Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Tari Labs launched its much-anticipated Tari mainnet on Tuesday, unveiling a new Layer 1 blockchain and desktop app designed to open “crypto mining to a global audience,” the team wrote in a statement.

“Anyone with a Mac or PC can download the Tari Universe application at www.tari.com, install it in minutes, and earn rewards by harnessing their computer’s processing power to mine Tari tokens (XTM),” according to the release.

The Tari network is often described as a merge-mined sidechain of Monero, tapping into the network’s proof-of-work security model to mine half of its blocks on Tari and half on Monero. However, the team often rejects the “sidechain” label, preferring to call it a distinct Layer 1.

Tari’s founders — early Monero contributors Naveen Jain and Riccardo “fluffypony” Spagni — were inspired by the early days of Bitcoin, when anyone with a personal computer could contribute hashing power and earn mining rewards.

Tari uses a bespoke RandomX hashing algorithm designed to be "ASIC-resistant," in an effort to prevent the runaway economic incentive structure that turned Bitcoin mining into such a competitive and commoditized industry.

“Tari Universe gamifies mining by visualizing the proof-of-work process as miners race to solve the chain's blocks and build the next ‘floor’ of the Tari blockchain tower,” the team said. “Users can easily control how much computational power is dedicated to mining and pause or stop mining at any time with a single click.”

According to the release, the average Tari miner spent more than four hours per day mining. About 100,000 participated in the Tari testnet program through the Tari Universe desktop app.

Tari Labs said it plans to launch a cross-chain exchange layer and native app store.

Last May, Tari started an airdrop program to reward early adopters for doing “tasks” like engaging with the brand on X, joining the Tari Reddit community, and creating memes featuring "Soon," Tari’s turtle mascot.

Like Monero, Tari defaults to private balances and transaction histories. It uses the Mimblewimble protocol for lightweight, private transactions and includes a modification that allows for reusable emoji-based addresses.

Tari Labs is backed by Blockchain Capital, Pantera, CMT Digital, Slow Ventures, and DV Chain, among others. The firm raised a $1.25 million seed round in 2018 followed by $12.6 million early-stage VC round in 2021 with two undisclosed secondary transactions, according to Pitchbook.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

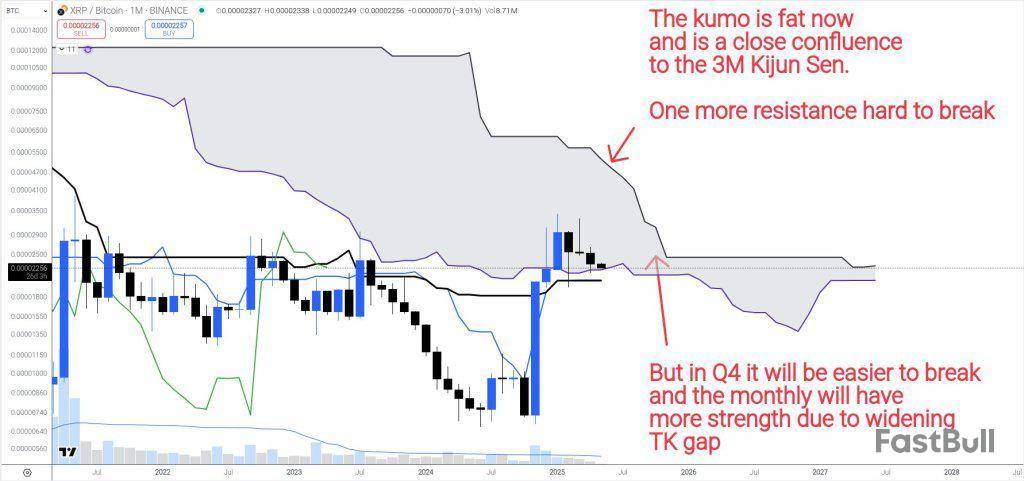

In a post on X, crypto analyst Dr Cat (@DoctorCatX) laid out a detailed road map for the XRP/BTC pair that hinges on both the thickness of the monthly Ichimoku cloud and Bitcoin’s eventual trajectory toward six-figure territory.

The analyst’s working target is a test of 5,200 satoshis by June—a level that “must fight three obstacles at the same time: the quarterly Kijun Sen, a bearish TK cross with a decent gap between Tenkan Sen and Kijun Sen, and the Chikou Span resistance,” he wrote. As a result, he assigns “around 90 percent” odds that the first assault on that level will fail to close a quarterly candle above the Kijun, noting that on a three-month chart “a few candles/tries” implies a time horizon “= a year and more.”

How High Can XRP Price Go?

The accompanying monthly chart, shows a fat kumo acting as near-term ceiling and forming “a close confluence to the 3M Kijun Sen.” One annotation highlights “one more resistance hard to break,” while another points out that by the fourth quarter the kumo is forecast to thin dramatically, giving any later attempt “more strength due to [a] widening TK gap.”

Dr Cat sees two pathways once May trading is underway. If momentum carries through and the 5,200-satoshi zone is pierced during May–June, “we attack in May and June and get $4.5-$6 then reject at least initially (but it might be also rejecting for good).” That dollar translation, he clarified, assumes Bitcoin fluctuating between $90,000 and $120,000: “If BTC is at $90K this is roughly $4.5 and if it is at $120k this is roughly $6.”

The second scenario involves the weekly chart slipping into range-bound behavior, triggering either “a complete flop” or “long consolidation (think months).” Prolonged coiling would shrink the gap between Tenkan and Kijun, erode the thickness of the monthly cloud and, crucially, dull the influence of the quarterly Kijun. “In this case,” he argued, “the chance for the moon target of 12K satoshi significantly increases.” Pushed on what that would mean in dollar terms, Dr Cat replied: “30 $ is the same, assuming BTC explodes much higher much later to $250K (probably even $270K), multiply this by 12K satoshi and you get $30.”

The implication is that XRP’s upside ceiling is bound to Bitcoin’s own expansion. A parabolic run in BTC to a quarter-million dollars would effectively scale Dr Cat’s sats-denominated target into a $30 spot price for XRP—roughly a 5,000 percent rally from current levels.

While the analyst’s framework leans heavily on traditional Ichimoku mechanics—cloud thickness, TK gaps and Chikou Span interaction—he repeatedly cautions that quarterly resistance levels do not yield easily. Even a successful penetration this summer would likely be followed by pullbacks before a sustainable break. Conversely, the comfort of an extended base-building phase could allow XRP to confront those same resistances “significantly easier” later in the year, when the cloud is paper-thin.

For traders, the message is that timing and context may matter more than the raw number. Whether XRP first taps the $4-$6 window and retreats or spends months coiling below resistance, the analyst argues that the ultimate escape velocity to double-digit prices is conditional on Bitcoin’s march past its all-time high and toward the $250,000–$270,000 band.

At press time, XRP traded at $2.10.

TL;DR

Shiba Inu (SHIB) was launched in the summer of 2020 as a meme coin with a dubious utility and largely driven by community hype. In the past few years, though, the project evolved into a more ambitious ecosystem with serious development goals.

This could be among the reasons why the self-proclaimed Dogecoin killer is one of the most popular cryptocurrencies, with the number of its holders recently exceeding 1.5 million.

A thorough look at IntoTheBlock’s data shows that around 78% of those investors have hopped on the bandwagon more than a year ago. 20% have done so in the last 12 months, whereas only 2% have entered the ecosystem in the last 30 days.

In comparison, around 75% of Bitcoin (BTC) holders have held their assets for over a year – a figure that’s nearly identical for Ethereum (ETH) investors.

The large share of long-term Shiba Inu holders signals a committed investor base, which is typically considered less likely to sell impulsively during turbulent times.

It’s worth noting that a significant portion of these investors could have entered the market in 2021 when SHIB skyrocketed to prominence amid its explosive price surge. With the token now trading well below those peak levels, many of them may be currently sitting at unrealized losses.

According to IntoTheBlock’s data, almost 60% of all Shiba Inu investors remain underwater. 37% are in the green, while 4% are breaking even.Time for a Pump?

While SHIB’s price has suffered a 9% weekly decline, certain elementshintat an upcoming resurgence.

One example is the burn rate, which has increased by over 350% in the last seven days. The total amount of scorched tokens since adopting the program in 2022 is more than 410 trillion, meaning there are around 584.4 trillion in circulation, according to this SHIB tracker.

Reducing the overall supply makes the asset more scarce and could make it more valuable. However, this needs to be combined with a non-declining demand.

Other factors suggesting a possible revival are the development of Shibarium and the recent SHIB exchange netflow. The layer-2 blockchain solution has recently passed numerous major milestones, with some industry participants predicting a significant price jump for the meme coin in the event of further advancement.

For its part, SHIB exchange outflows have dominated inflows in the past several days, signaling a shift toward self-custody methods and reduced selling pressure.

Representative Maxine Waters, ranking member of the House Financial Services Committee (HFSC), led Democratic lawmakers out of a joint hearing on digital assets in response to what she called “the corruption of the President of the United States” concerning cryptocurrencies.

In a May 6 joint hearing of the HFSC and House Committee on Agriculture, Rep. Waters remained standing while addressing Republican leadership, saying she intended to block proceedings due to Donald Trump’s corruption, “ownership of crypto,” and oversight of government agencies. Digital asset subcommittee chair Bryan Steil, seemingly taking advantage of a loophole in committee rules, said Republican lawmakers would continue with the event as a “roundtable” rather than a hearing.

HFSC Chair French Hill urged lawmakers at the hearing to create a “lasting framework” on digital assets, but did not directly address any of Rep. Waters’ and Democrats’ concerns about Trump’s involvement with the crypto industry. He claimed Waters was making the hearing a partisan issue and shutting down discussion on a digital asset regulatory framework.

This is a developing story, and further information will be added as it becomes available.

Being wedged between a significant support level and a massive on-chain resistance cluster, Shiba Inu is in a precarious position that could be referred to as a 29 trillion SHIB trap. With technical and on-chain data indicating a struggle to break out in either direction, this price zone, which is currently around the $0.000012 mark, is both a battleground and a bottleneck for SHIB.

Technically speaking, SHIB is presently trading at about $0.0000122, just above a crucial horizontal support. Since it has been tested several times in recent months, this level serves as a short-term buffer against additional declines. In the event that selling pressure continues, it is also perilously close to turning into resistance. The declining volume suggests waning interest, while the RSI, which is at 44, suggests waning momentum and increasing bearish pressure. Chart by TradingView">

The on-chain data, however, tells the true tale. Over 29 trillion SHIB distributed among holders at $0.000012 and $0.000013 are currently concentrated in a small price range, according to IntoTheBlock. With a significant portion remaining just out of the money and many in the money, just these holders are essentially stuck. Approximately 25,700 and 19,800 addresses were purchased, close to $0.000012 and $0.000013, respectively.

When combined, these wallets offer substantial potential sell pressure at even slight price increases, making upward movement more challenging. The opposite is also true: this concentration can serve as a buffer for support. Numerous holders may double down to safeguard their holdings if SHIB declines, increasing demand close to current levels.

Nevertheless, this trap may last for weeks unless the market as a whole regains its appetite for risk or SHIB presents a fresh bullish narrative. To put it briefly, Shiba Inu's own investors limit its price. The only way out of this trap is to make a clear break either above or below $0.0000115. In the interim, anticipate choppy movements and stagnation within this small band.

The broader cryptocurrency market is under selling pressure in the early Tuesday session, fueled by a mix of macroeconomic uncertainties, profit-taking and risk-off sentiment.

The markets are anticipating the commencement of the Fed's policy meeting on Tuesday and Wednesday. Traders are pricing in a 4.4% chance of the central bank cutting rates.

"We expect the Fed to keep rates steady and avoid explicit forward guidance about the policy path ahead," analysts at Deutsche Bank said in a note to CNBC, adding that "the overall tone of the meeting is likely to echo comments from Chair Powell and his colleagues in recent week." Daily Chart: TradingView ">

Major cryptocurrencies are trading down, and XRP is no exception. At press time, XRP was down 3.98% in the last 24 hours to $2.10.

After sustaining four days of drop since May 2, XRP approached the $2 mark, dropping near the daily SMA 200 at $2.07. The loss continued today, reaching lows of $2.08, putting XRP on course for its fifth day of declines since May 2. XRP has broadly declined since highs of $2.36 on April 28, having marked six out of seven days in losses since then.

Key levels to watch

Eyes are on today's price action as XRP nears the $2 mark, which many view as critical for its next move. A break and close below $2 might put the sellers in command, causing XRP to retest the critical support level at $1.61, where buyers are expected to jump in.

XRP remains trapped between $2.60 and the $2 support, indicating buying on dips and selling on rallies. The recent drop has caused XRP to return below the daily SMA 50 at $2.174, returning to trading between its daily moving averages of 50 and 200, as it has since early February. The move increases the chances of consolidation in the coming days.

On the other hand, a decisive break above $2.60 might cause XRP to target the $3 level once more.

Bitcoin and the broader crypto market are headed for a sharp uptrend, according to Binance founder and former CEO Changpeng "CZ" Zhao.

Bitcoin could climb to anywhere between $500,000 and $1 million this cycle, and the total crypto market capitalization could touch $5 trillion by the end of this year, Zhao said in an interview with Farokh Radio published Monday. He didn't offer a specific timeline for the cycle.

This isn't the first time Zhao has floated a seven-figure bitcoin target. In February of this year, he hinted at the $1 million mark in a post on X, imagining a future headline about bitcoin that could read it "crashes" from $1,001,000 to $985,000.

Zhao had similarly hinted at a $100,000 bitcoin price prediction back in 2020, referencing a hypothetical drop from $101,000 to $85,000. That prediction eventually played out — bitcoin crossed $100,000 for the first time in December 2024.

Bitcoin is currently trading at around $93,900, according to The Block's bitcoin price page. Its all-time high was $108,786, reached on January 20, 2025. Meanwhile, the current total crypto market capitalization stands at about $3 trillion, according to CoinGecko.

Beyond price predictions

Beyond price targets, Zhao also shared broader thoughts on the crypto space in the interview. He pointed to memecoins as a current source of froth, saying 99.99% of them will fail and that they distract from real innovation. He highlighted artificial intelligence (AI) and decentralized science (DeSci) as two areas with real long-term potential. "AI will marry blockchain," he said, predicting tighter integration between the two technologies. On DeSci, he said crypto will play a key role in funding and incentivizing scientific innovation globally.

Zhao also praised the pro-crypto stance of the current U.S. administration under President Donald Trump, noting how quickly the regulatory environment has shifted. "The U.S. is now like 180 degrees from where it was 100 days ago," he said.

On the future of trading infrastructure, Zhao reiterated that he sees decentralized exchanges eventually becoming bigger than centralized ones. But he pushed back against framing CEXs and DEXs as opposites — calling them just different doors to the same blockchain-based world. While centralized platforms offer simpler onboarding, he said the long-term shift will favor DEXs, and noted that he's actively backing multiple decentralized projects.

Reflecting on his four-month prison sentence last year, Zhao said the experience reshaped his priorities, placing health and family above all else. He described it as mentally taxing, particularly because of the uncertainty around whether his sentence might be extended. Overall, he called it a difficult experience — one he wouldn't wish on anyone.

As for what's next, Zhao said he has no plans to return as Binance CEO, calling that chapter closed. While he said he "would love to have a pardon," his focus now is mentoring new founders. "I don't foresee myself leading another project," he said, describing his new role as that of a mentor, coach and helper.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up