Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Over the past week, Michael Saylor’s Strategy purchased another 430 bitcoin for $51.4 million, funded primarily by new stock issuances. The move comes just weeks after Saylor said the firm would not further dilute its equity unless shares traded below 2.5 times the value of its Bitcoin holdings, outside of paying debt interest and preferred equity dividends.

However, the firm already appears to be relaxing that constraint, adding a byline that Strategy may offer new shares "when otherwise deemed advantageous to the company" when its market Net Asset Value (mNAV) is below 2.5x. For reference, Strategy will “actively issue MSTR” to buy BTC when mNAV is above 4x “opportunistically” sell shares when it’s between 2.5x and 4x.

To Strategy bears like Jim Chanos, this may appear hypocritical; though to other analysts, this simply appears to be an apt reallocation of priorities given market conditions and future prospects. In a client note on Monday, TD Cowan calls Strategy "a new kind of firm" that "converts market appetite for volatility and return – on an effectively leveraged basis – into Bitcoin."

"What started as a defensive strategy to protect the value of its reserve assets has become an opportunistic strategy intended to accelerate the creation of shareholder value," TD's analysts wrote. "Strategy intends to continue acquiring and holding bitcoins via proceeds of debt and equity offerings."

Notably, the analysts point to the fact that Strategy isn't directly issuing its common MSTR stock, but instead its preferred share, a class of assets meant to give the firm flexibility in how it raises funds. The past week’s purchases, for instance, were "funded primarily" by about $19 million worth of STRK preferred stock; $18 million worth of STRF preferred stock, and $12 million worth of STRD preferred stock.

The firm is holding its price target steady at $680, on the prediction that by the end of 2027, Strategy will have accumulated 4.3% of Bitcoin’s total supply — i.e., 900,000 coins — and that bitcoin will have reached a price of $232,000. For reference, MSTR is trading at $363, while bitcoin is sitting above $116,000.

Not only that, TD Cowen seems to be pricing in other potentially bullish catalysts, like MSTR possibly being added to the S&P 500 index, increasing clarity around bitcoin tax obligations, and progress in cloud technology, which was once Strategy’s core business and remains a revenue generator.

Further, not even the growing competition of copycat bitcoin treasuries — like Tether-backed Twenty One Capital or David Bailey’s Nakamoto — is much of a challenge. The analysts estimate there are around 160 such firms, some of which could become viable investment vehicles over the coming 12 months.

"To be clear, we view the proliferation of PBTCs as unequivocally bullish for Strategy," they write. "Benefits of additional new entrants will in our opinion likely include further legitimization of the PBTC model, deeper pools of debt and equity capital available to the PBTC space, increased demand for bitcoin, improved accounting standards, and broader adoption of bitcoin and blockchain technologies throughout the traditional financial community."

Earlier this month, Strategy posted positive quarterly earnings showing record net income of $10 billion and a boosted "BTC $ Gain" metric of $20 billion from $15 billion. The firm holds over 3% of the total bitcoin supply.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Usual and Brevis are holding a Community Spaces event to explain new reward programs, use of ZK tech, and the CPI program. These talks may help users trust and join the projects. If the ideas are new and show the project is growing fast, there could be fresh buyers, leading to price gains. On the other hand, if no strong news is shared, effects may be limited. Community news calls often move the price if the project gives out rewards or launches new features soon after. source

Usual@usualmoneyAug 18, 2025This Thursday, we’re joining @brevis_zk for a deep dive into Community-First Rewards

Expect insights on:

- CPI program & the Revenue Switch

- How ZK makes RWA rewards trustless & transparent

️ With Usual's cofounder @AdliTB and the Brevis team. Don’t miss it: Aug 21 at 12PM… https://t.co/qJdhh5am3Y

The GIP-130 vote asks GnosisDAO to approve changes to the gnosis.eth system. Such proposals can impact both GNO and SDAI if they bring new features or make the chain more useful. If the vote passes and the changes are seen as good or making Gnosis stronger, this could bring more demand and push prices up. If the changes are confusing or not liked, traders may sell. Votes like this often create price swings both before and after the final result is known. source

Avalanche is set to host the Bowmore Whisky collection as tokenized assets on September 30. This mix of real-world assets and NFTs can get new buyers interested in AVAX. Tokenizing famous whisky could bring in collectors and investors who want both unique assets and blockchain safety. If the drop is popular, we may see a boost in AVAX price. But, if there is little interest, price change may not be big. The size of the whisky collector group is smaller than typical crypto buyers. More news near the launch may drive price moves. source

Avalanche@avaxAug 18, 2025The Bowmore x Avalanche tokenized whisky drop is available for presale now and launches September 30.https://t.co/rxXwEMco1E

By Stephen Nakrosis

FT Intermediate, which uses blockchain technology to provide lending, trading and investing activities in areas such as consumer credit and digital assets, filed for an initial public offering on Monday with the U.S. Securities and Exchange Commission.

The company, which will change its name to Figure Technology Solutions, reported revenue of $190.5 million for the six months ended June 30. In the prior year period, the company said it had revenue of $156 million.

Michael Tannenbaum, the company's chief executive officer, previously served as an executive at technology and financial services company Brex. Tannenbaum also held roles at SoFi Technologies, including as Chief Revenue Officer, FT said.

The company will have two classes of common stock, with Class A shares entitled to one vote, while Class B shares will entitled to 10 votes.

FT didn't give an expected size or an anticipated price range for its IPO.

The company said it applied to list its Class A stock on the Nasdaq Stock Market under the symbol FIGR.

Write to Stephen Nakrosis at stephen.nakrosis@wsj.com

Ethereum is down $132.01 today or 2.95% to $4337.97

Note: The Ethereum price is a 5 p.m. ET snapshot from Kraken

Data compiled by Dow Jones Market Data

The US Securities and Exchange Commission (SEC) has delayed rulings on three high-profile crypto exchange-traded funds (ETFs), extending review deadlines into October.

In notices filed Aug. 18, the agency set new decision dates of Oct. 8 for NYSE Arca’s Truth Social Bitcoin and Ethereum ETF, Oct. 16 for 21Shares’ and Bitwise’s Solana ETFs, and Oct. 19 for the 21Shares Core XRP Trust.

The Truth Social Bitcoin and Ethereum ETF, submitted on June 24, is structured as a commodity-based trust holding Bitcoin (BTC) and Ether (ETH) directly and issuing shares backed by those assets. While branded under US President Donald Trump’s Truth Social platform, it functions like other spot Bitcoin and Ether ETFs already on the market.

Cboe BZX also seeks approval for the first US spot Solana ETFs through filings from 21Shares and Bitwise. These products would hold Solana (SOL) tokens and give investors a secure way to gain exposure to Solana’s price performance.

A separate application from 21Shares aims to launch the Core XRP Trust, designed to hold XRP and track its market value. First filed in February and later amended, the trust was approaching its 180-day deadline on Wednesday before the SEC granted itself an additional 60 days to review.

Related: US regulator considers simplified path to market for crypto ETFs

October shaping up as a big month for ETF rulings

The most recent ETF extensions are not out of the ordinary. The SEC has been filing ETF extensions all summer, and many of them are shaping up to be decided on this fall.

In March, Cointelegraph reported that the SEC had delayed decisions on multiple altcoin ETF proposals, including products tied to XRP, Litecoin and Dogecoin.

Among them was CoinShares’ application for a spot Litecoin ETF, which would hold (LTC) directly and issue shares backed by the token. Cointelegraph noted that the SEC’s extension placed its deadline in the same cluster of fall reviews as other altcoin filings.

Separately, the SEC extended its review of Bitwise’s request to allow in-kind creations and redemptions for its spot Bitcoin and Ethereum ETFs. Now slated for September, that decision would determine whether investors can exchange ETF shares directly for the underlying crypto rather than cash.

The SEC often uses its full extension periods to evaluate new products and collect public feedback. Bloomberg ETF analyst James Seyffart wrote in a post on X on May 20 that the SEC “typically takes the full time to respond to a 19b‑4 filing.” He added that “almost all of these filings have final due dates in October,” and an early decision would be “out of the norm.”

Ether ETFs smash records as crypto products see $3.75B inflows

BlackRock dominates as ETF funds grow in popularity

The US market now counts a dozen spot Bitcoin ETFs, several Ether products, and a growing roster of applications for Solana, XRP and other tokens. Globally, over a hundred crypto-related ETFs are listed.

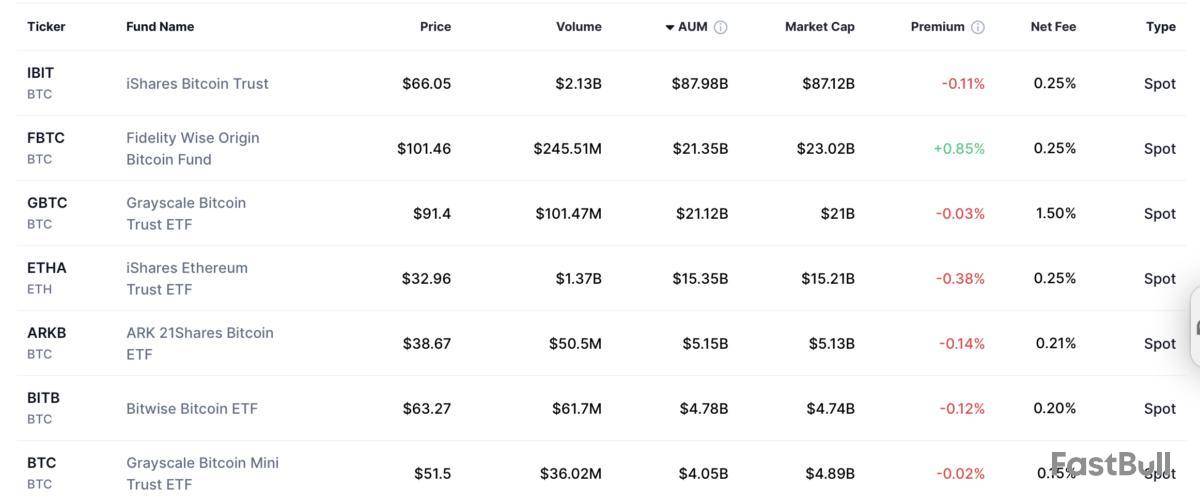

BlackRock’s iShares Bitcoin Trust dominates the field, with more than $87 billion in assets under management (AUM). Its scale, liquidity and brand strength have set it apart, drawing the bulk of flows while rivals remain far smaller.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up