Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Last edition, I wrote about how “DAT (digital asset treasury) summer” was pulling attention and capital away from traditional startup rounds. At the time, some VCs also flagged another issue: limited partners (LPs) had become far more cautious about backing crypto funds. So in this edition, I’m digging into why raising a crypto VC fund has gotten harder — even in a bull market — and what that means for the road ahead.

Fundraising began to get materially tougher after the 2022 collapses of Terra (LUNA) and FTX, which eroded LP trust and left reputational scars across the sector, several VCs told me. “The sentiment on crypto has improved a lot, but that has not outweighed broader concerns about venture performance,” said Regan Bozman, co-founder of Lattice Fund. “The new challenge is crypto venture is now competing with ETFs and DATs for inflows.”

Today, only funds with a clear edge or exceptional track record are still drawing new LP commitments, said Michael Bucella, co-founder at Neoclassic Capital. That dynamic has fueled what Dragonfly’s general partner Rob Hadick described as a “flight to quality.” In 2024, he noted, just 20 firms captured 60% of all LP capital, while the other 488 split the remaining 40%. Even with liquidity improving this year through M&As and IPOs, the fundraising bar remains far higher than before the 2022 collapses.

The broader data backs it up. Crypto VC fundraising has shrunk dramatically since the 2021–2022 boom. In 2022, firms raised more than $86 billion across 329 funds, but that collapsed to $11.2 billion in 2023 and $7.95 billion in 2024, according to The Block Pro data from my colleague Ivan Wu. So far in 2025, just $3.7 billion has been raised across 28 funds — underscoring how much tougher the environment has become. Both the amount raised and the number of funds are on a steep downtrend, reflecting LP caution and a more selective capital base.

Family offices, wealthy individuals, and crypto-native funds remain active in backing crypto VCs. But pensions, endowments, funds-of-funds, and corporate venture arms have largely stepped back since 2022, leaving a smaller, more selective pool of LPs, several VCs told me.

Why it’s harder to raise now than in 2021 or early 2022

The last bull cycle was unusual — in 2021 almost anyone could raise a crypto VC fund, often without much experience, but many of those funds still haven’t returned capital. LPs are now waiting for real DPI (distributions to paid-in capital) before committing fresh money. “LPs are increasingly skeptical about unrealized gains and prioritize funds with proven track records of realized returns,” said Sep Alavi, general partner at White Star Capital.

Rising interest rates since March 2022 have also pushed allocators toward safer, more liquid assets. Neoclassic Capital’s other co-founder, Steve Lee, noted that this cycle’s gains have been concentrated in bitcoin, ethereum, and a few blue chips through ETFs and DATs, leaving little spillover into smaller projects where VC value usually emerges. “LPs see short-term gains in large caps, while VC value takes longer to materialize,” Lee said.

An early-stage VC founder, who didn't wish to be identified, added that the lack of an “altcoin bid” — with very few tokens performing since the 2021–22 cycle — has weighed on LP appetite, since many crypto VCs invest in tokens. AI is also a major distraction: “AI is such an overarching shiny object that it has captured a lot of tech-focused LP interest,” said Lattice Fund’s Bozman.

Overall, while raising today may not be harder than the post-Luna/FTX years, it’s still far tougher than the easy-money days of 2021 and early 2022.

What the future of crypto VC could look like

If fundraising remains tight, most VCs expect a wave of consolidation ahead, where smaller, weaker or undifferentiated funds will quietly disappear. Alavi expects smaller or underperforming funds to struggle with follow-on vehicles, while Hadick noted the market is already thinning out as capital concentrates with the strongest players.

The early-stage crypto VC founder argued that the middle tier will hollow out: small, sub-$50 million funds with a sharp edge will survive, as will the mega-funds like Paradigm and a16z, but underperforming mid-sized funds will fade away. Neoclassic’s Bucella added that crypto VC may increasingly resemble traditional markets, with a large liquid base supported by a smaller, but higher-quality venture segment. “Capital markets have a wonderful way of self-corrective behavior. We’re coming out of a period of over-allocation to venture and under-allocation to liquid strategies,” Bucella said.

Others see the model itself evolving. Erick Zhang of Nomad Capital predicted fewer firms will remain purely crypto-focused, with web2 VCs dipping into crypto and crypto funds branching into web2.

The timeline for LPs returning in size varies. Lee at Neoclassic said LPs will return once capital flows shift from bitcoin and ethereum toward mid- and small-cap token ecosystems — a change he expects to be accelerated by stablecoin-driven on-chain capital.

Alavi thinks it could be mid-2026 as interest rates decline and M&A boosts distributions, while Hadick believes most institutional investors are already back, apart from pensions, which he expects to return over the next few years with regulatory clarity and a market that has matured. The early-stage VC founder suggested LPs will only flood in again once the next “super-hot narrative” — like stablecoins or another breakout use case — takes hold.

To subscribe to the free The Funding newsletter, click here.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

New allegations surfaced, claiming Binance is deliberately holding back Solana’s momentum to protect the BNB token, throwing the crypto market into controversy.

It adds to the list of times the largest exchange on trading volume metrics has been accused of using Wintermute market maker to influence prices.

Is Binance Secretly Holding Back Solana in Favor of BNB?

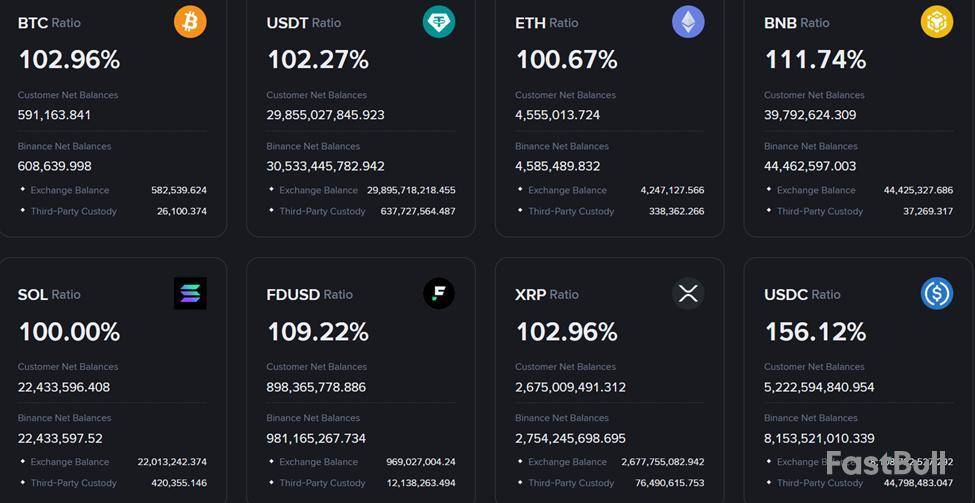

He shared what he called “receipts,” questioning how the Binance exchange could be sourcing SOL for trading activity when its proof of reserves (PoR) shows no Solana holdings beyond customer deposits.

As of the time of this writing, Solana was trading at $203 with a market cap of $109.7 billion, just behind BNB’s $865.97 price and $120.6 billion capitalization.

Indeed, Binance’s proof of reserves shows no Solana holdings beyond customer deposits of 22.433 million SOL tokens. The holdings comprise 22.013 million in exchange balance and 420.35 in third-party custody.

Meanwhile, this is not the first time Binance and Wintermute have been tied together in market controversy.

Five months ago, reports suggested Wintermute was involved in coordinated sell-offs that tanked smaller tokens such as ACT. Binance was also allegedly linked to the activity.

Similarly, seven months ago, Binance also faced scrutiny over $20 million worth of crypto transactions tied to Wintermute.

BeInCrypto reported that this sparked heated debates about opaque relationships between exchanges and market makers. BeInCrypto also explored the role of market makers beyond providing essential liquidity and preventing price volatility.

Critics argue that if Binance uses Wintermute to influence liquidity flows and suppress Solana, it would represent a direct conflict of interest.

More closely, it would undermine the credibility of both PoRs frameworks and the fairness of open markets.

Industry Voices Call for Action with Market at a Crossroads

The allegations have reignited questions about Binance’s dominance and the vulnerabilities of centralized exchange-driven markets.

“So the ‘new system’ is even worse than the old system? Why are any of us accepting a system this fragile … corrupt … and manipulatable? When will Binance be involuntarily shuttered? Arrest them. Prosecute them,” wrote Alan Knitowski, founder and former CEO of NASDAQ-listed companies Cisco Systems and Phunware Inc.

These remarks highlight growing frustration among traditional finance (TradFi) veterans entering crypto. Many of them believed blockchain markets would provide a more transparent alternative to legacy systems.

Instead, recurring accusations of manipulation and conflicts of interest may fuel skepticism.

The accusations come at a pivotal time for Solana, which has seen explosive adoption across DeFi, NFTs, and meme coins.

Its rise has positioned it as a potential challenger to Ethereum’s scaling dominance, and now, apparently, to Binance’s BNB token.

Whether the claims prove accurate, the controversy mirrors the fragile trust underpinning crypto markets.

On one hand, Solana’s community sees a network surging toward mainstream adoption. On the other hand, critics say entrenched players may be actively engineering ceilings to preserve their own dominance.

The tension leaves regulators, investors, and developers facing the same unresolved question: How much power should centralized exchanges still wield over market outcomes?

Pavel Durov, founder of the messaging app Telegram, reflected on his arrest one year ago by French authorities with a message on the platform, claiming French authorities have so far failed to find evidence of wrongdoing on his part.

"Arresting a CEO of a major platform over the actions of its users was not only unprecedented — it was legally and logically absurd," Durov wrote of his arrest, which made international headlines and spurred support from the crypto community.

Durov was arrested on August 24, 2024, and was later charged with 12 counts related to complicity in crimes facilitated by the messaging app, from money laundering to child sexual abuse material distribution. Durov was formally placed under investigation related to the charges.

"A year later, the 'criminal investigation' against me is still struggling to find anything that I or Telegram did wrong," Durov continued. "One year after this strange arrest, I still have to return to France every 14 days, with no appeal date in sight."

Telegram is home to a thriving Web3 scene through its integrations with The Open Network, whose native token, Toncoin, is the twenty-first largest cryptocurrency by market cap, according to price data. Toncoin has been adopted into a digital asset treasury (DAT) company called Verb Technology, which currently holds over 8% of the token's circulating supply and plans to rebrand to Ton Strategy Company.

Active addresses on TON spiked in the weeks following Durov's arrest, though activity has somewhat subsided since that peak, according to The Block's data.

Durov was first allowed to leave France in March to travel to Dubai, where Telegram is headquartered and Durov's family is based. Following an appeals court decision, Durov may leave metropolitan France only to Dubai, for up to 14 consecutive days per trip, provided he notifies the investigating judge one week in advance. Other locations require additional authorization from a French judge.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

ArcBlock will participate in the CIE-SEA 2025 Annual Convention on September 7, joining the BELLEFounders event. CEO Robert Mao will present his vision on Decentralized AI and Digital Identity in a panel discussion alongside leading figures from AWS, Microsoft, and other tech giants. The event will be held in Seattle.

Refer to the official tweet by ABT:

ArcBlock@ArcBlock_ioAug 21, 2025🔥 ArcBlock will be joining BELLEFounders at CIE‑SEA 2025 on September 7th.

ArcBlock CEO @mave99a will share his vision for Decentralized AI & Digital Identity on a panel alongside industry leaders that include @AWS, @Microsoft, and more.

Learn More: https://t.co/k98PDzWtBl

ABT Info

ArcBlock is a platform designed for the creation and deployment of decentralized applications (DApps) and blockchains. It was established with the objective of facilitating developers in creating and deploying DApps by providing them with the necessary tools, services, and standards. Here are some key features and aspects of the ArcBlock project:

Blocklet OS: ArcBlock includes Blocklet, a microservice for blockchain applications. This allows developers to utilize standard libraries and development tools without having to rely on blockchain-specific instruments.

Compatibility with Various Blockchains: One of the standout features of ArcBlock is its ability to integrate with different blockchains, such as Ethereum, Hyperledger, and others.

Open Chain Access Protocol: This protocol enables the development of applications that are compatible with multiple blockchains, thus ensuring flexibility and resilience of applications to changes in the blockchain sphere.

Marketplace: ArcBlock provides a platform for the exchange of various services, components, and even chains, streamlining the development and promotion of decentralized applications.

ABT Token: This is the primary token of the platform, used for facilitating network operations, including participant compensation, payments, and so on.

Render Network announced that SUBMERGE: Beyond the Render, the largest immersive art exhibition ever powered by decentralized rendering, will open on September 19 in New York. The event will feature works from 16 prominent digital artists, including two Emmy Award winners, in what is set to be the most extensive showcase of its kind. The initiative demonstrates the creative potential of decentralized GPU-based rendering technology.

Refer to the official tweet by RENDER:

The Render Network@rendernetworkAug 21, 2025BIG NEWS: The largest ever immersive art exhibition powered by decentralized rendering opens Sep 19th at @artechouse NYC!

SUBMERGE: Beyond the Render features 16 leading digital artists, including two Emmy winners, in the largest showcase of this kind ever staged, powered by… pic.twitter.com/bBhrtsbmON

RENDER Info

Render Token, also known as RNDR, is a project aiming to democratize the process of rendering 3D content. Built on the Ethereum blockchain, the platform enables anyone in the world to use their computational resources to assist in rendering processes and be rewarded for their work in the form of RNDR tokens.

Typically, rendering 3D content can be a highly resource-intensive process, requiring significant processor time and energy. For many individuals and organizations, especially those working in industries where 3D rendering is important (like gaming, film, virtual and augmented reality), this can pose a significant challenge.

The Render Token platform addresses this issue by providing a path to a decentralized rendering network, where anyone with suitable hardware can participate. Users can “rent out” their computational resources to assist in rendering 3D content, and be rewarded for it in RNDR tokens. This creates a more democratized and efficient system, which can enhance the accessibility and speed of 3D content rendering.

Moreover, Render Token is working on innovating new uses of blockchain in the realm of digital art and graphics, including the creation and distribution of NFTs (non-fungible tokens) and other forms of digital content.

Gnosis has announced the upcoming deprecation of Hashi integration, approved under proposal GIP-93, due to funding limitations. The feature will be removed from the Bridge UI on August 29. Canonical bridges will remain fully operational via the 4/7 multisig configuration, and no action is required from users.

Refer to the official tweet by GNO:

Gnosis Chain 🦉@gnosischainAug 21, 2025🚨 Important @gnosischain update 🚨

Hashi integration, approved under GIP‑93, will be formally deprecated and remove from the Bridge UI (on 29 Aug 2025) due to funding constraints.

✅ Canonical bridges remain fully operational under 4/7 multisig

✅ No user action required…

GNO Info

Gnosis is a blockchain platform built on the Ethereum network that offers tools and services for creating decentralized prediction products, new models of decentralized governance, and asset management solutions.

One of Gnosis' flagship products is the Gnosis Protocol, which serves as a trading protocol providing high liquidity for any ERC20 token.

The GNO token is the native token of the Gnosis platform, utilized for participation in platform activities such as voting on governance proposals and earning rewards. GNO token holders have the option to stake their tokens to receive OWL tokens, which can be used for fee payments on the platform.

Yield Guild Games has become the first official community partner for the Pixelmon Trading Card Game (TCG) launch. An exclusive YGG tournament for Pixelmon TCG Season 0 will run from August 25 to September 1, featuring a $4,500 prize pool for top players. All participants will receive gem rebates in Season 1. The tournament is limited to players in the APAC region, with game access provided via Google Play.

YGG Info

Yield Guild Games (YGG) is a decentralized autonomous organization (DAO) that uses blockchain to provide access to play-to-earn (P2E) games worldwide. YGG invests in NFTs used in blockchain games.

Yield Guild Games is based on the idea that games can be a source of income. Using the P2E model, players can earn assets by playing games. These assets can then be converted into real money.

The YGG token is used within the ecosystem for voting and community governance. YGG token holders can vote on various issues related to community management, including the buying and selling of NFT assets.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up