Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

On Monday (February 2), At The Close Of Trading In New York (05:59 Beijing Time On Tuesday), The Offshore Yuan (CNH) Was Quoted At 6.9426 Against The US Dollar, Up 158 Points From The Close Of Trading In New York On Friday. The Yuan Traded In The Range Of 6.9630-6.9380 During The Day

The Philadelphia Gold And Silver Index Closed Down 0.40% At 380.81 Points. The NYSE Arca Gold Miners Index Fell 1.62% To 2699.52 Points, After A Sharp Rise Followed By A Fall In Early Trading. The Materials Index Closed Up 0.58%, And The Metals & Mining Index Closed Up 1.44%

On Monday (February 2nd) In Late New York Trading, Spot Silver Fell 6.73% To $79.4438 Per Ounce. Comex Silver Futures Rose 1.56% To $79.760 Per Ounce. Comex Copper Futures Fell 1.49% To $5.8345 Per Pound, Having Fallen As Low As $5.5640 At 14:40 Beijing Time. Spot Platinum Fell 2.93%, While Spot Palladium Rose 0.74%

On Monday (February 2nd) In Late New York Trading, Spot Gold Fell 4.54% To $4671.58 Per Ounce, Remaining In A Downward Trend Throughout The Day. At 14:38 Beijing Time, It Had Fallen To $4402.95. On The Daily Chart, Gold Prices Have Fallen For Three Consecutive Trading Days, Approaching The December 31st Low Of $4319.37, And Briefly Breaking Below The 50-day Moving Average And Approaching The 100-day Moving Average (currently At $4483.43 And $4228.16 Respectively). Comex Gold Futures Fell 0.90% To $4702.60 Per Ounce, Also Briefly Falling To $4423.20 At 14:38

US President Trump, Speaking About The Justice Department's Investigation Into The Federal Reserve, Declared: "We'll See How It Goes."

U.S. Treasury Secretary Bessant: Federal Reserve Chairman Nominee Warsh Will Have A Great Start

[Airline ETFs Rise 3.5%, Leading US Sector ETFs; S&P Energy Sector Falls About 2%] On Monday (February 2), The Global Airline ETF Rose 3.51%, Regional Bank ETFs And Banking ETFs Rose Up To 1.79%, Semiconductor ETFs Rose 1.12%, Technology ETFs Rose 0.96%, And Energy ETFs Fell 1.96%. Among The 11 Sectors Of The S&P 500, Consumer Staples Rose 1.58%, Industrials Rose 1.26%, Financials Rose 1.02%, Information Technology/technology Rose 0.46%, And Energy Fell 1.98%

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)A:--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)A:--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)A:--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)A:--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)A:--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin treasuries in 2025: A corporate reserve strategy under pressure

By 2025, the Bitcoin treasury model has reached critical mass. Over 250 organizations, including public companies, private firms, ETFs and pension funds, now hold BTC on their balance sheets.

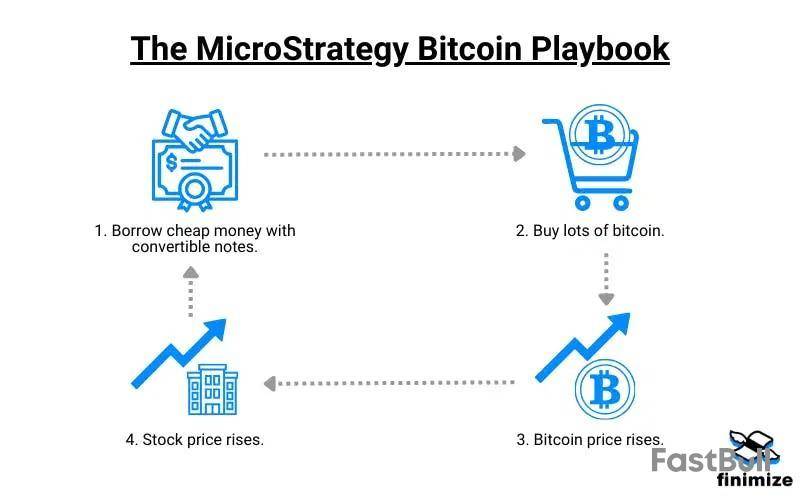

The Bitcoin treasury model trend was ignited by Michael Saylor’s Bitcoin plan, with Strategy pioneering the use of Bitcoin as a corporate reserve asset in 2020.

What began as a hedge against inflation evolved into a financial playbook adopted by a new class of Bitcoin holding companies, some structured to resemble quasi-exchange-traded funds (ETFs).

Strategy’s Bitcoin strategy remains the most high-profile, yet the wider BTC corporate treasury movement now faces growing strain. The model relies on a simple thesis: raise capital, convert it into a supply-capped crypto asset and wait for long-term appreciation.

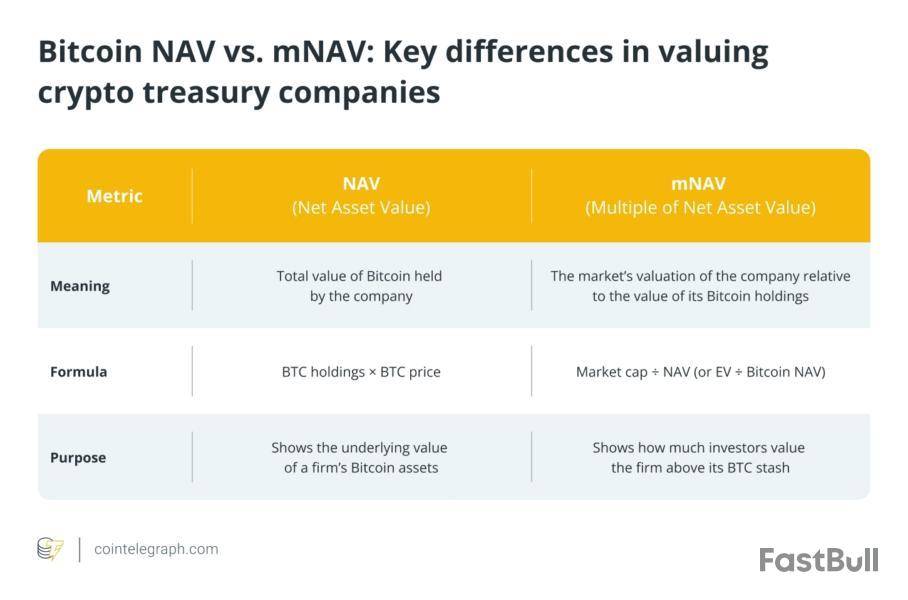

However, volatility in Bitcoin’s price exposes these companies to significant Bitcoin corporate treasury risks. Let’s suppose that a company’s stock price slips too close to (or below) the value of its underlying Bitcoin, known as its Bitcoin-per-share metric or net asset value (NAV).

Once that multiple of NAV (mNAV) premium evaporates, investor confidence collapses. MNAV measures how much the market values a Bitcoin-holding company relative to the value of its BTC reserves.

A recent Breed VC Bitcoin report outlines how this scenario can trigger a BTC NAV death spiral: declining prices erode NAV, cut off equity or debt funding and force distressed companies to sell their Bitcoin into a falling market, accelerating the downturn.

Did you know? MNAV (multiple of net asset value) shows how much more (or less) the market values a Bitcoin-holding company than its actual BTC stash. It’s calculated as: mNAV = Enterprise Value ÷ Bitcoin NAV.

BTC NAV risk: The mNAV death spiral, explained

The “death spiral” begins with a sharp drop in Bitcoin’s price. This reduces a company’s NAV premium (the valuation buffer that gives its shares lift).

As the market cap contracts, access to new capital tightens. Without equity buyers or lenders, companies can’t expand their holdings or refinance existing Bitcoin debt financing. For companies built on this BTC equity vs. debt strategy, the cracks start to show.

If loans mature or margin calls hit, forced liquidations follow. Selling BTC to meet obligations depresses the asset’s price further, dragging other companies closer to their own spiral. In this environment, even minor shocks can set off cascading failures.

The Breed VC report warns that only companies maintaining a strong mNAV premium and growing their Bitcoin-per-share holdings consistently can escape collapse. Others may be acquired or go under, prompting further industry consolidation.

Fortunately, most Bitcoin treasuries in 2025 still rely on equity financing rather than high leverage. This lowers contagion risk, as shareholder losses are more likely than systemic fallout.

Still, the situation could change. A pivot toward aggressive borrowing would raise the stakes. If heavily leveraged entities unwind, they could endanger creditors, spread damage through the market and undermine long-term faith in the Bitcoin treasury model.

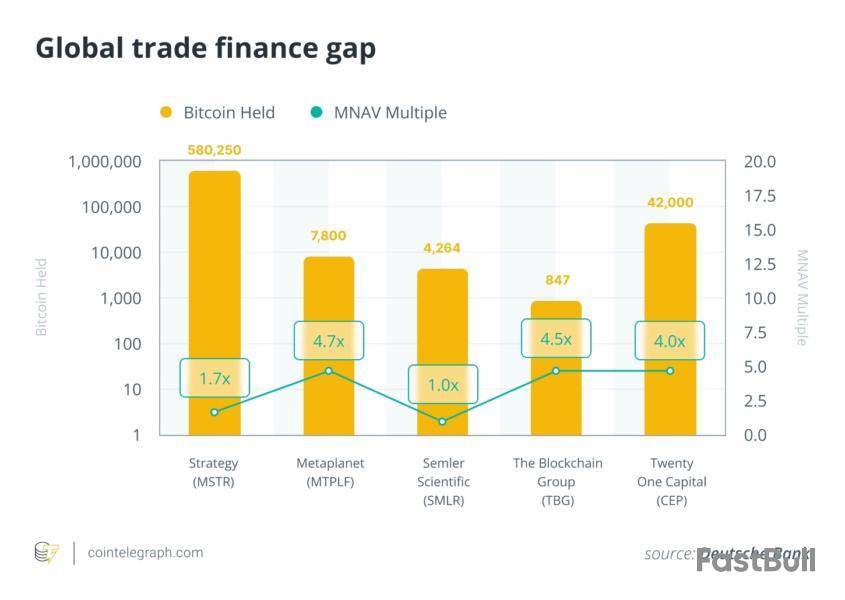

Even now, tracking sites like BitcoinTreasuries.org show growing divergence: While Strategy’s BTC performance remains resilient, weaker imitators are faltering.

As ETF and pension fund BTC exposure rises, the pressure to separate disciplined execution from blind accumulation has never been greater.

Did you know? BTC buys by treasury companies barely move the market, usually. Corporate Bitcoin purchases typically affect less than 1% of daily volume (except on days when Strategy buys, when they’ve accounted for up to around 9%).

Strategy’s Bitcoin plan: Why Saylor’s treasury model still works

While the broader Bitcoin treasury model is showing cracks, Strategy’s Bitcoin strategy continues to stand out as a rare success.

Under Michael Saylor’s Bitcoin plan, the company has methodically built a dominant position, holding over half a million BTC by mid-2025, more than half of all Bitcoin held by public companies.

Crucially, Strategy’s stock still trades at a significant premium to its Bitcoin NAV (typically 1.7-2.0x its underlying NAV). This mNAV premium signals sustained investor confidence, based not just on its BTC holdings but on the company’s ability to keep growing its Bitcoin-per-share metric through a disciplined capital strategy.

Rather than relying solely on leverage, Strategy employs a balanced BTC equity vs. debt strategy. On the equity side, it has used at-the-market offerings to sell new shares at elevated valuations, recycling proceeds into more Bitcoin without excessive dilution.

On the debt side, it issued low-interest convertible notes, which are structured to only convert into stock if Strategy’s price surges. This allows access to capital while minimizing immediate dilution. Though it did briefly use secured loans, the company exited those positions early, mitigating Bitcoin debt financing risk tied to margin calls.

This approach has enabled Strategy to nearly double its BTC holdings every 16-18 months, outperforming other Bitcoin holding companies both in accumulation and market trust.

As Adam Back on Saylor has noted, the company’s premium is a reflection of its compounding execution, steadily increasing BTC per share while maintaining solvency and optionality. In contrast to companies that simply hold BTC, Strategy actively manages its treasury as an asymmetric bet on a supply-capped crypto asset, one with long-term upside and short-term volatility.

The company has also demonstrated resilience during market downturns. Even amid price shocks and a looming BTC NAV death spiral for some peers, Strategy preserved its mNAV premium by clearly communicating with investors, maintaining debt servicing and opportunistically raising funds through equity rather than distress sales.

Did you know? Strategy’s stock has outpaced Bitcoin itself. Over the past five years, its stock soared around 3,000%, far outpacing Bitcoin (around 1,000%) and even chip giant Nvidia (around 1,500%).

Future of Bitcoin treasuries and mNAV crypto companies

Looking ahead, Bitcoin treasuries in 2025 are entering a phase of consolidation.

Only a handful of companies are likely to maintain their mNAV premiums. Weaker players (especially those overleveraged or lacking investor trust) may face acquisition, collapse or irrelevance.

Strategy’s lead and market credibility make it the benchmark. New entrants in the mNAV crypto companies category will need to differentiate themselves by offering new value, unique structures or improved capital efficiency. Simply being a corporate Bitcoin reserve vehicle may no longer be enough.

Meanwhile, plates are shifting as ETF and pension fund BTC exposure expands. With traditional finance offering new ways to access Bitcoin, from spot ETFs to institutional custodianship, the appeal of publicly traded Bitcoin proxy stocks could fade. If ETFs gain further traction, they may siphon demand away from companies like Strategy, shrinking the mNAV premium and compressing valuations.

Still, the long-term thesis remains intact: Bitcoin is a supply-capped crypto asset, and scarcity dynamics will drive value. The question is who can hold through volatility without being forced to sell. Companies with high leverage and weak governance are most at risk. Those relying on equity may dilute, but they’ll survive the next downturn.

Bitcoin corporate treasury risks are real, but not insurmountable. Strategy has set a playbook: use capital strategically, maintain investor trust and stay long-term aligned.

For others in the space, survival may depend on how well they can adapt that approach before the next BTC market downturn forecast becomes reality.

Bears have seized the initiative today, according to CoinStats.CoinStats" />

The price of DOGE has fallen by 5.55% over the last 24 hours.TradingView" />

On the hourly chart, the rate of DOGE is on its way to the local support of $0.1884. If its breakout happens, the correction is likely to continue to the $0.18 area soon.TradingView" />

On the daily time frame, the price of the meme coin keeps going down after a false breakout of the resistance of $0.2067.

If bulls cannot seize the initiative soon, one can expect a test of the $0.18-$0.1850 zone shortly.TradingView" />

From the midterm point of view, the situation is similar. If the weekly bar closes far from the $0.2067 level, there is a chance of seeing an ongoing decline to the $0.18 mark by the end of the month.

DOGE is trading at $0.19 at press time.

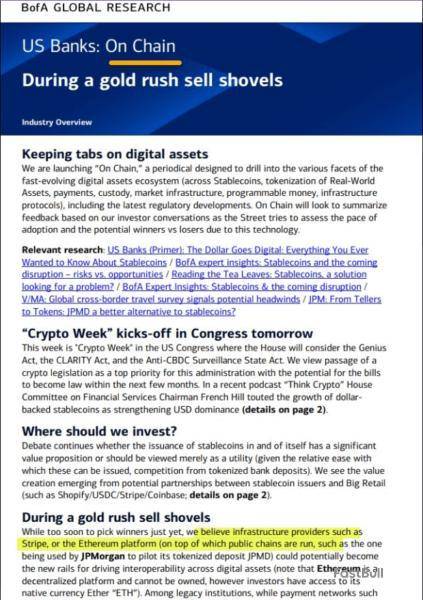

A new weekly “On Chain” report from Bank of America is shining a spotlight on Ethereum. According to the report, the network is set to draw steady interest from stablecoin investors as lawmakers in Washington take up crypto bills in Congress.

Ethereum’s role as the home for over 50% of all dollar‑pegged coins has caught the eyes of big banks and asset managers alike.

Stablecoin Legislation Under The Lens

Based on reports, this week’s Crypto Week in the US House of Representatives could reshape the stablecoin sector. Lawmakers are debating three major bills: the GENIUS Act, the CLARITY Act, and the Anti‑CBDC Surveillance bill.

House Financial Services Chair French Hill told a “Think Crypto” podcast that dollar‑backed coins would solidify the US dollar’s global lead. If Congress backs clear rules, the rails that already carry the most volumes could see fresh inflows.

matthew sigel, recovering CFA@matthew_sigelJul 14, 2025BofA launches new weekly periodical ‘On Chain,’ designed to “drill into the various facets of the fast-evolving digital assets ecosystem.”

First call: Bullish ETH pic.twitter.com/sERRZiTgMq

Rails For The Future

Bank of America called out infrastructure providers like Stripe and the Ethereum network as prime plays for anyone looking to get stablecoin exposure.

That nod isn’t just for the token itself. It’s a bet on the whole stack—wallets, apps and payment tools that ride on Ethereum’s code. Investors who pick up Ether now could tap growing on‑chain activity as stablecoin use climbs. Institutions Bet On Ether

The report also mentioned Treasury Secretary Scott Bessent predicting that the dollar‑pegged stablecoin market may swell to $2 trillion in the next five years. That forecast has fund managers circling the charts.

Thomas Lee, Fundstart CIO and new chairman of BitMine, even dubbed stablecoins the “ChatGPT of crypto.” His firm now holds Ether in its treasury. The move shows how big players are gearing up for a stablecoin surge on Ethereum.

Other sectors are racing alongside stablecoins. BlackRock CEO Larry Fink said tokenization could expand 4,000 times over time. He sees on‑chain assets tied to real‑world items booming soon. Some say XRP and Ether are the go‑to tokens for that play. But Ethereum already has the advantage of scale.

It isn’t all smooth sailing. Regulation could tighten or split along different chains. New networks chase faster speeds and lower fees. That competition could chip away at Ethereum’s lead. Still, the network’s mix of smart‑contract tools and high stablecoin volumes gives it a strong head start.

For now, plenty of eyes are on Congress and on‑chain data. If US lawmakers set clear stablecoin rules, Ethereum may keep its crown as the top hub. Investors looking for exposure will likely track Ether flows and watch the bills as they move through committee. The weeks ahead could spell out the next big chapter for the network.

Featured image from Pexels, chart from TradingView

The market needs time to accumulate energy for a further move, according to CoinStats.CoinStats" />

The rate of Binance Coin (BNB) has dropped by 2.5% over the last day.TradingView" />

On the hourly chart, the price of BNB is in the middle of the local channel, between the support of $675.30 and the resistance of $691.10.

As neither bulls nor bears have seized the initiative so far, sideways trading in the range of $675-$685 is the most likely scenario.TradingView" />

On the bigger time frame, the rate of the native exchange coin is falling after yesterday's bearish closure. If the candle closes near its bar low, the correction may continue to the $665-$670 area.TradingView" />

From the midterm point of view, the price of BNB has made a false breakout of the resistance of $697.73. If the candle closes far from that level, sellers may seize the initiative, which may lead to a drop to the $660 zone.

BNB is trading at $680.65 at press time.

TAC, a Layer 1 network aiming to bring Ethereum composability to The Open Network (TON) and the messaging platform Telegram, launched its public mainnet.

Popular Ethereum-based decentralized finance (DeFi) protocols including Curve, Morpho, Bancor, ZeroLend, and Euler are available for TON and Telegram users, bringing decentralized lending, yield, exchanges, and other use cases, according to a release shared with The Block. Developers can launch apps straight onto TAC, short for the TON Applications Chain.

"TAC’s mainnet launch is a major step toward bringing DeFi to the mainstream. By connecting Ethereum dApps with the Telegram ecosystem, TAC unlocks real utility for over a billion users," said TOP Labs Managing Partner Andrew Klebanov in a statement. "The team combines deep technical expertise with a clear growth strategy and is uniquely positioned to bring the best of Ethereum into TON."

Telegram surpassed 1 billion in monthly active users in March, the platform's CEO Pavel Durov said in a personal Telegram channel.

TAC raised a total of $11.5 million in funding, stemming from strategic investments and a $6.5 million seed round led by Hack VC and Symbolic Capital in November 2024. The Open Platform (TOP), a TON development project that backs TAC, also raised $28.5 million in an extended Series A raise on July 3 to net the firm a $1 billion valuation, The Block previously reported.

The Open Network supports Telegram mini-apps, including the popular crypto games Hamster Kombat and Notcoin. The blockchain claims to have over 40 million active users.

The blockchain's native asset Toncoin traded at $3.01 as of publication, according to The Block's TON Price Page. TON maintains a market capitalization of $7.4 billion and brought in $287 million in trading volume in the last day.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up