Investing.com — December 2025 opens with a fresh wave of macro uncertainty as markets digest the latest labor market report, which signaled cooling job growth and stirred debate over the Federal Reserve’s next steps on interest rates. Tech stocks, already under pressure after sliding over the past 30 days, continue to feel the weight of shifting expectations around monetary policy and corporate earnings. With sentiment fluctuating and volatility elevated, investors are navigating a landscape where narratives can change quickly.

In moments like this, relying solely on emotion or headlines can cloud judgment. Data-driven, AI-powered insights have become increasingly valuable for identifying emerging trends before they gain broader attention. Our proprietary Tech Titans strategy leverages machine learning models to distill the data from the noise and spotlight high-conviction tech names showing early-month strength. Even just a few days into December, several of these signals are already posting notable gains, offering an early read on this month’s momentum.

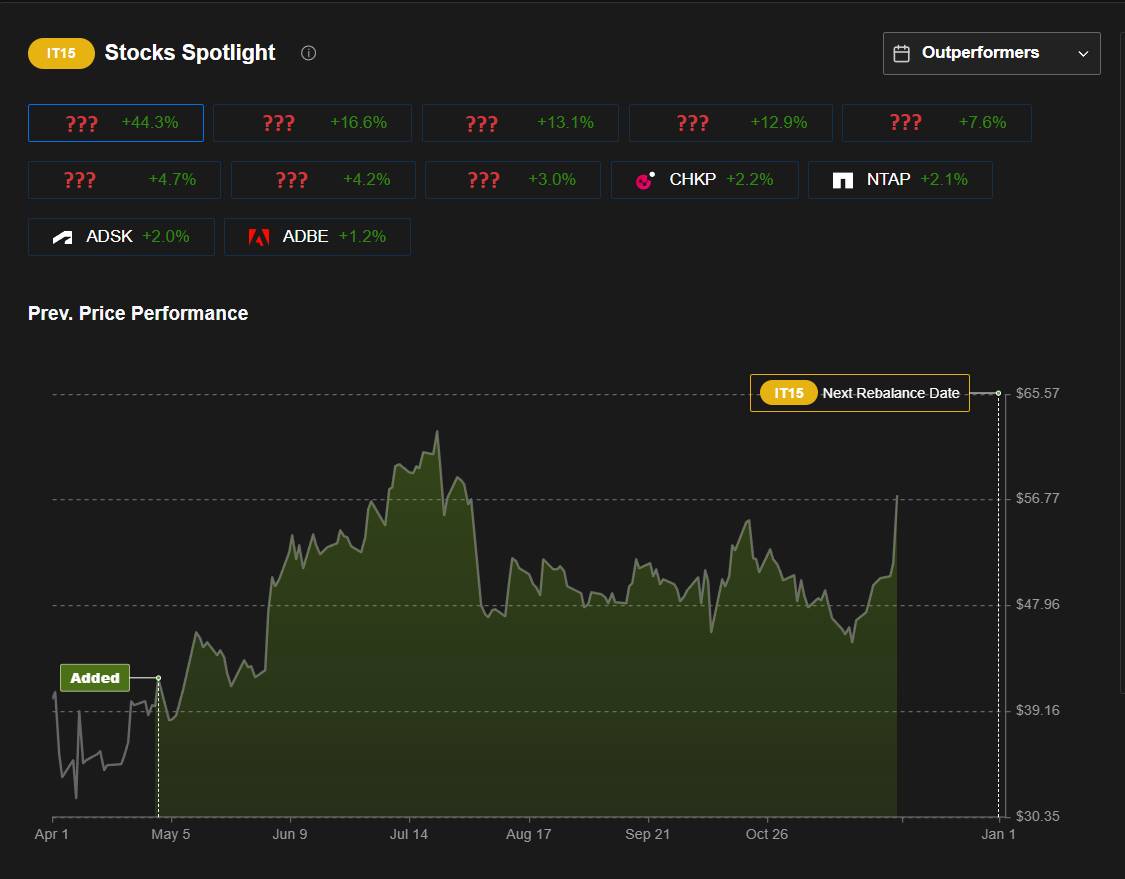

Here’s how some of our big winners are performing so far:

- Amkor Technology (NASDAQGS:AMKR): +16.64% in December ALONE

- ON Semiconductor (NASDAQGS:ON): +13.33% in December ALONE

- Entegris (NASDAQGS:ENTG): +13.08% in December ALONE

Among several others...

Want to see the full list of tech stocks that our AI flagged as high-conviction choices for December?

*InvestingPro members can click HERE to jump straight to our full list of December tech picks.

Still not a member? Now is your chance to join at up to 55% off and get instant access to our complete list of AI-picked tech stocks FOR LESS THAN $8 A MONTH.

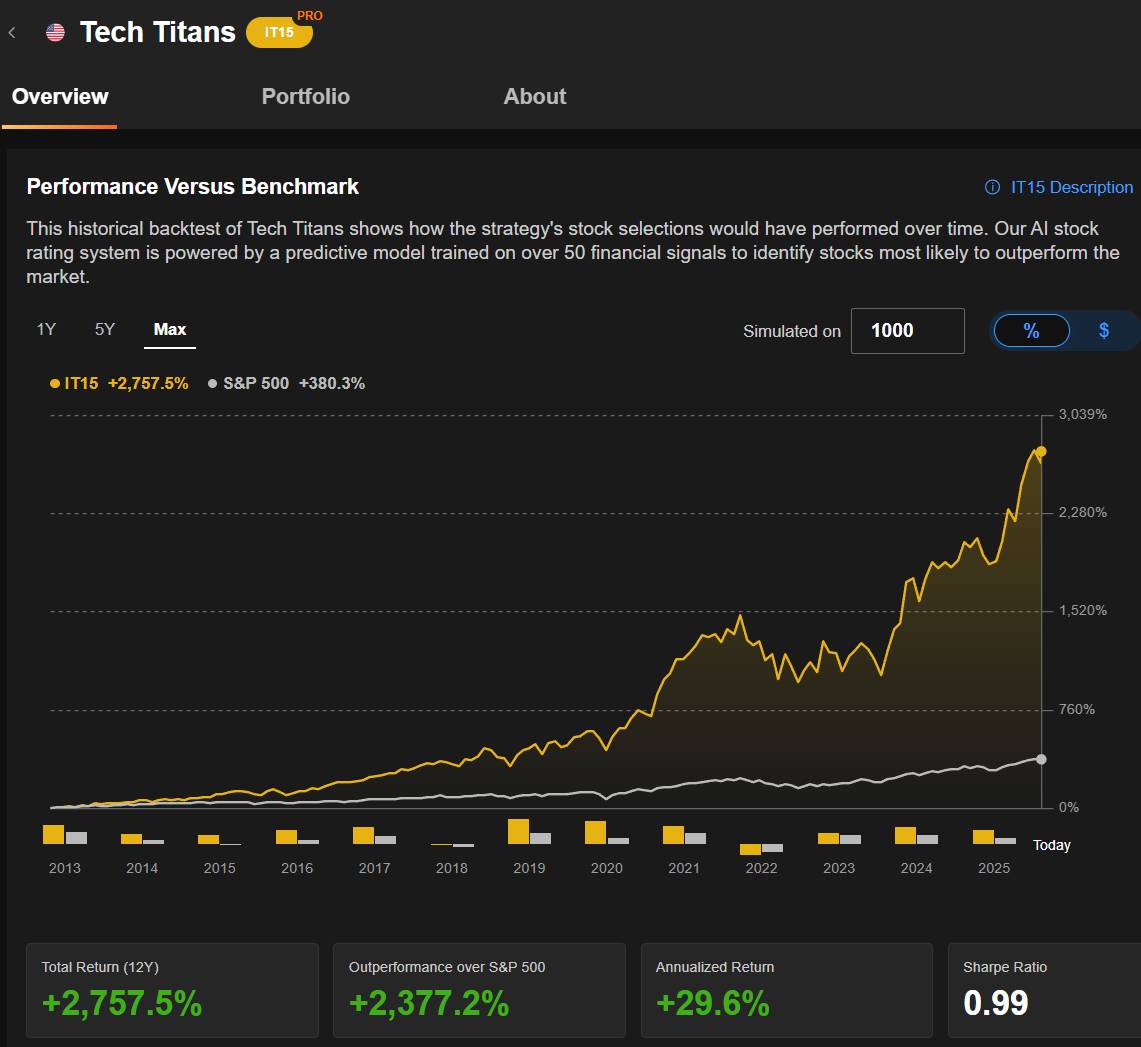

Proven performance that keeps compounding

250K+ investors trust InvestingPro’s AI strategies, and the results continue to reinforce why. The same engine powering December’s early winners has consistently delivered exceptional results over the last two years.

Our Tech Titans strategy is now up +153.34% since its launch in November 2023.

The strategy doesn’t chase trends; it identifies durable opportunities in semiconductors, automation, cloud infrastructure, and other high-growth categories and then continually refines its selections.

Here’s why our AI selected Amkor Technology during its last rebalancing on December 1:

- Strong recent momentum with a 103% six-month gain and trading near its 52-week high.

- Q3 outperformance with EPS and revenue beating forecasts, showing solid operational strength.

- Key partnerships with Nvidia and Apple enhance exposure to AI and high-performance computing demand.

- Major $7B Arizona packaging facility signals long-term growth supported by CHIPS Act incentives.

- Valuation remains reasonable, and analysts expect 65% EPS growth through 2027.

But how does the AI behind these picks actually work?

At the start of each month, the AI refreshes every strategy with up to 20 new stock picks, analyzing more than 150 investor-grade financial models built on over 15 years of global market data. It identifies where risk and reward align best — removing underperformers, keeping promising names, and adding fresh opportunities.

Each decision is backed by a rationale that clarifies why a stock was added, removed, or kept in the strategy.

The strategies use equal weighting across all selected stocks, creating a transparent and consistent way to track results. The goal is not just to find winners but also to know when to move on from the ones that stop performing.

Check out the 12-year outperformance of Tech Titans over the S&P 500 below:

This means a $100K principal in our strategy would have turned into an eye-popping $2,757,500.

Use your chance to get InvestingPro now for less than $8 a month during our Cyber Monday Extended sale.

Disclaimer: Prices mentioned in articles are accurate at the time of publication. We regularly test different offers for our members, which may vary by region.