Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Strategy MSTR shares have declined 14.7% in the past month, underperforming the Zacks Computer - Software industry and the Zacks Computer and Technology sector’s returns of 0.3% and 3%, respectively.

Strategy is the world’s largest bitcoin treasury company, holding 628,791 bitcoins as of July 29, 3% of all bitcoin in existence. MARA Holdings MARA, Riot Platform RIOT and Tesla TSLA are other well-known companies that hold bitcoins in their respective balance sheets. As of June 30, MARA Holdings, Riot Platforms and Tesla had 49,951, 19,273 and 11,509 bitcoins, respectively.

Strategy shares have underperformed MARA Holdings, Riot Platform and Tesla over the past month. While Tesla has climbed 2.1%, MARA Holdings and Riot Platform shares have dropped 14.5% and 12.3% over the same time frame.

Image Source: Zacks Investment Research

Strategy benefits from the Trump administration’s announcement of the establishment of a strategic bitcoin reserve. Bitcoin, the most popular cryptocurrency, has been soaring due to increasing acceptance as a non-sovereign asset, as well as higher institutional and corporate adoption. President Trump recently issued an executive order directing the Labor Department to explore allowing 401(k) retirement plans to hold cryptocurrencies and other alternative assets, which is expected to drive retail adoption of bitcoin.

Strategy now expects to achieve a bitcoin yield of 30% and $20 billion in gains, assuming the bitcoin price hits $150,000 at the end of the year. Bitcoin yield has hit 25% year to date and was 19.7% at the end of the second quarter of 2025. In dollar terms, bitcoin gain was $9.5 billion at the end of the second quarter and $13.2 billion year to date.

For 2025, Strategy expects operating income of $34 billion, net income of $24 billion and earnings of $80 per share, based on a bitcoin price outlook of $150,000 at the end of the year. The company’s estimated 2025 net income of $24 billion is better than Riot Platforms’ and Mara Holdings’ net loss of $0.5 billion and $0.8 billion, respectively.

The company’s disciplined approach to capital raising through preferred equity offerings — Strike (STRK), Strife (STRF), STRD (Stride) and STRC (Stretch) — is a key catalyst. STRK offers an 8% dividend coupon plus MSTR exposure through conversion rights, and has an effective yield of 7.5% as of July 29. STRF offers a 10% cash dividend coupon with enhanced payment protection features and has had an effective yield of 8.7% as of July 29. Stride offers a 10% cash dividend coupon with strong collateral coverage and has an effective yield of 11.9%. Stretch offers a variable monthly cash dividend with an effective yield of 9.5% as of July 30.

Strategy has issued $10.7 billion in equities and $7.6 billion in fixed income securities year to date. Among fixed income securities, the company raised $2 billion, $0.94 billion, $2.52 billion, $1.13 billion and $1.02 billion through convertible notes, STRF, STRC, STRK and STRD, respectively.

For third-quarter 2025, the Zacks Consensus Estimate for MSTR’s loss has been unchanged at 11 cents per share over the past 30 days. The company reported a loss of $1.56 in the year-ago quarter.

MicroStrategy Incorporated price-consensus-chart | MicroStrategy Incorporated Quote

For 2025, the Zacks Consensus Estimate for MSTR’s loss has been unchanged at $15.73 per share over the past 30 days. The company reported a loss of $6.72 per share in 2024.

Strategy shares are overvalued, as suggested by the Value Score of F.

In terms of Price/Book, Strategy is trading at 2.15X compared with Mara Holdings’ 1.24X and Riot Platforms’ 1.38X, suggesting a premium valuation.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

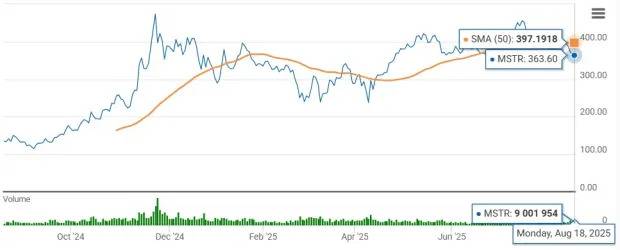

The MSTR stock is currently trading below the 50-day moving average, indicating a bearish trend.

Image Source: Zacks Investment Research

Strategy benefits from its growing bitcoin holdings and increasing subscription revenues. However, challenging macroeconomic conditions and uncertainty about tariffs increase volatility in bitcoin trading. Stretched valuation is another concern.

Strategy currently has a Zacks Rank #4 (Sell), which implies that investors should avoid the stock right now.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

Marathon Digital Holdings, Inc. (MARA) : Free Stock Analysis Report

Riot Platforms, Inc. (RIOT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

Shares of business analytics software company MicroStrategy (NASDAQ:MSTR) fell 3.2% in the morning session after a nearly 4% drop in Bitcoin's price weighed on crypto-related stocks, amid growing concerns over the company's valuation and fundamentals. The downturn in Bitcoin was linked to a hotter-than-expected Producer Price Index (PPI) report, a key measure of inflation that can influence investor sentiment towards riskier assets. This macro news compounded existing investor worries specific to Strategy.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks. Is now the time to buy MicroStrategy? Access our full analysis report here, it’s free.

MicroStrategy’s shares are extremely volatile and have had 77 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The previous big move we wrote about was about 21 hours ago when the stock dropped 4.6% on the news that markets pulled back as a hotter-than-expected wholesale inflation report for July dampened hopes for a Federal Reserve interest rate cut. The U.S. Producer Price Index (PPI), a key measure of wholesale inflation, rose 0.9% month-over-month in July, far exceeding the 0.2% increase that economists had predicted. Annually, prices at the wholesale level jumped 3.3%, also surpassing the 2.5% forecast. This hotter-than-expected data has poured cold water on widespread expectations for an interest rate cut from the Federal Reserve next month. Persistent inflation makes it less likely for the central bank to ease monetary policy. Sectors with high-growth stocks, such as SaaS, are particularly sensitive to interest rate changes, as the prospect of higher rates for longer can diminish the present value of their future earnings, leading to a decline in stock prices.

MicroStrategy is up 20.4% since the beginning of the year, but at $361.16 per share, it is still trading 23.8% below its 52-week high of $473.83 from November 2024. Investors who bought $1,000 worth of MicroStrategy’s shares 5 years ago would now be looking at an investment worth $25,108.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Wall Street debates Strategy's Bitcoin blueprint originally appeared on TheStreet.

One of Wall Street's most famous short sellers, Jim Chanos, has made a name for himself by finding firms whose market value is way higher than it should be. Now, his eyes are set on MicroStrategy, a Virginia-based software company that has lately changed its name to "Strategy."

The company is well known for its corporate Bitcoin vault. But Chanos is clear in his criticism: the company's business model is "financial nonsense," and its shares are worth a lot more than the Bitcoin they represent.

Chanos's main point is based on a single number: market net asset value, or mNAV. This represents the value of the company's Bitcoin holdings per share, minus its debts and preferred equity, relative to the actual stock price.

Strategy now has around $77.2 billion worth of Bitcoin. However, the price of its shares suggests that each share is worth significantly more than the coins themselves. Traders call that extra gap the "premium," and Chanos thinks it's not fair.

Join the discussion with Scott Melker

Strategy's premium has been under both scrutiny and praise. The corporation doesn't just use cash reserves or issue traditional debt to get money. It also sells perpetual preferred shares, such as its STRD ("Stride") and STRC ("Stretch") offerings.

Investors in these preferreds receive regular dividends, typically ranging from 9% to 12%, which Strategy uses to purchase additional Bitcoin.

The method gives investors more power: when the market is strong, the extra Bitcoin raises returns for regular stockholders. But in poor markets, those fixed dividend obligations stay in place, which might lower value and force Strategy to keep raising money.

Michael Saylor, the executive chairman of Strategy and the person who came up with this plan, says the extra money is well worth it. He talks about it in terms of four main benefits.

The first is "credit amplification," which means that the company can raise more money than its equity base would normally allow, which increases its exposure to Bitcoin.

The second is an "options advantage." Strategy's common stock, which still trades under the MSTR ticker, has one of the most active options markets tied to the price of Bitcoin. This allows investors to set up trades using calls, options, and spreads in ways that aren't easily possible with direct Bitcoin holdings.

"Passive flows" is the third pillar. MSTR is included in index funds and other investment products that follow regulations. These funds automatically acquire the stock, regardless of its cost, which keeps the demand consistent.

Lastly, there is "institutional access." Many big pools of money, such as pension funds and endowments, can't acquire Bitcoin directly. By holding MSTR shares, they can still acquire exposure to Bitcoin's price swings.

on CNBC Saylor said:

"Believe it or not, there are a lot of people who …don't want the Bitcoin return. They want 100% return. So MicroStrategy, the equity, or strategy,..We actually aim to generate 2x the Bitcoin return and 2x the volatility."

Analysis by Ryan (@ryQuant) highlights that the perpetual preferred model could drive 51% annual growth and a $1,960 fair value, allowing Strategy to keep adding Bitcoin indefinitely by paying dividends.

Join the discussion with CryptosRUs

Chanos and other skeptics are uncertain whether the benefits outweigh the costs.

First of all, "credit amplification" costs money. Chanos says that preferred dividends must be paid no matter how well Bitcoin does, and that individual investors can often borrow money at lower rates than Strategy does.

Skeptics also disagree with the "passive flows" thesis, arguing that index inclusions can alter the market and that the buying pressure they create is not permanent.

Critics argue that the restrictions preventing large investors from buying Bitcoin directly are diminishing, particularly with the introduction of U.S.-listed spot ETFs.

Further, holding Bitcoin through a corporate wrapper introduces "double taxation," where profits could be taxed at both the corporate and shareholder level, as per reports.

Chanos says that the biggest risk is that the premium itself might fall apart. If investors are less inclined to pay more than mNAV, MSTR's shares could drop a lot even if the price of Bitcoin stays the same.

Some traders take a short position in MSTR and a long position in Bitcoin at the same time, anticipating that the premium would go down over time.

At press time, Strategy's mNAV stands at up by 0.62%. Interestingly, MSTR has been 91% volatile among all assets over the last year — even more extreme than Tesla or Bitcoin.

Wall Street debates Strategy's Bitcoin blueprint first appeared on TheStreet on Aug 14, 2025

This story was originally reported by TheStreet on Aug 14, 2025, where it first appeared.

Bitcoin (BTC-USD) rose over 1% Thursday to just above $121,655 after hitting a record $123,500 Wednesday, driven by institutional demand and bets on looser monetary policy.

The cryptocurrency has gained 31% year-to-date and is up 60% from April’s market lows.

Inflows into spot exchange-traded funds, along with purchases from public companies copying the blueprint of software firm-turned-bitcoin juggernaut Strategy (MSTR) by adding bitcoin to their balance sheets, have been key drivers of this year’s token rally.

Strategists also point to the Trump administration’s pro-crypto stance as a major catalyst.

"The administration is pushing crypto. They are pushing bitcoin. Bitcoin is the lead dog in the crypto market," Tom Essaye, founder of Sevens Report Research, told Yahoo Finance earlier this week.

"So is it short-term a little frothy? Sure," he added. "But longer term, there are some fundamental changes here that I think are bullish for it and we'll send it much higher in the future."

Last week, President Trump issued an executive order directing the Labor Department to explore allowing 401(k) plans to hold cryptocurrencies and other alternative assets, a move that could significantly expand retail access to crypto.

The price surge also comes as US equities have notched all-time records on expectations the Federal Reserve will cut interest rates in September, and that Trump’s next Fed chair pick will likely favor looser monetary policy.

Meanwhile ethereum (ETH-USD) prices rose to near record levels on Wednesday as Wall Street grows increasingly bullish on the world's second-largest cryptocurrency by market cap.

Ethereum's native token, ether jumped as much as 6% to hover above $4,700 per token, just shy of its 2021 record highs.

Companies have been adding ether to their balance sheets as a way to gain exposure to the tech infrastructure behind decentralized finance and digital assets, such as stablecoins.

This week Bitmine Immersion Technologies (BMNR), an ethereum treasury company, announced plans to sell up to another $20 billion worth of stock to boost its holdings of the cryptocurrency.

"We have stated multiple times we believe Ethereum is the biggest macro trade over the next 10-15 years," Fundstrat head of research Tom Lee, who also serves as chairman of Bitmine, wrote in a note Wednesday.

Lee noted the majority of Wall Street crypto projects and stablecoins, or digital tokens backed by assets like the US dollar, are being built on the ethereum infrastructure.

Ether, the native token of ethereum, is up more than 50% since the GENIUS Act legislation, which creates guardrails for the stablecoin industry, was passed last month.

Additionally, the Securities and Exchange Commission's recent "Project Crypto" announcement, an initiative to modernize the agency and establish clear regulations around the digital asset industry, has also fueled the rally in ethereum.

Fundstrat sees ETH hitting prices moving as high as $15,000 by year-end.

Ines Ferre is a Senior Business Reporter for Yahoo Finance. Follow her on X at .

Cryptocurrency has come a long way since Bitcoin’s debut in 2009. Over the past decade and a half, the space has captured global attention, dominated headlines, and gone through wild cycles of boom and bust. Today, thousands of cryptocurrencies circulate on the market, and while global regulation is still taking shape, under the new administration the U.S. framework is advancing rapidly in a distinctly positive direction.

For investors looking to cut through the noise, one compelling option lies in Bitcoin treasuries. These are public companies that hold Bitcoin as a strategic asset, aiming to benefit from its long-term value appreciation.

Covering the sector for Cantor, analyst Brett Knoblauch gives us the background and points the way toward finding sound investments.

“What makes a good Bitcoin treasury company? A successful Bitcoin treasury company needs access to capital. Without capital, they simply cannot acquire Bitcoin. The amount of capital a company has access to in this space is largely driven by trading liquidity. For shares to have a relatively high amount of volume, we believe they need to have a management team that carries weight in the crypto ecosystem,” Knoblauch opined. “However, not all Bitcoin treasury companies are created equal, and we believe some offer better risk/reward than others.”

The Cantor digital expert goes on to put his background research to work – and he’s tagged Strategy (NASDAQ:MSTR) and Semler Scientific (NASDAQ:SMLR) as two of the best bitcoin treasury stocks to buy right now. Let’s give them a closer look and find out what makes these stocks so compelling.

Strategy

The first stock on our list is MSTR. Formerly known as MicroStrategy, the company rebranded itself earlier this year as Strategy, and its stylized ‘B’ logo points to the company’s core work. Strategy is a Bitcoin treasury, but more importantly, it was the first Bitcoin treasury. The company has been buying up Bitcoin since 2020, and today its holdings total 607,770. At current prices, that digital asset is worth approximately $72 billion. Strategy is the world’s largest corporate holder of Bitcoin.

As a Bitcoin treasury, some of Strategy’s vital stats are a bit different than those of most other public companies. A look at the last quarterly report, covering 1Q25, shows this. Strategy reported strong results on several important KPIs related to its Bitcoin business. These include the ‘BTC Yield,’ which was listed as 13.7%; the ‘BTC Gain’ of 61,497; and the ‘BTC $ Gain’ of $5.8 billion. These performance indicators were given ‘year-to-date,’ as of April 28, and show that Strategy’s bitcoin treasury business was performing well in the first four months of this year.

In addition to its expanding role as a Bitcoin treasury, Strategy also maintains a legacy software business – and boasts that it is the world’s largest ‘independent, publicly traded business intelligence company.’ The company provides cloud-native business intelligence software solutions, along with AI-powered, enterprise-scale data analytics services, for subscription customers. The company generated $111 million in revenue from its software business during the first quarter, a total that was down 3.6% year-over-year. Within that figure, subscription revenue rose 61.6% year-over-year, to reach $37.1 million. Strategy will announce Q2 earnings today (July 31) after the close.

For Cantor’s Knoblauch, the key point here is Strategy’s role as the largest Bitcoin treasury. The analyst notes that this company was the first into that niche, and had taken a large lead – which bodes well for Strategy’s future. Knoblauch writes, “MSTR created the segment, and it has a Bitcoin stack that is unlikely to ever be matched by another entity. Assuming MSTR acquires ~$20bn worth of BTC a year, this puts MSTR on track to reach 1m BTC in just over three years, and that assumes BTC compounds at a 30% CAGR. The sheer size of MSTR’s BTC stack combined with capital markets innovation makes MSTR a must-own name in this space, in our view. If BTC is going to $1m, which we think is highly likely at some point in the future, MSTR could be one of the largest companies in the world.”

These comments back up the analyst’s selection of MSTR as his top Bitcoin treasury pick, and his Overweight (i.e., Buy) rating on MSTR. The analyst’s $680 price target indicates potential for a 72% upside in the year ahead. (To watch Knoblauch’s track record, click here)

Strategy has earned a Strong Buy consensus rating from the Street’s analysts, based on 12 recent reviews that feature a lopsided split of 11 Buys to 1 Sell. The stock is priced at $395.04, and its $547.75 average price target implies a one-year upside potential of 39%. (See )

Semler Scientific

The next stock on our list, Semler Scientific, has an interesting similarity to Strategy – like the Bitcoin treasury leader, Semler Scientific got its start in a different field and came to the Bitcoin treasury niche later on. Semler started out in the medical sciences field, as a developer and provider of innovative medical products and services. On this side, the company’s chief product is QuantaFlo, an FDA-cleared point-of-care product used in the early diagnosis of vascular disease. The device has been found helpful in diagnosing asymptomatic patients.

In May 2024, however, Semler started to chart a new path by purchasing Bitcoin to hold as a digital asset. Since then, the company has amassed 5,021 bitcoins in its holdings, which are worth approximately $595 million. This makes Semler the 15th largest Bitcoin treasury on the global scene and the fourth largest in the US. Semler has an aggressive Bitcoin purchase strategy and aims to hold at least 10,000 bitcoins by the end of this year – and to acquire 105,000 by the end of 2027. The company’s purchase plan is based on a combination of equity, debt financing, and operational cash flows.

Along with its aggressive purchase plan, Semler is also packing its Board of Directors with Bitcoin experts. The latest addition, announced this past June, is bitcoin market researcher Joe Burnett. Burnett has a reputation as an unabashed booster of Bitcoin as an advanced digital asset.

Turning to the company’s last earnings report for 1Q25 and its bitcoin KPIs, we find that Semler’s BTC yield through May 12 this year came to 22.2%; its BTC gain for the same period was 510.3; and its BTC $ gain, also through May 12 this year, came to $52 million.

Semler reported $8.8 million in revenue for Q1, down 44% from the prior-year period. We should note that in 1Q24, Semler’s primary business was still in the medical field; its switch to a Bitcoin treasury-centered strategy came during the second quarter of last year.

Knoblauch, in his write-up of Semler, is impressed by the company’s ability to swiftly embrace this new field and to quickly amass a significant bitcoin holding. He says of the company, “SMLR was the second company in the US to pursue a Bitcoin treasury strategy. Unlike MSTR, whose core business is to raise capital and buy Bitcoin, SMLR was using excess cash on its balance sheet to acquire Bitcoin. More recently, it began raising money to buy Bitcoin… SMLR has increased its focus on Bitcoin, as it has recently hired a new Chief Bitcoin Officer (Joe Burnett) and added Natalie Brunell, a top-rated Bitcoin podcast host, to its BoD. The company is targeting 105k Bitcoin by the end of 2027E, and given this target, SMLR being one of the least expensive Bitcoin treasury names, we think risk/reward is attractive.”

Knoblauch rates SMLR as Overweight (i.e., Buy), with a $61 price target that suggests the shares will gain 70% over the next 12 months.

All 3 of the recent reviews on SMLR are positive, giving the stock a unanimous Strong Buy consensus rating. The stock is currently trading for $35.91, and its average price target of $85.67 implies an upside potential of a hefty 138.5% for the year ahead. (See )

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Disclaimer & DisclosureReport an Issue

(Bloomberg) -- Michael Saylor isn’t backing down. The Strategy co-founder is preparing to sell $4.2 billion more in preferred stock to fuel his latest Bitcoin bet — while throwing a lifeline to investors worried he’s diluting them into oblivion.

The plan, unveiled with second-quarter earnings on Thursday, is Saylor’s latest answer to the big question hanging over his stock: how long can he keep using a lofty premium to fund ever-larger Bitcoin buys?

To reassure shareholders, Strategy pledged it won’t issue new common shares at less than 2.5 times its net asset value, except to cover debt interest or preferred dividends. At the same time, Saylor will keep tapping the market “opportunistically” when the premium is high, turning equity sales into fresh Bitcoin buys.

The move does two things at once: it locks in a floor aimed at reassuring any skeptical shareholders and arms the company with a larger war chest to keep buying Bitcoin. It’s a double play that pits Saylor directly against hedge fund managers like Jim Chanos, who have been betting the company’s premium will collapse.

“That would put common shareholders who are concerned about potential dilution at ease,” said Brian Dobson, managing director for Disruptive Technology Equity Research at the brokerage firm Clear Street. “The market is reacting positively to Strategy’s equity products. The demand is there as evidenced by their substantial capital raises.”

It’s the latest in a string of financial maneuvers that have transformed a once-obscure software firm into a leveraged Bitcoin proxy.

The dual move showcases Saylor’s mastery of capital markets during these bullish digital-asset times: using a self-imposed floor to placate critics, while simultaneously arming the company with fresh ammunition to keep buying Bitcoin.

The company - which is known formally as MicroStrategy Inc. — has already raised more than $10 billion this year through stock and structured offerings, feeding a balance sheet now holding $74 billion in Bitcoin. Its stock has surged 3,300% since Saylor’s first crypto purchase, outpacing Bitcoin itself and forcing hedge funds into a high-stakes battle over whether his premium-fueled strategy can last.

Since Strategy’s first Bitcoin purchase in 2020, Saylor has sold equity, issued various types of debt and layered stacks of preferred shares on top. In the process, he has encouraged a fleet of imitators and spurred a new industry of public companies following a so-called treasury strategy dedicated to buying and holding cryptocurrencies.

Good Times

Since Strategy trades so far above the value of its Bitcoin, the company can sell stock at rich levels, buy more Bitcoin, and in turn reinforce that premium. It’s a reflexive loop that critics warn would snap if sentiment shifts. For now, Saylor’s ability to turn equity markets into a Bitcoin funding engine has made his firm both a proxy for the cryptocurrency and a pressure point for critics betting the spread will collapse.

The company reiterated that it registered an unrealized gain of about $14 billion in the second quarter. After factoring in deferred taxes, the Bitcoin treasury company had net income of $10 billion, or $32.60 a share, the firm said in a statement. The eye-catching benefit, first disclosed at the start of the month, was due to a rebound in Bitcoin’s price and a recent accounting change.

Demand for offerings can fluctuate depending on Bitcoin prices. The firm had to sweeten one of its earlier preferred stock offerings this year with a steep discount to win over price‑sensitive buyers.

Just last week the company launched a new kind of preferred stock, dubbed Stretch, that was upsized from $500 million to more than $2 billion. It was yet another move that showed how deftly Saylor can turn financial engineering into crypto firepower. For now at least.

“Strategy’s upsize is a huge reflection on the market demand for its Stretch Preferred Stock offering,” said Tyler Evans, co-founder and chief investment officer of UTXO Management. “They have had similar upsizes from previous preferred stock offerings, but this one is an eye-popping number.”

--With assistance from Kirk Ogunrinde.

©2025 Bloomberg L.P.

Record Q2 2025 results with $14B operating income and $10B net income, driven by bitcoin holdings and fair value accounting. 2025 guidance projects $34B operating income and $24B net income, with continued strong capital raising and market leadership in BTC exposure.

Original document: Strategy Inc [MSTR] Slides Release — Jul. 31 2025

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up