Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin treasury company Strategy (formerly MicroStrategy) acquired an additional 13,390 BTC for approximately $1.34 billion at an average price of $99,856 per bitcoin between May 5 and May 11, according to an 8-K filing with the Securities and Exchange Commission on Monday.

Strategy now holds a total of 568,840 BTC — worth over $59 billion — bought at an average price of $69,287 per bitcoin for a total cost of around $39.4 billion, including fees and expenses, according to the company's co-founder and executive chairman, Michael Saylor. That's the equivalent of more than 2.7% of bitcoin's total 21 million supply and implies around $20 billion of paper gains — with 303,230 BTC bought in the last six months alone.

The latest acquisitions were made using proceeds from the sale of its class A common stock, MSTR, and perpetual strike preferred stock, STRK. Last week, Strategy sold 3,222,875 MSTR shares for approximately $1.31 billion. As of May 11, $19.69 billion worth of MSTR shares remain available for issuance and sale under that program, the firm said. Strategy also sold 273,987 STRK shares for approximately $25.1 million, with $20.85 billion worth of STRK shares remaining available for issuance and sale under that program.

Strategy's STRK and STRF perpetual preferred stocks are in addition to the firm's "42/42" plan, which targets a total capital raise of $84 billion in equity offerings and convertible notes for bitcoin acquisitions through 2027 — upsized from its initial $42 billion, "21/21" plan, of which the equity side was recently depleted.

Saylor again hinted at the likelihood of another bitcoin acquisition filing ahead of time, sharing an update on Strategy's bitcoin purchase tracker on Sunday, stating, "Connect the dots."

Strategy portfolio tracker. Image: Saylortracker.com.

Strategy previously acquired an additional 1,895 BTC for approximately $180 million at an average price of $95,167 per bitcoin between April 28 and May 4 — taking its total holdings to 555,450 BTC.

Corporate bitcoin accumulation race

There are now more than 70 companies that have adopted some form of bitcoin treasury. Cantor Fitzgerald, SoftBank, Bitfinex and Tether recently announced the planned launch of a $3.6 billion bitcoin venture called Twenty One, joining the likes of Semler Scientific, KULR and Metaplanet in pursuing a bitcoin acquisition model, pioneered by Strategy and Saylor.

Analysts at Bernstein predict that Strategy and its corporate copycats could add $330 billion to their bitcoin treasuries over the next five years, driven by a more pro-crypto regime in the U.S..

Earlier this month, Strategy posted a $4.2 billion net loss for Q1, driven largely by around $6 billion in unrealized losses on its bitcoin holdings during the first quarter under new fair value accounting rules.

Strategy's $113.7 billion market cap trades at a significant premium to its bitcoin net asset value, with some investors continuing to air reservations about the firm's premium to NAV valuation and its increasingly numerous bitcoin acquisition programs. However, analysts argue that with Strategy's relatively low debt levels and no payments due until 2028, the firm's leverage remains manageable.

"Remarkably, the Strategy enterprise value premium to its BTC holdings remains massive, with the company currently trading at a 2x valuation to the value of its BTC," analysts at K33 said last week. "These valuation premiums have remained elevated [since] 2024, peaking at 3.4x in late November. Since that peak, the company has raised over $15 billion via ATM issuance. Despite the considerable dilution, its shares have retained a strong premium, positioning the company to continue aggressive, ATM-funded bitcoin acquisitions in the coming months."

Strategy's class A common stock, MSTR, closed up 0.4% on Friday at $416.03, according to The Block's Strategy price page, following a week that saw bitcoin gain more than 10% to reapproach its all-time high. MSTR is currently up 1.5% in pre-market trading on Monday, per TradingView, and 38.6% year-to-date.

Benchmark recently reiterated its "buy" rating and $650 price target on MSTR, while analysts at Bernstein maintained their "outperform" rating and $600 target for the stock.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Business intelligence firm Strategy has purchased an additional $1.34 billion worth of Bitcoin, according to a Monday announcement.

The most recent purchase brings the total number of coins held by the company to nearly 569,000 (a staggering $59 billion at current prices). To put this into perspective, this is higher than the entire GDP of some countries like Mozambique.

Strategy's unrealized profits currently stand at more than $19 billion following the latest price surge.

As usual, co-founder Michael Saylor strongly hinted that he was going to announce another major purchase on Friday.

The latest Bitcoin buy has been completely priced in, meaning that there was no market reaction. In fact, the price of the leading cryptocurrency has slipped below $104,000 despite a breakthrough in the trade negotiations between the US and China.

According to Bitwise, a total of 80 publicly traded companies now hold Bitcoin on their balance sheet. Fundstrat's Tom Lee predicted that the leading cryptocurrency is going to become "central" to how companies actually manage their treasuries.

Japanese Strategy copycat Metaplanet also recently completed its largest purchase ever, adding $125 million in one go.

Casa co-founder Jameson Lopp believes that the best way to counter centralization concerns surrounding Strategy's massive Bitcoin purchases is for more companies to actually follow its lead.

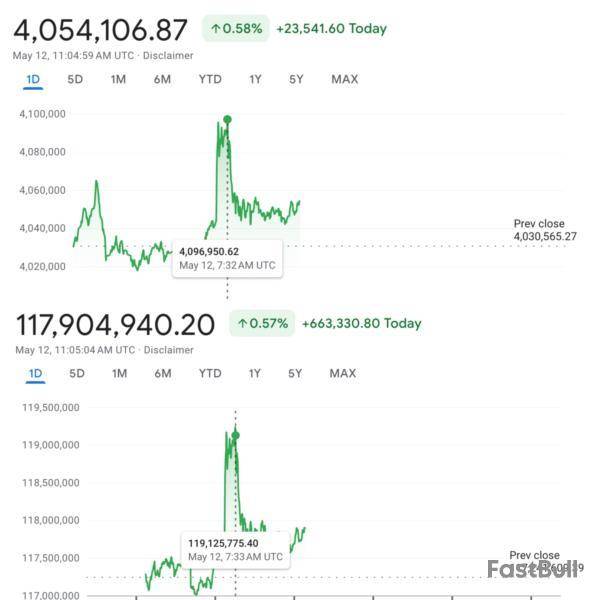

Bitcoin has reached a new all-time high against both the Turkish Lira (TRY) and the Argentine Peso (ARS), sparking speculation about whether the US market will be next to see a record-breaking surge.

Given BTC’s latest rally, market watchers are increasingly optimistic that the coin will soon reclaim its dollar ATH as well.

Bitcoin Price Breaks Records in Turkey and Argentina as Inflation Accelerates

According to the latest data from Google Finance, the BTC/TRY pair peaked at a record high of 4.09 million TRY (approximately $105,000) in early Asian trading hours. Similarly, in Argentina, the BTC/ARS pair reached an all-time high of 119.1 million ARS (approximately $105,600).

Nonetheless, BTC’s varying “all-time highs” reveal more about these fiat currencies than they do about Bitcoin. This surge comes amid the ongoing devaluation of both TRY and ARS. Inflationary pressures have significantly impacted the currencies.

“Turkey seems to always lead. When fiat is dying faster that’s what happens,” an analyst wrote on X.

Data from Trading Economics indicates that Turkey’s inflation rate has remained a significant concern. As of April 2025, the annual inflation rate stood at 37.8%. For Argentina, the situation isn’t any different.

“The country’s inflation rate remains high, with projections indicating a potential 110% by the end of the quarter,” another analyst added.

When inflation is high, the purchasing power of the local currency declines. This, in turn, prompts people to seek assets that can preserve value, such as Bitcoin. This shift can drive up demand for Bitcoin, pushing its price higher in those specific markets.

This trend was also observed in the BTC/USD pair. The rising inflation concerns and the falling US Dollar Index (DXY) pulled the coin from its Liberation Day lows to over the $100,000 mark.

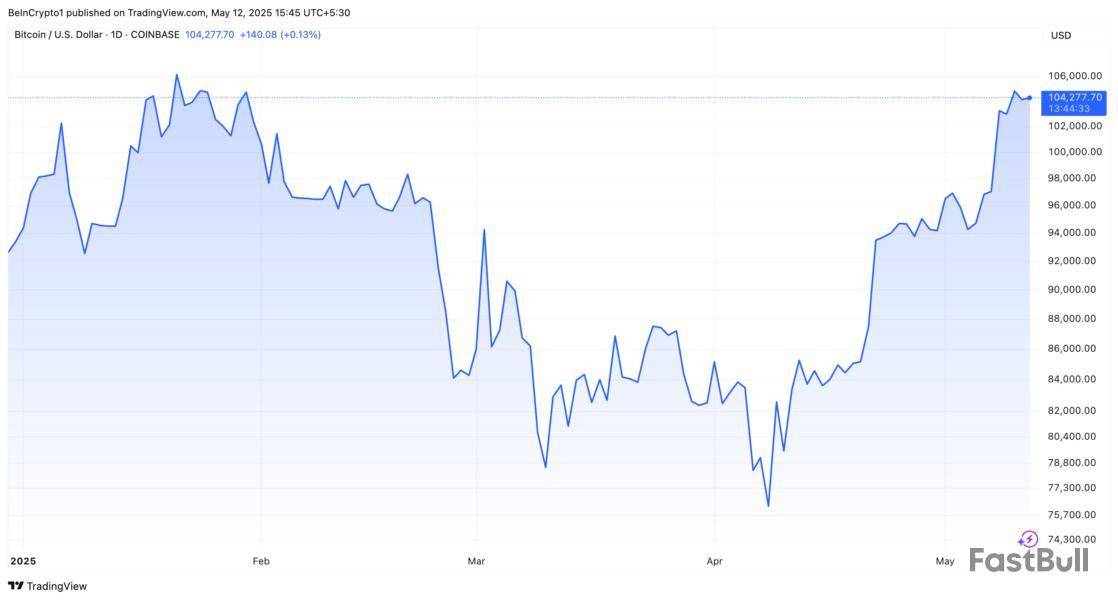

Moreover, after the US-China tariff deal, Bitcoin also reclaimed the $105,000 mark for the first time since January 31.

At the time of writing, BTC’s price adjusted to $104,277, just 4.0% below its ATH of $108,786.

Will Bitcoin Reclaim Its All-Time High? Analysts Predict Possible Surge

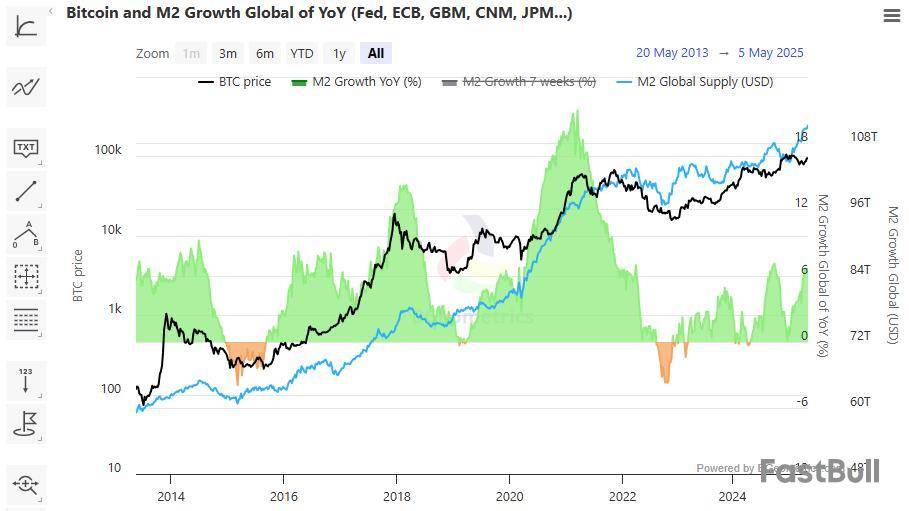

Analysts predict that the current rally can continue, eventually pushing BTC to or above its peak. In a recent X post, crypto analyst Edward Gofsky highlighted the correlation between the global M2 money supply and Bitcoin’s price movements.

He suggested that the recent increase in M2 could signal a rise in Bitcoin’s price, potentially pushing it to new all-time highs.

“Final measured technical target of the current move off the $69,000 backtest is between $140,000 and $150,000,” Gofsky predicted.

Another analyst, Lark Davis, pointed out that retail interest remains low despite BTC’s recent highs. This is evidenced by Google Trends data. Search interest in “Bitcoin” has been declining since November 2024.

“That’s how you know the pump is just getting started,” he stated.

Institutional interest is another catalyst that could fuel BTC’s rise. BeInCrypto reported that Metaplanet spent $126.7 million to increase its holdings by 1,241 BTC. Strategy’s CEO, Michael Saylor, has also hinted at more purchases.

“Michael Saylor about to buy billions worth of Bitcoin. New all-time high is coming!!” Ash Crypto remarked.

Last week, Standard Chartered also forecasted that institutional investments and ETF inflows could push BTC to $120,000 in Q2.

The long-term outlook appears even more bullish. Analyst Josh Mandell foresees BTC reaching $444,000 by Q2 2026. According to Thomas Young, Managing Partner at Rumjog Enterprises, this would mark “a monetary regime shift.”

“This isn’t just a bull run. $444,000 Bitcoin means: A broken trust cycle, the start of post-fiat finance, Bitcoin as global neutral collateral,” Young stated.

He cited several driving factors, including savers and investors abandoning fiat currencies, a potential bond market breakdown, a surge in institutional Bitcoin adoption, global South nations like Brazil adopting Bitcoin, and a retail mania fueled by renewed media attention.

XRP rally continues with a minor increase of 3.5% daily, but can it break $2.6?XRP Price Predictions to Watch This Week

Key Support levels: $2.3, $2.0

Key Resistance levels: $2.6, $31. Price Makes Higher Highs

The rally is picking up speed after XRP closed the weekend in green. This took the asset to almost $2.5 before a short pullback. If buyers continue the pressure, they have a good chance to test the resistance at $2.6 next. If they break above that level, then XRP has a good shot at $3.2. Momentum is Picking Up Speed

The price is making higher highs and higher lows with a clear uptrend. However, the buy volume remains low compared to previous rallies. Hopefully, this can change as soon as the price breaks above $2.6, since that will encourage buyers to return in numbers. The current support is at $2.3.3. RSI Makes New Highs

On Saturday, the daily RSI reached almost 69 points and made a new high before sellers returned to take XRP into a pullback. This shows a clear bullish uptrend. As long as the RSI makes a higher low as well, there is no reason to think this uptrend will stop any time soon.

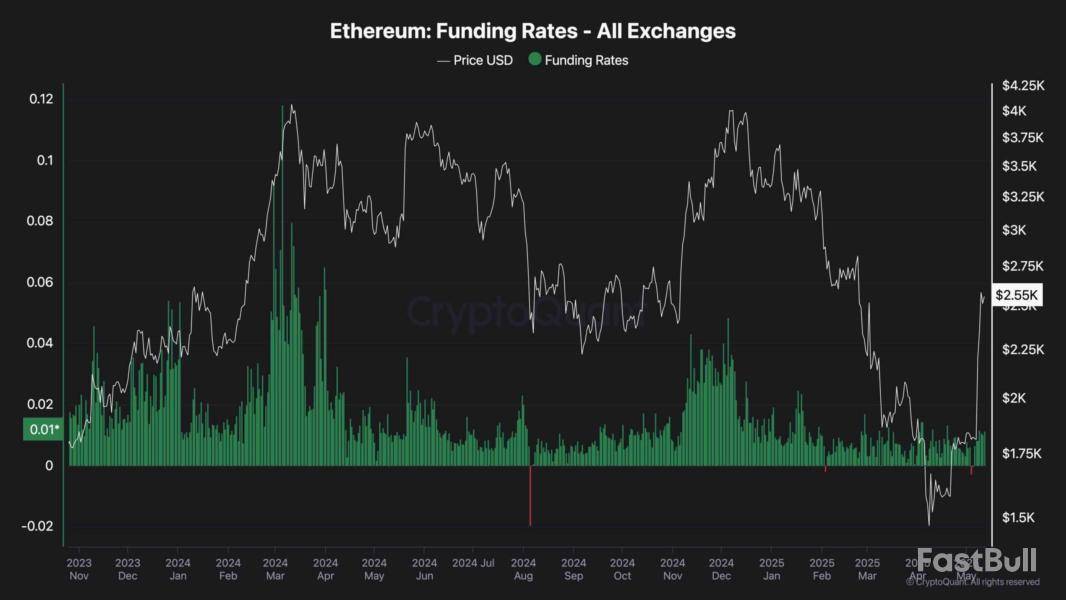

Ethereum has experienced a notable surge in the past few weeks, reaching a crucial resistance region at the $2.6K level. However, the confluence of key resistance factors at this range suggests a likely consolidation before the next major move.Technical Analysis The Daily Chart

ETH has been in a strong and impulsive uptrend, reflecting a clear return of demand and buying strength in the market. The price has now reached a critical resistance zone near $2.6K, which aligns with both the 200-day moving average and the previously broken lower boundary of a multi-month ascending channel.

This confluence forms a strong resistance cluster, suggesting potential supply at this level and posing a significant challenge to further upward movement.

As a result, a temporary consolidation or corrective phase appears necessary for the market to stabilize and gather enough momentum for a potential breakout. The RSI indicator has also entered overbought territory, reinforcing the likelihood of a short-term correction.

On the lower timeframe, Ethereum’s aggressive buying momentum has driven the price through several resistance levels. This rally signals the buyers’ intention to target all-time highs in the coming months. However, ETH has now reached a key supply zone of around $2.6K, which corresponds with a major swing high in March. This area has already capped the rally, suggesting a potential short-term pause or consolidation.

While a quick breakout above this resistance is still possible, the overbought RSI levels make a brief correction or sideways movement within this range, which is the more probable near-term scenario.

By ShayanMarkets

The funding rates metric is a key indicator of sentiment in the futures market. Analyzing its recent behaviour offers valuable insight into Ethereum’s latest surge. In healthy and sustainable bullish trends, funding rates typically rise gradually, indicating increased participation from buyers in both the perpetual futures and spot markets.

Currently, however, funding rates remain relatively flat, showing no significant uptick. This suggests that Ethereum’s recent price surge has been primarily driven by spot market demand rather than speculative activity in the futures market. This is a bullish sign, as it implies the uptrend is organic and not fueled by excessive leverage, reducing the risk of liquidation cascades and indicating a more stable trend.

Still, for the bullish momentum to be sustained and validated, funding rates should begin to rise, reflecting increased confidence and more aggressive positioning by futures traders.

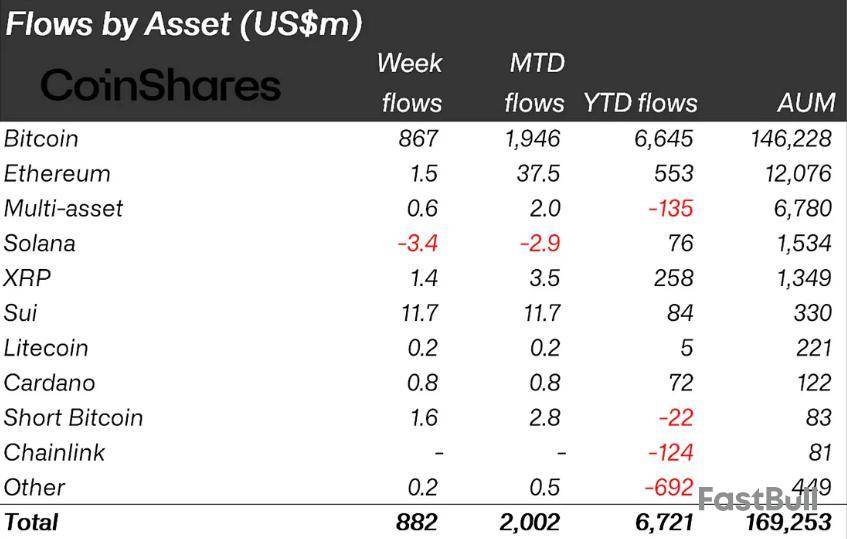

Digital asset investment products witnessed a surge in institutional interest last week, raising $882 million in crypto inflows globally.

This marks the fourth consecutive week of gains, pushing year-to-date (YTD) inflows to $6.7 billion, just shy of the $7.3 billion peak observed in early February.

Four Consecutive Weeks of Crypto Inflows

The latest CoinShares report shows the fourth week of consecutive positive flows. In the week before that, crypto inflows hit $2 billion. The week prior, crypto inflows reached $3.4 billion as investors turned to digital assets for their haven status.

Before that, inflows into digital asset investment products were $146 million, where XRP bucked the trend.

CoinShares’ researcher James Butterfill notes that Bitcoin led the charge with $867 million in inflows, reflecting its growing role as a macro hedge amid rising economic uncertainty.

Since the launch of spot Bitcoin ETFs (Exchange-Traded Funds) in the US in January 2024, cumulative net inflows have hit $62.9 billion, surpassing the previous high of $61.6 billion. While Ethereum has seen a strong price recovery, investor sentiment remains lukewarm, with only $1.5 million in inflows last week.

Sui, on the other hand, stands out among altcoins. It recorded $11.7 million in inflows, overtaking Solana weekly and year-to-date. Sui’s total inflows now stand at $84 million YTD, outpacing Solana’s $76 million, despite the latter seeing $3.4 million in outflows over the past week.

CoinShares attributed the sharp rise in crypto prices and investment flows to multiple converging macroeconomic trends.

“We believe the sharp increase in both prices and inflows is driven by a combination of factors: a global rise in M2 money supply, stagflationary risks in the US, and several US states approving Bitcoin as a strategic reserve asset,” wrote Butterfill.

Indeed, states such as Arizona and New Hampshire advanced their efforts with Bitcoin strategic reserves. Nevertheless, others, like Florida, hit a brick wall.

Macro Shifts Offering a Trading Compass for Crypto Investors

In the same tone, the expanding global M2 money supply is becoming a focal point for Bitcoin investors. Data on TradingView shows China’s M2 money supply remains at an all-time high of Trading View. This signals a potential flood of global liquidity that risk assets like Bitcoin are now absorbing.

Analysts have also observed that Bitcoin’s price correlates positively with global M2 trends. This outlook reinforces Bitcoin’s narrative as a macro-responsive asset.

However, not all experts are convinced. While a growing consensus is linking M2 expansion with crypto price action, skeptics argue that the relationship may be overstated.

Recession fears in the US are further fueling crypto allocations. Goldman Sachs recently raised its 12-month US recession probability to 45%, quietly increasing exposure to Bitcoin via funds that include spot ETF products.

Investors interpret this as a signal that aligns with the broader theme of crypto as a hedge against faltering traditional finance (TradFi) instruments and dollar-denominated assets.

This perception is gaining institutional validation. Standard Chartered recently noted that Bitcoin is increasingly positioned as a hedge against Treasury market volatility and systemic financial risk. This is particularly relevant as US deficits balloon and Treasury yields remain volatile.

The bullish momentum in crypto inflows, alongside Bitcoin’s increasing role in institutional portfolios, suggests that investors are turning to digital assets as both a directional bet and a macro hedge.

1141 GMT - Bitcoin trades steady on the day, reversing earlier gains when it surged to a three-and-a-half month high after news that the U.S. and China had agreed to reduce tariffs substantially for 90 days. The market reaction was "quick and spectacular," although investors might reflect that "significant trade damage has already been inflicted," Trade Nation analyst David Morrison says in a note. Bitcoin's gains have also been limited since it surged above $100,000 last week, he says. Bitcoin last trades at $104,345, having hit a high earlier of $105,716, LSEG data show. (jessica.fleetham@wsj.com)

1115 GMT - Improved Sentiment after news of a U.S.-China deal to lower tariffs significantly lifts both Treasury yields and the dollar. Ebbing trade tensions eases concerns about the U.S. economic outlook and reduces expectations for U.S. interest-rate cuts, boosting the dollar, says Erkin Kamran, CEO of forex trading platform Traze. The rise in Treasury yields, taking the 10-year yield above 4.40%, reflects "improved sentiment as investors rotated out of safe-haven assets," he says. The U.S. and China agreed to mutually slash tariffs for 90 days, giving time for further negotiations. The 10-year Treasury yield is up 8 basis points at 4.453%, according to Tradeweb. The DXY dollar index rises 1.5% to a one-month high of 101.937. (emese.bartha@wsj.com)

1113 GMT - Investors are looking ahead to Tuesday morning's consumer-price-index data for a reading on inflation impact of the first few weeks of President Trump's "Liberation Day" tariffs. In line with WSJ's survey consensus, Goldman Sachs economists expect that core CPI inflation sped up to a 0.3% month-over-month increase, up from 0.1% in March. That would leave the 12-month core CPI rate unchanged at 2.8%. "We have penciled in moderate upward pressure from tariffs on categories that are particularly exposed (such as apparel, recreation, and communication)," Goldman writes. On the other hand, used car prices were likely down by 0.5% last month, helping keep a lid on inflation, Goldman projects. (matt.grossman@wsj.com, @mattgrossman)

1100 GMT - Significantly lower U.S. tariffs brighten the outlook for Chinese growth in the coming quarters, Danske Bank economists say. The truce between Beijing and Washington will let Chinese firms ship goods at manageable rates, and those could be reduced further if a deal on fentanyl is struck, Allan von Mehren and Antti Ilvonen say. That seems likely, based on positive comments from Bessent on China's efforts on this point. For China, the talks happening in a good atmosphere sincerity was key, vindicating its initial strong retaliation, with the U.S. now showing more respect, they say. Though a deal that meets all demands for both sides will be difficult, a scenario that U.S. tariffs on China are ultimately placed around 40% seem more likely. "A headwind, but manageable for both sides." (fabiana.negrinochoa@wsj.com)

1057 GMT - The Japanese yen could weaken further after the U.S. and China agreed to lower tariffs for 90 days, ING economist Lynn Song says in a note. With global markets rallying on improved risk sentiment, the safe-haven yen and Swiss franc have suffered heavy losses. Long yen, a position that bets on the currency strengthening, is one of the most crowded trades, he says. That means the dollar's rally versus the yen could have further to run, potentially lifting it to 150.000 yen, he says. The dollar rises 1.5% to a one-month high of 148.592 yen, according to FactSet. (renae.dyer@wsj.com)

1055 GMT - U.S. Treasury yields rise across the board as a U.S.-China deal to mutually slash tariffs for 90 days encourages investors to buy risky assets and sell safe havens. Shorter-dated yields lead the rise as the deal improves the U.S. economic outlook and could reduce the need for interest-rate cuts by the Federal Reserve. Currently, sentiment may matter more than substance for market confidence, Fidelity International's Stuart Rumble says in a note.The two-year Treasury yield is up 12 basis points at 4.00%, the 10-year Treasury yield is up 8 basis points at 4.45% and the 30-year Treasury yield is up 3 basis points at 4.86%, according to LSEG. (emese.bartha@wsj.com)

1030 GMT - The current rise in U.S. Treasury yields is a concern and suggests that U.S. debt and fiscal policy are still worrying investors, says Eurizon in a note. After weeks of a triple selloff in U.S. equities, U.S. bonds and the dollar due to tariff uncertainty, the current good news on U.S. tariff deals, especially with China, has boosted equities and the dollar but not Treasurys."Despite the logical positive implications for growth, the persistently high levels of rates suggests that the U.S. fiscal trajectory is still a concern," the asset manager says. Ongoing negotiations in Congress on the budget will be key for the bond market, it says. The 10-year Treasury yield rises 6 basis points to 4.437%, according to Tradeweb. (emese.bartha@wsj.com)

1028 GMT - Base metal prices rise, with LME three-month copper up 1.1% at $9,542 a metric ton and LME three-month aluminum up 2.5% at $2,478.50 a ton. Metals rallied as easing U.S.-China trade tensions gave markets a boost, ING analysts say in a note. Both countries said they would temporarily lower tariffs on each other's products, though questions remain for markets as to what the end game will be, ING says. Trading in metals has been volatile since President Donald Trump's inauguration, with much of the uncertainty stemming from comments made by Trump and tariff risks--copper saw its worst performance since mid-2022 in April as signs began to emerge of tariffs hurting economies, ING says. While uncertainty remains high, the U.S.-China agreement has boosted the outlook for metal demand.(joseph.hoppe@wsj.com)

1007 GMT - The euro is unlikely to fall much further against the dollar after the U.S. and China agreed a temporary reduction in tariffs, ING's Lynn Song says in a note. "After all, we're still waiting to find out what impact the tariff story has had on U.S. consumption." More importantly, the euro should benefit from increased German fiscal stimulus, he says. The euro could still extend its current losses given its strength in April was a function of its liquidity as dollar aversion grew. However, any moves below $1.10 probably won't be sustained, he says. The euro falls 0.8% to $1.1919, having earlier hit a one-month low of $1.1083, according to FactSet. (renae.dyer@wsj.com)

1007 GMT - Fentanyl tariffs and export control measures are in focus after the latest de-escalation of U.S. China trade tensions, Citi research analysts Xiangrong Yu and Xinyu Ji says in a research note. Looking forward, the 20% tariff on fentanyl is a "low-hanging fruit" for the two sides, the analysts note. More cooperation from China could eventually remove the 20%, they say. The impact on GDP from the tariffs could be further lowered to negative 0.6 percentage points in this case, making the tariff gap between China and the rest of the world even narrower, they note.Export control is another thing on the list, and is missing in the joint statement this time, Citi adds. "The tensions have peaked out, but uncertainties could stay with the 90-day suspension," they note. (tracy.qu@wsj.com)

0945 GMT - U.S. tariffs on China remain substantially higher than those on other countries after the latest reduction in levies, Capital Economics' Mark Williams says in a note. The current effective U.S. tariff on Chinese goods is around 40%, according to CE. Meanwhile, the chief Asia economist notes that the U.S. still appears to be trying to rally other countries to introduce restrictions of their own on trade with China. "There is no guarantee that the 90-day truce will give way to a lasting cease-fire," he says. However, the agreement marks another substantial retreat from the Trump administration's stance, as it doesn't include any commitments from China on the trade imbalance or exchange rate, he adds. (sherry.qin@wsj.com)

0944 GMT - U.K. inflation data is the dominant factor in U.K. monetary policy decisions rather than tariff concerns, Bank of England's Clare Lombardelli says at the Bank of England Watchers Conference. Tariffs are less of a concern as they should have minimal direct impact on the U.K. economy, leaving the focus on inflation. Services and wage data shows inflation is gradually falling but remains above target and needs to be continuously monitored, she says. (miriam.mukuru@wsj.com)

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up