Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The British pound gained modestly to $1.347 after a survey showed UK businesses experiencing their strongest month in a year, driven by a rebound in the services sector.

The data followed a hot inflation print, which had only briefly lifted sterling, as analysts noted the rise largely reflected higher airfares rather than broad-based price pressures.

The inflation numbers are unlikely to alter the Bank of England’s policy path significantly.

Money markets now see less than a 50% chance of a rate cut before end-2025, with only about a 36% probability of a quarter-point reduction this year and the next cut likely priced in for spring 2026.

Sterling has risen nearly 8% against the dollar in 2025.

The British pound edged higher to just below $1.35 after UK inflation came in hotter than expected.

July CPI rose 3.8% year-on-year, the fastest pace since January 2024 and above economists’ forecasts.

The data prompted traders to scale back bets on Bank of England rate cuts this year, with markets now pricing only about 10 basis points of easing by December—less than a 50% chance of another cut.

Instead, a quarter-point reduction is seen as more likely in early 2026.

Stronger-than-expected GDP and jobs data had already tempered expectations for further easing, and the upside surprise in inflation has further reduced the likelihood of near-term cuts.

With growth holding up and inflation running above forecasts, another rate cut this year could be viewed as too risky.

Sterling rises after data showed U.K. inflation accelerated more than expected in July. Annual inflation rose 3.8% in July, up from 3.6% in June and above the 3.7% forecast by economists in a WSJ survey. Core inflation also increased 3.8% after a 3.7% rise in June, exceeding the 3.7% expected. With a peak in prices not anticipated until later in the year, the Bank of England's scope to cut interest rates will be "severely limited," Raymond James Investment Services strategist Jeremy Batstone-Carr says in a note. Sterling rises to an intraday high of $1.3508 after the data from $1.3482 beforehand. The euro falls to a five-day low of 0.8603 pounds from 0.8630 pounds. (renae.dyer@wsj.com)

The latest Market Talks covering Equities. Published exclusively on Dow Jones Newswires throughout the day.

0625 GMT - Sterling rises after data showed U.K. inflation accelerated more than expected in July. Annual inflation rose 3.8% in July, up from 3.6% in June and above the 3.7% forecast by economists in a WSJ survey. Core inflation also increased 3.8% after a 3.7% rise in June, exceeding the 3.7% expected. With a peak in prices not anticipated until later in the year, the Bank of England's scope to cut interest rates will be "severely limited," Raymond James Investment Services strategist Jeremy Batstone-Carr says in a note. Sterling rises to an intraday high of $1.3508 after the data from $1.3482 beforehand. The euro falls to a five-day low of 0.8603 pounds from 0.8630 pounds. (renae.dyer@wsj.com)

0612 GMT - U.K. inflation looks persistent and will keep the Bank of England from cutting interest rates further, writes Joe Nellis, economic adviser at MHA. The rate of annual inflation climbed to 3.8% in July from 3.6% in June, figures show Wednesday. "Given these underlying pressures, the [BOE's] monetary-policy committee will not, and should not, cut interest rates when it next meets in September," Nellis says. "Inflation will need to show some sign of improving if we are to see any cut at all before the new year."(joshua.kirby@wsj.com; @joshualeokirby)

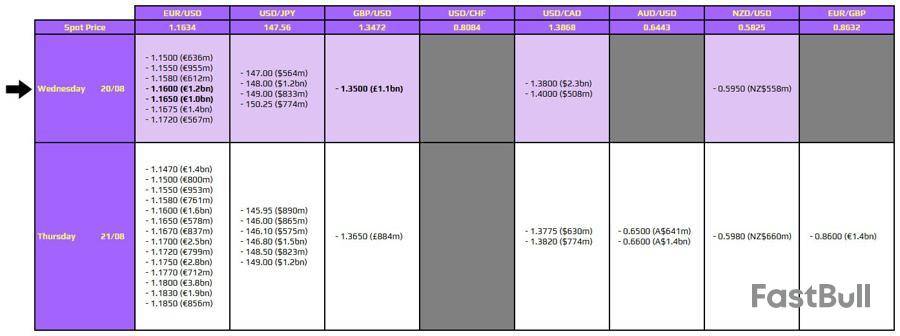

There are a couple to take note of on the day, as highlighted in bold below.

The first ones are for EUR/USD at the 1.1600 and 1.1650 levels. The pair dribbled lower yesterday amid a firmer dollar but the expiries today could help to keep price action more limited in European trading. That especially with a lack of major catalysts to work with. Overall risk sentiment will still be one to watch but the pair might be more rangebound in between the above levels until the Fed minutes release.

Then, there is one for GBP/USD at the 1.3500 level. That rests near the 200-hour moving average of 1.3504 and could come into play as we look towards the UK CPI report later. That being said, traders are pricing in ~94% odds of no rate cut by the BOE in September. As such, it will be hard to move the needle and that presents limited upside for the pound. So, the expiries could help to limit any upside extensions in the session ahead at least.

For more information on how to use this data, you may refer to this post here.

Head on over to investingLive (formerly ForexLive) to get in on the know! This article was written by Justin Low at investinglive.com.

The prospect of the Bank of England sticking to a cautious stance on interest-rate cuts should support sterling over the rest of 2025, Ebury strategist Matthew Ryan says in a note. The U.K. economy showed surprise resilience in the second quarter, he says. Data Thursday showed stronger-than-expected 0.3% economic growth. This should ease pressure on the BOE to continue cutting rates, with markets now bracing for a pause in policy easing at upcoming meetings in September and December, Ryan says. Sterling rises 0.2% to $1.3563 against a weaker dollar. It falls versus the euro, which is last up 0.2% to 0.8618 pounds. (renae.dyer@wsj.com)

The British pound changed hands at $1.588, the highest in around five weeks, after UK GDP beat forecasts.

The economy grew 0.3% in Q2 versus expectations of 0.1%, with annual growth at 1.2%.

June GDP also surprised on the upside, rising 0.4%.

The stronger-than-expected data lowers the chances of further Bank of England rate cuts soon, after last week’s narrow 5-4 vote to cut by 25 bps.

Earlier labour data showed payrolls fell just 8,000 in July, far better than the 20,000 drop expected, with previous losses revised lower.

Unemployment stayed at 4.7% and private-sector wage growth eased slightly to 4.8%.

At the same time, the dollar weakened after US inflation data boosted bets on a September Fed rate cut.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up