Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Bitcoin Briefly Drops Below $78,000] February 1st, According To Htx Market Data, Bitcoin Briefly Dropped Below $78,000, And Is Now Trading At $78,184, With A 24-Hour Decrease Of 6.52%

India Budget: Targets 3.16 Trillion Rupees Dividend From Reserve Bank Of India, Financial Institutions

India Budget: Government To Switch Bonds Worth 2.5 Trillion Rupees For Fy26 (Adds Dropped Words)

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Swift is experimenting with an onchain migration of its messaging system using Ethereum Layer 2 Linea, according to a report from The Big Whale published Friday.

More than a dozen financial institutions are involved in the developmental project, including BNP Paribas and BNY, the report said.

"The project will take several months to materialize, but it promises an important technological transformation for the international interbank payments industry," an anonymous source said, according to the report.

Swift, which services more than 11,500 financial institutions, has previously dabbled with blockchain technology. Last year, Swift said banks would conduct live trials of digital asset and currency transactions over its network at some point during 2025.

In August 2023, the global financial messaging network released results from a series of experiments focused on the transfer of tokenized value across multiple public and private blockchains.

"The findings have potential to remove significant friction slowing the growth of tokenised asset markets and enable them to scale globally as they mature," Swift said at the time.

Why Consensys' Linea?

Swift chose Linea, according to The Blue Whale, because the "network emphasizes privacy through advanced cryptographic proofs, a feature deemed crucial for banks concerned with balancing innovation and regulatory requirements."

Built by Consensys, Linea is a zkEVM that leverages ZK-rollup technology for scaling and is compatible with Ethereum apps. It has been operationally live since July 2023.

Consensys declined to comment.

This month, Linea opened claims for its native asset, LINEA, with a token generation event.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

According to Shibburn, the Shiba Inu burn rate is higher in the last 24 hours, as over 7,069,830 SHIB tokens get slashed from SHIB's total supply.

In the last 24 hours, a total of 7,069,830 SHIB have been burned, marking a 510.87% increase in burn rate. This contributes to a total of over nine million SHIB burned in the last seven days.

Shibburn@shibburnSep 26, 2025HOURLY SHIB UPDATE$SHIB Price: $0.00001169 (1hr 0.47% ▲ | 24hr -1.08% ▼ )

Market Cap: $6,886,216,910 (-1.05% ▼)

Total Supply: 589,247,697,077,123

TOKENS BURNT

Past 24Hrs: 7,069,830 (510.87% ▲)

Past 7 Days: 9,043,922 (125.46% ▲)

According to Shibburn, a total of 9,043,922 SHIB has been burned in the last seven days, marking a 125.46% weekly surge in burn rate.

Shiba Inu's total supply is now 589,247,697,077,123 SHIB out of an initial supply of one quadrillion tokens.

Despite the rise in the Shiba Inu burn rate, the Shiba Inu price remains in red as the crypto market extended its losses in the early Friday session in anticipation of PCE data.

Shiba Inu price

At press time, SHIB was down 0.84% in the last 24 hours to $0.00001173 and down 10% weekly.

The broader crypto market traded in red early Friday with nearly $900 million in liquidations as investors anticipated the Fed's preferred inflation gauge, the PCE report, and what it could mean for the economy.

Shiba Inu saw a sharp drop in the Thursday session, hitting a low of $0.00001151. Bulls are currently attempting a rebound following the release of the latest inflation report.

Core inflation was little changed in August, according to the Federal Reserve’s favored inflation gauge, likely keeping the central bank on track for interest rate cuts ahead.

Markets are strongly betting on a rate cut in October, which would be bullish for cryptocurrencies, including Shiba Inu, though there is a bit less enthusiasm for another move in December.

Michael Saylor posted two words on Thursday — "Be Unstoppable" — just as new rankings confirmed Strategy’s unmatched lead in corporate Bitcoin holdings. The company now controls 639,835 BTC, worth more than $70 billion, with Bitcoin trading around $109,500.

The distance between Saylor’s firm and the rest is wide. MARA Holdings is second with 52,477 BTC. Tesla has 11,509. Coinbase sits at 11,776. Even if the next 10 companies combine their reserves, they fall short of Strategy’s total.

In the meantime, the Bitcoin price action recently looks more like a roller coaster ride, climbing above $124,000 in August before dropping to $106,000, and then recovering to just under $110,000.

For traders, those swings decide wins or losses. For Strategy, they have not changed the approach: accumulate and hold.

Michael Saylor's Strategy

A single software company has turned itself into the biggest Bitcoin vault on the planet, larger than miners and exchanges that run the infrastructure of the network. Public firms like CleanSpark, Riot and Block are active players, but they look small next to Saylor’s balance sheet.

Saylor’s post puts a face on those numbers, as the Strategy chairman himself is the face of his company. The image of him in a dark hoodie with an orange tie, paired with the words "Be Unstoppable," is a reminder of how he frames the company’s position.

Strategy is not treating Bitcoin as an experiment. It has built its identity around it, and the latest figures show that no one else is even close.

Cassie Craddock, Ripple Executive and Managing Director, U.K., has revealed that the firm is set to leverage recent collaborations between the U.S. and the U.K. In a post on X, Craddock noted that the recent shift in partnership between both countries has laid a solid foundation for the crypto market.

Ripple positioned to influence digital finance standards

Notably, a U.K.-U.S. Transatlantic crypto taskforce for the future will be set up, comprising government officials and leaders from both the financial and crypto industries. According to Craddock, the event has laid the groundwork that will strengthen cooperation between the nations. The primary focus will be on finance and digital assets.

Some key sectors that the taskforce will address include stablecoins, tokenization, cross-border market access and international coordination. The goal is to make it easier for companies and investors in the two countries to operate seamlessly across the two markets.

Cassie Craddock@CraddockCJSep 26, 2025Earlier this week I posted about the Downing Street roundtable during President Trump's state visit to the UK that I attended alongside representatives from the UK and US governments and financial and crypto industries. This meeting was the precursor to the announcement of the…

It could also set an acceptable standard that other countries might follow once the task force is up and running. Already, Ripple has gained a major foothold in the African market.

Craddock maintains that given Ripple’s strategic positioning as a U.S.-based company with a strong U.K. presence, it is poised to contribute to the task force initiative. She believes that Ripple could become a key player in shaping the future of transatlantic digital finance.

This might create a huge opportunity for XRP and Ripple USD stablecoin (RLUSD). Ripple could leverage this to secure a partnership with financial institutions like banks and asset managers and capture a significant share of the market.

Its RLUSD in particular could gain traction in cross-border transactions, supporting its quest to be among the top leaders in the stablecoin sector.

Regulatory compliance and market impact on XRP

Meanwhile, the task force’s emphasis is also on regulatory compliance. Ripple could offer its zero-knowledge proofs (zkPs) for privacy and know-your-customer (KYC). Such a development could serve as a boost to attracting traditional institutions.

Overall, Ripple could become a notable leader in institutional DeFi and cross-border finance transactions. All of these might positively impact its assets like RLUSD utility and XRP as well.

On the broader crypto market, XRP has lost over 8.4% of its gains in the last 30 days. The asset has been stagnating below $3, and every climb above that critical level has not been sustained. As of press time, XRP changes hands at $2.74, representing a 3.56% decline in the last 24 hours.

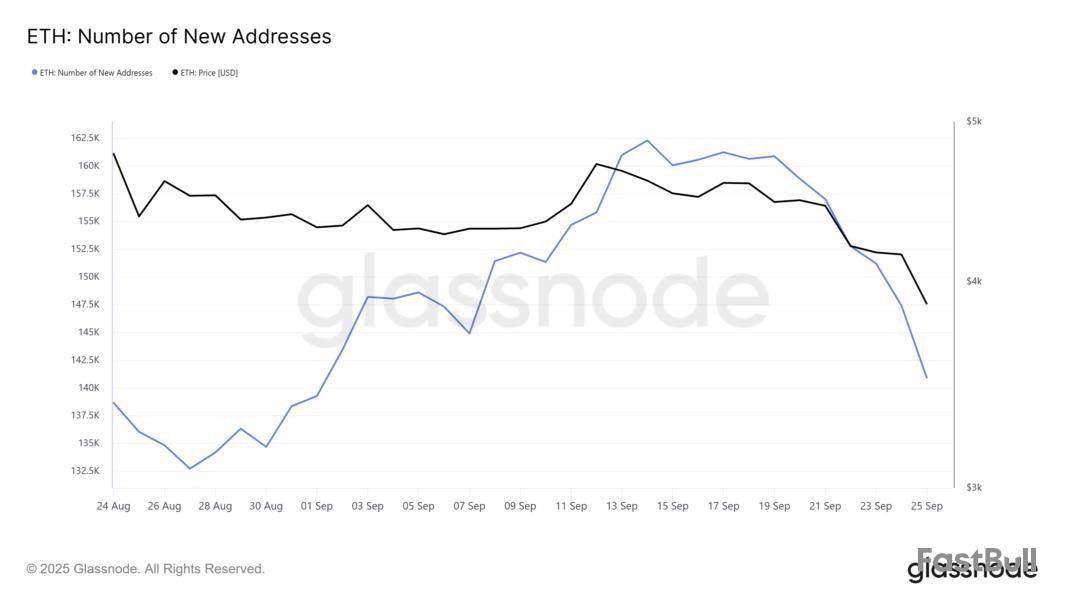

Ethereum has fallen to a six-week low, slipping under the $4,000 level amid broader market weakness.

The altcoin king’s price is now at $3,938, showing that bearish momentum continues to dominate. Despite the decline, certain on-chain signals suggest that this downturn may present a buying opportunity.

Ethereum Investors Have An Opportunity

New address creation on the Ethereum network has slowed significantly, with activity hitting a near-monthly low. This decline signals waning interest from potential investors, who are hesitant to enter the market while volatility remains high. Without fresh participation, Ethereum struggles to generate upward momentum.

The lack of new entrants into the ecosystem highlights a concerning slowdown in demand. Fresh inflows typically provide crucial support for long-term rallies, as more users adopting the asset can bolster network growth.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On the other hand, Ethereum’s MVRV ratio presents a more optimistic outlook. The metric currently places ETH within the opportunity zone, which ranges from -9% to -30%. Historically, this zone has marked points where reversals often occur as losses prompt accumulation.

When profits fade and holdings slip into losses, investors tend to hold or buy at lower levels instead of selling. This behavior often creates the base for a recovery. As ETH remains in this zone, the probability of renewed demand building up is significant, even amid bearish pressure.

ETH Price Needs A Push

At press time, Ethereum’s price is at $3,938, attempting to establish $3,910 as a support floor. This decline marks a crucial break below the $4,000 level, highlighting short-term weakness.

Given current signals, ETH may remain rangebound under $4,074 resistance until stronger bullish cues emerge. Market sentiment suggests consolidation rather than a sharp recovery, keeping investors cautious.

However, if Ethereum flips $4,074 into support, a push toward $4,222 could follow. This move would require investor participation and sustained inflows to counter bearish momentum, ultimately invalidating the short-term negative outlook.

Bitcoin exchange-traded funds (ETFs) recorded another wave of investor redemptions on September 25, with $258.4 million in net outflows, to SoSoValue.

The withdrawals come just a day after the products staged a strong rebound, showing continued volatility in institutional flows.Bitcoin ETFs Fall to $144B Amid ETH Losing Over $500 Million in 4 days

BlackRock’s iShares Bitcoin Trust (IBIT) was the only bright spot, attracting $79.7 million in fresh inflows. IBIT remains the market leader, with $84.35 billion in net assets and cumulative inflows of $60.86 billion. Bitcoin ETFs Inflow Chart September 25 Source:

However, other major issuers saw heavy withdrawals. Fidelity’s Wise Origin Bitcoin Fund (FBTC) posted the sharpest single-day decline, losing $114.8 million.

Grayscale’s GBTC recorded $42.9 million in outflows, while Ark Invest and 21Shares’ ARKB shed $63.05 million.

Bitwise’s BITB lost $80.5 million, and VanEck’s HODL fell by $10.1 million. Valkyrie’s BRRR also saw smaller redemptions of $4.9 million.

In total, Bitcoin spot ETFs now hold $144.3 billion in assets, representing 6.64% of the cryptocurrency’s market capitalization.

Historical cumulative inflows stand at $57.2 billion, with total trading volume on September 25 reaching $5.42 billion. Ethereum products, meanwhile, extended their losing streak for a fourth consecutive day.

Ethereum spot ETFs reported $251.2 million in net outflows on September 25, bringing cumulative inflows to $13.37 billion and total assets under management to $25.6 billion, or 5.46% of ETH’s market cap.Ethereum ETF Inflow Chart September 25 Source:

Fidelity’s FETH again led the declines, with $158.1 million in outflows. Grayscale’s ETHE lost $30.3 million, its ETH fund saw $26.1 million in redemptions, and Bitwise’s ETHW shed $27.6 million.

Smaller withdrawals were also recorded from VanEck’s ETHV, Franklin’s EZET, and 21Shares’ TETH. BlackRock’s ETHA remained flat on the day, reporting no significant flows.

The persistent selling follows a difficult stretch for ETH products, as it records over $500 million in outflows in the last 4 days. On September 24, Ethereum ETFs lost $79.4 million, with Fidelity, BlackRock, and Grayscale leading the declines.

🔻 ETFs surge back with $241M in net inflows on Sept. 24, following two days of outflows. ETFs saw $79.4 million in net outflows.. — Cryptonews.com (@cryptonews)

A day earlier, September 23 saw $140.7 million in redemptions, while September 22 marked $76 million in outflows, largely driven by Fidelity’s FETH.

Bitcoin ETFs have also faced sharp swings over the past week. After losing $363 million on September 22 and $244 million on September 23, the products staged a rebound on September 24, posting $241 million in inflows led by BlackRock’s IBIT.

The renewed outflows on September 25 suggest continued investor caution, with trading patterns closely tied to macroeconomic conditions, including the Federal Reserve’s recent rate cut and upcoming U.S. inflation data.

At present, Bitcoin spot ETFs remain the largest driver of institutional activity, but the latest redemptions across both BTC and ETH products highlight the fragility of sentiment in digital asset markets.Bitcoin and Ethereum Extend Losses Amid Heavy ETF Withdrawals

The ETF outflow comes amidst the general drop in the crypto market. Crypto markets extended losses this week, with exchange-traded fund (ETF) outflows adding pressure to already fragile sentiment.

The global market fell 1.45% in the past 24 hours, pushing its seven-day decline to 6%.

Bitcoin (BTC) dropped 1.7% to $109,329, erasing nearly 6% over the past week. Ethereum (ETH) slid 1.5% to $3,956, deepening its seven-day loss to 12.5% as leveraged liquidations and ETF delays amplified the decline.

The pullback has erased gains from earlier in the month, when Bitcoin briefly logged its second-best September rally in 13 years.

Historically, September has been unkind to crypto, with negative returns in eight of the past 11 years. Analysts attribute the pattern to institutional portfolio rebalancing and fiscal year-end adjustments.

This year’s cycle appears to be following suit, as profit-taking and macro uncertainty weigh on sentiment.

On technical charts, Bitcoin trades below both its 50- and 100-hour moving averages near $113,700, reinforcing bearish momentum.

A descending triangle points to support at $107,300, with further downside possible toward $105,200 and $102,800. Resistance remains at $111,100 and $113,700.

Ethereum’s technical picture is similarly weak. Its relative strength index (RSI) has from 82 earlier this month to 14.5, its most oversold level since June 2025. Source:

Analysts this could trigger a short-term bounce if ETH holds above $3,900. A failure, however, risks a deeper correction toward $3,600 or even the $3,000–$3,300 zone.

Kraken has reportedly raised $500 million at a $15 billion valuation, strengthening its financial position amid growing speculation that the cryptocurrency exchange is preparing for an initial public offering (IPO).

The funding was first reported by Fortune, which cited a source close to the negotiations in a profile on co-CEO Arjun Sethi. The source claimed that Kraken closed the round earlier this month.

When contacted by Cointelegraph for confirmation, a Kraken representative declined to comment.

The raise and valuation are broadly in line with Cointelegraph’s reporting in July, which revealed that Kraken was seeking $500 million at a $15 billion valuation — a move widely interpreted as a step toward IPO readiness.

While Kraken has not filed any regulatory paperwork for a public listing, several of its actions appear consistent with IPO preparation, including enhancing financial disclosures. However, the company has yet to submit an S-1 registration statement to the US Securities and Exchange Commission (SEC), a necessary step for any US public offering.

Founded in 2011 and launched in 2013, Kraken is one of the industry’s oldest operating exchanges. It processed roughly $1.9 billion in trading volume over the past 24 hours, ranking among the top 15 global crypto exchanges, according to CoinMarketCap.

Crypto IPO mania grows

Kraken’s reported interest in a public offering comes amid a wave of crypto firms heading to public markets with remarkable success.

Gemini, the exchange founded by Cameron and Tyler Winklevoss, was over 20 times oversubscribed in its Nasdaq debut, raising $425 million. Since going public earlier this month, its market capitalization has swelled to over $2.8 billion.

Circle, the issuer of USDC (USDC), completed a billion-dollar IPO in June, with shares surging 167% on opening day. The company now commands a valuation of roughly $31.4 billion.

Figure Technology Solutions, a blockchain-based lender, also staged a blockbuster debut. Its shares jumped over 20% when trading began in September, lifting its market cap above $8.4 billion.

Meanwhile, BitGo, a leading crypto custodian with over $90 billion in assets, has filed S-1 registration documents with the SEC as it seeks to list its Class A common stock on the New York Stock Exchange.

The IPO rush comes amid a backdrop of favorable regulatory developments in the United States, including the passage of the GENIUS stablecoin bill and progress on market structure and anti-CBDC legislation, which together have provided greater clarity for the digital asset industry.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up