Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Democrats will likely not be at top posts at the U.S. Securities and Exchange Commission, giving way for Republicans to adopt crypto-related rules, according to TD Cowen. That scenario could also be risky, the investment bank noted.

Following elections in November, President-elect Donald Trump has tapped Paul Atkins to chair the SEC. Atkins will lead the agency alongside his fellow Republican commissioners, Hester Peirce and Mark Uyeda. Current Democratic SEC Chair Gary Gensler and Democratic Commissioner Jaime Lizárraga have said they will leave the agency in January.

That leaves current SEC Commissioner Caroline Crenshaw as the sole Democrat. Notably, no more than three commissioners can be in the same political party.

This comes as Crenshaw is facing an uphill battle to be nominated to serve another term. A vote to renominate her was set for last week during a Senate Banking Committee hearing but was delayed due to Republicans blocking the vote, according to the committee's Chair Sen. Sherrod Brown (D-Ohio).

"We believe it is increasingly likely that there will not be any Democrats on the SEC next year," TD Cowen Washington Research Group's Jaret Seiberg wrote in a note on Monday.

Some in the crypto industry have called for Crenshaw's removal, citing her dissent after the approval of spot Bitcoin exchange-traded products earlier this year. In her statement, Crenshaw warned of fraud, manipulation, and the potential for investors to falsely believe they had protections.

The Senate Banking Committee will meet again on Wednesday to vote on Crenshaw's nomination, according to reporting from Punchbowl News.

TD Cowen's Seiberg said an all-Republican commission would help Atkins push forward rules more quickly since Democrats wouldn't delay that process. However, there are also risks to bipartisanship that could affect future crypto regulation, Seiberg said.

"If the rules are viewed as partisan, then a Democratic SEC is more likely to change them," Seiberg said. "By contrast, bipartisan rulemakings likely create a regulatory regime that survives elections. We view that as providing the policy stability that would benefit crypto trading platforms, token issuers and the broader crypto sector."

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Customers affected by crypto exchange FTX's collapse will be able to receive bankruptcy distributions through Kraken and BitGo as its plan is set to be effective on Jan. 3, 2025.

The "initial distribution" is expected to happen within 60 days of the effective date, FTX said on Monday in a statement.

"For the past two years, our team of professionals have meticulously and efficiently worked to recover billions of dollars to reach this point," said FTX Debtors CEO John J. Ray lll. "The Plan becoming effective in January 2025 and the start of distributions are reflections of the outstanding success of the recovery efforts."

Earlier, a representative of the largest FTX creditor group Sunil Kavuri noted that FTX posted two distribution partners, Kraken and BitGo, with a third coming soon. Funds can also be distributed through stablecoins, Kavuri added.

FTX, Kraken and BitGo did not immediately respond to a request for comment.

Judge John Dorsey in the U.S. Bankruptcy Court for the District of Delaware approved FTX's bankruptcy plan in October, two years after the exchange filed for bankruptcy. Under the plan, 98% of creditors will receive at least 118% of their claim value in cash.

About 94% of creditors in the “dotcom customer entitlement claims” class who returned their ballots — representing about $6.83 billion in claims by value — voted in favor of the reorganization plan, according to previous The Block reporting.

The plan also garnered criticism from Kavuri who said the estate should pay out cryptocurrencies in kind rather than the dollar value when the exchange filed for bankruptcy back in 2022.

FTX filed for bankruptcy in late 2022. The exchange's CEO, Sam Bankman-Fried, was found guilty in November 2023 of seven criminal counts, including two counts each of wire fraud and conspiracy to commit wire fraud, and was sentenced to nearly 25 years in prison. Sister trading firm Alameda also subsequently fell, and its CEO Caroline Ellison was sentenced to two years for her role in the downfall of FTX.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Renewed interest in XRP and excitement over the upcoming Ripple USD (RLUSD) stablecoin launch have driven a significant increase in user activity for Xaman, a self-custodial wallet built for the XRP Ledger (XRPL) ecosystem.

The number of active weekly users on Xaman has surged 250% since summer, topping 212,000 active users last week, Xaman chief operating officer Robert Kiuru told Cointelegraph.

The spike in user activity on Xaman reflects a renewed interest in the XRPL ecosystem amid the ongoing rally of XRP and community anticipation of the Ripple USD (RLUSD) stablecoin launch.

Launched in March 2020, Xaman was formerly known as Xumm and has received indirect investment from Ripple’s investment arm Xpring, which rebranded to Ripplex in October 2020.

80,000 new users join Xaman amid XRP rally

As of December 2023, Xaman had around 80,000 active weekly users, which dipped to 60,000 users during summer 2024.

Xaman’s recent spike in user activity was driven by 80,000 newly signed-up users and many returning users as XRP briefly revisited the position of the third-largest cryptocurrency by market cap on Dec. 2.

“This growth reflects a renewed interest in XRP volatility and RLUSD launch,” Kiuru said, adding that 90% of the active user base spike should be attributed to the XRP price.

Xaman leverages XRPL fork for smart contracts

Rebranded from Xumm in May 2023, Xaman is a self-custodial wallet supporting on-ramps and off-ramps through platforms like Uphold’s Topper.

While XRPL itself doesn’t support smart contracts, Xaman features them on the Xahau Network, which is a separate blockchain and a fork of the XRPL, Xaman’s Kiuru said.

“Smart contracts on Xahau use Hooks, developed by XRPL Labs,” Kiuru noted, adding that the Hooks add lightweight functionality tailored for developers and users.

“Almost every XRPL project integrates with Xaman via ‘Sign in with Xumm,’ offering secure, seamless transactions,” he said.

Xaman secured indirect investment from Ripple in 2019 and 2020

Ripple’s investment arm Ripplex — then Xpring — backed Xaman through investment in XRPL Labs in 2019 and 2020.

“It was one of the first grantees from Ripple when it was funded by Xpring,” Kiuru said, adding that Xpring initially invested in XRPL Labs in early 2019.

Originally known as the Xumm wallet, Xaman was created by prominent Ripple developer Wietse Wind, who also released XRP applications like XRParrot and XRPTipBot.

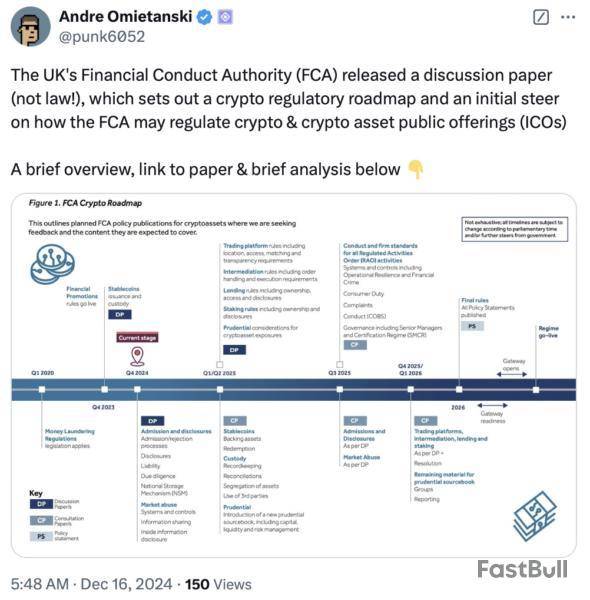

The United Kingdom may see crypto asset regulation in 2026, the Financial Conduct Authority (FCA) said. In its latest step in that direction, the FCA has released a discussion paper on admissions and disclosures and market abuse regulation.

What to admit and how

Under government plans, the FCA’s authority will be extended beyond its current Anti-Money Laundering and promotions supervision to include crypto asset trading, stablecoin regulation, intermediation, custody, and other activities.

Tokenized financial instruments, security tokens and investment vehicles are already covered by the Financial Services and Markets Act 2000 (Regulated Activities) Order (RAO) 2001.

The FCA foresees allowing crypto asset offerings only through exemptions:

Once an exemption is made, due diligence and disclosures are carried out, leading to the asset’s admission to the CATP at its discretion. Public disclosures will be required to meet certain standards, otherwise, “we can use our power […] to direct a firm to provide compensation in relation to breaches of the financial promotions regime.”

Who stops the abusers?

A civil market abuse regime exists for traditional finance in the United Kingdom, but it has already been determined that the regime cannot be transferred directly to crypto assets. The FCA acknowledged the influence of the International Organization of Securities Commissions (IOSCO) crypto and digital asset market recommendations on its proposals.

According to the FCA, “The government’s consultation response has made clear the intention to facilitate through legislation cross-trading platform information sharing.” The FCA does not intend to create mechanisms to facilitate the sharing. Nonetheless:

HM Treasury first released its plans for a crypto regulatory framework in February 2023.

In November 2024, the new government confirmed its intentions to stick to that plan, but with revised implementation, eliminating the phased approach. The FCA will hold consultations on stablecoin regulation separately. It is accepting feedback on the 49 questions in the paper from domestic and international stakeholders, particularly those in the wholesale sector, through March 14, 2025.

TL;DR

Where Is XRP Headed Next?

The cryptocurrency market has been booming in the past month, with Ripple’s XRP among the top performers. Its price exploded by approximately 120% for that period, briefly becoming the third-biggest digital asset.

In the past few weeks, though, XRP experienced severe volatility, with its valuationplungingbelow $2 and later spiking above $2.50. Currently, it is worth around $2.36, which represents a 2.5% decline on a 24-hour scale.

Numerous market observers think XRP could be poised for another major rally soon. The X user JAVON MARKS predicted a potential price explosion based on the asset’s performance on a 4-hour scale.

Dark Defender chipped in on December 15, analyzing the same time frame. The strategist highlighted the price push above $2.50, maintaining that the asset might be headed to $2.72. Additionally, Dark Defender set $5.85 and $8.76 as short-term targets, outlining $2.29, $2.24, $2.10, and $2.02 as major support zones.

X user Bark made a bullish forecast, too, seeing XRP jumping to a new all-time high of $5. Such a spike would require the token’s market cap to cross $265 billion. A few months ago, an increase of that type seemed unlikely given the fact that XRP was worth less than $0.60, while its capitalization stood at around $30 billion. However, things look quite different now, and we have yet to see whether the bull run will continue in the near future.XRP Metrics on a Downfall

Despite the optimistic predictions, some important indicators suggest that the bulls may take a blow soon. The latest data shows that the number of XRP payments from one account to another, active accounts, executed XRP transactions, and newly activated accounts have sharply declined in the past 24 hours.

Fewer users joining the ecosystem can lead to reduced buying pressure, potentially lowering the demand for the asset and negatively affecting its price. Additionally, a decrease in executed transactions indicates lower utility for XRP. This reduction in activity might discourage speculative investors, further weakening demand.

Crypto analyst TradinSides has suggested that it might be time for investors to start closing their XRP long positions. This came as the analyst revealed a bearish pattern, which showed that the XRP price could witness a significant crash.

XRP Price Could Crash As Head And Shoulder Pattern Forms

In a TradingView post, TradinSides predicted that XRP could crash as the price could form the Head and Shoulders pattern, driving the crypto to $2.2 or below. The analyst stated that this price correction could happen if some bullish fundamentals don’t happen for the altcoin as expected. The fundamentals that TradinSides cited include the RLUSD stablecoin and the upcoming XRP ETFs.

While these fundamentals present a bullish outlook for the XRP price, the crypto analyst stated that XRP still stands under heavy selling pressure due to the SEC’s decision to appeal the Ripple case ruling, which is impacting demand and market sentiment. TradinSides alluded to SEC Commissioner Caroline Crenshaw’s reappointment and how it could ultimately impact the Ripple case and the XRP price.

The analyst noted that Crenshaw’s reappointment is set for December 18. However, if Crenshaw’s renomination fails, Donald Trump could nominate a new Commissioner. Crenshaw’s renomination is significant as the SEC must file its opening brief in the appeal case on January 15.

If she is reappointed, she could vote in favor of the Commission filing its opening brief since she has been known to take an anti-crypto stance on several occasions. The crypto analyst believes the altcoin could face selling pressure if the SEC pursues the appeal.

On the other hand, if the SEC withdraws its appeal, TradinSides predicts that the Commission could also withdraw its appeal. This would lead the agency to approve the pending XRP ETF applications, which could drive demand up. If this doesn’t happen, the crypto analyst predicts that the Head and Shoulders pattern could drive the XRP price to $2.2.

The State Of Things

In an X post, crypto analyst Dark Defender provided an update on the current XRP price action. He stated that the 4-hour time frame confirms the break for XRP. The analyst added that the daily time frame will be confirmed above $2.52. Once XRP breaks above that level, Dark Defender predicts that the altcoin will then rally to $2.72.

The crypto analyst also highlighted crucial targets to watch out for. He stated that $5.85 and $8.76 are short-term targets. Meanwhile, he mentioned that $2.29, $2.24, $2.10, and $2.02 are support levels to watch out for. Dark Defender has before now predicted that the XRP price would eventually reach $18 in this market cycle.

At the time of writing, the XRP price is trading at around $2.41, up in the last 24 hours, according to data from CoinMarketCap.

XRP, the cryptocurrency associated with Ripple Labs, has firmly positioned itself as one of the top-performing assets of 2024, with CNBC describing it as the “biggest winner of the Trump trade.”

CNBC@CNBCDec 14, 2024XRP is the biggest winner of the Trump trade but investors are split on how far its rally can run https://t.co/6c6xshZB2D

Since Donald Trump’s victory in the 2024 U.S. presidential election, XRP’s price has surged 370 percent as investors anticipate a more favorable regulatory environment under the new administration.

At the time of writing, XRP is trading at $2.51, marking a 4.0 percent gain in the last 24 hours and a 6.0 percent increase over the past hour. Its market capitalization has soared to $144.30 billion, solidifying XRP’s position as the third-largest cryptocurrency behind Bitcoin and Ethereum.

While this milestone is noteworthy, it remains below XRP’s all-time high of $3.40, recorded on January 7, 2018.

Throughout most of 2024, XRP traded sideways with minimal volatility. From February through October, the price fluctuated below $0.80 as the crypto market struggled with regulatory uncertainty and reduced liquidity. However, the landscape shifted dramatically in late October when investors began pricing in expectations of a more crypto-friendly U.S. government under Trump’s leadership. XRP’s breakout in early November triggered a sharp, sustained rally, driving prices close to multi-year highs.

A major catalyst for XRP’s rally has been growing optimism around U.S. regulatory changes. With Trump’s return to the White House, expectations are mounting for a shift toward a more crypto-friendly environment. Since his victory, Trump has named several pro-crypto individuals to key positions in his administration, further bolstering market sentiment. David Sachs, a venture capitalist and former PayPal COO, has been appointed as the White House’s Crypto and AI Czar, signaling an increased focus on digital assets and emerging technologies. Additionally, Scott Besant has been selected as the Treasury Secretary, while Paul Atkins, a long-time advocate for lighter crypto regulation, has been nominated as the new SEC Chair.

Atkins’ nomination is particularly significant for Ripple Labs and XRP. The SEC’s ongoing lawsuit against Ripple, which alleges XRP is an unregistered security, has been a long-standing overhang on the asset’s price. Investors are hopeful that a more lenient SEC under Atkins’ leadership could resolve or even drop the case, clearing the way for broader XRP adoption.

Adding to the bullish sentiment, Ripple announced on December 16, 2024, that its much-anticipated stablecoin, RLUSD (Ripple USD), will launch globally on December 17, 2024. RLUSD is designed as an enterprise-grade stablecoin pegged 1:1 with the U.S. dollar. It aims to enhance institutional liquidity, trust, and compliance within Ripple’s ecosystem.

Ripple confirmed that RLUSD will initially be available on several major platforms, including MoonPay, Uphold, CoinMENA, Bitso, and Archax, with additional partners to follow. The stablecoin will debut on both the XRP Ledger and Ethereum blockchain, ensuring broad accessibility and interoperability.

https://twitter.com/Ripple/status/1868688420643774854Ripple CTO David Schwartz previously cautioned the community about potential supply shortages in RLUSD’s early days, which could lead to temporary price volatility. He reassured users that any short-term deviations would stabilize quickly, as arbitrage mechanisms bring RLUSD’s value back to its intended $1 peg. Schwartz emphasized that the stablecoin’s core purpose is to maintain price stability, warning against irrational speculative behavior.

https://twitter.com/JoelKatz/status/1868329931698245843XRP’s price surged immediately following Ripple’s RLUSD announcement, reflecting heightened optimism about its role in Ripple’s growing ecosystem. Some XRP community members speculate that RLUSD could indirectly drive demand for XRP, particularly as the stablecoin enhances liquidity and adoption for institutional cross-border payments.

With XRP already up 370 percent since Trump’s election victory and now trading above $2.50, investors are watching closely to see whether this rally can reclaim XRP’s all-time high of $3.40.

XRP’s strong price performance in 2024 has been fueled by multiple factors: renewed regulatory optimism under the Trump administration, the anticipated resolution of Ripple’s legal challenges, and growing excitement surrounding RLUSD. As the stablecoin launches and institutional adoption gains momentum, Ripple’s ecosystem appears well-positioned to capitalize on this wave of enthusiasm.

Featured Image via Pixabay

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up