Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Crypto has struggled with one major problem for years. People own digital assets but can’t spend them anywhere useful. SpacePay tackles this issue head-on by enabling merchants to accept crypto payments through their existing card machines.

The London-based fintech startup converts crypto to cash instantly, works with over 325 different wallets, and charges just 0.5% in fees. Their approach removes the complexity that has kept businesses away from digital currencies for so long.

Most crypto payment solutions ask merchants to replace their entire system. SpacePay works differently by updating the software on Android terminals that millions of shops already use every day.

How This Altcoin Solves Real Crypto Problems

The $SPY token serves multiple purposes within SpacePay’s ecosystem. Token holders receive voting rights on platform decisions and monthly rewards for staying active in the community. They also get early access to new features before public release.

Revenue sharing creates a direct connection between platform success and token value. When more merchants process payments through SpacePay, holders earn a portion of those transaction fees. This ties the token’s utility to actual business performance rather than pure speculation.

Every three months, SpacePay jumps on video calls where anyone holding tokens can ask the team whatever’s on their mind. That’s refreshing when most crypto projects disappear after taking your money and only surface again if things go well.

You can pay with Bitcoin, Ethereum, Binance Coin, USDT, or whatever crypto you’ve got sitting in your wallet. No need to download yet another app or convert everything to some random coin you’ve never heard of.

Why Payments Could Explode in 2025

The stars seem to be aligning for crypto payments to finally take off in 2025. Instead of just saying “crypto bad,” governments are writing real rules that businesses can follow. When shop owners know they won’t get in trouble for accepting digital money, they’re way more likely to try it.

Traditional payment processors continue raising their fees while crypto solutions become more reliable. Small businesses especially feel the pinch when credit card companies take 3% or more from every sale. SpacePay’s 0.5% rate could save restaurants and retail stores thousands of dollars annually.

About 400 million people worldwide own cryptocurrency now, but most can’t spend it anywhere practical. This creates enormous pent-up demand for payment solutions that actually work in physical stores. SpacePay positions itself to capture this market by making crypto spending as simple as tapping a phone.

The tech side has gotten its act together too. Remember when Bitcoin transactions took forever and cost a fortune? Those days are mostly behind us now. Everything works faster and cheaper than it used to.

SpacePay’s Growing Presale Success

The $SPY token presale has attracted significant investment, with funding now approaching $1.3 million. This demonstrates genuine market interest in practical crypto payment solutions rather than speculative trading opportunities.

Token prices increase as each presale stage sells out, rewarding early participants with better rates. The dynamic pricing model creates some urgency while still allowing newcomers to join at reasonable entry points.

Here’s what’s smart about SpacePay – they actually built something that works before asking people for money. Most crypto teams do it backwards, raising millions with nothing but fancy presentations and big promises.

Instead of blowing cash on celebrity endorsements or Super Bowl ads, they’re putting money into boring stuff like compliance and business partnerships. It’s not exciting, but it’s exactly what you want to see from a company planning to stick around.

Visit SpacePay Presale

Real-World Integration That Works

Most businesses avoid crypto payments because of volatility concerns. Nobody wants to accept $100 in Bitcoin only to find it’s worth $85 an hour later. SpacePay eliminates this risk by converting payments to regular currency immediately.

Merchants receive their local currency within seconds of the transaction. They never actually hold cryptocurrency or need to monitor price charts. This removes the gambling aspect that scares shop owners away from digital payments.

The platform requires minimal technical knowledge from business owners. Staff members don’t need training on blockchain concepts or wallet management. Transactions look identical to regular card payments from their perspective.

Security features include encryption and real-time monitoring without making the system complicated for users. Everything happens automatically in the background, where regular people don’t have to think about it.

Looking Ahead at Market Opportunities

Traditional payment companies know crypto is coming, but they’re moving slowly to adapt. Most of their solutions are expensive and require significant operational changes. SpacePay’s simpler approach could capture substantial market share before larger competitors catch up.

Corporate adoption continues accelerating as major companies add Bitcoin to their balance sheets. This legitimizes cryptocurrency for smaller businesses that follow industry leaders.

The shift toward digital payments isn’t slowing down either. Cash usage drops every year while contactless payments become the norm. Crypto transactions represent a natural progression in this trend.

Anyone interested in the $SPY presale can visit SpacePay’s official website and connect their crypto wallet. The platform accepts ETH, BNB, MATIC, AVAX, USDT, USDC, and regular bank cards for those new to cryptocurrency.

With tokens currently priced at $0.003181 each, participants can select their desired amount and complete the purchase through straightforward on-screen instructions.

JOIN THE SPACEPAY ($SPY) PRESALE NOW

Website | (X) Twitter | Telegram

The post This Altcoin Bridging Crypto and Real-World Use Is Set to Explode in 2025, Presale Ongoing appeared first on 99Bitcoins.

XRP's performance against Bitcoin is returning to a familiar pattern, and the charts are not looking good as August comes to a close. On the daily time frame, the pair is orbiting 0.000025 BTC after failing to hold its push above 0.000030 BTC.

The candles are below the midline of the Bollinger setup, and the bands are tighter, which often happens before a bigger move. Since XRP is on the lower end of that range, it suggests that the bias is on the downside.

On the weekly chart, the pattern looks even clearer. The rally that started at the end of last year lifted XRP from its lowest point in years, but it topped out quickly once it hit the 0.000030 zone.

Since then, weekly closes have been dropping, and it looks like they have hit a ceiling, similar to what we saw before. The rejection from the upper band leaves the pair in a position to support itself, and the next pocket that is easy to spot is closer to 0.000023 BTC.

TradingView">

The monthly view tells the longest story. XRP used to have ratios that put it in the same ballpark as Bitcoin — trading above 0.000100 BTC in 2017 and even hitting 0.000200 BTC at its peak. Those days are long gone.

What's next?

Every time there has been an attempt to recover, it has been cut down before crossing the long-standing ceiling around 0.000055 BTC. That barrier has not been broken in over five years, and the market has seen every test as a chance to sell into strength.

When you put it all together, it looks like XRP is entering another period where it is going to lag behind Bitcoin. With BTC dominance still close to 59% and capital flow favoring the leading coin, altcoin pairs like continue to show weakness.

Attacks on European crypto holders continue to escalate, as a bad actor impersonated a police agent to steal assets using social engineering tactics.

North Wales Police are investigating a theft of roughly 2.1 million euros ($2.8 million) in bitcoin after a scammer posing as a senior UK law-enforcement officer convinced a victim to reveal their wallet seed phrase through a phishing link, the force said in a public warning.

A seed phrase—typically 12 to 24 words—is the master key to a self-custodied crypto wallet. Anyone who obtains it can control the associated assets.

According to the notice, the culprit claimed an arrested suspect’s phone contained the victim’s identification documents and urged them to “secure” their assets. The victim then entered their recovery phrase on a sophisticated spoof website, allowing thieves to access the wallet and withdraw the funds within minutes.

Police cautioned that officers will not contact the public to discuss crypto holdings or instruct them to take action on cold-storage devices. They also emphasized that no legitimate company or agency will ever ask for a seed phrase. The alert urged anyone receiving such calls to hang up and verify by dialing the non-emergency 101 number.

Such social engineering attacks, where cybercriminals trick victims into providing critical wallet credentials, are common in the crypto industry. Blockchain security firm TRM Labs noted that private key theft and seed phrase exploits comprised 80% of stolen funds in the first half of 2025.

Europe also faces a wave of physical attempts to steal crypto assets. France alone has been hit with at least 10 “wrench attacks” with cases of attempted kidnappings and crypto ransoms reported.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Most crypto presales feel like sitting in a quiet waiting room; you buy your tokens, close the tab, and then wait for weeks or months before anything happens.

PEPENODE is different because the moment you join, you step into a virtual mining world where you can start building, earning, and competing right away.

Instead of staring at a countdown timer, you can set up virtual Miner Nodes, upgrade facilities, and climb a leaderboard that rewards the most active players.

There is even the fun of earning meme coins along the way. Early adopters are not just buying tokens here; they are creating value before the official launch even happens.

From Tokens to Virtual Mining Rigs Right From the Presale

Once you join the presale, the mining game begins. You get access to a digital dashboard where you can purchase Miner Nodes and upgrade facilities to boost your hash power. Every new node you add and every upgrade you make increases your mining strength.

It feels more like a resource-building game than a traditional staking platform; your mining rig is entirely virtual, but the sense of progress and ownership is very real.

The best part is that these assets will carry over after the Token Generation Event, so what you build now will still matter once the mining goes on-chain.

Right now, the mining game runs off-chain for speed and accessibility, but after the Token Generation Event, all gameplay will move on-chain. This shift will introduce NFT-based upgrades, expanded mechanics, and full transparency on mining activity.

All the progress you make during the presale carries over, so early participants will start with a significant advantage when the on-chain phase begins.

Mining in PEPENODE is not just about collecting the project’s token; the game rewards top-performing miners with popular meme coins like $PEPE and $FARTCOIN. Your mining performance during the presale directly affects how much you can earn in these extra bonuses.

It is a lighthearted twist that taps into the huge meme coin market while also giving participants more reasons to stay active. This combines fun and value in a way that keeps players engaged and talking about the project long before launch day.

Early Adopters Get the Strongest Nodes

There is another reason to get in early: the tiered node system means the first buyers get access to more powerful Miner Nodes. These early nodes mine faster and bring in more rewards, giving early participants a noticeable head start.

That advantage does not just apply during the presale; once the game moves on-chain, stronger nodes will continue to produce more over time, making early decisions even more valuable.

PEPENODE keeps track of every miner and shows the results on a live leaderboard. It works like online games where rankings change in real time, which makes it exciting to follow.

The top players get extra rewards, so there is always a reason to keep mining, upgrading, and checking progress. This makes the presale feel like a daily competition instead of just a single purchase.

Deflationary Burns That Create Scarcity

Every time you spend $PEPENODE on new nodes or upgrades, 70% of those tokens are permanently burned, meaning they are removed from circulation for good. These burns happen during the presale itself, reducing supply even before the token starts trading.

For long-term supporters, this built-in scarcity can be a strong value driver, and it rewards active participation while tightening overall supply.

A Fair and Accessible Presale for Everyone: How to Join

Why just hold tokens when you can mine, compete, and earn before the launch? The PEPENODE presale offers a chance to turn the waiting period into a rewarding and game-like experience.

PEPENODE is taking a community-first approach; there are no private rounds or insider allocations, so everyone gets the same access from the start. It also has anti-bot measures that make it harder for automated accounts to grab early spots, and purchases require simple manual steps to keep things fair.

The presale lets you pay with ETH, BNB, USDT, or even a card, so joining is simple. You just need to fund a wallet like MetaMask, Trust Wallet, or WalletConnect, or use a card if you prefer.

Next, visit the official PEPENODE website and connect your wallet. Choose how much you want to buy and select the “Buy and Stake” option if you want to start earning immediately. Confirm the transaction, and then you are ready to begin mining and climbing the leaderboard.

VISIT THE PEPENODE ECOSYSTEM

Website | Telegram | X (Twitter)

The post New Meme Coin PEPENODE Presale Lets You Build Virtual Rigs and Earn $PEPE appeared first on 99Bitcoins.

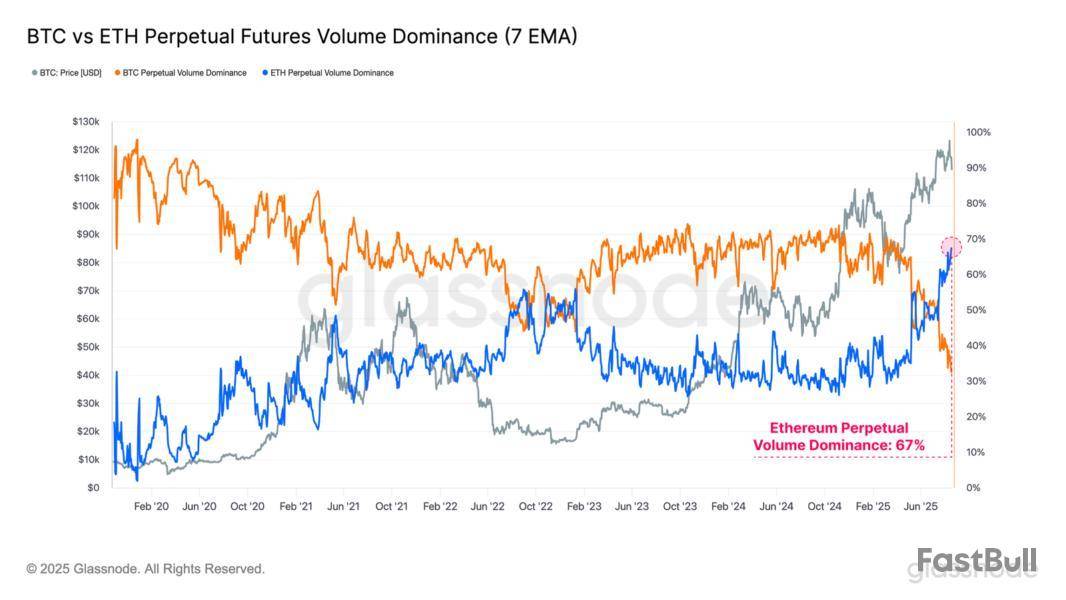

Ethereum’s perpetual futures trading volume share hit a historic high of 67% over the past week. In other words, two-thirds of all crypto perpetual futures trading involved Ethereum.

This indicates that crypto investors are unusually favoring high-risk investments, even amid a market downtrend caused mainly by concerns over rising US inflation.

BTC-ETH Open Interest is Very Close

Glassnode released its weekly report, “A Derivatives-Led Market,” on Wednesday. It explained that while Bitcoin’s price recently hit a new all-time high before correcting, the crypto derivatives market primarily drove the market’s direction.

Despite the correction, Glassnode pointed out that market participants still consider this a bull market, which is reflected in the rising open interest dominance of ETH, a key “bellweather asset“

As of Thursday morning UTC, the spot dominance gap between Bitcoin (59.42%) and Ethereum (13.62%) is about fourfold. However, the open interest dominance is much closer, with Bitcoin at 56.7% and Ethereum at 43.3%. This suggests that leveraged investors are showing significantly greater interest in ETH.

This trend is even more pronounced in trading volume. Ethereum’s perpetual futures trading volume share has reached an all-time high of 67%.

Glassnode explained that these figures highlight the high level of investor interest in the altcoin sector and indicate that investors are now willing to take on greater investment risk.

So, could the price of ETH rise further and serve as a stepping stone to an “altcoin season”? Ultimately, the key appears to lie in the attitudes and interest rate decisions of the US Federal Reserve (Fed) officials.

One of the main reasons for the recent crypto price correction is the uncertainty surrounding the Fed’s interest rate cuts due to renewed US inflation. If Fed Chair Jerome Powell’s speech at the Jackson Hole meeting on Friday signals a move toward interest rate cuts, ETH is expected to rise much faster than BTC.

TRM Labs has teamed up with big crypto firms like Coinbase, Ripple, and Binance to launch the Beacon Network. This is the world’s first crypto crime response system. Its goal is to stop illegal money from moving through the blockchain.

Beacon Network: An Approach to Prevent Crypto Fraud

The crypto industry is often hit by scams and fraud, making it a risky space for investors and users. To tackle this, leading crypto companies have come together to launch the Beacon Network, a system built to stop illegal activities.

The Beacon Network scans blockchain transactions in real time to spot unusual patterns and block suspicious activity.

It also lets trusted members flag shady wallet addresses, trace stolen funds across different blockchains, and share details with law enforcement.

TRM Labs calls it the first complete “kill chain” designed to target and shut down illicit crypto assets.

Esteban Castaño, CEO and co-founder of TRM Labs, stated, “This isn’t about adding another layer of compliance. It’s about unlocking the full potential of crypto: real-time transparency, automated detection, and rapid response. Beacon Network proves that with the right infrastructure, crypto can be the most secure financial system in the world.”

Crypto Giants to Launch Beacon Network

Coinbase, Binance, PayPal, Robinhood, Stripe, Kraken, Ripple, Crypto.com, Zodia Custody, Blockchain.com, Anchorage Digital, Bitfinex, HTX, Poloniex, OKX, LFJ, 1inch, Rhino.fi, Coinspot, and ChangeNow are the founding members of Beacon Network.

“Beacon Network represents a new chapter, defined by real-time intelligence, proactive risk management, and cross-sector collaboration. At Ripple, we’re proud to be a founding member,” said Andrew Rosenberg, Head of Financial Crimes Compliance at Ripple.

The “Kill Chain” Disrupts Illicit Funds

TRM data shows that since 2023, at least $47 billion in cryptocurrency has been sent to fraud-related addresses. Now with Beacon Network, the members seek to end this criminal cycle.

The Beacon Network is already in use and has reportedly achieved successes in tracking illicit funds from cybersecurity incidents. It froze $1.5 million linked to a global scam and identified $800,000 in scam-related deposits at a major exchange.

The network will prioritize taking down major crypto criminals, such as North Korean IT workers involved in crypto scams. It also aims to prevent terrorist financing and recover funds for victims.

Ethereum is rapidly emerging as the go-to asset for institutions, with a growing number of organizations adding it to their treasuries for its role in DeFi, staking, and Web3.

Could this be the start of Ethereum challenging Bitcoin’s dominance?

69 Entities Hold Over 4M ETH

Data from strategicethreserve shows that 69 entities now control over 4 million ETH, valued at a massive $17.6 billion. That is approximately 3.4% of all Ethereum in existence.

BitMine Immersion Technologies tops the list with about 1.5 million ETH worth $6.6 billion. Sharplink Gaming follows next with around 740,800 ETH worth $3.2 billion. The Ether Machine holds roughly 345,400 ETH, while the Ethereum Foundation manages about 231,600 ETH.

In addition, the ETH ETFs reserve currently holds 6.36 million ETH worth about $27.4 billion, representing 5.26% of the total supply.

ETH Outpaces BTC in Treasury Trading

Analyst Miles Deutscher highlighted a “crazy chart” and notes that ETH is overtaking BTC in Treasury Company trading volume. While ETH is gaining ground, he believes it still has plenty of room to catch up with Bitcoin.

Miles Deutscher@milesdeutscherAug 20, 2025This is a crazy chart.BINANCE:ETHUSDT is now flipping BINANCE:BTCUSDT for Treasury Company trading volume.

Tbh, looking at this image makes me think ETH still has a lot of catchup up to do vs BTC, and is the far less saturated trade. pic.twitter.com/SyAZ3LAKJy

The analyst also recently shared that ETH looks like the better buy than BTC right now, pointing out the following:

He believes ETH will rebound stronger than BTC and even outperform many altcoins, offering a better risk-adjusted return.

Expert Views on ETH Treasury Momentum

Adding to the bullish outlook, Ethereum co-founder Joseph Lubin also told in an interview with CNBC that ETH could overtake BTC in market cap within “the next year or so,” with treasury companies playing a key role in that shift.

But not everyone is convinced by the ETH treasury boom.

Ethereum co-founder Vitalik Buterin noted that although treasury companies can strengthen ETH as an asset, he also warned that heavy leverage could trigger cascading liquidations.

Bitcoin bull Samson Mow has argued that ETH’s recent momentum is largely driven by insiders rotating BTC into ETH, only to eventually dump it back into Bitcoin.

With strong momentum in place, ETH could be on a path to outperform Bitcoin in the near term.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up