogratz, this sideways movement is normal as capital rotates into altcoins.

“Bitcoin is simply pausing before its next big run, which could arrive by the end of the year,” Novogratz said.

Fed Cuts and Regulation Could Spark the Next Rally

Novogratz believes the Federal Reserve’s upcoming rate cuts will be a major driver of Bitcoin’s next surge. Historically, lower rates benefit risk assets, and Bitcoin could be one of the top winners.

On the regulatory front, the tone is also shifting. SEC Chair Paul Atkins has been pushing for updated securities rules to bring more activity on-chain. Meanwhile, Nasdaq has filed for approval to tokenize stocks and ETFs, signaling that traditional markets are beginning to embrace blockchain technology.

Beyond Bitcoin’s Store-of-Value Role

For years, Bitcoin has been viewed mainly as a digital store of value, while stablecoins handled payments. But now, with faster blockchains, safer infrastructure, and clearer rules, the crypto landscape is expanding.

Novogratz explained:

“Ethereum, Solana, and other chains each have their own strengths. Instead of one winner, the industry will grow as a full ecosystem.”

From Hype to Real Progress

Summing up the market’s shift, Novogratz said:

“Crypto is moving from narrative to plot — from hype to real progress.”

If he’s right, Bitcoin’s calm phase is just a pause, while altcoins continue to fuel the next chapter of crypto’s growth story.

FAQs

Will Bitcoin go up after the Fed rate cuts?Yes, many analysts, including Mike Novogratz, believe Fed interest rate cuts will boost Bitcoin. Lower rates usually help risk assets, and Bitcoin could benefit the most.

Why are altcoins rising today?Altcoins are rallying due to fresh institutional inflows. Ethereum saw a $200M treasury boost, while Solana gained backing for a $1.65B treasury plan.

Is Ethereum becoming stronger than Bitcoin?Not stronger, but Ethereum is gaining traction as institutions like BitMine increase ETH holdings. Both BTC and ETH are seen as key players in the ecosystem.

What could trigger the next crypto bull run?Analysts point to Fed rate cuts, ETF approvals, rising on-chain adoption, and tokenized assets as key catalysts.

The fight between Coinbase and the U.S. Securities and Exchange Commission (SEC) has taken another sharp turn and Cardano founder Charles Hoskinson just added fuel to the fire with a sarcastic jab at former SEC Chair Gary Gensler.

Here’s what’s buzzing on X.

Coinbase Calls Out SEC Over Destroyed Records

Coinbase’s Chief Legal Officer Paul Grewal revealed this week that the SEC, under Gensler, destroyed internal texts from October 2022 to September 2023. These messages, he said, were directly related to ongoing legal battles and should have been preserved.

“The Gensler SEC destroyed documents they were required to preserve and produce. We now have proof from the SEC’s own Inspector General,” Grewal wrote on X.

He called it a “gross violation of public trust” and confirmed Coinbase is asking the court for expedited discovery, sanctions, and the immediate release of any remaining communications.

For Coinbase, the accusation highlights a double standard: the same regulator that fines crypto companies billions for poor record-keeping is now accused of breaking its own rules.

Hoskinson Turns Gensler’s Line Back on Him

Hoskinson wasted no time in pointing out the irony. Responding to Grewal’s post, he wrote: “I’m sure Gary can come in and register :)”

Charles Hoskinson@IOHK_CharlesSep 12, 2025I'm sure Gary can come in and register 🙂 https://t.co/OLvgqkiBdq

The comment cuts at one of Gensler’s most famous talking points. During his time at the SEC, he repeatedly told crypto firms to “just come in and register.” Industry leaders argued that no clear path for registration existed.

Hoskinson’s one-liner flips that message back on the regulator itself – highlighting what many see as hypocrisy.

Coinbase’s Lengthy Legal Battles

The regulator has previously charged the exchange with operating as an unregistered securities exchange, broker, and clearing agency. It also accused Coinbase of running an unregistered staking-as-a-service program, which has been a major revenue source for the company.

According to the SEC, Coinbase has made billions since 2019 by combining exchange, broker, and clearing functions without registering any of them. The agency argues this deprived investors of critical protections such as proper disclosures, inspections, and safeguards against conflicts of interest.

It goes beyond this too.

In July, it challenged the Federal Deposit Insurance Corporation (FDIC) for allegedly trying to push crypto firms out of banking. In Oregon, it is contesting the state’s attempt to enforce its own crypto rules, arguing that only federal regulators have that authority.

Coinbase says these cases are about forcing real regulatory clarity for the crypto industry.

A New Dawn for Crypto

But things have shifted dramatically under President Trump’s second term. With Chairman Paul Atkins now leading the SEC, the agency has launched Project Crypto – an initiative to draft clear, simple rules and bring digital asset activity back onshore.

Atkins has made it clear that most crypto assets should not be treated as securities, and even where they are, the rules will be rewritten to encourage innovation, not punish it.

Backed by the America First Policy Institute and embraced by industry leaders, the new SEC has signaled a complete break from Gensler’s crackdown era – positioning the U.S. to become the global capital of crypto.

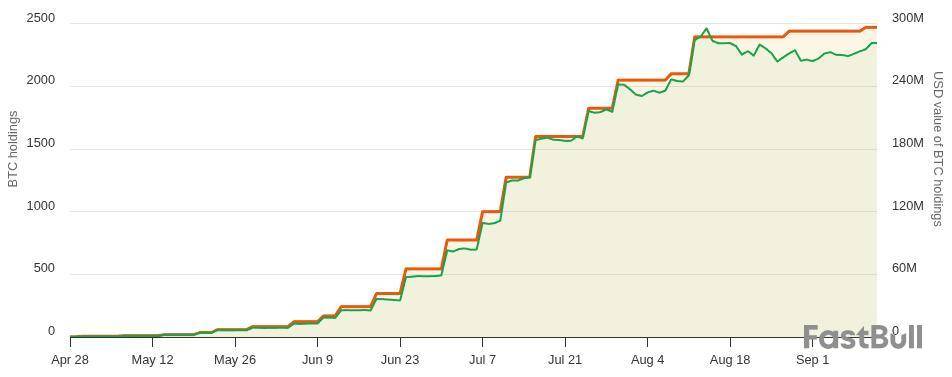

The Smarter Web Company, the United Kingdom’s largest corporate Bitcoin holder, is considering acquiring struggling competitors to expand its treasury, CEO Andrew Webley said.

Webley told the Financial Times that he would “certainly consider” buying out competitors to acquire their Bitcoin (BTC) at a discount.

According to BitcoinTreasuries.NET data, The Smarter Web Company is the world’s 25th biggest and the UK’s top corporate Bitcoin treasury. It currently holds 2,470 BTC worth nearly $275 million.

The Smarter Web Company’s CEO also said the company aspires to enter the FTSE 100 — the UK’s top 100 listed companies index. He also noted that the firm changing its name is “inevitable” but said that he needs “to do it properly.”

Alex Obchakevich, the founder of Obchakevich Research, told Cointelegraph that “buying the assets of bankrupt crypto companies often promises discounts, but the reality is actually much tougher than everyone thinks.”

Obchakevich cited the bankruptcies of crypto exchange FTX and crypto lender Celsius. He explained that while initially discounts reached 60% to 70%, “after deducting liabilities liquidated in bankruptcy, encumbrances removed by the court and taxes, the net discount drops to 20–50%.”

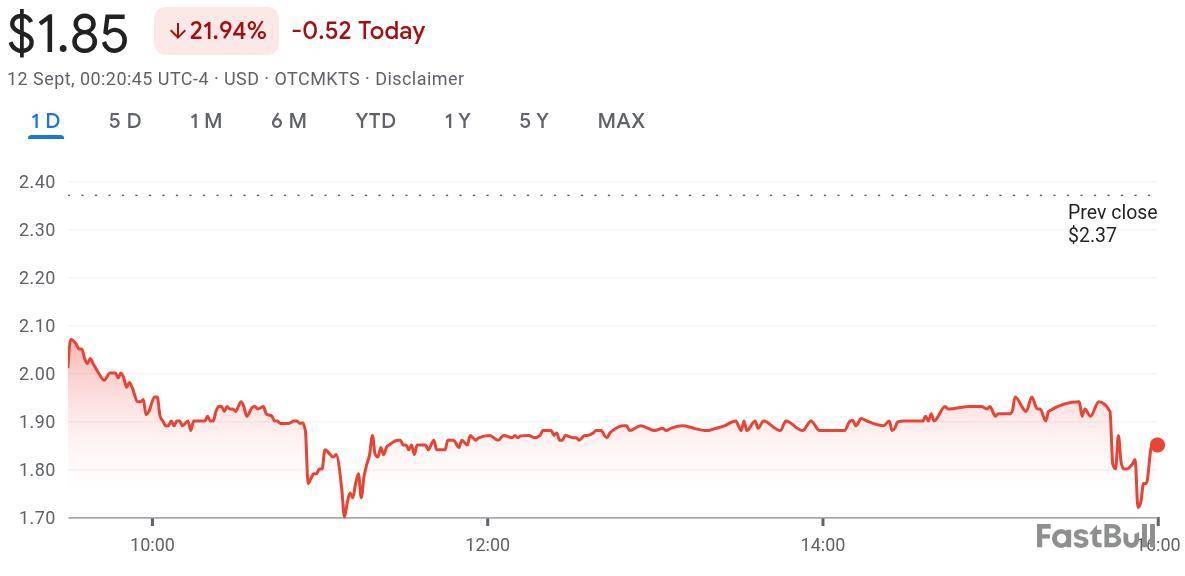

Webley’s comments came after Smarter Web’s stock fell nearly 22% on Friday, dropping from $2.01 at the open to $1.85 at the time of writing. The decline came despite BTC gaining more than 1% over the past 24 hours.

Over the last month, Bitcoin also lost over 4% of its value, while The Smarter Web Company’s price fell by around 35.5%.

Smarter Web’s price correction also comes after the UK allowed retail investors to access crypto exchange-traded notes (cETNs) in early August, with the change taking effect from Oct. 8. This provides an alternative to investing in crypto treasury companies, which were previously the most accessible regulated vehicle for getting exposure to digital assets in the UK.

Profiting from the failure of competitors

Webley’s comments about acquiring competitors follow reports that Bitcoin treasuries, especially new and smaller ones, are likely to encounter trouble. Coinbase head of research David Duong and researcher Colin Basco recently said that crypto-buying public companies are entering a “player vs player” stage that will see firms competing harder for investor money.

They said that “strategically positioned players will thrive” and supercharge the crypto industry with their capital flow. Also, analysts said that this market segment is quickly becoming oversaturated and that many crypto treasuries will not survive in the long term.

Josip Rupena, CEO of lending platform Milo and a former Goldman Sachs analyst, told Cointelegraph at the end of last month that crypto treasury companies mirror the risk of collateralized debt obligations, which played a key role in the 2008 financial crisis.

“There’s this aspect where people take what is a pretty sound product, a mortgage back in the day or Bitcoin and other digital assets today, for example, and they start to engineer them, taking them down a direction where the investor is unsure about the exposure they’re getting,” he said.

Key points:

Bitcoin “shark” wallets have started buying the dip, adding 65,000 BTC to their holdings in just seven days.

Short-term holders also cross a milestone, with the profit ratio of coins moving onchain flipping positive.

Long-term holders have yet to return to net accumulation.

Bitcoin “conviction-driven” holders have bought 65,000 BTC in just seven days as price bounces from two-month lows.

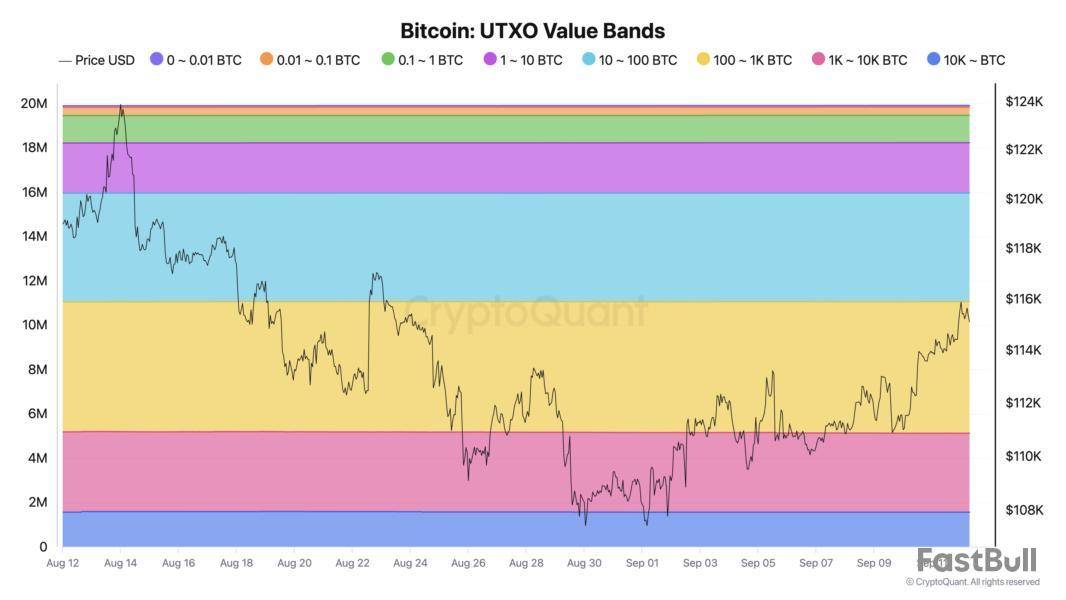

New research from onchain analytics platform CryptoQuant released Thursday shows Bitcoin “sharks” buying the dip.

Bitcoin’s big players rethink distribution

Bitcoin wallets with a balance between 100 BTC and 1,000 BTC have wasted no time bagging coins at lower prices.

CryptoQuant data shows that in a single week, these “sharks” added 65,000 BTC of net market exposure.

“Bitcoin’s recent market action highlights a sharp divide between short-term traders and larger, conviction-driven buyers. Addresses holding 100–1,000 BTC—known as ‘sharks’—have added 65,000 BTC in just seven days, lifting their total to a record 3.65 million BTC,” contributor XWIN Research Japan wrote in one of its Quicktake blog posts.

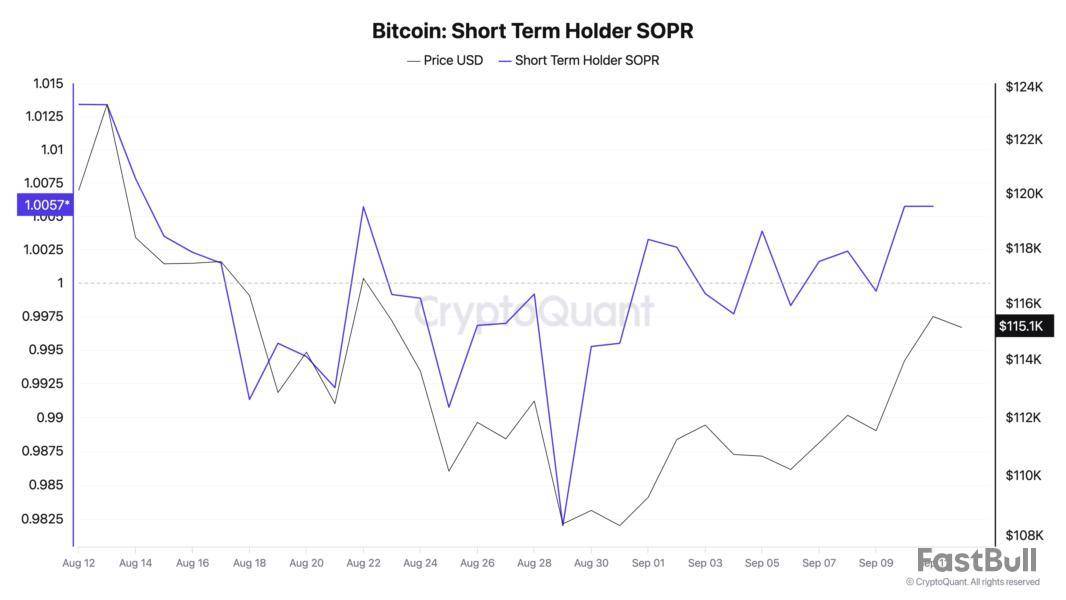

XWIN referred to knee-jerk reactions to BTC price volatility from the Bitcoin speculative trader base, or short-term holders (STHs) — wallets hodling for six months or less.

CryptoQuant data shows the spent output profit ratio (SOPR) of these investors only just beginning to flip positive on Friday, after a nearly month-long period in which STH coins were moving onchain at a loss.

Predicting the next “strong leg up” for BTC

XWIN observed declining exchange balances as proof of buyer demand at current prices.

“Net outflows—BTC withdrawn from exchanges—have dominated recently, signaling that investors are moving coins into cold storage rather than keeping them liquid for trading,” it wrote.

While more BTC price corrections “remain possible” in the future, the market structure thus appears strong.

“Beneath surface volatility, the groundwork for Bitcoin’s next strong leg upward appears to be forming,” XWIN concluded.

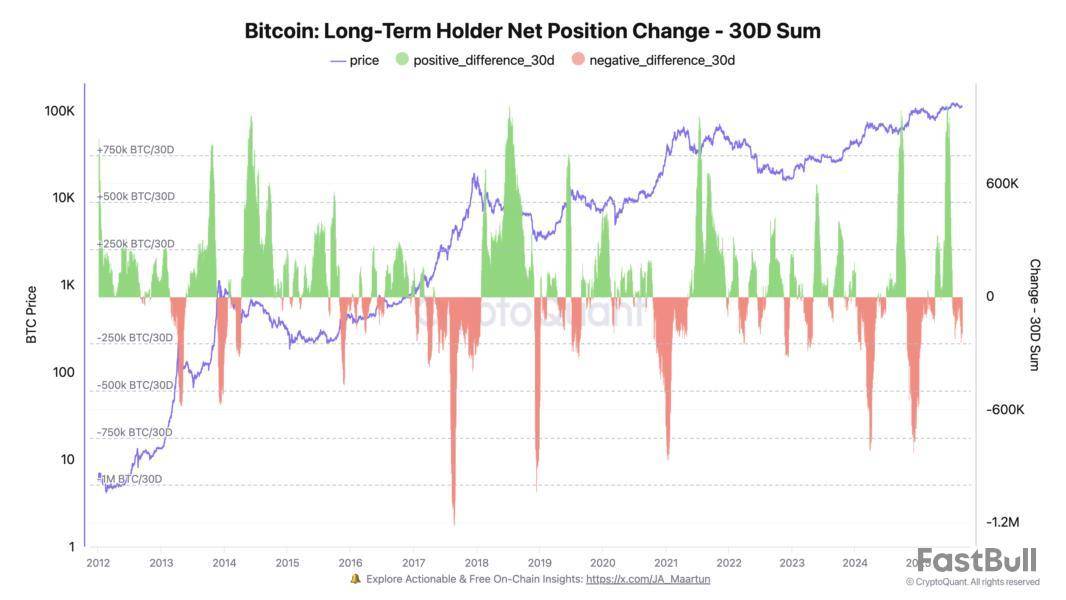

The situation among some BTC investor cohorts is nonetheless precarious. As Cointelegraph reported, whales and long-term holders echoed the 2022 bear market with their selling habits through August.

CryptoQuant shows that LTH wallet balances have yet to recover, with the rolling 30-day balance change still being negative.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

World Liberty Financial’s community is lining up behind a proposal to route all fees from the project’s protocol-owned liquidity into open-market purchases of WLFI that are then permanently destroyed.

If approved, the POL-fee burn would run continuously. This means that fees accrue to treasury-owned LP positions, then are swapped for WLFI on the open market. Next, the purchased tokens are sent to a burn address, reducing circulating supply and, in theory, increasing each remaining token’s claim on future protocol activity.

Burns would be executed and disclosed onchain, and the program could later expand to other protocol revenue streams, the proposal states. Fees earned by community or third-party LPs are unaffected.

With a week left in the vote, support stands at 99.57% in favor, 0.09% against, and 0.34% abstaining, according to the project’s governance portal.

WLFI is the native token of World Liberty Financial, a decentralized finance project publicly backed by members of the Trump family. The protocol presents itself as a bridge between traditional finance and on-chain markets, featuring a fully reserved USD 1 stablecoin and treasury-style operations. Earlier community votes cleared the way for WLFI trading and explored buyback mechanisms tied to broader protocol income, as World Liberty builds out exchanges, payments, and DeFi integrations.

The buyback-and-burn push follows World Liberty’s token launch this month and adds to a wave of protocol revenue recycling across crypto.

Protocols like Hyperliquid, Solana launchpad, Pump.fun, and Raydium have spent nearly $400 million in cumulative buybacks since mid-June, The Block’s data dashboard shows. It’s part of a broader shift by DeFi venues to use cash flows for supply reduction rather than pure emissions.

WLFI’s latest governance move would formalize a similar mechanism focused on fees generated by the protocol’s own liquidity positions on Ethereum, BNB Chain, and Solana. According to The Block's price page, the Trump-backed crypto has slipped almost 40% from its all-time high logged shortly after a Sept. 1 debut.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Dogecoin is approaching a familiar inflection on the monthly chart that previously preceded its most explosive advances, according to a new high-timeframe analysis from Kevin (Kev Capital TA) published on September 11. The analyst argues that a fresh stochastic RSI (stoch RSI) cross to the upside on the monthly timeframe—now forming but not yet above the 20 threshold—echoes the technical regime that fueled Dogecoin’s prior cycle blow-offs.

Dogecoin Explosion Imminent?

“Back in February 2017, Dogecoin got a V-shaped stock RSI cross above the 20 level and it went on another rally… 1,852%,” he said, adding that a subsequent monthly cross “produced a very nice 1,751% gain” before the market ultimately topped. The setup, he contends, is again coalescing into Q4.

The framework is deliberately simple: pair the monthly stoch RSI with the monthly RSI and an anchored trend structure. In the 2015–2017 cycle, sustained stoch RSI crosses above 20 were the dividing line between failed bear-market feints and true bull-cycle advances. By contrast, a 2019 impulse rally faded because “the stock RSI never really got a durable cross to the upside,” occurring amid a still-dominant bear regime, he noted. In the 2020–2021 cycle, a new stoch RSI bull cross above 20 “goes on its major bull market rally, which was the biggest rally Dogecoin has ever been on.”

Kevin says the present cycle has followed a cleaner sequence than prior ones. After a confirmed monthly stoch RSI bull cross earlier in the cycle, Dogecoin delivered an initial advance “roughly 280%,” then, following a corrective phase, another monthly cross powered a “November-December rally” of about “497%.” The market then reset again.

Today, he sees that process restarting: “We are getting a monthly stock RSI cross again. However, we have not yet crossed the 20 level. So this is the very beginning stages of a potential rally for Dogecoin.” He emphasizes that historically, “you don’t even get your most bullish price action until the stock RSIs are above the 80 level,” calling the current moment the “first or second inning.”

Beyond momentum, the analyst highlights a three-part structural confluence he considers critical on the monthly chart. First, the RSI itself has repeatedly crossed back above its moving average at inflection points; second, each of those RSI/MA recaptures “has coincided with a stock RSI cross to the upside”; third, price has defended a long-running trend line on a series of higher lows.

After a brief deviation below, “we’re now breaking back above the trend line and the [RSI] MA at the same time after holding the 50 level,” which he describes as a textbook double-bottom reaction. He stresses that monthly closes still matter—“we still have… more than half a month to go… this is not guaranteed”—but the multi-indicator alignment is intact. In his words, “we’re talking about a combination of indicators and technicals that have never failed before,” provided the macro backdrop doesn’t flip adverse.

Macro Conditions Need To Align

Macro is the caveat and, potentially, the accelerator. Kevin frames US monetary policy as the decisive driver of the crypto risk cycle: “Monetary policy… that’s the earnings report for the crypto market.” He argues that inflation has been range-bound on a year-long view while labor data “continues to soften,” a mix he believes anchors expectations for rate cuts “this month… and… in November and December.”

If that path holds and the Federal Reserve’s tone is dovish at the upcoming FOMC, he expects Bitcoin dominance to drift lower and for “alt season” dynamics to reassert, with Dogecoin positioned to “outperform over Bitcoin.” Conversely, a hawkish turn or a renewed inflation drift higher would be a “major hiccup” for the setup.

Seasonality and timing also figure in his risk management guidance. September remains “seasonally weak,” and with the FOMC roughly a week away from his recording date, he anticipates choppier, indecisive price action in the near term while markets “sit back and wait for the tone of Powell.”

The higher-timeframe roadmap, however, remains his anchor: monthly uptrend structure, RSI reclaim over its MA, stoch RSI in early-stage turn, and the historical tendency for major Dogecoin expansions to ignite only after those momentum gauges push well into overdrive. “These charts are telling us right in our faces that Dogecoin is preparing for a bigger move higher… the pathway is laid,” he said.

At press time, DOGE traded at $0.261.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up