Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Opinion by: Dipendra Jain, co-founder of TCX

Regulation has become the baseline for crypto. From the United States’ regulatory enforcement to Dubai’s comprehensive crypto rulebook and India’s renewed debate on formalizing Bitcoin reserves, governments are rewriting the rules of digital finance. As listed institutions, retailers and social networks weigh in on digital asset rails, stablecoins and yield mechanisms, the real story is no longer what’s next, but who is building what comes next.

Speculation once drove adoption, but structured compliance catalyzes scale across the Asia-Middle East corridor. Hubs like the United Arab Emirates and India represent the treatment of regulation as the backbone of innovation. The UAE is pushing a unified virtual asset service providers (VASP) framework to accelerate global crypto ambitions. At the same time, India is opening the door for offshore crypto exchanges to return, with approvals now subject to the review of the Financial Intelligence Unit (FIU).

As regulatory frameworks formalize, platforms must align with new taxation, data governance and licensing rules to access expanding markets without friction. The global center of gravity is tilting eastward, and the question is: Who will master the age of “permissioned scale,” where sustainable growth comes from thriving within regulation, not skirting them?

Jurisdictional intelligence and the demographic interplay

Once sufficient for market entry, understanding jurisdictional rules is no longer enough. The Dubai Virtual Assets Regulatory Authority (VARA) has issued 36 full licenses and supports over 400 registered companies. VARA is also piloting tokenized gold and DeFi products, which promise growing enthusiasm to experiment with real-world assets beyond established solutions within a controlled environment.

But regulation alone renders platforms powerless if they fail to meet users where they are. With over 1.12 billion cellular mobile connections in India, 55.3% have internet access, and only 27% of adults meet basic financial literacy requirements. Platforms must recognize the need to bridge the knowledge gap through education-embedded user journeys. Crypto platforms can offer far more efficient, blockchain-based fintech solutions in remittance-heavy Cambodia and the Philippines, where such transactions make up 9% of GDP, by leveraging stablecoins to simplify transfers, reduce costs, and enhance transparency.

Financial sovereignty will remain aspirational for underbanked populations and emerging markets without contextualized features and user-oriented solutions. Platforms that embed jurisdictional intelligence at their core and localize products with compliance and cultural relevance will set the standard for future adoption. This ultimately differentiates between short-term participation and long-term leadership.

Compliance as a competitive moat

The industry is at a juncture where compliance has become the ultimate competitive moat. Low-cost, government-backed payment rails are displacing traditional payment flows, challenging global card networks like Mastercard and Visa. Today, regulated fiat-crypto integration carries similar potential to displace legacy infrastructure, which can only be unlocked by those actively building trusted access by working within regulatory parameters.

Related: The rise of Money2: The next financial system has already begun

When there is regulatory clarity, progress and adoption will follow. The UAE attracted $34 billion in crypto inflows in the Middle East last year. India’s Unified Payments Interface (UPI) is another example of how regulation can boost fraud indicators in safeguarding user funds. Collective efforts across borders can encourage crypto platforms to integrate automated compliance and risk monitoring at the protocol level.

A regulated foundation also makes cross-border capital flow more viable. This allows them to meet institutional demands for transparent, scalable access to diversified liquidity and global capital markets. Permissioned scale is underway, where regulation, payments and liquidity infrastructure extend in sync. Stablecoin developments further complement this infrastructure, providing a strong, programmable medium for cross-border settlements that bridge traditional finance and crypto ecosystems.

AI and RWA as financial democratisation enablers

AI introduces three indispensable elements: real-time regulatory interpretation, fraud detection and parity-based trading. Platforms can navigate jurisdictional requirements by injecting regulatory intelligence directly into trading mechanisms while optimizing user experience.

Real-world assets (RWAs) further expand that opportunity. Tokenized real estate, sovereign bonds, and commodities such as gold are gaining traction, with a projection to grow into a $10 trillion market by 2030, particularly in economies seeking to diversify wealth pools and investment options. In ESG sectors like agriculture, carbon credits and trade receivables, tokenization removes friction, reduces reliance on intermediaries and accelerates settlement timelines. It creates liquidity for underserved participants, including small- and medium-size enterprises (SMEs), while offering institutional investors new, risk-adjusted, diversified returns.

Partnerships across capital markets and crypto companies also lay the groundwork for tokenized private equity and other frontier assets. While still deemed mainly uncharted waters, clarity is poised to catch up as giants like BlackRock, eToro, Robinhood and Coinbase call for RWA representation in mainstream portfolios.

An AI-native approach that can price, route and settle RWA trades must integrate compliance throughout the stack, from onboarding and identity verification to transaction monitoring and regulatory reporting. This compliant, AI-powered core will become a definitive innovation for the next generation of financial infrastructure.

Victorious platforms are those that scale by design

The payoff from speculative surges has faded. Today’s growth comes from platforms designed to scale with the rules. When regulation is a given, the true differentiator lies in those who will build trust, liquidity, and utility that endures across jurisdictions.

Leadership in this emerging reality will come from platforms fluent in regulatory nuance, grounded in user behavior and equipped with the technology to unlock compliant access to global capital and real-world assets. As the Asia-Middle East corridor sets the pace, the platforms that master permissioned scale will write crypto’s next playbook.

Opinion by: Dipendra Jain, co-founder of TCX.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Despite the broader market showing signs of fatigue, the BNB price train is still on track. Over the past 24 hours, Binance Coin has slipped 1.5%, now trading at $877. Given its relentless performance, this pullback, however, looks more like a scheduled pause than a derailment.

In the past month alone, BNB has gained 15%, while three-month returns sit at 30%, and the yearly swing is an impressive 51%. At just 2% below its all-time high of $899, the token is still within striking distance of a breakout that could carry it into four-digit territory for the first time.

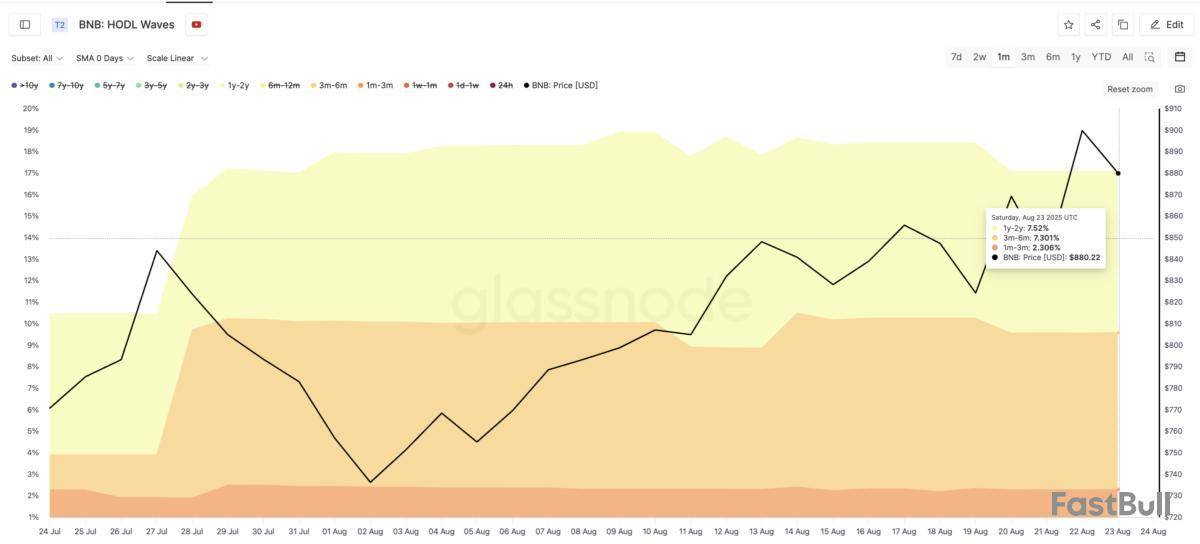

Spot Demand Builds Through HODL Waves

Supporting this steady climb is the expansion across multiple HODL wave cohorts: a metric that tracks the percentage of circulating supply held across different holding periods.

Between July 24 and August 23, three key cohorts all grew their holdings: one-year to two-year wallets rose from 6.55% to 7.52%, three-month to six-month holdings surged from 1.62% to 7.30%, and one-month to three-month wallets ticked slightly higher from 2.29% to 2.306%.

These increases confirm that both long-term and mid-term investors are buying into strength rather than waiting for dips, adding fresh fuel to the BNB price train.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Futures Open Interest Keeps Momentum Alive

It isn’t just spot markets that are feeding the rally. BNB futures open interest has been climbing steadily alongside prices, hitting a three-month peak of $1.27 billion on August 22. The current levels are still around the same zone.

Rising open interest means leveraged traders are piling in, amplifying the potential for both upward surges and sudden squeezes. If momentum favors the bulls, short liquidations could accelerate the move past $899 and unlock higher price discovery levels.

On the flip side, a sudden long squeeze could trigger volatility and pullback, but the current alignment of spot and derivatives suggests the bias remains upward.

Futures open interest measures the total number of outstanding futures contracts that have not been settled, showing how much capital is tied to derivatives.

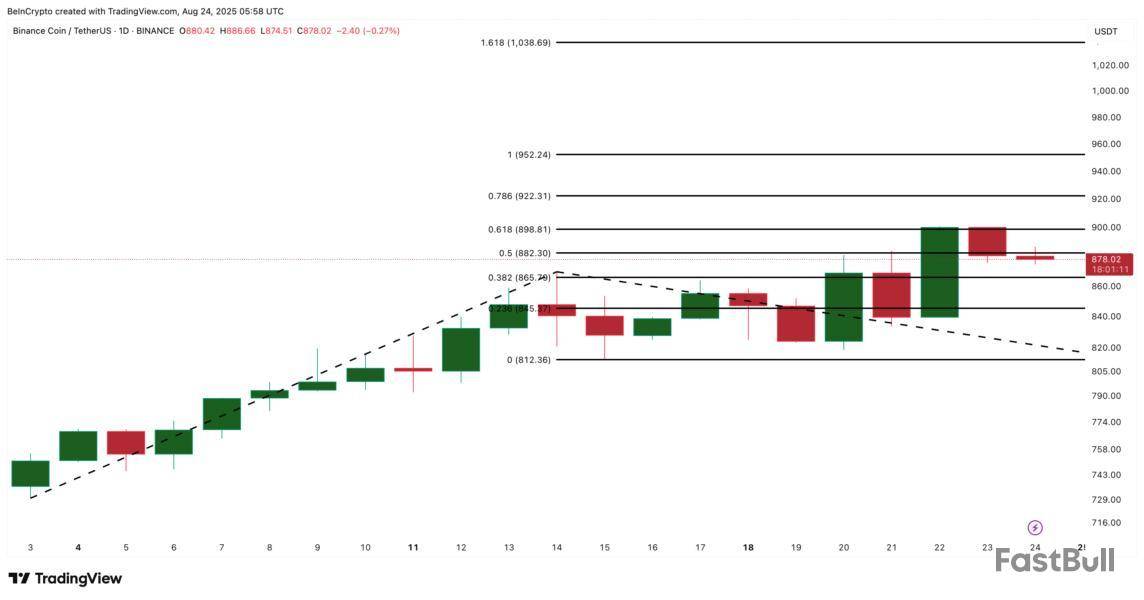

BNB Price Action: $898 Is the Gateway to Four Digits

BNB is testing critical resistance zones that could define its next move. The token recently pulled back from $898, which aligns with the 0.618 Fibonacci extension, often seen as the strongest barrier in an uptrend. The BNB price is currently trading a notch under another key resistance level of $882.

With $898–$899 marking its historical high and one of the toughest resistance zones, a decisive candle close above that level could open the tracks toward $922 and $952.

Once BNB breaks past $898 strongly and into price discovery, the first four-digit target stands at $1,038. If spot and derivatives momentum holds, this may only be the beginning of a longer rally, where $1,000 is less a destination and more a milestone on the journey.

However, if the BNB price breaks under $812, a key retracement zone, it would invalidate the bullish hypothesis in the short term. That would momentarily put a halt to the BNB price train.

TL;DR

Fed Rate Cuts to Pump XRP?

The Jackson Hole speech took place on Friday as the crypto market had braced for impact with a week-long correction that drove BTC from over $118,000 to under $112,000, ETH from above $4,800 to $4,100, and XRP dumped below $2.8 to market a multi-week low.

Although Powell failed to specify whether the Fed will indeed cut rates at its next FOMC meeting in September, his words were perceived as promising by investors, who poured billions of dollars into the ever-volatile, risky crypto market. BTC jumped beyond $117,000, albeit briefly, while ETHrocketedto a new all-time high of almost $4,900.

Another sign that the market will now anticipate a rate reduction in September came from Polymarket as the odds for such a Fed move went from under 60% to almost 80% within hours. Consequently, CryptoPotato explored the potential effects on the two largest cryptocurrencies by market cap, more on which canbe found here, and we have now shifted our focus to the third-biggest.

We asked ChatGPT about its take on the matter, and the AI solution explained that lower rates mean that borrowing becomes cheaper and money flows more easily into risk assets, at least in theory. History shows that rate cuts have boosted stocks, gold, and cryptocurrencies, as investors seek higher returns.

For XRP in particular, this could mean more speculative inflows from traders reallocating from bitcoin or even other traditional assets into well-known and established altcoins, such as the second-largest.

It also explained that lower rates weaken the US dollar, which often strengthens bitcoin first but “altcoins like XRP typically follow with a lag – sometimes explosively once capital rotates.”ETF Exposure and Potential Risks

With roughly ten filings made by different companies to launch their own spot XRP ETFs, Ripple’s community is frequently speculating when such financial vehicles will finally be approved in the US, following those for BTC and ETH. ChatGPT believes the right timing ofpotential approvals of Ripple ETFscould be massive for the underlying asset.

“A lower interest rate environment makes yield-bearing Treasuries less attractive. Institutions may look harder at crypto ETFs (including pending XRP ETF filings) as a way to diversify.

If an XRP ETF is approved around the same time, rate cuts could supercharge inflows.”

However, the AI chatbot also outlined potential short-term risks. If rate cuts occur due to recession fears, risk appetite will initially decline, which includes bitcoin and the altcoins. As such, it warned that investors might “exit risk assets (including XRP) until confidence in economic recovery returns.”

Overall, though, ChatGPT was bullish on XRP if the US Federal Reserve indeed cuts the rates. It outlined a positive medium-term path for the asset, and a highly bullish run if the ETF stars align.

“Bullish Medium-Term: Fed rate cuts are generally positive for XRP because they boost liquidity, weaken the dollar, and increase demand for alternative assets.

Catalyst Combo: If rate cuts coincide with an XRP ETF approval or favorable legal clarity, XRP’s upside could accelerate toward — or beyond — its all-time high.”

Bitcoin’s (BTC) momentum has cooled down in recent weeks as investors persist in locking in profits. Slowing demand has also contributed to the cool down, with current figures about two-thirds less than last month’s records.

According to the weekly report from CryptoQuant, the Bitcoin market has moved from an extra bullish to a bullish cooldown phase.Bitcoin Momentum is Cooling Down

During this cool-down phase, Bitcoin’s apparent demand has fallen from a Julypeakof 174,000 BTC to 59,000 BTC today. Institutional BTC buyers have slowed down in their accumulation – they are still buying, but not as much as before. The business intelligence firm, Strategy, which is the lead BTC buyer, has seen its purchases tumble from a November 2024 high of 171,000 to 27,000 over the past 30 days.

Spot Bitcoin exchange-traded funds (ETFs) are also seeing their lowest inflows in four months. Their 30-day net purchases currently hover around 11,000 BTC, a level not seen since late April.

“This broad-based decline in demand growth suggests fading momentum, which likely contributed to the recent price correction. Continued softness in demand could keep Bitcoin in a consolidation phase,” CryptoQuant stated.

Moreover, on-chain indicators are flashing weaker signals, which reveal that the market remains constructive, but withfadingbullish momentum. The CryptoQuant Bull Score Index moved from the “Extra Bullish” to “Bullish Cooldown” phase after BTC rallied past $120,000. Current market conditions tally with the ongoing price decline.

“The transition to a bullish cooldown typically precedes sideways movement or mild corrections. Without a return to strong demand signals, further upward momentum may remain limited in the near term,” the analytics firm added.Support at $110K?

Furthermore, new whale investors have been taking profits. This cohort of investors has led a spree that has realized at least $74 billion in profits since July 4. Notably, the market recorded its largest daily profit so far this year ($9 billion) on that same day.

Since then, the investors have not relented in taking profits – August 16 saw new whale investors realize up to $2 billion in gains.

Meanwhile, bitcoin’s price hovered around $116,000 at the time of writing, but with reduced downside risk. CryptoQuant analysts believe the leading digital asset may find support near $110,000, which is the Trader On-chain Realized Price. This level often acts as support during bull cycles, and traders’ unrealized profit margin goes to zero, discouraging more selling.

TL;DR

200K ETH Out of Exchanges

It was less than five months ago when the second-largest cryptocurrency plunged to $1,400, erasing years of gains. The overall market situation was grim due to Trump’s tariff policy, but ETH seemed to be taking the correction the worst.

However, the landscape changed big time in the following months, as etherskyrocketedto almost $4,900 last Friday to mark a new all-time high – nearly four years after its previous peak.

Different types of investors continue to accumulate the token, ranging from smaller and retail to institutions,corporations, andwhales. The ETFs are back in the green after a brief four-day hiatus, while even this Bitcoin OG swapped a big portion of their BTC holdings for spot and long ETH positions.

Ali Martinez provided more promising data for Ethereum’s short-term future, as investors using centralized crypto exchanges had pulled 200,000 ETH out of those platforms within just two days. Such withdrawals reduce the immediate selling pressure, which should, in theory, be bullish for the underlying asset if demand increases or even stays the same.

200,000 Ethereum $ETH withdrawn from exchanges in just 48 hours! pic.twitter.com/XJ3EQuLxEd

— Ali (@ali_charts) August 24, 2025

From a USD perspective, this amount is worth close to $1 billion, given ETH’s current price tag of almost $4,800.CME Gap Filled, Altseason to Begin?

The crypto market, being open 24/7, often performs faster than the traditional financial industry, and this leaves some weekend (or holiday) gaps for digital assets that trade on legacy platforms. Due to ETH’s surge in the past few weekends, it left a gap on the CME futures, and many analysts believe it had to be closed before the asset could resume its rally.

According to Rekt Capital, the weekly CME gap (in the green) has been filled and ETH has “reversed to the upside from it.”

$ETH

Ethereum has successfully filled its Weekly CME Gap (green) and reversed to the upside from it#ETH #Crypto #Ethereum https://t.co/VuKCZhPPbI pic.twitter.com/qnaNWGbbrW

— Rekt Capital (@rektcapital) August 22, 2025

Satoshi Flipper also weighed in on ETH’s recent performance, especially against the market leader. After observing the 3 Day ETH/BTC chart, the analyst concluded that the “eagle has landed,” as it’s shaping up for a “glorious” altcoin season.

$ETH / $BTC 3 DAY

The eagle has landed, I repeat, the eagle has landed

Position wisely and don’t get caught sidelined, this is all shaping up for a GLORIOUS ALT SEASON + ENDING to the cycle

(4 years we have waited for this moment) pic.twitter.com/QQbHhCkWif

— Satoshi Flipper (@SatoshiFlipper) August 24, 2025

Michael Saylor kept his latest update short as the Strategy co-founder posted an AI photo of himself riding a bright orange scooter and wrote just two words: "Bitcoin delivers." This new message came as the company’s Bitcoin holdings reached new heights in both size and value.

And this figure may increase further, if the usual Monday announcement hits the press tomorrow.

For now, according to filings, Saylor-led Strategy holds 629,376 BTC, to buy which it spent about $46 billion, averaging $73,320 per Bitcoin. At current levels, the stash is valued at $72.24 billion, putting the company more than 56% on paper.

Not to forget that Strategy is a public company and trades under the ticker MSTR with a $98 billion market capitalization, of which Bitcoin accounts for roughly 74%. Still, the enterprise value is listed at $115 billion, and its stock recently traded at around $344.

Strategy's Bitcoin and MSTR business

As all eyes are on Monday, let's remember that on Aug. 11, Strategy disclosed the purchase of 155 BTC. Then, on Aug. 18, the software provider purchased another 430 BTC.

Insider trading reports meanwhile show busy activity around the MSTR stock. Over the last three months, there have been 31 transactions: 13 open-market purchases and 18 sales. Over the last year, insiders have executed a total of 69 trades, buying 286,132 shares and selling 474,471.

TL;DR

Double-Bottom Structures in Play

Bitcoin has printed another double-bottom pattern, according to ZYN. Similar setups earlier this year were followed by sharp rallies.

In April, BTC rose by more than 50%, moving from about $86,000 to over $125,000. A second pattern in June triggered a 25% climb, lifting the price from near $100,000 back to $125,000.

$BTC double-bottom just printed.

April: +50% pump. June: +25% rally.

Even half that move now sends Bitcoin above $127K before Q3 ends.

This isn’t a chart pattern, it’s a launchpad. pic.twitter.com/rOMGmrYhyd

— ZYN (@Zynweb3) August 22, 2025

Notably, the latest structure is forming near $112,000, as BTC slipped to that level on Friday before it bounced off to over $117,000. So far, the asset’s price action is holding within a $112,000 to $124,000 range, reflectingconsolidationafter recent swings.Inverse Head and Shoulders Formation

A chart shared by Merlijn The Trader shows Bitcoin completing an inverse head-and-shoulders. The left shoulder was formed in December 2024, the head in April 2025, near $70,000, and the right one in June 2025.

The neckline, which slopes upward, has now been broken and retested near $113,000. Holding above this zone is marked as confirmation of the breakout. Based on the scale of the setup, the pattern points toward higher levels if momentum continues.Futures Market Sentiment Turns Positive

Data from CryptoQuant analyst Darkfost shows BTC futures sentiment has moved back intopositive territoryafter five days of negative readings. The sentiment index, which combines net taker flows, open interest, and long/short volumes, reflects short-term positioning in the derivatives market.

In early August, sentiment followed a similar path when the ratio dropped below -1 before recovering into positive territory. That shift coincided with a price rebound—the current bounce from -0.7 signals that bearish pressure has eased in recent sessions.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up