Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The launch of Alpha Season 5 in The Sandbox (SAND) with exclusive Jurassic World rewards is a significant event. This brings in excitement and could attract new users, especially fans of Jurassic World. The increase in users and activities can stimulate demand for SAND tokens, potentially increasing its price. However, if the season does not meet player expectations, there might be less interest and a chance of price stagnation. Observing user engagement and feedback will be essential to gauge the actual price impact. source

The Sandbox@TheSandboxGameMar 28, 2025The wait is almost over. Alpha Season 5 is coming on March 31st!

Pre-register now for an exclusive @JurassicWorld reward https://t.co/FlVlHgMiRV#TheSandbox #AlphaSeason5 $SAND #JurassicWorld pic.twitter.com/Hvh4PmrRGp

Alchemist AI (ALCH) is deploying important updates like Deepseek V3 and Sonnet 3.7, which could be crucial for user experience. Improved UI/UX may draw more users, increasing demand for the token. These updates can show progress and innovation, boosting investor confidence and possibly driving prices up. However, if the updates fail to meet user expectations or there's a bug, it may cause prices to drop. Attention to community feedback and update success will be vital to understand potential price changes. source

The BSCDaily X Space AMA is a big event for Solidus Ai Tech (AITECH) as it covers a huge airdrop and a new product launch. The airdrop may attract new investors, leading to a possible price increase. Revealing a new product can show the project's growth and development, which also encourages buying activity. Together, these elements could be a catalyst for a major price move. However, if the market response is lukewarm, the impact may be limited. It's important for investors to watch market sentiment during and after the AMA. source

BSCDaily@bsc_dailyMar 28, 2025EXCLUSIVE: Join our X Space AMA with @AITECHio - discussing MASSIVE Ecosystem Airdrop, NEW Product Date Reveal & 10% Supply Burn

X Spaces: https://t.co/CHKdUzV0DP

April 2nd, 13:00 UTC

$200 #Giveaways ️

Follow @AITECHio

Ask questions on X!

Like & RT… pic.twitter.com/RgAGkWwF7T

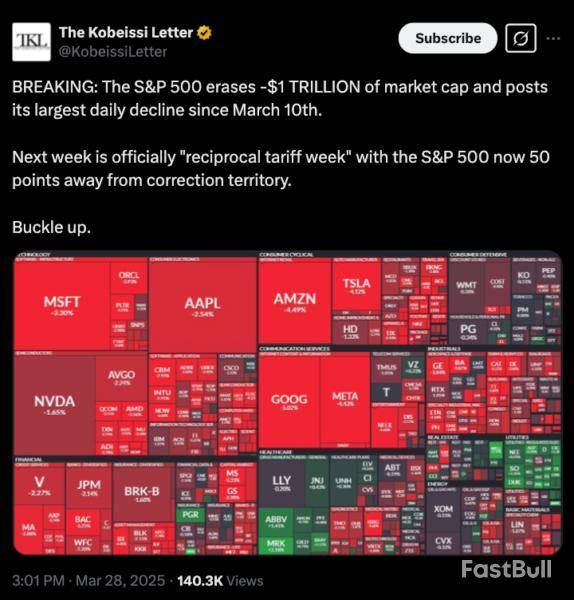

Bitcoin price extended its decline on March 28, falling for a fourth consecutive day to paint an intra-day low of $83,387. BTC’s (BTC) decline mirrored the Wall Street sell-off, where the DOW closed 700 points lower, alongside the S&P 500 index, which dropped 112 points.

The sell-off in equities is widely attributed to investors increasing worries over inflation after the core Personal Consumption Expenditures index data from February rose to 2.8% (a 0.4% monthly increase), which was higher than expected.

The sell-off was further amplified by the markets’ response to US President Trump’s newly levied “reciprocal tariffs,” which applied a 25% tariff to “all cars that are not made in the United States.”

The chances for a Bitcoin relief rally or oversold bounce are likely diminishing as traders cautiously keep an eye on April 2, the day Trump has labeled “Liberation Day,” where additional tariffs, including “pharmaceutical tariffs,” are expected to be unveiled.

Bitcoin price to fall to $65K?

According to veteran trader Peter Brandt, Bitcoin could be on the path to $65,635.

In an X social post, Brandt confirmed the completion of a “bear wedge” pattern and said,

Crypto trader ‘HTL-NL’ agreed with Brandt, suggesting that Bitcoin’s failure in “breaking the ice” of a long-term descending trendline and the confirmation of the bear wedge are proof that BTC is destined to revisit its range lows.

From a purely technical point of view, it’s difficult to project a swift reversal in Bitcoin’s price action as many of its daily timeframe metrics are not oversold. Despite the absence of strong spot market demand in the current price zone, crypto trader Cole Garner says that “whales are going wild right now.”

According to Garner, the Bitfinex spot BTC margin longs to margin shorts metric just fired a powerful signal which shows historical returns of 50%+ returns “within 50 days.”

Beyond the day-to-day price fluctuations, positive crypto industry developments continue to occur on the regulatory front.

On March 28, White House AI and Crypto Czar David Sacks commended the FDIC and its Acting Chairman Travis Hill for clarifying the “process for banks to engage in crypto-related activities.”

Essentially, the Federal Deposit Insurance Corporation’s letter to institutions under its oversight provided clear guidance on their ability to engage in and provide crypto-related products and services without needing to notify the FDIC first.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bangalore, India--(Newsfile Corp. - March 28, 2025) - KoinBX, a rapidly growing crypto exchange, recently listed the native Gala token of the Gala ecosystem - which includes music, games and entertainment in web3.

Image 1

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8717/246556_006c370b1469cbe6_001full.jpg

With the growing interest in play-2-earn and Web3 entertainment projects, the listing of Gala aligns with KoinBX's mission of betterment for the project.

Saravanan Pandian, CEO and founder of KoinBX said, "Entertainment and gaming is undergoing a revolutionary change in the Web3 domain. As KoinBX continues to expand its GameFi offerings, we are thrilled to bring GALA to our global community."

With strategic partnerships across the gaming and entertainment industries, including collaborations with gaming giants, Gala is at the forefront of the $200 billion global gaming industry's transition to Web3.

Key Listing Details

Token: GALA

Trading Pair: GALA/USDT, GALA/INR

Deposit Opened: March 13, 2025

Trading Started: March 13, 2025

About KoinBX:

KoinBX is an institutional grade crypto exchange that offers fairness, transparency, compliance and access for all. It has proprietary trade matching technology along with the secure custody, architecture, and resilience business continuity standards. Established with a mission to democratize access to financial opportunities and pave the way for a more inclusive and interconnected global economy, KoinBX offers a wide range of digital assets, and robust security measures to ensure seamless transactions and safeguard user assets.

For more information visit: koinbx.com

Contact Details

Aheli Raychaudhuri

aheli@koinbx.com | +91 98844 25592

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/246556

Ethereum is down $130.48 today or 6.50% to $1876.47

Note: The Ethereum price is a 5 p.m. ET snapshot from Kraken

Data compiled by Dow Jones Market Data

GameStop (NYSE: GME) suffered a sharp 25% drop yesterday, a sudden downturn that followed a 16% rally on March 26. The catalyst? A bold decision by the gaming retailer’s board to establish a Bitcoin treasury—joining the ranks of MicroStrategy, Metaplanet, and other corporations. Initially, the news sent GME shares soaring, as investors viewed the move as a bullish signal. However, the stock quickly reversed course and now finds itself in turbulent waters.

Investor optimism over GameStop’s Bitcoin play was palpable at first. The announcement sparked excitement similar to when MicroStrategy began accumulating Bitcoin. Yet the initial rally gave way to heavy selling pressure, erasing nearly $3 billion in market value. While the company has not fully detailed its strategy or timeline for Bitcoin acquisitions, the market’s whiplash response has prompted widespread debate.

GameStop’s ‘Convertible Arbitrage’ Factor

On X, analyst Han Akamatsu offered an explanation rooted in parallels to MicroStrategy’s past financing methods. He began by noting: “Let me explain to you why GameStop is falling today, as far as I understand based on my MSTR experience.”

According to Akamatsu, when MicroStrategy previously issued convertible notes, large institutional buyers used a strategy known as convertible arbitrage: “When MSTR issued convertible notes, institutional buyers used convertible arbitrage: They bought the bonds, shorted MSTR stock to hedge [and] waited for the bond to either convert or mature.”

He emphasized that this process created “artificial short pressure” on the stock—despite MicroStrategy’s own bullish outlook on Bitcoin. Akamatsu then referenced MicroStrategy’s 2021 issuance: “In 2021, MSTR issued $1.05B of 0% convertible notes, the stock dipped after the announcement due to hedging shorts, but later exploded when Bitcoin ripped and the arbitrage unspooled.”

Akamatsu went on to connect these dots to GameStop’s current situation: “GME is following the same blueprint now:Issue $1.3B in 0% convertibles, likely going to buy Bitcoin [and] institutions are now shorting GME to hedge.” He pointed out that if GME or Bitcoin rises substantially, the short positions set up to hedge the convertibles could be unwound en masse: “If GME or BTC goes up a lot, the trade gets very interesting as we have a squeeze opportunity here.”

He further explained the typical ratio of shorts involved: “A common practice is to short 50–70% of the bond’s notional value in stock. They make money on the arbitrage between the bond conversion price and the stock price, even if the stock stays flat or drops.”

Finally, Akamatsu noted that the volume-weighted average price (VWAP) would influence the conversion price: “VWAP pricing window behavior, they’ll want the stock low to get favorable conversion. Conversion price will be based on GME’s VWAP […] from 1:00 PM to 4:00 PM EDT on the pricing day.”

Criticism Over the Risk

Some market watchers have criticized GameStop’s board for incurring what appears to be self-inflicted selling pressure. One user on X questioned whether Chairman Ryan Cohen (often referred to by the initials RC) had miscalculated: “Hi Han, great analysis as usual… however, nearly $3bn market value is wiped out today. RC should really ask himself if it is worth it or he miscalculated. The hedge is supposed to mitigate risk in nature. But itself creates much more risk.”

Akamatsu stood by his take, asserting: “Calculated and all going according to plan. If you’re not really into the MSTR playbook, I recommend you to check their strategy.”

In another post, Akamatsu drew comparisons to a setup he observed with Celsius Holdings (NASDAQ: CELH): “GME has a similar pattern with what CELH had when I claimed this was an easy 100% setup.”

He referenced chart analyst Thomas Bulkowski’s work on wedge patterns, hinting that a retracement might offer a buying opportunity: “If GME starts retracing after that solid breakout, textbook Bulkowski says that 7/10 times price tests the wedge again and then has a greater takeoff.”

The analyst reassured traders not to panic if the stock dips further, stressing it could be a standard technical move: “So, if you see GME retrace … don’t panic as this will be normal. You’ll have another chance at a great entry when this tests the wedge again.” He concluded on a hopeful note: “I’m having my fingers crossed this will simply skyrocket.”

At press time, GME stood at $22.30.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up